During our recently-ended Million mile Madness challenge, I stayed at two different Ibis Styles properties: Ibis Styles Sepang KLIA and the Ibis Styles Ambassador Incheon Airport, both of which belong to the Accor Live Limitless loyalty scheme. As you can guess from the names, both of these are airport hotels — in fact, I chose these hotels primarily because of their very close proximity to the airports in question. I was very happy with both from a price/value/quality perspective, but regular readers might be surprised to know that I eschewed conventional wisdom (and indeed my own typical advice) and did not book these stays directly with Accor Live Limitless. I think my experience really illustrates why Accor is likely to continue facing headwind in breeding loyalty among American consumers.

What is Ibis Styles?

Accor Group is a hotel group based in France with more than 45 brands worldwide. Many readers are likely familiar with some of their brands, including Fairmont, Raffles, Sofitel, Banyan Tree, 21c Museum Hotels, Mövenpick, and Novotel, among many others. Accor Live Limitless, the loyalty program of the hotel group, is a Capital One transfer partner (2:1) and recently became a Bilt Rewards transfer partner (3:2). Accor points are worth a flat / consistent €0.02 (that’s two Euro cents) each.

Ibis is another Accor brand, though, confusingly (at least for those of us less familiar with Accor), Ibis gets broken down even further into three different Ibis brands Ibis, Ibis Styles, and Ibis budget. As a consumer (and a blogger who writes about hotel loyalty programs for a living), I wasn’t even aware that there were three different Ibis brands — never mind being able to tell you the difference between them.

Here’s what Wikipedia says about Ibis Styles:

In 2007, Accor relaunched All Seasons in France, making it a non-standardized economy brand focused on stylish designs…..

….In September 2011, Accor rebranded All Seasons into Ibis Styles, and Etap Hôtel into Ibis Budget, turning Ibis into the group’s economy megabrand. The “Sweet Bed” was rolled out throughout the Ibis brands, the first bed entirely designed by a hotel group. The mattresses, pillows and digital access were upgraded. The lobby was turned into a living space.

That all sounds about right — the beds were indeed comfortable and the hotel lobbies did seem like an inviting sort-of-stylish place to hang out. I’d say that the brand of which it reminded me the most is an Aloft (a Marriott-but-former-Starwood brand), which is to say that it looked “cool”, while being budget-friendly.

