Bilt is a program where you can earn points in many ways: housing payments, dining out, shopping, using a Bilt credit card, and more. You can then use those points in a variety of ways, including transferring them to one of Bilt’s industry-leading portfolio of travel partners.

This guide will cover everything you need to know about Bilt’s rewards program.

Bilt Overview

Bilt was a program originally designed to enable renters to earn points on their rent. This makes the program and associated cards unique in offering a simple path to earn points on the largest monthly expenditure for many people.

Over the past couple of years, Bilt has continued to expand through partnerships with neighborhood restaurants, fitness centers, Walgreens, and other businesses, creating opportunities to earn rewards on many types of neighborhood purchases.

There are several ways to earn and redeem Bilt points, each of which is covered below.

Bilt Elite Status

Bilt has an elite status program that allows you to earn interest on rewards points, among other benefits. One of the biggest perks of elite status is having access to better offers on Bilt’s monthly Rent Day promotion, where transfer bonuses and various other opportunities will be more generous depending on your elite status level.

Here’s the current summary of Bilt elite levels:

You can qualify for elite status by total points earned or through the “Fast Track” via non-rent spend in several different channels, including:

- Bilt credit cards (excluding housing payments)

- Neighborhood Fitness classes booked through Bilt

- Bilt Dining at restaurants with any card linked to your Bilt account

- Spend at Walgreens with any card linked to your Bilt account

- Booking trips through the Bilt Travel Portal

- Linking your Lyft account and using it for rideshare

Elite status thresholds are as follows:

- Blue – anyone enrolled in Bilt Rewards with under 50,000 points

- Silver – 50,000 points earned or $10K in qualifying non-rent spend

- Gold – 125,000 points earned or $25K in qualifying non-rent spend

- Platinum – 200,000 points earned or $50K in qualifying non-rent spend

Benefits as you move up status tiers include:

- Silver and higher

- Earn interest in the form of points to a member’s Bilt Rewards account every month based on the average daily points balance for each 30-day period (rate is based on the FDIC published national savings rate)

- Bilt will deposit up to 50% bonus points on top of the points issued by landlords to

members for signing new tenant leases and lease renewals, depending on

member status - Match to Virgin Voyages Blue Extras status

- 10% discount on Blade flights booked through the Bilt app

- Minimum transfer of 1,000 points when transferring to partners (Note: Blue members have a minimum transfer of 2,000 points)

- Cash out earned Rakuten rewards at a rate of $1:100 Bilt points

- Gold and higher

- All Silver benefits, plus:

- Access to Home Away from Home Benefits

- Bilt Homeownership Concierge: Members who redeem Bilt Points toward a home down payment can get help from a dedicated concierge who will walk the member through the home-buying process

- Access to BLADE lounges (even when not flying BLADE, although you’re limited to two beverages in that case)

- Match to Virgin Voyages Blue Extras status

- Priority access to Rent Day experiences (for example, an earlier booking window for Neighborhood Comedy / Bilt Dining experiences)

- Platinum

- All Silver & Gold benefits, plus:

- Members will receive a complimentary gift from the Bilt Collection (apparently some type of home decor/art)

- One free BLADE helicopter ride each time you qualify (or re-qualify) for status

- Air France/KLM Flying Blue Gold Status: Platinum members can receive 12 months of Flying Blue Gold status by registering and transferring 10,000 points to Flying Blue. This also gets you Sky Team Elite Plus, which can be beneficial for partner lounge access

- Match to Virgin Voyages Deep Blue Extras status

Bilt Cash

How to earn Bilt Cash

Bilt members earn $50 of Bilt cash for every 25,000 Bilt points that they earn. In addition to that, Bilt cardholders earn 4% Bilt Cash for every dollar they spend on non-rent/mortgage expenditure.

Bilt Cash expiration policy

An important feature to be aware of with Bilt Cash is that it expires on December 31 of the year in which it’s earned, even if you only earned the Bilt Cash a matter of weeks before. Bilt will roll over $100 of Bilt Cash at the end of the year.

How to redeem Bilt Cash

Bilt allows you to redeem Bilt Cash in the following ways:

- Grubhub: Limit $10 per month. Credit expires at the end of the month in which it’s issued (i.e. redeem for this benefit on May 30 and it’ll expire on May 31). Available from March 1, 2026.

- GoPuff Membership: Limit $5 per month, valid towards monthly or annual membership only (not orders). Available from March 1, 2026.

- Select Bilt Dining partners: Limit 1 visit per month up to $25 via Mobile Dining Checkout. Available from February 1, 2026.

- Dining experiences: Limit $50 per month. Available from March 1, 2026.

- Point accelerator: Cost: $200. Earn 1x bonus point per dollar spent on a Bilt credit card with a limit of $5,000 spend per activation and a limit of five activations per calendar year. Activation expires after $5,000 spend or at end of calendar year.

- Earn points on housing payments: Earn 1,000 points for every $30 Bilt Cash redeemed towards $1,000 of rent or mortgage payments. Redemptions can be made for any amount of Bilt Cash starting at $0.03 (i.e. 1 point).

- Bilt Travel portal for hotel bookings: Limit up to $50 per month for Blue and Silver members; limit up to $100 per month for Gold and Platinum members. Minimum two night stay required. Available from February 1, 2026.

- Higher transfer bonuses: Redeem Bilt Cash to jump up one status tier for transfer bonuses on Rent Day. Redemption requirement varies depending on the transfer partner. Available from February 1, 2026.

- Lyft: Limit $10 per month. Credit expires at the end of the month in which it’s issued (i.e. redeem for this benefit on May 30 and it’ll expire on May 31). Available from February 1, 2026.

- Blacklane: Limit $50 per year for Blue and Silver members, $100 for Gold members, and $150 for Platinum members. Available from March 1, 2026.

- BLADE airport flights: Limit $350 per seat and limit two seats per year. Available from March 1, 2026.

- Home Away From Home hotel bookings: $95 for Blue and Silver members to gain access to this luxury hotel booking program (Gold and Platinum members have access by default). Available from March 1, 2026.

- Priority Pass extra guests: Bilt Palladium cardholder Priority Pass membership includes two guests. Extra guests can be paid for by redeeming $35 per guest with a limit of $70 credits per month. Available from February 7, 2026.

