NOTICE: This post references card features that have changed, expired, or are not currently available

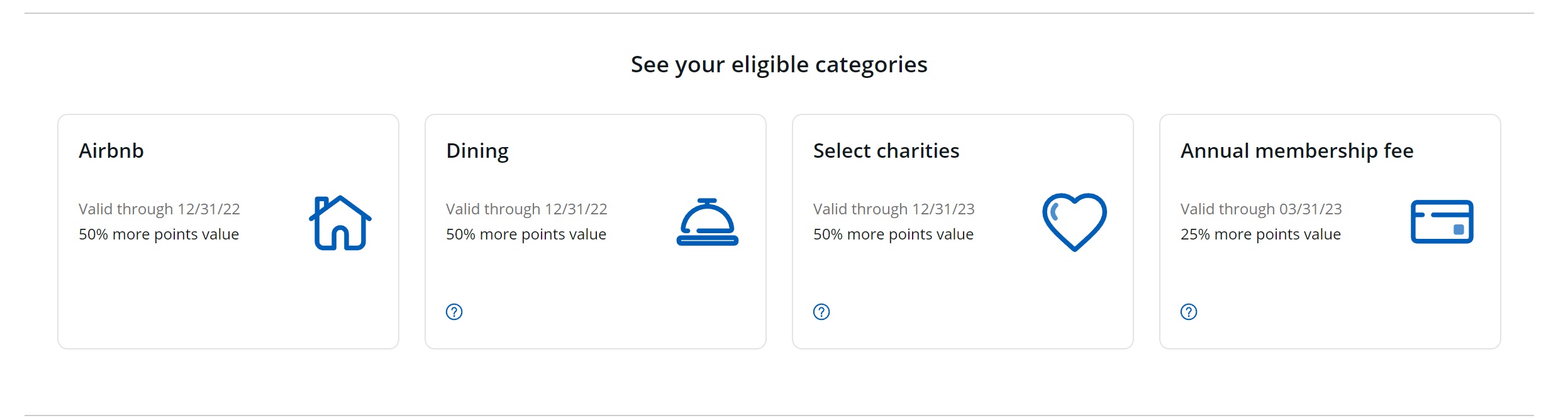

Chase Pay Yourself Back has been an extremely popular way to redeem Chase Ultimate Rewards points over the past couple of years. For much of 2022, Chase Sapphire Reserve cardholders have had the ability to “pay yourself back” with a 50% bonus in the value of points when redeemed against qualifying charges for dining and Airbnb purchases, charity donations, and against your annual fee. In other words, it has been possible to redeem Chase Ultimate Rewards points at a value of 1.5c per point toward qualifying charges in those categories. The 50% bonuses on Dining and Airbnb redemptions are scheduled to last through 12/31/22.

While there has been no official announcement, it appears that Pay Yourself Back will bring in Grocery as an eligible category (or indeed already has), but at just a 25% bonus. They’ve also reduced the bonus when applying points toward the annual fee. Is this a signal of negative changes to come, or will Chase have mixed redemption rates for different categories of charges?

Doctor of Credit reported this morning on rumors from Reddit that changes appear to be slowly rolling out to Pay Yourself Back. We checked my wife’s Sapphire Reserve account and at first glance I only noticed one major change: the option to redeem points toward the card’s annual fee has been extended through 3/31/23 and reduced to a 25% bonus (1.25c per point).

I was disappointed to see that decrease in value and it seemed to lend some credibility to the Reddit rumors. On the other hand, I did not see any mention of Grocery being an eligible category for Chase Pay Yourself Back.

