You don’t need a Capital One card to use Capital One Shopping. I like to get that out of the way at the beginning because that always seems to confuse people. Capital One Shopping is just a run-of-the-mill shopping portal, but it is notable for the not-so-run-of-the-mill targeted cash back offers that they are known to feature now and then. Because of those offers and the huge referral offer they ran last year, I’ve earned a lot of Capital One Shopping cash back. But calling it “cash back” isn’t really accurate: you can’t get “cash” at all from Capital One Shipping but rather rewards earned through this portal can only be redeemed for gift cards. On the one hand, that severely reduces the utility of the portal (or at the least it reduces the value of the rewards). In light of that, a reader recently asked how we’re redeeming our Capital One Shopping rewards, so I thought I’d share.

Capital One Shopping has nothing to do with Capital One cards

While I addressed it in the intro, I want to double back and disambiguate between several entirely different (and entirely separate) ways that Capital One offers shopping rewards.

Capital One Offers are something that exist within a Capital One credit card account and operate like a shopping portal but offer statement credits. That’s not what this post is about.

Capital One Travel is a third-party travel-booking platform that sometimes has coupon offers to save on travel. That’s not what this post is about.

Capital One Shopping is a shopping portal that anyone can join just like Rakuten or TopCashBack or AAdvantage eShopping or the many other shopping portals that exist where you click through the portal’s link and earn extra rewards on your purchase. That is what this post is about. Just like Rakuten or TopCashBack et al, anyone can join Capital One Shopping, no Capital One account required.

However, the story isn’t quite that simple.

Capital One Shopping has a website and a web browser extension and an app. And the cash back rates between those three things don’t always match. Confusing matters more, they often have targeted rates on their home page that are not found on individual store pages (so it pays to scroll and/or filter on the home page) and they often send targeted rates via email that are even better. That all combines to make this the most complicated shopping portal around.

However, it can also be the most rewarding. While the tide of amazing offers has ebbed considerably, I still periodically get very good targeted offers via email. We’ve seen things like 30% back on Hertz and Viator, 21% back on IHG, 18% back on GiftCards.com and so on. Those targeted offers are often so far beyond what you’ll find via other portals that it can be worth dealing with the headache of only being able to redeem for gift cards given the huge gap between the rates offered by other portals and those rates sometimes offered by Capital One Shopping.

How I earned Capital One Shopping Rewards

Obviously, I earned rewards from shopping. However, I’ve earned a large sum of rewards from a relatively limited number of ways:

- Targeted offers on big purchases. I got an offer for 30% at Goodyear and spent about $1,000 on tires for $300 back. I also got an offer for 30% back at Lenovo and I bought a laptop that cost around $1400, so that was another $420 back. I’ve periodically received offers for 18% back at GiftCards.com and I put that portal rate to use early and often for quite a bit back.

- Referrals. Late last year, Capital One Shopping offered an incredible referral offer that provided $200 for both sides when referring a new customer who signed up and made their first purchase through Capital One within 30 days. I maxed out referrals on that (or rather my wife did — that only took 3 referrals as Capital One Shopping allows members to earn up to $500 per year from referrals). In January, I learned that if someone signs up under a referral in December but doesn’t make their first purchase until January (but still within 30 days of sign-up), that referral would count toward the new year’s cap. So my wife ended up getting about $1,000 in referrals (from just 6 referrals!) because some people who signed up through her link in December 2023 didn’t make a first purchase until January 2024 (I think). Prior to that, over the course of 2023, I had maxed out my $500 in annual referrals from the various $30 and $40 referral promotions they ran.