- Neighborhood parking: Limit $5 per month. Available from March 1, 2026.

- Fitness classes: Redeemable for SoulCycle, Barry’s, & more. Limit $40 per month. Available from February 1, 2026.

- Walgreens: Limit $10 per month. Available from February 1, 2026.

- Bilt comedy experiences: Limit $50 per month. Available from March 1, 2026.

- Bilt Design Collection: Limit $10 per month. Available from February 1, 2026.

How to earn Bilt points

Pay rent (non-cardholders)

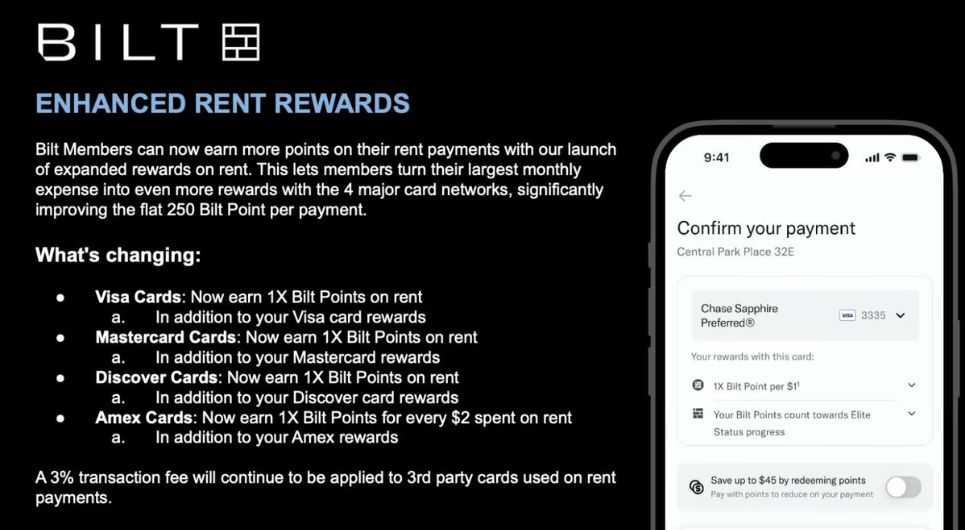

Almost anyone with a credit card can now earn at least 1 point/mile per dollar when paying rent through Bilt, but there is a 3% fee. The earnings vary slightly depending on what type of card you use:

- Rent payments made via a Visa, Mastercard, or Discover earn 1 Bilt point per $2 spent (in addition to credit card rewards)

- Rent payments made via an American Express® credit card earn 1 Bilt Point per $2 spent (in addition to credit card rewards)

- United Airlines consumer cardholders will earn 2x United miles per dollar, but DO NOT earn additional Bilt points

- Alaska Airlines / Atmos Rewards consumer cardholders will earn 3x Alaska miles per dollar, but DO NOT earn additional Bilt points

Essentially, you can look at it as though you are buying points for 3 cents per dollar when paying rent. In most normal cases, that won’t be worth it. However, it may be worthwhile to meet the minimum spend for a new credit card welcome offer or use a card that offers rewards that outweigh the 3% fee.

Non-Bilt cardholders are limited to paying rent via the Bilt portal or by ACH. Check payments are not an option if you don’t hold a Bilt credit card.

Pay Rent or Mortgage (Bilt cardholders)

Bilt now allows cardholders to pay their rent or mortgage by check, ACH, or through Mastercard’s billpay services (embedded directly in Bilt). In addition, you will be able to use your Bilt Card at in-network mortgage providers who are partnered with Bilt.

There is no fee for the payment itself, but you don’t automatically earn rewards either.

Earning Bilt points on rent or mortgage is a bit more complicated:

- You can unlock up to 1x on rent by using Bilt Cash at a value of $30 in Bilt Cash for each 1,000 points (you can use more or less Bilt Cash depending on the total cost of your rent or mortgage)

- If you don’t have enough Bilt Cash to unlock a full 1x points on your rent or mortgage payment, you can choose to pay a 3% fee on the amount not covered by Bilt Cash or choose not to earn 1x points on the full payment. There are no minimums, and cardholders can apply any amount of Bilt Cash to offset the fee for earning rewards.

- Alternatively, Bilt cardholders can choose to earn Housing-only Rewards rather than Bilt Cash which enables you to earn rewards on the following basis:

- Spend 25% of housing payment – Earn 0.5x points on housing spend

- Spend 50% of housing payment – Earn 0.75x points on housing spend

- Spend 75% of housing payment – Earn 1x points on housing spend

- Spend 100% or more of housing payment – Earn 1.25x points on housing spend

For instance, if your rent costs $3,000 and you have $60 in Bilt Cash, you can use that $60 to unlock 2,000 points on that housing payment. You can then choose to also pay $30 to earn a full 1x (3,000 total points). If you only have $45 in Bilt cash, you can use that to unlock 1,500 points on your housing payment, and then choose whether you want to pay $45 for the next 1,500 points.

Note that you cannot use Bilt Cash to offset the 3% credit card transaction fee for non-Bilt cards. In other words, if you pay your rent with your Alaska Airlines Visa Signature card (which currently incurs a 3% fee), you will not be able to offset the fee with Bilt Cash. You can only use Bilt Cash to earn rewards when using your Bilt card to pay rent/mortgage.

Use a Bilt credit card

Bilt credit cards are issued by Cardless and are currently available for applications. The new cards will be available for use beginning February 7, 2026.

