We now have a clearer picture as to the details regarding the transition of Barclays Aviator and Aviator Silver cardholders to Citi accounts. The accounts will be moving to Citi in April 2026, and Barclays cardholders will get a bit of a “best of both worlds” in terms of having both legacy and new benefits. There are a lot of granular details that we don’t yet know, but it is worth understanding the finer points.

High-level details of the Barclays -> Citi transition

Barclays Aviator cardholders recently received word from Citi outlining coming changes to their cardmembership. Key details include:

April 24, 2026, the bank that issues your AAdvantage® credit card is changing from Barclays Bank Delaware to Citibank, N.A. (Citi)

- Continue to use existing card after April 24.

- Citi card will be sent within 6-8 weeks beginning April 27, 2026

- Your cardmember anniversary date will remain the same.

- If your account has an annual fee, it will be assessed on or after your next anniversary date.

- Your existing credit limit will stay the same at the time of transfer. Over time, we may review your account as part of our standard practices.

- You can keep enjoying the legacy Barclays benefits for a limited period of time

In short, you’ll get a Citi card sometime after April 24th, and you’ll get access to some new benefits on the Citi side, while also keeping some of your legacy benefits for some unknown amount of time.

I’ll dig into legacy vs new benefits in a moment, but it is worth calling out that the email and associated documentation from Citi made no mention at all of the annual fee apart from the fact that it will be assessed on your next anniversary date. It is not at all clear whether the fee may increase or when that will happen.

Digging into the details of the transition

Barclays AAdvantage® Aviator® World Elite Mastercard® to American Airlines AAdvantage® MileUp® Card

Link to details from Citi about this transition

The following chart shows the high-level details of these two cards, with key differences underlined.

| Card | Annual Fee | Category Bonuses | Key Benefits |

| Citi AAdvantage Mile Up | $0 | 2X AA, Grocery Stores | 25% savings on in-flight food & beverage |

| Barclays AAdvantage Aviator World Elite Mastercard (Aviator “White”) | $0 | N/A | 25% savings on in-flight food & beverage |

The Aviator “White” as it was sometimes known was a no-annual-fee downgrade option (I don’t believe it ever existed for new applicants). Those with the Aviator White will transition to the Citi AAdvantage Mile Up card, picking up 2X on American Airlines and at grocery stores. Keep in mind that the AA cards only earn 1 Loyalty Point per dollar spent (even in bonus categories). That said, the Mile Up is probably a slight upgrade for most cardholders.

Barclays AAdvantage® Aviator® Red to Citi AAdvantage Platinum Select transition

Link to details from Citi about the transition

The following table lists the core benefits of the Citi AAdvantage Platinum Select card and the Barclays AAdvantage Aviator Red card. Note: Those benefits that are underlined are unique to the respective card.

| Card | Annual Fee | Category Bonuses | Key Benefits |

| Citi AAdvantage Platinum Select | $99 | 2X AA, Gas, Dining | $125 AA Flight Discount with $20K membership year spend |

| Barclays AAdvantage Aviator Red | $99 | 2X AA | $99 + tax domestic companion certificate after $20K membership year spend; $25 annual inflight Wifi Credit; |

