NOTICE: This post references card features that have changed, expired, or are not currently available

I’ve said it before and I’ll say it again: Don’t sleep on the bank bonuses. Last year, my wife and I earned well over four thousand dollars in bonuses from opening checking and brokerage accounts and set ourselves up to start out 2021 with a bang as well. Just as I did last year, I’m tracking each of the wins (and this year’s errors that cost me several bonuses as well) in order to show what’s possible with a little effort. While I love credit card bonuses and 5x bonus categories as much as anyone who reads this post, it is easy to forget the low-hanging fruit of bank bonuses. This time around, several of the bonuses in this post are still available and have very easy requirements, but some of them end on 6/30/21. If you like low-hanging fruit, it’s harvest time — but if you snooze, you lose.

Note that this post is much better viewed on the web than in email because of the easy table of contents for skipping around.

Quick Totals: Bank account bonuses earned in 2021

Here is a list of bonuses we’ve earned this year with links to the pertinent sections below outlining the deals we pursued. In some cases, one of us has done the bonus previously or plans to do it in 2021 and/or there was a large deposit requirement that we didn’t want to double, hence why we haven’t overlapped on all of them.

Earned

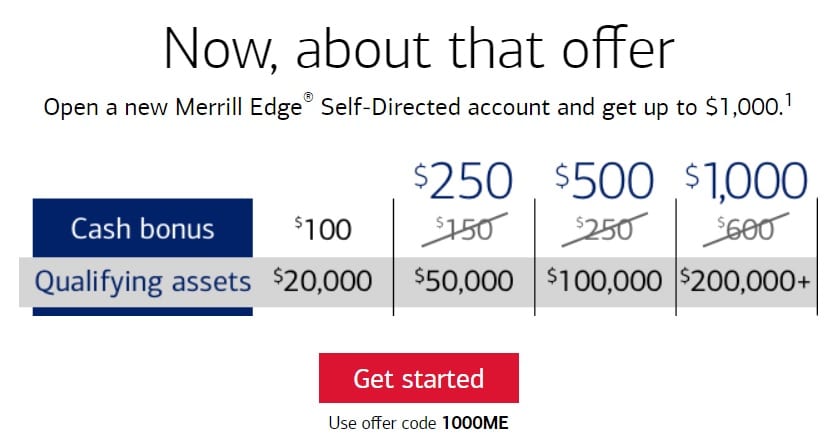

- $225: Merrill Edge (one of the bonuses hasn’t posted as expected, still following up)

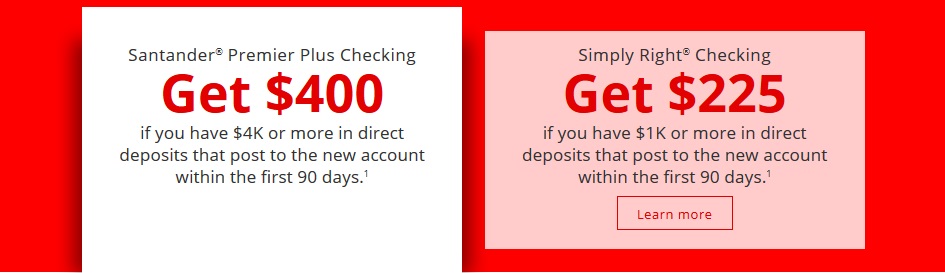

- $400: Santander (P2)

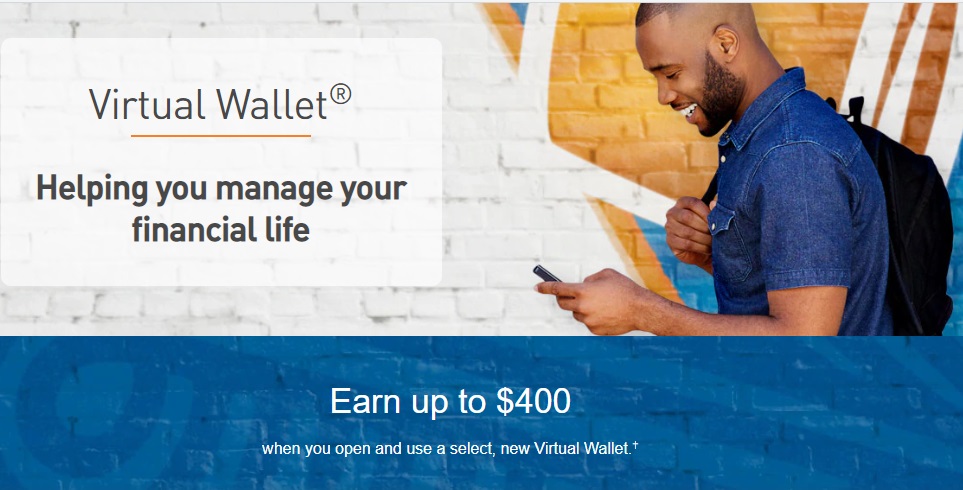

- $400: PNC Bank Checking account (P1)

