NOTICE: This post references card features that have changed, expired, or are not currently available

Let me start by saying that I really struggled with an appropriate title for this post. I know that some people will skim ahead and think, “We knew that worked! It’s not unexpected!”. I furthermore understand that most people won’t be in the position to have something work out quite the way this did for my family — though I thought some readers would find value in understanding what happened so that they could leverage it to their benefit as much as possible. Finally, this one was a bit confusing — I apologize in advance if it gets tough to follow and I invite questions in the comments.

While this post isn’t necessarily about a completely unique path to the Southwest Companion Pass, it is about how it happened unexpectedly and offered some insight that may be particularly useful for anyone who refers friends to Chase products — and especially to those whose Companion Passes expire at the end of this year.

The Southwest Companion Pass quick overview

As you probably know, Southwest awards a Companion Pass to anyone who earns 110K Rapid Rewards points within a single calendar year. With this Companion Pass, someone can fly for free with the pass holder (paying only the taxes) an unlimited number of times throughout the validity of the pass. The pass is good for the rest of the year in which the 110K points are earned and the entire following calendar year. For more on the pass, see our Complete Guide to the Southwest Companion Pass. In my opinion, it’s the hands-down best deal in domestic travel.

The ideal time to earn the pass

We know that the ideal situation is to earn Companion Pass qualifying points early in the calendar year. This is because once you earn 110K points in a single calendar year, your Companion Pass is good for the rest of that calendar and the entire next calendar year. For example, if you finish earning 110K points in November, your Companion Pass is good for a total of just over 13 months (the rest of November, all of December, and the entire next year). On the other hand, if you earn 110K points in January, your Companion Pass is valid for more than 23 months (the remaining 11+ months of the current calendar year and all of the next year). For this reason, the best strategy has long been to sign up for two Southwest Airlines credit cards late in the year, but hold off on meeting the minimum spend until January. This way, your bonus points would post in January or February and you could enjoy nearly two years of Companion Pass travel.

But 5/24 puts a wrinkle in that for many

Unfortunately, all three Southwest Airlines credit cards are subject to the Chase 5/24 rule — meaning that you will not be approved for these cards if you have opened 5 or more new credit card accounts with any issuer in the past 24 months. That locks many people out of earning the Companion Pass through signup bonuses and has them scrambling for other ways to earn the pass (especially in light of the fact that Southwest plans to fly to Hawaii sooner or later).

Something that we already knew: Referrals count towards the Southwest Companion Pass

Something that isn’t news on the Southwest Companion Pass front: if you have the Southwest Rapid Rewards Premier or Southwest Rapid Rewards Plus credit cards, you can refer friends to apply for those cards and you will earn 10,000 points per approved friend. There is a cap on points earned from referrals: you can earn up to 50,000 points per calendar year on each card for referring friends. Now that many regular readers are well over 5/24 (and thus can not get approved for new Southwest cards and their associated signup bonuses), referrals can be a useful component in earning toward the Companion Pass. Even if you only get a few referrals each year, they can reduce the number of points you need to earn via other methods (many of which are detailed in our Complete Guide to the Southwest Companion Pass).

The timing & posting of referrals

Chase has recently begun sending out emails to let you know that your bonus “is on the way” when your friend or family member signs up through your referral link. Unfortunately, I’ve found these emails to be….glitchy. I sometimes receive such an email when I’ve made a referral and I sometimes don’t. The amounts shown in the emails don’t always line up. The good news is that if I receive an email, I know I’m going to earn some referral points on my next statement. While Chase referrals were notoriously slow to post in the past, my recent experience has indicated that points become “pending” about 7 days after your friend signs up using your link. Those pending points should then post on your next statement cut date. For example, let’s say you referred a friend today (February 20th). I’d expect the points to be “pending” as of about February 27th and to then post on your next statement after February 27th. One key note: While you can see how many Ultimate Rewards you’re earning on your next statement and use that number to determine your “pending” referral points, there is no way to know if and how many “pending” points you have with co-branded cards apart from receiving a Chase email saying that “points are on the way”.

