NOTICE: This post references card features that have changed, expired, or are not currently available

| Sorry, this deal is no longer available. Do you want to be alerted about new deals as they’re published? Click here to subscribe to Frequent Miler's Instant Posts by email. |

|---|

Update: We previously posted this about a month ago in January 2020. Last week, Doctor of Credit reported new targeted deposit bonuses and then I received another big deposit bonus offer. I don’t think my new offer is worth it, but I figured it was worth reporting for readers who are tracking offers like these. In the previous post (re-published below), my offer was for 20 free shares of stock after a $10K deposit. I made that deposit and successfully received those stocks (20 shares of Vonage, which was trading at $9.02 per share the day I received it and has been as high as $10.70 since I received it and closed just under $10 today). At the end of last week, I received a new offer for an additional 25 shares of stock after I make net deposits of $25K by 3/13/20 and leave the money deposited until at least 4/17/30 (35 days). That’s not worth it to me, but I thought it was worth reporting that Webull is continuing to target those who have made large deposits with bigger offers. See more about my previous offers (along with updates as to what I got for free stocks) and the new account offer below.

WeBull is an online app-based brokerage similar to Robinhood and SoFi Investing. Recently, Stephen Pepper sent me an email to let me know about a promotion to earn 3 free stocks for depositing $500 (I later saw Doctor of Credit report that offer). I signed up for an account before we realized that his promotion was targeted. We’ve since seen a number of different targeted promotions ranging from two free stocks up to an offer I just received on my new account for 20 free stocks with a big deposit. Read on for an overview and how you might get targeted for the bonus you want.

The Deal

- Webull is sending out targeted email offers to invest cash and get bonus stocks (and in some cases sends such offers within a few days of opening a new account). New accounts may or may not be targeted via email, so there’s no guarantee new users will receive these (though as shown below new users can get 2 free stocks pretty easily). Bonus offers reported so far include:

- Deposit $500, get 3 free stocks (worth $9-$1,000 each)

- Deposit $1,000 get 4 free stocks (worth $9-$1,000 each) (H/T: Miles to Memories)

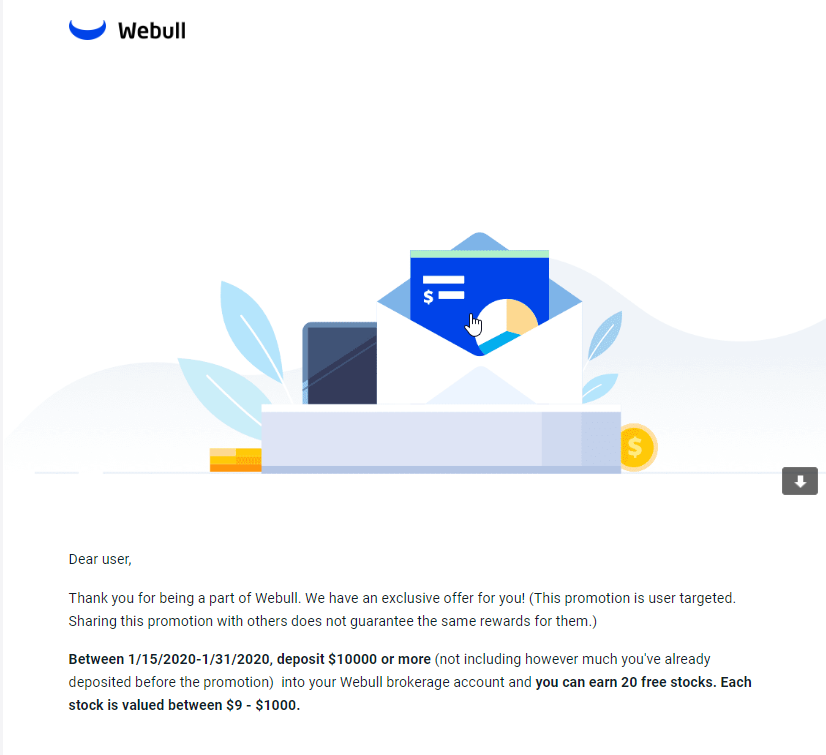

- Deposit $10,000 get 20 free stocks (worth $9-$1,000 each)

- Deposit $25,000, get 25 free stocks (worth $9-$1,000 each)

- Again, the above are targeted. All new users can currently get 2 free stocks as follows:

