Last week, Amex shook things up with some fantastic dining and wireless credit offers on a variety of co-branded cards (See these links for the Hilton card offers, Marriott card offers, and Delta card offers). The monthly Amex Gold Uber credit also started up at the beginning of this month. Chase Sapphire Reserve cardholders have a $60 DoorDash credit to use this year. Then there’s the Chase Peloton credit. And the Amex Variis by Equinox deal. And the Platinum PayPal credit. And the . Is anyone else’s head about to explode? I hate to complain about our current embarrassment of riches, but keeping track of it all is becoming a problem. Wait until the last minute and you risk forgetting something — or worse yet, you might make a last-minute purchase only to find the charge post the next day and you’ve missed out. What are you doing to solve the problem? I finally got serious with Google Calendar and I’m hoping it’ll help.

Note: Amex credits appear to be temporarily broken

In this post, I’m laying out my strategy to make sure all of my various credits get used. However, it is worth noting that Amex credits may be broken at the moment. That is to say that I’ve seen reports of the monthly PayPal credits not having reset. I also used The Motley Fool Amex Offer on January 27th and it has not yet triggered a reimbursement (despite having received the email from Amex when the purchase was made) and I also used the Hilton Aspire card for an Uber Eats charge over the weekend and have not seen a dining credit reimbursement. I think Amex must be dealing with some sort of glitch on the back end and as such credits are not processing correctly. However, I imagine they’ll get that sorted out and I’ll still need my organizational method to use the credits long-term. For now, I’ll just hold off on new charges until later in the month.

Using Google Calendar Events w/ email reminders

I know that some readers prefer automation and would like a way to “set it and forget it” when it comes to using all of their various credits. Yesterday, Greg published a cheat sheet for ways to trigger many of these credits and you may prefer a method where you use all of the credits on the first of the month and get it out of the way right away. That makes sense. And in some cases, I think that is best. For example, I used last month’s Platinum PayPal credit to order meal kits from EveryPlate (owned by Hello Fresh). Unfortunately, due to a shipping delay, the box sat in a warehouse for days and the ice packs inside all melted, so we weren’t confident enough that the meat inside was OK to eat. EveryPlate ended up refunding the box, so I assume that the PayPal credit will now get clawed back and we’ll have lost that credit for the month of January (Ugh!). For that reason, I’ll probably use Fluz for that credit moving forward. However, I’m sure that I will naturally use up the dining and wireless credits each month and I’ll take all of the organic uses of Amex credits that I can get in order to reduce the chances of claw backs. I wanted to at least give myself a chance to use as many credits as possible organically and yet also have a reminder system set in place before the end of the month so that I can go back to Greg’s cheat sheet if I have credits still unused.

I ultimately chose to use Google Calendar to help me make sure that I use all of my various credits before they expire. Unfortunately, I do not (yet) use a calendar app effectively, so take my method here not as a suggestion for how you should do it but rather a look at how I’ve decided to do it. I both accept that you may have a method hat is more effective for you and maybe even suggestions about how I could make this more effective for me. I am not a calendar organization life hacker, but I needed to do something about all of these credits because there are just too many to rely on memory alone.

My problem with calendar reminders is that I just haven’t made the habit of regularly looking at my calendar (something I need to improve upon). As such, adding reminders to my calendar is not as effective as I’d like it to be. Calendar reminders pop up a notification on my phone, but with all of the apps constantly notifying me of one thing or another, it is easy to get lost in the sea of drop-down notifications on my phone.

While I often ignore phone notifications, I look at my email all the time. For me, a recurring email reminder would be ideal. Thankfully, it is possible to create an email reminder for events in Google Calendar (though I didn’t find this to be intuitive).