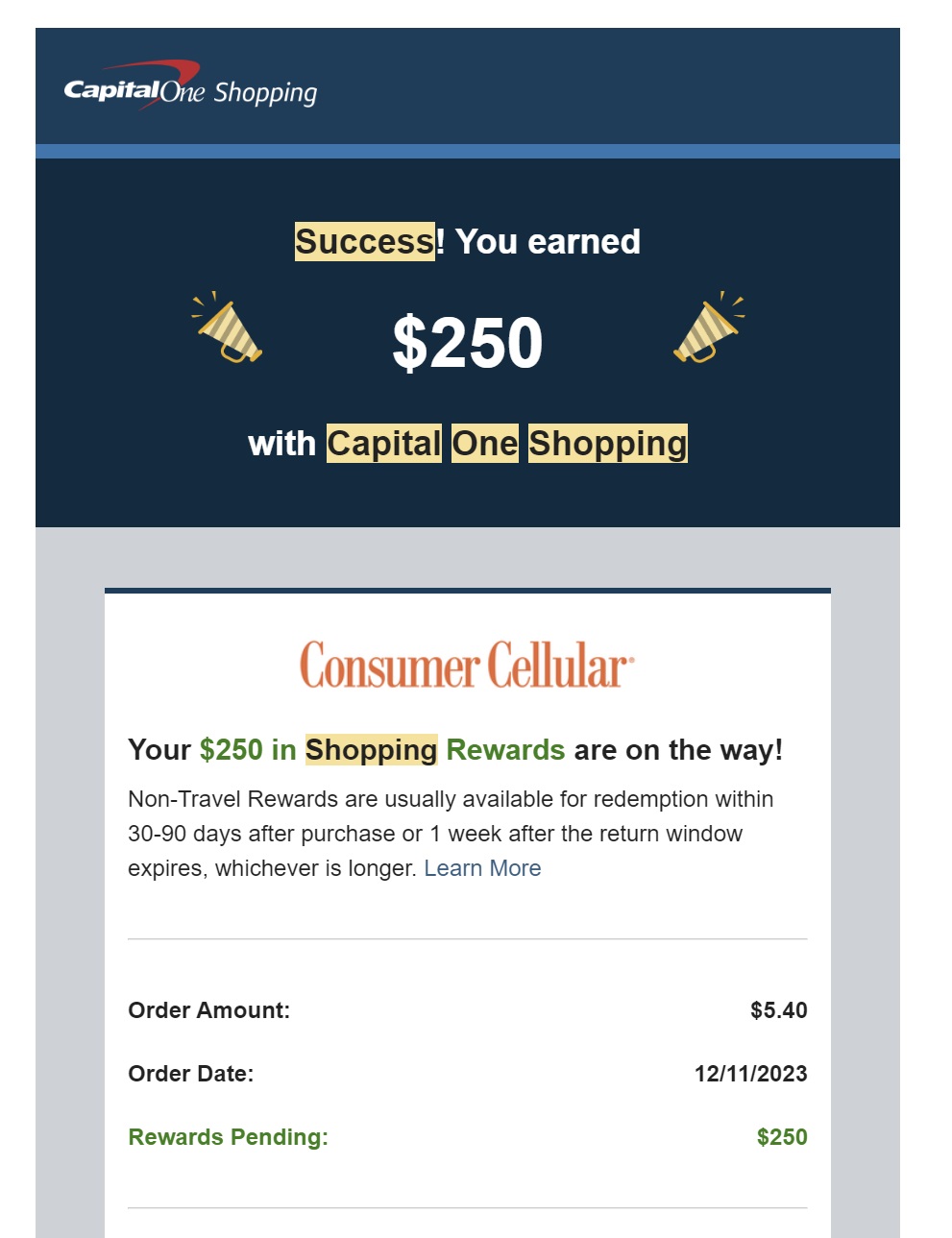

- Occasional offers too big to miss. Every now and then, there’s been a money-maker big enough to make it well worth taking advantage. For instance, there was an offer for $250 back on Consumer Cellular that only required paying for two months of service. That service only costs $20 per month for the cheapest plan (and there were card-linked offers on many cards for $20 back on $20 or more!). So for about $20 (or maybe $40) out of pocket, I picked up $250.

- Lots of other purchases. I had targeted offers for 30% back at Hertz and Viator that I used and lots of other offers in the 15-30% back range that were smaller than those mentioned above but still added up.

As you can see, just the things listed above add up to several thousand dollars in cash back. There’s no doubt that it’s been a great run with Capital One Shopping offers, but those rewards are only redeemable for gift cards.

The gift cards for which I’ve redeemed and how I’ve used them

So far, I have redeemed for the following gift card types:

DoorDash Gift Cards

Last year, my family had plans to go to Fiji. In a half-hearted attempt to ease the jetlag on the kids, we planned a stop in Las Vegas for a few days before we had planned to continue on to Los Angeles and then Fiji. Unfortunately, in the rental car on the way to the airport to fly to Los Angeles, we found out that our 5yr old wasn’t feeling well.