Two lovely hotels

Ibis Styles Ambassador Incheon Airport

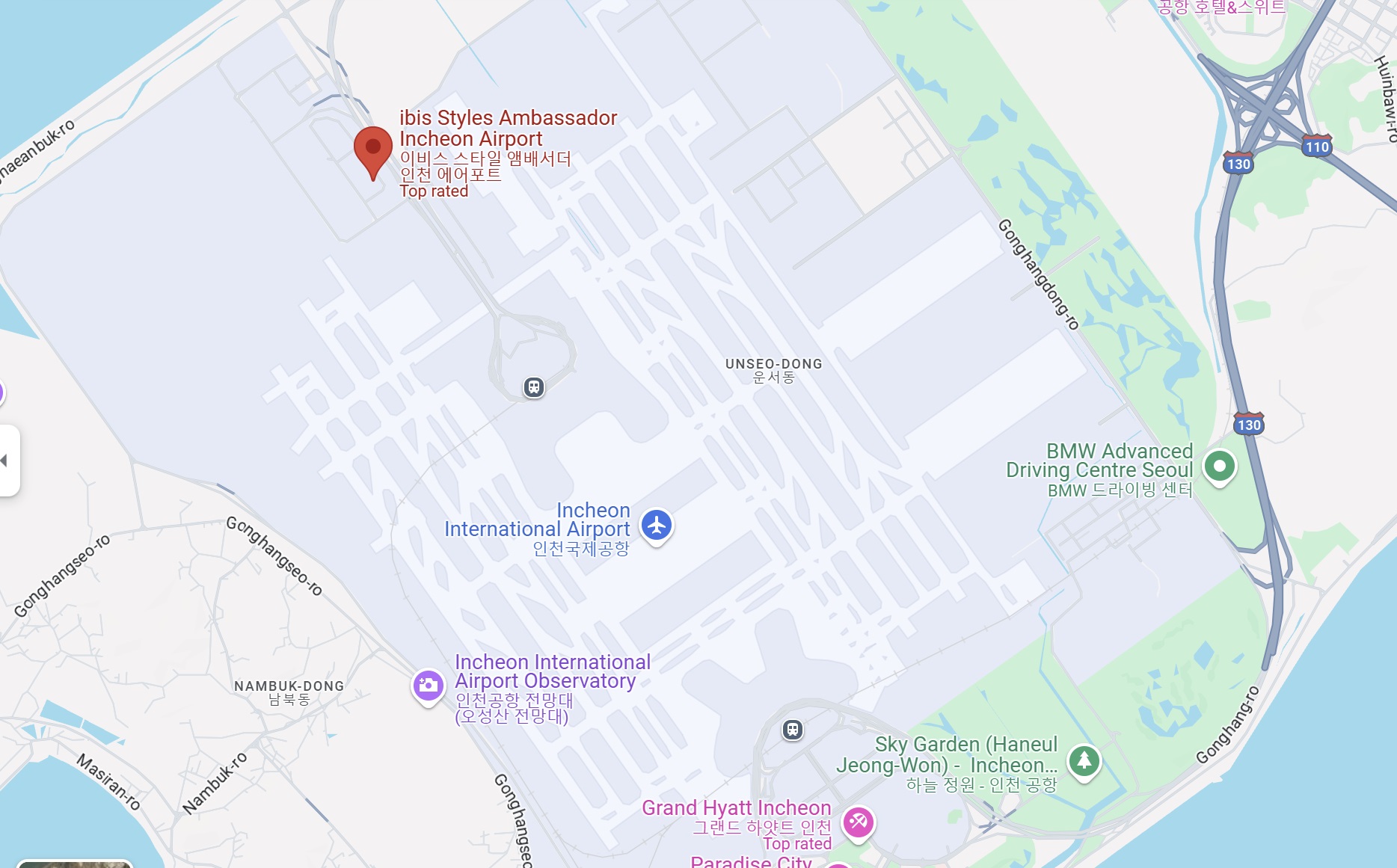

I want to emphasize that I primarily chose both of the Ibis Styles hotels at which I stayed based on proximity to the airports. The Ibis Styles Ambassador Incheon airport looks like you could walk out of Incheon airport and run into it.

Unfortunately, you can’t walk there (or at least Google Maps can’t show you how to do it). The hotel does have a free shuttle, but it only runs from 5am to 10:45pm — my flight arrived at 11pm and I departed the next morning at 8am, so I had to take a taxi to the hotel (but I took the free shuttle bus back to the airport in the morning). I noticed a recent online review noted having spent 30,000 won (about $21.52) to get a taxi to the hotel, but my taxi driver used the meter and it was 8,100 KRW — about $5.81.

I had initially booked a room at the Grand Hyatt Incheon using Hyatt points, but I cancelled and rebooked a cash rate at this Ibis Styles property instead since I was only going to be in the room for a few hours and this was significantly cheaper than the value of 12,000 Hyatt points. Once I arrived at the Ibis Styles Ambassador Incheon airport, I was reasonably impressed with my room. For the $99.74 all-in price with tax, I thought this was a perfectly good alternative for a short overnight airport stay.

Most importantly, the bed was indeed comfortable! I hadn’t read the Wikipedia description until I went to write this post after the trip was over, but I don’t find it hard to believe that this is something they’ve focused on, particularly since the firmness of mattresses in Asia isn’t always to my liking (making the comfort here stand out).

