NOTICE: This post references card features that have changed, expired, or are not currently available

It’s been a year since Chase unveiled their blockbuster new credit card: Chase Sapphire Reserve. Chase originally launched the card with an eye popping signup bonus: 100,000 points after $4K spend (the offer has since dropped to 50,000 points). Even though the card has a $550 annual fee, the combination of the giant signup bonus and card perks make it a no-brainer and a huge number of people signed up for the card.

Now, many early adopters will soon see their second $450 (Update: the annual fee has increased to $550 as of January 2020) annual fee and will have to decide whether it’s worth paying.

As a reminder, here are a few key benefits of the card:

- 3X points on dining and travel.

- $300 statement credit towards purchases in the travel category each calendar year.

- Points transfer 1:1 to travel partners.

- Points are worth 1.5 cents each when booking travel through Ultimate Rewards.

- Up to $100 Global Entry/Precheck fee credit every 4 years.

- Priority Pass Select membership with free guests.

- Travel Insurance:

- Primary rental insurance

- Free Roadside Assistance

- 6 hour Trip Delay reimbursement

- Emergency Evacuation and Transportation

- Emergency Medical and Dental coverage

- Trip Cancellation and Trip Interruption insurance

- Lost Luggage, Baggage Delay reimbursement

- Travel Accident Insurance

For more information on this card and its benefits, see: Chase Sapphire Reserve Complete Guide.

The real question: Keep or product change

If you decide that the card’s annual fee isn’t worth paying, I recommend product changing to a no fee card instead of cancelling it. That way you’ll keep alive any points you’ve earned and not yet spent, you may get a valuable card worth keeping, and you may be able to product change back to the Sapphire Reserve in the future if you ever change your mind. Product changes are free and do not impact your credit.

Chase has a mysterious formula that determines which cards they allow an individual to switch to, but it is almost certainly the case that they’ll allow a product change to the no-fee Sapphire card (not to be confused with the Sapphire Preferred or Sapphire Reserve).

Once you have changed to the no-fee Sapphire card, you should then be free to change again to either of these no-fee cards which also earn Ultimate Rewards points:

- Chase Freedom: Earn 5X rewards in rotating categories (up to $1500 spend per quarter), and 1X everywhere else

- Chase Freedom Unlimited: Earn 1.5X everywhere, no limit

Both cards are useful for earning Ultimate Rewards points. On their own, the points are worth only 1 cent each, but if you or someone in your household has a premium Chase Ultimate Rewards card (Sapphire Reserve, Sapphire Preferred, Ink Business Preferred), you can freely move those points to that account and then get better value when redeeming those points.

If you already have a Freedom Unlimited card, there’s no reason to get a second. With the regular Freedom card, though, you may want a second one as a way of exceeding the $1500 per quarter 5X cap.

Is the Sapphire Reserve worth the annual fee?

The Sapphire Reserve has a number of valuable perks, but the value to you depends upon how much you use those perks and whether you can get those same perks more cheaply elsewhere.

The Sapphire Reserve has a number of valuable perks, but the value to you depends upon how much you use those perks and whether you can get those same perks more cheaply elsewhere.

Here is how I personally value each of the primary perks:

- $300 travel statement credit: $300.

