NOTICE: This post references card features that have changed, expired, or are not currently available

What is the 5/24 rule?

In the past year or so, Chase has frequently denied applications for certain cards (such as the Sapphire Preferred and Freedom) due to having opened 5 or more credit cards (with any bank) in the past 24 months. That means that anyone who regularly signs up for credit cards in order to earn points & miles is likely to be denied when they try to sign up for these cards. There are exceptions. It appears that being pre-approved for an offer may be the key to circumventing the rule (see this post, for example).

Which cards are affected by the 5/24 rule?

Currently, the 5/24 rule does not apply to co-branded cards (e.g. it does not apply to hotel or airline cards) and it does not apply to business cards. According to Doctor of Credit, though, the 5/24 rule will be applied to business cards beginning sometime in March 2016.

We don’t know at this time whether the 5/24 rule will be applied to co-branded business cards in March (such as the United Business card). My guess is that it will not.

Apply for Ink before March

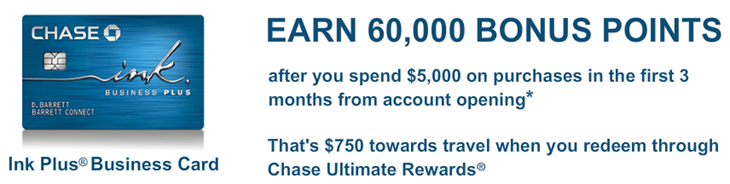

If you have many new credit cards on your credit report and you’re interested in adding a new Ink card to the pile, I’d recommend signing up before March. Currently, the standard offer is for 60,000 points after $5,000 spend in 3 months. If you signup through a public offer online, the first year fee is not waived. If you signup in-branch, or receive a targeted offer, the first year $95 fee is waived.

To increase your chances of success, please read: How to get approved for the Chase Ink 60K offer.

[…] Credit card junkies: it’s time to apply for Chase Ink. […]

[…] Credit, though, the 5/24 rule will be applied to business cards beginning sometime in March 2016 (as I previously reported), and to co-branded cards sometime in April […]

Thought I read somewhere that anything over 50k points is considered taxable income. Does anyone have the scoop on this? Would I be taxed on $750 if I do this offer?

Only bank account offers get taxed when they’re worth more than $600. Credit card offers are never taxed.

[…] Chase Ink 5/24 Rule? […]

FM,

I saw your post about Chase Private Client a couple days ago…a little late. I specifically didn’t apply for the Ink last week because I wanted to wait until the new business has more revenue so instead I applied for four other cards(one was Freedom, others non-Chase)…all approved.

Now this is happening. If I start a new LLC which I was going to do anyway and open a Business Checking Acct mid February with Chase in Branch and do an Ink app there at the same time, would that increase my chances of getting approved or am I straight up screwed because of my apps for those four cards last week? Any recommendations about conversations to have with Chase if Private Client might still be doable given this scenario? Thanks.

My guess is that waiting until mid Feb and getting the business checking account in-branch may indeed help. Hopefully you’ll get a pre-approved offer for the Ink card at the end of the business checking account setup.

I applied for the chase ink in branch but was denied because of too much credit available to me in my personal account and too many inquiries in the last year. Even with the agent as my advocate they wouldn’t allow me to change credit limits on my personal account since the chase ink is a business account.

Please post how many inquiries you’ve had in the last year and also how much available credit you currently have. We need these numbers to try and establish a pattern.

Available credit: $50k

Inquiries : 12

I am wondering if I should go ahead and apply for the chase southwest now

That’s not terrible, but 12 in a year probably gave Chase a heart attack. Do you have a short credit history? When did you apply in branch and when did you receive the denial? Did you try calling recon?

Credit history x10 years. Pending, next day denial, called the following day for reconsideration.

Thanks for data points.

What is the limitation on the INK plus as far as how often you can get the bonus for the same business. Is it 24 months like the personal cards? I know the banks often let you do get the signup bonus for business cards more often but wasn’t sure how chase handled this. Hoping to get it one more time before 5/24 kicks in.

The stated limit is the same: 24 months from the last bonus. I assume that’s enforced, but haven’t tested it.

Hi Frequent Miler,

Thanks so much for all of your direction the past couple of years…our four kiddos and the two of us have traveled so many different places for nearly free (there are 6 of us-smile) and it has been absolutely magnificent.

My husband was denied the Ink and called after we received the rejection~received another letter with rejection but it said to call if there was any info to add that could change their mind…do you have any suggestions with adding to our plea and calling again?

When calling, I believe that the #1 consideration is the mood of the analyst you talk to. This is purely conjecture, but you might have better luck calling early in the day instead of at the end of the day when people just want to go home. One thing that can sometimes help is to make it clear that you’re not looking for new credit — that you don’t mind if they reduce the credit line from another Chase card.

Thanks so much for the advice, Frequent Miler!

Does anyone have any experience applying by phone? I have one of the offers that came in the mail where I can apply via internet, mail, or by calling in with the invitation code. I am wondering if doing that way might let them ask me all the questions up front, possibly avoiding the reconsideration call later. Any suggestions?

The people who accept the apps over the phone are different than the analysts at the reconsideration line, so I don’t think that calling will improve your odds. Just my guess, though.

The first sentence was a question. Missed the question mark

Just for clarification, is it 5 cards or more than 5 cards that would get you rejected. Oh, some other people asked too but I didn’t see any answer. Do the previously denied applications count or just the approved ones? Thanks

I believe it is 5 cards. I don’t think that denied apps would count since they are supposedly looking at new accounts on your credit report

anything I can do to legally screw Chase , they deserve for closing all my accounts in 2013 including a checking account at 0% with 60k in it. No reasons,was not doing the level of MS even close to other people, many tens of thousands in actual charges.

I think that I now have 5 cards with them (for no reason they stopped rejecting me when I was told it was a lifetime ban).

I plan to open a checking account with $60k, then the next month send them a letter from my corporate risk cntrol department closing all of their accounts with me.

No loss to me.

I’ll list about 10 things the corporation has done that was pretty bad. I can easily google that.

Was denied for CSP due to 5/24 last week. I had a CSP, cancelled couple years back and focussed on Ink. Wanted that bonus again! But noooo…… anyhow good wakeup call for spring cleaning.

Pulled my Equifax report. It prompted me to remove a bunch of dangling Authorized User cards. Some I’d only gotten to get bonus points and they were sitting in a drawer since. Did the same with spouse cards. Also cancelled a few primary cards while I was at it.

I thought this was already the case???? didn’t realize ink cards were exempt…

Can anyone apply in branch for the Ink Plus card, and do they have the 60k offer in all branches? I have a legit business, what do I need to bring with me for the application?

I got my Ink Plus in branch last year. I don’t even have a Chase checking account, just CC. The lady was just filling out a form on the screen so they asked questions about revenue and so on. It was just verbal, was not asked for any paperwork. She did of course take the opportunity to “sell” their branch services, gave me business card, etc.

Thanks. Really wish I could do this online, the closest Chase is a 30min drive each way for me.

Yes, anyone with a business can apply in branch. I believe that the offer is in all US branches. To open the credit card you may need ID, but I don’t think you need anything else. To open a business checking account you may need to bring a DBA