NOTICE: This post references card features that have changed, expired, or are not currently available

We often extol the value of transferable currency points like Amex Membership Rewards points, Bilt Rewards points, Brex points, Capital One miles, Chase Ultimate Rewards points or Citi ThankYou points. While we most often talk about the ability to leverage transfer partners for amazing sweet spots and incredible value, most of these currencies can alternatively be used to book hotels, flights, rental cars, and more directly through the credit card travel portal. There are indeed some ways to get solid value when booking through a credit card portal, though the problem with booking via the card portal is that there are a lot of ways to get a bad deal. In fact, I think that most cardholders probably get less value than they could or expect by redeeming points in suboptimal ways, so I thought it was worth highlighting some of the downsides to booking with your points through your credit card travel portal.

Booking hotels

You’ll often hear us talk about the value of transferring Chase Ultimate Rewards points to Hyatt, where it isn’t uncommon to get 2c per point in value or more (our Reasonable Redemption value of 1.6c per point for Hyatt is intentionally conservative). Greg has sometimes pointed out that during a high transfer bonus, transferring Membership Rewards points to Hilton can be an acceptable value. And you may have even heard Greg and I talk about booking hotels through Chase Travel℠ at a value of 1.5c per point.

However, there are several potential pitfalls when redeeming points through your credit card portal.

American Express & Capital One: Poor value for points

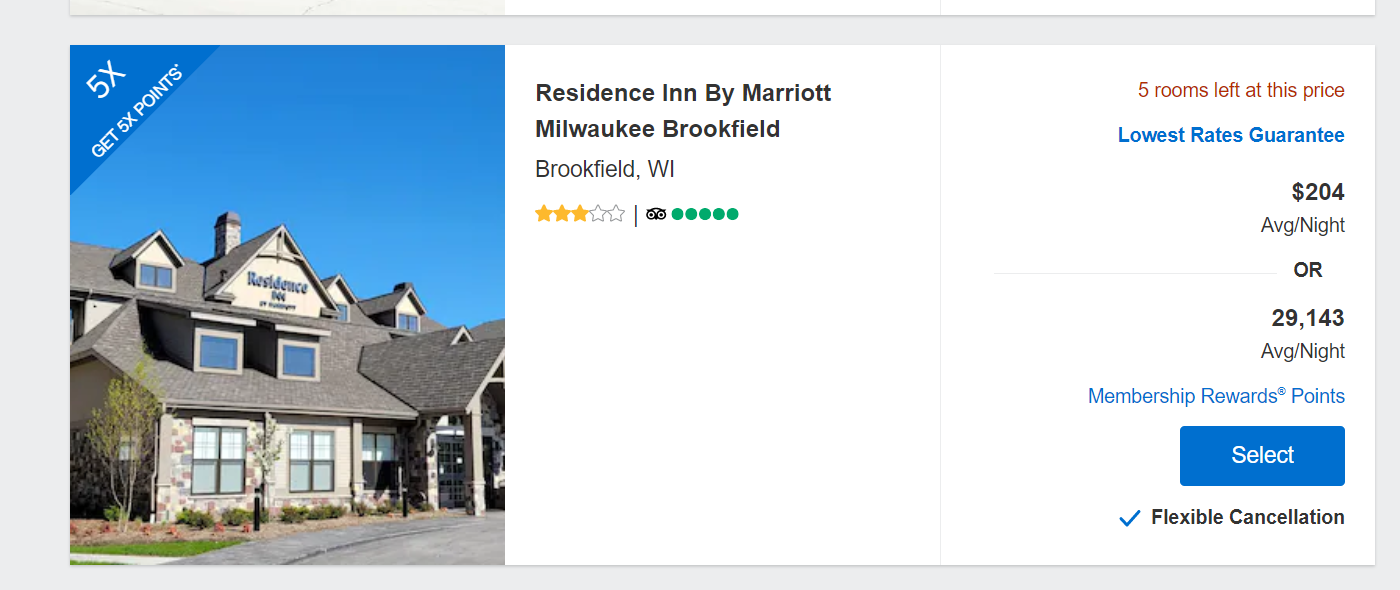

One thing you never hear us talk about is using our American Express Membership Rewards points to book a hotel through Amex Travel or our Capital One miles to book a hotel through Capital One Travel.

The reason you don’t hear us talk about these redemptions is because we don’t do them. They present poor value.

For most hotel bookings, Amex offers about 0.6c per point in value against the cash rate they display (which, as you’ll see below, isn’t even necessarily the actual amount of cash you’re replacing by booking through them and using your points). I’d never accept 0.7c per point through Amex Travel — I’d rather open a Schwab Platinum card and redeem points for cash deposits into a Schwab account at a value of 1.1c per point and then book the hotel directly, likely using half as many points and getting the additional benefit of booking directly.

