I use Google Flights almost daily. Whether I’m actively researching for an upcoming trip, curiously clicking around looking for deals, or just trying to get a general sense of award availability (thanks to the Points Path extension), I pull up the site multiple times each day.

However, until recently, I hadn’t employed what is arguably the most useful feature of Google Flights: the ability to track flight prices. In a podcast episode, Greg had almost offhandedly mentioned that he uses that feature all the time. I hadn’t thought much about using it since most of my flying is via award travel. However, I’ve had a number of recent flights / upcoming reservations that were booked with airline credits (in many cases, credits banked over time). I realized that Google Flights might help me save a few bucks, or perhaps a few points.

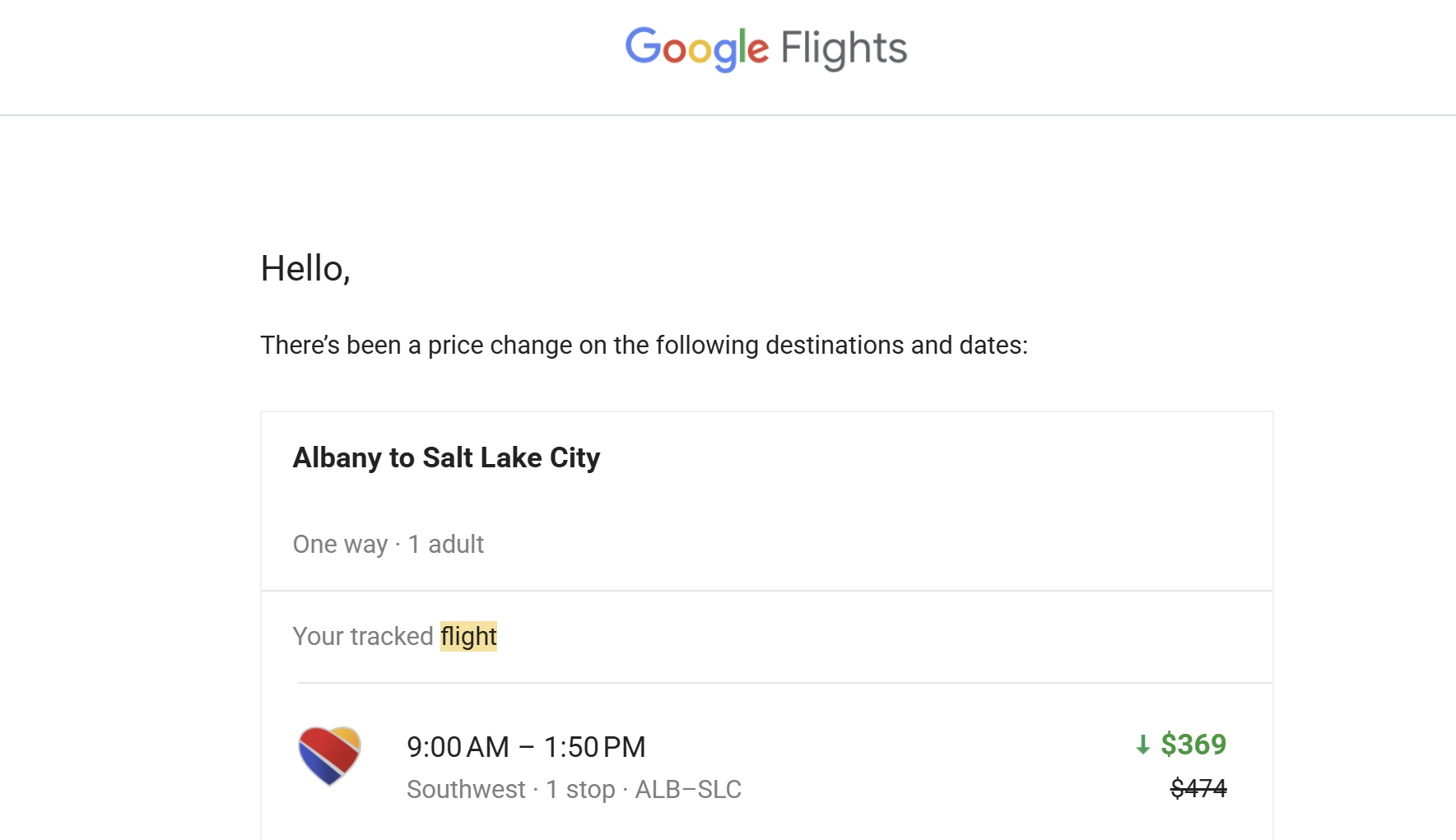

Sure enough, just last week, I saved $40 in airline credit when upcoming Southwest flights for this coming weekend dropped in price at the last minute. Then, a price alert close-in made me realize that I could probably save Southwest Rapid Rewards points I had used for an additional passenger — sure enough, I saved 8,500 points just by rebooking the same flights with a few clicks. In yet another instance, I had a 7am departure booked that I didn’t really want, but the 9am flight was too expensive. An alert from Google Flights let me know when the 9am departure dropped in price by more than $100 per passenger, making it cheaper than my 7am departure, so I was able to make a quick change to the flight I really wanted.

I am really glad that Greg mentioned using Google Flights to track prices — even though I knew that feature existed, it wasn’t until his recent mention that I put it to use, and it has already saved me well over $100 in points and airline credits and put me on a better itinerary. Sometimes, even I save more money and travel better thanks to our podcast!

This week on the Frequent Miler blog…

Amex Platinum: The card most frequent flyers should have, but rarely use