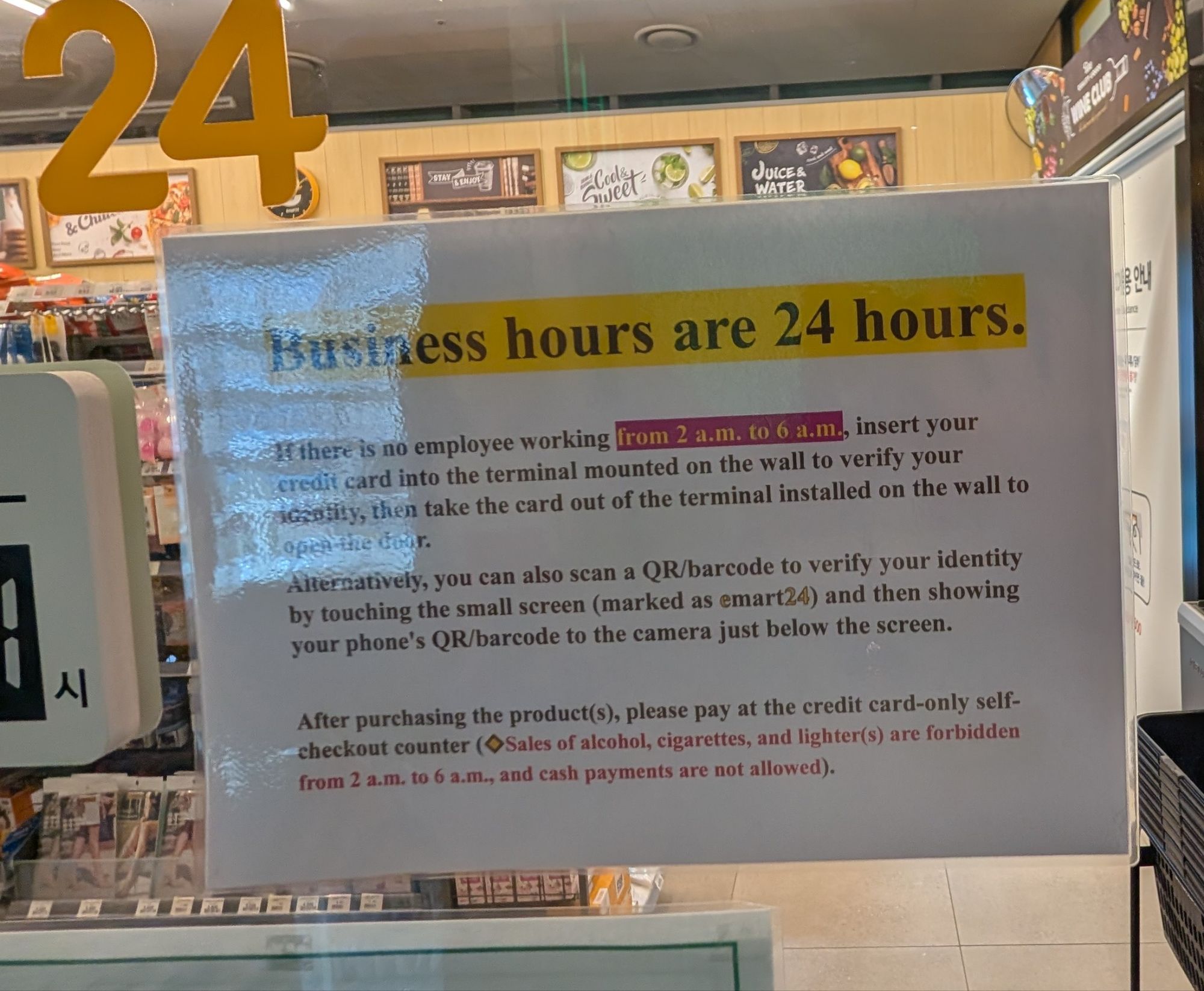

But that wasn’t the only thing I liked about the hotel! There was a 24hr convenience store in the lobby — which, if you’ve been traveling for days on end and barely know what day of the week it is no less time of day, is a very welcome sight.

Interestingly, it is not staffed 24hrs a day. During the overnight hours, you enter a credit card into a terminal to the left of the door to unlock the store. Then you simply go inside, pick out what you want, and use a self-checkout register.

This was essentially a full convenience store — they carried not just snacks and drinks, but also basic needs like chapstick, razors, simple beaty supplies (including stuff like hairclips and stockings that I didn’t need, but I know my wife has needed while traveling more than once before!), etc. There was a microwave to heat up cups of noodles. It was a nice convenience to have!

I didn’t take pictures of the lobby unfortunately, but near the elevators they had a Playmobil display with some giant figures, an enclosed display, and a table with some Playmobil toys that kids could presumably play with. I can really appreciate that in an airport hotel where kids might be jetlagged and up at odd hours.

I didn’t hang around long enough to see what breakfast looked like since I had an 8am flight, but my room was clean, the bed was very comfortable, and the value was excellent as compared to either spending more money and time to get downtown and stay downtown or stay at the also-nearby Grand Hyatt Incheon.

