View from the Wing reports on a new, easy, and potentially fairly lucrative offer to earn miles with a savings account from Bask Bank. While many long-time readers will remember BankDirect, this is actually a different account that I believe is backed by the same entity (Texas Capital Bank, N.A.). This Bask Bank account works similarly, but is better in many ways. I’m only half sold on the long-term value proposition, but I was sold enough to sign up and pick up a very easy 6,000 American Airlines miles at least in part because you never know when that kind of mileage may get you to New Zealand.

The short story

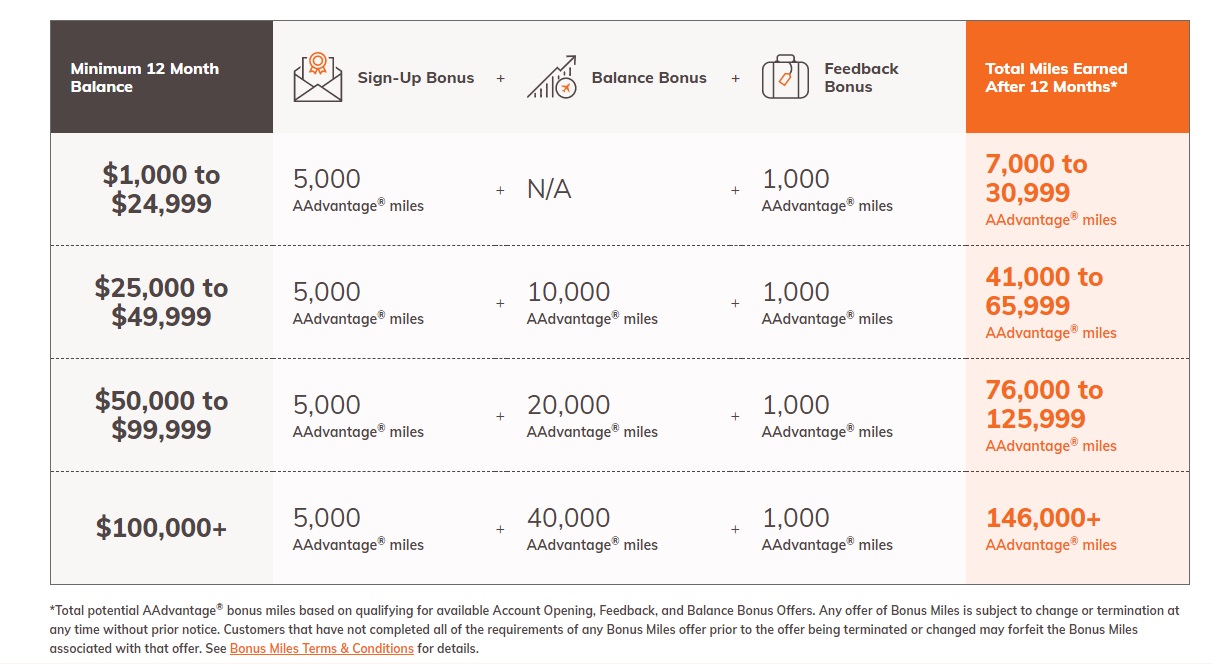

- Bask Bank is offering a mileage-earning savings account. You’ll earn 1 American Airlines AAdvantage mile per dollar saved annually (more on how this is determined below). You can additionally earn new account bonuses as follows:

- Open an account and provide app feedback (can be done immediately after opening an account), get 1,000 AAdvantage miles

- Deposit $1,000 and maintain that minimum deposit for 30 consecutive days within 60 days of account opening and get 5,000 AAdvantage miles

- You can additionally earn bonus miles by funding your account within 60 days and maintaining a minimum balance for 360 days thereafter (keep in mind that these totals are in addition to 1 mile per dollar saved for a year):

- Fund and maintain $25,000 for 360 days and get 10,000 bonus miles

- Fund and maintain $50,000 for 360 days and get 20,000 bonus miles

- Fund and maintain $100,000 for 360 days and get 40,000 bonus miles

- Direct link to Bask Bank for more information and to open an account

Will you get a 1099-INT tax form?

Yes, you will. However, Bask Bank is valuing the miles at a rate of 0.42c per mile. In other words, you’ll be taxed on a value of $4.20 per thousand miles. If you earn 10,000 bonus miles, you’ll therefore owe tax on $42 worth of “income”. I’m not an accountant, and this obviously varies based on your tax bracket and situation, but doing the quick math on tax brackets between 12% and 32% (which I think covers most Americans), that seems like a fairly reasonable amount.

Of course, note that Bask Bank could make changes here. At the moment, it seems they have a pretty fair valuation that won’t necessarily be a deal-breaker.

