NOTICE: This post references card features that have changed, expired, or are not currently available

Most people’s lives are hectic enough without having to remember what day the credit card bill is due. For credit card churners who might be juggling 5 or 6 active cards in their wallet at any given time (along with another 10-20 cards in the sock drawer), it’s an even harder task to keep track of all those due dates across multiple cards and financial institutions.

While setting up automatic payments can certainly help, it’s not always feasible to know ahead of time where your next payment will be coming from, especially if you’re a manufactured spender with funds moving in and out of constantly changing accounts. So the easiest way to make sure you always know your credit card due dates is simple: just have one due date.

Since almost every credit card company allows you to pick a specific due date, if you set every card in your inventory to an identical due date of your choosing, you’ll never forget when the next payment is due.

The online option.

One way of going about this is to pick up the phone, call every bank you have a credit card with, and get some poor agent to go through each of your cards and reset the due date. Yes, agents get paid to take care of tedious tasks like this, though I doubt your call would be the highlight of their day.

But as I’ve written before, I am not a fan of talking to people on the phone, especially customer service representatives. And since many major banks have implemented the ability to change the due date of your credit cards right on their websites, I decided to put together a guide demonstrating precisely how to make due date changes online for each bank.

Note there are a few banks listed below which do not currently offer the ability to change your due date online. I’m listing them anyway so I can update this guide as things change in the future, as I have with my past guides on getting your application status online and the 24-hour cancellation policies for award tickets. In the meantime, for banks still living in the 20th century you can do things the old fashioned way and call the number on the back of your card.

Also, keep in mind that almost every bank has a limit on how often you can change your due date. Usually it’s one change every 90 days or 3 billing cycles, so you’ll want to be sure you’re picking a date that works for you (and a date that is available at every bank) before you commit to it.

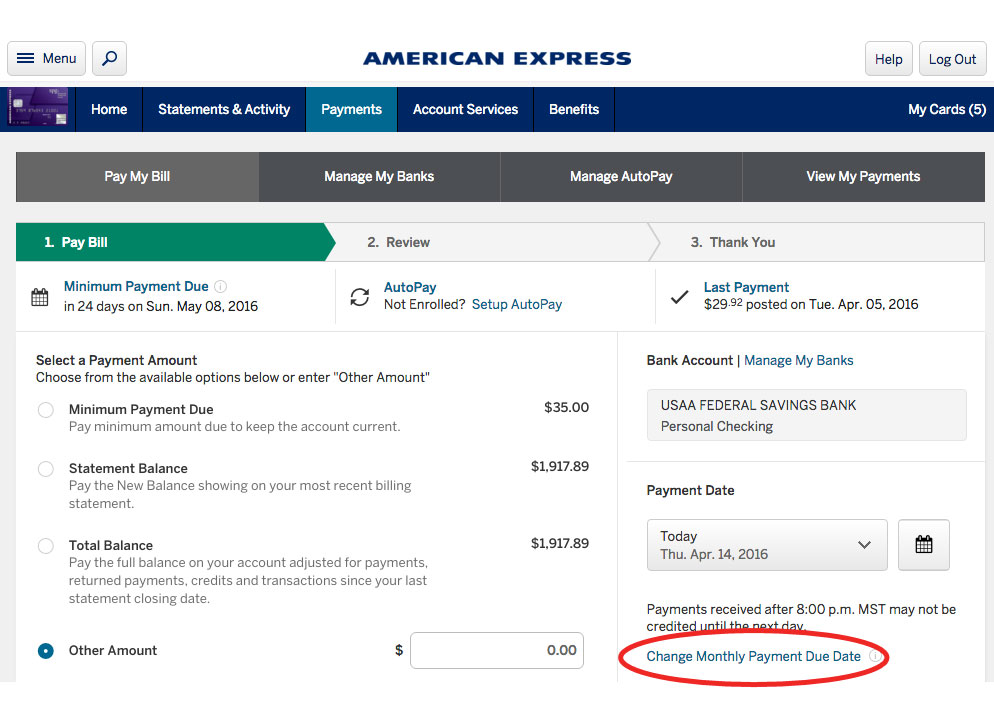

American Express

For some reason Amex seems to be going out of their way to make their due date change link less than obvious. But it’s there. Click the “Payments” tab from the menu on the home page and you’ll see it hiding in the lower right corner.

