My wife and son recently found that they were pre-approved for a few business cards that they’ve had before. Through these offers, my wife got one new card and my son got two. Once they finish the minimum spend requirements for these offers, they’ll have racked up a total of 340,000 transferable bonus points (not counting the usual points earned on spend). Sadly, I wasn’t targeted for any of these, but since I manage the family’s points, its all good.

The Business American Express Platinum Card®

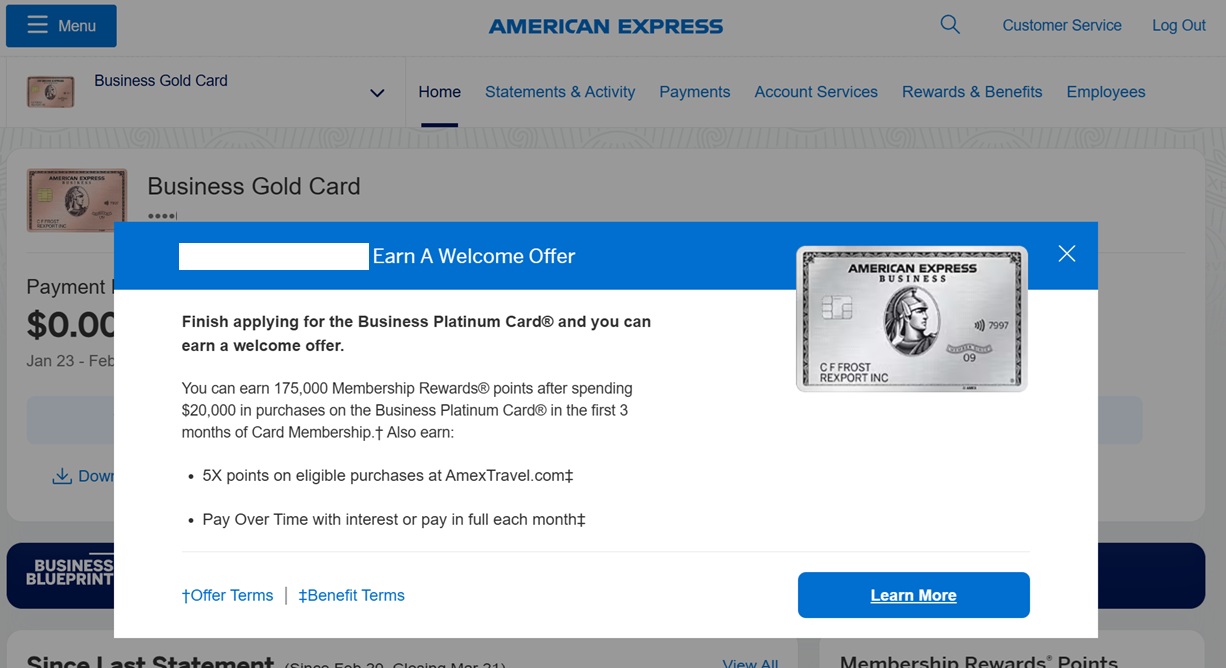

When my son logged into his Amex account where he already had a Business Gold card, a 175K bonus point offer popped up to add a Business Platinum card to his business. He clicked the “Learn More” button and noted that there was no language in the offer barring him from getting the bonus if he’s had the card before. That was good news, because he’s had the Business Platinum card many times before. He didn’t actually apply right then, but each time he logged in afterwards the offer popped up again with the words “Finish applying for the Business Platinum Card®…”

Finally, he gave in and applied. He was instantly approved.