- $500: Bank of America business checking account (P1)

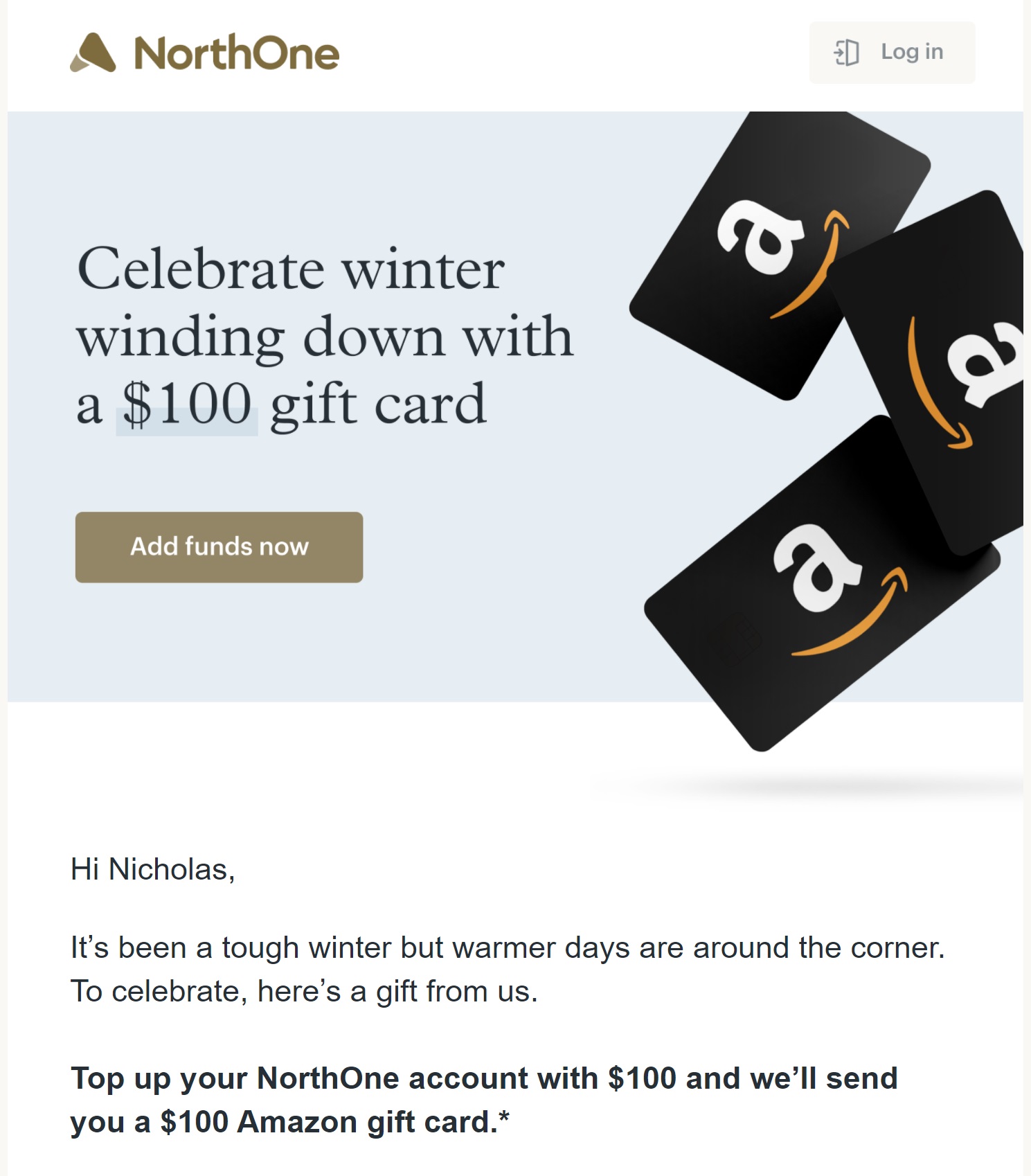

- $170: NorthOne

- $500: TD Bank

- $400: US Bank

- $255: Betterment

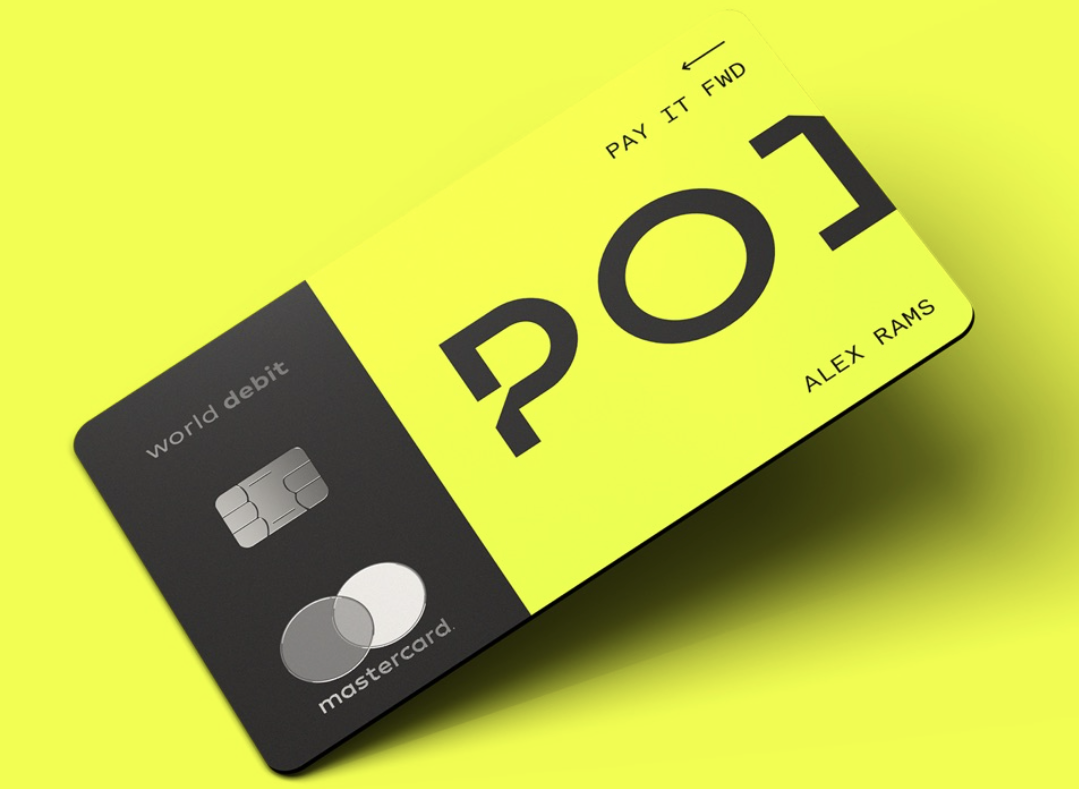

- $301: Point

Total: $3,151

Expected and awaiting

- $200: Tastyworks (could be more)

- $250: Monifi

Total: $450

Failures

Does this stuff count?

- Brex: $2200

- Reward Wizard: $900+

Total: $3,100

That’s a total of more than $3,500 in bank and brokerage bonuses earned and another $3100 with Brex and RewardWizard at the halfway point for 2021. It has taken some time, but it’s been worth the effort.

Key tips / notes on bank account bonuses

Bank account bonuses can be surprisingly lucrative. Some can be frustratingly complex, but the juice can definitely be worth the squeeze in many cases.

One thing that most checking account bonuses have in common is that they usually require some amount of direct deposit (the amount varies considerably; within this post you’ll see some bonuses that only required $1 deposited and others that required thousands). While terms typically indicate that a direct deposit must be funds from an employer, pension, social security, etc, seasoned bank account bonus chasers know that in reality other things often work. Doctor of Credit maintains a fantastic resource page with data points about what works and doesn’t with various banks. I highly recommend checking there (and their general bank account reference pages) if you are more interested in bank account bonuses than your company’s HR rep is.

I’m noting in this post when I’ve triggered a bonus with an ACH transfer. In all cases, that means a push from the external account into the target account rather than a pull the other way around. I intentionally haven’t noted which bank I used to push the money in most cases. There are two reasons for this: first, Doctor of Credit maintains an excellent resource that doesn’t take much effort to search. Second, my single data point for each account type is of highly limited value since things may have changed. What worked for me may have stopped working. It’s like the old adage about giving a person a fish versus teaching them to fish. I’ve shown you to the fishin’ spot, but you’ll have to cast your own line.

Keep in mind for your tax planning purposes that bank bonuses are taxable and you’ll typically get a 1099.

