NOTICE: This post references card features that have changed, expired, or are not currently available

On this week’s episode of Frequent Miler on the Air, we discuss how Amex has changed the game pretty significantly in terms of how we extract max value out of credit cards — and therefore what strategy we need to pursue regarding opening/closing/keeping/using. It was particularly interesting to me to consider the entirely different approaches being taken by Chase and Amex in the current environment. It’ll be interesting to see if other issuers fall in on one side or the other. Also join us for our chat on Marriott’s awful IT, a double confession, and an intriguing question about the Hyatt credit card. Watch or listen below and read on for more of this week at Frequent Miler.

Subscribe to our podcast

We publish Frequent Miler on the Air each week in both video form (above) and as an audio podcast. People love listening to the podcast while driving, working-out, etc. Please check it out and subscribe (if we get enough people to subscribe, we might be able to earn some income from this someday. So far, the podcast is just a labor of love).

Our podcast is available on all popular podcast platforms, including:

Apple |

Spotify |

You can also listen here in the browser:

This week at Frequent Miler

Amex changes the game

Amex’s preemptive retention credits mark a strategy shift. Will others compete?

Amex changed the game this week when they added new credits on the Hilton cards, the Marriott cards, and the Delta cards. These credits seemed clearly aimed at getting people to keep their cards. In some cases, the credits are worth more than the annual fee. More importantly, as Greg aptly points out in Frequent Miler on the Air, if you want to get full value out of them, you’ll need to keep your card open until December. Giving out credits a month at a time is a very different strategy for Amex. It’s smart for them in that it forces cardholders to keep the card to extract value, which is remarkably different than the way things have historically been given that annual credits could often be used up entirely after a card anniversary but before paying to renew.

Amex derails my Hilton plans with great new offers (on my mind)

We noted the way the above strategy is a smart one from Amex that makes it hard to get rid of associated cards since it means walking about from easy monthly credits. While that is a plus by most measures, Greg shows how one can still be grumpy about free money in this post about how I messed up his master plan with the help of that free money from Amex. While he blames me here, I’ll point out that I told him to drop everything and apply for an Aspire card when it was available very briefly without an annual fee for the first year — had he listened then, he’d have a free night certificate that is valid any night of the week and all the Hilton points he needs right now, but he conveniently leaves that part out of this story :-).

COVID Credit Card Enhancements Ultimate Guide: Now with Amex dining & wireless credits…

If you’re finding it hard to keep track of all of those new Amex credits along with Chase temporary spending offers and whatever else gets added to your cards in the coming months in the form of temporary COVID credits and benefits, you’ll want to bookmark this page right now and come back to it monthly. You’ll be glad you did.

In Marriott news

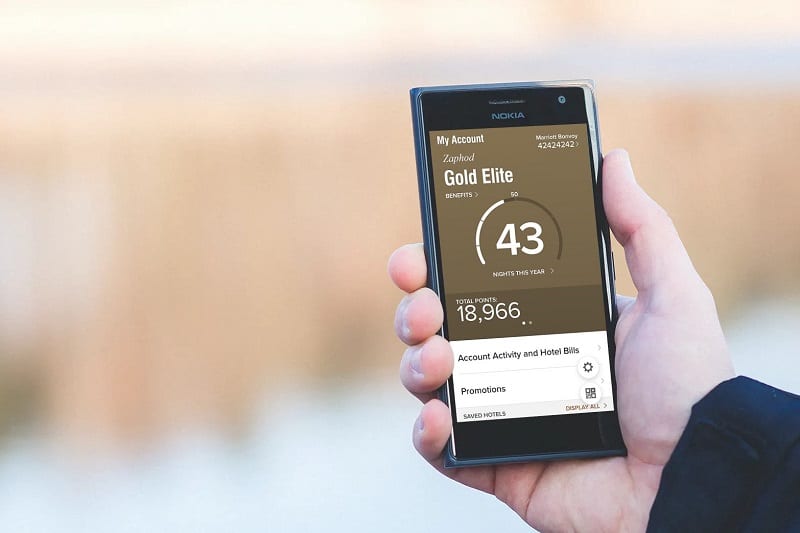

Marriott launches easy elite status for 2021 and cheaper saver awards (registration now open)

Marriott’s latest promotion is open for registration and it is definitely worth registering for double points and double elite nights. That is, if you can. No, this promotion is not targeted, but Marriott’s poor IT has made it such that many people have had difficulty registering. I recommend trying a few times online and calling if not to make sure that Marriott helps you get registered because this is open to everyone. Combined with the bonus nights that I believe have posted to accounts for most people who held elite status last year, the path to Platinum should be pretty easy for many readers and may just warrant a mattress run. More details in the post.