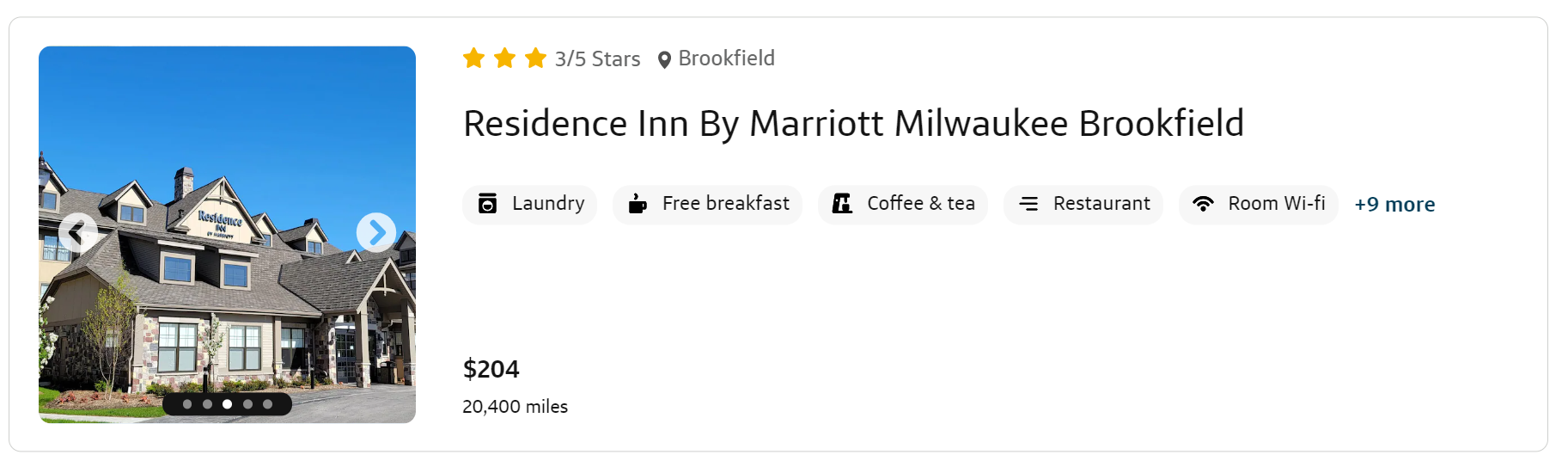

Booking via Capital One Travel looks comparatively better since they offer 1c per point in value, so the same hotel costs just 20,400 points.

However, apart from using the annual Venture X travel credit, I can’t see a reason why you would book that Residence Inn via Capital One Travel for 1c per point when you could alternatively:

- Click through a shopping portal to earn cash back (currently only 3%, but sometimes as high as 10%) and book directly at Marriott.com.

- Collect at least 1,000 Marriott Bonvoy points (Residence Inn only earns 5 base points per dollar; note that you’ll earn more if you have elite status)

- Use Capital One Miles to reimburse the $204 charge with the same 20,400 miles while collecting the portal cash and hotel points noted above

Booking hotels through Amex or Capital One just doesn’t make much sense to me.

Chase is better, but you still might be overpaying

If you’re booking a hotel through Chase Travel℠, you probably aren’t getting the best deal in most cases. That’s because you’ll get:

- No discounts. Are you a member of AAA? Work for a company with a negotiated rate? Is there a coupon code available? Don’t answer those things if you’re booking through the credit card travel portal since you won’t be able to utilize the discounts — you’re just stuck with the price the credit card travel portal shows you.

- No stacking with *shopping* portals. When you’re booking paid stays at chains like Marriott or IHG, you have the opportunity to click through a shopping portal like Rakuten or TopCashBack that brings you to book directly with the hotel chain while offering some percentage in cash back (we sometimes see 10% back or more!). There’s no way to use a shopping portal if you’re booking through your credit card’s travel portal.

- No stacking with hotel loyalty programs. In most situations, If you’re booking through your credit card portal, your stay will not quality to earn hotel points or hotel elite credit and the hotel won’t be required to honor your elite benefits.

- No extras offered by the hotel. Some independent hotels offer extra benefits by booking direct. I just recently saw an independent hotel that offered free COVID cancellation insurance that allowed cancellation up to the day of arrival for no fee (versus the 7-day cancellation window offered when booking through other channels). They also offered free electric car charging for those booking a rate with breakfast included — but credit card portals were missing the breakfast-inclusive rate.

All of the above can easily add up to quite a bit of sacrifice when booking via the credit card travel portal.

You probably know that you can redeem Chase Ultimate Rewards points at a value of 1.5c per point toward hotels booked through Chase Travel, but if you’re missing out on a 10% shopping portal rate or a 10% AAA discount or a discount offered directly by the hotel, then you’re overpaying for the room and not really getting 1.5cp per point.

To illustrate this, imagine you wanted to book an IHG property that costs $100 per night. If you have the Sapphire Reserve card and you book via Chase, you’ll pay about 6,667 points per night (1.5c per point). If you have the Sapphire Preferred, it would cost you 8,000 points per night (1.25c per point).

At the time of writing, TopCashBack is offering 7% cash back on IHG Hotels. Therefore, you could alternatively click through TopCashBack to go to IHG.com and book the same property. Assuming the same $100 price tag, you would earn:

- $7 back from TopCashBack. Keep in mind this is based on the 7% rate at the time of writing, but we sometimes see this hit 10% or more.

- At least 1,000 IHG points (Worth about $6 based on our Reasonable Redemption Values) assuming no hotel elite status). Note that if you have an IHG credit card and therefore IHG Platinum elite status, you would earn more points both as a multiplier on the base rate and from the welcome amenity, you would earn 1,600 points + 500 points welcome amenity = 2,100 points – worth about $12.60). This ignores any other temporary promotions.

As you can see, you’ll get at least $13 back in cash and points by booking directly (and make that $19.60 if you have an IHG credit card for status). Therefore, you’re likely getting no more than $87 in value by using Chase points and perhaps only around $80. If you have the Sapphire Preferred card and would have paid 8,000 points through Chase, you might be better off cashing those points out at 1c per point and paying at the hotel — earning credit card points, elite credit, hotel points, and portal cash back (though YMMV).