There are three different cards on offer: Blue, Obsidian, and Palladium. Each one offers a combination of Bilt points and Bilt Cash from spending. We’ll take a brief tour below:

Bilt Blue card

| Card Offer and Details |

|---|

ⓘ $50 1st Yr Value Estimate$100 Bilt Cash valued at $50 Click to learn about first year value estimates $100 Bilt Cash ⓘAffiliateThis is an affiliate offer. Frequent Miler may earn a commission if you are approved for this offer $100 Bilt Cash when you apply & are approvedNo Annual Fee Earning rate: 1X points + 4% Bilt Cash on everyday purchases if you choose Bilt Cash rather than housing-only rewards ✦ 0.5X-1.25X points on rent & mortgage payments (if Housing-Only Earnings selected) ✦ 1X points on rent & mortgage payments when redeeming Bilt Cash (if Bilt Cash earning option selected) Base: 1X (1.55%) Card Info: Mastercard World Elite issued by Column NA. This card has no foreign currency conversion fees. Noteworthy perks: Transfer points to airline and hotel partners ✦ Earn miles on rent or mortgage payments |

- Annual fee – $0

- Bilt points earning rate – 1x on everyday spend (including unlimited 1x on mortgage and rent, subject to a 3% fee that can be offset with Bilt Cash)

- Bilt Cash earning rate – 4% on everyday spend (excludes mortgage & rent) if choosing that option rather than Housing-only Rewards

- Card features/benefits:

- No foreign transaction fees

- Access to the Neighborhood Benefits program

- Redeem Bilt Cash to waive mortgage and rent transaction fees

Bilt Obsidian card

| Card Offer and Details |

|---|

ⓘ $30 1st Yr Value Estimate$200 Bilt Cash valued at $100, $100 Bilt Travel hotel credit ($50 per six months) valued at $25 Click to learn about first year value estimates $200 Bilt Cash ⓘAffiliateThis is an affiliate offer. Frequent Miler may earn a commission if you are approved for this offer $200 Bilt Cash when you apply & are approved$95 Annual Fee Earning rate: 4% Bilt Cash on everyday purchases if you choose Bilt Cash rather than housing-only rewards + 3X points on dining or grocery (Limit $25K per year for grocery) ✦ 2X points on travel ✦ 1X points on everyday purchases ✦ 0.5X-1.25X points on rent & mortgage payments (if Housing-Only Earnings selected) ✦ 1X points on rent & mortgage payments when redeeming Bilt Cash (if Bilt Cash earning option selected) Base: 1X (1.55%) Travel: 2X (3.1%) Flights: 2X (3.1%) Hotels: 2X (3.1%) Grocery: 3X (4.65%) Dine: 3X (4.65%) Card Info: Mastercard World Elite issued by Column NA. This card has no foreign currency conversion fees. Noteworthy perks: Transfer points to airline and hotel partners ✦ 2x $50 Bilt Travel portal hotel credit every six months (minimum two night stay) ✦ Earn miles on rent or mortgage payments |

- Annual fee – $95

- Bilt points earning rate:

- 3x on dining or grocery (you can choose within 30 days of approval and then change once per year in January). 3x grocery earning is capped at $25K spend per year

- 2x on travel

- 1x on everyday spend (including unlimited 1x on mortgage and rent, though be aware that you will need to use Bilt Cash to offset the credit card transaction fee to earn points on rent/mortgage)

- Bilt Cash earning rate – 4% on everyday spend (excludes mortgage & rent) if choosing that option rather than Housing-only Rewards

- Card features/benefits:

- $100 Bilt Travel Hotel credit (twice annual, i.e., $50 Jan-Jun & $50 Jul-Dec). Two-night minimum stay required.

- Cellphone protection

- Redeem Bilt Cash to waive mortgage and rent transaction fees

Bilt Palladium card

| Card Offer and Details |

|---|

ⓘ $630 1st Yr Value Estimate$300 Bilt Cash valued at $150, $200 Bilt Cash valued at $100, $400 Bilt Travel hotel credit ($200 per six months) valued at $100 Click to learn about first year value estimates 50K points + $300 Bilt Cash ⓘAffiliateThis is an affiliate offer. Frequent Miler may earn a commission if you are approved for this offer 50K Bilt points + Gold elite status after $4K non-housing spend in the first 3 months, plus $300 Bilt Cash when you apply & are approved$495 Annual Fee Earning rate: 2X points + 4% Bilt Cash on everyday purchases if you choose Bilt Cash rather than housing-only rewards ✦ 0.5X-1.25X points on rent & mortgage payments (if Housing-Only Earnings selected) ✦ 1X points on rent & mortgage payments when redeeming Bilt Cash (if Bilt Cash earning option selected) Base: 2X (3.1%) Card Info: Mastercard World Legend issued by Column NA. This card has no foreign currency conversion fees. Noteworthy perks: Transfer points to airline and hotel partners ✦ $200 Bilt Cash annually ✦ Up to $400 in Bilt Travel hotel credits ($200 per six months, two-night stay required) ✦ Earn miles on rent or mortgage payments ✦ Priority Pass (lounges only) |

- Annual fee – $495

- Bilt points earning rate:

- 2x on everyday spend

- Unlimited 1x on mortgage and rent, though be aware that you will need to use Bilt Cash to offset the credit card transaction fee to earn points on rent/mortgage.

- Bilt Cash earning rate – 4% on everyday spend (excludes mortgage & rent) if choosing that option rather than Housing-only Rewards

- Card features/benefits:

- $400 Bilt Travel Hotel credit (twice annual, i.e., $200 Jan-Jun & $200 Jul-Dec). Two-night minimum stay required.

- $200 Bilt Cash annually

- Priority Pass

- Redeem Bilt Cash to waive mortgage and rent transaction fees

Bilt “Rent Day”

For a 24-hour period on the 1st of each calendar month, Bilt offers a promotion called “Rent Day” where members with a Bilt credit card earn double points on all non-rent purchases up to 1,000 bonus points. Not only does this increase the base earning rate, but it also doubles existing bonus categories…but for one day only and only up to 1,000 bonus points.

It’s also worth pointing out that, despite the name, you only earn 1x when paying rent on “Rent Day.” The double rewards apply only to non-rent purchases.

Bilt runs several promotions on Rent Day, in addition to the increased earnings on spend via the Bilt card. So far, offers we’ve seen have included increased transfer bonuses, a monthly rent giveaway, free SoulCycle classes, and a monthly “Rent Free” game where 10 players earn a free month of rent, and others earn bonus points.

Referring friends to a Bilt card

Bilt doesn’t currently offer a referral program for its new card portfolio, but it will eventually.