Ink Business Cards

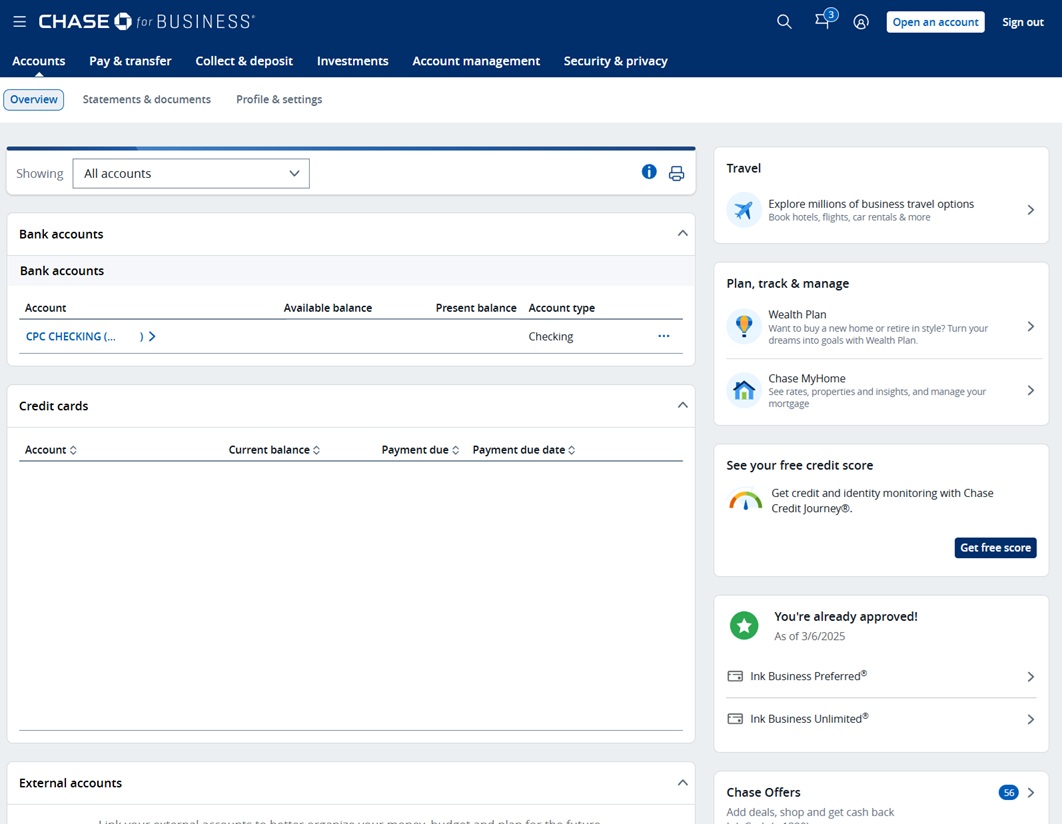

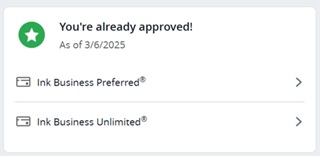

Shortly after getting targeted for the Amex Business Platinum card, my son found that he was “already approved!” for an Ink Business Preferred® Credit Card. And my wife found that she was “already approved!” for both that card and the Ink Business Unlimited® Credit Card. My wife and son found these offers by logging into their Chase business accounts. As you can see above, on desktop, the offers appeared on the right side of the screen. Here’s a close-up of my wife’s offers:

In both cases, my wife and son were pre-approved for cards that they’ve had before but didn’t currently have. I assume that my son wasn’t targeted for the Ink Business Unlimited card because he currently has one open. This is a good reminder to cancel or product change cards you’re not currently using so that you’ll have a chance for pre-approved offers like these.

My son was instantly approved for the Ink Business Preferred offer for 90,000 points after $8,000 spend in three months. Afterwards, I realized that it was dumb of me not to refer him so that I could earn rewards too. So, my wife used my referral and she was instantly approved for the Ink Business Unlimited offer for 75,000 points after $6,000 spend in three months. After applying for one card, both offers disappeared from her account even though she hadn’t applied through the pre-approved offer link. She could still apply for the Ink Business Preferred card as well, but she’s not necessarily pre-approved for it anymore. So, for that one it makes more sense for her to wait for an improved offer.

Minimum Spend

In total we have to spend $34,000 to earn all three welcome bonuses. Here are some of the ways I usually handle big spend needs:

- Pay Taxes: fees range from 1.75% to 3%

- Pay Bills: ~3% fee

- Kiva microloans: There are no fees to make Kiva microloans with a credit card, but there is a risk of not getting all of your money back and there’s the cost of money until your loans are repaid (e.g. you don’t earn interest on your money during that time).

