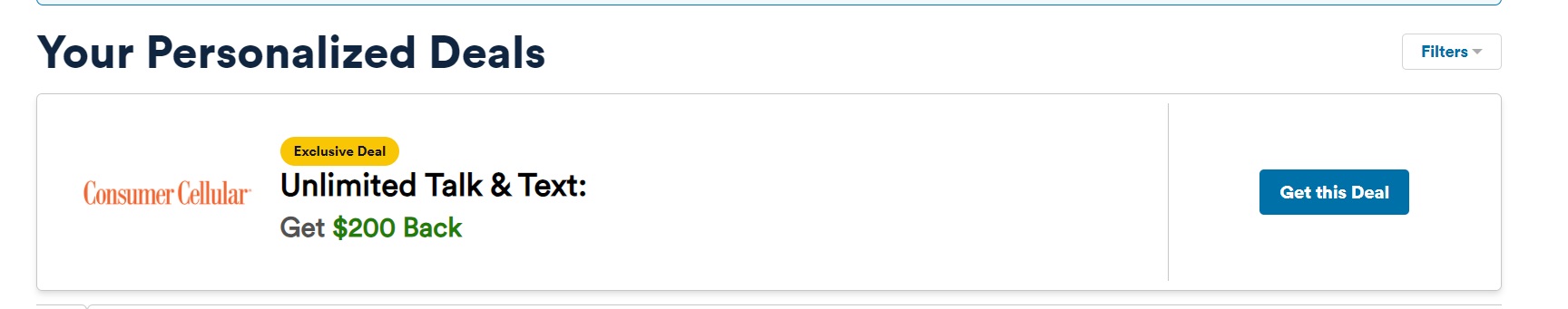

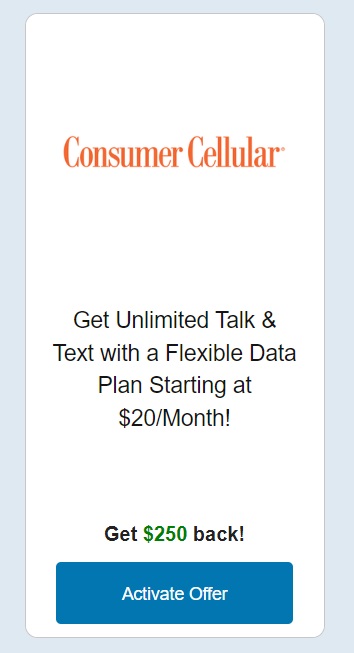

Capital One Shopping has many targeted offers that won’t be available for everyone, but this one is good enough that I thought it was worth highlighting for readers who want to check if they are targeted (as a reminder, Capital One Shopping is a public portal open to anyone that does not require any Capital One account). Buried in an email with a different headline targeted offer yesterday, I saw an offer for $250 back when signing up for a Consumer Cellular account. That was much higher than what the portal itself showed yesterday, though today I see my account is targeted for $200 back on Consumer Cellular. Since one month of Consumer Cellular only costs $20 (and the first month is actually free), I wanted to highlight what could be an opportunity for a large payout on a cheap purchase.

The Deal

- Capital One Shopping has targeted offers for some members of $200 or even $250 back when signing up for Consumer Cellular. Service plans start as low as $20 with no contract.

Key Terms

- Offers are targeted – be sure to check your emails and both the desktop site and app for the best rate available to you

Quick Thoughts

This is a pretty amazing deal if you’re targeted, but half my motivation for writing about it is to reminder readers not to ignore Capital One Shopping. I’m a regular Cashbackmonitor user, but because of the targeted Capital One Shopping offers, I find myself checking their site and emails daily.

Yesterday, I got an email where the headline offer was for 12% back at GiftCards.com, which is certainly a deal that I love to see, but I always check the rest of the offers in the email as well. I was pretty floored to see $250 back at Consumer Cellular buried somewhere down in the email where I had to scroll to see it.

I went to the website yesterday to see what offer I had there, but the offer on the website was only good for $100 yesterday in my login (today it shows $200 back on the desktop site and in the app for me).