Ibis Styles Sepand KLIA

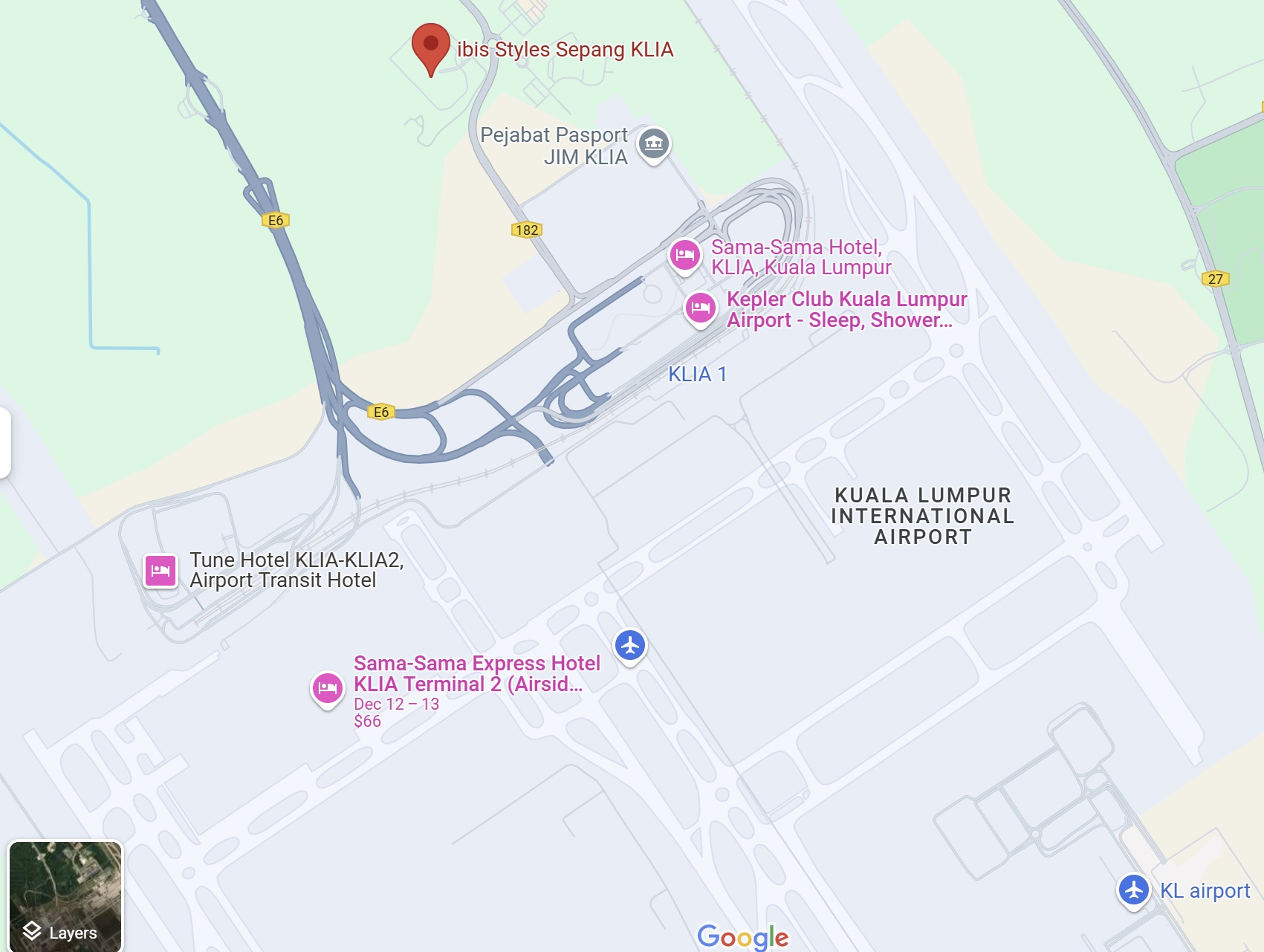

I spent a very brief night at the Ibis Styes Sepang KLIA during my layover between my KLM flight from Jakarta to Kuala Lumpur (which landed around 11pm) and my 8am departure on Xiamen airlines to Xiamen. Again, I selected this hotel for its proximity to the airport.

Since I’m mentioning proximity, I have to note that as you can see on the map, there are a couple of hotel options right within Kuala Lumpur International airport. My family stayed at the Sama-Sama Express Hotel KILA Terminal 2 (which is airside by gate C5) over the summer. While I said it hurt a little to spend about the cost of a luxury hotel in Kuala Lumpur for a very simple transit hotel, it was hard to beat the convenience and it was clean and comfortable enough. For convenience, I would have stayed there again on this trip since I was both arriving at and departing from Terminal 2, but the Sama-Sama Express hotel KLIA requires you to show your boarding pass for your outbound flight to check in to the hotel (or at least that’s what the rules say on the hotel website). I was unable to check in online for my outbound flight on Xiamen and it wasn’t clear whether they would have someone at a transit desk to help check me in airside, so I wouldn’t have a boarding pass. Rather than make a reservation and hope that I could get it worked out, I booked the Ibis hotel.

Also worth a mention is the Sama-Sama Hotel, not to be confused with the Sama-Sama Express hotel. The Sama-Sama hotel is landside, but looks to be immediately outside the airport (you can walk between the terminal and hotel). However, I couldn’t justify the cash rate. The total rate was nearly $200. My “Silver” status with Expedia (thanks to having booked a few things through them this year) gave me a $40 discount, but even still I couldn’t justify $160 with what I expected was a comfortable bed just a few minutes away for far less (especially given the competitive nature of the trip!).

I arrived at the Ibis Styles Sepang KLIA after midnight and after checking in, the bellman started giving me a tour, but I explained that I was heading back to the airport around 5:30am, so I wouldn’t be enjoying any of the facilities and he obliged my request to get straight to the room. We passed the swimming pool on the way, which is obviously hard to see in my midnight photo, but it actually looked more like a resort than an airport hotel.

Furnishings in the room were once again simple, but very clean and well maintained. And again, the bed was plush and comfortable.

Again, this wasn’t a luxury stay by any measure, but given an arrival at the hotel around midnight and the need to be back at the airport around 6am, I didn’t need luxury — I needed a clean bed, a desk from which to type up my journal update, and a power outlet to charge up my devices while I got ~2hrs of sleep. It served that purpose.

At $86.98 all-in, the price was right. I spent about another $18 round trip for a Grab (the Asian equivalent of Uber) from and back to the airport (I picked a more expensive ride type for a faster pick up).

Why I didn’t book through ALL (Accor Live Limitless)

Most hotel chains want to incentivize guests to book directly through the hotel chain. That’s why things like elite credit, hotel points, and elite benefits are usually subject to booking direct. If you book through a third-party online travel agency (like Expedia, Priceline, etc), you won’t earn those stay credits/points and in most cases you won’t be entitled to elite benefits.

And that’s why you’ve probably heard Frequent Miler and many other blogs mention for years how rarely we book hotels via online travel agencies since we usually want the benefits of our elite status. It helps that major US chains like Hilton, Marriott and IHG all offer relatively easy credit card pathways to status.

Accor, being based in France, doesn’t have a similar shortcut to status for Americans. That’s reasonable enough, but it is a first barrier to entry in engaging with the program in comparison to simply getting the right credit card to get Hilton Gold status (for instance), getting free breakfast at properties outside the United States (which is where Accor’s footprint is competitive).

