As of May 6, 2015, Target no longer accepts credit cards for in-store REDbird reloads. For more information, please see “REDbird Post Memo Answers“, and “REDbird grounded. Now what?“

My wife’s Target Prepaid REDcard finally arrived in the mail today. I quickly activated the card online then sped out to my closest Target store to test it out. The results were spectacular!

First, a little background…

REDcard is a new product that is so similar to Bluebird that some are calling it Redbird. For details about the card please see: The Target Prepaid REDcard.

In my first encounter with REDcard, a store manager told me that it could be reloaded with debit cards, but not with credit cards (see “Amex introduces new Bluebird-like Target REDcard!”). Then, when I discovered that the temporary card was reloadable after registering it, I found out that it was easy to reload with gift cards, but I botched the credit card experiment (see “Confirmed: REDcard likes Vanilla and more”).

It was a long shot, but there was still a chance that the manager was wrong about credit cards…

REDcard changes everything

Today, I hurried over to the Target customer service desk to see what this little card can do. At first, I asked to reload $2500. After all, that’s what the website says you can do (when you log into your permanent account):

Comically, the register told the clerk that the amount was too small. Obviously they need to work on their error messages. We then tried $1,500 with the same result. Finally, the register happily accepted $1000 as a load amount that wasn’t too small.

I then swiped my credit card and the clerk asked to see the last four digits on the card. Done. Sale complete! As advertised, there was no fee to load the card.

Before leaving the store, I loaded the card twice more and each time paid with a credit card. With hardly any effort at all, I was able to load the card up to the $2,500 daily load limit with a credit card. Since the card has a $5000 monthly load limit, I should be able to max it out with just one more trip to Target this month.

While at Target I also bought a few things and paid with the REDcard. That gave me an automatic 5% discount. Nice bonus!

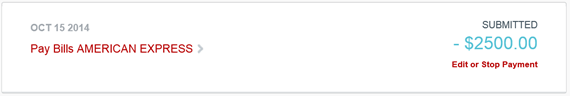

At home, I logged into my credit card account to make sure that the charges appear to be regular purchases (they do). And, then I tried out the REDcard bill pay feature which seems to have worked flawlessly.

Questions answered

Until now, there were several questions still unanswered regarding REDcard. Here’s what we now know…

Q: Can you reload REDcard with a credit card?

YES

Q: Are you sure it wasn’t a fluke?

It is possible that Target has plans to change the register to not allow credit cards, but I don’t think that’s the case. During my earlier botched credit card experiment, the cashier was surprised that the credit card didn’t work (it turned out that there was a fraud alert on my card). She said that she remembered from training that loading with a credit card was one of the key benefits of the card. She even mentioned that people should be able to earn miles with their cards!

Q: What are the card’s load limits?

When reloading the card at Target, the following limits are in place:

- $1000 maximum reload per transaction

- $2500 maximum reloads per day

- $5000 maximum reloads per month

Q: Will these charges count as cash advances?

While we don’t yet have absolute proof of this, I’m confident in saying “no”. The charges I’ve done so far fully appear to be purchases. And, previous experience with the similar Amex for Target card has shown that credit cards are safe to use for register reloads at Target.

Q: Can you reload REDcard at a Target store that doesn’t sell REDcard?

YES. The store I went to today doesn’t yet sell REDcard. Plus, the website explicitly says: “You can add cash to your Target Prepaid REDcard® Account for free at all Target locations in the US.” Note that when they say “load cash” they’re really referring to loading the card at the register. It doesn’t matter to Amex how you pay for that load.

Q: Can someone else buy a REDcard for you?

I’ll give this one a tentative “yes”. When you buy a Prepaid REDcard at Target, you have to give them your drivers license info, your SSN, birthdate, and more. Then, you have to register the card online in order to get a permanent card. In the process of registering online, you do need a bit of info about the original buyer (birthdate, for example), to get past the first screen, but then you can change the details on the following screens. I did this for my wife. I bought the card at Target and used my own driver’s license, SSN, etc. But, when I got home, I registered the card to my wife. I can’t promise this will work for everyone, but it worked for me.

Why does this matter? Not many stores yet sell this new card and you can’t get one online. You can find participating stores here. If you have a relative or good friend who lives near a participating Target, you might be able to get them to buy the card for you. Then, you should be able to register it in your own name online.

Q: Can you reload Serve at Target?

Since Serve and REDcard are on the same technology platform, and since you can reload Serve at Walmart (like Bluebird), it seems reasonable to assume that it would work at Target as well. I tried a Serve card, but it didn’t work. So, the answer for now is no. It won’t surprise me, though, if that changes in the future.

