Brex Cash is a business cash management account that comes with a linked credit card. The credit card works a bit like a debit card: you can only spend up to the amount you have available in your cash account (actually, with the Brex card, your credit limit is usually only 80% of your available cash). Even though the cash account is not technically a checking account, there’s no discernable difference that I can see. If you own an LLC, LLP, C-corp, or S-corp then this may be a good opportunity for you…

The biggest difference (in my mind) between this account and a regular business checking account is that this one is completely fee free and it offers the opportunity to earn awesome rewards. The current signup bonus (details here) offers up to 110,000 points. The Brex card also offers very good point earning rates for spend. You can cash out Brex points at a penny each (110K points = $1,100) or transfer 1 to 1 to a number of airline programs. The latter makes this opportunity even better than an $1,100 bank-like bonus. When booking flights, it’s often possible to get much more than 1 cent per point value by transferring points and booking award flights rather than paid flights.

Qualifying (and signing up) for the offer

To open a Brex Cash account, you have to own a business. Sole proprietorships don’t count. You must own a business that is registered in the United States as a C-corp, S-corp, LLC, or LLP.

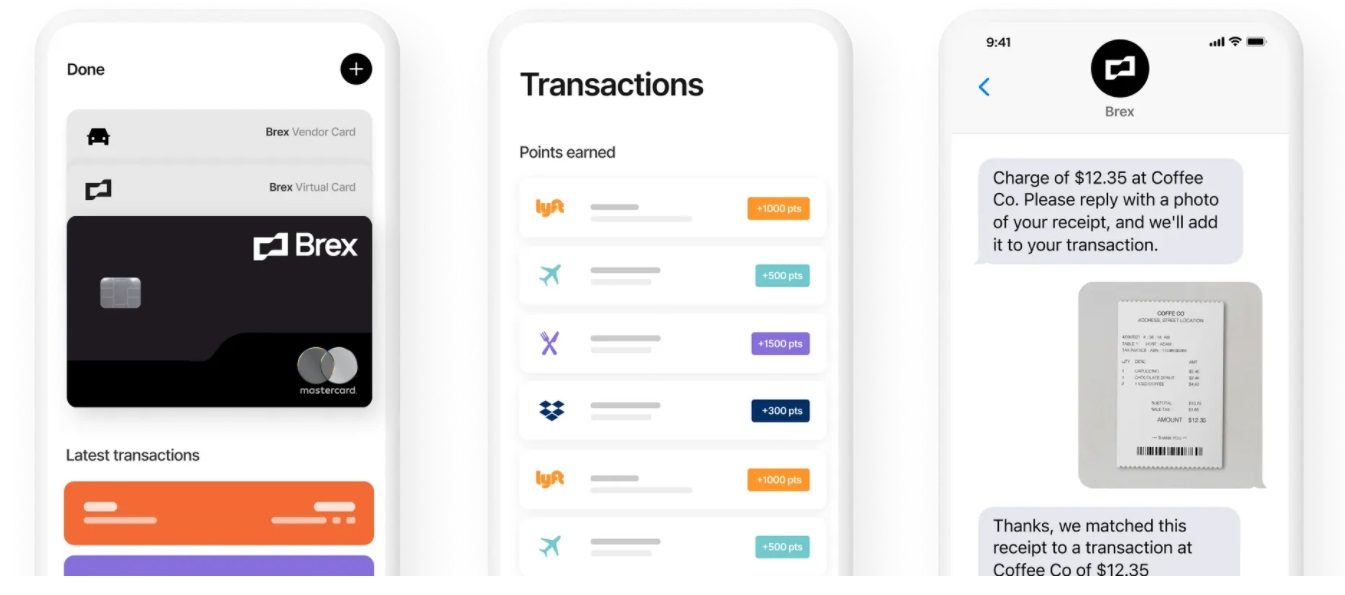

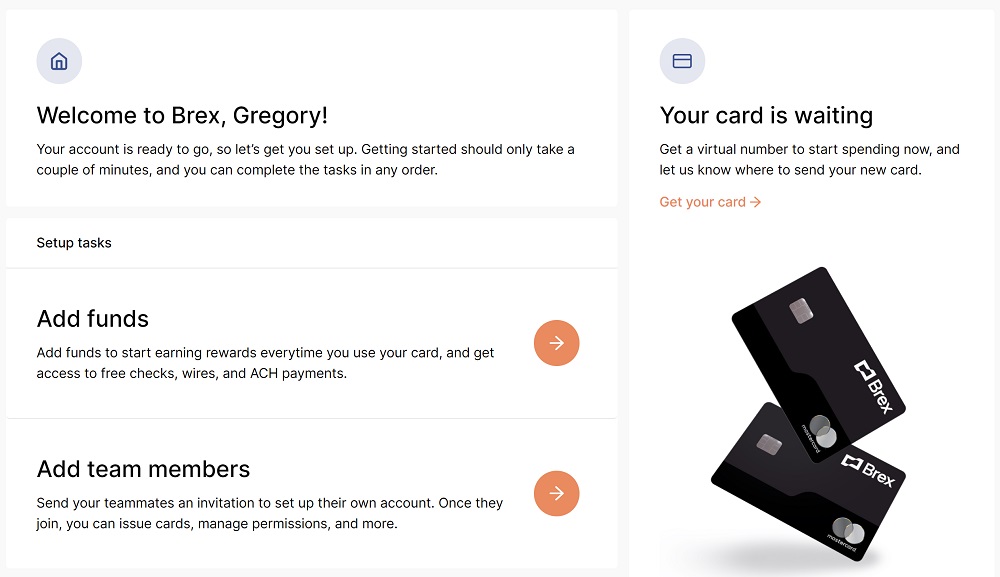