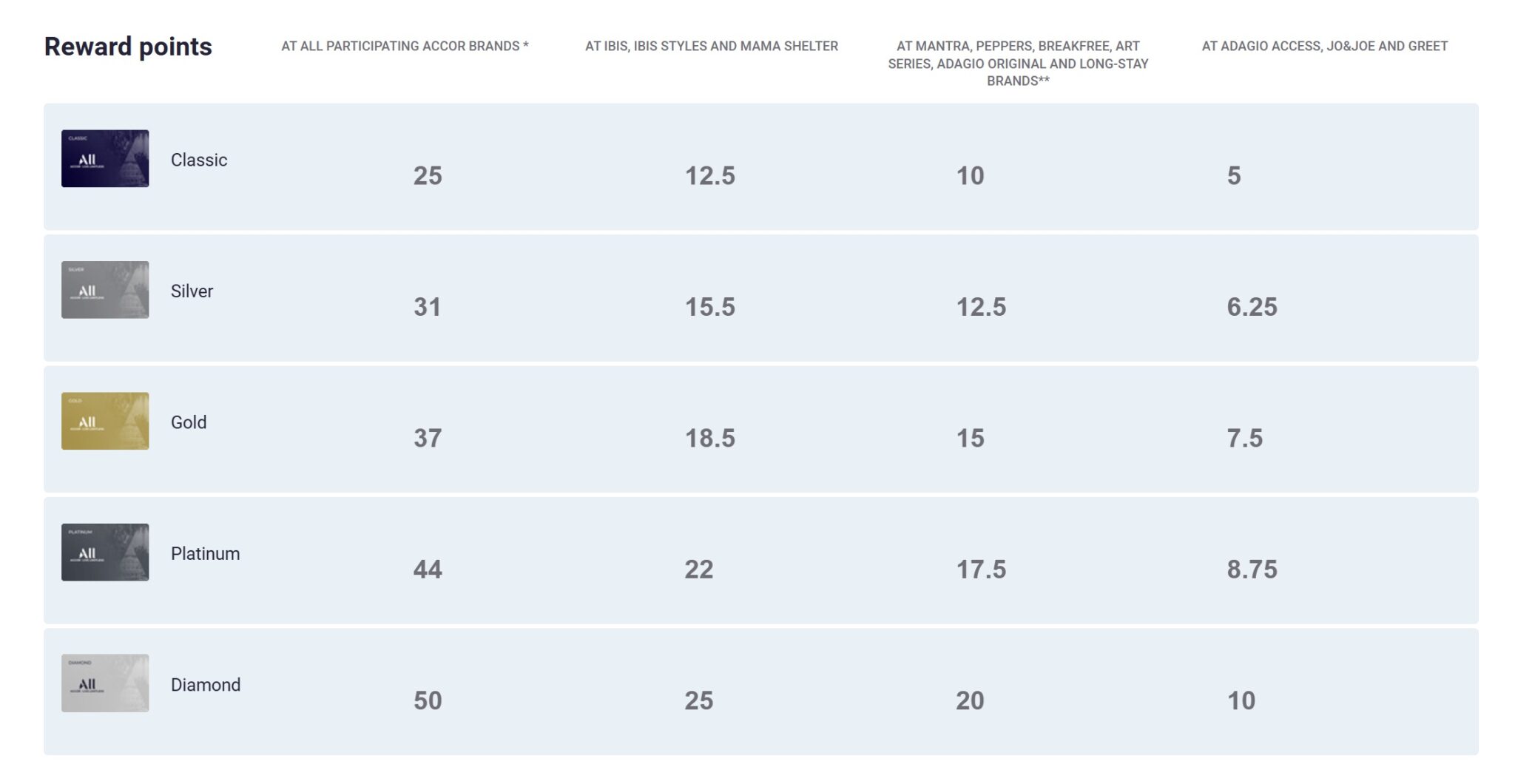

But perhaps bigger than that is the limited return on spend via the program itself. Earnings at Accor properties vary by brand — and they aren’t easy to decipher. Here was the rewards points earning rates per 10 Euro spent.

As you can see, as a member with “Classic” status (i.e. no status) with Accor, I would earn 12.5 points per 10 Euro spent at Ibis Styles properties like the ones where I stayed. Translated into more typical loyalty program math, that’s 1.25 points per 1 Euro spent.