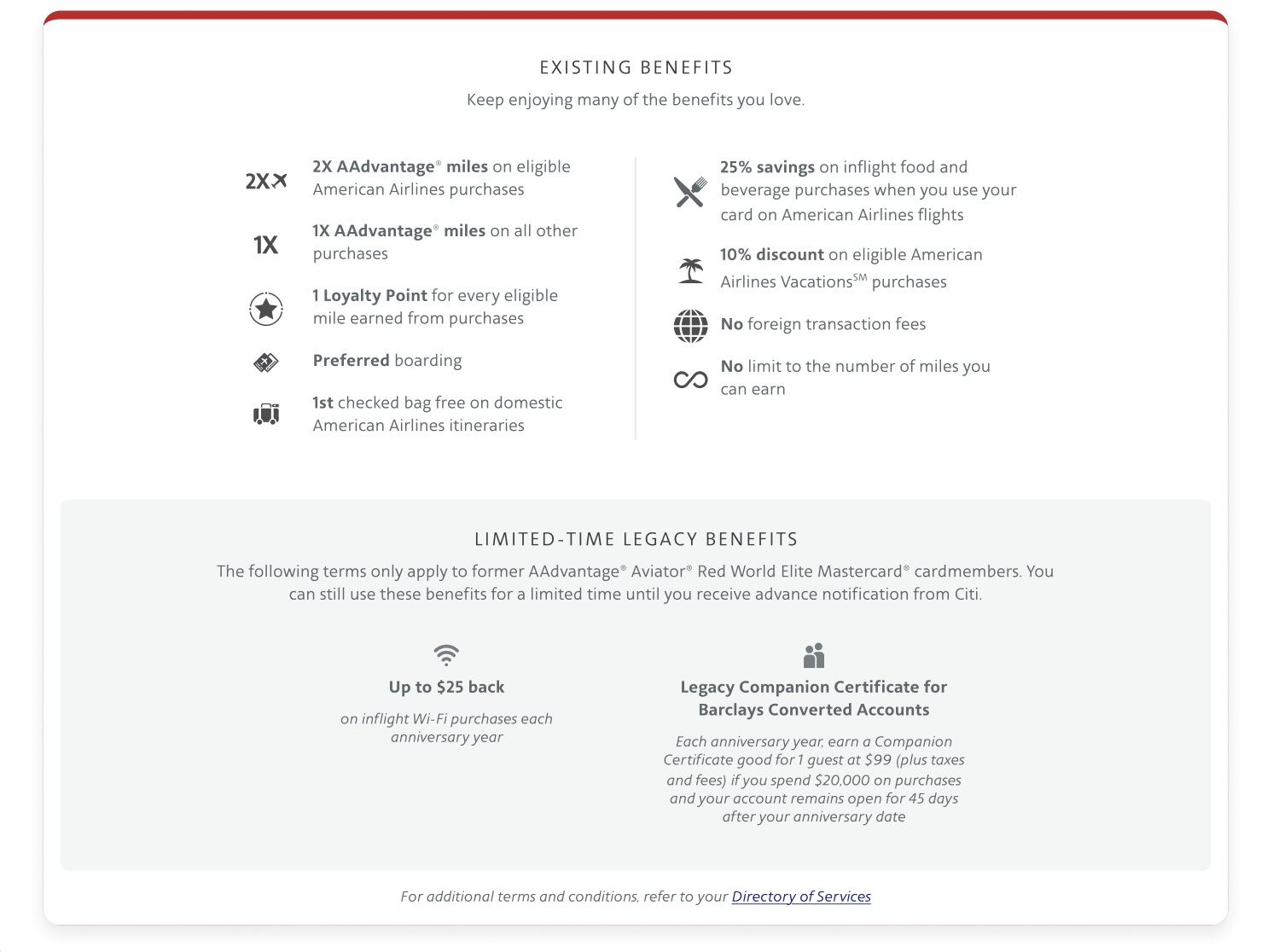

As you can see in the chart, the Barclays Aviator red will pick up a couple new category bonuses, with 2x gas and dining, when the card transitions to Citi. Note also that the Barclays card and the Citi card both offer benefits after $20,000 in purchases in a membership year, though the type of benefit is different.

The good news is that the documentation from Citi indicates that existing Aviator Red cardholders will hang onto legacy benefits “for a limited time”, until they receive advance notification from Citi.

We don’t yet know exactly how this will work in practice. Will it be possible to earn both the Companion Certificate and the $125 flight discount? We expect that it likely will be possible to earn both for some time (until Citi provides advance notice otherwise), but will spend that a cardholder has completed before the transition count for the Citi flight discount benefit, or will they only count spend from the time the card becomes a Citi card? What about those who have partially completed spending toward this year’s Barclays Companion Certificate? Will that spend carry over?

We don’t yet know the answers to those questions. My best guess is that spend completed since last anniversary will continue to count, even if that spend was completed before the card moves to Citi.

Note that the Citi Platinum Select also offers the ability to earn up to $30 in statement credits for each eligible Turo trip completed from April 24, 2026 to October 18, 2026.

Barclays AAdvantage® Aviator® Silver to Citi® / AAdvantage® Globe™️ card

Link to details from Citi about the transition

This transition is perhaps the one with the most potential to win or lose.

As we covered on a podcast episode last year, at a very high level, the Citi AA Globe card has similarish benefits to the Aviator Silver card. As you dig into the details, the benefits of the two cards (and their ongoing annual fees) differ significantly.