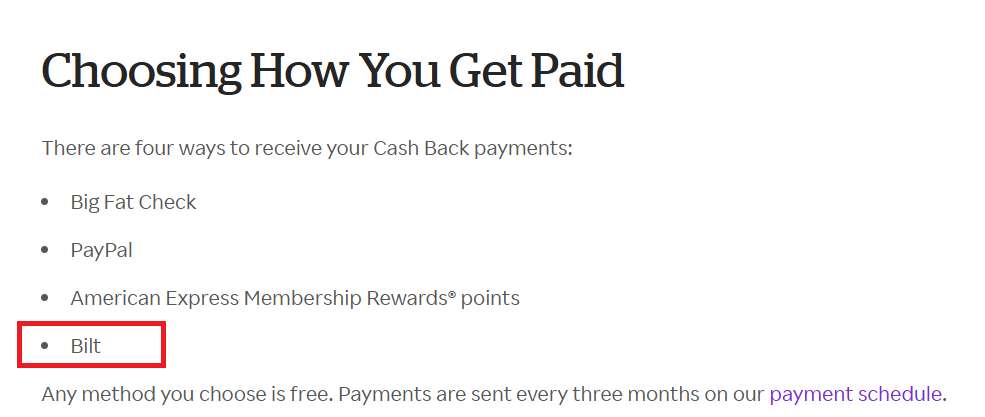

Link your Rakuten account to Bilt

It’s now possible to earn Bilt points when shopping via the Rakuten shopping portal. When this partnership launched in 2025, all Bilt members could earn on a 1:1 basis.

After six months, only those with some form of Bilt status will continue to have Rakuten earnings convert to Bilt at a 1:1 ratio. Those without Bilt status are due to have earnings reduced to 1:0.5, which would make American Express Membership Rewards a preferential earning option for most people going forward.

Find out more about this Rakuten/Bilt partnership here, including how to change your existing Rakuten earning preference to Bilt.

Link your Bilt account to Amazon (caution)

Bilt Rewards points can be used to buy things on Amazon. Don’t do it. It offers terrible value for your points. We’re always hesitant to link rewards programs to Amazon for the fear of a Player 2 accidentally using points — or, worse yet, having an Amazon account hacked and a thief draining rewards points. The risk/reward calculation just isn’t worth keeping rewards programs linked long-term in most instances, in our opinion.

Take Lyft rides (after linking your accounts)

Use any form of payment and earn 2X points on Lyft rideshare rides when your Bilt Rewards and Lyft accounts are linked, and Bilt is set as the active loyalty rewards partner. If you are a Bilt cardholder, you can earn 5X total points when paying with a Bilt Mastercard.

- Link to connect Bilt and Lyft accounts (Note: Frequent Miler may earn a commission if you link your Lyft account to Bilt through this hyperlink).

Earn points when paying through Venmo?

Bilt recently announced a 2026 partnership with Venmo that is expected to expand the ability to earn rewards with neighborhood merchants and enable splitting rent payments with other household members. Details are thin on how this partnership will work in practice and yield rewards, but we expect to learn more soon.

Bilt Neighborhood Rewards (card-linked offers)

In order to earn Bilt points on card-linked offers, you must have the credit card you’re using to pay linked to your Bilt wallet. After linking, you can earn extra points when using those cards to pay at restaurants or other merchants that participate in Bilt Neighborhood Rewards (such as Walgreens).

Link to manage your Bilt Wallet: frequentmiler.com/go/biltwallet/ (note that Frequent Miler may earn a commission if you add cards to your wallet through our link)

Dining

You can earn Bilt points when paying with any card you have linked in the Bilt Rewards app at participating restaurants. The exact payout varies depending on the promotions run by each participating restaurant.

Note that the points you earn at these restaurants are in addition to the points earned using your chosen credit card (which does not have to be the Bilt card, but rather must be linked in the Bilt app).

In addition to earning points, some restaurants will send targeted offers to customers in specific areas via the Bilt app. These offers can sometimes provide significant savings.

Fitness Classes

You can earn Bilt points for every dollar spent on taking classes at a Neighborhood Fitness gym when booked via the Bilt app. Neighborhood Fitness partners include CycleBar, Pure Barre, Soul Cycle, YogaSix, and many others. In order to earn points, classes must be booked through the Bilt app or website.

Walgreens

Bilt Rewards members can earn points when shopping at Walgreens, and it’s not even necessary to use a Bilt card. As long as you shop with a card that’s saved to your Bilt Wallet, you’ll earn points in addition to credit card rewards (like 3x Ultimate Rewards on the Chase Freedom Unlimited card).

Bilt also offers a service to identify purchases that are eligible for reimbursement by a Flexible Spending Account (FSA) or Health Savings Account (HSA). After flagging eligible items, it will then help by transferring funds to your credit card from a linked FSA/HSA payment card.

Earnings are as follows:

- 1x on in-store and online Walgreens purchases

- 2x on Walgreens-branded items

- 100 points on up to 26 prescription refills per year

To earn rewards, you must add a credit card to your Bilt Wallet and use it at Walgreens. In order to earn the 100 points prescription bonus, you’ll have to enable rewards in the Bilt app by going to the “Neighborhood” section of the app and selecting “Pharmacy” from the top menu option.

It is worth noting that you can link an HSA/FSA account, and the Bilt app can help facilitate reimbursements from that account.

Bilt Home Delivery

“Bilt Home Delivery” was launched in partnership with GoPuff. This allows Bilt members to both earn and redeem points on the delivery of various and sundry items from GoPuff’s catalog when placing those orders through the Bilt app. Members earn 1 Bilt point per dollar spent when ordering through the Bilt app and paying with a card linked to their Bilt profile.

Bilt Neighborhood Parking

“Bilt Neighborhood Parking” was launched in partnership with Metropolis in late 2025. Bilt Members will earn 1 point per dollar at Metropolis parking locations, and be able to search for (and eventually reserve) parking in the Bilt app. Metropolis locations equipped with “Metropolis Vision” will automatically recognize your vehicle when it arrives and charge you through the Bilt app when it leaves, creating a seamless experience.