Official word: Marriott mixed paid / award stays will earn double credit

When we first heard about Marriott’s double points and double elite night credits promo, we were told by Marriott’s PR team that a stay would count for double elite credit if there was at least one paid night in the reservation (meaning that stays with one paid night mixed with five award nights should earn 12 elite credits since all 6 nights should double) — whereas a 6-night award stay would not double. We were able to officially re-confirm that through Marriott after the promo launched (which we did because the promo terms didn’t seem to match this expectation). Marriott once again confirmed that this would work, so I expect those who book a single reservation with paid and award nights to get double credit on the whole thing provided you register for the promo and stay in the proper window of time.

Marriott category changes on 3/3/21: Pretty mild

If you are looking at a Marriott mattress run, you may want to take a quick glance at Marriott category changes to make sure that your chosen property isn’t changing price on March 3rd. Fortunately, only about 50 hotels are going up and 150 hotels are decreasing in category, so chances are good that this won’t directly affect your plans. While it is disappointing not to see more properties decrease in category, it isn’t surprising. Given that category changes made on March 3rd will stay in effect for a year (and members will be able to book a year in advance before the likely next set of changes next March), I’m just not surprised that many properties didn’t commit to lower pricing for the next 2 years in response to the current situation. Keep in mind that if you have the points to book now and you do have your eye on a property going up, you’ll want to lock in that award right now with the full points necessary for the stay.

In award booking and devaluations

Hyatt Points Advance: The Globalist perk you didn’t know about

The title is right: I had no idea that Hyatt elite members could make a reservation even before having the necessary points in their account. While Marriott has long had this feature available on its website, this is an unadvertised benefit from Hyatt that will require a phone call or perhaps an email to your concierge. Still, very cool to know that this can be done and something I intend to put to use in the near future. Hopefully this perk sticks around as it is particularly useful in the current environment.

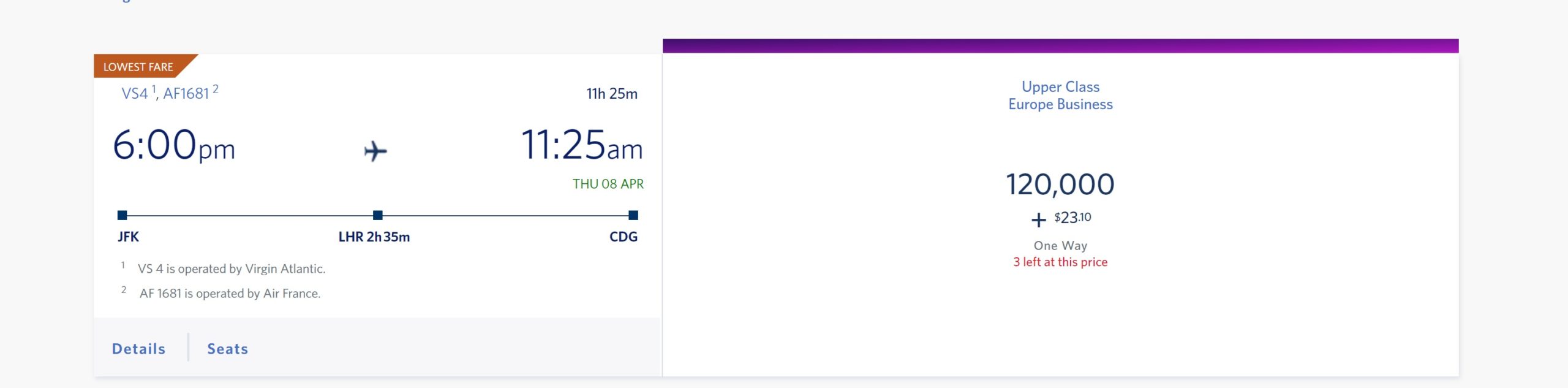

A trip down the Turkish Miles & Smiles rabbit hole

I spent some time playing around with Turkish Airlines award searches this week. For (more than) a minute, I thought I’d found something really awesome. Twice. Unfortunately, I eventually shot down my most exciting theories after more searches. The good news is that all was not lost for those interested in US Caribbean destinations or who would like to combine a trip to the Caribbean with a trip to South America. See the post for more.

I spent some time playing around with Turkish Airlines award searches this week. For (more than) a minute, I thought I’d found something really awesome. Twice. Unfortunately, I eventually shot down my most exciting theories after more searches. The good news is that all was not lost for those interested in US Caribbean destinations or who would like to combine a trip to the Caribbean with a trip to South America. See the post for more.

Searching for Emirates sweet spots with partner airline awards [JAL, Copa, and Qantas awards…

Greg had long ago written about the (relatively few) sweet spots in the Emirates Skywards program. Unfortunately, a few of those sweet treats are now bitter memories as Emirates has killed off the better values. See what changed in this update.

