NOTICE: This post references card features that have changed, expired, or are not currently available

Less than two weeks ago, in the post “Top 7 shortcuts to earning Alaska Mileage Plan miles,” I asserted that Alaska Airlines’ Mileage Plan miles may be the most valuable airline miles remaining. Then, Alaska suddenly and without warning raised award prices on Emirates flights. Previously, one of the best value uses of Alaska miles was to fly Emirates first class for 90,000 to 100,000 Alaska Mileage Plan miles one-way. Now, the price has suddenly risen to 150,000 to 200,000 miles one-way. With this change, Alaska Mileage Plan is no longer the best way to book Emirates first class. According to One Mile at a Time, the new best way to book Emirates first class is with Japan Airlines (JAL) miles. And, the best way to get JAL miles is by transferring from Starwood Preferred Guest (SPG).

There are still plenty of great uses of Alaska Mileage Plan miles, but the sudden change underscores the value of transferable points programs over airline specific programs. Transferable points depreciate less than airline specific miles because you are not tied to a single program.

As found on my Transfer Partner Master List, SPG has the most transfer partners by far compared to the other major programs: Amex Membership Rewards, Chase Ultimate Rewards, Citi ThankYou Rewards, and Diners Club. Plus, SPG is the only transferable points program to offer a standard 25% bonus on transfers. With SPG, when you transfer 20,000 points to most airline programs, you’ll receive 25,000 miles.

The obvious ways of earning SPG points (technically called Starpoints) are by staying at Starwood properties and by putting spend on Starwood credit cards. However, Starwood base members earn only 2 points per dollar for stays, and the credit cards earn only 1 point per dollar for spend (or 2 points per dollar at Starwood properties). Those options are slow. Here are a number of ways to speed up your points earnings…

#1 Sign up for great credit card bonuses (once they reappear)

In March 2016, Amex offered 35,000 point signup bonuses for their personal and business SPG cards. At the time of this writing, the offers are down to the usual 25,000 points. If you’re interested in signing up for either or both of these cards I recommend waiting. As I wrote in the post “SPG 35K. Is this really the last chance?” I believe that Marriott’s acquisition of Starwood will drive Amex towards signing up as many new cardholders as they can. So, unless the Marriott deal falls through, I do expect to see the 35K offers return.

Keep in mind that Amex has a standard clause in their credit card applications: “Welcome bonus offer not available to applicants who have or have had this product.” And, they do enforce this rule. There are, though, two exceptions: 1) The personal and business cards are separate products. So, even if you’ve had the personal card before, you can still earn the bonus on the business card as long as you haven’t had the business card before; and 2) Some targeted offers do not have terms restricting the bonus offer. If you receive a targeted offer, look carefully for words “Welcome bonus offer not available to applicants who have or have had this product.” If those or similar words are not there then you can get the bonus by signing up again.

#2 Refer friends and family (earn up to 110,000 points per year)

If you’re currently an SPG cardholder, you can refer friends and earn 5,000 SPG points for each approved referral. You are limited to earning 55,000 SPG points this way per calendar year, per card. If you have both the personal and business SPG cards, then you can earn up to 110,000 points per calendar year by referring 11 friends to each card.

The best way to refer friends is to log into your Starwood account at SPG.com and look for a link like this:

You can also go to Amex’s Refer a Friend site (found here), but you might not see an option to refer the SPG business card through that link. I prefer the Starwood site itself because it always shows both options.

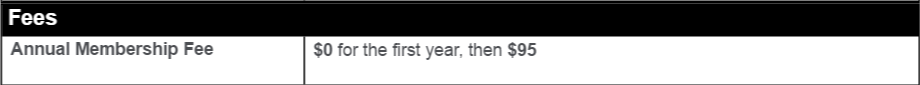

#3 Refer friends and family members who have had the card before

One problem with earning SPG points by referring friends (besides potentially losing friends due to being too pushy) is that you’re likely to run out of friends who have never had the card before. Luckily, the cards have benefits that can be worthwhile even if a person has had the card before. And, the first year is free:

As Will Run for Miles recently pointed out, a prior cardholder may want to sign up for the SPG business card in order to get free Sheraton lounge access for an upcoming stay. Lounge access alone can be quite valuable. Another reason a person may want to get these cards again is to reach elite status faster. Each card gives the cardholder 2 stays and 5 nights towards SPG elite status. If you have both cards, you get a total of 4 stays and 10 nights towards status. Signing up for a couple of cards is easier and cheaper than doing end of year mattress runs.