If you take away one tip, let it be this: take screenshots. If you ever need to follow up on a bonus, they can be helpful. All of the screen shots in this post are my own except for one that Stephen had already uploaded. I keep records of any offer for which I apply.

Finally, keep in mind that some banks will deem it risky if you have opened up many bank accounts in close proximity. Try to space things out rather than trying to open ten accounts at the same time.

On to more detail on each bonus broken into “Leftovers from Last Year”, “New 2021 activity”, “Bonuses still to come in 2021”, “Whoops / Failures”, and “Does this stuff count?”.

Details on bank account bonuses earned

Leftovers from last year

Merrill Edge Brokerage: $225

Between my wife and I, we opened 3 Merrill Edge accounts for bonuses last year and we expected this bonus in early fall 2020. I followed up multiple times via email with no response. If this were a normal bank bonus where I’d stretched the definition of a direct deposit, I’d just let it go and move on, but I had done exactly what was necessary (moved the minimum balance into the account and still hadn’t withdrawn a penny many months after the bonus should have posted. I finally wrote a letter in Microsoft Word and attached it as a document to a secure message and then the bonus was then promptly credited along with a couple straight months of apology letters and phone calls I missed. Better late than never!

Santander P2: $400

We try to stay organized with bonuses, but we very nearly dropped the ball on this one. Player 2 realized that she hadn’t yet met the direct deposit requirement the day before the final day to earn the bonus. The nice thing is that Santander sends a reminder email about a month in advance telling you the deadline for meeting the requirement and the date the account will be evaluated, so we weren’t guessing whether or not there was still time. An ACH push from an external account thankfully posted that next day and the $400 bonus (offer long since expired) came a day later. Whew! Cut this one close.

PNC P1: $400

I opened this account last year and met the requirements last year. As expected, the bonus posted in January. A PNC bonus is still available through 6/30, though it’s now $300.

Bank of America Business: $500

I opened this account last year and detailed it in my late 2020 post. As expected, the $500 bonus posted in January.

New 2021 activity

NorthOne: $50 + $100 + $20

This wasn’t a new account bonus but rather NorthOne just kept offering more money to people who kept their accounts open. First up was a $50 bonus for updating my information when NorthOne was preparing to move to a new backing bank. I had originally opened this account for a $300 bonus last year, so I was happy to take them up on another fifty bucks. After giving me $50 to update my information, NorthOne offered a $100 Amazon gift card for depositing $100. Yes, please! Done and one. But they weren’t done after all! Almost immediately after getting the $50 and $100 bonuses, I received an email inviting me to do a survey that took 3 minutes to complete for a $20 DoorDash gift card. It was easy breezy lunchtime cheesy. In fairness, I wrote in those posts about how this account made no sense to keep since it has a $10 monthly fee (but that they had waived it for a few months when I tried to cancel). All of this free money has led me to keep it and pay a few $10 monthly fees, so my net here is probably more like $130.

TD Bank: $500

This is a $300 checking bonus for receiving $2500 in direct deposits in the first 60 days and a $200 savings bonus for depositing $20K within 20 days of account opening and leaving it for 60 days (this one is still available now). I took the $20K savings from the Bank of America business bonus that I earned in January and moved it to TD to trigger this bonus — so that same $20K earned $700 between those two accounts in less than 6 months, which makes for around 7% APY annualized. Can’t complain about that!

US Bank: $400

US Bank was offering a tiered bonus depending on direct deposits. My wife went for $4K in direct deposits within 60 days to get a $400 bonus. Since we don’t live within the US Bank footprint, we had to use a workaround to get this, but it worked without a hitch. A semi-interesting note on that is that US Bank initially limits ACH transfers out of the checking account to no more than $2K per day but allows more out of the brokerage account. My wife still hadn’t funded her brokerage account (so it had a $0 balance). She wanted to move $4K out of her US Bank checking account , so she moved that $4K first to her brokerage account (instant transfer from US Bank checking to US Bank brokerage) and then transferred the full $4K from the brokerage account out to another external account immediately after. This resulted in the closure of her brokerage account (I think because she effectively transferred out all of the assets even though it only had the money in it for a few minutes). This wasn’t a problem since we probably weren’t going to keep that brokerage account long-term — in fact, it probably saved us a phone call down the road.

Betterment (12,750 Membership Rewards points x 2 = 25.5K / $255)

For a brief sliver in time, banking app Betterment offered a bonus through shopping portal Rakuten that was either $127.50 (if you earn cash back through Rakuten) or 12,750 Membership Rewards points (if you earn Amex Membership Rewards points through Rakuten). Note that if you click through to the post, you’ll see that they also offered a 7,500 point bonus. My wife and I each opened an account and deposited $10 and we got our 25,500 Membership Rewards points (worth a minimum of $318.75 if cashed out via the Schwab Platinum card, but we’ll likely transfer them to partners for outsized value). It sounded too good to be true but wasn’t.