Ouch: Big Delta devaluation on partner awards

Delta continues to send a clear message: you should use your miles for Delta flights and only Delta flights. Partner awards exist merely to reconfirm that you would have to be a certifiable lunatic or bent on extracting minimum value to do anything else but use your points for Delta flights. They’re happy to throw you a completely unadvertised domestic sale now and then that will give you a shot at good value if you happen to be looking up award tickets on the right day, just don’t expect to use those Delta miles to cheat on Delta. I haven’t personally ever earned or redeemed a SkyMile and I just don’t see that changing any time soon. The crowd for whom I feel worst are those folks who booked trips pre-pandemic and rescheduled once or twice already only to now not have enough nearly enough miles to ticket a new itinerary if they need to cancel and re-book as prices have in some cases darn near doubled in less than 16 months.

In the best offers out there

Greg’s Top Picks: February 2021

Greg updates his picks for February 2021. See which cards you should definitely consider right now, which ones might make sense in the right circumstances, and which you should wait on in hopes for a better opportunity. At the very least, following these updates should help you plot out a future strategy for when you’re ready to be in the game.

Brex: How I earned 20K for depositing sales revenue

Some are saying the Brex cash account is an early contender for Deal of the Year. I can’t argue – it sure does look terrific. In this post, Greg shows how seamless it was to trigger the first part of his bonus. I am happy to report that both Greg and many readers have no also earned the 80K points that make up the meat of the offer, making Brex a certifiable blue ribbon deal that you should definitely do if you’re eligible.

If You Snooze, Use Fluz | Ask Us Anything | Ep 25

This week, Greg and I were back for our latest Ask Us Anything live on Youtube. Check out this post to watch the replay and see what people are asking about — and what we thought about their questions.

That’s it for this week at Frequent Miler. Don’t forget to check out this week’s last chance deals.

Happy to see Amex moving toward keeping customers as opposed to getting the next ones. I have never been comfortable with churning and so don’t do many sign ups, but I think the game of maximizing utilization perks sounds like a fun challenge and seems more inline with my Midwestern Protestant guilt complex ;).

This will probably lead toward me finally dropping Chase UR and focusing on Amex MR and Citi TYP.

Regarding the question about getting Hyatt elite nights via WOH CC twice in a year. My DP: I canceled my WOH CC in early 2020. Signup bonus was earned over 24 months prior. I was approved in November 2020 for a new WOH CC. This one included the 10 elite nights. I got 5 from my old canceled card in January 2020 and 10 additional from my new card in December. Of course, I got my 10 nights again in January 2021. Greg’s expectation matched my experience.

Awesome! Thanks for sharing that.

Towards the end of the episode Nick says he pays the full bill with his CC with cell phone insurance (CFF/CIP/etc.), and then uses the Amex cell phone credits before the next statement cuts. I’ve been doing the same thing in the hope that an insurance claim will be approved if the actual bill was paid in full with the CC that has the insurance.

I plan to double up the monthly payments so that every other month’s payment doesn’t have the extra Amex payments. This should ensure the cell phone coverage sticks for at least every other month.

Examples for 6 months of statements and cell phone credits:

Jan 7 Statement cuts for $100

Jan 25 Auto (or regular pay) $100 with CFF/CIP/etc.for the cell phone insurance

Jan 28 $20 (or $10/15) payment with Amex CC with cell phone credit

Feb 1 $20 (or $10/15) payment with Amex CC with cell phone credit

Feb 7 Statement cuts for $60 (or $70/$80)

Feb 25 Auto (or regular pay) $60 (or $70/$80) with CFF/CIP/etc.hopefully for the cell phone insurance

Mar 7 Statement cuts for $100

Mar 25 Auto (or regular pay) $100 with CFF/CIP/etc.for the cell phone insurance

Mar 28 $20 (or $10/15) payment with Amex CC with cell phone credit

Apr 1 $20 (or $10/15) payment with Amex CC with cell phone credit

Apr 7 Statement cuts for $60 (or $70/$80)

Apr 25 Auto (or regular pay) $60 (or $70/$80) with CFF/CIP/etc. hopefully for the cell phone insurance

May 7 Statement cuts for $100

May 25 Auto (or regular pay) $100 with CFF/CIP/etc.for the cell phone insurance

May 28 $20 (or $10/15) payment with Amex CC with cell phone credit

Jun 1 $20 (or $10/15) payment with Amex CC with cell phone credit

Jun 7 Statement cuts for $60 (or $70/$80)

Jun 25 Auto (or regular pay) $60 (or $70/$80) with CFF/CIP/etc. hopefully for the cell phone insurance

Of course it gets more complicated with Verizon auto payment rules, lower cell phone bills, multiple cards with cell phone credits. Hopefully my explanation is clear!

That’s smart!

It’s also worth noting that cell phone insurance kicks in on the first of the next month following the month in which you pay the bill on your card (for most cards with cell phone insurance), so you can always get insurance back fairly quickly. But I think I’ll try your strategy!