However, as is the case with the Aviator Red card, the informaiton provided by Citi does not indicate whether or when the annual fee will increase for existing cardholders. Similarly, it indicates that existing cardholders will maintain key legacy benefits “for a limited time”, until advance notice is given by Citi. Here is a chart showing the key details, with key differences between the cards underlined.

| Card | Annual Fee | Category Bonuses | Key Benefits |

| Barclays AAdvantage Aviator Silver | $195 | 3X AA, 2X Hotel, Car rental | $25 per day inflight food and beverage credit; $50 annual inflight Wifi credit; $99 Companion certificate good for 2 guests after $20K membership year spend. Up to 15K bonus Loyalty Points: 5K at $20K spend, 5K at $40K spend, and 5K at $50K spend during the status qualification period; $100 Global Entry application fee credit |

| Globe | $350 | 6X at AA Hotels ✦ 3X American Airlines purchases ✦ 2X restaurants ✦ 1X everywgere else | Four Admirals Club Globe passes per year Up to 15,000 additional AAdvantage Loyalty Points per year: Earn 5,000 bonus Loyalty Points after every four qualifying American flights, for up to 15,000 bonus Loyalty Points each status qualification year ✦ $99 Companion Certificate starting in your second year after card renewal, valid for a single round-trip domestic economy trip each year $100 in statement credits for in-flight purchases per calendar year ✦ Up to $100 Splurge credit per calendar year: (choose up to two): AAdvantage Hotels bookings, 1stDibs, Future Personal Training, and Live Nation ✦ Up to $240 annual Turo credit (up to $30 in statement credits for each eligible completed trip on Turo, up to $240 per year) |

It is interesting that benefits will apparently overlap for at least some period of time. For instance, we expect that existing Aviator Silver cardholders will receive the Admirals Club passes and splurge credits after the cards transition in April. It also sounds like it will be possible, for at least a limited time, to earn both the spend-based Loyalty Point bonuses from the Barclays card and the bonus Loyalty Points offered by the Globe card based on flight activity. That could make it far easier to qualify for elite status for those who can manage to meet both sets of requirements.

We wonder whether transitioned cardholders will get both the Globe card’s automatic $99 Companion Certificate at renewal and the Aviator Silver card’s Companion Certificate that is good for two companions if they have met the $20K spending requirement. As things stand, we expect that it should be possible to get both. It is also worth noting that while those benefits sound similar, in practice, Citi companion certificates have carried fewer restrictions than Barclays certificates, including being valid on a wider range of fares and without the Barclays blackout dates.

The big question, of course, is whether and when existing Aviator Silver cardholders will be subject to the Globe card’s $350 annual fee. As with the Aviator Red card information, it is interesting and probably notable that Citi has made no mention at all of the annual fee apart from noting that one will be assessed at renewal.

As an educated guess, I would suspect that Citi probably needs to provide advance notice of an increase in the annual fee. Furthermore, since many existing Barclays Aviator Silver cardholders have presumably already made progress in spending toward the companion certificate, and that certificate is contingent upon renewal, it would be at least customer-unfriendly to move the goalpost by increasing the required renewal fee. It may be that there are regulatory considerations there also. I think it isn’t impossible to imagine that Aviator Silver cardholders could keep the $195 annual fee at next renewal, at least for near-term renewals. However, that is only a guess. Time will tell how that shakes out.

Barclays AAdvantage® Aviator® World Elite Business Mastercard® to Citi® / AAdvantage Business™ Card

Link to a document from Citi with transition details

The following chart outlines the key details of these two cards, with those features unique to one card or another underlined.

| Card | Annual Fee | Category Bonuses | Key Benefits |

| Barclays AAdvantage Aviator Business | $95 | 2X AA, office supply, telecommunications services, and at car rental agencies | First checked bag free ✦ Preferred boarding ✦ 5% bonus on miles earned the previous year after AF is paid ✦ 25% statement credit on in-flight purchases |

| Citi® / AAdvantage Business™ World Elite Mastercard® | $99 | 2X AA ✦ 2X certain telecommunications merchants ✦ 2X car rental merchants ✦ 2X gas | First checked bag free ✦ Priority Boarding ✦ Save 25% on inflight purchases |

As is the case with all of the other cards, the Citibusiness AA card is keeping legacy benefits “for a limited time”.

