Wyndham charges either 7.5K, 15K, or 30K per night for their hotels, making them one of the rare chains that still has fixed prices for their hotels, with no peak or off-peak modification. Having only three award categories, combined with Wyndham often making multiple room types available for the same points price, means that there can be quite a bit of variation in award value.

Periodically Wyndham makes category changes as to which hotels fit into each of those three buckets. Unfortunately, unlike Hyatt, Wyndham doesn’t publish this information. So, we periodically take a look at current hotel rates and point prices in order to recalculate our Reasonable Redemption Value (RRV) for Wyndham points.

The new result is slightly higher than when we last calculated this in March 2023: the new RRV is 1.01 cents per point vs. 0.88 previously.

Background

When collecting points and miles, it’s always a good idea to have a general idea of what points are worth. Let’s say, for example, that you have the opportunity to either earn 2,000 Wyndham points or 3,000 Hilton points. Which should you go for? If you don’t know what the points are worth, you’d likely go for the Hilton points. But, in our analyses we’ve found Wyndham points to be worth almost twice as much as Hilton points. Therefore, on average, 2,000 Wyndham points are worth considerably more than 3,000 Hilton points. In this post, you’ll find our best current estimate of the value of Wyndham points.

Methodology

In order to determine the value of Wyndham points, we collected real-world cash prices and point prices. As we’ve done previously, we examined a number of major hotel markets in the U.S.: Chicago, Denver, Los Angeles, Las Vegas, Orlando, Miami, New York City and Seattle. Within each market, we identified the first three search results with rating of four or above and recorded both the cash and award prices for three stays: a weekday, a weekend, and a 3-day holiday weekend.

- Why U.S. only? U.S. consumers are known to spend most of their points and miles on domestic travel. Since the majority of this blog’s audience resides in the U.S. we opted for a U.S. centric view of point values.

- Why the first three hotels? The goal wasn’t to find the 3 best Wyndham hotels in each market. Instead, the goal was to find the 3 properties that are most likely to be chosen. By using a Wyndham’s default sorting and adding the four star qualifier, we think it’s reasonable to assume that many members would pick these hotels.

- Which paid rates were selected? We always picked the best refundable paid rate shown on Wyndham’s website, but without applying any discounts like AAA, military, government, etc. In most cases, that’s Wyndham’s Member Rate. Unlike many other programs, Wyndham sometimes allows you to book several different room types for the same points price. In those instances, we chose the best room available.

- Which specific dates did we use?

- Weekday: Wednesday September 11, 2024

- Weekend: Friday-Sunday September 13 – 15, 2024

- Holiday Weekend: Friday-Mon August 30 – September 2, 2024 (Labor Day Weekend)

How we calculate cents per point (CPP)

When we calculate Cents Per Point (CPP), we want to account for taxes and fees, as well as points that would be earned on paid stays (and conversely wouldn’t be on award stays). The calculation is based on the following terms:

- Base Cash Rate: This is the hotel room rate before taxes and fees.

- Total Cash Rate: This is the total amount, including taxes and fees, that would be paid if booking a hotel’s cash rate.

- Resort Fee: This is a fee that is imposed by many hotels above and beyond any required taxes. This goes by different names at different hotels: Resort fee, Destination charge, Facilities fee, etc.

- Points Per Dollar Earned: The number of points per dollar earned by non-elite members on paid stays. For example, Sonesta members earn 10 points per dollar at most hotels.

- Points Earned on Cash Rate: This is the number of points you would earn if you paid the cash rate. The calculation for this is: (Base Cash Rate) x (Points Per Dollar Earned). For this calculation, our default approach is to assume that the traveler does not have elite status (elite members earn more points per dollar).

- Point Price: The number of points required to book a night at the hotel

- Cents Per Point (CPP): This is the value you get per point when using your points instead of cash to pay for a stay.

Hotel Programs that Waive Resort Fees on Award Stays

Hilton, Hyatt, Sonesta and Wyndham waive resort fees when you book stays using points or free night certificates. For these chains, the resort fee does not have to be considered separately from the Total Cash Rate (which includes the resort fee). So, the CPP calculation is as follows:

CPP = Total Cash Rate ÷ [Point Price + Points Earned on Cash Rate]

Results

Wyndham Rewards Point Value

| Analysis Date: | 7/17/24 | 3/7/23 |

|---|---|---|

| Point Value (Median) | 1.01 | 0.88 |

| Point Value (Mean) | 1.03 | 0.93 |

| Cash Price (Median) | $237 | $190 |

| Cash Price (Mean) | $283 | $218 |

| Point Price (Median) | 25,000 | 15,000 |

| Point Price (Mean) | 25,000 | 22,373 |

The median observed point value was 1.o1 cents per point. This means that half of the observed results offered equal or better point value and half offered equal or worse value. Another way to think about it is that without trying to cherry pick good awards, you have a 50/50 chance of getting 1.01 cents or better value from your Wyndham points when booking free awards.

