This week, I felt the pinch for the first few times since my wife’s Chase Sapphire Reserve® Card got access to the new benefits (she was a cardholder prior to 6/23/25, so her card took on the new benefits on 10/26/25). We booked a flight via Expedia that wasn’t available via the airline’s website directly (nor was it available through Chase Travel). We also (re)booked a couple of airport transfers through TripAdvisor that we had previously booked through Viator, thanks to 70% back from Capital One Shopping, and then we later booked a couple of things through Viator for 50% back via Capital One Shopping. In each case, we opted for a more rewarding card than the Sapphire Reserve to book our travels.

Meanwhile, as we checked out of a (Hilton) hotel that we had booked directly, we paid our bill not with the Sapphire Reserve for 4x but rather using Amex cards that featured broadly-useful Hilton credits.

While we were in Los Angeles a week ago, I looked for an opportunity to use our Sapphire Exclusive Tables credit, but none of the nearby options really fit.

Is Chase going to miss our business on any of those transactions? Probably not, but it goes to show how a once-darling travel card is just a niche player in our wallets these days, coming out occasionally at best.

Meanwhile, my wife’s Citi Strata Elite has taken on more of our dining spend than I’d have otherwise anticipated. Given that we have young kids, we don’t tend to dine during the ridiculous “Citi Nights” window of 6pm-6am Eastern Time on Fridays and Saturdays, but since we have been in French Polynesia for the past week, “Citi Nights” became “Citi Lunch” last weekend for 6x. I’ll take it!

On the blog this week, Greg talks about how to fix the Sapphire Reserve, Visa and Mastercard settle on letting merchants be more picky on which cards to accept, Greg considers returning to Bilt, and more.

This week on the Frequent Miler blog…

How to fix the Chase Sapphire Reserve® Card

The Chase Sapphire Reserve is a card that most of the blogosphere used to easily recommend to newcomers to the hobby whose income and spending would support an ultra-premium card. It was easy to understand and provided an excellent set of benefits. And I think it did its job for Chase: I often see people ask whether it’s worth expanding to a non-Chase points ecosystem, suggesting that they found the simplicity of a Chase-only credit card world satisfying. Sadly, it is now a very complicated card that I certainly wouldn’t bother trying to explain at a dinner party when somebody asks me, “What’s the best credit card?”. All that is to say that I completely agreed with Greg’s suggestions here for how to fix the card and make it recommendable again, and that I shared his follow-up reaction to Gary Leff’s reaction at View from the Wing. In fact, I’m fairly perplexed at Gary’s take that part of the purpose of the refresh was “to generate new excitement for a product that had become fairly stale and that faced new competition from other issuers.” He suggested that the refresh has done that. What? Generate new excitement? Where? Who has said that they are excited about the limited footprint of Sapphire Reserve Exclusive Tables, the more limited footprint (and silly name) of The Edit, or $500 worth of Southwest credit with $75,000 in spend? For everything printed about this card since the refresh, I don’t think I’ve seen anyone call it exciting. Will people apply to get a big infusion of Ultimate Rewards points? Sure. People are excited about a big points bonus. Let’s not confuse that with finding the card exciting. I agree with Greg: it isn’t, and Chase should fix it. Just this week, I made bookings through Expedia, Viator, and TripAdvisor; 8x on Chase Travel didn’t influence my booking behavior, but 3x on travel would have influenced which card I used to book (and which card I recommend to others).

