NOTICE: This post references card features that have changed, expired, or are not currently available

By Julian, author of Devil’s Advocate…

We’re at one of those “transition points” in the miles and points world that happens every so often, when we have the chance to speculatively take advantage of a change in the industry.

Or, perhaps, to avoid one.

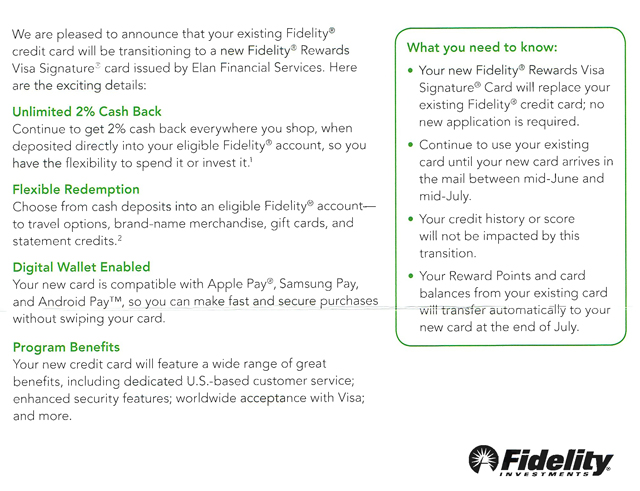

Fidelity cards have long been popular for their 2% cash back rewards structure, and back in the day Fidelity cards were the only way to get 2% cash back on every purchase without restrictions. While other 2% cash back options such as the Citi Double Cash card have appeared on the market in recent years, the Fidelity cards continue to be popular.

This past January, Fidelity announced they would be switching their cards from FIA Card Services (which is part of Bank of America) to Elan Financial Services (which is part of U.S. Bank). Soon thereafter, Greg the Frequent Miler reported that the new Elan Services version of the Fidelity Visa was available for signups, but conversions of the old cards weren’t scheduled to begin until last week.

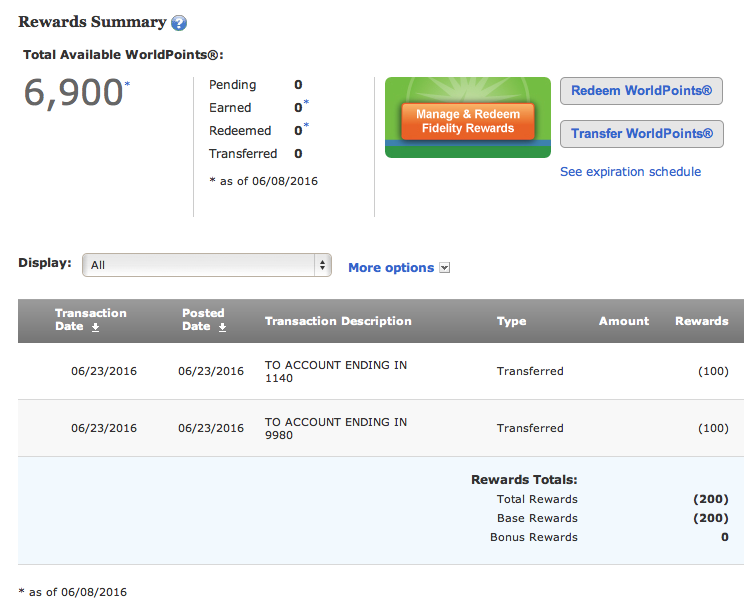

However, even if your new card has already arrived, the rewards earned by the existing Fidelity cards will continue to be managed by the Bank of America system until Friday, July 22nd. Then over that weekend, the rewards system will be switched over to Elan’s Rewards Center and you’ll be able to access your Fidelity rewards there beginning Tuesday, July 26th.

Old Fidelity cash back = WorldPoints

While it isn’t commonly known, the old Fidelity card cash back rewards were actually awarded as Bank of America WorldPoints. These WorldPoints were earned at 2x per dollar which could then be deposited into a Fidelity account at 1 cent per point (thereby equaling 2% cash back).

WorldPoints is an old Bank of America proprietary rewards program that has mostly been phased out, but a few Bank of America WorldPoints cards are still available.

There are also a few neat tricks you can pull with WorldPoints, and the best resource for those tricks is probably the guest post by Arneal over at Doctor of Credit. That post is almost a year old and I’m not sure how up-to-date the information is, but I don’t know anywhere else with a more comprehensive look at the WorldPoints program.