How hard is this to do?

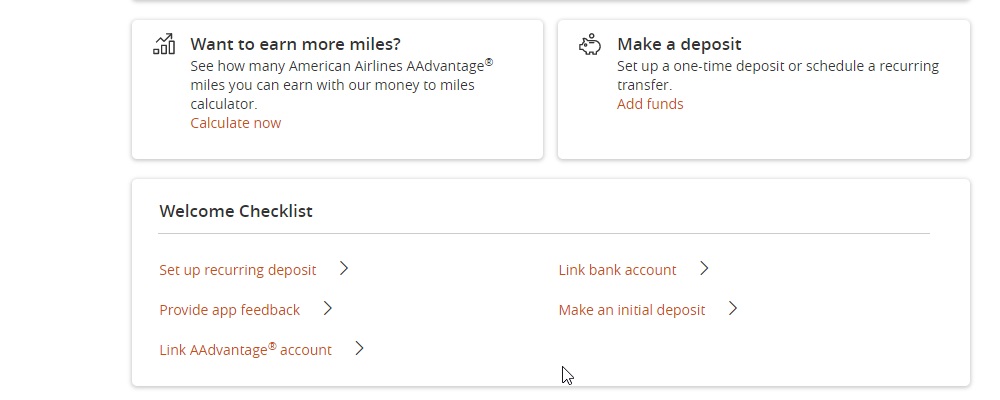

Opening this account is incredibly easy. It took me 9 minutes and 37 seconds total from the time I hit “Open an Account” to the time when I had arranged the transfer to fund it and logged in to provide feedback. That includes time spent taking screen shots and Googling an answer for one of the ID verification questions (just an odd coincidence I think — they asked which street was closest to an address on file and none of the answers sounded familiar to me) — you may find it takes you half my time. There is no hard pull and you can link your external account via bank login (they use Plaid for this) and fund your new Bask Bank account that way or you can alternatively use their routing number and your account number to fund from an external source after opening. It was as quick and easy to open the account as one would expect.

Normal mileage earning

This account earns 1 mile per dollar saved annually. Here’s how the FAQs explain that:

The Bask Savings Account awards one AAdvantage® mile for each dollar saved annually. Miles are accrued daily and awarded monthly based on your average monthly balance. For example, if the account’s average monthly balance for January is $60K, you will earn 5,096 AAdvantage® miles for that month ($60K ÷ 365 × 31). If that same balance is maintained in February, you will earn 4,603 AAdvantage® miles. After one year of maintaining an average balance of $60,000, the customer will have earned 60,000 AAdvantage® miles.

In other words, they figure your average monthly balance and pay you the miles earned for that month’s share of a year’s miles, so the number of miles you earn could vary each month if you are depositing or withdrawing. If you leave the money alone for a year, you’ll earn 1 mile per dollar at the end of a year’s time.

Bonus 1: Share feedback get 1,000 miles

After opening the account and logging in, you can easily click to “Provide app feedback” within your account and given them a star rating and write a couple of sentences. In my case, I gave a slightly longer piece of feedback due to the identity verification question oddity I encountered, but I don’t think others are likely to have the same situation.

Note that the terms state that miles will be deposited in your AAdvantage account within about 10 days (assuming you link your AAdvantage account, which can be done from your account dashboard after opening your account and logging in by clicking the “Rewards” tab). However, Gary Leff reports that these bonus miles for feedback showed up in just a couple of days.

Bonus 2: Fund with $1,000 within 60 days and maintain it for 30, get 5,000 miles

Bask is also offering a new account opening bonus. When you deposit $1,000 and maintain that minimum balance for 30 consecutive days within 60 days of opening your account, you’ll get 5,000 bonus American Airlines AAdvantage miles. While that quantity doesn’t feel huge, the total of 6,000 bonus miles between providing feedback and depositing this $1,000 is potentially enough for some economy web specials within the US, and we’ve even seen international flights to New Zealand and Australia for 6,000 miles one-way (not likely to be a regular occurrence, but a good illustration as to why I’d argue that it’s worth picking up easy miles when you can). With the extremely low bar set here, I’m happy to collect 6K miles with near-zero effort and very little opportunity cost.