Point Player 1 ($100 – $49 + $250 = $301)

If you haven’t yet read it, you really need to read Stephen’s post about this and you should jump on this while you can. I mostly opened this one to refer my wife figuring that between the two of us would get $300 – $98 in fees = $202 with almost no effort since Point is offering $100 for both sides when you refer a new customer and they make a purchase. Here’s what that looks like:

- Player 1 signs up through a referral and makes a purchase and gets $100

- Player 1 refers Player 2 and when Player 2 makes a purchase, Player 1 gets $100 and Player 2 gets $100 (running total of $300 in bonuses)

- Player 1 and Player 2 each pay a $49 annual fee (subtract $98 for a net win of $202).

There are a number of oddities here: the app says that the person you refer needs to spend $1,000 to get the $100 bonus. However, I can confirm that the bonus posts after first purchase (I reloaded my Amazon balance with $10 and got the $100 bonus within 12 hours). Stephen also noted in his post that while the referral offer says that both the person making the referral and the new account holder will get $100, many people are reporting that the person making the referral is actually receiving $250. We messed this up on my wife’s account (see below), but I referred someone else the other day and I can confirm that I received 25,000 points (worth $250) even though the offer in the app says 10,000 points ($100). A couple playing in 2-player mode could therefore end up with a $352 win. If you know other people in your life who like easy money, that’s $250 for each of them that you refer (and an easy win for them). Note that there’s no guarantee you’ll get the $250 bonus since it doesn’t reflect that in the app in advance, but I’m still recommending it to family members since I think it’s worth a shot.

Bonuses still to come in 2021

Tastyworks: At least $100 x 2 = $200 (or more)

Brokerage Tastyworks is offering a bonus of 100 shares of stock worth $1-$6 each for depositing $2,000 (still available through the end of June 2021) and leaving the money there for 60 days (though the shares are awarded soon after making your deposit). You don’t need to invest the $2,000 and you can sell the stock when it is awarded, you just can’t withdraw immediately. They say that the average bonus is $200-$220 per person, but I’m figuring on the minimum above (and will update this post when the bonus posts with what we got). I saw some people in the comments at Doctor of Credit reported having gotten stocks worth less than $2 per share over the winter that later increased in value to as high as $9 per share. That was enough to get me to take a bite outta Tastyworks. My wife and I each opened a Tastyworks brokerage account since it seemed like low-hanging fruit and I’ve noted my enjoyment of brokerage bonuses that pay out in free shares of stock that I’d have never bought. We’ve had exceedingly good luck with those over the past year or two (in all seriousness, who hasn’t with the way the market has gone, but we’ve had free shares earned from stuff like this that soared as much as 600%+). Obviously our luck may be totally different this time, but the fun of these small brokerage bonuses is that they can turn into something better. Given the low bar, there wasn’t much opportunity cost here.

Monifi: $250 (two $1K direct deposits)

This looks like a super simple $500 win in two-player mode. Monifi is offering a $250 bonus when you open an account by the end of June 2021 and subsequently receive two deirect deposits of $1,000 or more each (and people are reporting that the bonus posts within days of the second direct deposit). We tried to do this for both Player 1 and Player 2, but one of us got auto-declined surprisingly early in the application – I assume that was due to having opened many checking accounts, but I was still kind of surprised as I feel like velocity hasn’t been that outrageous this year. Now I see in the comments at Doctor of Credit that some people in that boat have taken another swing and subsequently gotten approved, so maybe I’ll take a second shot at getting this for both players. I tend to think of smaller bank bonuses in terms of 2 player amounts, so I had this imagined as $500 and kind of felt like it took the wind outta my sails when one app got declined so fast. Given that people have reported receiving the bonus in less than two weeks, even if we only get this for one player I will soon find two hundred fifty reasons to be happy enough.

Whoops…mistakes / failures

Point Player 2 ($2)

My wife signed up using my referral, but there was some sort of glitch in the process as she tried to create her account. She got to the step where you set an account password, but after entering a password it gave her some sort of error that she unfortunately didn’t screen shot. Then, when trying to set her password again, it kept saying that she already had an account. She eventually went back to Step 1 and made sure that my referral code was still there and tried the sign up process again, but she kept running into the error that she already had an account. She backed all the way out and went to the beginning and clicked “log in”. She used the password she had been trying to set when she got the initial error and that worked and took her back to where she had left off in the account setup process when she had gotten the error. However, when she was done, the app only showed a bonus of 200 points (worth $2) after first purchase. Doh! I intended to follow up with Point about this to see if we could get it fixed, but now that I received a $250 referral for referring someone else I’m not sure I want any attention on the account. I’ll probably just suck up the loss here.

