At Frequent Miler, we keep a database of point valuations called “Reasonable Redemption Values.” These are estimates of the “worth” of airline miles, hotel points, transferable points, and more. The idea is that we try to identify the point at which it is “reasonable” to get that much value or more from your points.

This information is critical for making informed decisions. In fact, it’s a key component of the First Year Value information shown on our Best Credit Card Offers page, and it’s similarly used to show which cards offer the best value for everyday spend and which offer the best category bonuses.

When we first started looking at the value of hotel points, we used a laborious process that involved manually comparing the cash and award prices of hundreds of stays each year, then using those results to create RRV estimates. However, we now have a much better way of pinning down the value of Hyatt points.

Gondola is a terrific free hotel search tool that shows prices of properties both in cash and in points, and it keeps data of both for searches done via its platform.

The kind folks over at Gondola have made this data available to us for the purpose of identifying hotel program point values. Thanks to them, we now have access to the results of around 580,000 domestic and international World of Hyatt award searches at over 1,600 different properties, and each one notes both the cash and award prices for the same room. Using this data, we can provide a far better estimate of the “Reasonable Redemption Value” of Hyatt points than we were ever able to obtain by using manual calculations.

Outside of the manner in which we’re collecting data, the biggest change between this analysis and last year’s is our decision to include Mr & Mrs Smith (MMS) properties. Hyatt bought MMS in 2023, intending it as a replacement for Small Luxury Hotels of the World (SLH). However, unlike the majority of Hyatt’s properties, Mr & Mrs Smith awards are not priced according to an award chart and tend to offer much worse value when using points as compared to (most of) the rest of Hyatt’s brands.

We debated whether or not to include Mr & Mrs Smith. However, Hyatt owns it, and its a massive portion of Hyatt’s international footprint. In fact, almost 20% of the total search results that Gondola obtained were MMS properties. Given that, we felt like it represents a substantial component of the value and utility of a Hyatt point and decided to include those properties in the RRV. Under the “Brand Comparison” below, we’ll discuss the variance between Hyatt RRVs with and without MMS.

Based on Gondola’s data, even with Mr & Mrs Smith properties included, the Reasonable Redemption Value (RRV) has gone up, if ever so slightly. It’s now 1.8 cents per point, which we rounded up from 1.75.

Background

When collecting points and miles, it’s always good to have a general idea of what points are worth. Let’s say, for example, that you have the opportunity to either earn 1,000 Hyatt points or 2,000 Marriott points. Which should you go for?

If you don’t know what the points are worth, you’d likely go for the Marriott points. But, in our analyses, we’ve found Hyatt points to be worth more than twice as much as Marriott points. Therefore, on average, 1,000 Hyatt points are worth more than 2,000 Marriott points. In this post, you’ll find my best current estimate of the redemption value of Marriott points.

Methodology

In order to determine the value of Hyatt points, we looked at Gondola’s collected, real-world cash and point prices for over 1,600 World of Hyatt properties. Since Hyatt award bookings are fully refundable, we excluded data from all cash rates that were non-refundable in order to make it a complete apples-to-apples comparison. We also used the Total Cash Rate, which includes taxes and any local fees.

Hotel Programs that Waive Resort Fees on Award Stays

Hilton, Hyatt, and Wyndham waive resort fees when you book stays using points or free night certificates. For these chains, the resort fee does not have to be considered separately from the Total Cash Rate (which includes the resort fee). So, the RRV calculation is as follows:

RRV = Total Cash Rate ÷ Point Price

Hotel Programs that Charge Resort Fees on Award Stays

IHG, Marriott, and many other hotel programs impose resort fees on award stays. For these chains, the resort fee must be specifically taken into account in the calculation. We do that by having Gondola subtract it from the Total Cash Rate. The RRV calculation is as follows:

RRV = [Total Cash Rate – Resort Fee] ÷ Point Price

Gondola Data

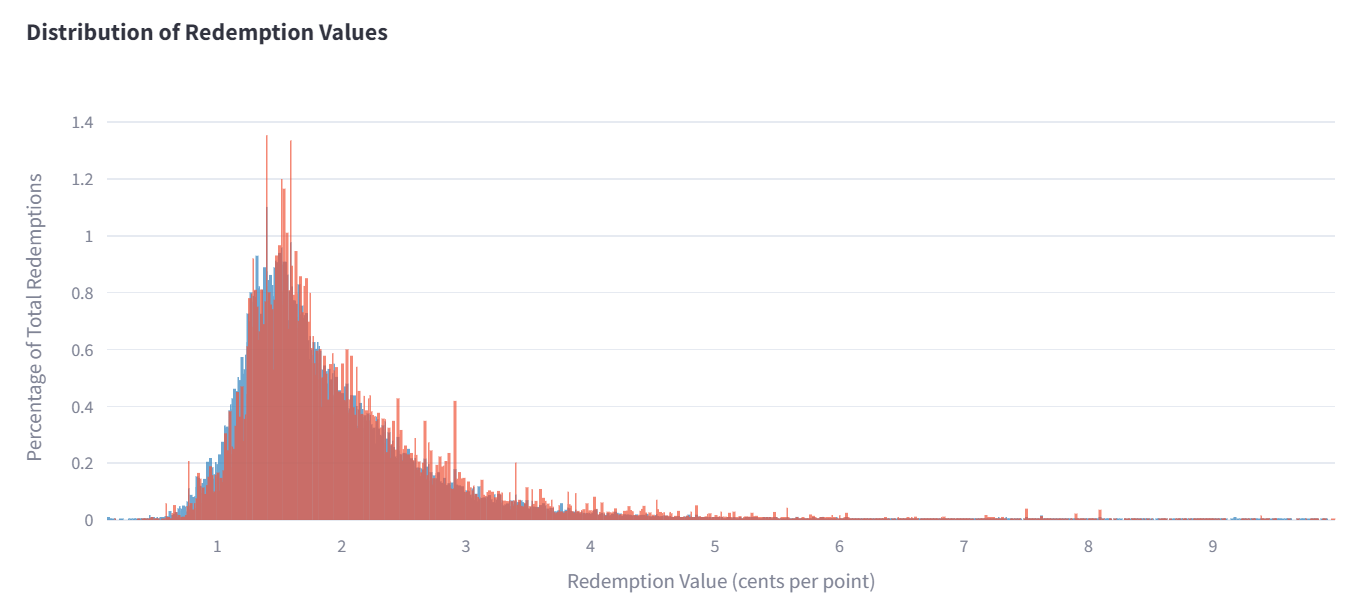

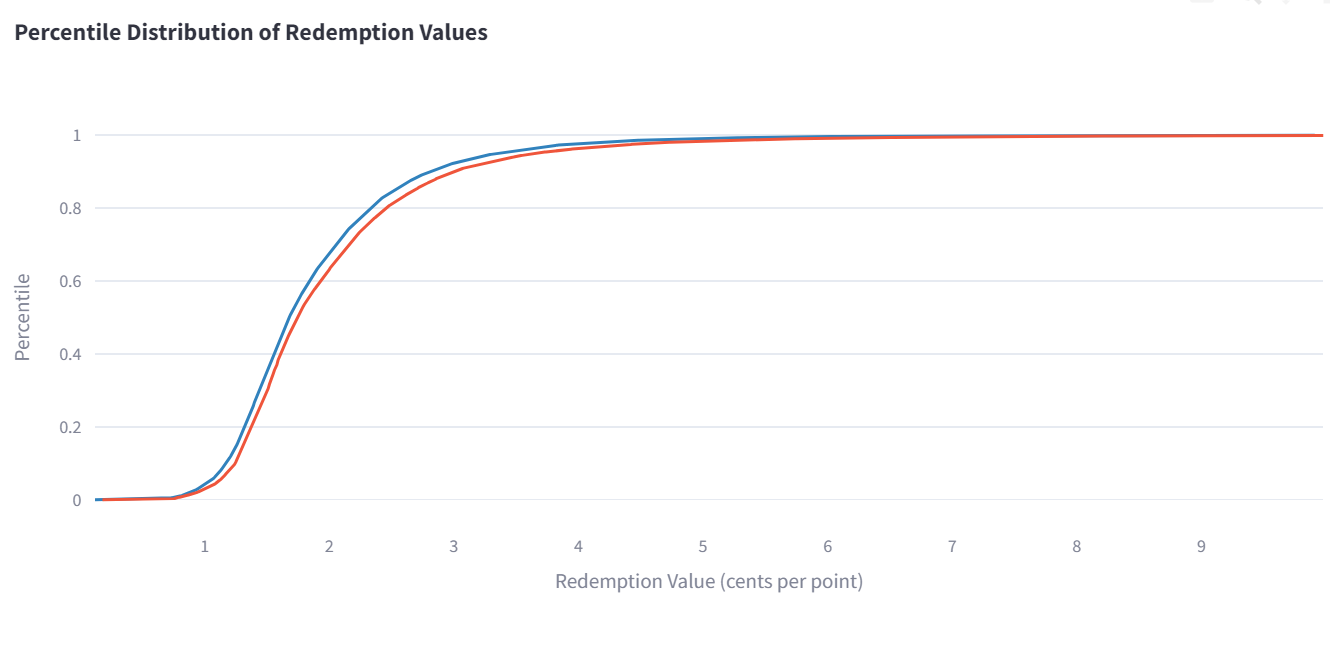

For our hotel RRV values, we use the median value we see based on the data from Gondola. If the median is 1 cent per point, meaning that half of all searches produced a value of less than 1 cent per point, and the other half above 1 cent per point.

- Gondola Median Observed Value for Hyatt redemptions: 1.8 cents per point (rounded up from 1.75)

(based on data as of June 9th, 2025) - Range: .60 to 8.09 cents per point

Brand Comparison

Another cool feature of the data set that Gondola provides for us is that we can actually see how point values vary across a program’s different brands. There’s a decent amount of variance among Hyatt’s brands, especially with Mr & Mrs Smith and some of the all-inclusive properties. Here are some of the most notable examples:

| Brand: | RRV | Difference |

|---|---|---|

| Impression by Secrets | 2.44 | +39% |

| Hyatt Regency | 2.06 | +17.7% |

| Hyatt Place | 1.99 | +13.7% |

| Park Hyatt | 1.98 | +13.1% |

| Hyatt without Mr & Mrs Smith | 1.91 | +9.1% |

| Andaz | 1.67 | -4.6% |

| Dreams | 1.62 | -7.5% |

| Mr & Mrs Smith | 1.44 | -17.7% |

| Zoetry | 1.41 | -19.4% |

The most interesting comparisons are Mr & Mrs Smith vs Hyatt without it.

Mr & Mrs Smith isn’t quite as bad as we thought it was, or perhaps it’s been improving since we first looked at it last year. At that time, it was fairly common for us to see values approaching 1 cent per point, while the top end seemed to be around 1.4. A median RRV of 1.44, while not great in comparison to Hyatt’s legacy brands, is much better than we would have anticipated. If it is due to an effort by World of Hyatt to improve value, let’s hope it continues.