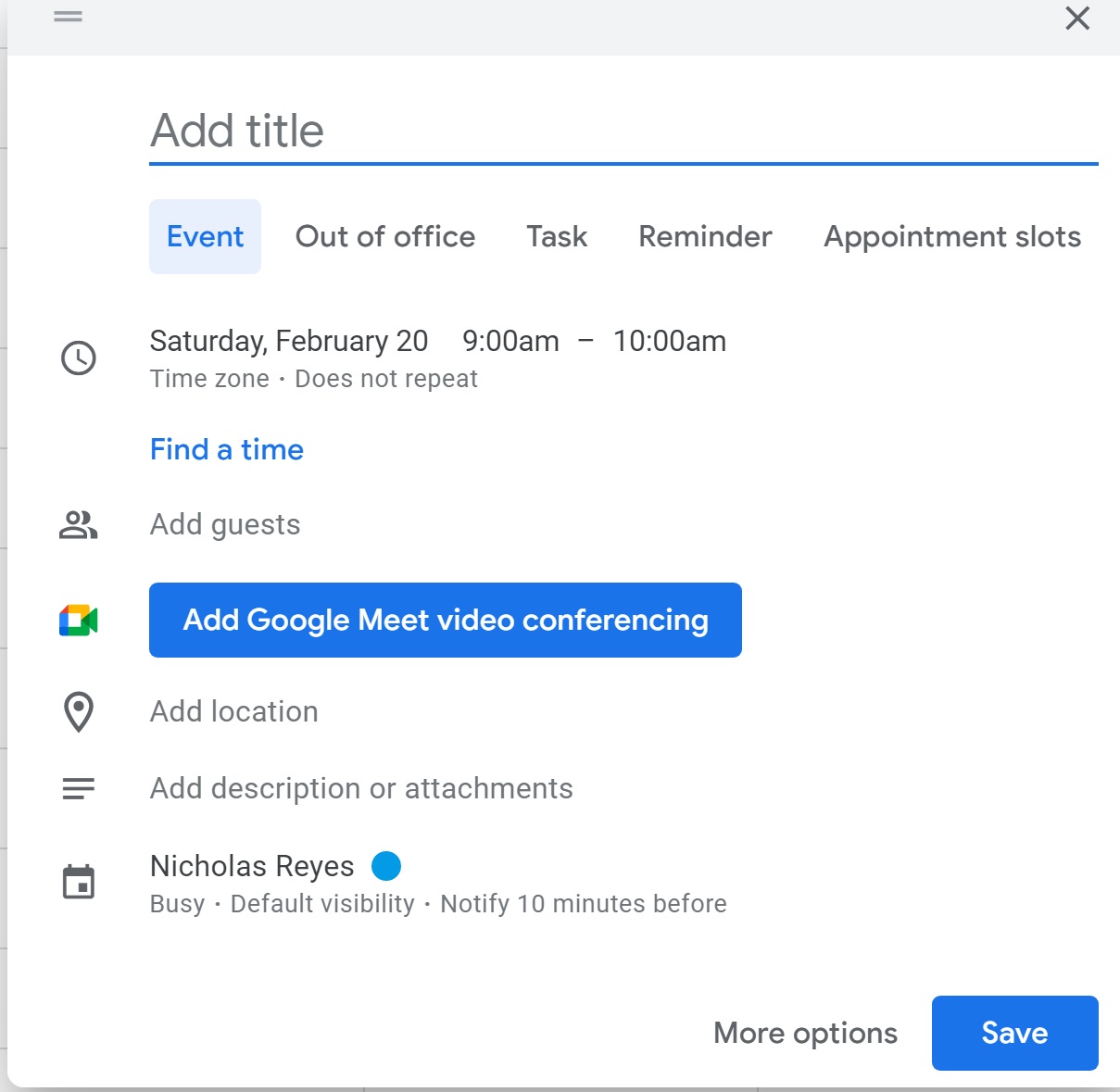

I started at calendar.google.com and clicked on a date to set up an event. The important thing for me was to choose an event. That’s because I will be able to set an email reminder for an event, whereas it doesn’t appear possible to set an email reminder if you label a calendar item as a “reminder” within Google Calendar.