- 1 free stock (worth $2.50 to $250) for successfully opening a brokerage account within 24 hours of registration (Update: I received a stock worth $4. The company eventually went through a reserve split and I got paid out about $4.16 cash)

- 1 free stock (worth $12-$1400) when you deposit any amount by 3/31/20 (I received GE, valued around $11.81 at the time)

- Additionally, if you refer friends who open accounts this month, you will receive 2 free stocks (worth $12-$1400 each) for each friend who successfully opens an account (I received a mix of only two stocks for those I referred: ISBC (worth $11.78-$12.37 at the times shares were awarded) and GE (worth between $11.44-$11.81 at the times the shares were awarded. Most of the shares I received were worth under the $12 minimum at the time they were awarded, though both stocks have fluctuated over and under $12 in the time since)

- If you are new to Webull, consider signing up with one of our referral links:

Key Details

- All users get 1 free stock upon successfully opening an account within 24 hours of starting the process and then 1 free stock when depositing any amount. Further bonuses are targeted.

- There are some restrictions on the free stock offers. See more below and in the terms of any targeted offer you receive.

- Free stock will credit in about 5 trading days.

- Offer open to U.S. residents currently living in the U.S. who are at least 18 years of age with a valid SSN.

- Expect you could get a 1099 if the free stock turns out to be valuable

Quick Thoughts

WeBull is giving everyone a chance to get two free stocks: one when you successfully open a brokerage account and one when you deposit any amount between (1 and 2). I can’t guarantee that anyone will be targeted for anything beyond that. One minor disappointment I’ve had is that the “free” stocks I’ve gotten for referring others were worth a bit less than Webull’s stated range, though they weren’t terribly far below and at the end of the day I won’t complain over a free promo. The shares I received for deposit bonuses all fell in the advertised ranges.

That said, I opened an account last month and was targeted a day later for a big bonus, so I thought this was worth sharing for those who may be interested in taking a shot at it. Here’s Stephen’s story and mine:

Stephen opened an account several months ago under a promo and deposited $100 to trigger that promo. He then left it alone and didn’t even invest the hundred bucks but rather let it sit in his account along with his free stock. Recently, he received the aforementioned targeted offer for 3 more free stocks when he deposits $500 or more before the end of the month, with each stock worth $9-$1,000.

Before either of us looked closely at the terms, I signed up for an account. We later realized that the above offer was targeted. Bummer.

Before realizing it was targeted, I signed up through Stephen’s referral link. Note that means I set up an email and password via the link and then downloaded the app on my phone and signed in to it using the info I set up via the referral link. I immediately received an offer to get 1 free stock worth $2.50-$250 when I completed the process of opening my brokerage account within 24 hours.

I went ahead through the steps. It gave an option as to whether to open a margin or cash account (margin gives you the chance to buy with leverage). I went ahead and opened the margin account despite the fact that I don’t intend to use it as such (I figured I’d rather have the option than not). There was no hard pull and my account was approved within a few minutes after finishing the application process, which includes entering your personal info and uploading a picture of photo ID (there were a few more steps in opening this account than Robinhood or SoFi Investing). Again, I initially saw a message that my application was submitted and would be reviewed

It said it would be approved within 2-3 business days, but it it was only a few minutes before that was done and I got a notification that it was approved.

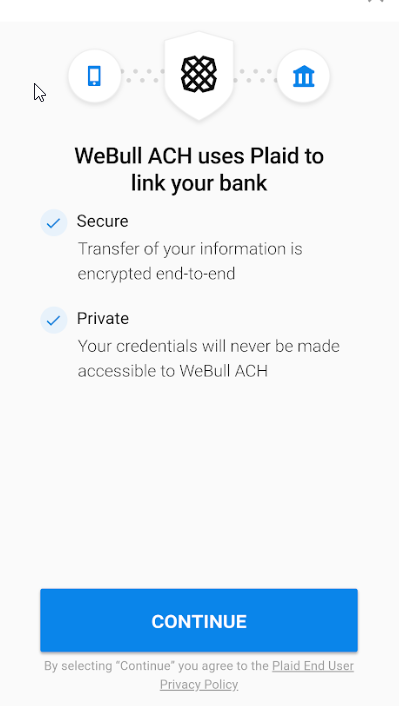

I then went ahead and linked a bank account to make an ACH deposit electronically. You can either wire money in or use Plaid to connect your external account via bank account login. I used to avoid accounts that required this electronic linking, but as Plaid has become more prevalent, I’ve come to accept it.