On the other hand, a survey of Hyatt’s non-MMS properties produces an RRV of 1.91, and common brands like Hyatt Regency, Hyatt Place, and Park Hyatt hover closer to a full 2 cents. Adding international DPs this year almost certainly provided some juice to those numbers, as you can often find excellent value at those brands abroad. Although we decided to include MMS in the RRV that we use, those who never plan to book those properties could safely use 1.9 as their benchmark.

The various all-inclusive properties were all over the place, with Impressions (the highest-end option) leading the entire pack in RRV and Zoetry trailing behind even MMS. All of the others were huddled around 1.7-1.8. When Hyatt first acquired all of its new all-inclusives, they represented some of the best value in the program. Several devaluations and award chart changes later, that’s clearly no longer the case.

Results

Point Value

| Analysis Date: | 6/9/25 | 6/20/24 | 12/5/22 |

|---|---|---|---|

| Point Value (Median) | 1.8 cents | 1.7 cents | 2.1 cents |

| Minimum Point Value | 0.6 | 0.9 | 1.3 |

| Maximum Point Value | 8.1 | 3.6 | 4.9 |

* Analyses starting 6/9/25 include international properties, as well as Mr & Mrs Smith.

The median observed point value for Hyatt points was 1.8 cents per point. This means that half of the observed results offered equal or better point value, and half offered equal or worse value. Another way to think about it is that, without trying to cherry-pick good awards, you have a 50/50 chance of getting 1.8 cents or better value from your Hyatt points when booking free night awards.

Compared to our last analysis, and despite including Mr & Mrs Smith properties, the value of Hyatt points has gone up a bit. My guess is that this is primarily due to including international properties this year, which can often be excellent value when looking at Hyatt’s mainline brands. The uptick in value of international properties seems to have more or less offset the ding that MMS properties provide, leading to an overall RRV that’s very similar to what we found last year.