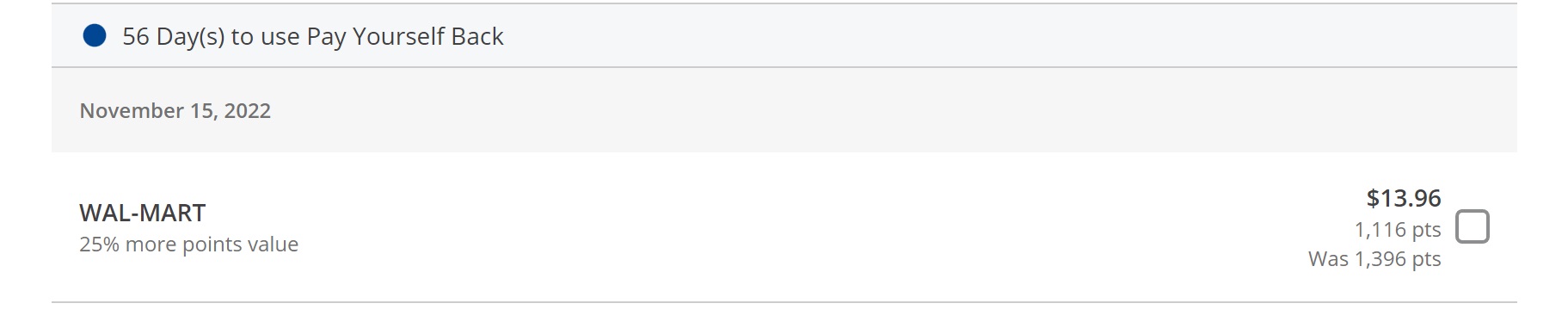

I then read through comments about the changes at Doctor of Credit and I realized that people were reportedly noticing that grocery charges they had put on their Sapphire Reserve card were showing up as eligible charges for reimbursement. That’s notable first because Chase has not publicly advertised grocery as a qualifying category, but also because they are not eligible for the customary 50% bump in value that we have come to expect with Pay Yourself Back on the Sapphire Reserve but rather with only a 25% bonus.

I was able to confirm this for myself. My local Walmart has always coded as grocery for the purpose of short-term Chase grocery bonuses (like targeted Chase spending bonuses). Sure enough, we had a small Walmart charge a few months ago on the Sapphire Reserve that appears under charges eligible for reimbursement with a 25% bonus on the value of points redeemed (1.25c per point).

That purchase is eligible for reimbursement through the middle of February (90 days from the date of purchase as is the case with Pay Yourself Back), but the redemption rate yields less value than Pay Yourself Back historically has.

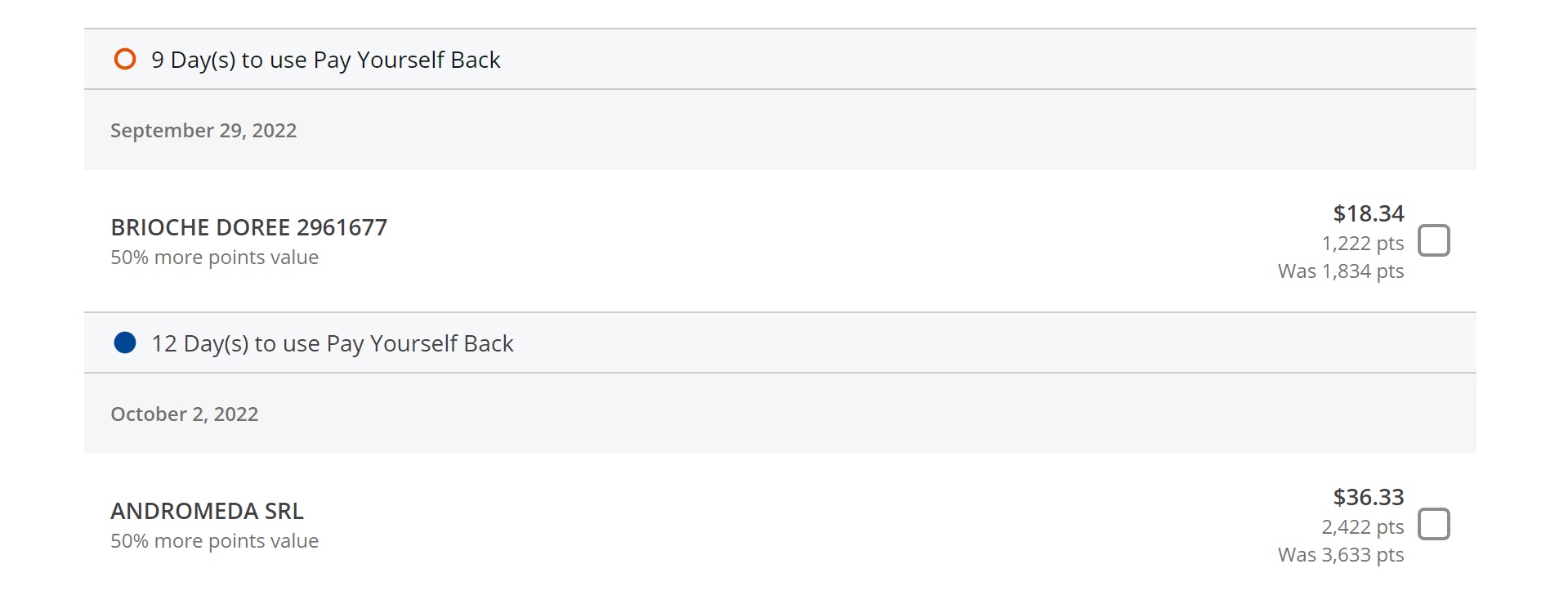

Contrast that with the 50% bonus for eligible restaurant charges over the past 90 days, which yields of a value of 1.5c per point.

It is important to reiterate that there has been no official announcement of grocery as an eligible category, nor has Chase announced a change in the bonus bump given to Pay Yourself Back redemptions. However, they have historically been relatively quiet about changes to Pay Yourself Back options until just before current options are due to expire.