Since the Frequent Miler business is an LLC, I was able to apply for Brex during the original 110K offer. The process was easy but quirky. A few times the screen just churned away with nothing happening, but by refreshing, clicking the email confirmation, or logging in again, the process moved forward. The only slightly difficult part of the application itself was uploading a picture ID to prove my identity. That part fortunately went smoothly. Altogether I had my account up and running in about 15 minutes and was immediately able to access my new card number.

Earning the full bonus

In order to earn the full 110K bonus, you’ll have to complete 3 steps:

1) 80K: Spend $9,000 within 30 days

This is undoubtedly the hardest part. You have to spend $9,000 with the Brex credit card. And, keep in mind that your credit limit will be constrained by the cash in your Brex account. So, it will be necessary to first add a lot of cash to your Brex account and then use your Brex card to spend $9,000 or more within 30 days of opening your account.

2) 10K: Spend $3,000 within first 3 months

There’s nothing to do here. If you completed step 1 and spent $9K in 30 days, then you’ll have more than met the requirement for this step.

3) 20K: Connect your payroll to Brex

The fine print says “*As well as connecting payroll, depositing sales revenue from ecommerce platforms or specific payment gateways may also qualify.” In our past experience, simply adding Brex to your PayPal wallet was enough to trigger this 20K bonus. See: Brex – How I earned 20K for depositing sales revenue.

