NOTICE: This post references card features that have changed, expired, or are not currently available

| Sorry, this deal is no longer available. Do you want to be alerted about new deals as they’re published? Click here to subscribe to Frequent Miler's Instant Posts by email. |

|---|

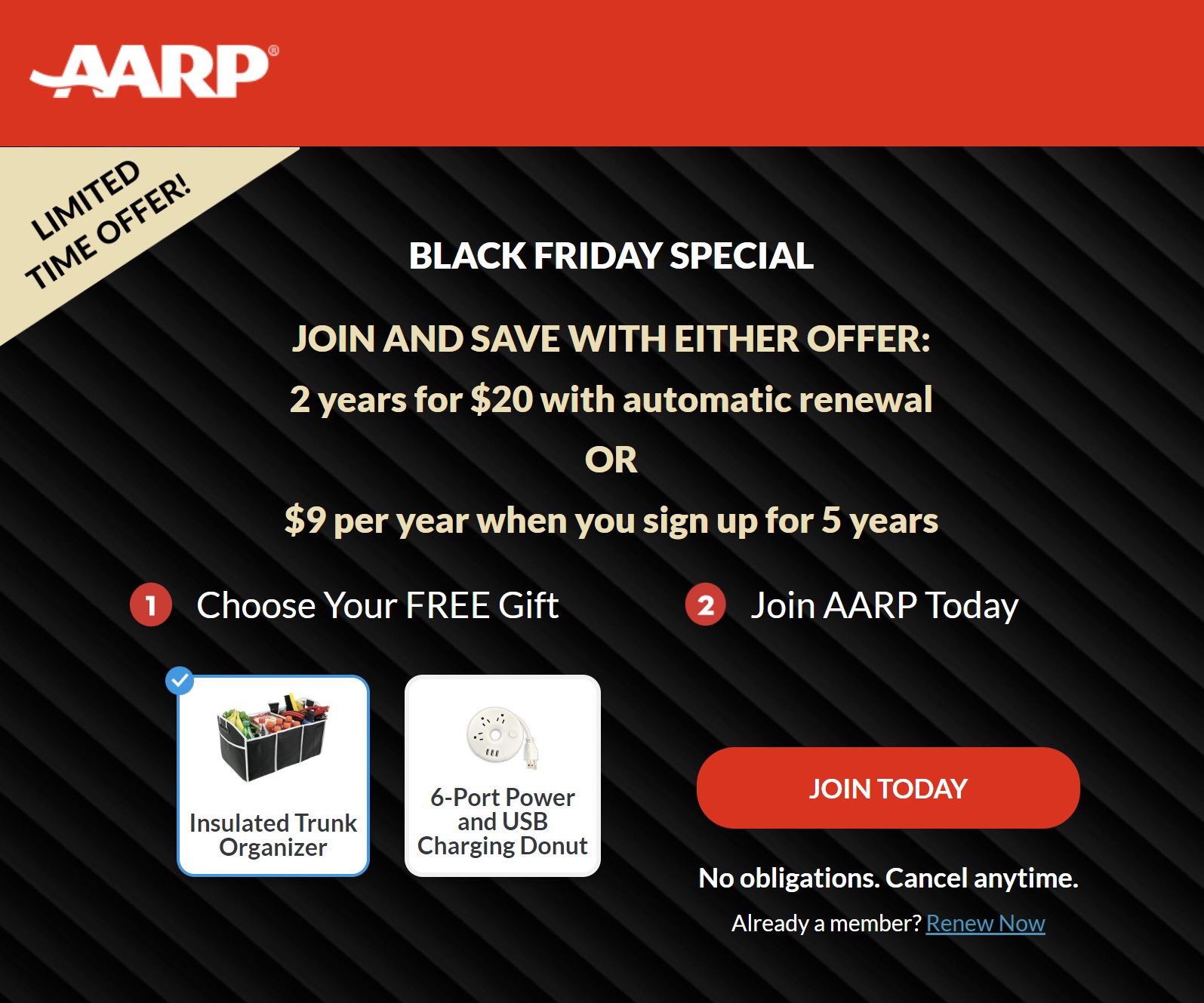

AARP is offering a 5-year membership for $45 (anyone can join, you don’t need to be an elderly guy or gal). Several shopping portals are offering increased return for AARP memberships right now, so you can pay a net $25 or even as little as a net $7 (or maybe less?).

The Deal

- AARP is currently offering a 5-year membership for $45. Go through a shopping portal to potentially get $20-$30 back.