At this point, speculation is that the drop to a 25% bonus will likely apply across whichever categories are eligible for Pay Yourself Back in the new year, but we certainly don’t know what will be universally true. I expect that we may see either an end to the eligibility of dining and/or Airbnb charges as scheduled on 12/31 or see a reduction in value. With redemptions against the annual fee already dropped to a 25% bonus and grocery charges already showing up with a 25% bonus, I expect that we’ll likely see most eligible categories only yield a 25% bonus in the new year. That said, it is also possible that we’ll simply see mixed redemption rates by category, with some categories beyond charity still eligible for a 50% bonus.

It’s worth mentioning that the charity category is scheduled to carry a 50% bonus through the end of 2023, so Pay Yourself Back will likely still be billed as a way to get “up to 50% more value” for your points. Hopefully that will be true in other categories as well.

Overall, this is ominous news for Pay Yourself Back enthusiasts. In our recent podcast discussion of the value of points and “cost” of redemptions, I mentioned that a reader’s comment made me realize that I probably should have been redeeming against restaurant charges all along because, in hindsight, transferring 20,000 points to Hyatt for a hotel feels like it costs me $300 since those points could have otherwise put $300 back in my pocket via Pay Yourself Back. I’m not usually one to spend $300 per night on a hotel room when paying cash and, although Greg and some readers will vehemently disagree with me, it feels like I’m doing precisely that when I’m using 20K points that could have otherwise erased $300 in charges that I’ve made — I essentially got the hotel for “free” instead of $300 cash in my pocket, making it feel significantly less free. I do enjoy Hyatt redemptions, but this bump in value has been making me think about the “cost” of those redemptions a bit more.

Anyway, if you’re looking to redeem points at a value of 1.5c per point with your Chase Sapphire Reserve, the writing may be on the wall for the 50% bonus on redemptions. We don’t know that for sure, but if you had it in mind to erase dining or Airbnb charges, you may want to do that sooner rather than later.

What about when you use Sapphire Reserve points to book a hotel and pay with points? Is that 1.5 going to 1.25?

I used to do some PYB but have just been getting such good value on Hyatts lately.

Chase = Worst bank ever, even beating Wells Fargo for this dubious honor. If you like being a sap, bank at Chase.

With all the positive changes made to the other UR cards, it was really hard to justify keeping my Sapphire Reserve. But I did specifically because I reimburse myself for AirBnBs at 1.5. If they reduce this to 25%, it is now like the Preferred. How does Chase justify anyone keeping this card?

Cutting bonus for redeeming for annual fee is just rude, it’s not like Chase has to pay anyone for it.

And they could’ve just let it expire at the end of the year and set new terms for the new year like with the Airbnb and dining. Instead they changed it before it expired.

I have enough points at Hyatt and United. I will be cashing out points.

Chase is also treating Walmart / Paypal Bill pay as cash advance in 2023, mentioned among many things in the letter i received today

Wait, what!?!

I’m mourning this loss deeply.

Could book a Kimpton over a Hyatt, then eat/drink for free.

I’m amazed at how few knew the power of 1.5 PYB Dining.

Dwelling on the whole cash back opportunity cost aspect takes a lot of fun out of the game for me, but it’s hard not to.

As much as I love business class flights, when I think about the value of the points I’m using for two tickets each way I often find myself wondering if I’d rather just have the $2,000 or whatever. Before all the devaluations it was an easy decision, but at this point I have to really work to justify it. Usually I end up convincing myself that it’s like an extra day of vacation and day of work since I don’t need so much time to recover…but that’s a stretch.

not happy with changes as i liquidate all my UR points.

@Nick Reyes – your above thoughts on NOT transferring 25000 UR to hyatt for a room, as it assigns a cash value of $375 for it, is the exact reason i dont do these transfers unlike am willing to spend that much in cash.

i know i am losing out on getting rooms like the GHK in kauai, but i cant justify spending that much for a hotel room.

Effectively an immediate $33.33 annual fee increase and retroactively for those who hadn’t offset it yet. Can we get a screenshot of the previous terms? Wasn’t it supposed to expire 12/31/22?

Any changes to Preferred?

Looked in my CSP today. I see two grocery purchases (online grocery specifically) within the last 90 days that I have the option to redeem for 1 cent per point (lame).

So it appears CSR will be 1.25 x for grocery and CSP will be 1.00 x for grocery PYB. (which is completely pointless, since you can just cash out at 1 CPP)

How do you use your points to off set the AF?

This is literally what the article is about??

Please point me to HOW you use your points to pay for the AF? It says you can but it doesn’t say HOW to do it.

You go the UR site, select the “pay yourself back” option, and it should show up as one of the allowed charges to get reimbursed for.

Ah.. VERY helpful.

Thank you

I hope they add rental car or some spend in travel outside of Airbnb!