Even with the Sapphire Reserve and a best alternative of $87 in net cost, your 6,667 points are getting you more like 1.3c per point in value compared to your net cost when booking direct — and as seen above, maybe even less if you hit an increased shopping portal rate or you have IHG elite status or there is a good hotel promotion running through its elite program, etc.

Keep in mind that’s just one simple example. In cases where you’re booking a hotel that isn’t on a shopping portal or doesn’t offer a loyalty program, you may actually be getting the full 1.5c per point in value, but you have to compare against the best rates offered by the hotel directly to determine how much cash your points are really replacing.

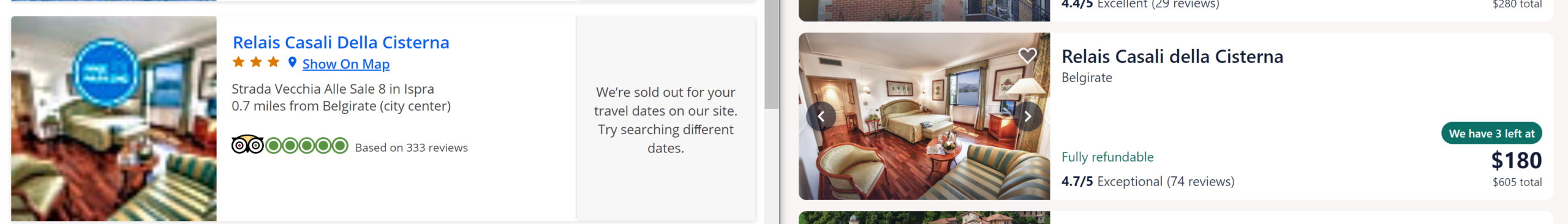

Unfortunately, your available options may be more limited when booking via your credit card travel portal. Just recently I was looking at hotels via Expedia and expecting to see the same options available through Chase, but that wasn’t the case. Take this hotel for example, where Expedia showed several available room types (including a couple of suites, which were also available via the hotel’s direct website) but Chase showed no availability at all.

In that case, you couldn’t get 1.5c per point in value if you wanted that hotel since you couldn’t book it via Chase. While Chase usually has most of the same stuff you’ll find elsewhere, sometimes the options available through Chase are far fewer than those available via other online travel agencies.

Booking cars

You can use points to book rental cars through your credit card portals, but once again you need to compare the points you’re using against the actual cash those points are replacing based on your best booking alternative.

Once again, Amex and Capital One just don’t make much sense to me here. Amex will yield the same poor ~0.7c per point in value toward the prices they show and just like with hotels I don’t see any benefit in redeeming Capital One miles at a value of 1c per mile through their portal when you could book directly with the rental car company (taking advantage of shopping portal cash and/or discounts you may qualify to receive) and still redeem those Capital One miles at a value of 1c per mile against the charge.

Chase is really the main player in this space, but even then it can be difficult to gather comparison points.

