NOTICE: This post references card features that have changed, expired, or are not currently available

Bank of America has updated its Preferred Rewards program and it’s good news. There’s been no devaluation because existing tiers will remain unchanged; the updates simply include a couple of new tiers at the top end.

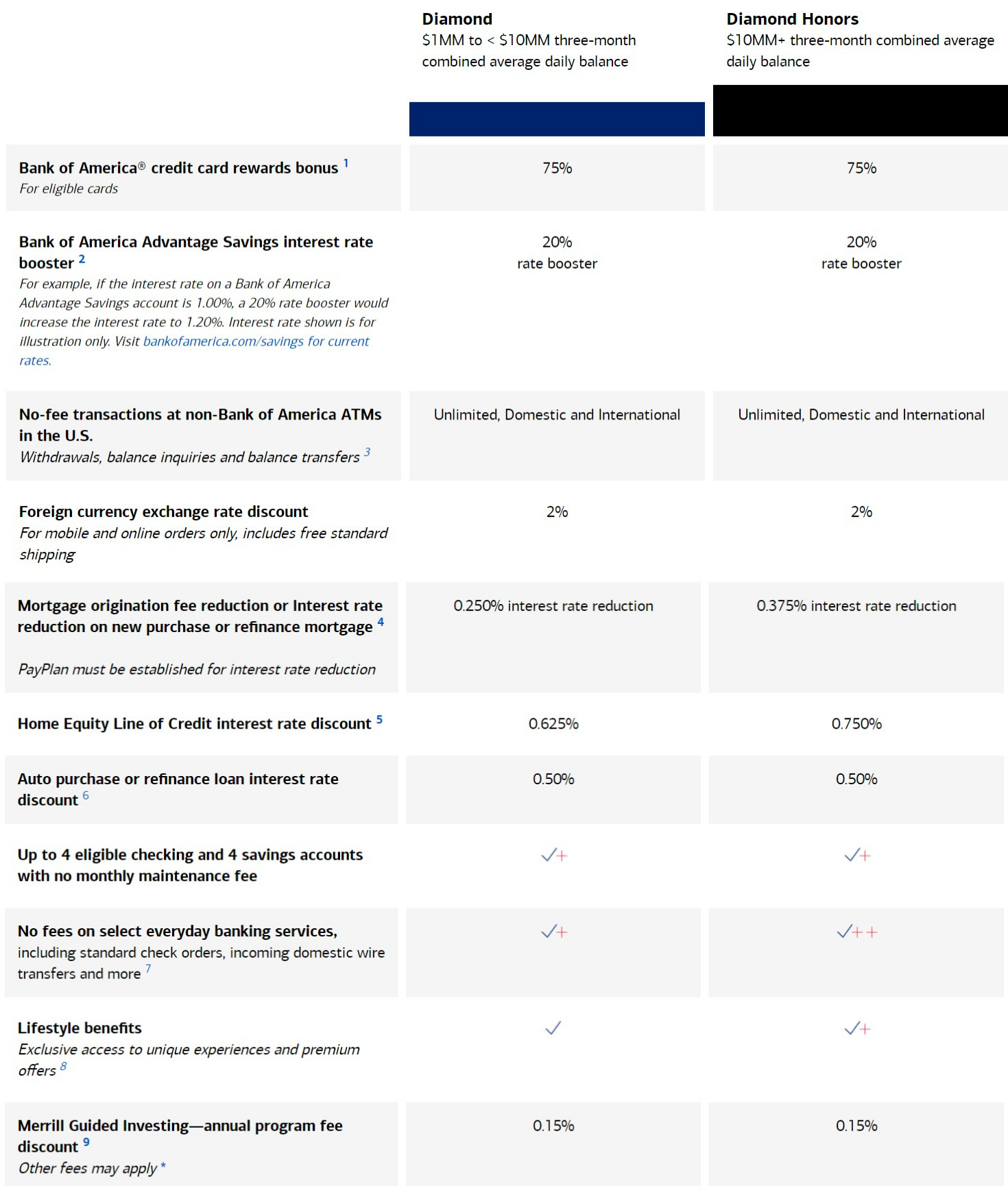

You can find more information about the existing Gold, Platinum and Platinum Honors tiers here. The changes that have just been launched relate to two new tiers – Diamond and Diamond Honors. Here are the benefits you receive at both of those levels:

You can earn Platinum Honors status with Bank of America Preferred Rewards by having $100,000 with them which can include retirement funds with Merrill Edge. For these two new tiers you’ll need significantly more funds saved with them – $1 million for Diamond status and $10 million for Diamond Honors; that’s based on a three month combined average daily balance.

Unfortunately that doesn’t come with a higher credit card reward bonus as both of these new tiers offer a 75% Rewards Bonus which is the same as Platinum Honors. At 20%, the Savings Rate Booster is the same too.

Where these higher status tiers could be more useful is in different areas. For example, if you have a Home Equity Line of Credit you can get a 0.625% or 0.75% discount for Diamond and Diamond Honors respectively. That’s higher than the 0.375% discount you get from having Platinum Honors status.

Mortgage origination fee or interest rate reduction on mortgages could represent significant savings depending on the size of said mortgage. Platinum Honors comes with a flat $600 reduction in the origination fee, so the percentages on offer for Diamond and Diamond Honors customers could save far more depending on the size of the mortgage. The Platinum Honors benefit is also only available for origination fees, whereas Diamond and Diamond Honors members can apply that discount towards the interest rate itself.

It seems like Lifestyle benefits are the other main enhancement, with savings and/or unique opportunities being available for Diamond and Diamond Honors members in the following categories:

- Travel

- Luxury Merchandise

- Events & Experiences

- Personal Services

Platinum Honors used to have no-fee international ATM. Looks like it’s for Diamond only now.

I hope the tellers in my local bank know the status and don’t make you fill out a freaking deposit slip or make you wait 20 minutes to go to safe deposit vault.

My family has done personal and business banking with BofA since the 1920s (and perhaps before). I have done personal and business banking with BofA since the 1970s. It just ain’t the bank it used to be. “Relationship” is no longer in its vocabulary. I’m closing my last two business accounts by year end.

Disappointing ☹️

Very similar story. My father used to do work with the Giannini’s back in the day.

It’s becoming a high end coupon book just like Amex platinum, without the desirable transfer partners.

Guess I’ll apply for the new Capital One ultra premium card after all. Happy though they didn’t change the bonus tier thresholds…

This is not at all exciting news. Former BofA customer here. After years of banking with BofA, I went to other banks for personal and business banking. You can get better interest rates in checking and savings, no-fee banking, and reduced mortgage fees if you just shop around and can live without the elite labels. If you have the kind of liquid assets that BofA requires to get these perks, why would you want to tie up those funds with a bank that gives you little and charges you more?

Bah humbug …. These 2 extra tiers do not give much more discounts in rewards – The 75% Honors tier at the 100k level with a cheap no cost IRA at Merrill does most of the work – the sweet spot – the rest are illusions for most and not worth the extra money at BofA

Yes, but that’s the good news! Many of us were worried that they would reduce the 75% benefit for the $100K level. It’s awesome that that is intact.

Agreed!