NOTICE: This post references card features that have changed, expired, or are not currently available

It’s been a big week for surprise news: from the sneak preview of Marriott’s new award chart being better than expected to a Chase rumor that gave me the kick in the pants I needed to pool my points properly, there will and could be interesting changes on the horizon. In preparation for the new Marriott program to be, we laid out some of the best opportunities – from top-of-the-line properties that could become a steal to how to eek max value out of a travel package certificate. All that and more in this Frequent Miler week in review.

SPG’s Off the Chart Properties, and a Map

Are these properties really going to be bookable for 60K per night in August? I don’t run the program, but the guy who does introduced us to the person who told us they would be. Is it going to be every room at those properties for 60K? Of course not. I expect there to be a very limited supply and a very high demand, but this map will help you decide your strategy should this work out as we’ve been told it will. If you’re preemptively booking, I’d suggest trying to book the room category least likely to be considered premium in August — the beach bungalow rather than over-the-water, etc.

Surprise: Some NYC hotels will only cost 35K Marriott points (free cert eligible)

I know that long-term Starwood Platinum loyalists are disappointed in the changes on the horizon when the programs merge, but as someone who is not in that camp I have to say that I feel like Marriott’s changes just keep exceeding my expectations (Did I just have the bar set too low?). They have released a preview of the new award chart, and while we’ve all seen a movie that looks great in the trailer but turns out to be a trainwreck, I’m at least ready to buy a ticket. I was surprised by some of the hotels dropping in price and particularly surprised that there are four Manhattan properties (and a few in Paris as well) where we will be able to use the annual free night certificate that will come with the SPG cards (after August 1st) and the new Marriott Premier Plus card due to come out next week – at least at “standard” pricing, which will be active through the end of this year. I do not expect that the free night certificates from the current Marriott Rewards Premier cards will work at 35K properties, but rather those will likely map to 25K properties (same as the current value). Still, the SPG cards may not be an automatic cancel after all.

Fly (semi) private on points or credits: JetBlue selling JetSuiteX seats

With JetBlue now code-sharing some JetSuiteX flights, it is easier than ever to fly semi-private (more like charter) on rewards points. No, you can’t yet do it with TrueBlue points, but if you live out west and you’re looking for a more unique redemption opportunithy, this post lays out the options to give you a taste of what it’s like to fly private (with 29 other passengers).

Marriott Platinum Premier 75. Should I go for it?

Greg presents a pretty compelling argument for why it might make sense to go for Marriott Platinum Premier 75 status this year — and if the soft landing works out, it’s hard to argue with the numbers here. If you have all of your credit cards lined up, going for Marriott Platinum (50-night status) will be incredibly easy this year (remember that award stays in both Marriott and Starwood count) — and it will never get easier to qualify for the 75-night status. I’ll add one more reason to consider going for it: What if Marriott brings back the status buy-back? It might have been that they ended the buy-back this spring to focus on getting the programs worked out. I definitely wouldn’t go for status counting on the buy-back in the future — but I don’t think it’s far-fetched to think we might see it return down the road.