That led to an unexpected two-week residency in Las Vegas with the kids alternating whose day it was to throw up all over the place. That was not more pleasant than you imagine and it means spending more time and money than we anticipated in Las Vegas since we didn’t want to get on a plane until we were sure that the kids weren’t going to erupt in flight.

Since we couldn’t really go anywhere outside of our hotel room for the first week+ of that time in Las Vegas, I turned to ordering delivery. Not having to pay for food each day helped to ease some of the sting of having to cancel our trip to Fiji only to be stuck in Las Vegas unable to go anywhere and do anything. I redeemed for a bunch of DoorDash gift cards and we didn’t rack up (as) much in expenses during that extended stay.

Hotels.com

Last summer, my family visited the original Legoland in Billund, Denmark. My kids love Legos (my six year old is obsessed). Staying on-property at Legoland is expensive (not so much if you’re comparing to on-property prices at Disney, but we’ve never considered that sort of thing).

Since Legoland isn’t part of any hotel chain with elite benefits or points, it seemed like a perfect opportunity to redeem Capital One Shopping cash back for Hotels.com gift cards and get to enjoy the splurge without spending cash out of pocket. I should note here that booking via Hotels.com was slightly more expensive than it would have been to book direct, so we definitely didn’t get full face value here. Still, the kids loved staying in a Legoland castle and we just wouldn’t have stayed there if we were paying in actual cash.

Then, on Leap Day in February we caught a good deal on a cash rate for a night at Great Wolf Lodge in the Poconos of Pennsylvania. That area in the Poconos is actually home to at least three major indoor waterpark resorts. I asked for recommendations about which of them was best in our Frequent Miler Insiders Facebook group.

A couple of people had good things to say about Camelbak / Aquatopia. Many others gave the nod to Kalahari resort. As it so happened, Camelbak was on Hotels.com and Kalahari wasn’t, so we decided to redeem more Capital One Shopping rewards for a Hotels.com gift card and spend a night at Camelbak after our Great Wolf Lodge stay.

StubHub

Perhaps my most unexpected Capital One Shopping redemption has been for a bunch of StubHub gift cards. I’m not a frequent event attendee these days (don’t worry, in my younger years I attended stuff like Woodstock 99 and I went to concerts ranging from Maynard Ferguson to George Clinton & Parliament/Funkadelic to Elton John and a lot more).

I was particularly excited about StubHub though because my wife is a Swiftie. Taylor Swift’s US concerts were so unreasonably priced that I never even considered buying tickets (apart from unsuccessful attempts in the presales). I mentioned that factoid in passing in a post or podcast episode last fall and a reader or listener pointed out that Taylor Swift’s shows in Argentina and Brazil were quite reasonably-priced compared to prices in the United States. While the dates in Argentina and Brazil wouldn’t work for us, that led me to look at the rest of her international tour and I stumbled on an opportunity to get tickets for a still-unreasonable but more-reasonable price for one of her European shows this summer. I redeemed Capital One Shopping rewards for StubHub gift cards and surprised my wife with the tickets for Christmas. I got my 6yr old son to give my wife a Little Golden Book about Taylor Swift and insist that she read it right away — and to his credit, he sat there bored out of his mind (I still laugh thinking about the video I recorded because she couldn’t see his face but I could) until she got to the last page and found the printout I’d taped there with the concert info.

For the record, I’m not going to the concert — my wife and a family member are and I’ll be on Daddy Duty with the kids. It worked out perfectly as I was able to get tickets for a show that lined up well with an MSC cruise booking so we could be planning flights to Europe without my wife getting suspicious.

Then, just recently, I realized that travel plans will have us in a city where Caitlin Clark and the Indiana Fever will be playing a WNBA game. I noticed that a couple of days before the WNBA draft earlier this week and on a whim we decided to redeem Capital One Shopping rewards for more StubHub gift cards to cover the cost of tickets to the game. I’m glad I did that before the draft because ticket prices increased substantially after. My wife and I love basketball and got caught up in the, erm, fever, surrounding the women’s college games this year. I’m excited about the game.

Would I have spent the money out of pocket for either Taylor Swift tickets or WNBA tickets? No, I probably wouldn’t have. Am I kind of excited that I’ve now got two trips sort of built around events that I’d probably never consider attending if not for the games we play? You betcha.