| Pick your own RRV | 7/17/24 | 3/7/23 |

|---|---|---|

| 50th Percentile (Median) | 1.01 | 0.88 |

| 60th Percentile | 1.08 | 1.00 |

| 70th Percentile | 1.18 | 1.05 |

| 80th Percentile | 1.28 | 1.14 |

| 90th Percentile | 1.48 | 1.21 |

When we publish point RRVs, we conservatively pick the middle value, or the 50th percentile. The idea is that just by randomly picking hotels to use your points, you have a 50/50 chance of getting this value or better. But what if you cherry-pick awards? Many people prefer to hold onto their points until they find good value uses for them. If that’s you, then you may want to use the table above to pick your own RRV. For example, if you think that you’ll hold out for the best 10% value awards, then pick the 90th Percentile. If you cherry-pick a bit, but not that much, you might want to use the 70th Percentile (for example). We’re guessing that most cherry-pickers will land around the 80th percentile: 1.28 cents per point.

The above guide can be helpful also when considering buying points when they’re on sale. For example, Wyndham often offers their points on sale for just under 1 cent each. If you’re confident that you will pick the 10% best awards with which to use your points, then the chart above suggests that it is reasonable that you’ll get 1.28 cents per point value, or better. In that case, buying points for around a penny each can make sense.

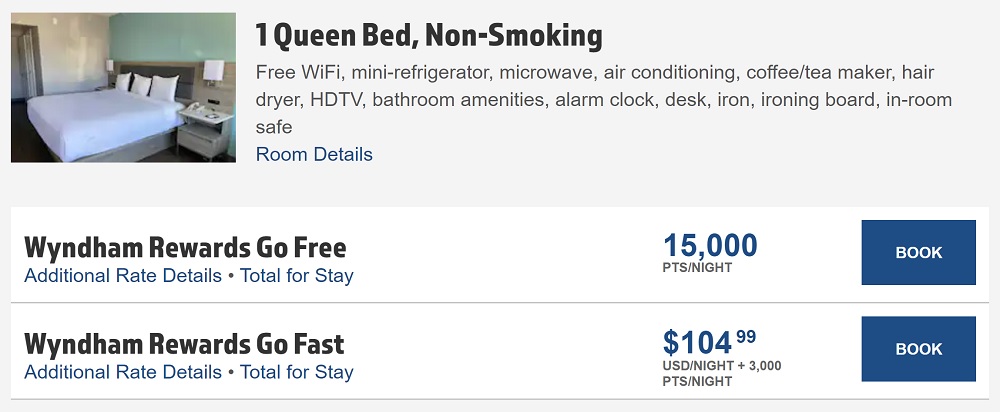

Go Free vs. Go Fast Rewards

Note that Wyndham offers two types of award bookings: “Go Free” and “Go Fast”. Go Free rewards are where you book a hotel entirely with points. Wyndham charges either 7.5K, 15K, or 30K per night for Go Free Awards. Go Fast awards are where you spend either 1.5K, 3K, or 6K to get a discount off the room rate. In the past, we’ve calculated both of these rates separately and found them to be broadly equivalent in terms of points value.

Note that Wyndham offers two types of award bookings: “Go Free” and “Go Fast”. Go Free rewards are where you book a hotel entirely with points. Wyndham charges either 7.5K, 15K, or 30K per night for Go Free Awards. Go Fast awards are where you spend either 1.5K, 3K, or 6K to get a discount off the room rate. In the past, we’ve calculated both of these rates separately and found them to be broadly equivalent in terms of points value.

New Reasonable Redemption Value: 1.01 CPP

Our Reasonable Redemption Value (RRV) for Wyndham points was previously set to 0.88 cents per point. RRV’s are intended to be the point at which it is reasonable to get that much value or better for your points. Therefore, we believe that the median observed value for Go Free Awards is a good choice for our RRV…

- Reasonable Redemption Value for Wyndham: 1.01 cents per point

- Reasonable Redemption Value for those who cherry pick awards: 1.28 cents per point

Overvaluing vs. Undervaluing Points

There is no perfect way to estimate the value of points. Decisions we made here in some ways overvalue points and in some ways undervalue points. The hope is that these things roughly offset each other…

Factors that cause us to undervalue points

- With hotel programs that offer 4th Night Free Awards (IHG, with some credit cards), or 5th Night Free Awards (Hilton & Marriott), or award discounts (Wyndham), we do not consider the point savings in our analyses.