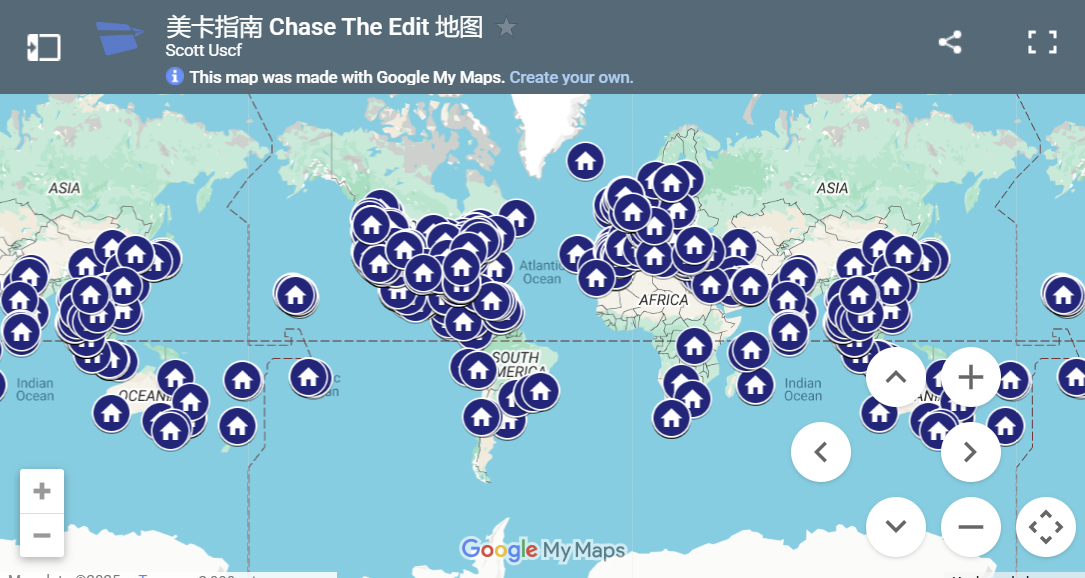

A map and list that show all of The Edit by Chase Travel℠ properties in the world

Speaking of that Edit Credit, there recently became a couple of ways to more easily find qualifying The Edit properties, including a map made by US Credit Card Guide and a list printed on Chase Travel. While Tim noted that he prefers the list for the ability to peruse property pictures, I have a preference for the map in order to identify general areas where I’m more likely to find some Edit options. Either way, it’s great to see a couple of ways to more easily identify opportunities to use those The Edit Credits.

Chase adds lifetime language to no-annual-fee Ink Cards

In news that is certainly a big time bummer, there has been new lifetime language added to the Ink cards, and it is worse than it sounds at first mention. The newly-added language indicates that you may not be eligible for an introductory bonus on a couple of popular Ink cards if you have or have ever had any no-annual-fee Chase for Business card. While I imagine this language is mostly intended to exclude people from getting many Ink cards, it would be a shame to see this applied in such a way that a business owner couldn’t get one of each of the currently available Ink for Business cards. We’ll have to keep an eye on whether and when this rule gets applied.

Visa and Mastercard reportedly nearing settlement allowing merchants to stop accepting rewards cards

In a move that could be bad news for rewards cards, Visa and Mastercard have come to an agreement with merchants that will make minor reductions in interchange fees over the course of several years while enabling merchants to choose not just whether to accept Visa or Mastercard cards but which Visa and Mastercards they want to accept. While this has the potential to shut out rewards cards at the register, I can’t imagine that many businesses will find it beneficial to place new limits on which cards they will accept. Still, I am surprised to see this settlement come to pass (it did get signed in the time since we published this post).

5 game-changing points & miles updates | Coffee Break Ep77 | 11-11-25

On this week’s Coffee Break, Greg and I covered 5 of the biggest recent points and miles developments, including that agreement between Visa, Mastercard, and merchants, Hilton’s new rumored Diamond Reserve status, a new Hyatt card coming soon, and more.

