NOTICE: This post references card features that have changed, expired, or are not currently available

Welcome to this week in review here at Frequent Miler, where we recap the top stories of the week. From building teenage credit to how you might get compensated for Equifax’s massive leak, we’ve got the news you can use. Read on for this week this morning.

Building (and viewing) teenage credit

Do you have kids? Have you taken any steps to prep them for a life of good credit and the financial advantages it affords? In this post, Greg explains how he has laid the groundwork to help his son get started. I hope to follow some of his blueprint, though I also certainly wonder what will have changed by the time I’m in Greg’s shoes….stay tuned for my comparison in the fall of 2036. 🙂

Plastiq no longer allows Amex mortgage payments

The title says it all on this one. Another one bites the dust — and we’re now down to Discover and Mastercard for paying mortgage payments via Plastiq.

Heads up: Same-day ACH debits possible starting Friday, 9/15/17

In case you missed it, same-day ACH debits became possible yesterday. I meant to make a couple of credit card payments first thing in the morning to see if any of them settled same-day, but it slipped my mind yesterday morning. Time will tell whether or not credit card payments are affected by this rules-change, but they certainly may be. I intend to begin testing this next week with payments in-app, on the website, and over the phone to see if I can determine the outcomes with each issuer.

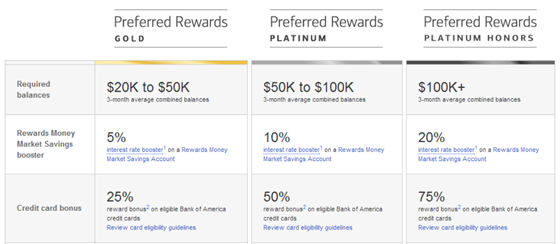

Which BOA cards earn bonus points via Preferred Rewards?

If you have some money to invest and you like earning more rewards, check out this post on which BOA cards earn preferred rewards and how much you can earn. The return on some cards is pretty compelling, though you’ll have to compare BOA’s options against how you can do elsewhere to decide whether or not this is worth it for you.

Pay estimated taxes via credit card (due 9/15)

Hopefully, you paid your estimated taxes yesterday if you had taxes due. And hopefully you earned some rewards when doing so! If you didn’t, check out Greg’s post for a quick guide on how to pay your Uncle Sam while sneaking some of it back into your pocket.

How much can you really save with Shipt and Amex?

Sometimes, when a deal sounds too good to be true….well, you know. And this deal certainly fits the bill as far as how it sounds — $50 back on $100 on groceries. Who doesn’t love half off? But does it really work out to be worthwhile? Check out this post to see. Truth be told, I was surprised by the answer…

Sometimes, when a deal sounds too good to be true….well, you know. And this deal certainly fits the bill as far as how it sounds — $50 back on $100 on groceries. Who doesn’t love half off? But does it really work out to be worthwhile? Check out this post to see. Truth be told, I was surprised by the answer…

Can I interest you in 40 Amazon Fire tablets?

This limited-time offer is one of those epic deals that you just can’t ignore. While the week in review doesn’t normally include quick deal-type posts, this deal was incredibly popular and seemed too good not to include. What’s more, it ends tonight at 11:59pm PT. If you have an American Express card that earns Membership Rewards points and you are an Amazon Prime member, you’ll want to find out how you can buy a Kindle Fire tablet for as low as $15. At this price, it would be easy to load up on an inexpensive and useful gift, you might be able to make a few bucks on the resale market, or it would make a great donation to your local school or for some type of benefit/organization. I imagine a new model is around the corner, but these devices look pretty good for the price!

The Fine Print: Equifax Data Breach, What It Means Today*

The Equifax hack is undoubtedly mammoth in proportion. More than half of us will rest uneasy knowing that Internet thieves have gained access to all of our personal information — and there is no telling when that information will be put to use for nefarious gains. Many people are rightfully angry and looking for Equifax to pay up for the mess they have created. You may have heard about the class action suit already forming — and about the lawyers already foaming at the mouth for their ~30% piece of settlement pie. Could there be a better way to make Equifax pay for playing fast and loose with your identity? Alex Bachuwa takes a look at The Fine Print and suggests that maybe you can secure yourself something closer to fair compensation for the damage that’s been done. Read on to find out how.

That’s it for this week in review at Frequent Miler. Check back soon for a recap from around the web and this week’s last chance deals.

![Mileage running 2026-style, playing the AA transition, a coming points conference and more [Week in Review] a group of toy airplanes on a game board](https://frequentmiler.com/wp-content/uploads/2022/01/American-Airlines-Game-218x150.png)