As a blogger, I’m very lucky

As you probably know, we list the best publicly available offers on our “Best Offers” page. Sometimes that means we list referral offers when they match the best publicly available offers. I know that I am infinitely lucky as a blogger with a platform from which to share my referral links with a large audience. I am very appreciative that people enjoy Frequent Miler content and sign up using our links – whether they be referral links, affiliate links, or links with no connection to us.

But at the risk for a moment of sounding ungrateful (and believe me, I’m not), when my wife received a couple of emails in late December that points were “on the way” from referring people for the Southwest Airlines Premier card, I was ever so slightly bummed about the timing: those points wouldn’t post until her January statement — meaning that even though these referrals signed up in December of 2017, the points would be posting in January 2018. As the points were being awarded in 2018, I assumed they would count against her 50K cap for 2018. Definitely not the end of the world as we’re lucky to receive these points either way — but this was something I would keep in mind in the future: December referrals might not post in time to count for the current calendar year.

But you might be able to leverage that big time…

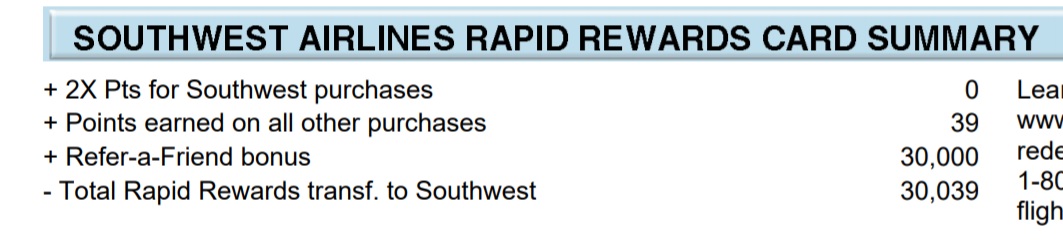

But something interesting happened. When my wife’s statement cut in early January 2018, she received 30,000 Refer-a-Friend points, presumably from people who had signed up in December 2017.

On the one hand, that was awesome. Thirty thousand points buys about $450 in Wanna Get Away fares. With the Companion Pass, it kind of feels like it’s worth double that amount (even though that’s some flawed math). But on the other hand, I thought that the referrals she picked up in December 2017 had consumed 30K of her 50K cap for 2018. While I certainly wasn’t going to lose sleep over being lucky enough to pick up some referrals, I thought that we could have potentially earned even more total referral points if those referrals had posted with her December statement (so that they wouldn’t count against her 2018 cap). But that didn’t turn out to be the case….