- With hotel programs that offer free parking on award stays to top-tier elites (Hyatt), we do not factor this in.

Factors that cause us to overvalue points

- We do not use discount rates (other than member rates) in our analyses. In real-life, many people book hotels cheaper (and sometimes far cheaper) by using AAA rates, government & military rates, senior rates, etc.

- We do not use hotel promotional rates. Often, individual hotels have deals such as “Stay 2 Nights, Get 1 Night Free” which can greatly reduce the cost of a stay.

- We do not use prepaid rates in our analyses. Sometimes these rates are significantly lower than refundable rates.

- We do not factor in rebates which can be earned from booking hotels through shopping portals.

- We do not factor in extra points earned on paid stays for those with elite status.

- We do not factor in rewards earned from credit card spend at hotels.

- We do not factor in hotel loyalty program promotions: Most promotions, but not all, only offer incentives for paid stays. We often see promos offering bonus points, double or triple points, free night awards, etc.

- With hotel programs that waive resort fees for top tier elites on paid stays (e.g. Hyatt), we do not factor this in.

Conclusion

Based on the latest analysis, we’ve increased our Wyndham RRV to 1.01 cents per point. This is a fairly sizeable increase, especially compared to other programs that we’ve looked at recently that have broadly stayed the same or decreased in value. Looking through properties this time, it seemed like Wyndham has expanded the ability to book multiple room types for the same cost. In some case, oceanfront rooms and suites were the same award price as the standard king. Our guess is that this had something to do with the increase that we found.

For a complete list of Reasonable Redemption Values (and links to posts like this one), see: Reasonable Redemption Values (RRVs).

Nice to see WR points increase in value 🙂

Some of the best value I have found is in Thailand and Vietnam. They treat you like royalty when you are a diamond member and the prices are fantastic – especially with points. I found a 4-bedroom, beachfront villa WITH pool for 15,000 points that would cost over $500 per night.

Is there a guide on how to extract good value from these points? I’ve piled some up with the Business Card, but when I go the website I just see a lot of low tier places that I would probably not take my family, and I prefer a professionally managed hotel experience to a home rental like Vacasa.

AwardWallet estimates Wyndham point value at 1.17¢

Oy Vey! You lost me

me too, right after “Wyndham charges either 7.5K, 15K, or 30K “

Thanks Greg. How often do you see transfer bonuses from Citi or Capital One to Wyndham?

This is the type of question that’s easy to answer by looking at our Current Transfer Bonuses page and going to the Expired Transfer Bonuses section. It shows that there has only ever been a single transfer bonus to Wyndham. Capital One offered a 20% bonus in March 2022.

Oh cool. Thanks!

So weird how it’s Hyatt>Wydham/Choice>IHG/Mariott/Hilton. Not that I think calcs are off, or anything, just weird how the biggest brands chose for their points to get this devalued that it becomes irrational to transfer in unless it’s to top off a really close redemption.

I guess they don’t value the marketing opportunities presented by having market transferrable currencies. Otherwise, they’d at least get the ratios better, like a 1:2, or even a 1:1.5.

Agree Nate, it really is crazy. Hyatt, Wyndham (for Vacasa), and Choice(for Citi) are all very realistic transfer options for great value, while I would only ever buy IHG points for .5 cpp from their sales, and the same with Hilton, unless Amex does a 50% bonus on transfer, then 3 points Amex point is decent value. Marriott, I really would never transfer unless they gave us 2:1 transfers, nor would I buy them, as there just isnt much to be had in terms of value there anymore. And now that I have exhausted all the sign up bonus opportunities for Marriott cards, I really am going to be slowly moving away once my stash of points are gone. It is crazy how Marriott destroyed theirs and SPG’s programs once they merged in less than 5 years.

That is interesting, I agree. Do note though that the standard transfer from Amex to Hilton is 1 to 2. The one I find weirdest is IHG. They so often sell their points for half a cent each so why isn’t the transfer ratio from a bank program to IHG always at 1 to 2 at a minimum?

Woot woot. First reply from Greg! Honored.

I had no clue on the MR/Hilton transfer ratio. Now I understand why you like Hilton Amex so much! If you’re carrying some Amex cards, then getting a Hilton Amex card makes so much sense. You should mention that more on the pod or do an article (if you haven’t already!) on what I’m humbly call “sweet pairings”: Chase UR / Hyatt, Amex MR / Hilton, and kind of Citi TYP / Choice, as they all offer around 2cpp for redemptions on card transfers due to ratios, and with the Chase and Amex cards, you pair that with status for a better overall value.

My explanation is that because a lot of the folks don’t read frequentmiler and lose out on value, of course!