Bonus 3: Bonus tiers for minimum 12-month balances

In addition to the bonuses for providing feedback and leaving $1,000 on deposit for the minimum time period, and in addition to the 1 mile per dollar saved annually that you earn in lieu of interest, you can earn the following bonuses for maintaining minimum balances over a longer period of time. Note that while these are advertised as being based on meeting the requirements for 360 days, the bonus are paid out each 180 days and they note that you could trigger different bonus thresholds (for example, earning the bonus on $50K deposited for the first 180 days and then withdrawing $25K and earning the bonus based on $25K for the second 180 days). Again, here are the bonus tiers:

- Fund and maintain $25,000 for 360 days and get 10,000 bonus miles

- Fund and maintain $50,000 for 360 days and get 20,000 bonus miles

- Fund and maintain $100,000 for 360 days and get 40,000 bonus miles

As noted above, these are in addition to all of the other bonuses and the miles earned annually.

For instance, if you opened an account today and deposited $25,000 and provided feedback and then left the money deposited for 365 days, you would earn:

- 1,000 miles for providing feedback

- 5,000 miles for depositing $1K and leaving it for 30 days within the first 60 days of opening your account)

- 25,000 miles for saving an average daily balance of $25K for 365 days (earning the full 25K miles is based on your balance for a full year)

- 10,000 miles as a bonus for funding and maintaining $25K for 360 days

- 41,000 total miles

That’s not terrible and could be pretty good depending on your use of the miles. Based on the current valuation, the 1099-INT for those miles should be for $172.20, so that should be the approximate amount of income on which you would owe tax based on your situation.

That stacks up great against the average savings account. On the other hand, most people with enough cash on hand to meet the bonuses are hopefully keeping that money in accounts with a decent yield.

Is this worth the opportunity cost?

In terms of opportunity cost, it’s a fairly interesting debate. You’re getting 6,000 miles for depositing a thousand bucks for 30 days, and I think that’s a no-brainer. The real question becomes whether or not to deposit $25K (or more) for a year.

By depositing $25K and leaving it for a year, you’ll earn 35,000 miles (25K at 1 mile per $1 saved and 10,000 bonus miles for leaving $25K for 360 days). Based on their current mileage valuation, the 1099-INT value of those 35K miles is $147. You’d therefore owe tax on $147 in “income” for the 35K miles. If your tax rate were 24%, you’d pay $35.28 in tax.

Let’s say that your other option was to keep that $25K in a SoFi Money account, where it currently earns 1.6% APY. Instead of earning 41,000 miles, you could earn $400. You would then pay tax on $400 in income. Based on the same tax rate of 24%, you’d pay $96 in tax for a net win of $304.

Is it worth taking the miles over the money? While miles devalue and money is much more flexible, I think that’s not a bad trade for many people.

That said, I’ve recently written about taking advantage of bank account bonuses and between high-yield accounts and new account opening bonuses, there are certainly opportunities to potentially do better than 1.6% APY with little effort. If depositing money here would take place of taking advantage of other opportunities, you’ll have to do the math on what makes more sense for you.

I’ve personally been putting more focus on investing as of late and I’m not sure I want to tie up $25K or more for a year to earn these miles. If you could otherwise invest $25K to the tune of a 5% gain over the course of a year, you’d do much better (in my opinion) than the value of the miles. That only compounds as you reach the higher bonuses.

However, investing carries risk and could result in a loss, whereas this is FDIC-insured savings that is earning a reliable mileage return. The buying power of those miles isn’t entirely reliable and neither is your account with AAdvantage guaranteed to remain open, but I imagine that many of us could maximize well enough to do reasonably well with very little risk.

Bottom line

After the recent revelations that BankDirect is now valuing miles quite highly, it’s great to see a new savings option that enables you to earn miles on money you have sitting around. Whether or not this type of account compares favorably to other options really depends on what you’re currently doing with your money. I suspect that many readers could put together the miles for a business class ticket with their emergency fund saved here through Bask Bank. If that money would otherwise be sitting in an “average” savings account earning next to nothing in interest, this would certainly be a better choice.

H/T: View from the Wing and Free Frequent Flyer Miles

[…] Poor Gary Steiger, has been around longer than everyone else online and gets no respect. Finds a way to earn AA miles with Bask Bank, posts it….and days pass and View From The Wing reads it and posts it and then….in true Boarding Area brotherhood everyone links to VFTW. It has been going on for years and this shit irritates me. Read Gary Steiger’s response to me pointing out the injustice in the FM post! […]

IMHO Bask beats BankDirect (their financial sibling, both being owned by same company) because the latter charges $12/month fee.

Like Nick, I found the ‘closest street to an address’ question very difficult on the Bask application. I evidently answered wrong, but a quick call to Bask got me approved.

And yes, funds ACH’d to Bask take several days to post…weird.

.42 c per mile works out to four hundred and twenty dollars of taxable income for one thousand miles which is quite high.

Your math is a little off there I think. One cent per mile works out to $10 in taxable income per one thousand miles. In this case, Bask Bank is valuing the miles at less than half that — 0.42c per mile (under half a penny each). In other words, four dollars and twenty cents of taxable income per thousand miles.