PNC Player 2: $400 $50

Doh! I messed this one up somehow. We were applying late at night and my phone died during the application process with the page still spinning. Either we were in a hurry and not paying close enough attention to detail or the Internet dying mid-application-consideration caused the wrong type of account to be opened, but my wife was trying to open this account for the same $400 bonus that I had earned (see above) and somehow we accidentally opened a different type of account that only offered a $50 bonus (I believe with $500 in direct deposits). We didn’t realize the mistake immediately and got stuck with just a $50 bonus to show for it instead of the $400 we expected. Ugh. I know this was found money anyway, but it sure felt like losing $350. Sometimes you’re the windshield, sometimes you’re the bug.

Webull: $225 $0

Webull offered an account transfer promotion in March to get up to 25 free stocks worth at least $9 each. The top end required transferring at least $25K to Webull. We had a brokerage account at Merrill Edge with a bit more than that in cash (not yet invested — see above for that long delay in getting the Merrill Edge bonus that led to cash sitting in this account), so I tried transferring just $25K from Merrill Edge in cash (not securities) to Webull to see if it would trigger the 25 free stocks. Part of the draw here was the fact that the transfer only needed to stay at Webull for a few weeks (initiate the transfer by 3/29 and no withdrawals before stocks were awarded on 4/20). Making $225 appear out of nowhere was too tempting to pass up. Unfortunately, the transfer failed. The problem must have been either that it wasn’t a total account transfer or didn’t include any securities — the money initially came out of Merrill Edge, but it never deposited into Webull and Webull told me it failed. By the time the money came back up on the Merrill side, it was too late to make the transfer and take advantage of the promotion.

NorthOne: $20 $0

While I earned a bunch of silly NorthOne bonuses above, I expected this $20 bonus for using my debit card by 2/28. I placed a charge on 2/26 (I spent more than the requirement at Bluehost for the website for my new LLC). For some reason, that charge posted with a 3/1 date even though I paid and created my website on 2/26. Ugh! You cost me twenty bucks, Bluehost! Ok, so my procrastination cost me $20. I should have just bought a gift card from Fluz on Day 1.

Does this stuff count?

While not quite “bank bonuses”, we did a couple of related things this year that I feel like count similarly in my mind:

Brex Player 1 and Player 2: $2200

Brex is actually a credit card, so maybe this doesn’t belong here, but it required opening a “Cash” (checking-like) account and putting money there to fund the card purchases, so it’s sort of a hybrid bonus. I actually ended up transferring my bonus to an airline partner (more to come on the award I booked at some point), but since these points can be cashed out at a value of $0.01 each, I’m looking at the decision to transfer as though it is a mileage purchase at $0.01 per mile (I feel like that keeps me honest in how I view the cost of the miles and I chose to transfer from Brex instead of from Chase because Chase points can be cashed out for $0.015 each via Pay Yourself Back, so it was a dollars-and-cents decision). My wife intended to cash her bonus out to cover the LLC startup costs we incurred, but she has dragged her feet and still has the points with the intention of cashing them out.

Reward Wizard $1,000 offer ($900+ net)

Doctor of Credit wrote about an offer that they labeled as a Swagbucks offer for $1,000, but the bonus wasn’t actually offered by Swagbucks — rather Swagbucks was where to find a link to the offer. A company called Reward Wizard was offering $1,000 via PayPal when you completed 10 offers through their site. Examples of deals I completed were a free 7-day trial of ESPN+ (I cancelled before being charged), opening a Slide account (an app that sells gift cards with cash back similar to the way that Raise and Rakuten do), a 1-month trial of ABC Mouse for something like $5, a Greenlight debit card account with a $10 deposit, and more things like that. In the end, I spent $34 that I wouldn’t have on trial memberships (would have been $27, but I forgot to cancel one in time and got hit with an extra charge) and $45 on a single Every Plate meal delivery kit (which we ordinarily buy off and on at least a half dozen times a year) and I got $1,000 via PayPal (which was awarded and cashed out to my bank within a week). Some of the deals could have been done through other avenues for some amount of cash back, but nothing close to the $1,000 received. This was a stellar deal that sounded too good to be true – but wasn’t.

What’s next?