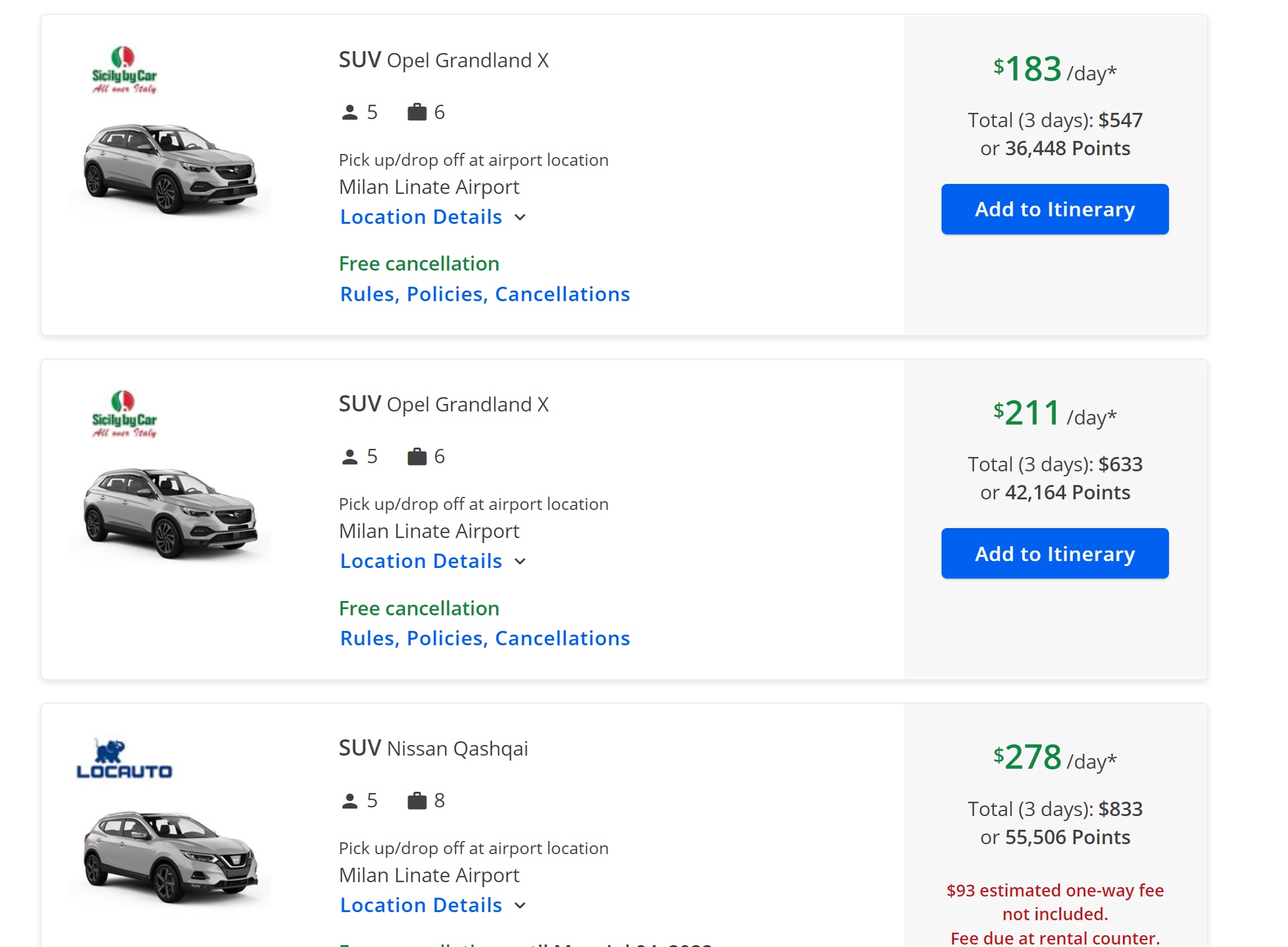

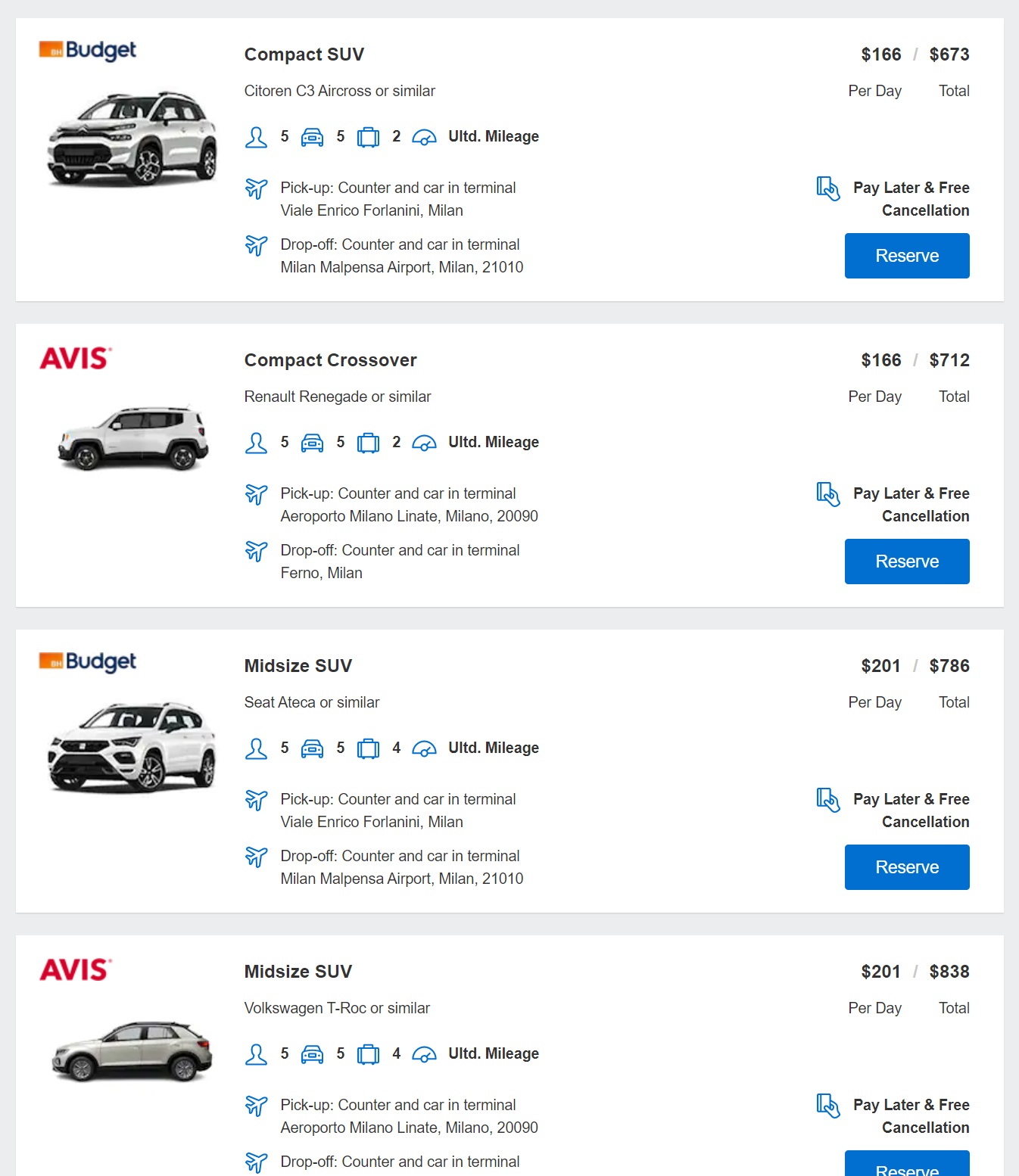

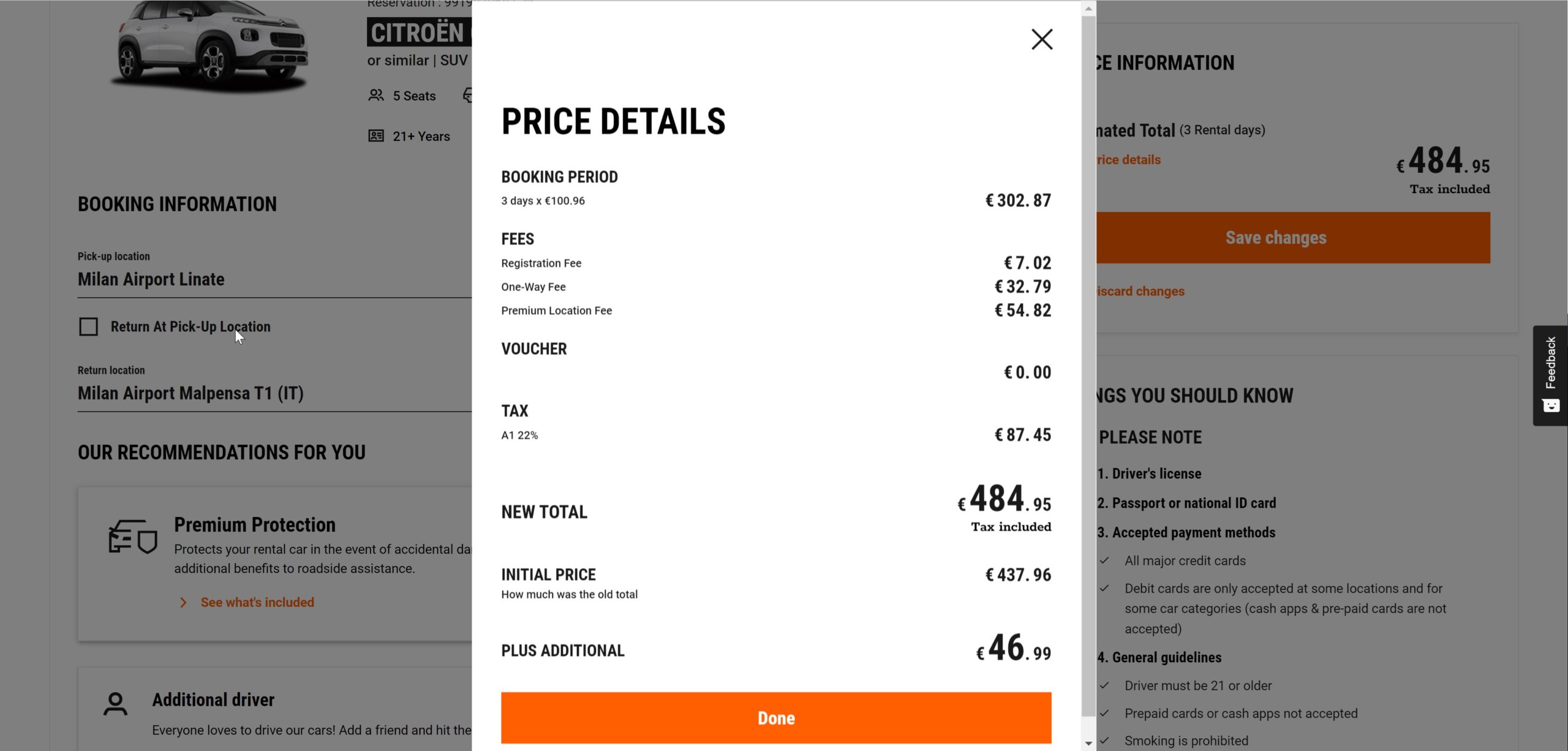

As an example, I have a trip coming up this summer where I’ll be flying in to Milan’s Linate airport and flying out of Malpensa (MXP), so I’m looking for a one-way rental. I prefer to rent an SUV since we’ve got 2 kids and all of the associated stuff.

The cheapest SUVs via Chase start around $547 for my dates.

I’ll point out a nice “gotcha” of booking via a credit card portal is the last car in the list above — the $93 “estimated one-way fee” is not included. Will that actually be $93? Will there also be an additional one-way fee charged by a rental car company located in Milan but called “SicilyByCar”? I feel like I might be in for a hassle at the counter.

Amex Travel wasn’t looking better with prices starting more than a hundred bucks higher (obviously for different rental car companies and you could make the argument for booking through an international chain like Budget or Avis, but it’s neither here nor there as you’ll see below).

Either of the above were better than booking via Capital One Travel since they would have me walk.