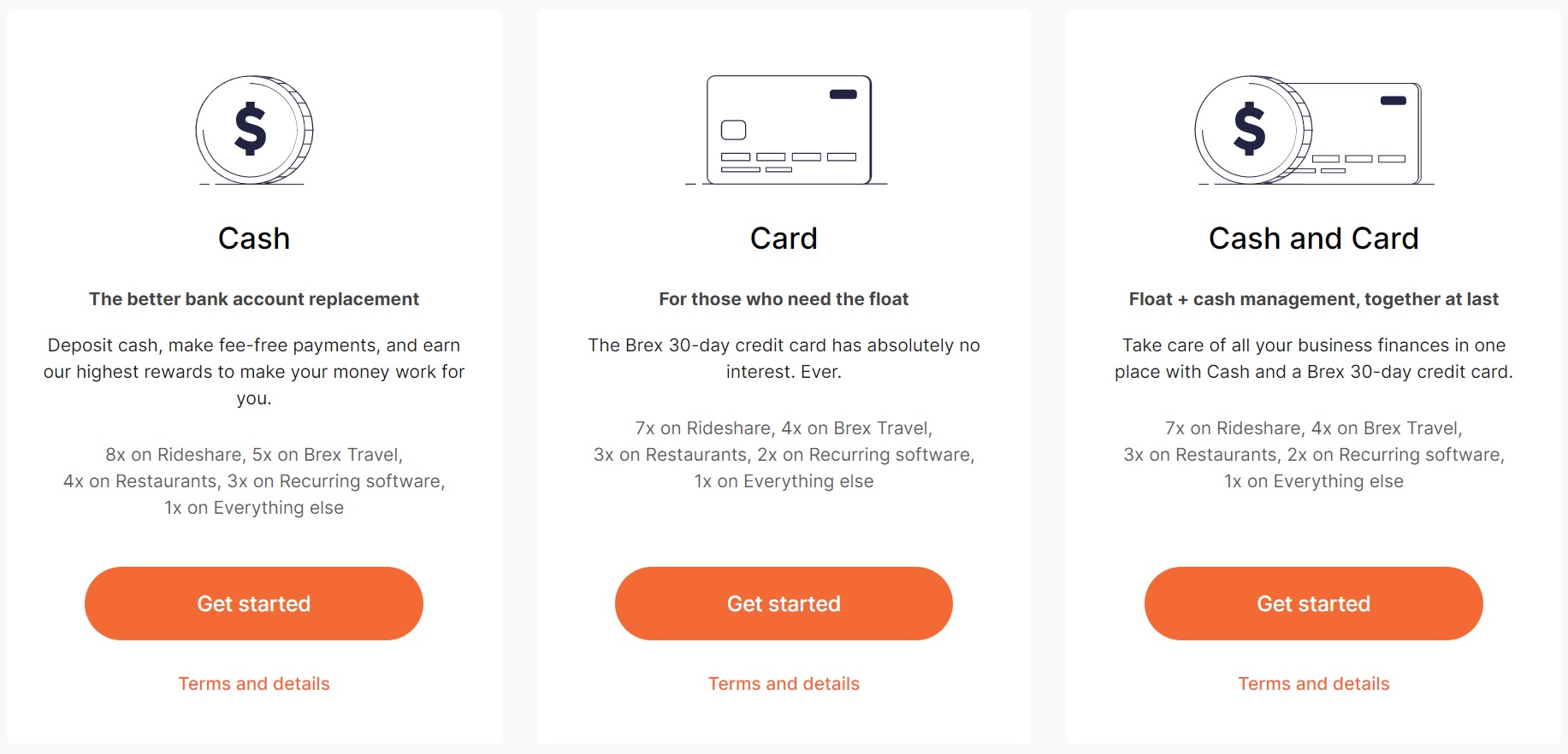

Earning for spend

The Brex card offers the following rewards for spend:

- 8x on Rideshare (or 7x if you select the Card or Cash and Card option above)

- 5x on Brex travel

- 4x on Restaurants

- 3x on recurring software like Salesforce, Zendesk, Twilio, and more

- 3x on eligible Apple products like Mac and iPhone, via the Brex portal

- 1x on Everything else

Earning 8x for things like Uber (probably including Uber Eats), taxis, scooters, etc. is pretty incredible. Similarly, earning uncapped 4X transferable points for dining with a fee-free card is terrific.

Point Value and Transfer Partners

Points can be redeemed for 1 cent each or, better yet, can be transferred 1 to 1 to a number of airline transfer partners:

- Aeromexico Club Premier

- Air France/KLM Flying Blue

- Avianca Lifemiles

- Cathay Pacific Asia Miles

- Emirates Skywards

- JetBlue TrueBlue

- Qantas Frequent Flyer

- Singapore Airlines KrisFlyer

The most widely useful of the above transfer partners, in my opinion, are Avianca Lifemiles and Cathay Pacific. Avianca is an excellent option for booking Star Alliance awards since they do not pass along fuel surcharges. Cathay Pacific is good for booking flights on Cathay Pacific itself or OneWorld partners (like AA, JAL, Qantas, Qatar, etc.). Air France is also useful for booking SkyTeam awards (Delta, for example) and select partners (such as Virgin Atlantic), but the best use is probably to fly Air France or KLM when they offer good Promo Awards (discounted awards). Most of the other partners are also useful at times. For example, Emirates is a great choice for flying Emirates itself. JetBlue points tend to be most valuable for cheap JetBlue flights.

Q&A

- Is the Brex card a debit card? No, but it acts a bit like one. Your credit limit is determined by the amount of cash in your Brex Cash account.

- Is the Brex Cash account FDIC Insured? Yes, Brex Cash offers FDIC insurance up to $250,000 through Brex Cash program banks.

- Is my application approval contingent upon business revenue or years in business? No. Brex is designed to support startups. Simply provide your business name, address, corporation type, and EIN during the application process.

- Will I be taxed on the signup bonus? Will Brex issue a 1099? No.

Bottom Line

If you own a LLC, LLP, C-corp, or S-corp, signing up for Brex can make a lot of sense. It has no fees and Brex won’t issue a hard credit inquiry. Additionally, the credit card that comes with the account will not appear on your credit report (and so it will not affect your ability to get Chase cards). Unfortunately the current signup bonus requires a very large amount of spend in a very short amount of time. But if you can swing it, it’s worth a shot.

For brex corporate card.

Is this deal still alive? Is there any recent experience on Brex, outside of the obvious closure of a number of accounts a few months ago?

No, sorry. It’s dead. Only 10K points now: https://frequentmiler.com/brex/

Thx for replying. I’m not seeing where you’re getting 10k points. This is the language I see at the landing page when I follow the link:

Brex and Get PEYD have partnered to give you a special offer.

Simplify your finances with corporate cards, rewards, banking alternatives, and spend management — all in one place. GetPeyd referrals get 30,000 points after spending $3,500, or 80,000 points after spending $9,000 on their Brex card within the first 30 days.