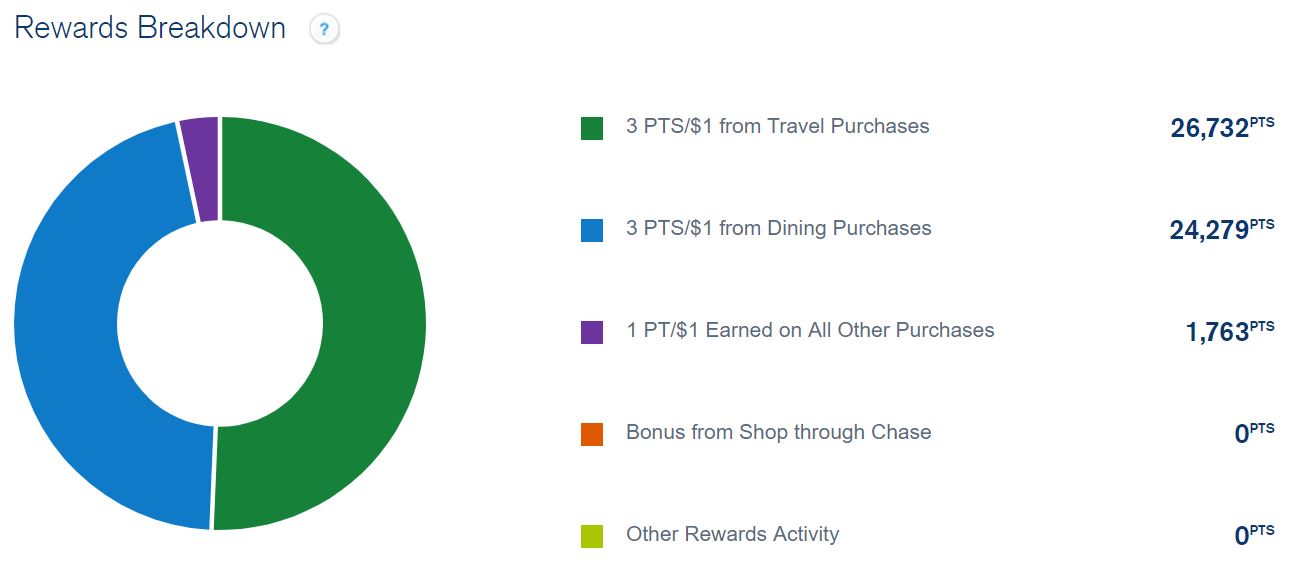

I value this at its full face value because I routinely travel often enough to get this credit without even thinking about it. I routinely use my Sapphire Reserve card to pay for travel (thanks to its 3X rewards), so I automatically earn $300 back every year. - 3X points on dining and travel: $190

My Rewards Dashboard shows my year-to-date point earnings for dining and travel (see above). Other cards offer 3X rewards for travel (the $95 Citi Premier, for example), so let’s say that the 3X travel benefit is worth $95. As for dining, with 8 months out of 12 accounted for this year, I earned over 24,000 points. Compared to cards that offer 2X for dining, the 3X dining benefit is worth over 8,000 points to me. Let’s conservatively call that a $95 benefit as well. So, together, the 3X travel + 3X dining benefits total to $190 in value to me. - Points transfer 1:1 to travel partners: $0

I can get this same benefit from the $95 per year Sapphire Preferred, or a similar benefit with the $95 Citi Premier. The costs for these alternative cards were accounted for in the valuation for 3X points on dining and travel, above. - Points worth 1.5 cents each for travel: $0

I usually transfer my points to Hyatt or to various airline programs in order to cherry pick the best value rewards. So, the ability to pay with points for travel at a value of 1.5 cents per point is nice to have, but not something I routinely use. I know that many readers use this feature regularly and so should compute their own value for this benefit. For example, suppose you use points to purchase $900 worth of travel. With the Sapphire Reserve, you would be charged 60,000 points, but with the cheaper Sapphire Preferred (where points are worth 1.25 cents each towards travel), you would be charged 72,000 points. In that example, this Sapphire Reserve benefit is worth 12,000 points in savings. You can then value those saved points either at the cash-out price of $120 or at the 1.5 cents per point value: $180. - Up to $100 Global Entry/Precheck fee credit every 4 years: $0

I have a bunch of premium cards that offer this benefit so there is no incremental benefit here for me. - Priority Pass Select membership with free guests: $0

I have other cards that offer this benefit so there is no incremental benefit here for me. The value you assign to it should be based on how often you expect to use the benefit and whether or not you already have a similar benefit from another card. - Travel Insurance: $75

Yes, I can get many of the travel insurance benefits from other cards, but I prefer to get them from a card like this one that earns 3X for travel. Plus, few other cards offer emergency evacuation and transportation, emergency medical and dental reimbursement, and free roadside assistance.

Total annual value to me: $565.

Total cost: $550 (if you add an authorized user for $75, the total cost goes up to $625).

In my case, based on a conservative look at the value of the card, I gain more than I pay. So, I’ll keep my card and evaluate it again next year.

Sapphire Reserve keep or downgrade cheat sheet

I realize that most readers won’t want to do the work of assigning value feature by feature, so here’s quick cheat sheet that may help:

Keep the card if:

- You travel extensively and eat out a lot; or

- You travel enough to earn the annual $300 travel credit, and you regularly pay with points for travel

Downgrade the card if:

- You rarely travel

- You travel, but get most of the Sapphire Reserve travel perks from other cards that you plan to keep

What about your spouse?

In many cases, couples each signed up for their own Sapphire Reserve cards in order to each get their own signup bonus. That was great, but with annual fees coming due it doesn’t make sense to keep both cards.

I’m in exactly that situation. My wife and I both signed up for the Sapphire Reserve last year and will soon be forced to figure out what to do about it. I previously described the problem in the post “The Sapphire Reserve Couple Conundrum“. In that post, I said that my plan was to “punt”. I would wait until the annual fees came due to decide what to do. That time is coming soon.