I read an anecdotal story about a boss bragging how he put all his spend on his Hilton card got to get free rooms for his vacation. Personally, I experienced my boss making a big show of giving me a free breakfast when I came down to for a meeting near the hotel he was living at for a few weeks. Loyalty programs work on the bosses.

Hmmm. edited my previous reply too much so I think I got spam’d. So, anyways, what I meant to say is maybe do an article where if you pair, a cc rewards program with a hotel program, you get double the value. Amex – 2:1 ratio on Hilton with status from their card, Chase – 2ccp on Hyatt, with some status on hyatt card; Citi – 2:1 on Choice (no status as Barclays has the card).

Not taking Vacasa into account at all is an interesting choice. Even though they are not available everywhere, the value is excellent. Vacasa could bump the value of points to 2.5-3cpp easily if you use them exclusively for vacation rentals. Maybe you could have given Vacasa cpp a smaller factor (like 20%) while keeping the bulk of the value estimate (80%) from Wyndham owns hotels? Or do a separate evaluation for Vacasa bookings?

Also, Barclays Wyndham Earner/Business credit card holders get 10% off, which changes cpp for them. I would assume a good chunk of people using Wyndham points have those, but maybe I’m mistaken.

There are a couple of really good redemptions at South Lake Tahoe. In peak times it can get to over $500 per night but many hotels are priced around 15,000 a night, giving Wyndham potentially over 3cents/point value

I get great value at Wyndham Clearwater during the summer, even compared to the early booking special, I am getting 1.12 cents/points on my stay this summer, and on the normal price, it is 1.45 cents/points. These are for the base rooms – you save the resort fee and all the taxes, which add an whopping 0.26 cents per point value.

@Greg Wyndham does charge resort fee on award stay here is one of many examples:

Sandpiper Bay All-Inclusive, Trademark Collection by Wyndham Rooms & Rates (wyndhamhotels.com)

I think you’re talking about the box that states “Resort Fee of $39.20 per night will be added to the indicated room rate and collected at checkout. Wyndham Rewards points cannot be used to pay the Resort Fee. Please see “Total for Stay” for fee details.”

That fee is only charged on cash stays and on Go Fast stays. Go Free stays don’t incur resort fees. You can see that by going to the Wyndham Rewards Go Free display that shows the 30,000 point price and clicking on “Total for Stay”. You’ll see that it says:

Price Per Night 0.00 USD

Estimated Taxes and Fees $0.00 USD *

Total 30,000 PTS

(see? no resort fees)

This is in contrast to the Go Fast “Total for Stay” which shows:

Price Per Night 342.30 USD

Estimated Taxes and Fees $80.28 USD *

State Tax 7% $23.96 USD

Occupancy Tax 5% $17.12 USD

Service Charge $35.00 Plus Tax $39.20 USD

(you can see the resort fee as the Service Charge)

@Greg, I could of swear i called the property in Florida last month to inquire about the resort fee and they said it would be charge at C.O, this property is not as nice as Alila Ventana Big Sur but cant wait to go, drinks and food included in the US.

I’m sure they told you this but I’m not at all sure they were right.

Greg, I also believe I read somewhere that some Vacasa rentals are requiring additional charges for certain properties in Hawaii. I don’t know if that was confirmed or not or if that has spread to the mainland, but there were people that had to pay some fees.

Brands, I’ve seen mention of additional fees in the reviews of Fort Lauderdale/Miami oceanfront vacasa units. Vacasa should list these additional fees to the guest BEFORE the reservation is made.

A commenter or two has mentioned that but I don’t have any hard data about that to report on. I’m going to Hawaii in May and will hopefully be able to prove that at least some units don’t impose mysterious extra fees.

What? No HoJo’s or Super 8’s on the list 🙂

My most recent redemption was at the Palladium White Sands Resort in Playa del Carmen, at 30k points replacing $412 per night, at a 1.4 cpp value.

One of the things that’s hard to quantify is the potential for outsized value. Hilton and Marriott have eliminated some of that potential, but a lot of it is still there for Wyndham.

Yep. I think you can see that in the “Pick your own RRV” section.

[…] Book Go Fast rewards – these is Wyndham’s Cash + Points option and can get you outsized value for the small number of points you have to redeem. See Greg’s calculations for examples. […]

0.82 cpp valuation seems quite low, given that you can transfer 30k points per year to Caesars for an easy 1 cpp. Which also plays very well with the Caesars Diamond status that you get with the Wyndham Earner Business for no resort fee, celebration dinner, and other perks. Such an overpowered card, just hope they don’t nerf it anytime soon!

There’s also plenty of Wyndham options for 1+ cpp. Recently booked Grand Wyndham in Puerto Rico at about 1.1 cpp and crossing my fingers for an upgrade for even better value. Can definitely get even better than that too.