[…] Frequent Miler also wrote about Brex and how it was a great deal if you could get in on it. […]

Has anyone ever confirmed that Uber Eats gets 8x points? And does your type of business matter? Their website seems to say in the fineprint that only ‘tech’ related businesses get the advertised points structure.

@Greg, not sure which number to believe.

The 80k points after $9k in 30d that I saw before I opened the account or the 10k points after $3k in 90d as I saw after I completed account creation.

I believe the 80K number. Back when the offer was 110K total, the website only showed a tracker for 30K (IIR). You can try online chatting with them to confirm before spending the $9k. If you do, please let us know what they tell you.

[…] (HT: Frequent Miler) […]

[…] (HT: Frequent Miler) […]

Wow…9k in 30 days. Brex ain’t playin!

Be warned, this company doesn’t always pay out. It’s been months of back and forth and I still don’t have my 100k.

Wow, less than 24h after I post this I got my 100k. Still don’t trust them 100% though. 3 mo 9 days was way too long.

FYI, signed up via the Peyd offer around ~3pm on 3/1, I just chatted and the rep confirmed that the 75,000 point offer is attached to my account and should receive after spending $1000. I will report back when that happens.

We got approved with our LLC. Thanks for sharing!

Quick question: There is a virtual card and a physical card. Does it matter which one we use for the $1,000 spend? (We don’t have the physical card yet so wondering if we can knock this out real quickly with the virtual) The two cards have different account numbers but I’m assuming they’re tied to the same account so no difference.

Thanks guys!!

It shouldn’t matter which you use, but it can’t hurt to wait for the real card if you’re unsure about it.

My 80,000 for 1k brex card spend bonus posted to my account last week, but then it disappeared from my account this morning.

Has anyone else had their 80,000 OMAAT bonus removed????

We’re looking into that to see what’s going on

Another discrepancy (in this case, for the better): I have made one transaction with Brex, and it was for $500 at 1x (when I look at the card transaction on the website, it confirms that I earned 500 points). When I go to my rewards section, for some reason it says I have 3000 points (so, 6x). I immediately redeemed the 3000 points for cash. I am concerned about eventually getting the 80k, but in this instance I’m sticking with one of my golden rules: don’t ask questions you don’t want answers to.

I opened on Mar 1 for the 75k offer and I received an email on Mar 5 saying it’s taking a little bit longer to review the application, but they were offering 2500 points as a token of appreciation. That’s maybe where your extra 2500 points came from.

So I instead got the 77.5k offer 😀

I signed up and loaded/spent $3000. I only got a 10k bonus within two days of spending. Signed up through FM link. How long does the 75k bonus take?

It can take a few weeks. They generally add that component of the bonus on Tuesday or Wednesday but sometimes skip a week.

@Jason, did you end up getting your 75k bonus?

Funny. I did get a bonus, but it was 80k, not 75k. Took 3 weeks.

Haha – awesome.

FYI – the offer might be back?

Why do you say that?

the following link https://www.brex.com/partners/getpeyd/?ref_code=peyd_startup&groupcode=freqm

says

“Credit cards, bank accounts, payments, expenses, and accounting all in one place keep you in control of your growth. Peyd referrals get 75,000 points after spending $1,000, plus 30,000 more through in-platform Brex Cash milestones.”

Unless i’m missing something?

That might work but we were told that that promo was paused. So, I wouldn’t trust it to work.

But if you had applied before ~9pm on 3/1/21 you should be good you think?

We’re you told that by Peyd or Brex?

I ask because the Peyd website doesn’t say it’s paused and the Peyd referral landing page on the Brex website (linked above) still shows the promotion offer. That’s unlike the original OMaaT landing page on Brex (https://www.brex.com/partners/omat) that no longer lists the 80k portion of the bonus.

I’m really curious where you guys heard that it was paused from, because I am seeing conflicting information online but I can’t find Anywhere where Peyd says it’s paused. I’m wondering if the Peyd referral still works, but Frequent Miler’s commission through your original Peyd link has been paused.

Thanks. I really do feel like you guys have offered the best insight overall on this Brex Cash bonus.

We heard this from Peyd. I’m checking again with Peyd to see what’s going on.

Peyd says that Brex hasn’t pulled the offer, but they also haven’t answered any of Peyd’s communications for a while now. The Peyd people have no idea if the deal is being honored or not. My assumption is that it is being honored, but there’s obviously some risk here.

If anyone tries our affiliate link through Peyd, please let us know if you get the points!

https://www.brex.com/partners/getpeyd/?ref_code=peyd_startup&groupcode=freqm

it seems the link is still working? https://www.brex.com/partners/getpeyd/

That might work but we were told that that promo was paused. So, I wouldn’t trust it to work.