What is even less commonly known is that old Fidelity WorldPoints are transferable between any other Bank of America WorldPoints card and even to and from Bank of America’s Travel Rewards Visa card.

Finally, the Bank of America Travel Rewards Visa card can be combined with the Preferred Rewards program to earn 2.625% cash back on all purchases. Again, this cash back is technically earned as “points” but even though these are not actual WorldPoints, various reports and my own tests show they can be transferred back and forth between Fidelity and other WorldPoints cards.

New Fidelity cash back = FlexPoints?

Under the new Elan Financial rewards system, Fidelity cash back will be awarded as FlexPoints. Yes, FlexPoints, as in the U.S. Bank FlexPerks program.

I know what you’re thinking. As Greg the Frequent Miler wrote back in January, if the new Fidelity FlexPoints are redeemable for travel in the same way as normal U.S. Bank FlexPoints, that would be quite a score! In theory you could get up to 4 cents per dollar spent if you maximized your Fidelity FlexPoints redemptions via travel.

But before you get too excited, it is already clear that Fidelity FlexPoints will not be directly redeemable for travel in the same way as U.S. Bank FlexPoints. As it stands, it appears Fidelity FlexPoints will just be worth 1 cent per point, as they were under the WorldPoints program.

What is currently unknown is whether existing Fidelity points will be transferable to a regular U.S. Bank FlexPerks card, and then redeemable for FlexPoints travel from there. It seems highly unlikely but we technically won’t know for certain until existing rewards are flipped on July 26th.

So what does all this mean to us?

Basically, for people who currently have a Fidelity card earning WorldPoints, you have three options…

- If your only goal is cash back, there’s no need to do anything. Your Fidelity WorldPoints will transfer to Fidelity FlexPoints. You’ll still earn 2 points per dollar spent on your new Fidelity Elan Visa card and those FlexPoints will still be worth 1 cent per point.

- If you have any other Bank of America WorldPoints cards (or a Travel Rewards card) and you’d rather play with WorldPoints than cash back, you can still transfer your Fidelity points to another WorldPoints card until July 22nd. You can do this via the same FIA Card Services website you currently use to manage your Fidelity card. Log in and click on the “Rewards” tab and you’ll see the option to “Transfer WorldPoints.” Point transfers should show instantly.

- If you’re feeling super adventurous and think there’s any chance Fidelity FlexPoints will be transferable to U.S. Bank FlexPerks, you can go the other way around and transfer any WorldPoints you might have on other Bank of America cards (or Travel Rewards points) into your Fidelity account. You do this the same way you transfer WorldPoints out, but just start with your other WorldPoints or Travel Rewards card. I was able to successfully transfer 100 Travel Rewards points into my Fidelity account in a matter of seconds.

My advice?

There are some neat tricks with WorldPoints, but you need the right set of Bank of America cards to pull them off. So if you don’t have those cards, there’s not much advantage to transferring WorldPoints out of Fidelity.

If you want to take the longshot chance of Fidelity FlexPoints being transferable to U.S. Bank FlexPerks, then you can move some WorldPoints into Fidelity before the conversion. The worst that could happen is your WorldPoints will be redeemable for 1 cent each, which might not be the end of the world if you weren’t going to get much more than that for them anyway.

Personally, I have so few WorldPoints that they aren’t doing me much good, so I’ll probably go ahead and transfer them into Fidelity before the switchover just so they’re all together and I don’t have any stranded useless WorldPoints. Because there’s nothing sadder than a stranded point, is there?

Other Recent Posts From The “Bet You Didn’t Know” Series:

American Airlines Still Offers Free 24 Hour Holds

Enhancements to Amex’s Plenti Rewards Program?

Entering Priority Pass Lounges Without a Physical Membership Card

Find all the “Bet You Didn’t Know” posts here.

![Fidelity $150 intro bonus via mailer [Targeted] a screenshot of a coupon](https://frequentmiler.com/wp-content/uploads/2021/03/Fidelity-150-offer-218x150.jpg)

Does this transition not make the BoA Travel Rewards card less valuable? It was easy to transfer to Fidelity and redeem for travel (as suggested in the DoC post) or cash. The BoA Travel Rewards allows for cash redemptions at < $0.01/point unless it's a travel expense. This rule was easily circumvented with Fidelity. Now you will need to use the BoA TR for travel (potentially losing out on points from another card (think CSP or Citi Thank You Premier)). Correct me if I'm wrong here.

[…] Bet You Didn’t Know: Last Chance To Transfer Points Between Bank of America and Fidelity by Frequent Miler. You have until July 22nd to make the switch. […]