- Donate to charity: I like to donate to my favorite charities through the PayPal Giving Fund Fundraiser Hub because PayPal waives the credit card fees and sends 100% of the donation to the charity.

In this particular case, I know I have some big tax bills coming up so I’ll probably handle most of the minimum spend that way.

Summary

We didn’t intend to do a mini application spree at this time, but these pre-approved offers were too good to pass up. Plus we have some big tax bills coming up that can be used to meet the minimum spend on these offers.

To position yourself for offers like these, you need to already have business cards with these banks. If you don’t already have them, watch for great offers and go for it.

In order to sign up for a business credit card, you must have a business. That said, it’s common for people to have businesses without realizing it. For example, if you sell items at a yard sale or on eBay, then you have a business. Similar examples include: consulting, writing (e.g. blog authorship, planning your first novel, etc.), handyman services, owning rental property, renting on Airbnb, driving for Uber or Lyft, etc. In any of these cases, your business is considered a Sole Proprietorship and you can apply for a business credit card using your own name as the business name, and your Social Security Number as your business Tax ID (also known as EIN).

I was hoping to get some clarification on signing up for, and using, business credit cards.

I just listened to E74 and was surprised how many business cards the team is signing up for each year. From what I understand, putting personal spend on a business card is big no-no. So do you all have that much business spend?! How are people managing that amount with Sole-Props and side hustle LLCs?!

I wouldn’t call it a big no-no. There’s nothing illegal about putting personal spend on a business credit card. Many, many people put all types of expenses on business credit cards.

You’ll find some discussion about that topic here: https://frequentmiler.com/how-to-apply-for-a-business-credit-card-as-a-sole-proprietorship/

Amex CSR tier 1 and dupe saying that taxes counts for MR, but not for SUB. Is there current guidance…always counts anyway or best practice so it counts? Biz gold.. biz line but csr said true for all cards

Paying taxes always counts

I got my first couple ink business cards the second half of 2024. Don’t intend on using them much. When should I cancel them? I don’t want to raise alarm bells at Chase by cancelling them too soon after getting the sign up bonus.

I recommend always keeping each card for at least a year

The big question is how to get targeted for these offers. I have two Inks, but haven’t been targeted for the AMEX or any others.

For Chase, how many business credit cards did they have open when getting pre-approval offers?

My wife had 2 and my son had 3. So now my wife has 3 Ink cards and my son has 4

Is there a rule on using miles earned via business cards for personal travel?

No.

Greg, On the spend requirements, I was recently reading a Reddit post saying that some people have used credit cards to fund their IRA’s. Would like to see a post from you guys on this topic as there is so little info on this subject floating around the miles and points universe…….

P2 keeps getting the Amex popup Plat 175k for 20k offer, too. 175k for 20k spend isn’t enough ROI for me. If it were 8k or 15k, yes. (On the other hand, I don’t like to leave low-hanging fruit)t. Earlier in the week, we each nabbed the 2 Hawaiian cards before they went away.

What was your wife and son’s 5/24 status? In other words was either of them at 5/24 or more and still approved for a Chase business card?

They were both well below 5/24

Very interesting, especially on the Chase side. TY for sharing!

Click bait

D*** head

Great post Greg

Also looking for big minimum spend bonuses for taxes too

I got a platinum and gold business NLL in 3 days and did both and then got a 75k BPP pre-approved email. It says good till June but I’m not sure if that’s accurate.

Is there a limit on signups for NLL or targeted offers? I had wanted to get the Hilton surpass FNC, but didn’t want to miss these NLLs.

The only limit is you can only have 5 Amex credit cards at one time (not charge cards like the Green/Gold/Plat) but otherwise have fun 🙂

if it’s ok to ask, what type of business does your son have as I assume he’s still a college student too?

He runs the blog “Semi-Frequent Miler” from his dorm room 😉

Greg’s son is probably around 25 now, so likely not a student anymore.

Exactly right!