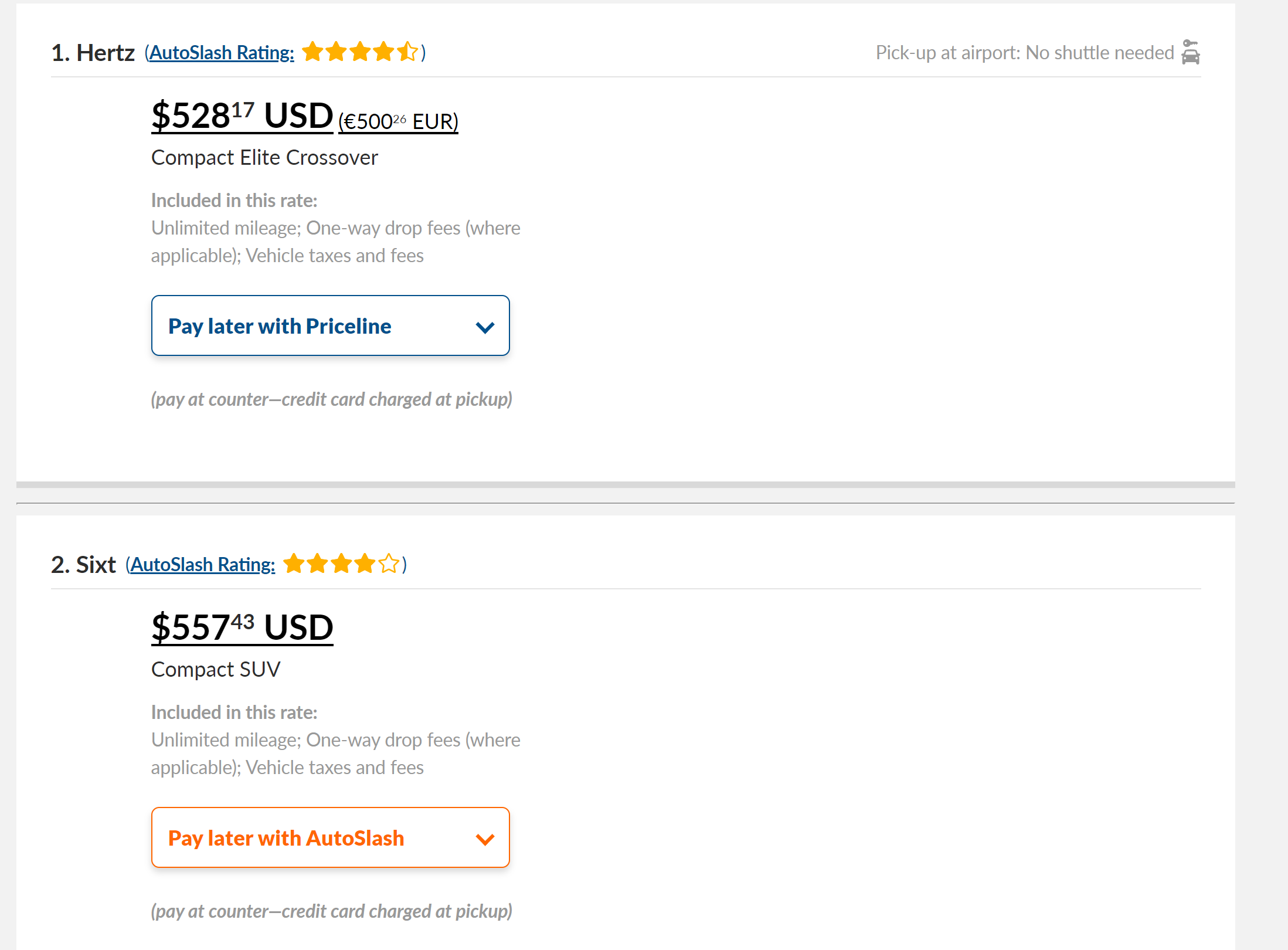

Autoslash, enter stage left. Same dates, same airports, and whatever discount magic Autoslash has hooked up and my options suddenly include Hertz and Sixt at less than the prices above for the international brands (and Hertz is still less than SicilyByCar, though it says the Hertz vehicle is a “compact elite crossover” despite me having entered a compact SUV as my reference, though it looks like Hertz lists the example model as a Jeep Renegade, so I guess that’s about right).

In this case, I actually have access to a couple of car rental discounts that I knew wouldn’t be available via Autoslash, so that same Sixt SUV came down to about $519.60 at the current exchange rate.

Add on top of the above that by booking direct, I can take advantage of shopping portal cash (currently as high as 12% back for prepaid rentals with Sixt, which would have cost even less) and be sure to get my elite status benefits and it makes it hard for me to justify booking through a credit card portal.

Booking flights

Flights are the one area where I am most likely to use credit card points to book through the credit card travel portal. That’s because flights are usually about the same price wherever you book them these days, there usually isn’t any shopping portal cash back (or it’s capped at a couple of dollars), and you generally get the same elite benefits / credit as booking directly.

In fact, sometimes you can do significantly better. More on this story to come, but I recently booked a business class itinerary for my family through Amex Travel and I did significantly better than I could have elsewhere. While I was primarily looking to Amex Travel to take advantage of the Business Platinum card’s pay with points rebate, I ended up getting better flights than I would have otherwise — in part because the best price for the same flights elsewhere was double what I was charged via Amex (and I’m using points to pay for it at a value of around 1.5c per point against that far-cheaper Amex Travel price). Again, more on that in a future post.

However, you do need to be aware of what the credit card travel portals aren’t showing you, like:

- Discount carriers. You typically can’t book discount carriers like Southwest, Spirit, Allegiant, and Norwegian through your credit card portal (though Greg did get Chase to book Norwegian over the phone once). In other words, the portal might not be showing you the cheapest flights.

- Some major carriers. Your credit card portal might even be missing major carriers. For instance, Capital One Travel doesn’t have JetBlue flights.

- The cheapest option sorted to the top. You might need to hunt around the page for the best price.