We’re only halfway through 2021 and don’t intend to quit on bank bonuses yet. The $20K in savings that we used to trigger the Bank of America business bonus ($500) in January and then again to trigger the TD Bank $200 savings bonus is now ready to be moved to pick up another bonus. My wife could do the same TD Bank checking and savings bonuses for a total of $500. However, we have a couple of other options. We were each targeted for a $200 savings account bonus via Bank of America for depositing $20K in new money and leaving it for 60 days. Since the TD Bank offer has been extended to August 3rd and requires a deposit within 20 days, we could wait until August and have until August 23rd to make a deposit that triggers that bonus. Since the Bank of America bonus is targeted and expires at the end of this month, we are tempted to go after the $200 savings bonus now (within the next day or two) in order to reach the required 60 days in time to then move that $20K to TD Bank for their $500 bonus in August. Assuming we thread the needle properly, that $20K of savings would end up earning us $1100 in a year’s time (and hopefully we’ll be able to move it on for my wife to earn a Bank of America business account bonus by the end of the year!). While the individual wins may be small, they cumulatively add up nicely.

Alternatively and perhaps a better option, Citi is offering a $300 bonus for depositing $15K and PNC has a business checking bonus of $200 with an average balance of $5K for 3 billing cycles. We could trigger both of those bonuses for a total of $500 with the $20K of savings. That might be a better choice, but we are still undecided at the moment.

We’ll also keep our eyes peeled for other low-hanging fruit like the Point debit card, Monifi, or Betterment bonuses that are easy wins. There have been fewer lucrative bonuses available than usual this past month or two, but I imagine we’ll continue to see more attractive offers in the coming months as we have with credit cards.

Bottom line

I’ve said it before and I’ll say it again: don’t sleep on the bank bonuses. While big credit card bonuses can obviously be far more lucrative, a little time invested in bank bonuses can yield a significant chunk of change that often requires no purchase activity (and rather it may encourage you to be better at saving so that you can keep triggering bonuses with your savings). While few of these bonuses are very significant on their own, I am very happy to be socking away some extra easy savings in the form of these bonuses that can be put to work as investments, used for future bonuses, or used to cover ancillary travel expenses like award taxes and paid hotel nights. Yes, it requires some time. And yes, I expect to pay taxes on bank bonuses just like any other income. But even if I invested an entire week’s time in earning the bonuses in this post, I will sleep well knowing that the effort will have made plenty of sense/cents.

Is there a way to determine if this counts as a hard credit pull for any bank ?

Doctor of Credit is a great resource for that. They have a section in the bank bonus details explaining whether or not it’s a hard pull. That said, I haven’t actually seen a bank account bonus that was a hard pull in a long time. Occasionally go run into a situation where you can opt into overdraft protection, and sometimes opting in for that will result in a hard pull. So if I have an option as to whether or not to opt in to overdraft protection, I always opt out just in case. In the past two years, we’ve opened a whole bunch of bank account bonuses and haven’t had a single hard pull.

The bank bonuses were the perfect pandemic “cross-word puzzle” equivalent to keep my mind sharp and to avoid watching movies.

Your recommendation to screenshot every step of the way is crucial. I needed those screenshots for multiple bank bonuses.

Its supper interesting and I will keep an eye out for this type of deal but one thing bothers me, does it not seem bothersome to have all these different financial accounts open with some cash in one or other? Do you leave them open or close them out. Some things like brokerages I would never switch as for me there are massive differences in experience and tools to trade with, and the small amount of time my money is out of use could cost me more then the bonus (options and futures are cheap but make a lot of return). The Merrill Edge one is tempting but looking at the ratings TD, Fidelity, and Interactive beat it every time (I use all three for different things). Anyway is interesting and helpful to know either way.

My actual investments are a very simple Bogleheads 3-fund-like approach with major Vanguard Index Fund ETFs. I’m buying and holding in my major investment accounts, not trading. In your case, I could see why it might not make sense to move around for the bonuses. In my case, there isn’t downside on that end because everything moves with its cost basis (though in the case of small bonuses like the Tastyworks one for depositing $2K, I’m just using cash reserves for that, not securities). My couple of limited interactions with Merrill Edge customer service have been less than good, but the times when I would need their service are so incredibly limited.

Hey Nick, It’s nice to see how much you earned. It’d be better to list the current deals in one place so we can compare. I’d imagine a table for brokerage bonuses would be great. Each row would be a brokerage and each column the amount required. Then it’d be easy to pick one if I want to transfer $X. DoC has an ok list but the table would be a much better resource. Thanks!

I don’t do a lot of chasing bonuses because you have to be careful reading the fine print and I know I’ve screwed it up at least one.