Returning to Bilt and reconsidering the Rakuten card

One of the updates discussed on Coffee Break was the ability to earn Bilt points through Rakuten. In my opinion, Bilt’s partnership with Rakuten was a cunning move. It cuts into Amex a small amount, thanks to stealing some Membership Rewards-earning customers and turning them into Bilt-earning customers, and it gives them access to sell a large quantity of Bilt points to Rakuten. It also reignites interest in Bilt among people like us. While Greg and I had both long ago transferred out most of our Bilt points, and neither of us was earning a significant enough number of Bilt points on an ongoing basis to keep it top of mind, the ability to turn our Rakuten rewards into Bilt points very much flips that script. Suddenly, many of us who regularly earn Rakuten rewards have a pile of potential Bilt points, which brings Bilt very much top of mind once again, as evidenced by the fact that Greg is once again considering chasing Bilt status and thinking about getting the Rakuten credit card. We’ll see what happens in February.

Rewarding Giving | Frequent Miler on the Air Ep332 | 11-14-25

They say that you get what you give, and on this week’s Frequent Miler on the Air, we discuss how to maximize your return when trying to do good, whether through charitable gifts or microloans. I especially like Greg’s tip about helping your favorite charity set up to accept gifts via credit card without cost to the charity. Elsewhere in the show, we discuss Virgin Atlantic’s bad math, flights to Europe for 88 miles one way, a big new one-card offer for business owners, and a lot more.

Spending your way to a “free” stay at Atlantis Bahamas with the Caesars Prestige card

Having spent a few nights at Atlantis Bahamas last week, courtesy of my now-expired Caesars Diamond status, I contemplated the value of spending toward elite status with the Caesars Rewards Prestige Visa Signature card. While I set out to write this post wondering whether it was worth spending toward Diamond status, I ultimately found that spending less to pick up Platinum might be the better play.

How often do you fly to earn points & miles? | Ask Us Anything, Live Ep80 | 11-5-25

During our most recent Ask Us Anything, we fielded questions about our hotel booking habits, the sustainability of the Atmos Summit, how often we fly to earn miles, and a lot more. Catch the replay here or find direct links to each of the questions we tackled in the show notes here.

Maison Métier New Orleans (Hyatt Unbound Collection): Bottom Line Review

Tim’s review of this New Orleans Category 5 Hyatt certainly makes it sound like a cool place to spend a few nights. A quick glance at the pictures shows a style that is anything but cookie-cutter, and it sounds like Tim enjoyed this stay for the most part. If you’re looking for a more unique place to stay in the Big Easy, check this review out.

Hotel David Whitney, a Marriott hotel in downtown Detroit

I’ve been a Detroit Lions fan since the Barry Sanders days, so it is great to know that there is a decent Marriott option near Ford Field if I should ever get plans together to attend a Lions game (I did once have tickets to a home game against Green Bay, but the NFL flexed the schedule and we couldn’t make the night game and had to cancel). Of course, Greg’s review of the Hotel David Whitney had nothing to do with the Lions specifically, but it sounds like it was a pretty good stay. I hate properties that try to benefit from a hotel chain’s marketing machine while cheaping out on the benefits offered to those with elite status, but this otherwise looks like a nice place to stay in downtown Detroit.

Updated reference posts

Each week, we work to update and republish various reference posts to be sure to keep them refreshed with the latest information. Each of these is worth a bookmark for future reference.

- Best Credit Card Category Bonuses: Which card should you use?

- Amex Airline Fee Reimbursements. What still works? (Note that this one is particularly pertinent for those looking to be sure to use these calendar-year benefits before the end of 2025 and again in 2026)

- Southwest Airlines Rapid Rewards Complete Guide

That’s it for this week at Frequent Miler. Keep an eye on this week’s last chance deals to be sure you get them before they’re gone.

![Mileage running 2026-style, playing the AA transition, a coming points conference and more [Week in Review] a group of toy airplanes on a game board](https://frequentmiler.com/wp-content/uploads/2022/01/American-Airlines-Game-218x150.png)

I am sorry, but this is too wordy to hold my attention throughout.

DOC does it right.

Please put your head down on your desk while the other children learn.

It is why I canceled it a month ago. Just doesn’t work for me.

