Starting today, the Bilt Mastercard is now widely available without a waitlist: anyone can now apply for the Bilt Mastercard (which is now issued by Wells Fargo) and earn points on any residential rental in the US (even if your landlord requires payment by check) in addition to earning 3x dining and 2x travel without an annual fee. Even better, you can now earn points for referring others to Bilt — even if you don’t have the card yourself.

Wells Fargo now issuing the Bilt Mastercard

Bilt has announced today its partnership with Wells Fargo to issue the Bilt Mastercard moving forward. The support of a major issuer is a good indication that Bilt is set to be a long-term player in this market. One would think that Wells Fargo has plenty of opportunities to issue co-branded cards. The fact that they’ve decided to expand with Bilt is both fascinating and exciting for those who enjoy earning easy points for paying rent.

This also represents a major coup for Wells Fargo in the sense that they suddenly pick up a growing transferable currency since those earning Bilt Rewards points by paying rent or using their card can enjoy broad use of their Bilt Rewards points.

Earning Bilt Rewards points

There are several ways to earn Bilt Rewards points:

Paying rent

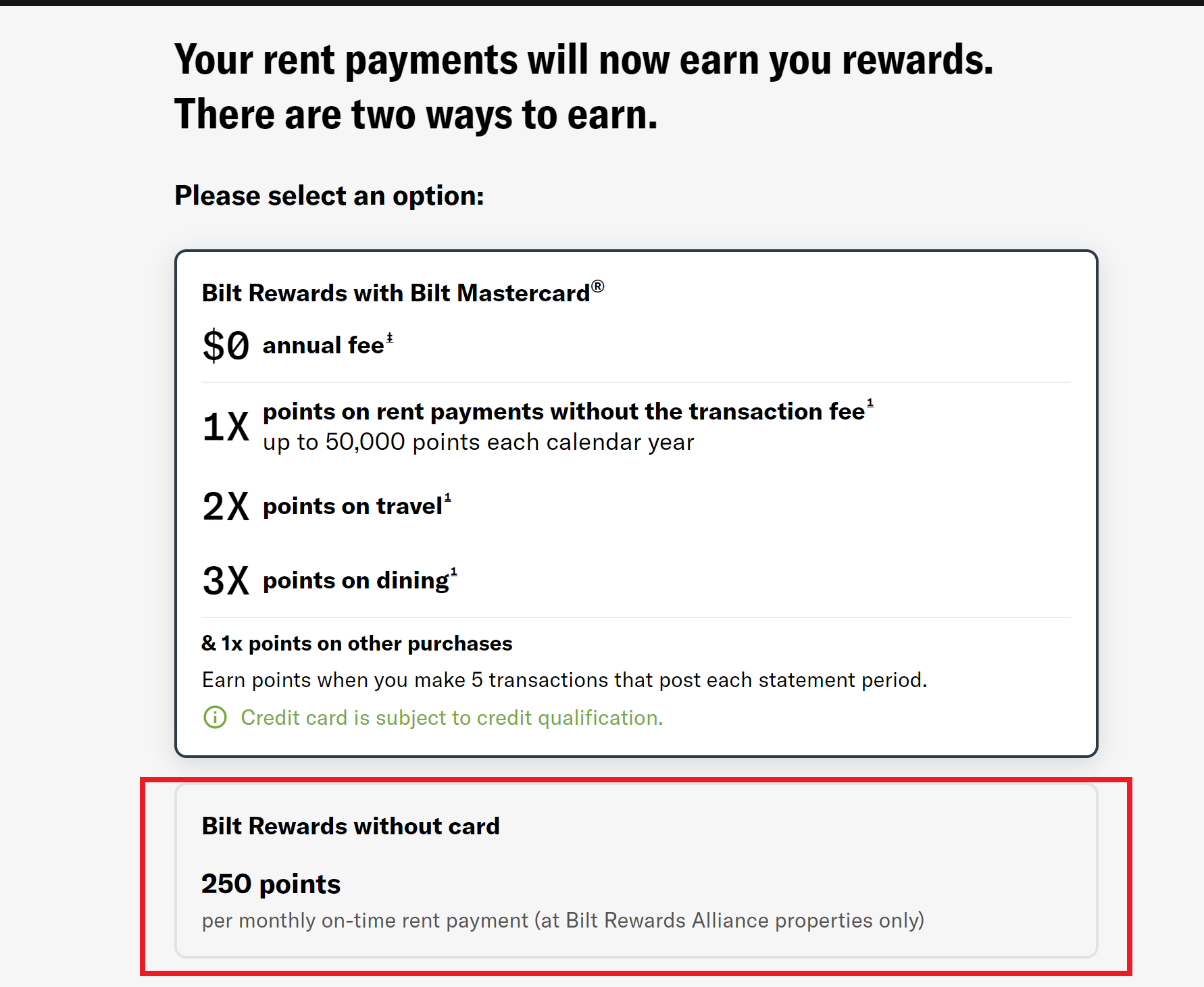

Anyone who rents can earn rewards by paying rent (without a fee) through Bilt, even if their landlord doesn’t accept credit card (Bilt can send a check in cases where your landlord doesn’t take any digital form of payment or you can even pay via ACH — see this post for more info). You’ll earn 1 point per dollar on rent paid through Bilt if you have the Bilt Mastercard (as long as you make 5 purchases per month on the card). If you don’t get the Mastercard, you still earn 250 points per rent payment. Note that you can earn 1x on a maximum of $50,000 in rent payments per year.

It is worth mentioning that Bilt does not offer a way to earn points for paying a mortgage. I’m sure that Bilt is readily aware that many people have mortgages and would like to earn points when paying for them, but they are a rent rewards program right now and they do not offer a way to earn points for paying your mortgage.

Readers also frequently ask if you can earn points paying for business rent, but you can not. Bilt offers points for residential rent.