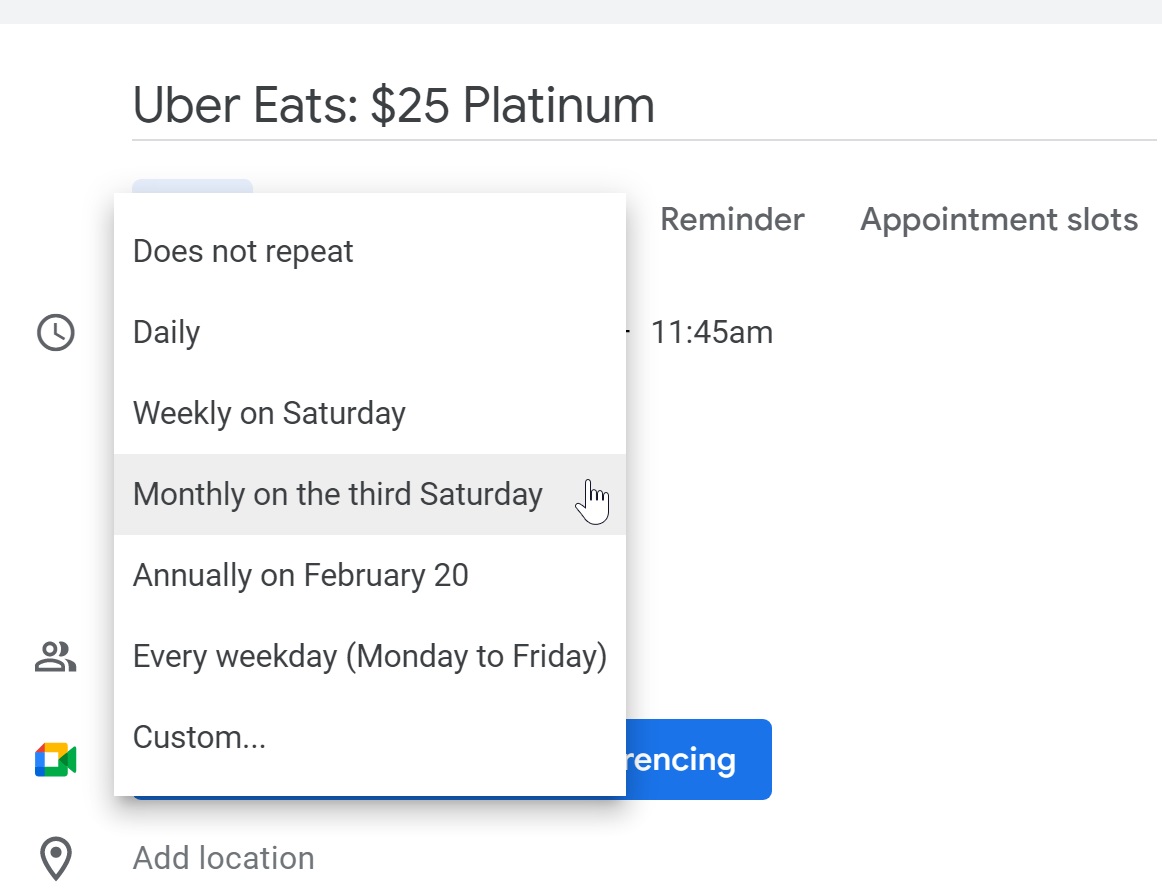

After picking my date and time, I chose to make events repeat. For example, I set my Platinum Uber Eats credit event to occur monthly on the third Saturday (more on the method to my madness below). Note that I had accidentally set this as $25 when I took the screen shots because I was mentally combining Platinum and Gold. The purpose here is to show how it works, so forgive me for error in how I labeled this.

The purpose here is to be reminded every month to make sure that I’ve used the credit. To aid in that, I added my wife as a guest for this event. She rarely looks at her email, but I figured that having it show up on her calendar as well at least increases the chance that she nags me to make sure it gets used one of us will remember.

