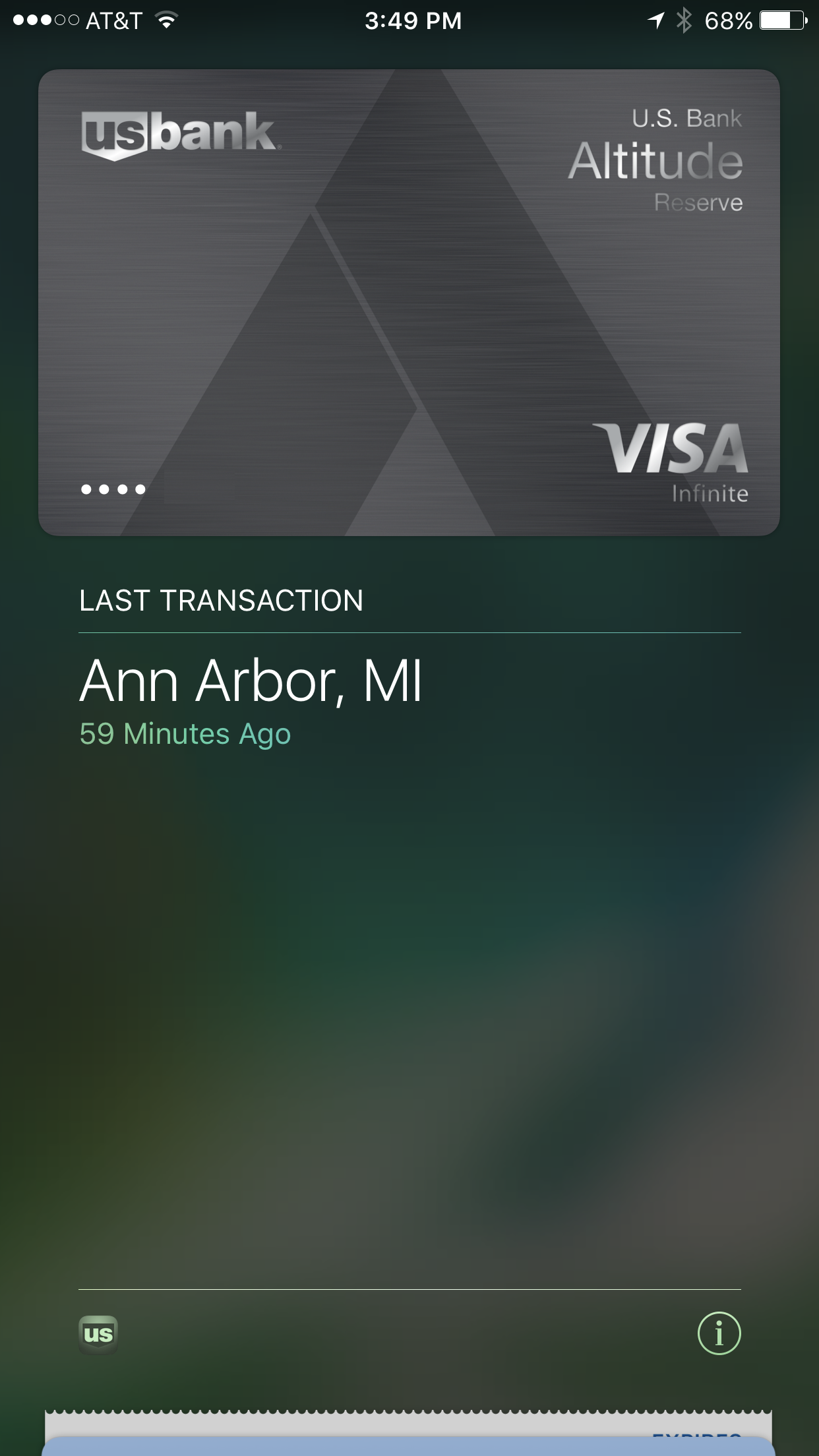

Doctor of Credit reports two very positive permanent changes rumored to be coming to the U.S. Bank Altitude Reserve card: the bank will reportedly soon notify cardholders that the card’s $325 in annual travel credits will be applicable toward dining purchases and the $75 fee for authorized users will be removed. This is great news for Altitude Reserve fans and makes the card an even better deal.

US Bank temporarily allowed dining purchases to qualify for the $325 dining reimbursement last year in response to the pandemic (See: US Bank Altitude Reserve Allowing Dining Purchases Towards $325 Travel Credit (Temporarily) + 3x On Dining). That change is reportedly becoming permanent, which would be great news. While I think that most people who would consider the Altitude Reserve probably spend $325 per year on travel naturally, this will be a great enhancement short-term and will make the card even more applicable for a wider range of people.

Elimination of the $75 authorized user fee is also awesome. The big advantage of this card is the ability to add it to digital wallets for 3x on mobile payments. While I haven’t specifically tried with the Altitude Reserve, I’ve generally had no problem adding my wife’s cards to my digital wallets and vice versa. Assuming the same is true with the Altitude Reserve, I’m not sure it would have made sense to pay the authorized user fee. That said, I’m not sure if the same card could be added to multiple digital wallets. Being able to add authorized users for free would mean that a family could easily make sure that everyone’s in-person charges are coding as 3x by adding each member as an authorized user.

Overall, these are great changes that make the card even better. For those who spend a lot of money in person, particularly at places like warehouse clubs where there are not often other category bonuses, this card is a no-brainer that has gotten even easier to choose. For more information on the Altitude Reserve card, see our dedicated US Bank Altitude Reserve card page.

I’ve added it to my wife’s digital wallet without issues.

I’ve had no problem adding it to multiple digital wallets.

Nice! I think my annual fee posted last month and I was planning to call them for retention, but if this change is permanent then that seems to be something worthwhile to hold on too… we havent been able to use the rest of the perks as much,,, Does anyone have any DP for retention offers on this card?

Called for retention in January. 10k points after I pay the annual fee, no spend requirements. 10k points plus $325 travel/dining credit is pretty much a profit to keep this card.

I’ve received that same offer the last two years

Same offer for me this year.

Thanks for the DP. I called in yesterday and after a few minutes of we can offer to product change to no annula fee card and lettimg me know that the dining credits are now permanent, the rep went, checked and came back with same offer.. 10000 points.

I’ve had a US Bank checking account for a while now. Maybe they will approve me this year tho I am so close to getting below 5/24.