How to use Bilt Rewards points

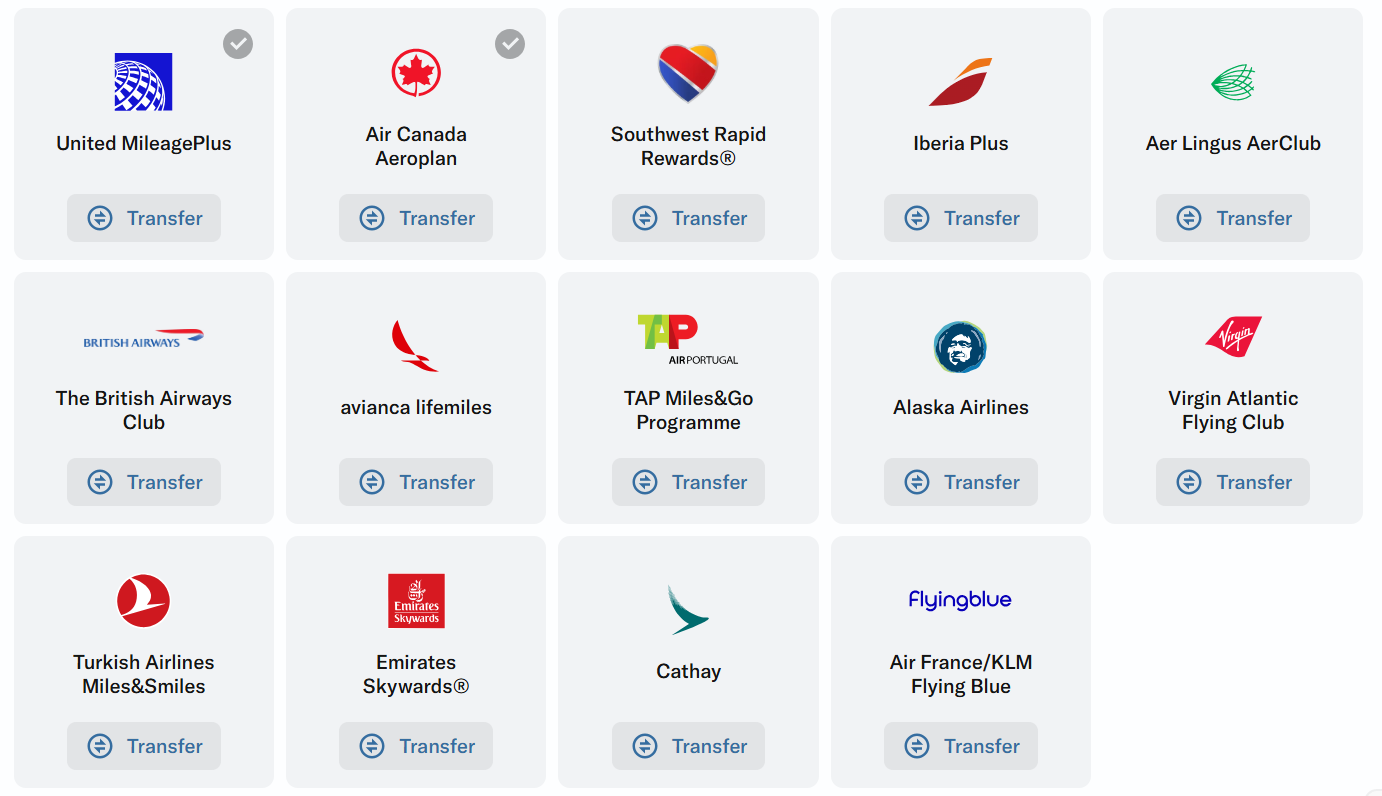

Transfer Bilt Rewards points to airline and hotel partners

Bilt has a very unique set of transfer partners that makes the program surprisingly strong. Outside of Accor Live Limitless, points transfer 1:1 to partners, with most transfers occurring almost instantly. Partner programs can provide opportunities for far outsized value.

Bilt Transfer Partners

Hotels

| Rewards Program | Best Uses | Bilt Transfer Ratio (and transfer time) |

|---|---|---|

| Accor Live Limitless | Use to pay hotel bill with value of 2 Euro cents per point. In some cases (such as hotel to airline transfer bonuses) it may make sense to convert Accor points to the following airline miles at a 1 to 1 ratio: Finnair, Iberia, Qantas, or Virgin Australia | 3 to 2 (Unknown) |

| Hilton | 5th Night Free awards. Best value is usually found with very low end or very high end Hilton hotels. Bonus: award nights are not subject to resort fees. Note that Hilton points often go on sale for half a cent each and so its rare for point transfers to Hilton to be a good value. | 1 to 1 (Unknown) |

| Hyatt | Use for Hyatt free nights, free suite nights, lounge upgrades, or suite upgrades. Hyatt points are often worth more than 2 cents each. Bonus: award nights are not subject to resort fees. | 1 to 1 (Instant) |

| IHG | IHG dynamically prices their awards and sometimes offer very good value. IHG Premier and IHG Premier Business cards offer the fourth night free on award stays. | 1 to 1 (Instant) |

| Marriott Bonvoy | 5th Night Free awards. Opportunities to get outsized value exist but can be hard to find. | 20K to 25K (Instant) |

Airlines

| Rewards Program | Best Uses | Bilt Transfer Ratio (and transfer time) |

|---|---|---|

| Aer Lingus Avios | Fuel surcharges are sometimes lower when booking with Aer Lingus rather than British Airways, Qatar, or Iberia. It's possible to move points (Avios) between Iberia, British Airways, Aer Lingus, and Qatar. See also: Avios Sweet Spots for Award Tickets. | 1 to 1 (Instant) |

| Air Canada Aeroplan | Redeem for Star Alliance flights and/or flights with Air Canada partners (such as Etihad). No fuel surcharges; $39 CAD award booking fee; 5,000 points to add stopover on one-way award. See: Air Canada Aeroplan: Everything you need to know. | 1 to 1 (Instant) |

| Air France KLM Flying Blue | Monthly Air France Promo Awards often represent very good value. Air France miles can be used to book Sky Team awards, including Delta awards. Air France often offers very good business class award pricing between the US and Europe & Israel. | 1 to 1 (Instant) |

| Alaska Atmos Rewards | Alaska Airlines offers decent oneworld award pricing, excellent short-distant pricing, and uniquely allows free stop-overs one one-way awards. Additionally, Alaska allows free award changes and cancelations (although they do have a small non-refundable partner award booking fee) | 1 to 1 (Instant) |

| Avianca LifeMiles | Avianca LifeMiles can be decent for Star Alliance awards. They offer reasonable-ish prices and no fuel surcharges on awards. Best of all, their mixed-cabin pricing can lead to fantastic first-class award prices. See this post for details. | 1 to 1 (Instant) |