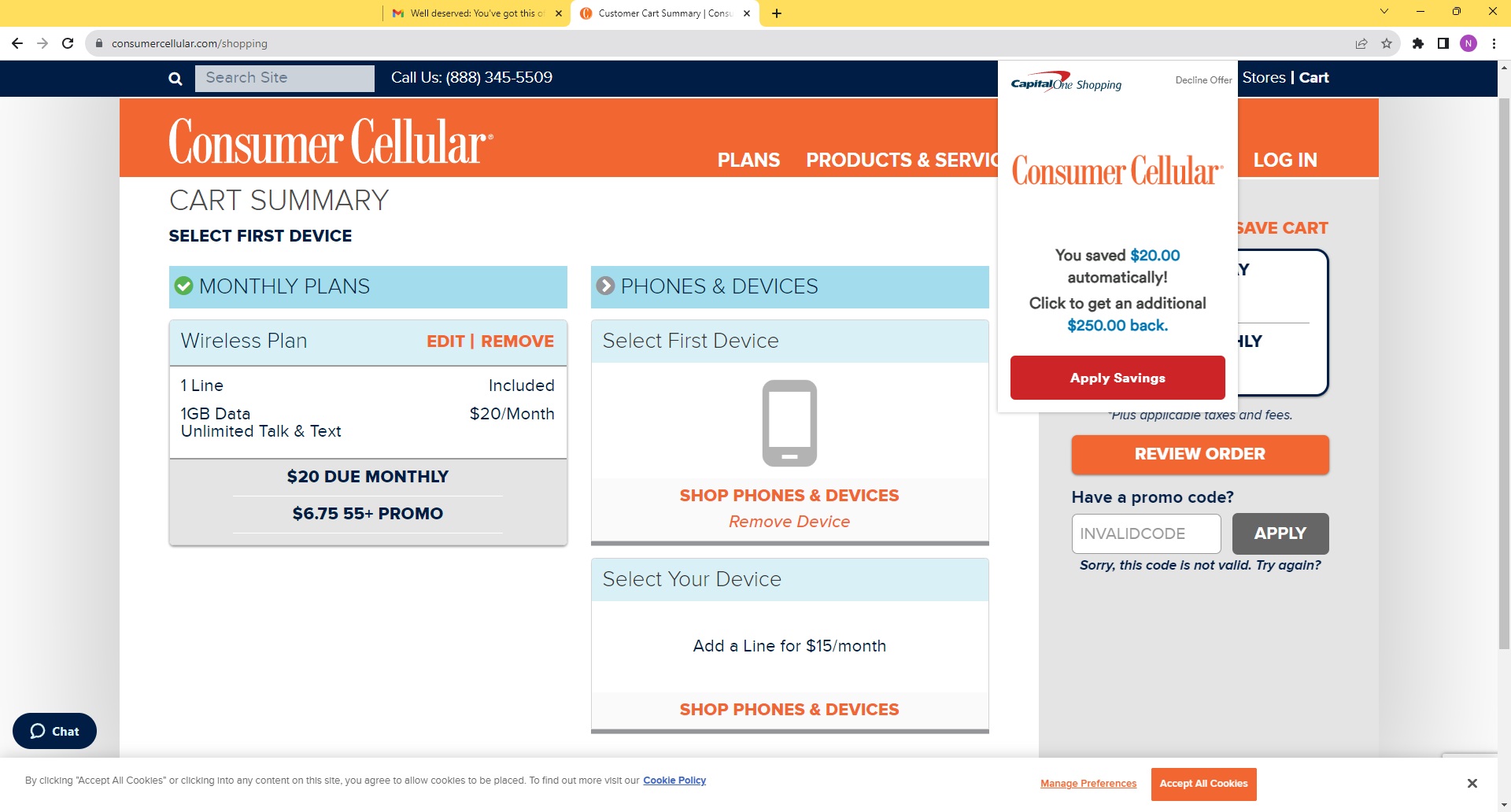

I clicked through the $250 link in the email yesterday and signed up for the cheapest $20 plan at Consumer Cellular. Sure enough, during the checkout process, I got a pop-up from the extension confirming the $250 offer (and providing the first month for free).

That seems like an amazing deal. There is no mention of the minimum amount of time that you need to keep your account open in order, but terms from other portals seem to indicate that rewards will post after your first payment for service for a new user. Note that in the screen shot above, you may notice that has a section to shot phones & devices — you can just select “bring my own” from the phones & devices page and enter the IMEI number of an unlocked phone in order to avoid needing to buy a device.

Note that there has also been a Chase Offer / Bank of America Deal / U.S. Bank offer / Wells Fargo offer for $20 back on Consumer Cellular for new users. Unfortunately, that offer is currently set to expire 12/31/23. Here’s hoping a new version comes out at the beginning of January since I won’t get my first $20 charge until then.

