Despite their sad approach to pandemic breakfasts, I’m hoping to return to the Madison Beach Hotel in Connecticut later this year (see my bottom line review here). The bad news is that cash prices are crazy high. The good news is that standard room rewards are available. The bad news is that I don’t have enough Hilton points to pay for our desired 3 night stay.

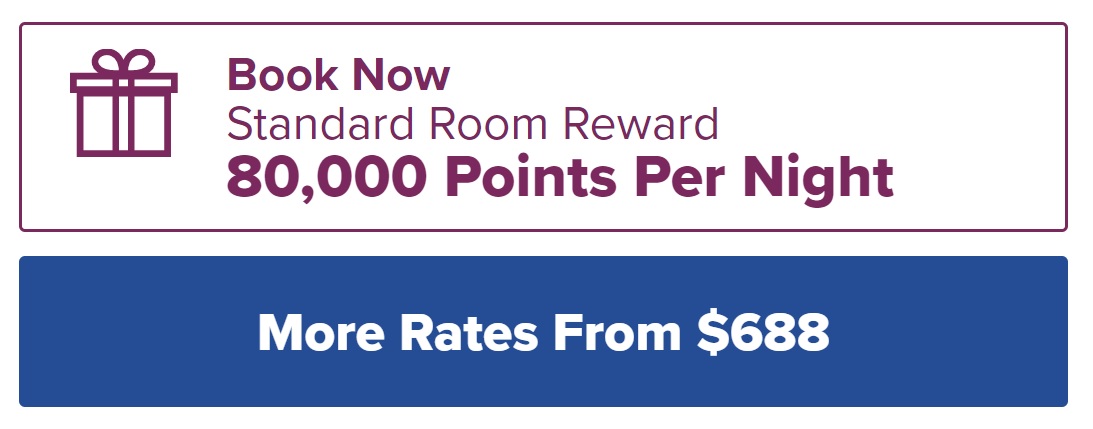

On the dates of interest, the cash rate is $792 per night after taxes. At 80K points per night instead, an award stay offers very close to 1 cent per point value vs. cash rates. Compared to the 0.45 cents per point Reasonable Redemption Value (RRV) for Hilton points, that’s a terrific award price. Alternatively, it would be an excellent use of a free night certificate.

I don’t have any Hilton free night certificates, but I do have 106K Hilton points. That’s enough for one night, but not 3. I would need either 134K more points or two free night certificates to book the award stay. No one in my family currently has a Hilton credit card for generating points.

The obvious way to earn enough points or free night certificates for this trip is to sign up for one or more Hilton cards. My wife and I each have more than the maximum 5 credit cards allowed by Amex, so signing up for a new Hilton card bonus wasn’t an easy option for us.

I could buy the required points when Hilton next has their points on sale for a half cent each, but that would be like spending $400 per night at this property. That’s a huge discount off the cash rate, but still very high. I’d prefer to find a way to get the points or certificates more cheaply.

I had considered transferring points from Membership Rewards while Amex was offering a 40% transfer bonus to Hilton. That bonus meant that Membership Rewards points transferred to Hilton at a ratio of 1,000 to 2,800. 48,000 Membership Rewards points would have been enough to meet my needs (48,000 x 2.8 = 134,400). I was earning an incredible number of Membership Rewards points at that time due to various promos and so it would have been an easy and cheap solution. I should have done it, but Nick talked me out of it. He convinced me to try for a new card welcome bonus instead…

Original Plan: Son gets new Hilton card

My son has fewer than 5 Amex credit cards and so we had an easy solution: he would sign up for a Hilton card and move the bonus points to me.

He gave it a shot… Or three.

He tried first for a Hilton Surpass 150K offer (at the time). Denied. How about a 100K offer (at the time) for the fee free card (I figured I could then transfer just a handful of Membership Rewards points to make up the gap)? Denied. Finally, he tried a 150K offer (at the time) for the business Hilton card. Denied again. Amex used to love him, but he now seems to be on their do not approve list.

Plan B: I try to get Aspire

I’ve wanted the Hilton Aspire card for quite a while. This seemed like the perfect time to get it. I have 8 Amex credit cards, though, so I knew I wouldn’t technically qualify. On the other hand, I’ve had success before in getting Amex cards when I shouldn’t have qualified. I tried applying, but I was instantly denied. An Amex agent called me and said that she could approve me if I cancelled four of my existing cards. No thanks!