| British Airways Avios | While flights on British Airways itself often incur outrageously high fuel surcharges, many BA partners charge low or no fuel surcharges. Excellent value can often be had in redeeming BA points for short distance flights outside the US. It's possible to move points (Avios) between Iberia, British Airways, Aer Lingus, and Qatar. See also: Avios Sweet Spots for Award Tickets. | 1 to 1 (Instant) |

| Cathay Pacific Asia Miles | Cathay Pacific has a decent distance based award chart, but they don't allow stopovers longer than 24 hours. Cathay Pacific Asia Miles can be a good option for booking American Airlines flights with a distance based award chart, especially if other OneWorld Alliance miles aren't available. For long distance flights, it is possible to reduce the cost of a premium cabin award by adding on a lower cabin segment. See this post for details. | 1 to 1 (Instant) |

| Emirates Skywards | The best use of Emirates miles has been to fly Emirates itself. Unfortunately fuel surcharges can be extremely steep. One workaround is to book select routes such as JFK to Milan or Newark to Athens. See: How to find and book Emirates first class awards. | 1 to 1 (Instant) |

| Etihad Guest | Etihad offers a distance based award chart for flying Etihad and another for its partners. Points may offer good value for expensive but short-distance flights. | 1 to 1 (Unknown) |

| Finnair Plus+ | Finnair points are now "Avios" and points can be moved to/from other Avios programs. Finnair uses zone based award charts rather than distance based. As a result, Finnair sometimes has better (and sometimes worse) pricing than other Avios programs. | 1 to 1 via BA (Instant) |

| Iberia Avios | On their own flights, Iberia offers low award prices and a very reasonable 25 Euro cancellation fee. Partner awards can offer good value under some circumstances as well, but these are usually nonrefundable. Fuel surcharges are sometimes lower when booking with Iberia rather than British Airways, Aer Lingus, or Qatar. It's possible to move points (Avios) between Iberia, British Airways, Aer Lingus, and Qatar. See also: Avios Sweet Spots for Award Tickets. | 1 to 1 (Instant) |

| JAL (Japan Airlines) Mileage Bank | JAL has a distance based partner award chart. Depending upon the length of the flights, this can lead to great award prices on partners such as Emirates and Korean Air. | 1 to 1 (Instant) |

| Qatar Privilege Club Avios | Qatar has reasonable award prices for flying Qatar itself. Points are now transferable 1 to 1 to British Airways (and from there to Aer Lingus or Iberia). It is now also possible to book JetBlue flights with Qatar Avios. | 1 to 1 (Instant) |

| Southwest Rapid Rewards | Award flights are fully refundable. Point values vary. Lower demand flights and those with higher taxes tend to offer better value. | 1 to 1 (~12 hours) |

| Spirit | 1 to 1 (Unknown) | |

| TAP Air Portugal | Surcharge-free Emirates redemptions. Increased availability on TAP flights between US and Europe. | 1 to 1 (Unknown) |

| Turkish Airlines Miles & Smiles | Miles & Smiles offers a number of awesome sweet-spot awards including 7.5K one-way anywhere within the US, even to Hawaii. Many awards cannot be booked online but can be booked via phone or email. See: Turkish Miles & Smiles Complete Guide and Turkish business class sweet spots from the US. | 1 to 1 (Instant) |

| United MileagePlus | United offers free award changes and free cancelations. Like Avianca and Aeroplan, United never charges fuel surcharges for awards. Unfortunately, United charges many more miles for international first class awards. | 1 to 1 (Instant) |

| Virgin Atlantic Flying Club | Virgin Atlantic offers a few excellent sweet spot awards. See: Best uses for Virgin Atlantic points (Sweet Spot Spotlight). | 1 to 1 (Instant) |

Current Transfer Bonuses

If Bilt Rewards is running any transfer bonuses, details will appear here:

| Transfer Bonus Details | Start Date | End Date |

|---|---|---|

| Up to 125% transfer bonus from Bilt to Accor Live Limitless | 02/01/26 | 02/01/26 |

Point.me access for partner flight searches

Bilt Rewards includes a free integration with Point.me, a search engine that lets you find award space with their transfer partners with a single click.

Bilt members have access to the Point.me engine to search for available awards (no Point.me subscription required). This makes award programs much more accessible for the average consumer. Note that searches are limited to Bilt’s transfer partners only, and searches are very, very slow.