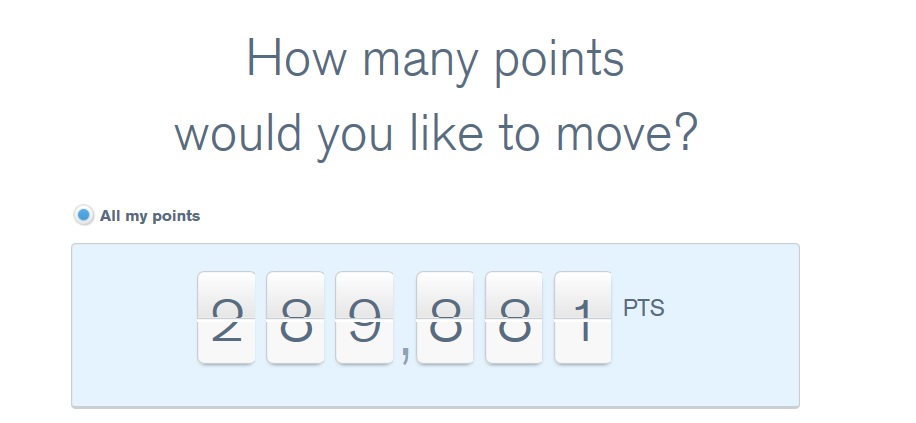

Leak: Chase may end Ultimate Rewards pooling

We received a piece of inside information this week about the ongoing discussion at Chase about changes to Ultimate Rewards pooling. Will this actually happen? I certainly hope not, and can think of plenty of reasons why it feels unlikely. On the other hand, if it’s being considered, it makes sense to be prepared in case it does. Do I think it is more likely than not to happen? No. Does it concern me that it’s being discussed? Of course. Do I think we will get a heads up if this were ever to happen? The answer to this question doesn’t really matter: I’d want to be prepared in case we don’t. And that’s why we shared – so readers could pool points appropriately. Will I move points every week from here until eternity? No – but neither will I let a six-figure balance sit in the wrong pile going forward.

Is Chase now restricting Freedom cards?

The short answer: no. Thanks to readers for chiming in. After product changing and applying this week, I was told by more than one reconsideration rep that it wasn’t possible to open a second Freedom product and that seemed believable only because my credit wasn’t pulled when applying and I heard the same story from more than one rep about it. While I knew I was playing with fire in how I handled the application, there were two reasons for it: First, without a credit pull the harm seemed limited (barring a shutdown). Second, readers often ask how soon after PC-ing one can re-apply. It seems that the answer is not this soon. :-). Since my status still has the 2-week message, I intend to wait this one out for the time being.

60+ retailers where Acorns Found Money offers the highest cashback

Acorns has gotten a lot of attention over the past several months for its big referral promotions, where you can earn a nice return for referring friends to microinvesting. But beyond that, if you’re using Acorns, the Found Money feature is really worth a look. In this post, Stephen illustrates how many of the payouts are very competitive — with a large number of merchants where Acorns was paying out more than shopping portals at the time of publication. Not only that — some of them don’t even require a purchase to pay out.

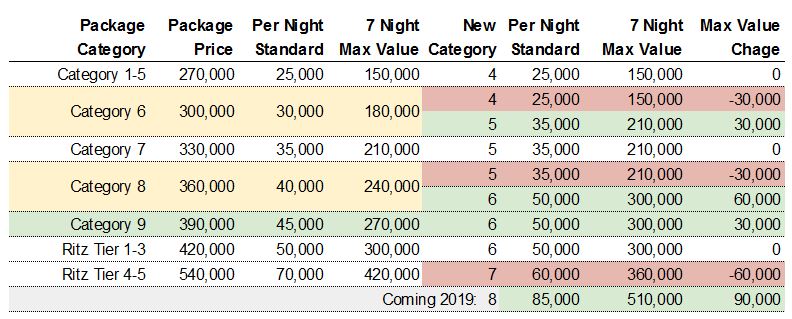

Marriott Travel Package Arbitrage

If you’re holding a Marriott Travel Package 7-night certificate, it is worth giving this post a read to see how to position yourself to get maximum value when the new program launches on August 1st. While it doesn’t make sense at this point to redeem points speculatively, if you have a need for the miles now or are holding a certificate, it makes sense to position yourself to come out ahead. I had intended to redeem for a package or maybe two before the program switch, but with top-end SPG properties coming down in price and what we’ve been told about the off-the-charts properties, I am now leaning towards holding my points for a sweet redemption next year.

That’s it for this Frequent Miler week in review. Check back soon for our week in review around the web and this week’s last chance deals.

![Mileage running 2026-style, playing the AA transition, a coming points conference and more [Week in Review] a group of toy airplanes on a game board](https://frequentmiler.com/wp-content/uploads/2022/01/American-Airlines-Game-218x150.png)

![Cutting our collections, comparing free night certificates, and expediting new cards [Week in Review]](https://frequentmiler.com/wp-content/uploads/2025/07/Nick-Platinum-cancel-218x150.jpg)