NOTICE: This post references card features that have changed, expired, or are not currently available

This week at Frequent Miler has been a busy one. We’ve explored the awesome new multi-referral program rolled out by Amex and wondered aloud whether the new Gold card is the latest would-be assassin to the CSR. While we don’t normally include quick deal posts in our week in review, a couple of deals this week seemed too good to leave out — including free and easy status and a way to meet your Amex minimum spend at low cost. All that and more in this Frequent Miler week in review.

Super credit card combos

What’s your killer combo look like? Are you all-in on Ultimate Rewards or thankful to rack up more ThankYou points? The truth is that I imagine many readers have a pretty diverse collection, preferring to have access to different types of rewards. But if you had to pare it down to one ecosystem, which would it be and why? Greg lays out the best options in this post.

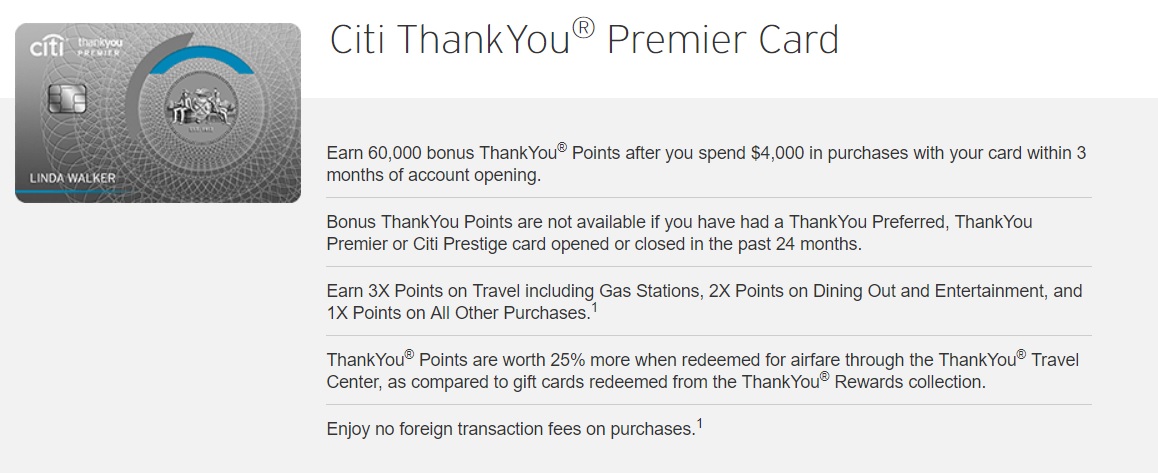

Citi Premier 60K offer still available

Speaking of those killer combos….if you would like to add a ThankYou Premier to the mix, you had better make a move. The affiliate offer was pulled this week, but you can still find a link to the 60K offer on our Best Offers and Citi ThankYou Premier pages. That link is living on borrowed time, so catch it while you can.

New Plastiq promo cuts fee to effective 1.25% [Targeted]

If you have Amex minimum spend to meet, listen up: give this promotion a look. While most Plastiq promos of recent months have been all-Mastercard all-the-time, this one is a bit different. You have to use a Mastercard now (by the end of this month) and then Plastiq will give you fee-free dollars on November 1st. Those fee-free dollars should work for any payment, so the strategy would be to pay a couple/few thousand right now on a card like the Citi Double Cash to bring your net fee down to 0.5% this month — and then pick up thousands in fee-free dollars for Amex spend next month. Remember that Amex limits the categories you can pay — so pay your taxes early and hit an Amex target without fear of the RAT squad. This one is targeted, but worth a look.

Price Protection overview by issuer

With the holiday shopping season almost upon us, you’ll likely be doing some buying — but nothing fuels the fire of buyer’s remorse quite like a price drop just outside of your return window. Luckily, you probably have a number of cards in your wallet that offer price protection — some for as long as 120 days. Do you have a tech geek in the family? What technology item isn’t going to drop in price between today and February 10, 2019?? Buy it now, get the difference back later. See this post for the basics, by issuer.

Re-link Hyatt to MGM Gold now

Do you have Hyatt Explorist or Globalist status? If yes, stop whatever else you’re doing while reading because this might take two hands for a second. Read this post and link this up now. This merry-go-round won’t spin forever, so ride it while it lasts. If you had M Life Gold, it expired recently and it’s now time to re-match. Match to MGM Gold now and back to Explorist later.

Sears might fold: spend your rewards sooner rather than never

People have been crying wolf on Sears for years. This time, it sounds like the big bad wolf is huffing and puffing for real, and Sears didn’t build its house outta bricks after all. If you’ve built a house out of Shop Your Way points, the party ain’t at your place, either. I wouldn’t wait for this to become official – get out while you can.

Maximizing value from Amex multi-referrals

This whole Amex multi-referral thing is awesome. That’s not just the blogger in me talking: that’s the married man playing this game in 2-player mode. It’s almost a guarantee that we’ll each open at least one new Amex card a year. With this new system, we’ll pick up 20 to 30,000 extra Membership Rewards points per year — and that’s assuming we don’t refer anybody else. Double our apps and this really starts to scale up quickly. This is a surprisingly generous move from Amex that completely changes the calculus on keep/change/cancel decisions. See this post for how to maximize it.

Are there any good ways to get to Tahiti on miles?

Spoiler alert: There just aren’t many airlines that fly to French Polynesia. Unfortunately, I’m not going to reinvent the wheel — but I did discover that one program allows bookings out further than anyone else, so that made it easy to scoop up availability while it was there

Free National Executive Elite status for Amex cardholders + free day after 1 rental

If you’re reading this, I know there is a 99.9981272618103946199045% chance that you have at least one Amex card in your pocket. If you do, and you haven’t yet signed up for this, I’m perplexed as to what you’re waiting for. Go go go go go. If you’re thinking, “I already have the Platinum card, so I’ve already got Executive status”, I’ll remind you that National doesn’t do a very good job with differentiating their levels of elite status by name. They have Executive status and Executive Elite status. Yes, those are different things. Go.

Did Amex’s new Gold card kill Chase’s Sapphire Reserve?

“Kill” is wording it strongly. “Reduce to a shell of its former self” is more accurate. We’ll keep a CSR in my household because we’ve found 1.5cpp redemptions to come in handy (just booked flights to Florida for family members for 7500 points round trip thanks to a cheap fare) and CDW/trip delay, but flights and maybe hotels are the only expenses going on it moving forward….and I don’t spend nearly as much on flights and hotels as I can at US Supermarkets and US Restaurants. Combined with Amex’s new multi-referral program, this card is hot. In the first year (i.e. before your second annual fee), you could pick up 110K in referral bonuses…..100K at US Supermarkets…..whatever you spend on restaurants times 4…..oh yeah, and a welcome offer. And then Amex will hit you with a transfer bonus like the current 40% bonus to Avios and increase your value some more. I love me some Ultimate Rewards and all, but the CSR isn’t on the same plane in my opinion. (See what I did there?)

That’s it for this week at Frequent Miler. Check back soon for our week in review around the web and this week’s last chance deals.

![A coupon book with a credit card, a credit card program with an airline, and more [Week in Review] a person reading a magazine on a couch](https://frequentmiler.com/wp-content/uploads/2017/05/kick-back.jpg)