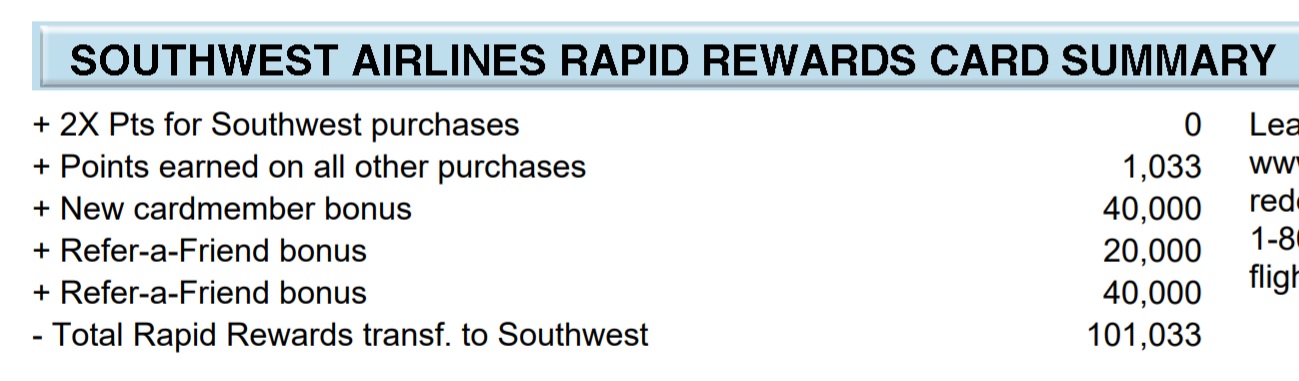

When her February 2018 statement cut, she received more referral points. On the statement below, you’ll see that she earned a 40,000 point new cardmember bonus (she applied when the signup bonus was only 40K) — but then check out the refer-a-friend bonuses:

She earned two separate totals of Refer-a-Friend bonuses: one total of 20,000 points and one total of 40,000 points. She earned a total of 60,000 Refer-a-Friend points from her February statement alone. Plus she had previously earned 30K in January — that’s 90K points from referrals that posted in 2018 — well over the 50K cap (she only has one Southwest personal card). Was Chase totally glitching out and allowing way over 50K points from referrals in a calendar year? I don’t think so….

What I’m pretty sure happened

After thinking about it, I realized what must have happened is this:

- Three referrals signed up in mid-December 2017 — late enough to be after her December statement cut, but early enough for at least 7 days to have passed before her January statement cut (so the points had time to become “pending” before her January statement). She received 30,000 points in January for those three mid-December 2017 referrals.

- Two people signed up at the very end of December 2017. My wife’s January statement cut in the first couple of days in January. Those late December 2017 referrals had not yet passed the 7-day threshold for the points to become “pending” before her January statement cut. Therefore, those three referrals came pending in January after her January statement had cut and did not post to her account until her February 2018 statement. That’s the 20,000 Refer-a-Friend bonus points in her February statement. Between the 30K that posted in January and these 20K, that adds up to the 50K cap for 2017 referrals.

- Four more people signed up during January 2018 and those 40,000 points posted on her Feburary 2018 statement — counting towards the 2018 referral cap.

- My wife received a total of 50K points for 2017 and has received 40K for 2018 — but all 90K points posted to her Southwest Airlines account in 2018.

Why does this matter?

It matters because of this: I realized that it is possible to actually receive 100,000 Southwest points in a single calendar year from referrals for a single Southwest card if you share your referral link with friends after your December statement cuts. Chase clearly counted the 5 people who signed up in December 2017 toward the 2017 cap — but as far as Southwest is concerned, the points posted to her Rapid Rewards account in 2018…meaning that they are all 2018 Companion Pass-eligible.

This might make a huge difference in your strategy if you rely on referrals to help you earn the Companion Pass (remembering that the best strategy is to earn 110K points as early in the calendar year as possible in order to get nearly 2 years of Companion Pass travel). It’s also great personal policy to refer your friends at the end of the calendar year so that they earn their signup bonuses early in the next calendar year — it’s a win-win.

As an example, let’s say that you have a Companion Pass expiring on December 31st, 2018 (many California residents may find themselves in this spot if they took advantage of the 1-card Companion Pass special last year). Ideally, you would like to earn 110K points in January 2019 so that you have a Companion Pass that is good for all of 2019 and 2020 (through December 31st, 2020). If you have one of the Southwest personal credit cards, your best play is to share your referral links in December 2018. This way, any referrals you pick up in 2018 will count towards your 2018 cap with Chase — but will post with your January 2019 statement and therefore count with Southwest Airlines towards your 2019–2020 Southwest Companion pass. In fact, if you have both Southwest personal credit cards, you could theoretically earn up to 200,000 referral points in 2019 if you timed it right and waited until December to share your referral links.