- Direct link to this deal (but you probably want to go through a shopping portal)

Key Terms

- Membership may set to auto-renew, but I believe you can change this in account settings

Quick Thoughts

A number of shopping portals are offering something back on membership. At the time of writing, Rakuten is offering $20 back / 2,000 Membership Rewards points, which would cut your net cost to $25 for five years of AARP membership.

Capital One Shopping, which is a public shopping portal (no Capital One card required) is offering $15 back on the desktop browser. However, in the Capital One Shopping app I was targeted for $30 back. That would drop my net cost to $15 for five years.

Even better, some people have a targeted Chase Offer for $8 back on AARP membership on various cards. I have that offer also, so if I clicked through the Capital One Shopping app and bought the 5-year membership for $45, I would expect to get $30 back from Capital One Shopping (note that this cash back is provided in the form of a gift card of your choice to retailers that include Amazon, Walmart, and Best Buy Update: As indicated in the comments, Amazon and Best Buy are not available for gift card redemptions. Other available options are Safeway, eBay, Lowe’s, Home Depot, Gamestop, Staples, Office Depot, and a number of other popular stores) and $8 back as a statement credit for a net cost of around $7. At seven bucks for five years, you wouldn’t have to leverage many benefits to come out ahead.

In terms of benefits, the most popular one among frequent flyers is a discount on paid premium cabin flights on British Airways. There are also hotel discounts with Wyndham and Choice and restaurant discounts that include places like Denny’s, Outback Steakhouse, and Carrabba’s.

Keep in mind that anybody can join AARP — you don’t need to be old or retired. I’ve been a member for years. I don’t use many of the benefits, but I got my membership in some sort of similar deal and it seems like a low price of admission to be prepared for the day when it comes in handy.

H/T: Brant in Frequent Miler Insiders

This deal is back. $45 for 5 years, $20/2000MR Rakuten cashback, $8 Chase offer and AARP also sends you a gift (I chose a 5-port USB charging station, the other option was a trunk organizer).

Did anyone try the 1 year membership and get it to track in C1 Shopping? Seems like it should work since no terms are listed.

For those of ya’ll who used the Capital One App Portal w/Capital One CC, how long did it take for the statement credit to appear?

to answer my own question if others are wondering, Capital One App w/statement credit, purchased 11/25, got email on 11/27 from Capital One that it tracked/ Statement credit within 3 billing cycles.

Is it bad that even for 7 bucks net im likely no doing this becuase im not sure i can recoup that? Besides BA, what else has anyone else used this for?

Their monthly gift card deals are quite popular.

You can find recent examples over at GCGalore: https://gcgalore.com/?s=AARP

And you can see deals from previous months here:

https://gcgalore.com/aarp-rewards-20-off-deals-for-members-2022/

YMMV as to whether or not it’s worth it, but for a net $7 for 5 years you don’t have to do many of those deals to come out ahead. I admittedly haven’t used a lot of those, but they can sometimes be useful. I should have bought the Saks one yesterday ($20 GC for $14) to use along with my Platinum card credit.

Thanks for sharing this! Yesterday, I went through the Capital One Offers portal (on the desktop site, not the app) for $30 back. If it actually worked, I’ll wait and see. If so, I got the 5-year membership for $45-$30 = $15. Thanks!

I am looking at the cap1 app offer (for C1 cards, app redirects me to captialoneoffers.com), the details are vague for the $30 deal on the C1 App. It just specify to make an eligible purchase at aarp.org. It doesn’t say we have to buy X year membership. I haven’t used C1 portals before, so unsure if it supposed to be this vague.

While Rakuten specified $6/1 yr, $10/3 yrs, $20 for 5 yrs.

I am considering getting the 1 year renewal over the 5 year, as I like those gifts for renewing… but never thought about the portals on this.

I found that C1 Shopping pays out in the end even though the offers are more vague than other portals or have fewer terms. I wouldn’t be surprised if everything works. However I don’t really value C1 Shopping at full value. Since the reward is a store gift card I could buy elsewhere at a discount, I mentally deduct 5% from C1 earnings.

How many people get their AARP membership automatically renewed after they pass away? Jus’ Askin’. 🙂

AARP offers some decent discounts but I don’t want to support their political lobbying efforts with my money. I’m sure it’s a good fit for many but not for me. It pays to check out organizations like this to make sure they align with your morals.

Supporting Medicare and Social Security is against your morals? I have supported AARP for almost 15 years. And I have NEVER questioned their agenda!!! Maybe it is your political ideology that needs questioning?

AARP collects over a billion dollars in royalties from companies marketing medicare products to AARP members per year yet lobbies for medicare benefits that sometimes conflict with members best interests. In fact, they collect far more from advertisers than from members. Tell me which is more important to them. They also support Planned Parenthood, LGBT causes, and other areas that you may agree with but I don’t. Maybe those are fine for your morals but not mine. Sure they may support some causes that are OK but they aren’t what they seem in many areas. To me, it’s not worth some travel discounts that can usually be matched in other ways.