Saks

This one is niche, but I thought it worth a mention. I needed a new pair of brown dress shoes. While I did not intend to buy myself shoes from Saks Fifth Avenue, Saks Off Fifth Avenue had some reasonably-priced options that I liked well enough.

Many Amex Platinum cardholders know this, but many others probably don’t: Saks Fifth Avenue gift cards can be used at Saks OFF Fifth, which is sort of the Saks “outlet” brand. Saks OFF Fifth carries some overstock / discontinued items and some items that are produced just for Saks OFF Fifth. I was looking at shoes from a couple of well-known men’s shoe brands and found some that I liked at Saks OFF Fifth, so I redeemed for a gift card and got myself some new shoes.

Actually, the full story is that I bought myself two pairs of shoes. Unfortunately, I didn’t like one pair as much as I’d hoped and I returned it. I mention that being unfortunate because it means that I now once again have a Saks Fifth Ave gift card. That’s one of the downsides of being limited to gift card redemptions — if you redeem for a store where you don’t frequently shop and have to return your purchase, you’re stuck waiting for an opportunity to buy something else you need from a store where you don’t frequently shop. Whoops.

Safeway / Albertons / Vons / et al

I’m lying here — I haven’t actually redeemed for a Safeway gift card, but I thought it worth a mention for those who do grocery shop at the many stores where these cards are accepted that this is a Capital One Shopping redemption option. If I lived within the footprint of one of the brands under this umbrella, I’d probably have a harder time justifying splurgy redemptions like the StubHub and Hotels dot com ones I’ve made.

Bottom Line

I’ve earned a lot in rewards from Capital One Shopping over the past couple of years. I note above some splurges we’ve made that we wouldn’t have if we weren’t boxed in to redeeming for gift cards. Keep in mind that considering those splurges to have been “free” because of these rewards is not really accurate because I surely could have redeemed for a gift card that I could resell on a gift card resale site and had cash in my pocket instead of rewards limited to a specific retailer. For that reason, I don’t really think of my stay at Legoland or the Taylor Swift tickets being free since there is at the least opportunity cost to consider in choosing Capital One Shopping over my next best option for rewards and then there’s the opportunity cost of choosing those specific gift cards instead of one that I could resell for dollars and cents. Still, given how easy it has been to rack up a lot in rewards, I’ve enjoyed the chance to redeem for some fun experiences and I look forward to redeeming for more things like these in the future.

I’m not sure why people have trouble with C1 Shopping. I’ve earned and redeemed about $3k with no trouble. But I also haven’t attempted to game it to extremes. My bigger issue rather than not tracking has been having it track when it shouldn’t have. Each time I’ve informed them and each time they’ve told me to keep it.

You can send on over the $1600 they owe me! Just kidding, but is this also not a red flag? If a bank randomly deposited money into your account and said don’t worry about it would you trust them with all your money?

Ha! You make a valid point but given that I’ve redeemed almost all of it successfully it’s not a major concern? I haven’t tried to game the portal. Just used it normally.

Not points-related, but we’re Las Vegas Aces season ticket members. They moved the Indiana Fever game to T-Mobile Arena due to demand.

I saw that. They play the Fever twice though — looks like only the July 2nd game has been moved.

I actually thought about that but was too lazy to look it up. Yes, next month’s game is still at Mandalay thankfully. Though I just checked our T-Mobile seats and they didn’t put us in nose bleed this time.

I have to second EastSideBK’s experiences outlined below. I’ve earned 5 figures of cash back from TCB, RMN, Rakuten, etc and my history goes all the way back to FatWallet.

Capital One shopping is borderline criminal in their handling of rewards. They have blatantly lied to me about reasons for rejection, they have taken back earned rewards without notification, they have refused referral payouts, and they have recently told me I’ve reached the maximum amount of manually credited rewards and will not do it anymore. This is despite screenshots showing every step of orders including the activated shopping button.

I have earned thousands thru this portal, including the $250 consumer cellular, but it is an absolute garbage portal and you must list a disclaimer that YMMV to readers.

I’ll go back to enjoying my vacation now, but this had to be said.