Plan C: Wife drops Delta card and gets Hilton Aspire

If my wife signs up for the Hilton Aspire card and meets the spend requirements, she would get 150K points plus a free night certificate upon approval. I could then move my Hilton points to her so that she could book the stay.

I knew she would be blocked by Amex’s 5 credit card limit, though, so I looked at the Amex credit cards she had:

She also has the Amex Gold card, but that’s not a credit card but rather a card previously known as a charge card (we now describe them as “pay over time cards”). Amex has a separate 10 card limit for those cards.

For various reasons, I was happy for her to drop her consumer Delta card. In early January (when I hatched this plan) she was earning an extra 3 miles per dollar on all spend with that card (thanks to an expired Amex refer-a-friend offer). So, the plan was this: she would continue to spend on that card until the offer expired near the end of January. Then she would cancel the card, wait a week or so, and then apply for the Aspire card.

Amex Derails Plan C

On February 1st, my wife would have cancelled her consumer Delta card, but that same day Amex came out with great new offers for existing cardholders of Delta cards, Hilton cards, and Marriott cards. Consumer cards got monthly restaurant rebates and business cards got monthly wireless cell service rebates. These amounted to easy free spend.

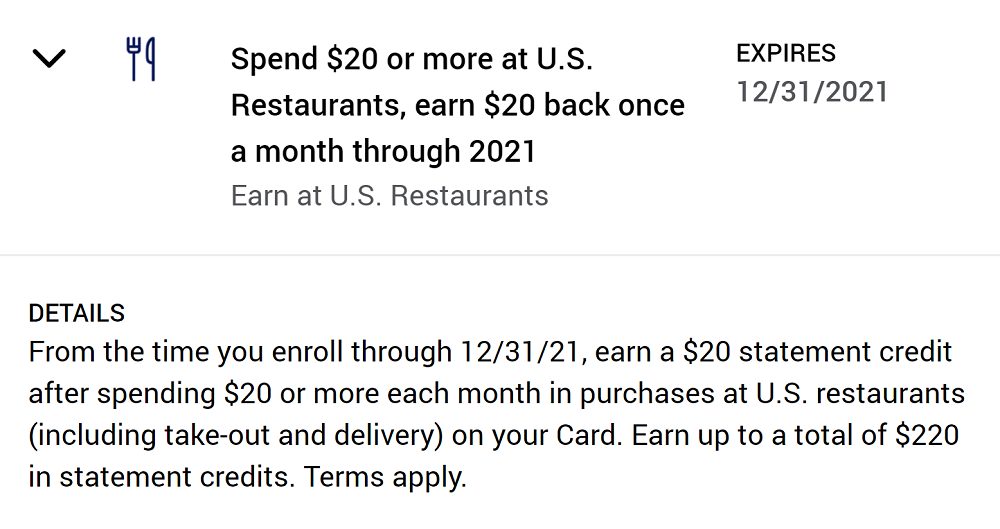

On my wife’s Delta Platinum card, she found that she would get $20 per month in dining rebates through the end of the year:

An eagle-eyed and detail-oriented reader might wonder why her offer was for $20 per month rather than $15 per month which we reported was the amount for Delta Platinum cards. The reason is that her card was a Delta Reserve card at the beginning of January and she had only recently downgraded it. It turns out that Amex gives you an offer based on what type of card you had earlier (presumably on January 1) and you get to keep that offer even if you downgrade your card.

Now, closing this card in order to sign up for a Hilton card is less attractive than before. If she closes it now, she’ll lose out on 11 x $20 = $220 in restaurant rebates. If she wanted to, she could even downgrade to the fee-free Delta Blue card and should be able to keep the monthly rebate offer.

It’s important to note, too, that if she gets a new Hilton card now, the Hilton card won’t come with a monthly restaurant rebate. Those rebate offers are limited to those who had their cards open on January 1st, 2021.

Developing Plan D

Let’s go back to my wife’s remaining cards to see which one she should cancel (if any). Here’s a list of her Amex credit cards, along with which great Amex offers are tied to each:

- Blue Business Plus: Spend $500+, Get $25 –10 Times (details here)

- Bonvoy Business: $15 monthly wireless

- Bonvoy Brilliant: $20 monthly restaurants + Spend $200 at Marriott, Get $50

- Delta Platinum business: $15 monthly wireless

- Delta Platinum consumer: $20 monthly restaurants

I find the wireless credits to be super easy to use. I simply log into AT&T each month to pay $15 with each enrolled card towards our family’s bill. Done. The restaurant rebates are a bit harder, but still pretty easy to get.

