NOTICE: This post references card features that have changed, expired, or are not currently available

I love transferable points programs. And I love when they become more valuable due to transfer partners becoming more valuable. For example, when Virgin Atlantic added the ability to book many Delta awards online (and especially when they make more saver level award space available than Delta itself), Virgin Atlantic miles became more useful and hence more valuable. And since all of the major transferable points programs transfer to Virgin Atlantic, those programs became more valuable too. The major transferable points programs are: Amex Membership Rewards, Chase Ultimate Rewards, SPG, and Citi ThankYou Rewards.

Perhaps best of all is when a transferable points program becomes more valuable by adding a valuable new transfer partner. This happened just a few days ago when Citi added Avianca LifeMiles as a transfer partner. As a reminder, you need to have either the Citi ThankYou Premier or Citi Prestige card in order to transfer ThankYou points to most of Citi’s airline partners. See: Citi Transfer Partners for more details.

Avianca miles are valuable for several reasons: Avianca is a member of the largest airline alliance, Star Alliance, and therefore has access to far more flight awards that many other programs. Additionally, like United, Avianca does not add fuel surcharges to awards. Some Star Alliance airlines add huge fuel surcharges to their award flights, and most other programs pass along these charges, but Avianca does not. Singapore Airlines, Citi’s other very useful Star Alliance transfer partner, does pass along these charges.

Of course, not everything is great about Avianca’s program. Here are some pros and cons:

Avianca LifeMiles Pros:

- Book Star Alliance awards

- Ability to book most awards online (their online award search feature has improved tremendously in the past few months)

- No fuel surcharges on awards

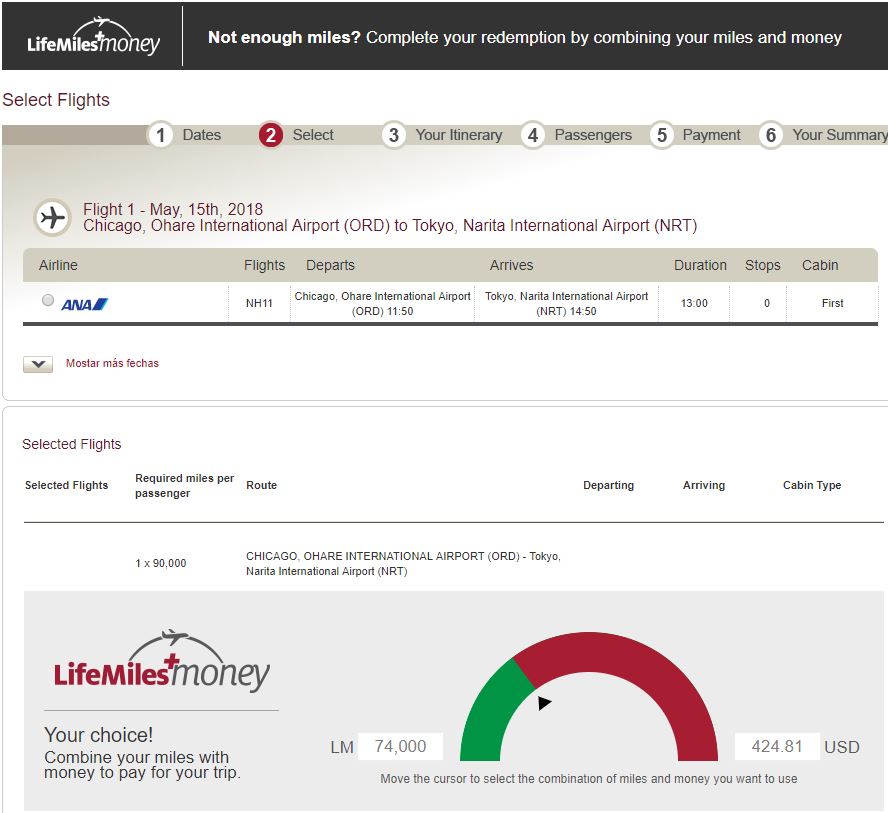

- Points and cash: If you don’t have enough miles for an award, or you want to keep them for future use, LifeMiles lets you pay part of the award with cash

- Frequent sales on miles: Avianca frequently offers their miles for sale at very good prices

- Miles do not expire as long as you have account activity every 24 months.

Avianca LifeMiles Cons:

- $25 award booking fee

- High award change fee: $150 [vs. $20 w/ Singapore]

- High award cancellation fee: Up to $200 for tickets that span regions ($50 within one region) [vs. $30 w/ Singapore]

- Avianca blocks some awards that are available to other partners. For example, One Mile at a Time reports that ” they often block awards in Lufthansa first class, Austrian business class, all Air China flights, etc.”