I immediately received one free stock for opening the brokerage account. I got BIOS, which it said was worth $4.08 (the initial account opening bonus stock is valued at $2.50 – $250).

I received my first deposit bonus stock after my deposit cleared, which was about a week (which is consistent with my experience with Robinhood and SoFi Investing). They advertise the deposit bonus right in the account menu.

I didn’t intend to write about this promo once we found Stephen’s offer was targeted (which was after I’d opened my account and taken the screen shots above).

However, after opening my account, the next day I received an email offer to get 20 free stocks valued at $9-$1,000 each if I deposited $10,000 in new money. That’s a large deposit for a bonus that may be as small as $180. On the other hand, it posted relatively quickly and then I was able to withdraw the money, so it was basically a free $180 in stock (that went up over $200 pretty quickly in my case).

I was surprised to receive the same type of targeted offer a day after opening. Seeing as Stephen had deposited $100 and received the offer to deposit $500 and receive 3 stocks and I deposited $2,000 and received this much larger offer, I assume that my larger offer is because of my large initial deposit. I also assume based on the wording above that my initial $2K deposit will not count toward the $10,000 or more necessary to trigger the bonus — I assume I’ll need to deposit an additional $10K.

Update: As noted at the top, I next received a new deposit bonus this month for 25 free stocks if I deposit another $25,000. The terms are clear that I’d need to have net deposits of $25,000 (deposits minus withdrawals) by 3/13/20 and then leave the money alone until 4/17/20 (I can invest and lose or gain, but I can’t withdraw before 4/17 to receive the bonus). That bonus isn’t worth it to me, but I found it interesting to again be targeted for a bigger yet bonus based on my past deposit activity (note that I never invested any of the money I deposited into Webull, I only have the stocks I got for free).

There are a few key restrictions. While there are more restrictions still (it’s worth reading through them at the link in the email), these are the ones that I think are most important to know:

- Terms indicate that users will be able to redeem their free stock(s) before 4/17/20 (updated date) and will have 30 days to initiate a redemption once it’s available for claim. Once redeemed, the free stock will be delivered to their account within 7 trading days. In other words, you may be waiting until April 17, 2020 until you actually have the stock bonus if you receive a big deposit bonus like this (note that the bonuses for opening an account (1 free stock) and making your first deposit (1 free stock) only take about a week to arrive.

- As noted above, this deposit bonus offer is targeted. I assume I got a larger offer because of my larger initial deposit. I don’t know that for sure and can’t guarantee that anyone else will be targeted for the same type of bonus.

- The offer only applies to Webull cash and margin accounts, not IRA accounts or other types.

- Once you get the ability to redeem the free stock, you have 20 days to initiate the redemption or the free stock is forfeited. Once redeemed, it will be delivered within 7 trading days.

- In another term, it states you have 30 days after your initial deposit settles to claim the free stock or it expires, so keep a close eye on your account for the ability to claim the stock.

- You may hold or sell the free stock, but the cash value at the time you received it must be held in your account for at least 30 days before being withdrawn. You can use the cash value to buy other eligible securities, but you won’t be able to withdraw the “free stock” money until 30 days after you receive the free stock — so it could be mid to late March before you can cash out this bonus.

- This is only open to US residents who have a valid SSN.

Is this bonus worth it? Not if it means typing up the money would prevent you from achieving other account opening bonuses. On the other hand, last month’s offer didn’t indicate that the $10K deposit needs to stay in the account nor any requirement to invest that money (but my new $25K offer does require leaving the money deposited for 35 days). I assume those funds could be withdrawn after they clear and you claim your free stock, in which case I’d expect this to only tie up the money for a couple of weeks.

On the other hand, since this is a brokerage account, I wasn’t sure how insurance worked since I assumed my deposit is not FDIC-insured like it would be at a bank. Stephen Pepper found this on the Webull site:

Brokerage services are provided by Webull Financial LLC, a registered broker dealer with the SEC, and a member of FINRA and the SIPC. Your Webull account is protected up to $500,000 (including $250,000 for claims for cash). Explanatory brochure available upon request or at www.sipc.org.