Ultimately, I’m leaning towards having her cancel her Blue Business Plus card. That’s an awesome card, in general, but she doesn’t need it. She hasn’t been using it for its 2X spend (we’ve been earning 2.62% cash back with my Premium Rewards card instead), and she doesn’t need it to keep her Membership Rewards points alive since she has a Gold card that she’s unlikely to cancel anytime soon. And while the Spend $500, Get $25 Amex Offer is really good, we have the same offer on both my and my son’s Blue Business Plus cards. I think there’s a good chance we wouldn’t use this offer on her card anyway.

Conclusion

Amex’s new restaurant and wireless credits have made it harder (or at least more costly) for my family to secure a new Hilton card right now. Of course, I’m not mad at Amex for giving us great deals! I do wish I hadn’t listened to Nick, though, when I considered moving my Membership Rewards points while a transfer bonus was in effect. That would have pushed the question of whether to get a Hilton card to a far later date. Thanks Nick.

My new plan is for my wife to cancel her Blue Business Plus card so as to open a slot for a new Hilton card. I don’t see much downside to it right now. However, I’m half hoping that Amex will come out with fantastic new Amex Offers for that card so as to make the decision difficult again…

![Hyatt goes next level with Mr & Mrs Smith [Integration “early 2024”!] a heart shaped sign over a house overlooking a body of water](https://frequentmiler.com/wp-content/uploads/2023/05/Mr-and-Mrs-Smith-and-Hyatt-218x150.jpg)

Huh. I finally got off the pop up hate list which I’ve been on for over a year and I think part of it was app’ing these new offers. I got the Hilton biz and had been denied it a few months ago

wife and I still holds OBC(old blue cash) cards, MSed $50K on grocery stores last year. With MS is getting harder and harder, not sure if it is worth it to keep them? any opinions? Thanks

Did you consider applying for Hilton Business card with different EIN ?

Like I mentioned in another post couple days ago, I was instantly approved even though I had that card several years ago under my SSN.

Greg’s challenge here is the Amex Credit Card limit (4 or 5 max per person). I believe Hilton Business card is still a credit card.

That’s right. The problem is that it’s a credit card

My point was that Amex may consider it as a different entity, just like Chase – denied Ink Cash under SSN, since other Ink card was issued already, but approved, when I used my other company’s EIN.

So if Amex does the same, they may approve you for a new card under new EIN (unless you have 4 cards for that EIN already) ).

Ah, I see. Are you saying that you’ve had success going over the 5 cc limit by using a separate EIN? I’ve tried that before with a second business (no go with Amex), but one of the 2 businesses was with my SSN instead of an EIN

Transfer from Virgin Atlantic?

I was thinking the same thing, but Greg would never give up the opportunity to spend a week on Necker Island.

Greg, what about this idea. You could borrow 134K Hilton points from someone that does not need them right now (like me). Then book your 3 night stay. Assuming another Hilton points sale or transfer bonus comes along in the next 1-2 months, you could either buy the cheap Hilton points or transfer MRs to Hilton, then transfer those points back to whoever you borrowed them from.

I think Necker Island is not in the cards for the next quite a long while, if ever. Earn & burn.

Good suggestions. Given what I do for a living, though, I want to find a good way to get the points or certs myself.

Fair enough, I’m looking forward to reading how you end up getting the Hilton points and certs. Have a great weekend.

I was told by amex yesterday that the current max limit of credit cards per person is 4, not 5.

They explicitly said the 4-credit-card limit was meant to be temporary, but it has been extended for the time being, and applies to everyone uniformly.

Your wife would need to cancel 2 cards to get the Hilton card.

I am afraid she will get stuck as well. I am not a Greg type spender but not too shabby and I also got caught in the four cards max issue recently even though I used to have five. No matter who I tried to talk to I couldn’t get around it – so frustrating if you are trying to have a strategy!

When I tried applying for a Hilton card myself, the agent explicitly said that I would need to drop 4 of my 8 cards in order to get approved for the Hilton card (which would be my fifth). I even asked her to list my credit cards to make sure she and I were on the same page and she did accurately list the ones I had. It’s possible of course that she was wrong but more likely they are applying different rules to different people.

Very interesting…

I had 5 amex credit cards when I applied for my latest amex credit card, and was told I’d need to close 2 of them to get my new application approved.

They even emphasized there is no exception to this rule these days.

I’d be very curious to find out what happens to your wife’s hilton card strategy eventually.

Please let us know!