This is a game-changer in terms of referral strategy. Obviously not everyone has the ability to pick up 5 referrals in December and 5 more in January — but even if you can only pick up two or three referrals, your best bet is to refer people during the December when your pass is expiring. Let’s say you pick up three referrals in December 2018 (after your December statement cuts). Those 30,000 points will post in January 2019. You’re then starting the year with only 80,000 points to go to reach the Companion Pass. If you can then manage to get 5 more people to sign up during 2019, you’ll be at 80K of the 110K points necessary for the 2019-2020 Companion Pass — greatly reducing the number of 1800Flowers orders you need to place to reach 110K — and that’s assuming you only have one Chase Southwest Airlines personal card.

This doesn’t only apply to the Southwest cards

Of course, this does not only apply to the Southwest cards. When I saw what happened, I checked data across other cards and I was able to determine that the same thing happened with other Chase cards — referral bonuses posted in January from December referrals, but they did not count against the 2018 referral cap. If you referred people for Chase cards in late 2017 and the referral bonuses posted to your account in 2018, be aware that those do not appear to count toward the 2018 caps.

Bottom line

Most people aren’t in the position to share referral links with a wide audience. However, whether you can pick up one referral a year or five, this means that in terms of inching toward the Southwest Companion Pass, your best bet is to time those referrals for late in a year in order to count together with your next-year’s referrals. In my case, my wife’s Southwest Companion Pass will expire on December 31st, 2019. I would not have her share her referral links between January and November 2019, instead choosing to share her links in December 2019 so that they could combine with her early 2020 referrals toward a 2020-2021 Companion Pass. Of course, that’s assuming that the Companion Pass remains the same and that referral points continue to count toward the pass. I think it’s safe to assume for those with passes expiring this December that you may be best off waiting until the end of this year to share your referrals with others so that the Rapid Rewards points can combine with next year’s referral earnings toward a 2019-2020 Companion Pass.

[…] the prior year and if they sign up on January 1st that would count toward the new year. (See also this interesting article from Nick on Frequentmiler regarding how to time your Southwest referrals right to maximize earnings toward a Companion […]

[…] annual cap on referrals is 50,000 points per card. A couple of years ago, I discovered that referrals made after your December statement cut date but by December 31st count toward the current calendar year’s Chase referral limit, but will […]

My wife’s Companion Pass expires next month. We took six trips with it this year and it has been great.

Now it’s my turn. I planned on getting a Southwest Business card for the 60,000 points. I received a mailer a few weeks ago for a Plus card – 40,000 points plus a $100 statement credit for $1,000 spend in 3 months. Applied and the web site said they would let me know. Received a letter – “Too many credit cards opened in the last two years associated with you.” I’m at 3/24. Is it worth a call? Should I try the Premier or Priority card? My credit scores are 822 and 823. Thanks!

If you’re sure you’re at 3/24, my guess is that it’s authorized user cards putting you over 5/24. Are you an authorized user on your wife’s cards and/or someone else’s? If that’s the case, the system will deny you, but you can usually talk with a reconsideration rep and explain that you’re just an authorized user and not financially responsible for those accounts. They will usually approve on recon in that case.

Thanks, Nick. Credit Karma shows 5 credit cards – 3 Chase, 1 Elan (Fidelity VISA) and Dell Financial.

I called reconsideration and he said that in the case of being declined for too many cards opened in the last two years there was nothing they could do. I guess I’ll try applying for one of the other Southwest Visas and see what happens.

[…] cause the points to post in January and count towards the new year’s Companion Pass. See: An unexpected path to the Companion Pass for more). So referring one person who plans the same sort of path would bump you up to 114K […]

[…] Since you can earn 50,000 points per calendar year from referrals (and I previously wrote about how you may be able to actually earn 100,000 from a single card in a single calendar year), it might make sense to have both if you think you might be able to refer friends in the […]

Does it make sense to try to get the companion pass this late in the year for us if ours just expired in Dec. My husband believes we should wait until we are going to travel more. We did however just purchase a second home out of state and would like to take advantage of low airfares. I also still have both Chase SWA cards but do not use the business card. Would you recommend cancelling it (or both) now or in May after I receive my anniversary points? When applying again for the SWA cards (possibly in 2 years), do I have to wait 2 years from sign up or cancellation. Thank you.