I did have to pay $5 and some change for shipping the SIM card. I’ll pay the $20 when it gets charged next month and then set a reminder to cancel in early February assuming that I don’t want to keep the service (I’m currently on T-Mobile and don’t imagine that I’ll be tempted to switch, but I can’t see turning down the chance to get paid $250 to make sure I’m right about that. To be clear, I did not choose to “keep my number” as I do not intend to port my primary number to Consumer Cellular. I’ll just sign up for a new number and pop the card in an old unlocked phone to check out the service for a month or two in exchange for the $250 in rewards.

The purchase hasn’t yet shown as tracked in my Capital One Shopping account, but given the very low risk ($5.40 here and ~$20 next month), I’ll gamble that they will show up sometime after I pay for a month of service.

Long-time readers may remember that I had talked about signing up for Consumer Cellular through American Airlines AAdvantage eShopping as a way toward earning enough Loyalty Points for my current status challenge. However, American has only been offering 3,700 miles for signing up for Consumer Cellular. That made going through American Airlines an expensive proposition; I just couldn’t forgo $250 back in favor of 3,700 miles / loyalty points.

Note that the $200 or $250 rates are not available for everyone (a family member only sees $40 in their online account), but this is a great reminder that you should check each avenue of Capital One Shopping. Sometimes, the rates differ between the Capital One Shopping app, the desktop website, and the extension. Then the targeted emails can often have yet another rate. It’s worth checking everything.

As a reminder, Capital One Shopping rewards are not in any way linked to Capital One. Your only option for redeeming Capital One Shopping rewards is for gift cards. Available brands sometimes change, but have long included options like eBay, Lowe’s, DoorDash, GrubHub, Hotels.com, StubHub, Safeway / Albertsons / etc. You do not need a Capital One credit card or Capital One account to use Capital One Shopping. See Capital One Shopping vs Offers vs Travel offersC is for confusion: for more info.

Overall, this seemed like a fantastic deal. With many new Capital One Shopping users over the past few days thanks to the incredibly generous (and now dead) $200 referral offer, I thought it was worth highlighting what could be a terrific deal if you’re targeted.

As it’s 3 months past purchase, I had to submit a request to be paid out the $200. Glad I took screenshots, but still had to request.

Did it never show a payout date under the help tab?

https://frequentmiler.com/heres-when-your-capital-one-shopping-rewards-will-post-to-your-account/

No, It did not. Reps wouldn’t help until 90 days past purchase. They did note the broswer/addons might interfere, but I had used the same browser setup as shopping in the week previous had tracked and paid out without needed help.

I received my credit in the past few days, automatically.

However, I had so many issues with other things during the Holidays that they’ve now stated:

“After looking into your request, we found that you’ve already received the maximum of manual adjustments you are eligible for. At this time, you are not eligible to receive any additional manual adjustments.”

So…I give screenshots of every step of an order, including showing the toolbar stating a cashback amount triggered, and they refuse to honor it because they’ve messed up so many times I’ve met the maximum amount.

I also got paid 0/4 on the $200 referrals (and my friends also didn’t get theirs).

This is a terrible portal and should be treated as such. Use it for things like this, but only things like this.

Has anyone’s reward become Available yet? Mine wasn’t tracked, so I emailed them. They issued me a courtesy reward that was available right away. I then canceled my service. My wife’s reward was tracked on Dec 18. It is still showing Pending in My Rewards & Savings but showing “You have no pending…” in Help. I am reluctant to cancel my wife’s service before her reward becomes Available.

I had $83 offer, today I got $225 offer and Chase has spend $20 get $20 off on Consumer Cellular on all my 5 cards. I guess I will pre pay next 5 months.

Signed up for this last week at $150, as I seemingly couldn’t get the higher targeted offer, but of course I receive the $225 today.

Do you know if signing P2 up though the same C1 portal acc will track/pay? Seems it just needs to be a new customer to Consumer Cellular, but I could find any terms.

Nick, did you get this cleared by C1? Mine still showing pending.

About a month ago, I wrote a separate post explaining how to see when your Capital One Shopping cash back will go from pending to available — and the example I used was that it showed that my Consumer Cellular cash back would be available on March 10th. So no, it hasn’t cleared yet, but I didn’t expect that it would. See this post for how to find when yours will become available: https://frequentmiler.com/heres-when-your-capital-one-shopping-rewards-will-post-to-your-account/

Probably goes without saying, but since this is a postpaid account you must cancel before your statement date to avoid being charged another month. They prorate the amount but still.

Capital One Shopping is very inconsistent. It showed $40 on the browser plugin, $150 on the Portal page (with an “exclusive” label), and I had received an email with the $250 reward as mentioned in your article almost 10 days ago, which I missed noticing.