I know that we’ve had some people report having problems with orders not tracking properly. That just hasn’t been my experience with it — I’ve earned plenty of cash back with only two issues: My Lenovo order didn’t initially credit right, but I think it was because I ordered the laptop + a $27 keypad and they shipped separately and shipped the keypad under the original order number and the laptop under a different new order number — an email to customer service fixed it and they credited me with the ~$420). The other order that didn’t track was one I made through an old targeted email at a time when I knew Saks orders were having tracking issues, so I only half expected it to work and it didn’t — wasn’t the end of the world to me, nor worth the time to follow up over just a few dollars in cash back (especially considered in the context of earning so much overall).

For what it’s worth, there have been plenty of readers who have told me that at least one of the other portals you mention favorably being a total scam that we should never write about because they didn’t get cash back that they should have from it. And we’ve heard those complaints on some of the airline portals, too.

And if I expanded beyond that, we’ve heard negative customer service stories and been urged to warn readers about just about every major travel company in existence (and numerous banks, too).

And it stinks — I don’t enjoy hearing a story like yours about having repeated issues. And I know that you’re a frequent commenter on all sorts of deals and you understand the ins and outs of shopping portals. I’d share your frustration if I had the same situation. I don’t know why my experience (and that of my wife and other family members and other FM team members) has been overwhelmingly positive and yours has been negative. I know that there is a lot of room for things to go wrong when it comes to portals in general (a fact evidenced if you hang around the comments of any post about shopping portals), but it’s hard for me to warn people about how bad something is when I’ve just not experienced those issues (and when I say that I haven’t experienced those issues, I’m also helping to manage things for a few other players, so it’s not just me — nobody in my family has run into those problems, either).

I wish I had more insight as to why some people have had negative experiences with C1 Shopping. I don’t get it.

That’s a fair response, and I appreciate your free-flowing comments section. Fingers crossed yours keeps working well, but when a company says they won’t fix it simply because they’ve fixed so many other issues that’s a real red flag. Never had any portal say they won’t help anymore, ones like Cartera (airlines) are often poor at tracking, but they at least work above-board to resolve it.

Keep up the a-plus work Nick!

I have been told that by several different companies including shopping portals-that they won’t continue helping because they’ve already helped to their limit. It is maddening but I guess they infer something is not working right.

Nick, I officially consider you a CapOne Shopping Expert. That is IMPRESSIVE. I’ve had some great little random savings happen from the browser extension, like buying a gift card directly from a retailer and boom, $10 comes off the $100 purchase. 30% back at Viator worked great for me too, on almost $300 of excursions in New Orleans last year. It all added up to $560 when my dishwasher bit the dust in January…I started thinking of ways to optimize the purchase and checked the gift card redemptions. Lo and behold, there was Lowe’s, where I had identified my first choice. Free dishwasher in what was a very expensive month already. AND I earned another $24 in rewards on that purchase, lol.

Great article, Nick. Love that your wife is getting to experience Taylor Swift. I took my daughters to a US concert and it was absolutely epic. I’m also glad the Cap1 portal has been amazing for you; I just want to share with readers that it has been an absolute nightmare for me. And since I have had a 99.9% success ratio for years on TopCashback, Rakuten, CouponCabin, etc. for purchases big and small I know it’s not me or my browser, etc.

First off, when I’d click on offers at Cap1 (I’ve used both the extension, the app and the website itself) my purchases often didn’t track. Like nothing. I kept trying. Then one of the ones I did at Wayfair (Cap1 is one of the only portals to offer cash back) tracked and then suddenly turned to zero over a week later. Even though I didn’t return the item. Never seen that happen on a purchase I completed. When I asked CS, they said “the retailer denied your request.” I’ve also never had that happen on an appeal to CS on an item that initially tracked. (Not accusing anyone of lying, just saying) I finally got a small purchase at Fanatics to track and if anyone has shopped there, you know that their orders track on basically anything you buy in any form (giftcards, PayPal, dedicated links from your credit card, etc) so this ain’t exactly a ringing endorsement.

Then of course Cap1 wouldn’t initially pay out my $25 referral for making 1 purchase. It never posted automatically. Other portal bonuses like BeFrugal post right away. It took several emails before I finally got it. Ive never cashed out portal cash (for gift cards) faster!

Sorry for the long post. By no means am I trying to rain on your parade or say that something you said isn’t true. I just wanted your readers to hear an alternate viewpoint and to say if Cap1 isn’t working for you, just cut bait. Cause it isn’t just you.

thanks for reading….

I need to sign up for this one – didn’t catch a referral code above. Have one I can use so you get the credit?