I have long said that I grew up being taught that paying an annual fee for a credit card was a bad idea. Funny enough, that topic just came up this week, and the Platinum card was my go-to example to explain why it sometimes makes sense to pay a high annual fee (a point I went back to after enjoying a good dinner at a Resy restaurant just last night). Ironically, as Greg points out, we pay that fee and rarely use our Platinum card (apart from for purchases that trigger credits). Somewhat ironically, then Platinum card now feels more like a coupon book with a credit card than a credit card with a coupon book. If you had told me at the beginning of last year that Amex would launch an $895 coupon book and that I would not only want it but that my wife and I would keep more than one, I’d have thought you were crazy. As it turns out, we are as happy with our coupon books as Greg is.

United MileagePlus announces huge changes to earning and redeeming miles

Whereas Amex has added so many coupons as to make their cards very compelling, whether you use them or not, United is hoping to make its cards compelling through a different strategy: you’ll soon need one to earn a competitive number of miles per dollar spent on United flights. In fact, Gary at View from the Wing suggested that United has demonstrated its recognition that Mileage Plus is a credit card program with an airline (rather than an airline with a credit card program). Tying its loyalty program earnings to having a credit card is an interesting strategy to boost its card business. I question that strategy, but hopefully, cardholders will benefit from the reduced-price awards they claim will be a benefit. Unfortunately, I think Gary at View from the Wing is right when he says that the net result will be an increase in award costs for everybody else, which will probably remove what little interest I had left in Mileage Plus.

Big United changes: Cardholders earn more, spend fewer miles | Frequent Miler on the Air Ep346 | 2-20-26

On this week’s Frequent Miler on the Air, Greg and I discussed the coming United Mileage Plus changes, Bank of America’s new rewards program changes, product changing away from the US Bank Altitude Reserve, and a lot more.