Q: Can REDcard be enrolled in Amex Sync promos like Serve?

No. I tried and the system said “Unfortunately, the Card you entered is not eligible.”

Which is best Bluebird, Serve, or REDcard?

Each person can only have one: Bluebird, Serve, or Prepaid REDcard so this is an important question. The answer depends on a lot of factors. I’ll address this in full in a future post. For now, suffice to say that if you’re uncomfortable buying and liquidating Visa or MasterCard gift cards, then REDbird is way better.

Keep in mind, if you want to switch from one to another, you can close your previous account online. Please see: How to cancel Bluebird online.

It doesn’t get any easier than this

For those with a Target store nearby, its hard to imagine an easier way to increase credit card spend. Simply go to Target, load up your REDcard, and pay with your credit card. Then, use the card to buy things at Target (for 5% off), to withdraw cash at AllPoint Network ATMs (for free), and to pay bills online (including mortgage, rent, credit cards, etc.). You can even use the bill pay function to pay individuals (Amex will mail a check).

To a large extent, this changes the game for credit card signups. People with the REDcard no longer have to worry (much) about whether they can meet the minimum spend requirements to get those huge signup bonuses. Interested in an offer that requires $5K spend? No problem. Two trips to Target and you’re done.

And, don’t forget about big spend bonuses. Want to earn hotel or airline elite status? How about the Southwest Companion Pass? With the right credit cards, it’s suddenly easy.

5X everywhere?

One more thing…

Suppose you have a card that earns a nice bonus at grocery stores. It so happens that some Target stores are coded as grocery stores. You can lookup your local store here: visa.com/supplierlocator.

It would be pretty cool to get 5 percent cash back when loading REDbird right? See “Playing 5X everywhere Whack a Mole.” Keep in mind a couple of things:

- Various registers in one store may code differently. Some may code as grocery while others may code as discount store.

- American Express codes are different. Even if your Target is coded by Visa as a grocery store, it probably isn’t a grocery store in the eyes of American Express.

More questions?

Many questions have already been answered in previous posts. Please first read these posts before asking questions in the comments section below:

- Amex introduces new Bluebird-like Target REDcard!

- The Target Prepaid REDcard

- Confirmed: REDcard likes Vanilla and more

And, of course, watch this blog for further developments!

Read more about REDbird:Also: |

|---|

[…] our family both for the points earning opportunities and its Target availability and discounts. I’ve been following The Frequent Miler’s Target experiments as closely as I follow the weekly Target sales, and today it was time to try and get my own Target […]

[…] 2. In case you haven’t heard about new product called REDcard (similar to Bluebird), here is some info on it on Frequent Miler blog. […]

[…] REDcard changes everything […]

[…] fourth year of blogging was dominated by REDbird: The Target Prepaid REDcard. This was yet another prepaid reloadable card from American Express. Unlike Bluebird and Serve, […]

[…] vast majority of my manufactured spend approach currently relies on REDbird (see “REDcard changes everything”). I currently manage four REDbird cards. Since each card can be loaded up to $5K per month, […]

[…] REDcard changes everything […]

[…] for 7 months of free credit card loads and 5 additional months of easy debit […]

[…] products that Amex allows each person to have only one. For details about REDbird, please see “REDcard changes everything.” For more about the three similar Amex products, please see “The complete guide to Bluebird, […]

Thanks for this info! I know the page is old but it looks like you’re still responding to comments. I’m in a time crunch and need to get $500 on a non-Amex credit card (Cap One Quicksilver) in the next 3 days, but I have a Serve account. Is it possible to register my temp card online with my SO’s information, then load it at Target with my Quicksilver?

Background: I had a friend buy me a Redcard with a $1 load a couple days ago, since I have Serve. I can’t get my money out of Serve, cancel it, register the Redcard in my own name, and get to a Target in time to hit the spend deadline. If I can hit my cc spend by loading someone else’s Redcard, that would be a giant help.

You can load someone else’ s card. If you are going to have problems, just go buy a 500 VGC

Can I load more than $500 onto the temp card after the initial load or do I have to wait for the permanent card to arrive in the mail?

Once you register the card online, you can load another $1000 ($1500 total, inclusive of initial in-store purchase/load).