If you don’t see the option to “Change Monthly Payment Due Date” it may be because you haven’t set up a bank to make online payments. You don’t actually have to make a payment, but you do need to have some sort of payment source attached to the account for the option to change due dates to appear.

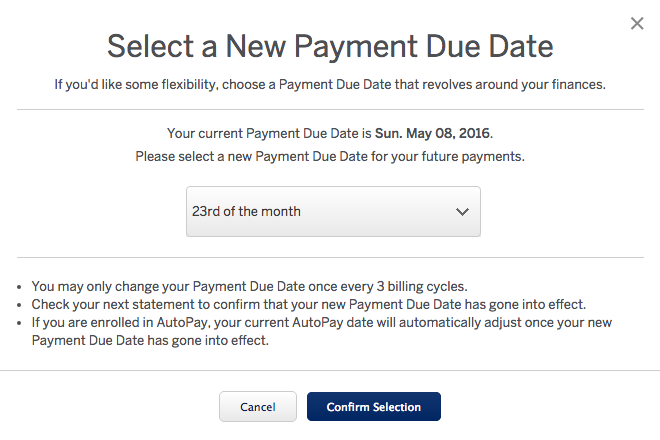

Once you’ve clicked on the link, you’ll get a screen showing your current due date and a drop down menu allowing you to select a new one, along with guidelines for changing your date. Not every date will be available as an option due to internal Amex protocols, but you should be able to choose from most dates.

Bank of America

Unfortunately Bank of America does not currently offer the ability to adjust credit card due dates online, but you can still make changes by calling them.

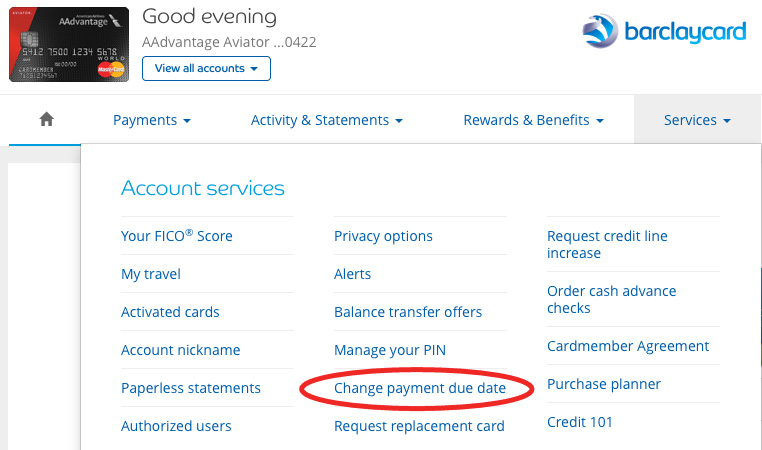

Barclaycard

Once you’ve chosen an account to work with on the home page, you’ll find the option to change due dates under the “Services” tab.

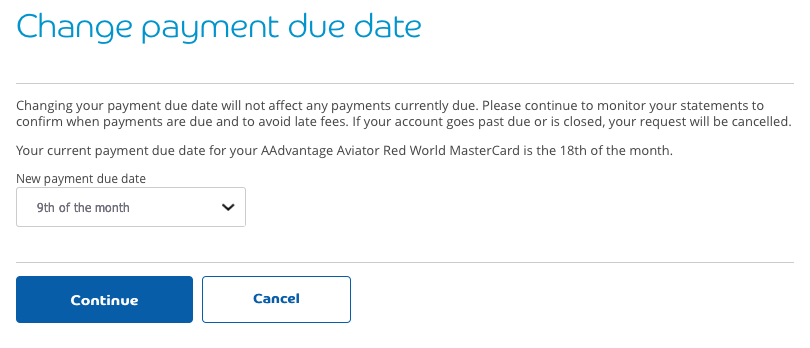

Scroll down a bit on the following page and you’ll see the link to “Change payment due date” which will lead you to a drop down menu with choices for alternate due dates, along with guidelines for changing your date.. Not every single date will be available as an option due to internal Barclaycard protocols, but you should be able to choose from most dates.

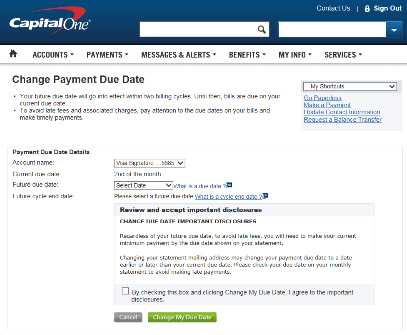

Capital One

You’ll find the option to change your due date under the Capital One “Services” tab, which will lead you to a link that allows you to “Change Payment Due Date.”