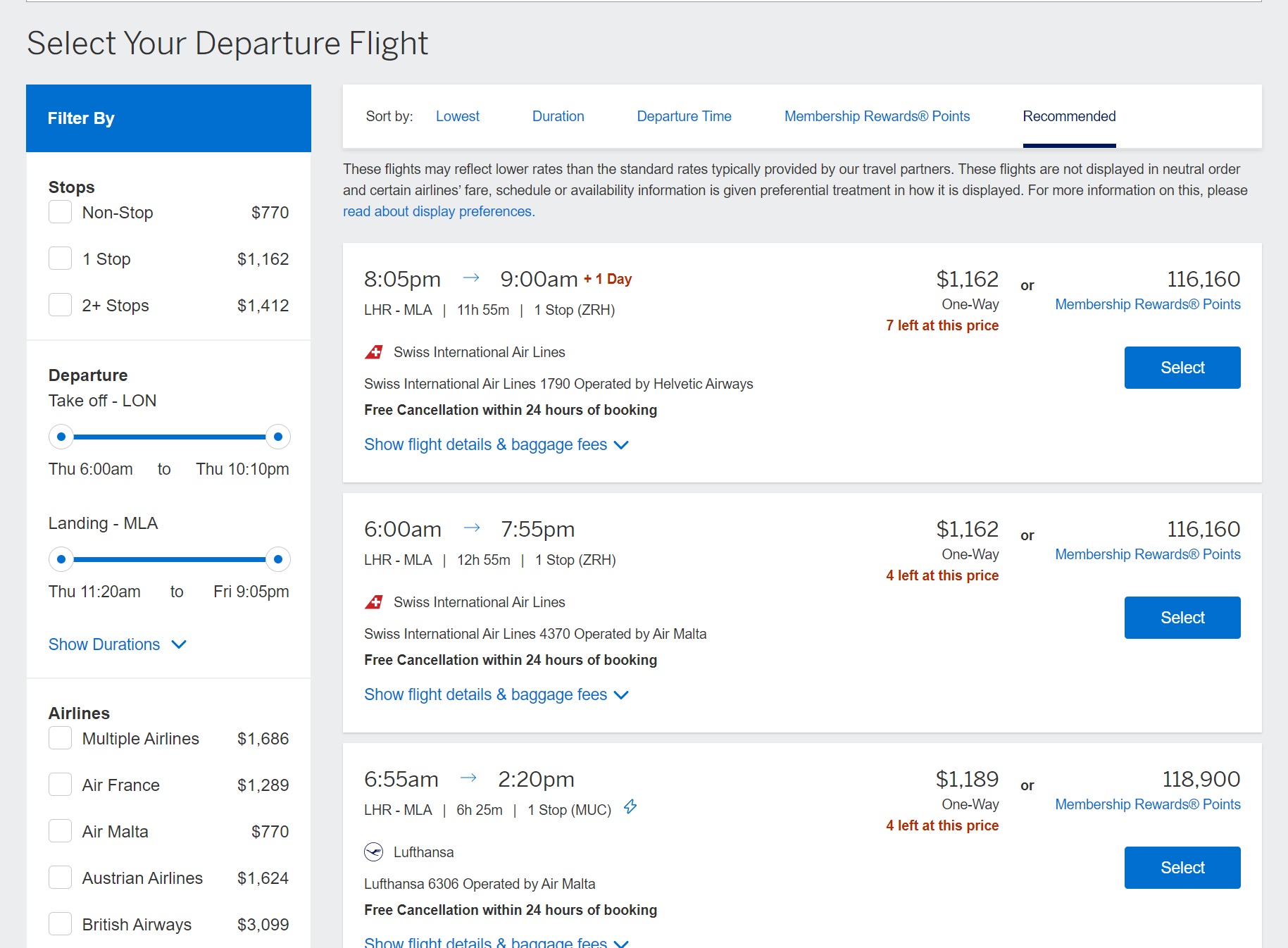

To that last point: I noticed this issue recently with Amex Travel. I looked up a business class flight from London to Malta and check out the results. You’d be forgiven for initially thinking that $1,162 is the cheapest price on this route.

However, look more closely and you’ll see that the list is sorted by “recommended” flights. Why is Amex Travel recommending a one-stop for $1,162 when a peak at the bottom left section shows that Air Malta flies the same route (non-stop) for $770? I don’t know either, but if I didn’t know that there should have been a cheaper option I certainly might have missed the small font there. Note that those prices above are for multiple passengers and it’s just an example to illustrate, not a deal per se.

In this case, you certainly can get the best deal through the credit card portal (that $770 flight), but you have to know what you’re looking at / looking for and beware that what’s shown first isn’t necessarily what’s best. As long as you go in with that knowledge and you use some tools to shop around (like Google Flights), you’ll probably do OK booking flights through credit card portals for the most part.

Bottom Line

All of the above factors ignore what I know is a psychologically significant factor: the Joy of Free. It’s definitely more fun to get “free” travel and if not laying out cash matters more than the cents-per-point value, I can understand why you may prefer to redeem points in at least some of the situations above. And in my own personal circumstances I’ve run into this lately: I’ve run into several pieces of a larger trip where credit card points don’t provide great value, but neither do I really want to lay out all of the cash necessary to protect myself from suboptimal redemptions of my Monopoly-money-esque points by using my definitely-not-Monopoly-money. However, I think it’s worth examining it and being aware that you may not be getting the best bang for your buck and to consider that when deciding how to redeem your points. Tim recently playfully slammed me for cashing out points at 1.1c per point (and I understand why!), but the truth is that in some instances it might make more sense to do that and use your cash to get a better deal than to have the wool pulled over your eyes by the allure of “free travel”. You might be able to get the same quality trip for fewer points / less money by stepping outside of the travel portals.