Pick your own point value

| Analysis Date: | 6/9/25 | 6/20/24 | 12/5/22 |

|---|---|---|---|

| 50th Percentile (Median) | 1.8 | 1.7 | 2.1 |

| 75th Percentile | 2.2 | 2.1 | 2.4 |

| 90th Percentile | 2.8 | 2.6 | 3.2 |

* Analyses starting 6/9/25 include international properties, as well as Mr & Mrs Smith.

When we publish Reasonable Redemption Values of points (RRVs), we conservatively pick the middle value, or the 50th percentile. The idea is that just by randomly picking hotels to use your points, you have a 50/50 chance of getting this value or better.

But what if you “cherry-pick” awards? Many people prefer to hold onto their points until they find uses that represent good value. If that’s you, then you may want to use the table above to pick your own point value. For example, if you think that you’ll hold out for the best 10% value awards, then pick the 90th percentile. If you cherry-pick a bit, but not that much, you might want to use the 75th percentile (for example). We’re guessing that most cherry-pickers will land around the 75th percentile: 2.2 cents per point.

This analysis shows that those who cherry-pick good value awards can count on getting around 2.2 cents per point in value or better.

Reasonable Redemption Value for Hyatt points: 1.8 CPP

Our Reasonable Redemption Value (RRV) for Hyatt points was previously set to 1.7 cents per point, but we’ve now raised it to 1.8. RRVs are intended to be the point at which it is reasonable to get that much value or better for your points. Therefore, we believe the median observed value is a good choice for our RRV.

- Reasonable Redemption Value for Hyatt: 1.8 cents per point

- Targeted Redemption Value for those who cherry-pick awards: 2.2 cents per point

Points are worth less for elite members

With most hotel programs, elite members earn more points per dollar on paid stays than do non-elite members. As a result, the relative value of an award stay compared to a paid stay decreases. The following table shows the median point values with various levels of elite status.

| Elite Level | Point Bonus on Paid Stays | Median Cents Per Point |

|---|---|---|

| None | None | 1.8 |

| Discoverist | 10% | 1.8 |

| Explorist | 20% | 1.8 |

| Globalist | 30% | 1.7 |

As you can see above, points are worth a tiny bit less for Globalist members, but the small elite bonuses for lower-level members don’t move the needle. Also, keep in mind that Globalist members get free parking on award stays, so if that was factored in, Globalists would actually get better point value than others.

Overvaluing vs. Undervaluing Points

There is no perfect way to estimate the value of points. Decisions we made here in some ways overvalue points and in some ways undervalue points. The hope is that these things roughly offset each other…

Factors that cause us to undervalue points

- With hotel programs that offer 4th Night Free Awards (IHG, with some credit cards), or 5th Night Free Awards (Hilton & Marriott), or award discounts (Wyndham), we do not consider the point savings in our analyses.

- With hotel programs that offer free parking on award stays to top-tier elites (Hyatt), we do not factor this in.

Factors that cause us to overvalue points

- We do not use discount rates (other than member rates) in our analyses. In real-life, many people book hotels cheaper (and sometimes far cheaper) by using AAA rates, government & military rates, senior rates, etc.

- We do not use hotel promotional rates. Often, individual hotels have deals such as “Stay 2 Nights, Get 1 Night Free” which can greatly reduce the cost of a stay.

- We do not use prepaid rates in our analyses. Sometimes these rates are significantly lower than refundable rates.

- We do not factor in rebates which can be earned from booking hotels through shopping portals.

- We do not factor in extra points earned on paid stays for those with elite status.

- We do not factor in rewards earned from credit card spend at hotels.

- We do not factor in hotel loyalty program promotions: Most promotions, but not all, only offer incentives for paid stays. We often see promos offering bonus points, double or triple points, free night awards, etc.

- With hotel programs that waive resort fees for top-tier elites on paid stays (e.g. Hyatt), we do not factor this in.

How can Hyatt points be worth more than Ultimate Rewards?