(Thanks to reader John S. for the screen capture!)

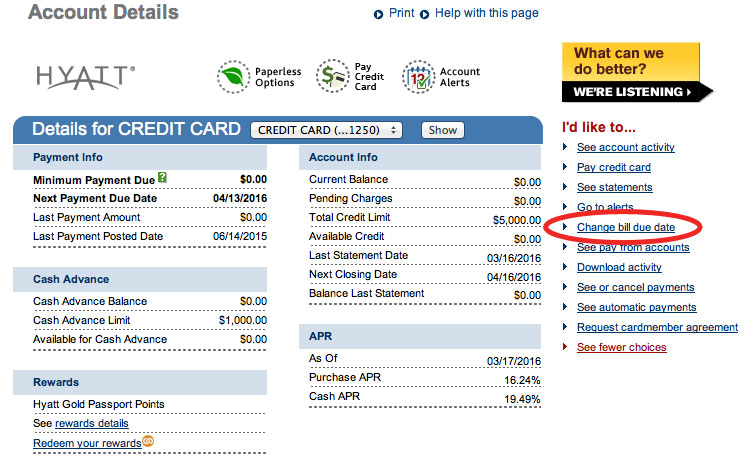

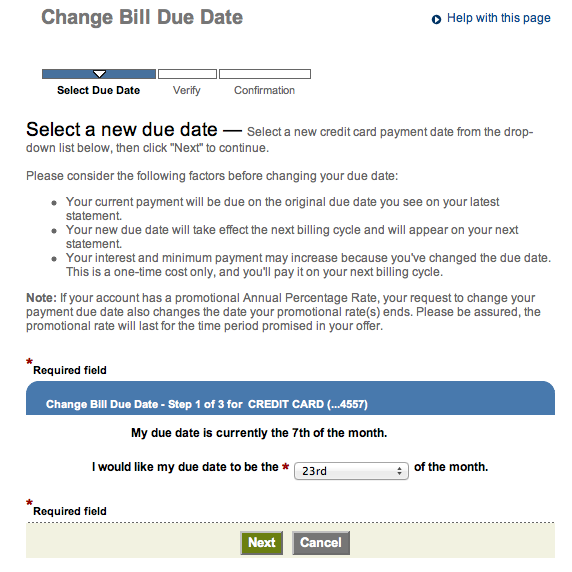

Chase

On the main Chase accounts page you’ll need to choose which account you’d like to change by clicking on the appropriate account number. From there, along with your account details you’ll find a list of choices on the right side of the screen, one of which is “Change bill due date.”

Clicking on that link will bring you to a drop down menu allowing you to choose any date between the 1st and 28th of the month, along with guidelines for changing your date.