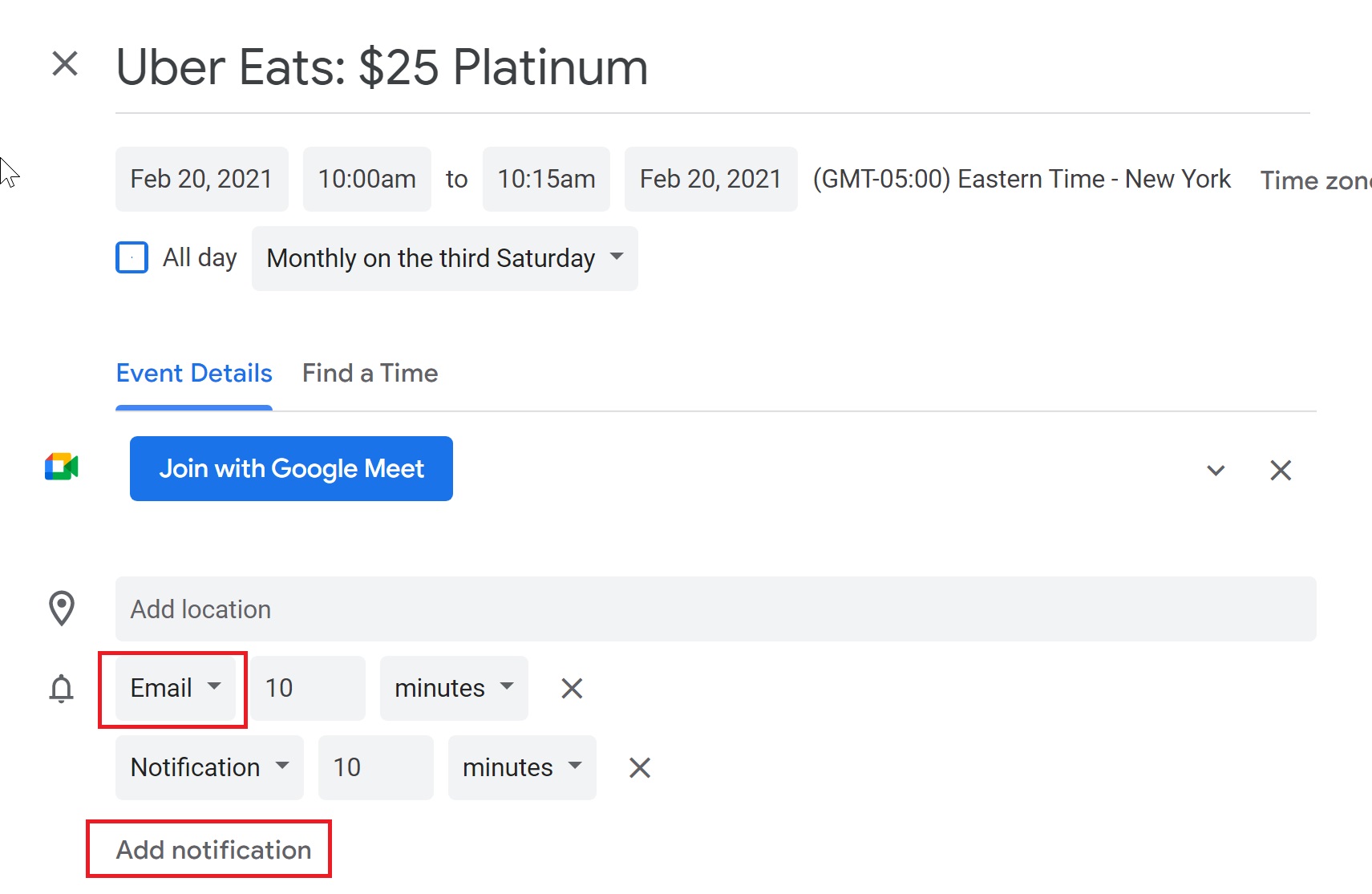

Immediately after saving the event, I re-entered the event by clicking it on the calendar and then I chose to “edit” the event.

From there, I was able to add a notification by email.

As I said, I tend to look at my email all the time, so I am much more likely to see the email reminder (given the volume of monthly credits, my phone will also now have a wave of notifications on the third Saturday of every month).

My goal here is to make sure that I am reminded of each of the various credits that I need to use. If I receive the email notification and I haven’t yet used the credit but I intend to do so on a later day, I will snooze the email. Gmail makes this easy:

At the very least, I’ll snooze it until the following weekend (unless I know I’ll have a specific opportunity to use the credit in between). This should hopefully make it hard to forget about any individual credit. Of course, I could just ignore all of the reminder emails, but I want to be sure that I get value out of these credits so I intend to be pretty committed to the system.