#4 Get elite status to increase your stay earnings

Obviously you can earn SPG points through paid stays at Starwood properties (except when booked through an online travel agency like Orbitz or Expedia). However, you can earn more points through stays as an elite member. Here are the earning rates:

- General Member: 2 points per dollar

- Gold or Platinum Member: 3 points per dollar

- Platinum Member with 75 elite nights: 4 points per dollar

There are two easy ways to get SPG Gold status:

- Sign up for an Amex Platinum card. Amex Platinum cards have many terrific benefits, one of which is free Starwood Gold status.

- Spend $30,000 in a calendar year on your SPG card.

And, as I mentioned above, being a cardmember can help get status if you’re short a few nights or stays. Each card gives you 2 stays and 5 nights towards elite status. If you have both cards (personal and business), you get a total of 4 stays and 10 nights.

#5 Plan Meetings

Meeting planners who sign up for SPG PRO will earn 1 point for every $3 of eligible room revenue you book for your clients (or more if you have elite status). And, even if you don’t qualify for SPG PRO, you can earn points. The SPG PRO FAQ states:

I am not a professional meeting planner but am responsible for booking and planning one or more meetings per year. Am I eligible to receive Starpoints for my meetings?

Yes, any SPG Member who books an Eligible Event with a SPG Participating Hotel is eligible to receive Starpoints for the event as outlined in the signed contract.

Click here to learn more about SPG PRO. Note that you can also earn elite credits through meeting planning.

#6 Earn with Starwood partners

Starwood lists a number of partners with which you can earn Starpoints (found here).

Examples:

- Delta

- Emirates

- Caesars Entertainment hotels

- Uber

- Audience Rewards (Broadway Tickets)

#7 Earn Marriott points (and hope for a temporary opportunity)

If the Marriott acquisition of Starwood goes through, then we can expect Marriott to eventually merge the two loyalty programs. Before that happens, there’s a reasonably good chance that Marriott will make it possible to move points back and forth between the programs. What is not yet known is what the transfer ratio will be. Everyone knows that SPG points are more valuable than Marriott points, but the exact multiplier is debatable. Even though there are good arguments that the ratio should be 1 to 3 or 1 to 4, my guess is that Marriott will settle on a 1 to 2 ratio, or worse. If I’m right about the 1 to 2 ratio, each SPG point will be convertible to 2 Marriott points. And, if they allow the conversion in reverse, it may be possible to convert 2 Marriott points to 1 Starpoint. That would be a great deal. Even a 3 to 1 conversion would be worth considering.

In case Marriott does allow transfers of Marriott points to SPG points in the post-merger-pre-loyalty-program-combined period, you can stock up on Marriott points:

- Sign up for Chase Marriott credit cards offering 80K bonus points or more.

- Stay at Marriott properties (most properties offer 10 points per dollar for stays).

I don’t recommend converting Ultimate Rewards points to Marriott points because Ultimate Rewards points are usually worth more than Marriott points when cashed out, redeemed for travel, or converted to higher value partners such as Hyatt, United, Southwest, etc.

#8 Buy points when SPG offers a 25% discount (but only if you have an immediate need for points)

Every now and then, Starwood offers a 25% discount on purchased points. Points usually cost 3.5 cents each to buy, but with a 25% discount the price goes down to 2.625 cents per point. Factoring in the 25% bonus for converting points to miles, that’s like buying miles for 2.1 cents each. That can be a good price, but I don’t recommend purchasing at this price unless you have a specific high value redemption in mind.

Starwood actually has the 25% discount deal going on right now until April 30 2016 (found here).