How long does it take for wireless credits to post? I made 3 separate wireless payments on the 1st and haven’t received a credit or even an email from Amex.

I’ve found they sometimes take a week or so. Who did you pay? I doubt you’ll have an issue with that.

This type of article is such a good tutorial on evaluating the choices and the reasoning behind them.

How do you identify the “pay over time cards”? I forgot about this difference in cards, and had no idea of the separate 10 card limit for those cards, nor the number of them!

Thanks. See this post to find which cards are pay over time cards (aka charge cards): https://frequentmiler.com/amex-cards-charge-cards-vs-credit-cards/

How old do children have to be to get credit cards? This could open up a whole new world of points for me. LOL.

18

My two kids are authorized users on several of my credit (or my wife’s) credit cards. But the actual earning potential for sign-ups of their own? I’m leaving that for them to use as and when they see fit.

As Greg said, 18 to get their own cards. However, they can be added as an AU at a younger age which varies by issuer. Amex requires them to be 13 to be an AU. I believe Discover is 15. Citi and Chase don’t seem to care how they are — we added our son who was less than a month old when we got an offer for 10,000 Marriott points for adding an AU on a Chase card. My first son was also an AU on a Chase card within a month or two of being born.

https://frequentmiler.com/a-bundle-of-points-with-our-bundle-of-joy-nearly-200k-points-earned-in-the-first-month-of-life/

Reasons to add your kids as AUs:

Example of the last case: My college-aged daughter and her roommates did a camping trip out west last summer in a rental car. I applied for (and overnighted) a Chase Sapphire A/U card for her despite the $75 cost and asked her to use that for the rental. Sure enough, she dinged the car in a parking lot. Nothing serious at all, but very thankful to be able to transfer the whole thing to Chase’s coverage supplier.

I added my daughter as an AU to 4 cards beginning at age 16. She is now 18, has no credit history other than being an AU on those four cards, and her credit score is 800!

Just another reason why I love Frequent Miler…

Thanks all! I have one child over 13 so can add AMEX AU cards and two more closing in or can get a Citi or Chase card now I will keep my eyes open for offers!

Similar to the suggestion in the discussion on Hyatt points on the last “Ask Us Anything,” why not do a friend to friend point swap? Hilton to Hyatt (3 to 1), or something similar?

Yep, that’s a good idea

Can you explain why your son was denied three cards? Did he get the pop up blocker just saying he would not get the bonus points or outright denials?

No pop ups. Each app was simply denied. The letter that came afterwards for each was vague about the reason

One assumes he’s at the maximum, and / or has a spend history with Amex that indicates he’s a card churner. The real question is why does Greg have more than the maximum number of cards, and why did he get a pro-active call from Amex offering to help him sign up for this new card (albeit by closing four existing ones)?

Pretty sure that his very, very, very high spend history with Amex (he’s talked about routinely spending a quarter million dollars on his Delta card each year to get the Diamond waiver) have him marked as a “whale” in their system.

right on

Oh, come on. Just buy Hilton points and use them to get half off the cash rate. $400 a night for the Madison Beach Hotel in summer isn’t horrible (and just walk a block away for a great breakfast). You know you want it!

I had a lot of trouble following this post until I realized that the title was “Amex derails my Hilton plans” and not “Amtrak derails my Hilton plans”.

Has your son tried calling using the “Do you know who my father is?” line? I’m sure that would clear things up right away.

LOL

If you cancel that Blue Business, won’t you still be at the max 4 cards? How about plan E: trade some of those Marriott points with someone for their Hilton points?

Was gonna say Amex will only let me have 4 cc open right now… So I would apply and then recon and see what they say. Although I may be at the end of the amount of credit they want to extend me. Only have 2k cl on most recent approval.

The max only temporarily dropped to 4 per person. It now seems to vary at 4 or 5 although the last semi-official word I got from Amex was 5.

I just tried to get the Blue Preferred and received a call from AX Cust Service. I have 5 open credit cards along with the Plat, Gold and Green. They advised that I needed to close 1 of my credit cards to receive the Blue. So basically the current limit is 5 credit cards. Of course I guess that this can vary based on your relationship with Amex.

Nice idea to trade Marriott points for Hilton points. I’ll definitely consider that

Greg, there’s also been some datapoint of people getting retention offers on BBP even though it’s fee-free. Even though you want some more Hilton points for a potential redemption, if she is offered the chance for an extra few thousand MRs, that might be worth it depending on what other MR redemptions you are interested in for the next year or two.

I sent an email to your gmail related to this. Thanks!