While PP and LGBT causes doesn’t agree with your morals, it agrees with the moral of the majority of Americans 🙂

Alternatively, AAA have some similar discounts as AARP..

A majority supported Hitler in Germany. A majority of the media is owned by a certain group who lie about Hitler. A majority of people beLIEved in the Covid Vaccine fraud. Booster #4 anyone, #5? A majority beLIEve in ____.

Nevermind the variants are caused by the vaccines….

majority doesn’t mean anything…a majority of people are liars in the world. (See Corruption Perceptions Index….)

anyway…back to regular FM programming.

Oh, so your right-wing bigotry finally comes out! I have seen your extremist comments on other miles/points blogs. AARP has had a partnership with United Healthcare for over 25 years. While they do sell Medicare Advantage Plans, AARP also sells retiree healthcare plans for people under age 65. Plans that are far less expensive than ones on Healthcare.gov. When you go shopping for retiree healthcare, you will be using tools that were developed with AARP’s assistance. But the truth is you don’t like that the AARP supported the passage of the Affordable Care Act. Or you work in the insurance industry resent AARP.

Medicare plans are a competitive industry with lots of competition and very easily comparable plans. One only has to search on Medicare.gov. AARP has no corner on the Medicare market.

People like you always have an axe to grind with a political ulterior motive. You can take your opinion and stuff it. Most Americans don’t agree with people like you or your morals!!!

Double check this. On my Capital One Shopping redemptions page I see Walmart, but not Amazon or Best Buy.

You’re right. It looks like available options include some broadly-useful stuff like Walmart, eBay, Lowe’s, and Home Depot — but not Amazon or Best Buy. I could have sworn those were options in the past, but maybe I’m misremembering. Updating.

For those with a C1 card and no Chase offer, I’m also seeing the $30 back as a statement credit through the Capital One Offers within my account (app). This might be a good option for some.

So Capital One offers are card-linked like Amex or Chase offers, rather than a portal? Do they typically track? I’ve read a lot of negative comments re the portal tracking.

No, not really.

I would recommend listening to last week’s podcast to get an overview of all the C1 ways to “save”

Basically, the C1 Shopping portal is open to anyone. The C1 Offers page I mentioned is basically that same portal, but only accessible to account holders. Sometimes the deals are different between the two.

At the end of the day, the main difference I’ve found is C1 Shopping gives you cash back within C1 Shopping and C1 Offers gives cash back as statement credits.

Clear as mud?

It sounds like Shopping you can use any card, but Offers would have to be C1 card (so not chase), am I understanding?

Yeah

What was the turnaround time for you on getting that statement credit?

I decided to enroll for two years at $20, using TopCashBack $12.80 and an $8 offer on one of my Chase cards. Net cost less than zero. CapitalOne portal hasn’t worked well for me in the past.

I must not have the Chase card that has the AARP offer. 🙁

I have found the Cap1 shopping portal will not accept my payments even Paypal. So I rate Cap1 a failure, like I always do…

Can we use this for renewal or extend our current membership?

Yes. Thanks to Nick’s tip, i just renewed for 5 years @ $45 using the same $30 cap1 app offer and $8 chase reward offer he did. We even got the insulated tote bag that we had wanted from the solicitation we received in the mail.

Was easy to take a screenshot of the $30 reward above the confirmation page. And, even though my membership expired Dec 31 2021 (as the renew page confirmed), they extended the membership till the end of November 2027..a customer friendly move.

Very pleased with this quick easy deal. Thanks Nick!

Don’t you need to pay with your C1 card through the app offer?

Nope, not at all. 🙂

C1 website -> C1 card

C1 Shopping app -> any card

just to be clear

aanihc is correct.

It gets confusing. The Capital One Shopping app is the same thing as the Capital One Shopping website and Capital One Shopping toolbar. Capital One shopping doesn’t even require having a Capital One card – literally anyone can use Capital One Shopping via the website / browser toolbar/ app. You could check out with a debit card – doesn’t matter, it’s a shopping portal like any other. You earn “cash back” that you redeem for gift cards.

Capital One Offers appear in your Capital One login if you have a Capital One card. Unlike with Chase and Amex, those Offers aren’t card-linked in the sense that you don’t sync them up, you clock through them like a shopping portal — but of key importance is the fact that Capital One Offers pay out via statement credit, so you have to use the associated Capital One card to pay (otherwise there would be no way to collect your rewards). With Offers, you don’t manually redeem rewards, they just post as a statement credit on your account.