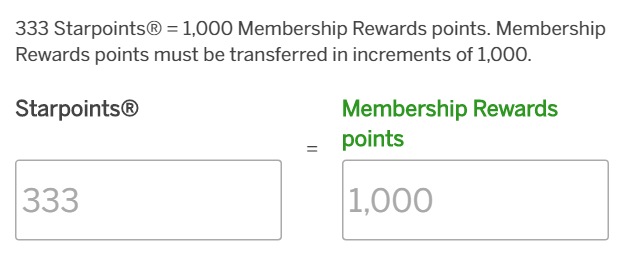

#9 Transfer from Membership Rewards when Amex offers a 50% transfer bonus

As found in my Transfer Partner Master List, Membership Rewards points transfer to Starwood at a rate of 3 to 1. 1000 Amex Membership Rewards points transfer to 333 SPG points:

In most cases, that’s a terrible deal. Most people would be far better off transferring Membership Rewards to airline partners at a 1 to 1 ratio. That said, Amex sometimes offers a 50% transfer bonus to SPG. When they do that, the transfer ratio improves to 2 to 1. That is 1000 Amex Membership Rewards points transfer to 500 SPG points. That’s still not a great deal, but it can be useful if you have specific needs that cannot be met with Membership Rewards points (such as point transfers to JAL or to Alaska Airlines).

#10 Transfer from Diners Club

If you’re one of the few people with a still active Diners Club card, you should be able to transfer Diners Club points to Starpoints. The transfer ratio is: 1250 Diners Club points transfer to 750 Starpoints (1.67 to 1). If you factor in SPG’s 25% bonus on transferring to miles, the conversion ratio improves to 1.33 to 1. Not great, but not horrible either. Before you make any such transfer, though, keep in mind that Diners Club has several decent 1 to 1 transfer partners such as Aeroplan, Alaska Airlines, and Korean Air.

The Marriott Risk

One potential risk in acquiring SPG points is that Marriott may massively devalue the program at some point in the future. I think that it is likely that Marriott will give warning before this happens, but there’s absolutely no guarantee. Personally, I’m willing to risk it, but if you’re less trusting consider using up or transferring your Starpoints within the next year or so.

[…] Additional options for earning SPG points which now convert 1 to 3 to Marriott Rewards, can be found here: Top 10 shortcuts to earning SPG points. […]

[…] for one of the best hotel loyalty programs to be methodically dismantled #sosad In the meantime, this is how you can get some SPG points before they eventually go away. Better have a plan to burn them […]

I would add #11 (YMMV) Try a Retention call! I called in Saturday March 26th on my Personal SPG card to see if I could get a retention bonus. I got transferred to the retention (or is that cancellation dept. ? ) and had a conversation where I talked about my concern with the annual fee going up to $95 and the fact that it appeared Marriott was buying Starwood out .. I told them I was not a Marriott fan. The agent said that he appreciated my long time relationship with American Express (30 + years) and offered me a $50 credit or 7000 bonus points. I accepted the bonus points since I value them at $0.022 each or a total of $154. Thanked him & hung up thinking to myself that was a short amount of time to invest (5-10 mins.) to get $154 in points.

However that is not the end of the story… a few hours later that same day I got an e-mail from American Express letting me know that they had cancelled my card & my wife’s AU card as I had requested. I am thinking UH-OH something went wrong on the AMEX customers service agent end to cause this to happen. For just a couple seconds I was quite upset & then a thought popped into my head.. how many Goodwill SPG points will I be able to get out of Amex for their mistake .. when life hands you Lemons make Lemonade 🙂 .