Of particular interest here is that both versions of this card include a Companion Certificate after $30,000 in purchases in a cardmember year and renewal of the card. However, that benefit is listed both under new card benefits in the Citi document and under legacy card benefits.

Maybe that’s just a coincidence. On the other hand, is it possible that this card will earn both certificates for those who meet the spend?

That probably won’t happen. However, I can’t count it out entirely. Barclays Companion Certificates have historically come with a host of blackout dates and a list of eligible fare classes. Citi-issued Companion Certificates have not had blackout dates and have been applicable to a wider range of fare classes. It is possible that these are being treated as different benefits because of those differences in the features of the product. I definitely wouldn’t count on earning both, but neither will I be caught completely off guard if that happens for those who meet the spend and keep the card through the next renewal.

Should you keep your Barclays card or cancel it before the transition?

In short, I think it won’t make much sense to cancel before the transition in most cases.

That’s because existing cardholders will get a combination of legacy and new benefits that will add some amount of value in most cases without adding any immediate measurable cost. Even if the annual fee ultimately increases on the converted Aviator Silver cards, it wouldn’t happen until at least next renewal (and maybe later).

We don’t believe that having a converted card will preclude anyone from getting a new card bonus on another Citi AA card with regard to welcome bonus restrictions. Here are the pertinent sections of the terms for the AAdvantage Platinum Select card and the Globe card with regard to eligibility for a new cardmember bonus:

*AAdvantage Platinum Select terms: “American Airlines AAdvantage® new cardmember bonus offer not available if you received a new account bonus for or if you converted another Citi credit card account on which you earned a new account bonus into a Citi® / AAdvantage® Platinum Select® account in the last 48 months.”

Citi AAdvantage Globe terms: “American Airlines AAdvantage® new cardmember bonus offer not available if you have received a new account bonus for or converted another Citi credit card account to a Citi® / AAdvantage® Globe™ account in the past 48 months.”

As we read that, you should be eligible for either new card bonus so long as you haven’t received a new cardmember bonus on that specific card or converted another Citi credit card account to it within the past 48 months. Since this is a conversion from Barclays, we don’t expect it will prevent you from getting a new cardmember bonus on the same card in the future.

Among the biggest potential disadvantages to allowing your Barclays card to convert is the fact that it is possible that the Citi card will be reported as a new account, increasing your 5/24 count. To be clear, we don’t know that will happen — it certainly may be that the account carries over your existing history and does not cause a new account to be added.

The other key disadvantage to allowing conversion is that it will add to your total exposure with Citi. If, for example, you have a large Barclays credit line that gets moved to Citi, you could reach your maximum exposure with Citi in terms of the credit they are willing to extend to you. That could make it harder to get approved for another new Citi account in the future.

However, we think that the advantages of allowing the conversion to proceed likely outweigh the disadvantages for most folks.

For starters, you’ll get access to both sets of benefits for at least a while. There is also the chance that existing Aviator Silver cardholders get grandfathered into the lower annual fee and legacy benefits for longer than expected. Stacking Loyalty Point bonuses could be useful for those chasing elite status. And, even if you ultimately do not want a Citi AA card, it should be possible to product change down the line.

In my own household, my wife is an Aviator Silver cardholder and probably won’t keep the Globe card long-term. However, she will gladly use the splurge credit, and it is possible that the Admirals Club passes and in-flight purchase credits could come in handy (note that the Aviator Silver will continue to offer up to $25 per day in statement credits for in-flight purchases, but maybe that will stack with the new $100 statement credit offer). However, in the long run, she will look to product change. She currently has a Citi Double Cash card with a relatively low limit. The limit on her Aviator Silver card is significantly higher. She’s probably going to request a credit limit increase from Barclays and hope to product change the resulting Globe card to a Double Cash card with a more useful limit down the line. Then, she could downgrade her existing Double Cash to a Custom Cash card. If we get data points of the automatic companion certificate posting and people renewing and $195, maybe she’ll keep the Globe card for another year before product changing. We’ll keep options open.

I don’t see enough upside in cancelling before transition in most cases, though there will be some fringe cases where cardholders decide that they don’t want to be transitioned to Citi for one reason or another. I expect those to be the minority of cases here, at least until next renewal on these cards.

It’s really hard to imagine that Citi will allow a PC from a co-branded card, unless it’s in the same (AA) card family. If they do, that will be the real news to come out of this.