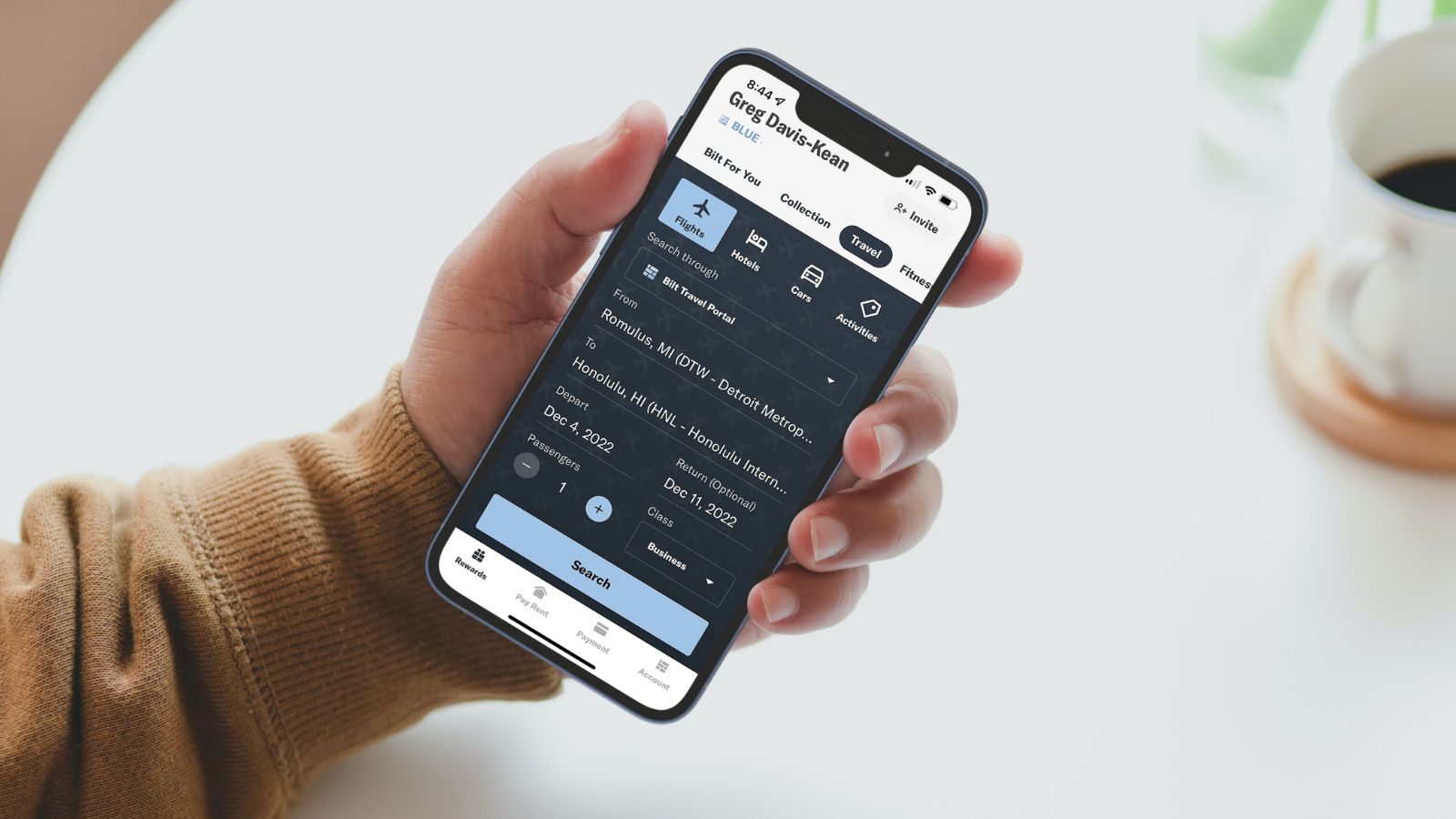

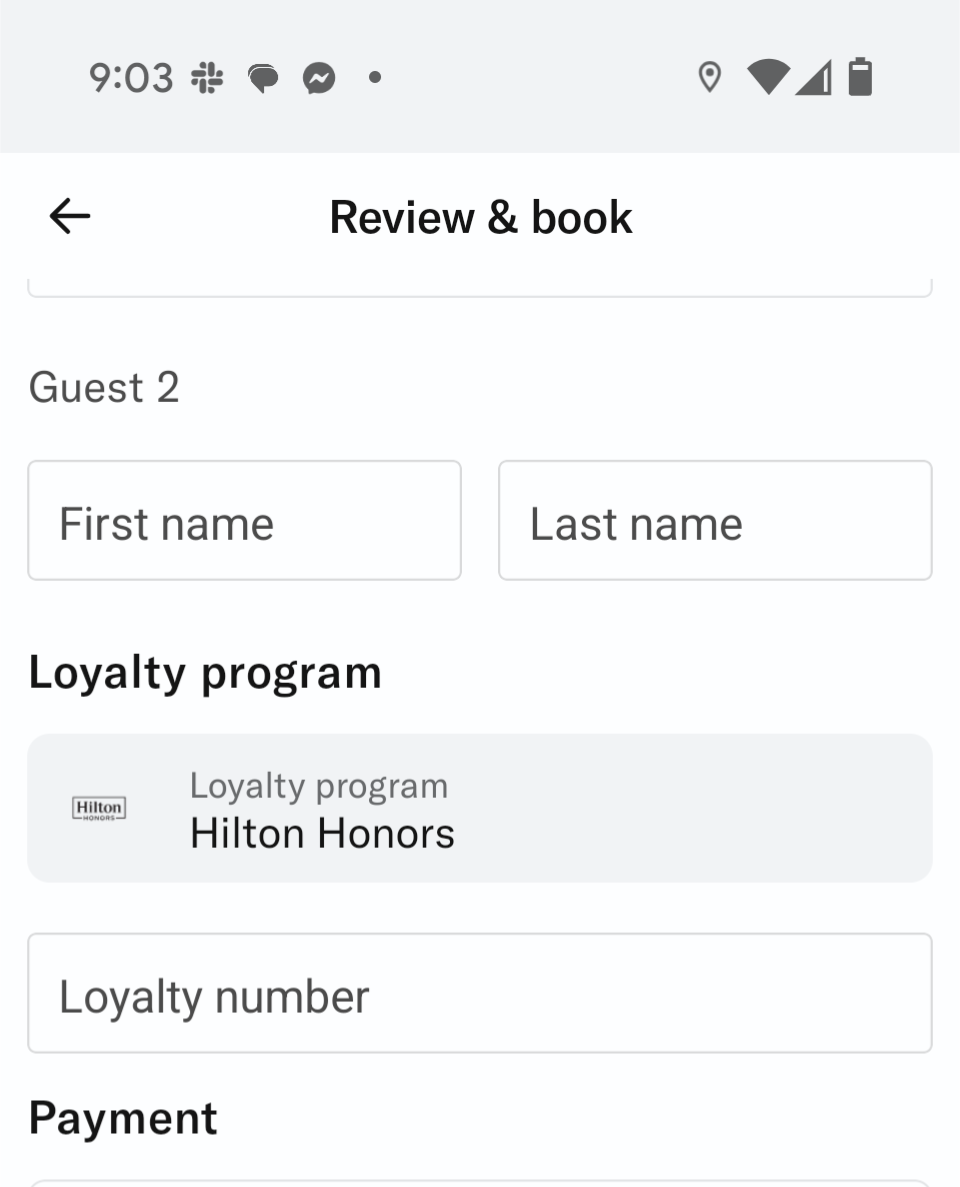

Use points to pay for travel

Bilt offers the ability to use points at a value of 1.25 cents per point when booking travel through their new travel portal. The portal is baked into the Bilt app (simply select the “Travel” tab) or members can browse to: travel.biltrewards.com.

Like many other travel portals, Bilt’s portal is powered by Expedia, though some hotels are now booked via NDC, and it is thus possible to earn hotel points and elite credit/benefits with some hotels. When it is possible to earn hotel points and elite credit, you will see a field to enter your loyalty program number in the booking flow.

There are opportunities to get far greater value when transferring to partners, but paying 1.25c per point for travel can be a good way to get decent value for points when booking hotels or certain experiences (like Disney World tickets).