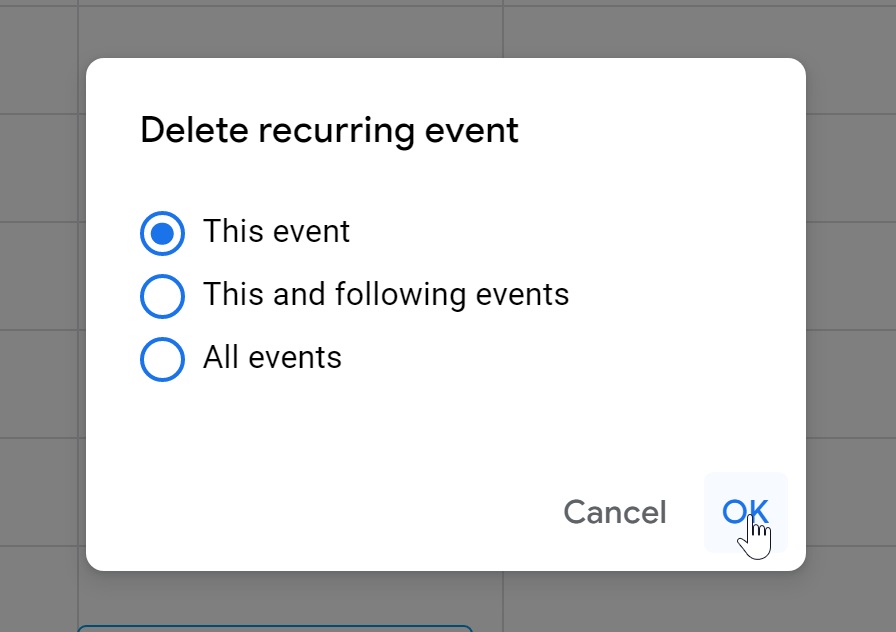

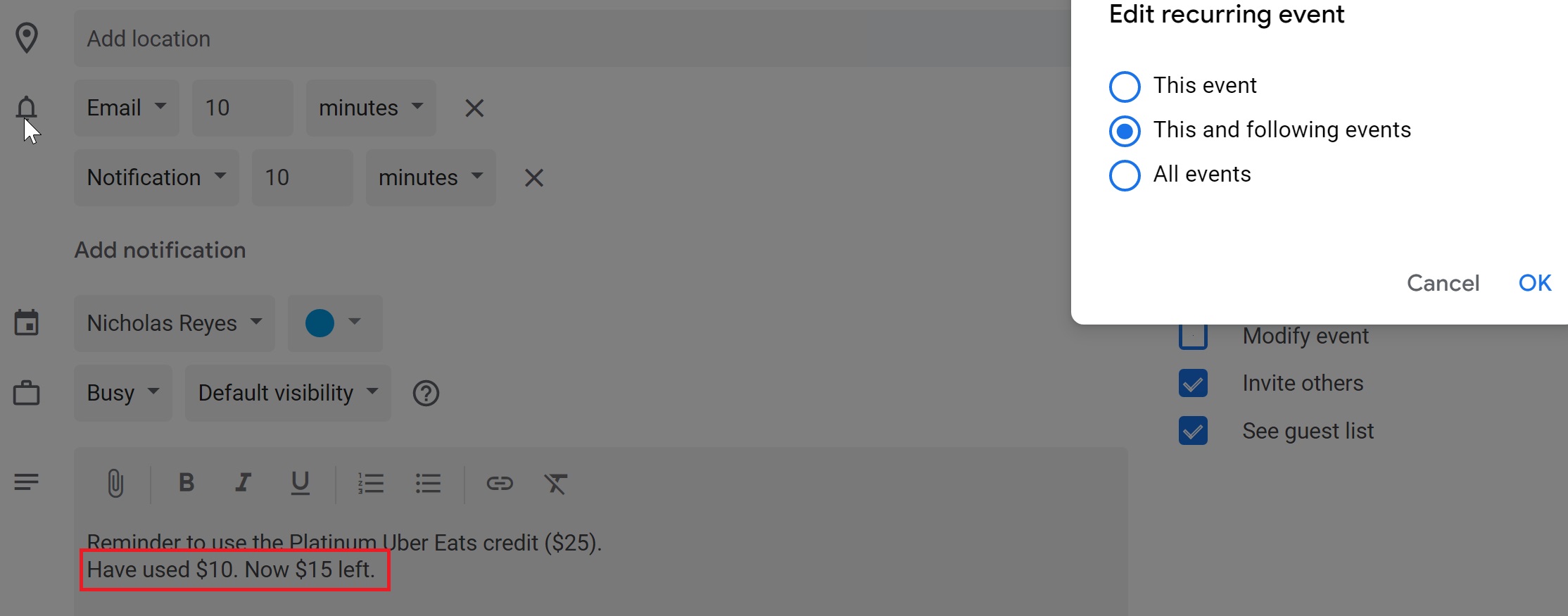

Once I have used a credit, I will delete the event for that month only (i.e. just “this event” below) unless it is an annual credit that is used in full, in which case I will delete “this and following events”.

The trouble there becomes tracking partially used credits. If you are someone who has a $20 dining credit and you’ll use $5 here and $14 there, this method may not be the ideal solution for you. This could be a particular problem with annual credits like the Sapphire Reserve Travel Credit or the Ritz or Amex airline incidental credits.

My solution for this will be to edit the event and add a note like this to “this and following events”. Again, this is just an example (note that the monthly Platinum Uber credit is only $15 except for December when it is $35).

My reminder method

Below, I’ll list the various credits and spending bonuses I am tracking with Google Calendar. First up are monthly credits, like the Amex Platinum / Gold Uber Eats credits. Personally, I am much more likely to use the Uber Eats credits on a weekend, so I set up my monthly recurring event for the third Saturday morning of every month. By setting a Saturday morning email reminder, I’ll give myself the heads up early on Saturday to look for a chance to use it on Saturday or Sunday. I can also easily snooze the email in Gmail as shown above until the next Saturday if I know I won’t have the chance to use it on the weekend of the third Saturday (this is why I went with the third Saturday — I figured that should give me a chance to have used it organically and then also a reminder with two weekends to go).

The “third Saturday” for monthly credit reminders also fits my life for a couple of additional reasons: first, we do our bills around that time of the month (so I’ll be able to verify that credits have posted for any purchases I’ve already made). Second, I noted during our last podcast that I have been using wireless credits to pay T-Mobile after my monthly T-Mobile bill is charged in full to my credit card but before the next statement cuts. The effect here is that my auto-pay credit card is charged around the 20th of the month, but my next T-Mobile bill doesn’t generate until early the following month. What I intend to do is pay my monthly bill with a credit card that has cell phone insurance (despite my previous grumblings about cell phone insurance) and then after my bill is paid to a $0 balance I will use the Amex Marriott Bonvoy Business card to pay an additional $15, giving my account a negative balance (-$15). Then, when my bill cuts the following month, it will have a carry-over credit from the previous month (reducing the next bill by $15), but I will technically be paying that bill in full on the card with cell phone insurance. Will a claims adjuster agree with the interpretation that I’m paying the bill in full on my credit card? I don’t know, but since the bill will show $X due and my card will be charged $X, I think it is more likely to work. All that is to say that reminders on the third Saturday of the month fit my personal schedule well.

I have also set up monthly reminders for spending bonuses and annual credits, though I set those up a bit differently.

For annual credits, I have my reminder set for the first of each month. I decided to remind myself early in the month mostly with the hopes that don’t find myself getting a reminder in late December with a week left in the year to use a thousand dollars worth of credits. By setting these annual credit reminders to the first of the month, I’ll get regular reminders to use them and get a reminder of any leftover credits at the beginning of December that hopefully won’t leave me scrambling to use all of the credits in just a few days at the end of the month.