Thanks for the analysis and real case scenario with your household’s Barclays Aviator future. Getting a credit limit increased on the Barclay card prior to conversion is an excellent way to leverage a product change path in mind considering Citi’s unique way of determining a customer’s credit limits.

I sure hope that the Barclay > Citi conversion will not infringe on 5/24 by “creating” a new account at Citi even though we, as customers, aren’t opening new lines of credit in a traditional fashion. Alas, we might get “Bonvoyed” by Citi because, hey, “What crazy thing did Citi do?”

Already set for AA and want to slim the wallet. Moved credit line to another Barclays card that is a keeper. Done.

[question answered already]

I got my latest Barclays card in Aug 2025 with only $1000 cl and would have normally cancelled it before the annual renewal fee kicked in. I already have an AA Plt Select with good credit line and I don’t need more. I am inclined to cancel it in March 2026 before this transfer takes place after 7 months of having the Barclays card. I don’t want to risk 5/24 as Chase usually instantly approves me as long as I am under 5/24.

I could see not risking the 5/24 slot. On the other hand, if it doesn’t end up adding to 5/24, that would be a prime credit line for downgrade to a Custom Cash card.

What if you already hold the Barclays & Citi AA card?

That doesn’t make any difference here. You can have more than one of the same card.

So many questions! It seems crazy that a forced transition would add to 5/24. But my question is different. I already have a Citi Advantage Plat Select, and the transition of my Aviator Red will give me one more Plat Select than I want. Have people been successful in PC’ing an AA card to another non-AA Citi card? I would like the Custom Cash instead. Thanks for a helpful article.

Yes, you should be able to do that.

Would it make sense to preemptively close it before the transition even if I have the card for less than 1 year? I really don’t want to add to my 5/24 for a card I would anyway close in August.

Let’s say it does unfortunately add to 5/24…will Chase reconsideration understand that it is not a true new account and be willing and able to reverse a denial? Has anyone been able to upgrade from Red to Silver recently, and if so is a prorated annual fee increase charged?

I wouldn’t bet that you can plead a case of it not being a new account. If that’s really important to you, then you might consider cancelling.

Barclays doesn’t charge a prorated fee increase — you don’t get hit with the $199 fee until renewal. But not everyone gets the opportunity to upgrade, so YMMV.

I opened the Barclays Aviator Red late April 2025, and planned on closing it once I reached the one year mark. Should I cancel now, to avoid potentially adding to 5/24 (already 4/24 now)? I do not have any interest in any new Barclays cards. Would closing before one year have a negative impact on other banks too?

Regarding eligibility for SUBs, TPG has a different take and says that the conversion will preclude you from getting a new SUB. From their article:

Can FM confirm directly with Citi?

We think TPG’s interpretation was wrong.

The statement, “Barclays AAdvantage cardholders will be subject to the same welcome bonus eligibility rules as Citi AAdvantage cardholders” doesn’t contradict anything I said in the post. In fact, I cited the application terms. Based on our read of the terms (and you’ll hear us talk about this on Coffee Break tomorrow), getting a card transitioned from Barclays shouldn’t preclude you from getting the bonus. As I said in the post, product changing from another Citi card to a Citi AA card would prevent you from getting it. I think this is a different thing, and TPG is just misinterpreting it.

I opened my Red in late Sep 2005. Last time around, I got the offer to upgrade to Silver after ~6 months. If Barclays is feeling frisky and offers that again and I can sneak in to getting five months of the Globe for the tail end of my $99 AF, that would be great. Even better if it renews in Sep at the $195 rate. No way would I be keeping it for $350.

Great article! As a Barclay Silver cardholder, you really helped me understand we may be in a sweet spot on this transition.

Nick,

Good analysis. As a Silver Aviator card holder, my question is this: should I sign up for the Globe 90k offer now (before the April transition), while I still potentially qualify? I presume once the Silver converts to the Globe I will no longer be eligible for the 90k bonus offer- true? Natural second question: will Citi allow one person to have two Globe cards, and will the benefits differ based on which card is used (with the legacy Silver Aviator card having crossover added benefits).

I think Nick answered this above. You can still get the Globe SUB if you haven’t gotten one before. A transfer of a Barclay Silver card shouldn’t cause a disqualification.

As Paul notes, that’s addressed in post. You should still be eligible even after your aviator silver converts to a globe.