1 mile = $0.0042 in taxable income

1K miles = $4.20 in taxable income

10K miles = $42 in taxable income

100K miles = $420 in taxable income

etc

I think the confusion is that .42 cents per mile works out to 420 cents not 420 dollars of taxable income.

I TINK if $600 before it’s report to the IRS.

CHEERs

Nick–any analysis on whether this beats $50K in Bank Direct checking? Seems like if the bonus tiers are reoccurring after the first year, yes (70,000 miles for $50K beats the 60,000 miles for $50K one earns with a Bank Direct checking account), but if they are not, no. Couldn’t quite tell from your write-up whether the bonus tiers are one-time or every year. Also important since I gather that once your BankDirect mileage checking is closed, you can’t get it back since it is a grandfathered product.

Yes, it was easy to open the account online. However, 4 business days have passed since my $1000 transfer left my other bank and it still has not been received in my bask account. This is very slow and very poor performance in my opinion.

Another day has passed, and despite Bask’s promise that my $1000 will be in my account today, it still is pending. Now they tell me I have to wait another day. I can not recommend anyone to open an account with them.

Well tomorrow will be a week for me. I opened the account on 1/15 and did the survey right away. The money disappeared out of my source account on 1/16 and here it’s 1/22. The 1000 AA miles for the survey say they’ve been awarded today but not showing up at AA. In addition,funds still not appearing at Bask and still no 5000 AA miles.

Bask Bank held my $1000 for 6 business days until it was available in my account. The 1000 miles for the survey posted promptly (within a day or two after I provided feedback). The 5000 miles posts after a month, according to a number of people)

This was first reported at veteran Gary Steiger’s site.

VFTW does not link to Gary S.

You link to VFTW.

And it goes on…

When I first saw this…I yawned. My threshold for adding mental real estate these days is much higher. I am stayinh with my high yield savings account.

Good luck y’all.

This bank will likely hit you on the way out imho.

Yes, it is a bit strange to me that bloggers don’t track my posts. I often post good offers before anyone else, and I don’t mind bloggers using that info (though credit would be nice…) I have been doing this since before the word blog existed.

I had very good experience with this offer, and described it on my What’s New page on http://www.freefrequentflyermiles.com/index.htm at the date 1/10/20.

Thanks for the link Gary. I always hat tip the first place I see something (or that site’s source if they hat tipped someone else). In this case, VFTW is where I learned about the deal, so that’s where I linked to.

I wasn’t familiar with your site and appreciate the link. It was initially a little hard to follow where to find this offer on your site, but I did eventually find it and added a hat tip to you. In this case, VFTW had much more detailed info on the promo, so I haven’t removed any links there but rather added a link to you as well. Thanks again for commenting.

Thanks much.

When all the necessary info for an offer is easily available on the page to which I link, I don’t repeat it on my website, thus not forcing my readers to plow through stuff they don’t want to read in order to get to stuff that interests them. I don’t “sell”. My readers seem to appreciate this.

Neither are we “selling” anything with regard to this deal. We have no vested interest in whether or not anyone opens an account, same as you.

I can certainly appreciate that we all have different philosophies and preferences in terms of how we want to present and absorb information, and that’s great. Different strokes for different folks. My point in mentioning that I had trouble finding the info on your site is that if you would prefer we (or any other blog) link to your content, it’s helpful to have a direct link rather than a generic link to your homepage as I know readers who click through are expecting to be linked directly to the information they want (as you note many folks do value that) rather than to a home page where they have to hunt around to find the desired information. I did eventually find that and added it.

Hi Gary, I used to track your site but as far as I know there’s no RSS feed, and the old method (change detection) no longer works for me since that service was acquired. Sorry I did not see you write about it. Best, Gary

I am now using Watchete to get notice to my readers of new posts on my website. Instructions at the top of my What’s New page.

I don’t think the 6,000 mile bonus is really a no-brainer. Using 1.3 cpm RRV, this bonus is worth $78. Bank account opening bonuses of $100 and up are dime-a-dozen. I actually set my bank account bonus threshold at $200, and that keeps me plenty busy, so this is an easy pass for me.

And anyone who values AA miles highly would probably be better off finding a better/higher cash bonus and purchasing miles instead, including at the tiers requiring large deposits.

Andy

I agree flip a card . Chase I have had their cards for 12 years .They email me about opening an account every offer is better too . But it’s like 3 pages to open a Bus account Forget that ..

CHEERs

Did you have Chexsystems frozen when you applied?

I did not. I wouldn’t think they pull Chex for a savings account, but I could be wrong.