There’s no doubt it my mind that one of us should downgrade their card. Since we combine our finances and manage our points together, there is literally no advantage to having two separate Sapphire Reserve accounts as far as I can tell. However, there may be an advantage for one of us to get a $75 annual fee authorized user card so that we both carry a Sapphire Reserve.

I’ll follow up soon with more about the couple conundrum and my final decision. Stay tuned.

Hi FM and Nick,

My wife has the Sapphire Preferred and I have the Reserve. The Preferred’s annual fee is coming up due. My wife doesn’t have another credit card that will earn more than 1x on dinning and travel. I am planning to have her cancel the Preferred and get her as an authorized user on my Reserve. Here are my concerns:

1) Adding her as an authorized user will add 1 more new credit card to her credit history (i.e. adding more the 5/24).

2) Does it negatively affect her if and when she wants to get the Reserve as an authorized user?

3) What would you guys do?

4) What are some good credit cards that she can get for more than 1x on dinning and travel at this time?

Thanks so much.

Adding her as an AU to your Reserve would add to her 5/24 count, but not in a way that is as bad as a new card for her. That is, if she is rejected from a Chase application for being over 5/24 due to AU cards, she can call, ask to speak to a supervisor, and make it clear to them that those cards are AU cards and she is not responsible for paying them. That usually works.

If I was in that situation, I’d add my wife as an AU. There are many other good travel & dining cards, but none (in my opinion) that are as good for those two categories as the Sapphire Reserve. The Citi Premier comes to mind as a close second since it also offers 3X for travel, but 2X for dining. It also offers 3X for gas, and 2X for entertainment.

Hi Greg. I’m still confused (sorry!) about getting the 3rd travel credit on CSR before downgrading. This is my situation:

-CSR opened mid 10/16

-received first travel credit in 11/16

-received 2nd travel credit in 2/17

-Annual fee posted 11/1/17

If I pay the annual fee now, would I be eligible to get reimbursed for a 3rd travel credit in Dec ’17 (since now they are counting by membership year instead of calendar year)?

Thanks in advance!

Yes that should work. See this post for more detail: https://frequentmiler.com/2017/08/22/sapphire-reserve-2nd-travel-credit/

Have you decided how to move forward? I will be in a similar situation soon.

Did either you or you wife cancel and pay the fee to join as a authorized user under the other person?

We decided to wait until January. We’ll earn the new travel credits and then downgrade.

I’ve been hemming and hawing over whether to keep the CSR. My annual fee hit on 10/1. Originally, I was going to keep it, but am having second thoughts now. I don’t anticipate to travel a ton in the next year, so paying $150 out of pocket doesn’t make a lot of sense. This is my first Sapphire card, and I already have a Freedom card. I’d rather not downgrade to a Sapphire Preferred, as I’d like to apply for it in the future to reap in the bonus points. If I decide I don’t want to renew for another year, should I just straight up cancel and re-apply for the CSR again in the future, when I’m ready to use it again? I’d like to take advantage of the 1.5 redemption rate, plus Priority Pass…just not now. Since I already have the Freedom, I can temporarily transfer my points there.

Is there any reason for me to downgrade to the Chase Freedom Unlimited, Chase Sapphire Preferred, or any other card now, instead of straight up cancelling? I’m also thinking about bonus points or bonus $ I might be missing out on by downgrading to these cards instead of having a fresh application.

Thanks!

Why not downgrade to a second Freedom card? Then you’ll have double the spending power on the quarterly bonus categories ($1500 per quarter on each Freedom card). On the other hand, a Freedom Unlimited could also be great if you do a lot of non-bonused spend (use that for 1.5x everywhere and the Freedom just for 5x categories). If you decide a year from now that you’d like to do a fresh application for a Freedom Unlimited, just product change your Freedom Unlimited to Freedom #2 at that point and you should be able to open a Freedom Unlimited (you can’t open a card that you currently have, but you can downgrade or product change to one you already have….and as long as you haven’t received a signup bonus on that product in the previous 24 months, you’d be eligible for the signup bonus still — product changing to a Sapphire Preferred or Freedom Unlimited won’t disqualify you from receiving a future signup bonus on those cards).

One thing to keep in mind — if you don’t have a Sapphire Preferred, Sapphire Reserve, Ink Business Preferred (or some of the discontinued Ink cards), you will not be able to transfer your points to partners. If you’re not anticipating travel, that might be fine for you. But if you want to be able to transfer points to Hyatt to book a Cat 1 hotel stay for 5K points, remember that you won’t be able to do that without one of the aforementioned cards. If you downgrade to a Freedom or Freedom Unlimited, you won’t be able to transfer to partners.