I have done something similar with monthly spending offers including both short-term Chase offers (like the 5x credits on some co-branded cards or 3x grocery on the Sapphire Reserve) and with quarterly bonuses. I put those in the middle of the month (15th of each month) to take stock of what I’ve used while also giving myself plenty of time left in the month to max out spend.

While I was going wild on my calendar, I decided to add this type of reminder for other travel credits and certificates. For example, I have a United bump voucher that expires in October of this year, so I have set myself a monthly reminder to keep it fresh and look for chances to use it. I intend to do the same today with free night certificates as I have so many set to expire this year and I want to make sure that I put them to use. I know that many use a spreadsheet for things like that, which is also helpful, but I think the monthly reminders will help keep it at the top of mind for me.

Here are the reminders I’ve set for cards in my household:

Monthly credits: Reminders on the third Saturday of each month

Amex Platinum: $15 Uber credit ($35 in December)

Amex Platinum: $30 PayPal credit (though June 30th)

Amex Gold: $10 Uber credit

Amex Gold: $10 GrubHub/select restaurants/Boxed.com

Amex Hilton Aspire: $20 dining credit (through December 31, 2021)

Amex Marriott Bonvoy Business: $15 wireless services (through December 31, 2021)

Monthly spending offers: Reminders on the 15th of each month

(up to $1500 in combined grocery / pharmacy / gas; I set these up for Marriott, Ritz, and Southwest; I probably won’t bother with IHG. These are available through March 31, 2021. Note that this is a $1500 cap in total, not per month, as was pointed out to me by members of Frequent Miler Insiders.)

Chase 3x offers: Sapphire Reserve (grocery, up to $1K per month) through April 30, 2021

Quarterly bonuses: Freedom 5x (I’ve marked this just as “wholesale clubs” as that is the only place where I intend to use this quarter’s bonus)

Annual credits: Reminders on the 1st of every month

Amex Business Platinum: $200 Airline incidentals credit

Amex Platinum: $200 Airline incidentals credit

Amex Hilton Aspire: $250 Airline incidentals credit

Amex Hilton Aspire: $250 Hilton resort credit

Bank of America Premium Rewards: $100 airline incidentals credit

Chase Ritz: $300 airline incidentals credit

Chase Sapphire Reserve: $300 travel credit

Chase Sapphire Reserve: $60 DoorDash credit

Random temporary credits

I haven’t bothered with the Variis by Equinox credit on the Amex cards since the credit doesn’t cover the entire cost. I also haven’t signed up for the Peloton fitness app, though I think that we likely will. Your Mileage May Vary points out that you can basically get the rest of the year for free between the two free month trial and the $12.99/mo charge thereafter. Instead of reminding myself to use this credit, I have set a December event with email reminder to cancel this unless we decide that we really want to spend $13 a month on an ongoing basis.

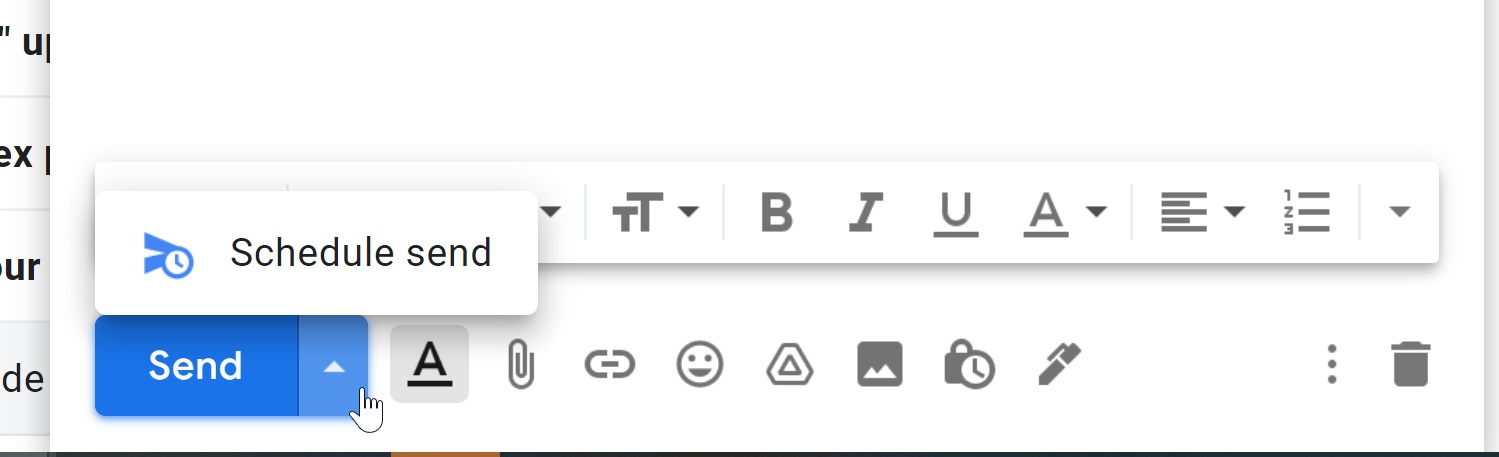

I should note that another option I have used for this type of reminder is to schedule an email to myself. That’s a new method I’m using to remind myself of when I can close bank accounts or when to cancel a free trial subscription if I decide not to keep those things. Just hit the arrow next to send to schedule an email to yourself at some time in the future.