Our clearing firm Apex Clearing Corp has purchased an additional insurance policy. The coverage limits provide protection for securities and cash up to an aggregate of $150 million, subject to maximum limits of $37.5 million for any one customer’s securities and $900,000 for any one customer’s cash. Similar to SIPC protection, this additional insurance does not protect against a loss in the market value of securities.

I therefore think the risk is relatively low, but I’m not an expert on how the above account protection and insurance works. Getting at least $180 for clicking some money around for a couple of weeks seems like low-hanging fruit. The gambler in me is certainly interested in taking a chance at getting something more valuable in the set of 20 stocks.

What’s the trading platform like?

I’ve barely played with Webull and have not bought or sold any securities with it yet (despite the fact that they made $1K of my initial deposit “immediately available for trading”).

However, based on aesthetics and some clicking around in the app, my first impression is that I don’t like it as much as Robinhood but like it significantly more than SoFi Investing. Here are my quick thoughts on each app:

- SoFi Investing probably has the sleekest most user-friendly interface of the three, but I find it lacks the detailed information that Robinhood and Webull display.

- Robinhood has my favorite interface of the three. The color scheme makes it easy for me to see which stocks are up and down and I can easily track the ones I want on the home page. I’ve done some buying and selling over the past few months and find this platform is really easy to use.

- Webull actually seems like it may have even more detailed information than Robinhood, but it feels the least user-friendly of the three to me. There is almost too much information packed on each page and it wasn’t immediately clear to me how to find securities to buy (I found it, but it wasn’t as obvious in my opinion).

Is this a competitive brokerage bonus?

I’ve not been playing the brokerage bonus game as long as the bank account bonus game, but I find that most major brokerages require big deposits for large bonuses. The apps like Robinhood and Webull offer small bonuses with small requirements.

From the perspective of new account bonuses from the three I’ve tried:

- SoFi Investing offers the most bang for the buck. Currently, when you open a new SoFi Investing account and deposit $1,000, you get $100 in free stock (the person who referred you also gets $100 in free stock). A couple playing in 2-player mode could do this (my fictional pair is Morgan and Ryan):

- Morgan signs up and deposit $1K to trigger the $100 in free stock

- Morgan refers Ryan.

- Ryan deposits $1K and gets $100 in free stock

- Morgan receives $100 in free stock for preferring Ryan.

- Following the above, a pair playing in 2-player mode ends up with $300 in free stock after depositing a collective $2K. That’s likely much better than I’ll do with the Webull bonus. Read more about the SoFi Investing bonus in this post.

- Robinhood offers the weakest bonus. You get 1 free stock when you sign up and deposit $100. You also get one free stock every time a friend signs up (2 free stocks after 3 friends). Free stock is valued “up to $500”. The stocks I’ve gotten have ranged from about $3-$9.

- Webull offers a bonus that’s at least a little better than Robinhood and could be quite a bit better. You get 1 free stock (valued at $2.50 – $250) for being approved for a brokerage account and then 1 free stock for depositing any amount (valued at $12-$1400 when you deposit by 2/3/20). You may additionally get targeted for one of these additional deposit bonuses noted in this post and you receive 2 free stocks (valued at $12-$1400 each) for every friend you refer. Morgan and Ryan could therefore do the following:

- `Morgan signs up and deposits and gets at least $14.50 in stock (at least $2.50 for opening and at least $12 for funding)

- Morgan refers Ryan and gets two more stocks worth at least $28.

- Ryan opens the account and deposits and gets at least $14.50 in stock as shown above.

- In total, a pair playing in 2-player mode gets at least $57 in free stock with no minimum deposit.

- If either of them is then additionally targeted for a further deposit bonus, the win becomes slightly higher.

At the end of the day, if I were only going to do one bonus, it would be SoFi Investing for the large and easy return. However, having already done that and having found this promo, I am pursuing Webull. I don’t know if I’ll put in the $10K for 20 free stocks, but I’m definitely considering it.

As I noted in my recent post about bank account bonuses, I think it’s definitely worth paying more attention to these. Deals like this aren’t without risk, but they do represent chances to turn a decent profit with low effort. I know I won’t win them all, but I’ll be happy to use some of these bonuses to buy cheap points when they go on sale.