It sounds like the $450 annual fee doesn’t fit your needs right now, so I think you’re right to consider your options. I hope that gives you some food for thought.

Hey Nick,

Appreciate the response – I didn’t know it was an option to product change to card you already have. Though I don’t think I need either cards for the cash back benefit (I don’t spend that much), but good to know I could downgrade to a second Freedom card in order to keep my account “alive” and to avoid the credit ding.

Thanks for the reminder regarding transferring points.

On another note, I just realized if I want the CSP for the 50K sign up bonus, I won’t be eligible for another 12 months since I just got the 100K CSR bonus 12 months back (need to wait 24 months in between). This is going to conflict as I do intend to reapply for the CSR in the mid-term.

Decisions, decisions…

Hey Laura,

[Edited]

Final note — you mentioned a product change to keep your account alive “and avoid the credit ding”. I’m not sure exactly what you mean by that. You don’t get dinged for closing a card. There main effect that closing a card might have on your score is that you will have a lower amount of overall available credit, which can affect the utilization portion of your credit score. If you’re not carrying balances, that probably isn’t an issue for you. And keep in mind that Chase is usually good about letting you shift credit — that is to say that if you call or secure message Chase, they will usually let you move the credit limit from one card to another before closing.

There are a lot of complexities involved in making the decision with the CSR. I wish you luck if determining what’s right for you!

Laura — my apologies. There was a change when I was on vacation and it slipped my mind. You’re right that you wouldn’t be able to get the CSR for 24 months after opening a CSP. Here’s the post Greg wrote about it:

https://frequentmiler.com/2017/08/28/chase-ends-ability-double-sapphire-reserve-sapphire-preferred-bonuses/

I edited my response here as the post above has the most accurate and current information.

So the plot thickens….though I believe a product change is still a possibility for you.

Thanks for the help Nick – yeah, this was a recent change on Chase’s part. Let me mull over my options 🙂

[…] as many people are coming up on renewal and trying to decide whether to keep it or cancel it (See: Keep or cancel Sapphire Reserve). We looked at maximizing the travel credits (See; Sapphire Reserve: How to get a 2nd $300 travel […]

Excellent diagnosis of the Reserve re-upping decision. As always, you dissected the situation on all possible fronts and did so in a very concise manner with no fluff. This constant awesome manner of your reasoning is the basis for my belief that you are the top travel blogger. I always recommend Frequent Miler to everyone that wants to learn more. You are the best!

Thank you!

[…] Keep or cancel Sapphire Reserve? […]

The free roadside assistance on the chase reserve is only when you rent a card right? and Is it like a roadside concierge service only, where they help to call the tow company, but you still have to pay the tow bill?

Thanks

No, roadside assistance isn’t limited to when you rent a car. It is good for when driving your own car too. They coordinate the service and pay the first $50 of the charge. If the total charge is $50 or less, you don’t pay anything.

[…] my post “Keep or cancel Sapphire Reserve?” I estimated how much I value each of the card’s benefits in order to decide whether or […]

I’ve updated this post to include more info and my valuation of the card’s travel insurance benefits.

If you downgrade from CSR to Freedom, does it count towards 5/24? If so, I’m at 4/24 right now and thinking I should first signup for Freedom to get the small signup bonus, move the points over from CSR to Freedom, then just cancel the CSR

If you product change your 5/24 count won’t change. You’ll still be at 4/24.

[…] I published “Keep or cancel Sapphire Reserve?” My plan is to keep the card, but many others (including my wife) may not. If you decide […]

Has anyone gotten a CSR retention offer?

Not that I’ve heard, but it will be interesting to see now that many will presumably cancel their cards within the next few months.

They have actually temporarily suspended my account as apparently I am a credit risk. Mind you I have not been late on a credit ccard or mortgage payment in my life, and earn a fairly decent living. I have opened 2 ccs in last 3 weeks(Merril + and Alaska). I also spent 2500 on Macerich VGCs last week. Im stunned

What cc did you use to purchase those vgcs? Did you season that card prior to that large purchase? Flags were raised somehow. Did you use a billpay service to pay the cc bill? That can also raise flags. The new apps put eyes on you and then something else triggered flags. Hopefully you can talk to a branch manager that can help. I hope you never deposited MOs into Chase.

Cards ive been opening have been giving me between 20k and 35k credit line- CSR just called me due to large credit lines being opened- should I call these cards and have the credit line lowered, or is that irrelevant at this stage

The answer would depend heavily on each person’s situation. What did the Chase person say to you?