Referring friends

Anyone can refer friends to get the Bilt Mastercard. Bilt is currently offering 25,000 points with 5 successful referrals up to a limit of 1 million points. That’s pretty awesome because it means that even if you don’t rent you can join Bilt Rewards and refer your renting friends to the Bilt Mastercard and earn points doing it.

Using the Bilt Mastercard

You need to make 5 purchases per month to earn rewards, but as long as you meet that minimum you will earn 3x on dining, 2x on travel, and 1x on rent with no annual fee.

It’s cool that you can earn points on rent even without having the card. While I’d think most renters would want to have the card, that’s almost enough points for a free night at an off-peak Category 1 Hyatt each year just for paying the rent through Bilt without the card.

Earn Referrals even without the card

Even if you don’t have the Bilt Mastercard, you can still earn points by referring new cardholders. That’s awesome because I imagine there are many readers who don’t rent but know people who do. You can now be rewarded for referring them to the Bilt Mastercard.

The referral program awards you with 25,000 points after 5 successful referrals. Unfortunately, that assures some breakage since you need to get 5 referrals to get any points. However, it is pretty easy to track referrals in the Bilt Rewards app to see where you stand en route to 5 referrals.

Again, anyone can sign up for Bilt Rewards, with or without the Mastercard. Just go to Bilt Rewards and when you sign up for an account you will be prompted to choose whether you want to apply for the Mastercard or “Bilt Rewards without card.”

Even without the card, you can still refer others. You’ll need the Bilt Rewards app to generate your referral link. When you are logged in on the app. you’ll see the “invite” link in the top right corner.

That brings you to a page where you can copy your link and also track how many referrals you’ve had.

![]()

It’s pretty cool that you can earn points even without the card. I know a lot of people who rent and who don’t currently earn points (and won’t jump through the hoops to buy gift cards and money orders or the other options to earn rewards for rent). This card would make a lot of sense for those folks in my life who don’t otherwise earn points but do pay rent.