Flights: I usually try booking with miles, or if not then i got too many of those stupid Amex flight credits that need to be gamed to get value from, so I could rarely use a travel portal, but then C1’s portal consistently gives me the cheapest prices, so there *is* some value in there. Chase’s portal at the start of the pandemic was a useless piece of crap, Lufthansa cancelled the flights without giving money back, and I could not get the supposedly super premium card’s (CSR) coverages because immediately when the agent found out the flight was booked through there I got connected there, and the Chase Travel agent couldn’t refund anything. Had to sue them in small claims court.

Car: I got access to corporate prices at Avis, even for lesure, what are sometimes 5 TIMES less than the best price found by Autoslash.. I don’t even search elsewhere, unless Avis is somehow not in that airport.

Hotel: chain hotels through the chain’s website (points or sometimes corporate pricing is a $10-30 cheaper than public), but for boutique hotels without loyalty, or when chains are not even near the area, C1’s prices are as good as Hotels.com (or anywhere else), and heck yeah I’ll want 10x points instead of 1/10th of an expiring, restricted certificate (or nothing).

I have an Avis personal code through my company also. They gave me one with Budget as well. They’re owned by the same company, so you might have one too.

Not sure if it’s common, but maybe there’s a place with Budget and not Avis.

Nick, is there an easy way to find the airline record locator for flights booked through Chase Travel? In this case, AA record locator…

I’ve been booking hotels through Capital one travel. The prices have been same as booking directly and if it’s not capital one will give you the difference. Recently got a adjustment of of $89 from capital one travel. Another plus to me is Capital One travel lets me cancel the room up to a few days before check in, booking directly it was non refundable

I just found CapOne can be even quite a bit cheaper in some circumstances if you let the hotel “pick your room” for you.

I love using my AMEX Business Platinum to book Alaska Airlines flights (my selected airline) and finding out that the flight is a few dollars cheaper when paying with MR Points booked through the AMEX Travel portal.

I was a little surprised that flights got the endorsement here. I am actually completely sworn off booking flights through portals, certainly Chase’s, because I had a terrible experience when I needed to work to get a voucher as a result of COVID cancellations in 2020. Chase’s customer service is horrific to work with and did not get me full value back from my booking. I wouldn’t recommend booking flights through them, mostly because of how incredibly massive a headache it is to try to get a refund or a new flight if anything goes wrong

I agree with this. Flights is by far the riskiest option since the OTA seem to provide close to zero service if anything changes with the flight or if it is cancelled. I had a call with United for 90 minutes last week and they were able to rebook my 2 international flights that had been cancelled. Yes, it took a long time, but at least I was able to talk to someone that could get approval to put be on new flights.

AGREE about Chase Travel. The absolute worst experience; incompetent agents (hold, please), and ridiculous results. I booked AA “refundable” flights at a $50 extra charge. Yet trying to cancel for the promised refund… after 45 minutes with a nice, but clearly untrained agent, she told me that I would receive Chase Travel credit. Why can it take 2 minutes to book and pay for a ticket and take 45 minutes to cancel it??? I have the confirmation email saying “refundable” yet the agents don’t see that, and do everything they can to NOT refund the tickets. This has happened to me 4-5 times over the past year, and now, I’ve finally learned. This is not a mistake. It is policy! Selling “refundable” tickets, and refusing to refund is, clearly FRAUD. Avoid these people. You might find a good use of UR points, but if ANYTHING goes wrong, you are literally going to get an ulcer trying to get it fixed. Better to transfer points to airline miles, and spend those.

Great analysis Nick! On balance, I would add that the thrill of finding the very best deal on a dream trip should always be balanced against the actual experience you will have. Those who follow my posts know that I am a “maxi-mizer” when it comes to redemptions. My theory is that accumulated points and miles mean nothing if you never use them and they certainly don’t appreciate in value over time. That said, anyone in the game should have an extrication plan in mind. In other words sh*t happens. Getting back home, safe and sound, should always be your default backup plan. My AMEX Platinum personal card and Chase Sapphire Reserve card are always close at hand, just in case. With a healthy credit limit on each, I’m prepared for the unexpected, should things go South. This gives me the confidence to make those outrageous travel plans and relax, knowing I’m prepared for surprises, should they occur. You can sort out the damage claims much better once you are sleeping at home in your own bed.

With CapOne I noticed a quirk on a number of properties where instead of picking your own Bed Selection they call it “assigned at check in” which is cheaper. When I compared the direct rate with the hotel for the lowest priced room (1 King) the CapOne portal was $36 per night cheaper. I just double-checked to make sure I didn’t screw up and I was comparing refundable to refundable and I am. I can get what looks to be about the same price direct with Hilton, but ONLY a non-refundable rate. I didn’t care much about my room for this stay. See the Redondo Beach Tapestry by Hilton hotel as example in Nov.

The credit card portals can also be more expensive for the same tickets than paying direct to the hotel/airline. Completely agree on the Capital One Travel Portal. It can be next to useless for trying to rent vehicles x-US, continually returning no availability even at major airports such as Heathrow and Frankfurt

It’s useless to me within the U.S. as well as a National loyalist