Amex Plat does work for me even if I exclude certain benefits like the $600 hotel credit. That might be ok overseas or some domestic locations but this year I can use one of them but not both but other benefits do work out well.

Getting me to pay for something I wouldn’t normally use/get isn’t really of value.

For example if there was a $200 restaurant credit at a restaurant we normally wouldn’t go to and if the amount would end up being $100 for each of us, thus the credit cover it, I wouldn’t value it at $200 because normally we would have gone to a place 1/2 as expensive.

Fortunately in our case we visit a couple of resy restaurants so that I give nearly full value to.

Still I can understand anyone canceling these cards due to all of the checklist checking you have to do to see when you’ve used a credit or haven’t used it.

Yeah, the credits have to have some level of broad applicability to make sense. And the hotel programs actually have to be competitive. If Chase Tables were actually functional, I would be interested, as the Stubhub credit is also pretty much as good as cash for me (I use Vivid Seats more, but Stubhub quite a bit with portal bonuses). But even living in NYC, I look at the Tables list and balk. The card makes more sense if the Edit credits are icing on the cake, rather than a necessary part of getting value back. You just can’t count on the pricing, and not all trips are luxury trips. Even if it isn’t a ton of work, the card feels like a gamble. And I wouldn’t put it in my wallet.

I personally think the Strata Elite will get a second look from some people. You can’t recover the entire annual fee, but $75 per AU is good and $500 of the credits are pretty easy to use comparatively. People have been walking around with the CFU as a catch-all card forever, and the Strata Elite can do that work for you. The only thing that keeps me from that card is the VX, which is slightly better in that role (but with less transfer bonuses and more unfavorable transfer ratios). If the VX made big changes, I would run to Citi pretty quickly.

Chase is obviously done with CSR being mass market card. I think they are fine with cutting the optimizers and low profit customers and slowly goosing benefits and seeing what sticks. They run the 3rd largest travel portal in the biz. Why give you points to spend on a competitor OTA? The math obviously works for them with flights and hotels but they were surely losing tons on Airbnbs/cruises/OTAs. Effective 4.5x wasn’t sustainable. I’m just surprised they haven’t leveraged the card into a relationship card like BoA and Citigold. It’s pretty clear this is going to become a niche, high end card, for people that dont have the bandwidth to maximize an extra point or two and carry 10 credit cards. Very odd they didn’t link this to CPC, JPMPC or something like that.

I’m still waiting for Bilt to get back to me on when the 1:1 transfers will end (2/15/26 or 5/15/26). Every day they say “we’re still working on your request”. Nice to get a bunch of Bilt points yesterday but who knows what is going to happen in February. Earn and burn those Bilt points…

FM has the better take on the CSR, although of course appreciate all of VFTW’s analysis over the many years. Chase may have wanted to make the card more profitable, but all businesses want to make their products more profitable. But some businesses have loss leaders that get people in the door and create positive brand associations. Chase can well afford to have a loss leader – it’s the market leading bank by far. So Chase didn’t “have” to do anything, but it did. If that aligns with their goals, great! But they must realize by now that they pissed off a large number of people, and the CSR is how a large number of the customers that they are targeting interacted with the bank on a daily basis. That is going to change.

Don’t take it as gospel, but some Reddit posts are saying Bilt confirmed 5/15 through its official reddit account. You can find it with a quick Google search.

Thanks! Almost as if their customers figured out their sleight of hand. Not sure why they could not clarify more publicly. Here is the post-

https://www.reddit.com/r/biltrewards/comments/1oxw46y/comment/np1hoyn/?utm_source=share&utm_medium=mweb3x&utm_name=mweb3xcss&utm_term=1&utm_content=share_button

Hey everyone! We want to clarify that the promotion will apply through the May 15th payout period for all Bilt Members.

I also now got e-mail confirmation from Bilt that 5/15/26 is a 1:1 transfer date. Good news!