Do you know how long the email targeted links on email are valid? I clicked thru to use the 10+ day old email and signed up. However the browser plugin didn’t ‘confirm’ the deal being tracked after the order was placed. (It rather suggests me to click on it for a measly $40 so I didn’t click). Hope I didn’t lose out on the CB entirely trying to go for the largest one.

Thoughts?

Unfortunately, how long the email links work is also inconsistent. However, in my experience thus far, if it’s going to work, the browser extension will pop up with the same offer you see in your email. For instance, when I clicked from the $250 email link (the day I received it), the browser extension showed the $250.

I’ve tested this previously by first going to a merchant shown with an increased email rate (without clicking the email) to see what offer the extension would give me, seeing a lower rate than the email, and then clicking through the email in that same browser — and in that case, the extension has then shown the email rate (even though it had shown a lower rate before). I didn’t specifically do that with Consumer Cellular, but to use it as a fictional but parallel example, I’m saying that I got the $250 email offer and didn’t click that but rather went to the Consumer Cellular site and during checkout it only showed $40, so then I went to the email in that same browser and clicked through the $250 email offer and the extension has then showed the $250.

In my experience thus far, when the extension doesn’t match what I clicked through, I haven’t gotten the higher rate.

All that said, we have seen email links in some cases continue to work for a long time. I don’t know the rhyme or reason there, if any.

Thanks for the insight. Its nice to know that whether the browser plugin reflects the targeted offer from email click through could be used as a litmus test, though I think CapitalOne should rather show an error if the link has expired, to be clear.

I wouldn’t be too comfortable using a week-old targeted emailer to make a big purchase if this didn’t work out. I didn’t have the browser plugin show this offer, so unlikely that my $250 cb would record, but the ‘trip’ is still recorded on the portal (doesn’t show what offer it’s tracking or if it’s mapped to an order yet) and will still keep fingers crossed.

Did anyone do this first for the AA portal and then later with Capital One?

AA has language , “Eligible on one (1) purchase per loyalty account member.” and Rakuten says, “Cash Back is only available on the first payment of a subscription plan and for new users.” Capital One doesn’t list special terms, but they may have terms without telling us.

If I use C.O.S. to create a a 2nd order in my name, even with different email, they match the partial SSN and DOB and say I must login or call to finish the order. The 2nd order probably needs to be done with a P2.

Does it make sense that you get hard pull to open this up!?!?

“By submitting your order you authorize having an industry-standard credit check performed”

Nick I can’t believe you took a hard pull for this account, how did you get around that?

Several things here:

#1) I’ve been shouting for years that the importance of hard pulls are so incredibly overblown. I’ve gotten approved with every major issuer with double digit pulls on my reports at some point, so I don’t even think about it anymore when it comes to pulls (and nowadays with 5/24 and BOA’s 2/3/4, etc, I just can’t see even opening so many that the number of pulls on my report is going to matter). I know that if it is possible to get approved with double digit pulls, so then the reason “too many inquiries” that is sometimes cited on denial letters is just a reason given to get you to go away. In reality, if approval algorithms were that simple, the credit bureaus would have nothing to sell the banks. We once had a reader report getting denied for a card and the denial letter said “too many new accounts” — and she hadn’t opened a single account with any bank in over 2 years. I just don’t put much faith in what a denial letter says in general, with the exception being rules that have been proven repeatedly over time (like Chase 5/24 for example, which has nothing to do with hard pulls but rather with credit card accounts). Yes, you temporarily lose a few points with a hard pull, but it’s a relatively meaningless change and if you have a decently thick credit profile you’ll likely earn the points back within 6 months. So first and foremost, I just don’t care if they pull my credit. Now I’m not going to give a timeshare company permission to pull my credit repeatedly to shop me around to lenders for a timeshare unit that I know I’m not going to buy, but if a cell phone service wants to pull my credit to open a phone line, I don’t care about that.

2) They only ask for last 4 digits of your SSN and your name and address. That’s usually a soft pull anyway. I didn’t receive any notification of a hard pull.

3) Even if it is a hard pull and even if I cared a little bit about hard pulls, this is still essentially a $250 bonus for $25. I’ve opened some cards with $200 bonuses before. So I don’t think this would be awful even in that instance, particularly since it wouldn’t be adding a new credit card account that would bring down average age of account.

In short, I saw that and it didn’t matter to me. Obviously if you are more concerned about it, you may choose not to open the account. I was happy with a pretty easy win.