We’ve been told it will be possible to pay for a stay through the Bilt portal using a combination of hotel credits, Bilt Cash, and Bilt points (at 1.25 cents per point), but there is a 2-night minimum stay when using a credit card, hotel credit, or Bilt Cash. Neither the travel credits nor Bilt Cash can be used for one-night stays.

Use points for Bilt Home Away from Home

In 2025, Bilt launched its Home Away From Home luxury booking platform. Bilt members with Gold or Platinum status have access to this Platform, which works through the Virtuoso network on the Bilt platform.

Booking through Home Away from Home offers benefits such as complimentary breakfast and a hotel credit, though exact offerings will vary. At launch, Bilt indicated an interest in tweaking these offerings over time to leverage its unique neighborhood network benefits.

When redeeming points for Home Away from Home bookings, members receive the same 1.25c per point as for other travel bookings.

Use points for home purchases

Bilt Rewards members can use points toward their down payment at a value of 1.5c per point when redeemed towards a down payment on a home purchase in the US, but only one redemption per home purchase.

There is a form you fill out that requires proof of purchase of a home, so it’s best to redeem points after you have a sales contract to purchase, but before closing.

Use points for student loan repayments

You can redeem Bilt Rewards points towards student loan repayments serviced by the following providers at a rate of 1 cent per point:

-

- Sallie Mae

- MOHELA

- Nelnet

- Navient

- Aidvantage

Use points for rent

Bilt allows you to redeem points for rent. The value here is very poor, as you will get less than 1c per point. If you intend to use credit card rewards to pay for rent, you would likely be better off with a credit card that earns 2% cash back everywhere and using that cash back toward your rent.

Use points for fitness classes

Bilt has partnerships with several popular exercise class brands, so you can redeem your points for popular classes like Soul Cycle, Rumble boxing, Solidcore, and Y7. These redemptions generally don’t provide maximum value.

Use points for art, home décor, and more

Bilt offers the Bilt Collection, a curated selection of limited-edition art and home décor. Redemptions start at 5,000 points. Whether or not these redemptions make sense is a matter of personal taste, but be sure to compare the cash price of a similar item.

Use points to cover Amazon purchases

You can use Bilt points at checkout to cover purchases at Amazon.com. This yields a very poor value of 0.7c per point and should be avoided.

Use points to cover gift card purchases

You can also use Bilt points to buy gift cards through Bilt’s portal. Like Amazon, the value is terrible at ~0.7c per point.

Use points for Lyft rides

This also falls under the category of “Don’t do it” because you’ll only get 0.7c of value per point – see more here.

Use points for statement credits

You can use Bilt points to receive a statement credit towards charges on a Bilt credit card. This is even worse than Amazon as points are worth only 0.55c each when redeeming them this way. Don’t do it.

Tim, in a recent ask us anything you had mentioned that Citi was difficult to move line of credit for. Said that one of the things that worked was reducing line of credit on a different car and then waiting a little bit and then seeing if you could bump it up through their online portal. So I have some business American Airline cards through Citi and I have hey Citi double cash they have two separate logins because one is a business and the other is a personal and so I’m wondering if I reduce on the business side will that potentially free of credit on the personal side so that I can increase my double cash line of credit?

1- does paying HOA assessments count as Rent or Mortgage payment- because they’re treated differently by Bilt?

2- FM Team- is there any possibility of you guys getting any kind of a SUB special arrangement like TPG did (understand that he has equity, but you guys also have a nice relationship and they pay you for Ads on you site & podcast?

3- I would like for you guys to get credit for my signing up, but if I click your affiliate link, will it open in my Bilt account so they will know I’m not applying as a new customer? With all of the sign up issues, I do not want to take any chances their systems.

Thanks all!

Looks like Bilt Sweet Spots article needs an update.

I wanted to use non-Bilt cards and pay mortgage with 3% to mean SUBs. From what I am hearing, that is impossible because mortgage is paid out of linked checking accounts, not actually charged to credit card. If I am wrong on this please correct me, I want to be wrong lol.

Alas, you are correct.

Rent-for now at least-can still be paid this way. But not mortgages are not being set up that way (at least at launch).

Wow. I’m exhausted and confused and am now going to take a nap.

Well that seems simple enough.

Does anyone know, if im applying for the card as a brand new user will i get a soft pull or hard pull for BILT 2.0? According to bilt support bot Theo everyone(?) is getting a soft pull…

A soft pull. However, the card will show up as a new account, so will count towards your Chase 5/24 status.

How can Cardless do a credit assessment on only a soft pull on a cleanskin?

My wife applied this weekend and we were just notified that her credit report was pulled on Experian.

So you can’t use non-bilt cards to pay mortgages?

That’s correct.

This is the biggest disappointment of this whole program. Makes it DOA for me.

You can’t even use Bilt cards to pay mortgages, as the payment will come from your bank account.

It’s only the mortgage fees which will be offset with Bilt Cash.

I have two comments on the paying rent with non Bilt card sections:

1. I’m not sure where I saw it but I heard rumors that the 0.5x Bilt points will be going away soon for non Bilt card rent payments.

2. I feel like you can combine the Amex cards with Visa and Mastercard section, since their earnings from rent is essentially the same now.

Was hoping to use my Atmos Summit card to pay my mortgage, but I guess homeowners are not legitimate customers for the Alaska/Bilt partnership. Big middle finger to these guys for this gaping hole in their program.

Does the blue card offer cell phone protection when paying the phone bill with it?

Yeah. Thanks for the couple of years but Im out. Don’t see the value in the new card.

Hey guys, a small correction. Although most Cardless cards are issued by FEB, I’m pretty sure the Bilt cards are issued by Column NA instead.

Correct, per the terms and conditions on the bilt site.

Thanks for highlighting that – I’ve just fixed it.

If I pay rent (or mortgage, hopefully soon) with Atmos Summit I know I get 3x AS points but do I also earn Atmos status points?

Yes, same as with other spend (1 status point per $2).

I’m going to be sticking with Summit to pay a family member’s rent over a Palladium card, partly for this reason.

From the Reddit posts, sounds like mortgage payments STILL won’t be allowed with Atmos cards.

Oh, well, I guess it won’t work for me anyway then. Thanks for the info.

[…] said that the company tried to make the loyalty point conversions simple for travel: 1,000 Bilt points is typically equivalent to 1,000 United miles, for […]