At the time of this writing, our Reasonable Redemption Value (RRV) for Chase Ultimate Rewards points is 1.5 cents per point. Meanwhile, our RRV for Hyatt is 1.8 cents per point. But, given that Ultimate Rewards points can be transferred to Hyatt and many other programs 1 to 1, shouldn’t Chase points be valued equal to or higher than Hyatt points? And, if given the choice to earn the same number of Hyatt or Chase points, wouldn’t we pick the Chase points?

Yes and yes. We would rather have Chase points than Hyatt points (as long as we also have a card like the Sapphire Preferred, Sapphire Reserve, or Ink Business Preferred which makes it possible to transfer to Hyatt and other programs) and so, yes, Chase points are “worth” at least as much as Hyatt points.

This is part of the reason why we try, as much as possible, to avoid the word “worth” in our Reasonable Redemption Values (RRVs). Our RRVs are point estimates showing that it is reasonable to get that much value or more. With Hyatt, you’re most likely to use your Hyatt points for Hyatt stays, and so, as our analysis showed, it’s reasonable to expect to get 1.8 cents per point value or more. With Chase points, however, it’s totally reasonable to use them in other ways.

If you have the Sapphire Reserve card, you’ll get 1.5 cents per point value by booking travel through Chase Travel℠, which can be a reasonable option, especially since you’ll earn both miles and elite-qualifying points when booking most flights. Similarly, it’s reasonable to transfer points to airline partners like United, Air Canada, Air France, etc. However, with those programs, you might get more than 1.5 cents per point value, but you might not get as much as with Hyatt unless you cherry-pick high-value awards.

So, the final answer here is that Chase points are worth at least as much as Hyatt points… when transferred to Hyatt or to an equally valuable transfer partner. But, it’s also reasonable for our Reasonable Redemption Value of Chase points to be lower than Hyatt points because it’s absolutely reasonable to get 1.5 cents per point value from those Chase points.

Conclusion

Based on the latest analysis, the Hyatt Reasonable Redemption Value (RRV) has increased to 1.8 cents per point (from 1.7 previously). If you leave out Mr & Mrs Smith properties, the RRV shoots up a little more, to ~1.9 cents per point.

The idea behind using the median for our RRVs is that you have a 50/50 chance of getting that much value or more from your award stays, and so it is reasonable to expect to get that much value or better. For those more advanced, this post’s percentile results show that it’s reasonable to expect to get 2.2 cents per point or better if you cherry-pick good-value awards.

Out of curiosity, is there anything stopping you from showing the calculations for ALL the Hyatt brands? Was curious about Alila, Thompson, etc

I would be very curious to see some of this data as it relates to the award category

While everyone wants a deal, I think we hobbyists endure/rationalize the subjective shortcomings of a property in the name of the almighty cents per point.

100% this. In truth, to use your points wisely, you’ve always got to weigh CPP together with “what is the actual quality of the product I’m getting for my points”, and also “what else might I do with these same points?”

If one had 100K points, and found a crappy hotel somehow way overpriced at 100K/night, but for which the cash price was $10K/night, you’d be getting a whopping 10 CPP to book there. But who cares if you don’t enjoy the place, or if you’d rather book five nights at a really good 20K/night property where you get 1.5–2 CPP. On no meaningful measure is opting for the latter a bad deal despite having an “insane” 10 CPP available to you. (Nor would opting to book just one night at the 20K property over one night at the 100K property, again, regardless of the comparative CPP.)

Obviously, this is an extreme example just to make the point that myopic focus on CPP can lull you into bad decision making at times. Undesirable properties shouldn’t suddenly become desirable just because, say, their cash price got jacked up, making the CPP for redemptions there sky high.

Since you have the data, maybe you could publish some of the better redemptions, say 5 cents and up.

We don’t actually have (or care to have) the raw results of all 580,000 searches. Gondola gives us the ability to look at the totals by program/brand based on the most recent tally of results.

However, my assumption is that almost all redemptions at that level don’t represent a property that routinely offers 5 cents or above in value, but rather an in-demand date at a property that normally is much less expensive. For instance, I occasionally travel to other cities for sporting events. I often get 4+ cents per point at Hyatt Places in smaller college towns. A property that costs 8,000 points might be selling rooms for $400+, but the rest of the year (not counting graduation), rates are a fraction of that.

Out of ~580,000 searches, only a few hundred produced 5+ cents per point value, so it’s only around 1-2 out of every 1,000 searches that’s getting a value that high.