Bottom line

There are just far too many credits available right now on cards in my wallet to keep them all memorized and be sure to put them to use before they expire. I had to do something to create a more organized system. While Greg’s cheat sheet will absolutely be helpful when I get down to the wire with credits unused, I would prefer to give myself the chance to use them organically. While tools like Fluz will probably come in useful when I do leave things to the last minute, I’d rather have used the credit while paying for something I was naturally going to get than have to track another gift card or lock myself in to one way to use the credit, so I decided to use Google calendar and email reminders to put a system in place to make sure I’ve used credits before they expire. Now that I got the ball rolling on this for credit card credits, I am putting it to use for free night certificates and other travel credits in order to take stock of my collection each month as we move forward. I think that all of the above will help me make more effective use of my benefits and help me avoid missing out on opportunities to get outsized value from the game.

I’m an IT guy and can’t find a technical solution for this problem. Post-Its on the fridge is what we use in my house. The reminder is there every time you go for milk/snack/water/ice/dinner etc.

@Nick Reyes – cut out a couple of steps by clicking “More Options” at the beginning, it will take you to the full view. Google Cal gives you the abbreviated version for quick adds, but you can launch the full view and set your reminder preferences without saving and re-entering the event. You can also set defaults on the notifications, both type, and number. Vaibhav’s suggestion of running it as a separate calendar is also what I do. It’s nice to be able to turn the view on/off, as I do unfortunately live by my calendar.

I have something easier. I have a spreadsheet for Paypal / Airline / Ubereats – since those I do at home. But for these dining credits – I made a little sticker (Address label cut up) and wrote on it F M A M J J A S O N D in a few columns.

Then I cross off each letter after I use each dining credit. Since I have 3 cards with these (Aspire, Delta G, Bonvoy) I made 3 stickers. Easy to keep track while on the road!

Coincidentally I just created a credit tracking system for myself over the weekend, but I just use a spreadsheet:

Each row is a different credit

Each column is a month

In the cell, I type the amount of the credit

Then I color fill the cell red, and when I use the credit I change it to green.

For single annual credits, I merge the 12 monthly cells.

Then I plan to look at the spreadsheet on the 21st of each month and see what I have left. Hopefully I update the credits as I use them, but even if I don’t then I can just look at my credit card accounts on the 21st and update the spreadsheet then. (I might do a calendar reminder on the 21st of each month to remind me to look at the spreadsheet.)

I started using a similar system to track my free hotel nights last year when they started to get extended and I found it very useful to see when free nights from subsequent years would overlap and could be used together.

Personally, your calendar reminder system would never work for me. First, I would always be worried that I had accidentally deleted all future recurrences instead of just the one event. Also, without a central place to look at all of them, I would be worried I had forgotten to add a new benefit that gets added to a card or extend the recurrences when a benefit gets extended. Then I would also hate how cluttered it would make my calendar look. Also, I find calendar reminders don’t work for me for this kind of stuff – my issue is trying to time them to when I know I will be home. If one goes off when I am out and busy, I end up snoozing it but then often get into a cycle where I’m also out when it goes off again so I snooze again, etc.

The only concern I see with using the 3rd Sat. is that it’s close to month-end. That puts you on the spot to use the credit in roughly 1 week before it expires at month end. Personally, I front load the calendar reminders to 1st or 2nd day of the month and use the snooze function as needed to prompt me to use it up sooner rather than later. This also allows time if need be if something is returned/has payment issues early on.

Otherwise, the Gmail/Google Calendar combo is a great organizational tool!

A much easier way to track all the offers is to stick a Post-It note for Dymo label with the information on each card.

Another tracking problem I have is that online orders to be delivered are arriving late, or are lost, or broken down into several orders (I get 3 of 5 items). Tracking these Is a big headache! My spreadsheet effort has been cumbersome.

I set my laptop browser to open with three tabs – Google Calendar, GMail and Google Keep. Those three tabs are always open no matter what else I open. All three apps are on the home page of my phone and tablet. It’s Google, so they sync across all of my devices.

My husband and I share our calendars, so we can see each other’s schedule. We use Google Calendar for a lot, including reminders to do something, like cancel a free subscription when the free period ends.