So I called in and started relaying my tale of woe… it took a couple of transfers & calls. They finally escalated to a specialist who called me back directly. They admitted that it was a MISTAKE on their end and they were “VERY SORRY” for the inconvenience. They told me due to the fact that it was Easter weekend that they could not resolve today due to some of the teams needing to intervene to resolve were not staffed this weekend (who knows if that was true or not???). Their specialist seemed genuinely sorry about the issue & promised it would be resolved by end of day Tuesday 3/29. He said that the SPG card account would be reactivated and new cards sent out & in my hand by EOD Tuesday. He again said he was so sorry and that he was immediately crediting my account with 10,000 SPG points to make up for the issue given since I am such a valued customer. I asked him about the original 7,000 points & he said those would still be coming and that these would be an additional 10,000 points (worth $220 to me) on top of the 7,000. I thanks him and told him I would be looking forward to Tuesday when the new activated cards were in my hand. I would say total time spent on the phone following up was around 60-70 mins. spread over a few hours.

So now we get to Tuesday 3/29 and guess what – “NO replacement cards showed up”. I called in again and was finally escalated to some sort of account specialist who said she see notes on my account that approved this SPG card account it to be reactivated but that it was not done yet. She said she could do that now & send me replacement cards (both mine and my wife as an AU) by EOD Friday 4/1. I think I rightfully pointed out …how they can guarantee this since I was promised something similar on Saturday and that did not happen.. She apologized for the mix-up but said she had already activated the acct & that the cards would be sent out. I noted that it would be almost 1 week since my wife & I could use these cards & earn SPG points… I asked what could be done. She said well we already gave you 10,000 goodwill points what else would I like? I said something to make up for the fact that I am unable to charge and this inability to use my Amex SPG cards was NOT due to anything I personally did. This was an Amex issue. She then offered to waive the $95.00 annual fee as well. I said ok – thanks but I will be watching the mail to ensure the replacement cards show up before EOD Friday 4/1. Total time on this call was around 30 minutes.

I decides to log on to my Amex account & did verify that the card had been reactivated & that a $95.00 fee credit was now showing on the acct. When I logged in on Sunday the SPG card acct. showed as cancelled. I also logged into my SPG account and was happy to see both the 7,000 & 10,000 points had posted.

So at is point I have received 7000 points on retention, 10,000 points goodwill and a $95 fee credit.

Fast forward to Friday April 1st. I got my April Fools surprise from Amex (no cards showed up!!). So Saturday morning I called in again and was finally transferred to a customer service specialist who did some digging & found that my original primary card was good to go & they did NOT need to send out a replacement. However my wife’s AU card was still cancelled & after trying to expedite the shipping he said all he could do is get it sent out via regular mail but that he had started the process so a new card in her name would be sent & could be activated once it was received. I did voice my frustration at the number of times I had to call , the fact that my wife & I were unable to charge for a full week and again not due to anything that was my fault. He apologized and offered 5000 goodwill points.. I took it and said I hope her new replacement card would show up this time. Probably 10-15 minutes total on the call.

Tuesday – April 5th, my wife’s AU card showed up & was activated. I confirmed my card still worked and did a couple charges. I also logged in to the SPG site & confirmed the 5000 good will points had posted.

So in Summary here is what my retention journey resulted in.

I spent about 75-100 mins. all in on the various calls this last week.

What I got in return

– 7,000 retention points (worth $154 to me)

-10,000 goodwill points (worth $220 to me)

– 5,000 goodwill points (worth $110 to me)

– $95 fee credit

Total value= $579 not bad for less than 2 hours work.. much better than what I get paid in my job.

Now good luck getting the same level of service (or lack of ) that I received during this period… YMMV .

P.S. I was amazed at the poor call center agents I had to deal with on these calls. They would do blind transfers, they could hardly speak intelligently in some cases. In this case I suspect that this specific situation it ended up to being a benefit to me based on my end result of $579 in retention value. However the quality of call center customer service I experienced from AMEX this last week was overall quite poor. Completely different when I have called in and talked to Chase and CITI earlier this year.

Great story Eric. Thanks for sharing!

If Marriott were to set the transfer ratio at 2:1 (2 Marriott points = 1 Starpoint), there’s no chance Marriott would let Marriott Reward members to transfer points to SPG (which can then be transferred to some of the high value airlines miles, such as JL/NH/KE/AS, etc). It that were to happen, Marriott would generate significant liability and losses in its frequent stay program.