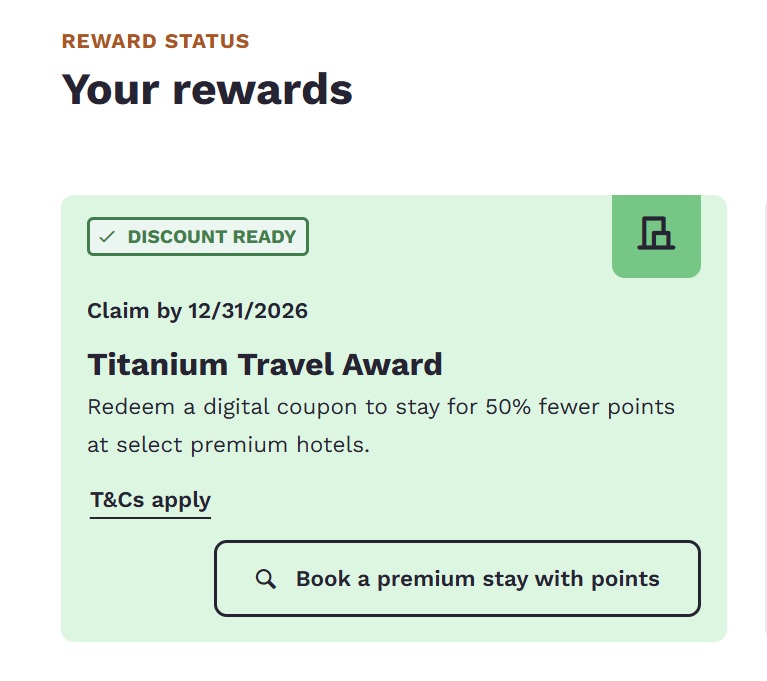

Choice Privileges Titanium Travel Award: Interesting, but limited value

Switching gears to hotels, Choice Privileges recently launched its Titanium Travel Award, which is essentially a coupon good for 50% off an award stay of up to 7 nights at select properties. I was glad to have a chance to sift through the eligible properties and see when and where that benefit might be of notable value. Interestingly, the savings with this benefit are not necessarily huge since quite a number of Choice properties — even those eligible for the Titanium Travel Awards — are so reasonably priced in terms of points. Ironically, the search drove home for me the fact that I shouldn’t sleep on Choice the next time I’m planning a trip, because transferring points from Citi or Wells Fargo might make it very reasonable to sleep at a Choice property.

Adding to the collection: Cards I’ve opened recently (on Nick’s mind)

Unfortunately, none of the cards that I’ve opened recently are going to make it easy for me to sleep cheap at Choice properties. Instead, I’ve recently added to my collection with a Southwest card, a Sapphire Reserve card, the Bilt Palladium (for my wife), and a JetBlue card, with a couple more hopefully in the pipeline. Not noted in the post, I am eyeing a decent cash back bonus next, and I’ll be making a couple of tax payments soon to pick up higher elite status with American and JetBlue.

ALL Accor: A Guide to Accor Hotels’ Loyalty Program

ALL Accor is a program that doesn’t get a lot of attention in the United States. However, during the recent Bilt transfer bonus, I moved some points to Accor in anticipation of booking a stay at an Accor property this summer. I later changed my mind on that specific stay, so I read Tim’s guide to the program with interest in learning more about how and why to leverage the program. A few readers have brought up Accor subscriptions in the past, though I might have to keep my eye out for a deal on the Signature subscription in the future if and when I anticipate more Accor stays. It is also worth mentioning that a few readers in the comments note being able to get Accor elite status by being a stockholder, though I think it requires a minimum of 50 shares, so the bar for that isn’t necessarily low.

Fine Hotels + Resorts® vs The Edit by Chase Travel℠ | Coffee Break Ep93 | 2-17-26

Greg recently had the chance to test out Fine Hotels + Resorts® and The Edit side-by-side (well, back-to-back) at the same Chicago hotel. That gave him some insight into at least some of the comparison points in terms of the relative strengths of each of the programs. Your experience can obviously vary, though I personally appreciate that FHR bookings can be made for single-night stays and the guaranteed 4pm late checkout, so I’d probably be booking through Amex more often than not. Still, the ability to use Chase points to good value for these stays can be really nice in the right situation.

Hyatt Regency Washington DC on Capitol Hill: Bottom Line Review

Tim stayed at the Hyatt Regency Washington DC a few months ago so that the rest of us don’t have to :-). His review certainly made me feel like this is a property to miss, at least until renovations are complete. Thankfully, DC has a lot of good options, so you shouldn’t find it too difficult to look elsewhere. While the Thompson Washington DC’s location isn’t really what I’m usually looking for, the price through Amex’s The Hotel Collection has often been so good that I might just deal with that location inconvenience when visiting DC for the foreseeable future.

Updated resources

The following resource posts have been fully updated and recently republished:

Greg’s top picks (my favorite card offers)

Current Amex Offers

Citi ThankYou Rewards Airline and Hotel Transfer Partners (2026)

IHG One Rewards Complete Guide (2026)

Chase Ink Business Cash Credit Card Review (2026)

Amex Blue Business Plus Credit Card Review (2026)

Citi Custom Cash Credit Card Review (2026)

Capital One Venture X Rewards Credit Card Review (2026)

That’s it for this week at Frequent Miler. Keep an eye on this week’s last chance deals to be sure you grab those ending this month.

![Mileage running 2026-style, playing the AA transition, a coming points conference and more [Week in Review] a group of toy airplanes on a game board](https://frequentmiler.com/wp-content/uploads/2022/01/American-Airlines-Game-218x150.png)

I think the best combination is tracking the same flight via Google flights and Points Path. Usually the cash and Miles components move in tandem so if you see a change in one, usually that means there’s a change in the other. Then you can manually check to see what happened.

Google flight tracking is amazing and I’ll continue to use it. However, I signed up for Autopilot about 10 days ago and it found AND secured lower prices on 4 itineraries so far. Absolutely worth the small percentage fee they collected with the free version. I’ve since upgraded to Pro because I see the value.