Recently I’ve gotten bonus from Marcus which was easy since I already had an account there and only needed to move money into the account. They also make it easy to track the timeline unlike other places that seem to hide things in hope you pull the money early and miss the bonus.

Someone gave me a referral link to Schwab and that was $500 for a $100K deposit.

I have money earning very little right now due to a house sale and unwilling to risk it in the market since I will need it within a couple of years so I don’t mind doing more of these bonuses.

With interest rates, CDs, bonds so low, it makes some of these bonuses worth the headaches although I tend to avoid going the direct deposit route if I can.

@ Nick, Did you get in on the $1000 Acorns referral (for 4 or 5 people depending on when you did it)?

Asking bc that was an easy $1000, although it’s technically a brokerage bonus, not a bank bonus.

Not for the past couple of years. Circa 2018 I got two big bonuses like that I think (one was $1,000 and one was several hundred), but I haven’t made any effort to get those bonuses the past couple of years (we do write posts now and then alerting readers when they run a good offer and I’ve picked up a referral or two from those now and then, but not enough at once for those bonuses in a long time). They those deals they run that only require 3 or 4 referrals are totally worth it if you have just a few people in your circle to refer though.

Reading this article made me tired, and I do quite a bit of bank bonuses. So I plan to be even more selective going forward to simplify my life (and taxes). Another downside with bank bonuses that I only recently realized is that, assuming you want to report the bonuses as income for tax purposes, you need to keep good records because many banks are no longer issuing or sending hard copy 1099s anymore.

I believe if your account is still open, they will tell you to download the 1099 form online, but if your account is closed, they will mail you the 1099 form.

Paying taxes is kind of like winning the lottery or gambling winnings, you won $500 bucks so now you owe taxes. You still come out ahead at the end of the day 🙂

On your first point, I agree that if your account is open and you can download the 1099, the bank may tell you to do that. However, with respect to your second point that has not been true in my experience with multiple banks this year, perhaps due to COVID? It is something to be on the lookout for, and I realized it too late to call those banks.

@Kim: Interesting on the note that you didn’t receive a hard copy 1099 from banks where your account was closed. If your account was closed, how were you supposed to get the form? I’d think they would legally have to mail it.

@Grant: Agreed. I wish everyone would just send me their $500 winning lottery tickets so I can save them the trouble of paying taxes on them! 😀

@Kim: I highly highly highly prefer the electronic copy 1099s. Easy to keep a file with all of those 1099s and re-print if I need to do so. I misplaced a couple of hard copy ones a couple of years ago and it was a pain getting new hard copies (and having to wait for them). I think Grant is correct that they’ll mail it if your account is closed.

But you’re right that you do need to keep track. Part of the impetus for me writing these tally posts is for my own reference at tax time to make sure I’ve gotten all the forms =).

1099s are taxed at your marginal tax rate. For high income earners, this can easily be 40%+ when you include state income taxes. There are also other tax credit phase outs that happen when you start adding additional income. Just something to consider.

I’ve had trouble with some banks too (both large and small) and these bonuses. While I believe they are required to send them (over $10 mind you), you have the requirement to claim all of this income on taxes. As I’ve missed 1-2 1099s per year after doing this a few years, I’ve found it easier to keep track for myself and self-report even if the forms don’t come. It’s been a hassle to log into the various apps/locations some of these banks hide this important information. Couple that with the mix of 1099 methods that banks send out (online only, paper only, paper/online both,etc…) it’s easy to lose something in the mix. Better to track than to be left hanging.

Agree; that was my bottomline message – if you do bank bonuses a lot, you need to keep good records or it becomes a headache at tax time, especially when you only realize you are missing a significant 1099 after you have filed. I use a spreadsheet that I copied off DoC to track these bonuses now, but learned the hard way that I need to do so. Now back to amending my federal taxes for the second time….

What about taxes?

I pay them?

I noted in the post that as with any other income you earn, you’ll pay tax on it.

Oh sorry Nick I missed that. So values in this post are not true earnings, they’re inflated by 20-40%. PSA to all!

Huh? Is your annual salary also inflated by 20 to 40%? All income is taxed. That doesn’t mean your gross isn’t your true earnings.

Nick-I think what Carlos is getting at is something like a $1k cash equivalent value from a credit card signup bonus is better than a $1k bank bonus because the bank bonus is taxable income.

My point was that the bank bonuses should also be tracked in a spreadsheet in case you are not sent the 1099s by the bank (and can no longer get into that account because you have closed it). Doing this alot means opening and closing a lot of accounts with potential tax paperwork headaches if not organized.