I asked a friend who lives in Ohio to get me a temporary Prepaid RedCard from their Target store. It arrived today but the package looks different. It says American Express for Target Reloadable Prepaid Card. Is this the same one? It doesn’t say Red Card. I’m very disappointed, i think it’s the wrong card. See pic below.

http://www.noobtraveler.com/wp-content/uploads/2014/11/IMG_3965.jpg

Reply

Yeah, unfortunately your friend got you the old Amex for Target card. It’s not completely worthless, but it’s definitely not nearly as useful as REDbird

I should have briefed him before he went to Target. The first time he went they asked for his driver’s license and didn’t know how much to load in the card so he didn’t get it. I told him to just give his info and load $1 and I can change the info when I register it online. He went back to Target over the weekend and mailed it to me, only to find out that it’s not the right card. The other bad thing about it is that he got charged $3 fee for a $1 load.

Ugh! I didn’t even know there was another kind of prepaid card from Amex. I showed him the Redcard photo but the packet you get from Target for the temporary card actually looks different so he probably just assumed it’s the right one and bought it anyway even though it didn’t say Redcard. He would have called and asked which one to take if Target had the Redcard prepaid version also but I’m assuming his store didn’t have it. Well he’s not very bright but partly my fault for not educating him enough. He did me a big favor so I just thanked him and left it at that. I’ll instead ask my friend from Oklahoma. The thing is, I need it sooner and he’s currently overseas and will not be back until May 1st.

I have a Barclay Arrival+ MasterCard. Is it okay to use this card to load the RedCard? It will not count as a cash advance, correct? I need to spend $3k in 3 months so I can get the sign up bonus. Thanks.

Hi Joey,

Yes, it is absolutely okay to use the Arrival+. I typically put $5000 per month on mine through Redbird. It has never shown up as CA.

Cheers!

Great! I went to Target today and they said that I have to get the Prepaid version online and the guy suggested eBay. I checked for participating Target stores who sell it but there is none in California. I am in San Francisco. Sorry but I’m new to this, so how can I get one besides eBay and where do I apply?

Look back through the posts and find NoonRadar and click on his profile picture. He has contact information and he sells them.

Cheers!

I also have two RedCards, still in there sealed packages, registered with $1 loads….if anyone is interested. Just give me a way to contact you.

Just a quick update on this…people can now buy the temporary activated Redbird (prepaid REDcard) instantly from my online store at NoonRadar.com

I need the RedCard to consolidate and -liquadite if possible- my Amex prepaid cards. I have to take a long ride to Target so could you please confirm if I can still load RedCard with Amex prepaid cards?

Thank you.

Yes, it still works at most Target stores, but some don’t allow it.

Can anyone tell me how to get the money from Red Card to my bank account. I have linked and verified my bank account with the purpose of withdrawing money from my Red Card account into my back account but I cannot figure out how to do so. I was able to do that with my Bluebird but now with my Red Card it seems there is only an option of loading the card using my back account. Any ideas?

If anyone needs a RedCard, I have two left (that are loaded, but unregistered)..so you can message me.

You only have four options to get money OUT of your RedCard account, and linking your (or any bank) account is only for ADDING money to your RedCard.

You can remove money by:

1) Online/Retail Purchases

2) Pay Bills

3) Send Money Transactions (must be to another RedCard account, so essentially the money is still ‘trapped’ within the RedCard system

4) ATM Withdrawals – You can withdraw cash at AllPoint ATM’s, to a maximum of $750/day $2,000/month

*Note: Each method listed above has its own set of restrictions…

FYI: You may only add ONE bank account to your RedCard account, and this is only for adding money to your RedCard; the ACH will reverse any attempts to thwart that restriction.

More information found here:

https://amex.serve.com/prepaidredcard/faqs/

Thank you soooooo much guys. John it is good to know I have that many options including the ATMs. FrequentMiler that is just what I was looking for so exited about this new account. Thanks for all your constant support you guys rock.

Martin: Once you have linked your bank account, simply go to Settings… Withdraw Funds, then click Transfer to Bank

john DELTA: You missed this option. You CAN withdraw to your bank account but not via ACH

Smooth!

https://secure.prepaidredcard.com/Funds/WithdrawMoney

I found my prepaid red card deposit information including routing and account number. Could I use that as E-check to pay for my rent ?

RedBird (as well as BlueBird/Serve) only allow ACH in, not out.

But I paid one of credit card in this way and it succeeded showing in my cc payment although not in prepaid card statement.

It seems that GM is right, after 2 days the payment was reversed.

[…] Target REDcard is not available in all areas. But from Frequent Miler’s reports, it could really help folks with meeting minimum spending requirements and earning extra miles and […]