Thanks so much Nick for the detailed reply!!! I love you guys and listen to every one of your podcasts!

I didn’t think that might just be soft pull, and if only asking for last 4 then that totally makes sense. Even just taking it down to risk of hard pull changes the equation for me.

I totally hear what your saying about inquiries, and I’m not too fussed about them either, but I’m still at stage in the game where I wouldn’t consider opening a card for that small of a bonus (opened my 1st rewards card like 2 and a half years ago). In addition im considering going after a cap1 or citi card or barclays card soon and ik they are more inquiry sensitive.

I think also, that it just made no sense to me why they would need to do one. I get it if I’m financing the phones, but just for a $20 plan that they can cancel at any time!? I was just very thrown off by that.

Either way thank you again for the response, and thank you for the amazing article highlighting this deal!!

(with a few accounts this deal can really go a long way…)

It’s funny when one finds something useful buried in comments about something entirely different.

I have 2 mortgage inquiries from Nov 2022 that show up on CK and I always assumed that would put me at 5/24 (a count on CK adds up to 6).

So can you confirm that when you say:

Chase will not count the mortgage pulls towards 5/24?

Just wanted to update to say that my purchase has tracked, showing a purchase amount of $5.40 (the shipping fee on the SIM card) and the $250 in rewards are pending. Awesome deal.

Awesome, thanks Nick. If you don’t mind, how much time did it took to track after your shopping trip?

If you do thebregular Sim and get charged for the shipping today, could you cancel after free month and not get clawback?

I don’t know, but I’m not going to risk losing $250 to save $20. I’ll just pay the $20 and wait until early Feb to cancel (before the next charge). If you try it, let us know if it works. Personally, I’ll be happy with $250 in GCs for $25 out of pocket.

Could not agree more. Definitely worth it 100% I’m just curious if anyway the terms don’t say you have to have it for a certain amount of time, what would be the difference between 1 month and 2 months?

(I don’t know what the terms say I’m just assuming it doesn’t specifically specify you need 1 paid month or that’s what you would have responded)

Mine’s tracking after $0 esim as well, fingers crossed

Nick,

You could join Mint Mobile instead, and still get the same T-mobile network you are on now, but for much lower prices. Also, Amex has Mint Mobile offers yearly and if you are in two player mode, you can refer your spouse as well for a bunch of credits.

I looked at the consumer cellular plans and they looked expensive for a tiny amount of data. Unlimited is $40/month and that’s very expensive for an MVNO.

I’m not looking to switch to Consumer Cellular – I’m just happy to pay $20 to get $250 in rewards.

Mint wouldn’t work for me. I regularly use 30GB+ of hotspot data and over 50GB total on a couple of my lines – and I currently have 9 lines on Magenta Max for about $128/mo, so there isn’t an MVNO that’s going to beat that.

Capital One shopping button also found a promo for 2nd month free, so it looks like 2mo free for me, free eSim download immediately activated and $250 portal cashback.

Thank you for pointing this out Nick! Screenshotted everything 🙂

Nice – I didn’t see the second month promo!

I’ve done the same for numerous other C1 shopping click throughs and >50% of the time they don’t pay out. I even submit the screenshots and they deny it or just never respond back despite me sending numerous emails. I’m done with C1, they’re just way to unreliable. And yes, I am careful about the browser, the click through, not having any other extensions/portals, etc that might steal the click through. C1 is just not reliable for me.

I’d rather use Rakuten where I know the orders will track and in the rare case they don’t when I submit a screenshot they always pay out.

I agree with this greatly, but when they are leaps and bounds above everyone else it’s worth the “hourly rate” of my hassle following up and forcing the issue. Would I go with them for a 20% higher payout…no, but for 500% yes. I’m guessing everyone has their same internal debate when choosing any portal aside from our most familiar.

Totally agree and I’ll too still use them when the cashback rate is crazy high. However, even if I provide screenshots of literally every step of the purchase, they’ll deny it, or just not follow up. I’m still fighting them for 20+ different purchases and they keep ghosting me.

I have one a few battles, but sometimes the small wis with Rakuten seem more satisying.

I was able to do eSIM and didn’t show any charges due today. I do see a temporary charge of $10 on credit card. I think it will drop so that can be an alternate way of avoiding physical SIM charge.

Great find on the eSIM!

If you do esim do you think you need to set up to get payout?

I did the esim setup but like Nick and Troy above, my purchase didn’t track yet. I have very low hopes of getting this payout for me. Because in past similar thing happened and Cap one just send boiler plate email of waiting for 30-90 days simce the purchase.