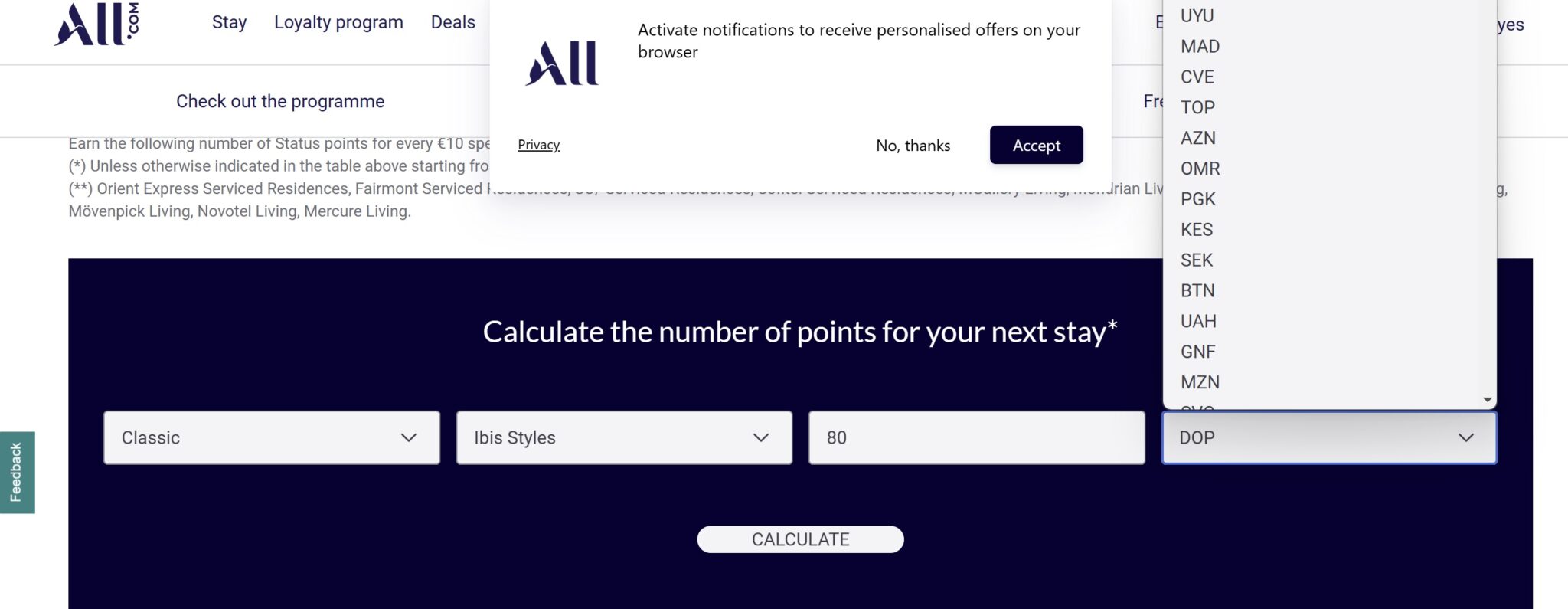

Since it isn’t necessarily simple to determine earnings, Accor actually has to provide a calculator for you to be able to figure out how many points you’ll earn (you can find it on this page). You have to choose your status, the brand, the amount spent before tax, and the currency. Absolutely maddeningly, the currency drop-down is not alphabetized. What is this madness?!??

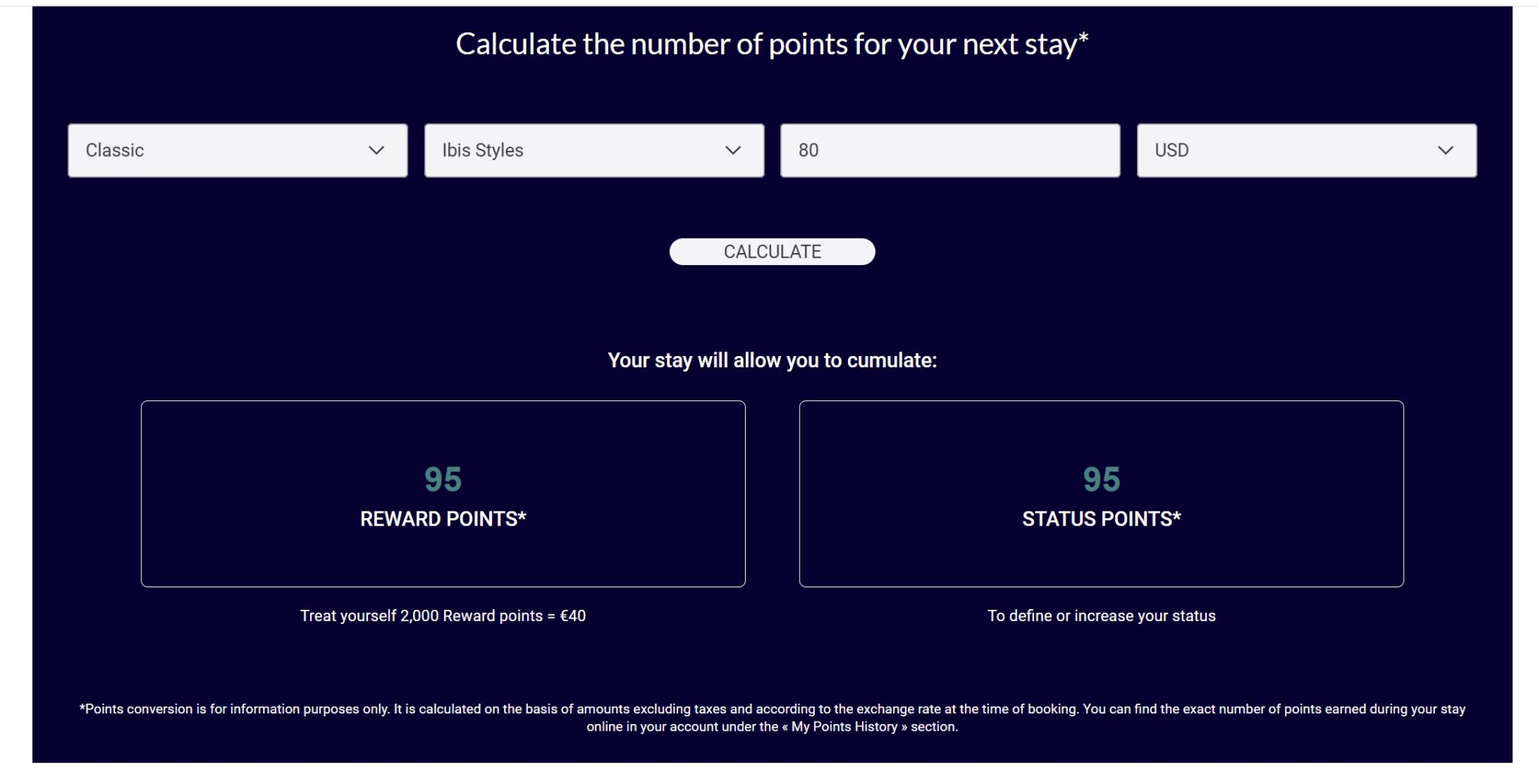

Once I finally found USD in the drop-down and calculated my would-be earnings on the ~$80 pre-tax rate of the Ibis Styles Sepang KLIA, I found that I could have earned 95 points if I had booked through Accor.

Accor points are worth a flat 2 Euro cents per point, meaning that my total return if booking through Accor would have been €1.90 — exactly $2 based on the exchange rate at the time of writing (or a 2.5% return on spend as compared to the cash rate).