This is a good point. This is why I prefer to use the “What would I be willing to pay for this stay if I didn’t have the points?” metric, since it forces you to actually take other viable alternative bookings into account. Booking an award stay based solely on the comparable rack rate can lead to some odd results. (I would know.) Kind of like buying a pair of jeans on sale based on how discounted the price is from the regular price, without considering how much you actually like the jeans. (I would know.)

Great analysis, especially broken down by Hyatt brands. Looking forward to seeing this data for Marriott and Hilton, who have so many brands too 🙂

[…] Frequent Miler […]

Another way to think of the Hyatt vs. Chase RRV paradox at the end is that Chase RRV is like a 1.5-cent Visa GC per point, and Hyatt RRV is like a 1.7-cent Hyatt GC per point.

I haven’t gotten into the math on this, but I suspect you can beat 1.7c pretty easily if you go to less buzzy locations. My favorite Hyatt destination is pretty easily repeatable at over 3.0c right now…but it’s not in a trendy vacation spot like most of the cities you guys are using for this methodology. (It is, however, a 5 minute walk from my favorite MLB team’s home stadium) I suspect there may be some similar results elsewhere in secondary and tertiary markets, while you won’t get nearly the extra value in places like New York, Chicago, Seattle, California, Florida, etc.

There’s a bit of irony in a blog that specializes in writing sweet-spots, how-tos, “which pts tools is best”, etc also writing about reasonable redemption values. As if we’re not all here to find said sweet spots.

While 1.7c is reasonable, based on the cost of acquiring them and based on the cost at which Hyatt sells them, anything below 2.0c makes less than sense.

In other words, cherry picking them is why we’re here.

Some great examples of cherry picked redemptions that I’ve recently made at >= 2.0c:

Further, as you mentioned there are a ton of unaccounted for variables which makes this less than accurate at an apples-to-apples comparison with other programs (which seems to be the goal of RRV). Instead if you focus on cost of acquisition, which is irrespective of the program, it becomes clear that anything greater than that is always a mathematical win.

My 2.0c

I actually find that considering the relative RRVs (i.e., RRVs between hotel programs, not just the cash-to-points comparison within a single program) is extremely useful. More often than not, I find myself comparing lodging options because there isn’t a single clear winner in front of me. If there is a clear winner (or “sweet spot” if you want to call it that) then that’s my answer and I don’t need to look any further. However, the reality for me is that most frequently there are at least 2 or 3 viable options to choose from. At that point, I have to consider the cash rate, the award rate, elite benefits, and above all, how subjectively valuable the hotel is to me. Juggling all of those factors at the same time, adding in the relative RRV of each program becomes extremely useful.

For an absurd Hyatt points example, during a 5-day Feb 24 stay at Hotel La Compañia in Panama City, our 12k/night award stay (reserved in early ‘23 before rates went up), was upgraded to a “Grand” class suite with a member rate of $2454/night, over $.20/pt.

You could also be upgraded to that suite if you paid cash. You didnt book that suite for 12k points originaly. Nor were you going to pay $2454 for a room. Of course you are entitled to believe whatever numbers that make you happy :0)

Another blogger has commented that his Hyatt redemptions tend to average out to about 1.5cpp. it would seem that the dispersion of experiences is quite large. And, when one’s redemption value gets below a certain threshold, it makes no sense to transfer points to the program.

I want to thank you for posting these articles periodically.I used an earlier version to get reimbursement for an unexpected Hyatt stay during a trip which was interrupted for medical reasons. I submitted a FM RRV analysis to my travel insurance provider and argued that the points had monetary value. I ended up getting reimbursed for the value of the points. I had paid nights as well, so that probably helped, but I was happy to get reimbursed for the points value.

What a cool data point!

I read the title and thought about 1.7¢. No analysis needed.

If you factor in the Mr and Mrs Smith abomination, its even worse.

I get 2.625c in cash from my BofA card thanks to the info out there

The best Ink unlimited or freedom unlimited gets me is 1.5 UR = 1.75c cost

I do get 3x groceries – small amounts at 0.85c cost

I get almost free from Visa gift cards at staples 0.5c cost

Overall about 1.5c

I probably get similar value but I get to stay at properties normally I would not be able to

Lastly, I get 3x with HH cards for regular spend, but only 1x with Hyatt or 1.5x via Chase

So as far as I am concerned, 1 Hyatt = 2-3 HH points