Whether or not it makes sense to go after the Companion Pass right now depends on how quickly you can earn it and how much use you’ll find for it the rest of this year. We’re still in Q1, so I wouldn’t call this late in the year necessarily — but if you won’t earn the pass until June and you won’t use it until November, you might not get enough value out of it this year for it to be worthwhile. On the other hand, if you’ll earn it next month and you have a lot of summer travels planned, you might get huge value out of it this year. It’s hard for me to say.

As for the signup bonuses timeline: With Chase, you have to wait two years from when you last got the signup bonus. It’s not connected to the date you signed up nor the date you cancelled — it’s 2 years from the date you were awarded the signup bonus points (which will be the next statement after you’ve finished meeting the minimum spend). You’ll want to go back through old statements to see when you last got a signup bonus.

I had the SWA business card for over 2 years now and my anniversary date is in May and do not use it much. Should I cancel now or wait for the 6000 anniversary points?

Chase gives you 30n days from the day the annual fee is billed to cancel and receive a refund of the fee. You may be able to get the points and cancel without paying the fee.

If you were thinking you’d pay the fee and get the points, that may or may not be worth it. Southwest points are only worth around 1.6c towards Wanna Get Away fares — so at best, the 6K anniversary bonus is worth $96 (and the fee is $99). That said, anniversary points count towards the Companion Pass. If that 6K will be useful in qualifying for the pass, it might be worthwhile.

Remember that there are 3 Southwest credit cards — 2 personal (Plus and Premier) and 1 business. The current signup bonus on the business is 60K and the Plus and Premier each have 50K signup bonuses. If you opened the business card and one of the personal cards, you’d get 110K from the signup bonuses alone — that extra 6K points wouldn’t matter. If you were to open the two personal cards, you’d get 100K from the signup bonuses and 4K from the required spend — in which case, that 6K anniversary bonus on the business card would put you over the top.

Just wondering if transferring in points counts too. Can you transfer in points from Marriott to southwest and have them count towards the 110k limit for the companion pass?

No. That stopped working in March 2017. See our “Complete Guide to the Southwest Companion Pass” (linked in the Companion Pass Quick Overview section of this post) for more on what works and doesn’t work.

Very well explained and a good catch.

A side question do you now If I can refer my self to the chase ink preferred and get the both the the referal and bonus ?

I have a ink plus

Good question. I’m not sure.

Is the business card really subject to 5/24? I thought it was separate meaning I could be at 4/24 and sign up for a personal card then get the business card too.

You have two separate questions.

1) Yes, the business card is subject to 5/24.

2) Yes, you can (theoretically) sign up for 2 Chase cards in the same day if you’re at 4/24. That’s not unique to the Southwest business card.

Finally, you might be confused by this: Chase business cards don’t *add* towards your 5/24 count. So if you’re at 4/24 and you apply for a Chase business card, you’re theoretically still at 4/24. A lot of people get confused by the semantics of “subject to the 5/24 rule” vs “count towards 5/24”. For a more thorough explanation, see this post:

https://frequentmiler.com/2017/09/07/chase-business-cards-dont-add-524-count/

Awesome, thanks!

I know people like you who put credit card links all over their FB page to get bonus points. It would be annoying , except I don’t look at Facebook.

Me, I’ll stick to placing 110 orders of $1 candy for $29.99 from 1-800-flowers.

Besides, the fatter I get eating the 1.5 million calories, the fewer people I have to deal with , and I get 2 seats for the price of one under the Customers of Size program

Can you elaborate on this strategy? I love candy and miles 🙂

See our Complete Guide to the Southwest Companion pass for more detail on that. Specifically, see section 3 on 1800Flowers:

https://frequentmiler.com/complete-guide-southwest-companion-pass/