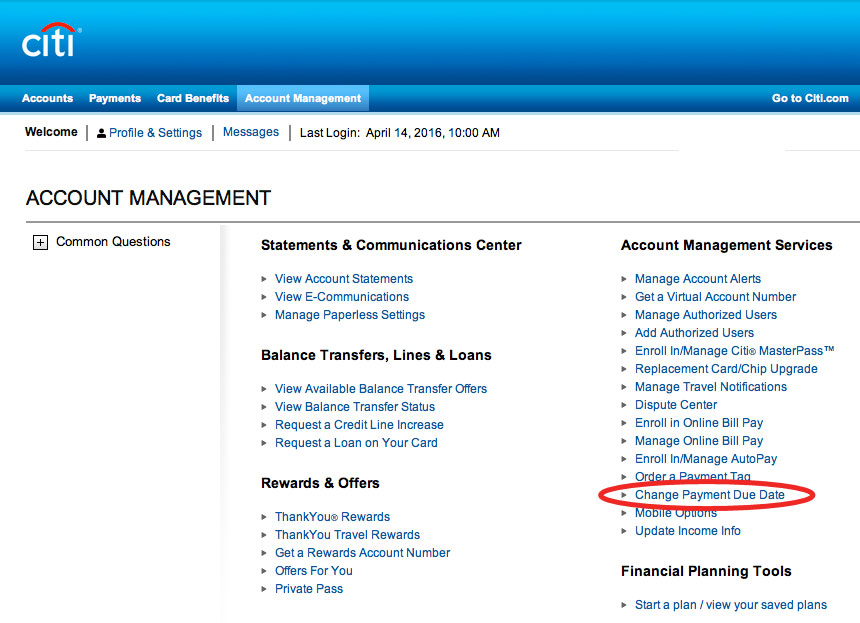

Citibank

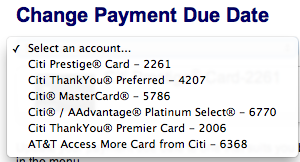

It’s not necessary to choose an account first with Citibank, as all Citibank due dates are handled on the same screen. You’ll find it by clicking on the “Account Management” tab at the top of the main page.

From the next screen you’ll pick which card you want to change by selecting it from the drop down menu under the “Change Payment Due Date” heading.

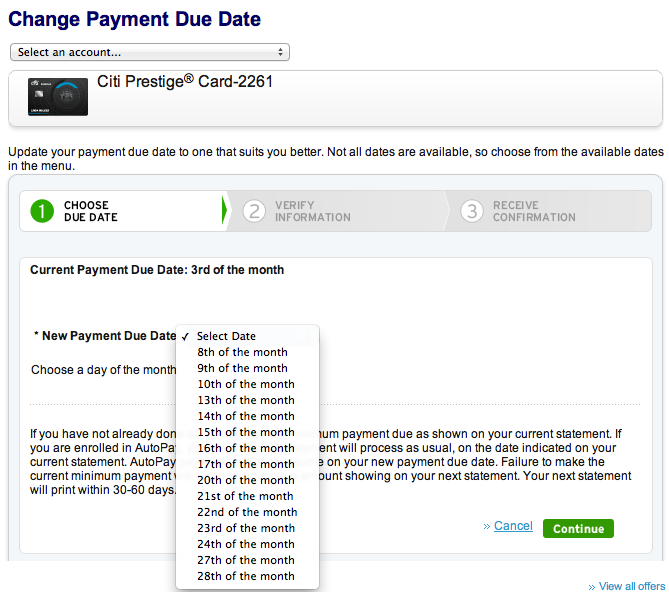

Once you’ve chosen the card, you can pick a new due date from the drop down menu with choices for alternate due dates, along with guidelines for changing your date. Not every single date will be available as an option due to internal Citibank protocols, but you should be able to choose from most dates.

Discover

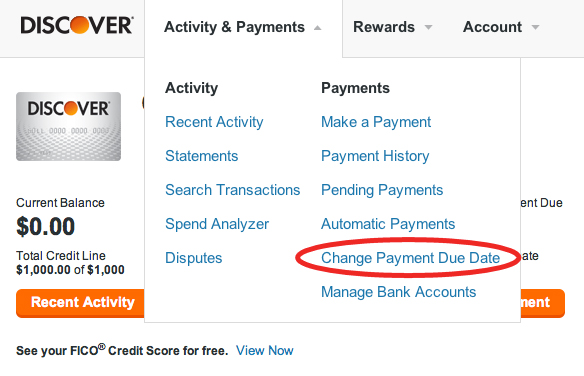

Since you can only have one Discover card tied to each User ID and password, there’s no need to choose an account. Simply log into whichever Discover account you want to change and pick “Change Payment Due Date” from the top “Activity & Payments” menu.

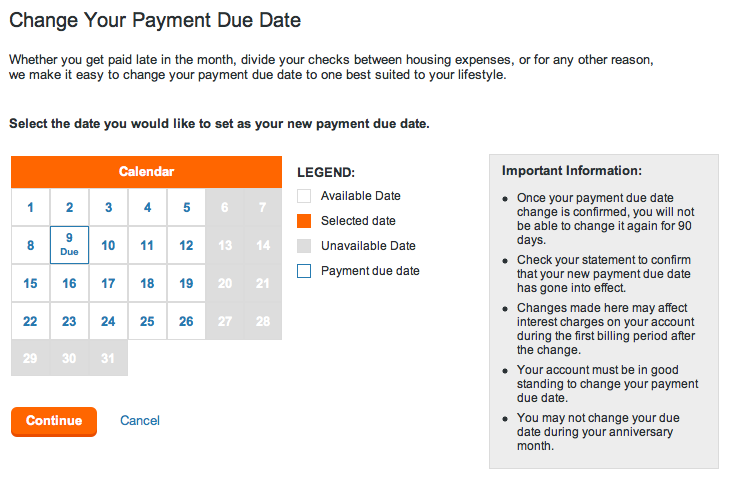

From there Discover will offer you a handy dandy calendar with options for new due dates, along with guidelines for changing your date. Not every single date will be available as an option due to internal Discover protocols, but you should be able to choose from most dates.