- Their call center is purportedly terrible, especially if you’re not fluent in Spanish (but I’ve been told by the owner of awardbookingservice.com that it is possible to accomplish many transactions via email instead).

Citi’s New Way Out

Readers often tell me that they want to cancel their Premier or Prestige card and they ask what they should do with their ThankYou points to avoid losing them. Should they transfer the points to an airline program? If so, which one?

In general, my advice is not to cancel at all. If your goal is to avoid the annual fee, then product change to the no-fee Citi ThankYou Preferred card. That will keep your points alive. You won’t be able to transfer them to airline programs, though, unless you upgrade the card, or sign up new for a Premier or Prestige card. Or, you can freely transfer up to 100,000 points to a friend who has one of those cards. I covered this topic previously here: Cancelling your Prestige or Premier card? Here’s how to keep your ThankYou points alive.

All that said, some just want out of Citibank altogether. Perhaps they are worried that Citi will shut them down. Or perhaps, Citi did something to piss them off and they’ve had enough. Whatever the reason, the best answer in the past for what to do with those ThankYou points has been elusive.

Singapore Airlines and Air France arguably have been Citi’s most widely useful transfer partners. Singapore is great for booking Star Alliance awards (unless heavy fuel surcharges are involved), and Air France is decent for booking SkyTeam awards. One big problem with Singapore, though, is that miles expire after about 3 years and there’s very little you can do about it. See: How to keep Singapore Krisflyer miles from expiring (for up to 1 year). Air France has a similar issue: miles expire after 2 years unless you’ve earned Air France miles from flying Air France or one of their partners (elite status or Air France credit card spend can also keep your miles alive). Potentially worse is the fact that Air France is overhauling their frequent flyer program next year. It remains to be seen whether they’ll still be a good option for booking SkyTeam awards.

Avianca miles, on the other hand, do not expire as long as you have account activity at least once every 24 months. LifeMiles Terms state:

Any activity in the member’s LifeMiles account extends the expiration date of the mileage credit of that account for a term of twenty four (24) months from the date of the latest qualifying activity. Qualifying activity is defined as any mileage accrual or redemption transaction, affecting the member’s mileage credit.

You can easily keep Avianca miles alive by occasionally redeeming miles, transferring additional miles to Avianca, or even donating a few miles to charity.

While I would always prefer keeping transferable points in the form of transferable points until ready to use them, if you want out of the Citi ThankYou Rewards program and you don’t have set plans for how you’ll use your miles, I believe that Avianca LifeMiles is the new best choice for most people. Alternatively, you can just cash out entirely. If you have the Prestige card, you can now redeem points for 1 cent each. Personally I’d rather have LifeMiles for booking business and first class awards, but if you don’t expect to travel much or you travel mostly in economy (which tends to be cheap anyway), then cash may be your best bet.

[…] Citi Thank You cards just became more valuable with the addition of a new transfer partner (See: Citi ThankYou gets more valuable and adds a way out). I love to see banks competing to make their cards more valuable — and so it was good news […]

You may need to learn about the latest announcement from SQ on the upcoming BIG DEVALUATION on their partner charts. They still charge hefty YQ on partner redemption so this devaluation just makes things much worse.

We reported that devaluation shortly after publishing this post. Here’s our post on Singapore’s devaluation: https://frequentmiler.com/2017/11/14/singapore-devalues-adds-online-partner-booking/

Can points from Avianca or Singapore Air be added to/combined with United Miles to obtain a reward? Or do you need to have the required points entirely from 1 airline?

Short answer: no, you can’t combine them.

Long answer: If you don’t have enough points in one program, it should be possible to book outbound one-way with one program and the return one-way with another program. Or, if you’re trying to book multiple people you can book different people with different points. The problem with the latter is that the bookings won’t be on the same itinerary and if there are problems that require rerouting, you can’t be sure that you’ll stay together.

Can I upgrade to the prestige cash out the points and close or downgrade the account and get the AF refunded?

I don’t see why not

I’d add that another Lifemiles benefit is the ability to purchase points inexpensively during their frequent sales. If someone is short of TYP or Starpoints and wants a premium cabin redemption, purchasing points for <1.4 cents each can be a pretty great deal. Plus they sell their points directly instead of using a third party like points.com so it will code as an airline purchase.

Thanks for the reminder. I added it to the “pros”