Keep might be what you’re really looking for though… take a look at keep.google.com

I use Google Keep for tracking offers, especially if they are on multiple cards. I title the “note” with the offer, e.g. Panera, 15% off up to $20, exp 2/11/21, then list the cards I added the offer to with check boxes. As I use the offer, I check off the box for that card.

For monthly offers, you could make a note/list for each offer with the month as the check box and set a reminder for a week before the end of the month. We don’t have that many, so I don’t need a reminder for them.

I use Keep for keeping track of which cards have Global Entry reimbursements, our grocery list, our travel bucket list, how much I have left to spend on Chase 5X quarterly across 3 cards, anything I want to keep track of in list form. You can pin notes to the top, color code them, share them with others, set reminders, organize them by label and add items to a list using voice commands. If I use up the last of something while I’m cooking, I can say to my phone, “Hey Google. Add <grocery item> to my grocery list.” and it does.

Keep might be one of Google’s best kept secrets.

Keep is horrible in that there is no undo button, I’ve accidentally deleted large notes while copy/pasting with no way to get the notes back at all. I haven’t touched it in years. [edit: looks like they added undo/redo functionalities finally]

Also, there’s a pretty good chance Google will kill off Keep at some point. https://killedbygoogle.com/

I used to use reminders but quickly got bogged down with some of the items you mention. I now use a combination of a note in Google Docs and a reminder in the phone that tells me to look at the note. The note has way more detail, and I can describe partial payments, etc. Generally I just bump the reminder out a day at a time, and I start at the beginning of the month for things like Uber/Eats, dining credits, etc, and at the beginning of the year/half year for airline credits and the Dell and Saks credits. It seems to be holding, but it can be a bear to track them all, to be sure. I also keep more limited notes in a spreadsheet that can help.

As to getting the credits, thus far they are coming in fairly regularly. Airline, Dell and Saks have come in, though perhaps a bit later than normal. The Motley Fool offer took about 5 days (1/28 – 2/3), did it through Glamour Rewards. Currently still waiting on Best Buy and Home Depot credits from January, and I just did the PayPal credits for February, we’ll see how long those take (in January it was only a day or two).

Also had a bonus on the Resy Gold card that took a couple weeks longer than expected to post, but it came through eventually. Keeping fingers crossed that all is worked out and will return to normal soon, and that taxes can be filed here shortly to get the big money back.

I use google calendar too to track my offers in a pretty similar system. The one thing I do differently is to use a completely separate calendar for Credit Card offers. That way my main calendar doesnt get cluttered with all these events, especially on the mobile apps. I leave it deselected in the view. And my wife can sync to this calendar instead of having all my “events” show up in her view.. The main goal is for them to send me notification which they can do while being invisible. Also I can set multiple notification and alerts to the parent calendar, and all the events that I create for that calendar inherits those notifications system. Description is where I add the info on P1/P2, card type, card # last 4, Offer terms (Spend X get Y, repeat N)…..

The one thing that we are bad is deleting offers, or marking them “used”. Although for the Amex spend 500, get 25, repeat 10 times I found myself making a note of how many times I have used so far… but repeat 10 times is an oddity… and I log in to Amex account atleast a couple times a week, so if there is a reminder in the email, and I am not sure if I had already used it, I find myself cross checking my “Added” offers.

I bought an appliance from home depot and am waiting on the $50 reward from Amex. We’ll see how long that takes. The $20 food offer from Hilton Aspire posted quickly.

Nick, you should check out a multi-platform (Mac, Windows, Android, iOS, Web, etc) tool called Todoist. While I use the paid version for some extra bells and whistles, the free version is quite good and even integrates with Google Calendar so that your tasks in the tool are shown on your calendar. The tool is quite good at letting you organize, categorize, and check off tasks. I’ve set up recurring reminders for credits there (just as I do for numerous other repeatable tasks like change furnace filter, pay property tax, flush hot water tank) and it also shows on my Google calendar. I use Todoist for both work and personal tasks and it all comes together in one convenient view. You can quickly make adjustments both from the Todoist and Google Calendar end, and they sync up. There are also a lot of other more advanced things you can do with Todoist too such as add tasks using your voice via Alexa (or Google Home) and much more.

I do the same thing with TickTick. I did use ToDoist for a long time, but the way TickTick does the calendar works better for me. Both are very good apps for this kind of thing though.

Came to the comments to also suggest Todoist 🙂

Looks good! I do think it may get confusing when there are multiple cards with the same offer. My (imperfect) method is just using the notes app on my phone. I list each offer and expiration date with the cards below it. I check off each card as it’s used. Haven’t figured out the monthly offers yet though. I think I will just erase the checks on the first of each month and start over.

I’ve used that in the past, but then I need a reminder to actually look at the notes. That could work for me with a scheduled email reminder though.

I use essentially the same method but add the month applied beside each credit card used, then add an * when I see it was actually credited. I set up a calendar notification with a week left in the month to remind myself to use them all up.