Fidelity/FIA

Unfortunately Fidelity/FIA does not currently offer the ability to adjust credit card due dates online, but you can still make changes by calling them.

TD Bank

Unfortunately TD Bank does not currently offer the ability to adjust credit card due dates online, but you can still make changes by calling them.

U.S. Bank

Unfortunately U.S. Bank does not currently offer the ability to adjust credit card due dates online, but you can still make changes by calling them.

Wells Fargo

Once you’ve logged into the Wells Fargo website, click on the “Manage your money” heading and you’ll find a link to “Change your payment due date.”

(As I currently do not have any Wells Fargo cards, I don’t have any screenshots of this process. But if any Frequent Miler readers would like to provide a few images I’ll be happy to add them and give you a hat tip!)

Other Recent Posts From The “Bet You Didn’t Know” Series:

New(ish) Rules on Hyatt Free Night Certificates

Unlimited Ticket Changes on Virgin America For $25

A Map of Walmart MoneyCenter Kiosk Locations

Find all the “Bet You Didn’t Know” posts here.

Hello, if you change due dates for boa cards does it mean your reward post date will change with the due date? I want to receive my points faster idk if it will work. Any DP?

[…] Frequent Miler lists a number of other banks with detailed instructions on how to change your date. If you can’t change your due date online, you might give them a call and ask over the phone. Just a quick PSA to let you know you have some flexibility. […]

[…] Frequent Miler lists a number of other banks with detailed instructions on how to change your date. If you can’t change your due date online, you might give them a call and ask over the phone. Just a quick PSA to let you know you have some flexibility. […]

[…] Frequent Miler lists a number of other banks with detailed instructions on how to change your date. If you can’t change your due date online, you might give them a call and ask over the phone. Just a quick PSA to let you know you have some flexibility. […]

[…] Frequent Miler lists a number of other banks with detailed instructions on how to change your date. If you can’t change your due date online, you might give them a call and ask over the phone. Just a quick PSA to let you know you have some flexibility. […]

[…] Frequent Miler lists a number of other banks with detailed instructions on how to change your date. If you can’t change your due date online, you might give them a call and ask over the phone. Just a quick PSA to let you know you have some flexibility. […]

[…] Frequent Miler lists a number of other banks with detailed instructions on how to change your date. If you can’t change your due date online, you might give them a call and ask over the phone. Just a quick PSA to let you know you have some flexibility. […]

[…] Frequent Miler lists a number of other banks with detailed instructions on how to change your date. If you can’t change your due date online, you might give them a call and ask over the phone. Just a quick PSA to let you know you have some flexibility. […]

[…] Frequent Miler lists a number of other banks with detailed instructions on how to change your date. If you can’t change your due date online, you might give them a call and ask over the phone. Just a quick PSA to let you know you have some flexibility. […]

[…] How To Change Credit Card Due Dates Online at Each Bank […]

[…] Sync up the due date of your Credit Card Bills […]

[…] Bet You Didn’t Know: How To Change Credit Card Due Dates Online at Each Bank by Frequent Miler. Very useful information, makes tracking things a bit easier if all the due dates are the same. […]

I’ve never been able to link my citi cards under one login. Every time I try, I get a message telling me that these accounts cannot be linked. It’s extremely frustrating to have to log in 5 times to see all my accounts. Fortunately, all 9 of my chase accounts show up beautifully on one page. I got my 6 amex accounts down to 2 logins, but can’t quite get them onto one. Barclay was easy-peasy as they default to one login per customer, not per card.

Sigh. Come on, Citi, get with the program.

I know someone mentioned the statement closing date, but for those of us that pay on or before the closing date, does changing the due date actually change the statement closing date?

Yes, the due date and statement closing date will generally change together.

It would also be cool to know like how long each bank allows you to change the due date. I sometimes change the due date a bit earlier in order to get the bonus sooner. I found that Chase only allow you to change the due date once every 180 days. Amex and Discover seems not having these restrictions (correct me if I’m wrong). Although for Discover the change takes effect only for next billing cycle.