You might think that I could save money as a member booking through Accor Live Limitless, but ironically, not only on my dates (and last-minute booking in the case of the Sepang KLIA property), but on quite a few that I’ve checked, the Accor site isn’t cheaper or isn’t measurably cheaper than booking through most other online travel agencies. My sample size is just these two hotels, so it is certainly worth shopping around on that and comparing prices, but I was surprised to find that there wasn’t an advantage of booking through my Accor Live Limitless account.

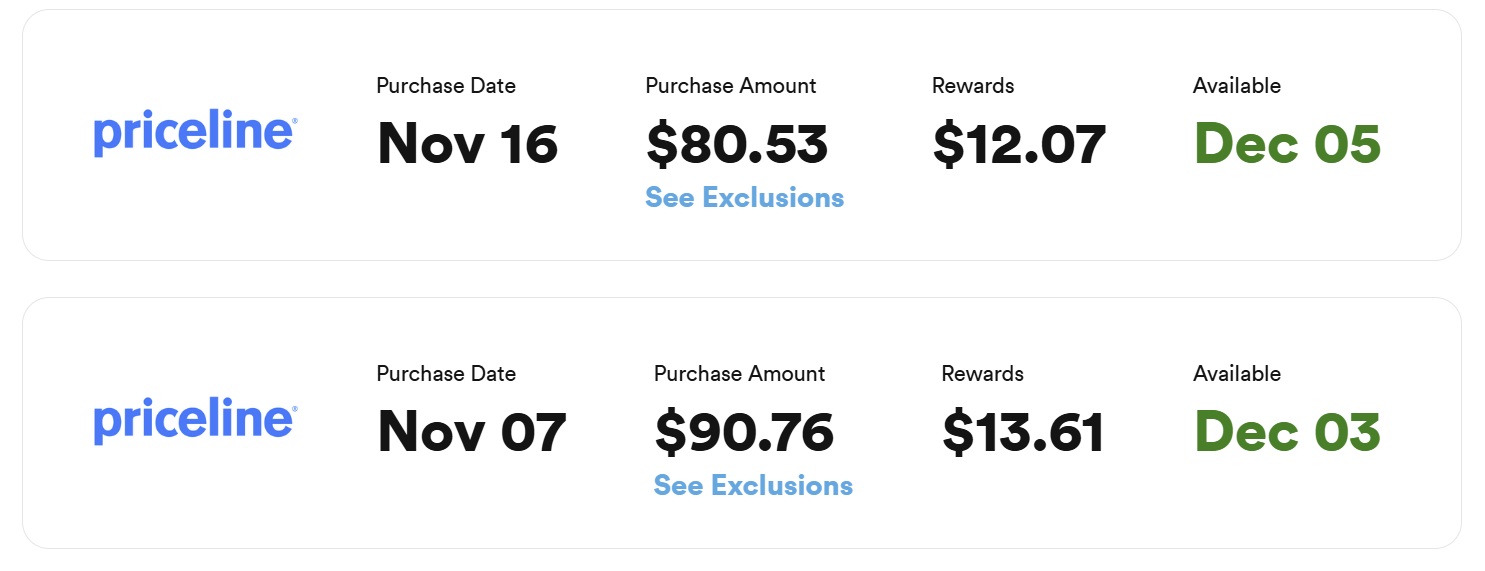

Quite the opposite was true. I continue to receive good offers from Capital One Shopping (the public shopping portal, no Capital One card required) for a wide range of sites, including Priceline. As it so happened, during the challenge, I had an offer in my Capital One Shopping account for 15% back on a hotel without a coupon code at Priceline. I therefore booked both of my stays via Priceline for 15% back — and both tracked as expected (based on these before-taxes prices).

As you can see, rather than earning $2 worth of Accor points on the $80.53 pre-tax rate at the Ibis Styles Sepgang KLIA, I earned $12.07 in Capital One Shopping Rewards. Now that Walmart is back as a redemption, that’s pretty close to cash value to me since we do a fair amount of grocery shopping at Walmart.

And that’s my core problem with Accor: the earning rates aren’t competitive. At 2.5% back, that pales in comparison to return on spend from US-based loyalty programs. See Greg’s post titled Which hotel loyalty program is most rewarding on paid stays? and you’ll find that without status, return on spend is typically in the 7-10% range and with easy credit card elite status, 13-20% back is easy breezy with US-based loyalty programs — and that’s before promotions!

While Ibis admittedly isn’t at the “standard” earn rate, that “standard” earn rate is still only 5% back — and there are multiple brands that earn even less than Ibis stays.

That makes it hard to consider booking direct as even absent a good targeted Capital One Shopping rate for Priceline (I’ve since been targeted for 24.5% back recently), standard portal rates for third-party booking sites like Hotels.com or Priceline will frequently outpace what you can earn from Accor — and that’s to say nothing of booking via a credit card rewards platform like Capital One to earn 10x miles with the right card.

I thought that perhaps there would be a current hotel promo — perhaps a chance to stack a couple thousand bonus points per stay. As a point of comparison, I earned a bonus 2,500 points on each of my one-night Hilton stays during this trip and additionally stacked an extra 7,500 points on one night for enrolling in Hilton for Business and booking the Hilton for Business rate — and that was on top of the standard Hilton earnings for the stays! Alas, I couldn’t find any similar promotions via Accor.