Bottom line

As I’d recently written, I used to play the bank account bonus game and mostly stopped when I started focusing on credit cards. I recently started back up with bank account bonuses since they are low-hanging fruit that can be used to buy cheap points on sale. I’m very new to brokerage bonuses, but it makes sense that they are a nice compliment to bank account bonuses since the bar is even lower, with most brokerage bonuses only requiring a deposit, not direct deposit from an employer or any other hoops. When I signed up for Webull yesterday through Stephen’s link, I thought I was going so to pick up 5 free stocks and was disappointed when his deposit promotion turned out to be targeted. However, that disappointment took a turn for the better today when I received the targeted offer for 20 free stocks. I only received the offer this afternoon, so I haven’t made up my mind on it yet, but I’m strongly considering it. I can’t guarantee that anyone else will be targeted for these additional deposit bonuses, but since I was targeted a day after opening (and for a much larger bonus that I suspect may be tied to a larger initial deposit), I thought some readers might be interested in giving it a shot.

![(EXPIRED) Webull again offering 3.5% match bonus with IRA transfer [Targeted?]](https://frequentmiler.com/wp-content/uploads/2024/05/Webull-IRA-match-218x150.jpg)

[…] (EXPIRED) Now up to 25 free stocks w/ targeted WeBull investing offers […]

I joined webull too late for the January bonus, but was just offered the same 20 stocks for $10k deposit offer for a deposit between 2/19/2020-3/13/2020

Oh nice. I did get my 20 free stocks when I met that deposit requirement. Mine ended up all being the same. The stock I got (Vonage) was worth $9.02 per share the day I got my shares, but it was up to $10.70 when the shares finally posted to my account (and back down to $10.27 right now, but who’s complaining?).

Stocks I got from referrals (which were supposed to be $12-$1400 each) were either GE or ISBC. At the time they were awarded to me, they were somewhere between $11.50-$11.81 per share — a little bit under the $12 threshold. They’ve since both been more than $12 (and ISBC is back down to $11.51 at the time of writing, though GE is at $12.76 and has eclipsed $13). So it’s a mixed bag, but free is free.

I got BIOS for the sign up bonus which did a reverse split and became $4.14 of cash because my one share wasn’t enough to retain ownership. The funding bonus was the same ISBC, which is under the $12 threshold like you said.

I’d be fine with 20 shares of Vonage since it’s free. Hopefully they’ll throw one or two in there that is a bit more valuable or they won’t get me to keep them as a brokerage if all they give me is shares of companies I have no interest in holding. I’m going to wait until closer to the end of the period to fund it.

BTW: I initially followed your path to transfer $2000 on the initial funding. I’m not sure if that impacted getting this offer.

the account opening process is a bit odd .. you have to download/register with the app, then use the web to open an account? (Not seeing any option to open account in the app.)

I did it the other way around. I noted in the post that I clicked through Stephen’s referral link and registered online with my email address and created a password. Then I downloaded the app and logged in using the credentials I created on the website and then I proceeded to open the account. Agreed that it’s a bit convoluted.

yeah, that’s what I tried to do .. I used Stephen’s referral link on the web, created userid, password, downloaded the app, logged in using those credentials, and there’s no apparent way to create a brokerage account in the app that I could find. Eventually got an email and the link to create the brokerage account on the web worked.

I was quite frustrated looking for the menu item or clicking on the big yellow create account button in the app, only to be taken to the community chat stream .. wondering why I was spending more than 10 minutes on this.

Finished the account creation and deposit. Got a share of BIOS. Apparently they give away a lot of BIOS 🙂

Odd that you couldn’t see how to open the brokerage acct in the app. As soon as I logged in there was a big blue button saying “Open an account” in the center of the screen. Glad you got it figured out anyway!

Yeah, I saw that too .. it took me to the community/chat page. I got it opened eventually, got a $4 share of BIOS lol. I hope Stephen gets something better.

How is it determined what stock you get? I’m going to guess the chances are really low that any stock would come anywhere close to the upper range of values….

Yup WeBull Dung !!!!

CHEERs

Just luck of the draw. My numbers assume the lowest values.

I should add that most of them are of course the cheaper end. My sign up bonus stock was worth $4. That had a range of $2.50-$250 listed, so at $4 I did better than the min. Stephen actually got a $12 stock.

The vast majority of the $9-$1000 stocks are going to be worth about $9. The vast majority of the $12-$1400 stocks are going to be worth $12. In my case, the appeal of the $10K deposit is that my odds of getting a valuable stock in there somewhere increase ever so slightly. At worst, it’s $180 ($9 per stock times 20). One or two decent stocks out of twenty and I’ll be happy.