In short, I would certainly recommend the Ibis properties where I stayed and I would certainly consider an Ibis Styles in the future, but I probably wouldn’t book it directly via Accor. Even if I were interested in elite status, I would have to question at what cost that would make sense. If I gave up the opportunity for the much-higher earnings possible via shopping portals or credit card rewards portals in order to credit stays to Accor, elite status would start to look pretty expensive.

Bottom line

I recently had two perfectly good airport hotel stays at Ibis Styles properties. While this is a brand with which I wasn’t previously familiar, I was very pleasantly surprised by the quality, comfort, and setup of the hotels. However, Accor’s loyalty program has to find a way to be more rewarding if it wants to encourage direct booking rather than paying commissions to online travel agencies — because as things stand, you might stand to be much better-rewarded when booking away from the hotel group instead of directly.

My curiosity about this program, which I’ve yet to try, is not about booking methods for cash stays. Rather, I’m wondering if transferring points to them during transfer bonuses provides good value lodging at their fixed cpp, relative to other hotel options. And if redeeming points with them is easy with their strange system I’ve read about of paying with points at check-out.

First rule of Accor All Transfer Bonuses is to not talk about Accor All Transfer Bonuses. In all honesty, transferring from Citi during the last bonus was a highlight of my 2024 points year (i xfered a LOT). It’s a really quirky program so be prepared to pull out your calculator and show your spreadsheet at checkout as you try to sort out the points (I am completely serious here, and best to do it way before checkout), but the value is there! Best of all, unlike most programs where the cheapest hotels start at 20k ($100+) points, its pretty easy in Asia and South America and Europe to find some hotels under 3000pts/nt ($50-$80 range). So you can get a ton of nights. Tack on the Accor Plus membership which fasttracks you to top tier, and it can be amazing. Accor IT sucks and I seem to get full points credit now and again for stays which makes it even better. Fingers crossed for another Citi xfer bonus asap!

Rotten transfer rate and rotten redemption rate.

Good to hear you point out the problems with Accor and ALL. I could not get points at the Tallinn Movenpick after booking via Hotelslash. It may because of the booking method but what was frustrating was that nobody at the hotel had a clue why I could not get the points. I was evden promised them several times! ALL is now off my radar — like yours.

Of course you did not get credit. You used a third-party booking platform. It would be the same with Hilton, Hyatt, Marriott, etc.

Of course you can get credit. For example, Hilton gives credit when you pay for items at the hotel, regardless of who you booked through. You have been getting your advice from someone who is pig-ignorant.

But, not the booking itself. If you meant incidentals, it was not clear in your statement. If you look in the ALL terms and conditions, certain incidentals charged to your room will only earn points if you use a Mastercard to pay for them. Seriously.

Read the question. seriously.

Nick, when choosing your hotel at KLIA, I’m curious if you considered Tune Hotel? I’ve never stayed there but I’ve long been intrigued by the brand, which is owned by AirAsia.

Nick the Accor program is for FREQUENT stayers. The rewards for loyalty are exactly what a frequent stayer wants. Unlike American chains who trip over themselves to get “decent” rewards to the newbie, Accor has a simple strategy: loyalty pays and they demand you PROVE your loyalty first. I stay at MGallery and Sofitel in upgraded to suites at 25-30% off of Expedia prices for entry level rooms. With all due respect, YOU are not the customer ALL wants.

I have spent 90 nights in hotels this year, with two more nights coming this weekend which probably won’t be my last two this year. I’m not talking elite nights from credit card spend or holding a credit card, I’m talking about nights in hotel beds.

I’m not sure how Accor is providing what a frequent stayer wants by offering lower value in return for spend than competitors offer? Even if I spent all 90 nights at Accor, I would be earning at best 10% back as a top-tier elite in the program. That’s easily giving up an additional 10% or more that I could have as a top tier elite in almost any us-based program even before considering promotions, milestone rewards, etc.

I don’t understand how you mean that loyalty pays with Accor – doesn’t it cost you to be loyal because you earn less than you would with any other major hotel program? Are there major guaranteed elite benefits I’m missing?

I’m not arguing against their hotels. I would certainly stay again! But I don’t have enough incentive to look through Accor.

Nick I have gold status that I got FOR FREE through the ALL subscription plan. (see https://all.accor.com/a/en/loyalty-program/subscription-program/all-signature.html) My last stay I paid $200 (all with points) for a suite at the Ink MGallery in Amsterdam with free breakfast for 2, 2 included bar drinks, and a $100 meal credit. AND I get KLM miles. I have done similar with the Sofitel at Heathrow Terminal 5. sorry but at the level of the occasional traveler (as seen by Accor not your overall travel) you are right but at the level of the actual frequent stayer you are very wrong.

Nick, you are correct regarding the percent return on cash stays. But, one thing some might add to the calculation is the value of guaranteed suite upgrades. ALL has a formula for earning these. Depending, it might move the needle enough for some.

As a follow-up, the value of the guaranteed suite upgrades alone might reasonably be a 20 to 30 percent reward rate. That’s where the action is. Combined, we’re talking 30 to 40 percent reward rate (excluding credit card points).

You can book Accor direct through Rakuten, and link your Accor account to a frequent flyer program to triple dip ALL, Rakuten/MR, & Airline miles. Depending on the Rakuten payout it may get closer to your numbers.

Super awesome tip, thanks! Any idea if you get Rakuten payout when paying with points?

The terms and conditions will answer your question.

Terms and conditions are optional for Accor! Keep trying and keep learning as there are lots of loopholes 🙂