Using Bilt points

Bilt Rewards transfer partners

Of most interest to me and most readers, Bilt Rewards points can be transferred 1:1 to any of Bilt’s transfer partners. Those include:

- Air Canada’s Aeroplan

- Air France / KLM Flying Blue

- American Airlines AAdvantage

- Cathay Pacific Asia Miles

- Emirates Skywards

- HawaiianMiles

- IHG Rewards

- Turkish Miles & Smiles

- Virgin Atlantic Flying Club

- United Mileage Plus (new)

- World of Hyatt

That’s an impressive array of partners for a young transferable points program. Bilt’s mix of partners gives rewards program members access to a really good selection of sweet spots (See: Bilt Rewards sweet spots).

Redeem for rent

Bilt points can be redeemed toward your monthly rent payment. However, when used this way, points are only worth 0.55c per point. That represents a very poor-value use of points, so we don’t recommend redeeming points this way unless you can’t make use of the many travel rewards sweet spots.

If you would be tempted to redeem points toward rent and your landlord accepts debit card payments, you would probably be better off using something like the PointCard debit card, which earns 1% back everywhere, or the Nearside Business Debit Card, which earns 2.2% cash back this year, rather than earning points at 1x and using them at 0.55c per point (an effective return of just 0.55%).

Redeem Bilt Rewards points for art / home décor, fitness, future mortgage

Bilt Rewards points can also be redeemed for art and home decor from Bilt’s curated selection. Whether or not that makes sense for you will probably depend on whether your taste matches that of the Bilt tastemakers.

You can also redeem points for fitness classes with select fitness partners (current partnerships include Soul Cycle, Rumble, Solidcore, and Y7.

Today’s press release also notes that renters can also redeem points toward a future mortgage when financing is arranged through Bilt. I’m sure that more information is yet to come on this option, though I also don’t expect it to offer much more value than the 0.55c per point currently offered when using points toward rent.

Bilt Rewards Elite status

Bilt Rewards has an elite status program and elite members to earn interest in the form of rewards points based on their rewards balance. The interest rate will be based on the FDIC federal savings rate, which means it will be even less than one tenth of one percent based on current rates. That won’t move the needle much, but I respect the hustle in adding a gimmick that sounds particularly appealing given how many of us have been sitting on large rewards balances since the beginning of the pandemic. Again, it’s a miniscule addition, but it made me smile nonetheless.

The ability to earn interest based on your points balance is available to those with Silver status or higher and today Bilt has simplified the process for earning status. Status is now earned based on total points earned over a calendar year as follows:

- Blue – anyone enrolled in Bilt Rewards with under 25,000 points

- Silver – 25,000 points earned

- Gold – 50,000 points earned

- Platinum – 100,000 points earned

You will need to have earned 25K points in a calendar year (Silver status) to earn interest on your points balance. Those 25K points can come from any type of spend — meaning that in addition to the points you earn for paying your rent, dining and travel spend will accelerate your pace up the status tiers.

Status earned between January 1 and June 30 each year will expire January 31 of the following year. Status earned between July 1 and December 31 will remain active the rest of the year in which it was earned and the entire following year.

Benefits as you move up status tiers include:

- Silver and higher

- Earn interest in the form of points to a member’s Bilt Rewards account every month based on average daily points balance for each 30-day period (rate is based on the FDIC published national savings rate)

- Bilt will deposit up to 10% bonus points on top of points issued by landlords to

members for signing for new tenant leases and lease renewal., depending on

member status.

- Gold and higher

- Bilt Homeownership Concierge: Members who redeem Bilt Points toward a home down payment can get help from a dedicated concierge who will walk the member through the home buying process

- Bilt will deposit up to 25% bonus points on top of points issued by landlords to

members for signing for new tenant leases and lease renewal., depending on

member status.

- Platinum

- Members will receive a complimentary gift from the Bilt Collection (apparently some type of home decor / art)

- Bilt will deposit up to 50% bonus points on top of points issued by landlords to

members for signing for new tenant leases and lease renewal., depending on

member status.

In my opinion, the status benefits are weak. Surely the home buying concierge will appeal to some folks nervous about the home-buying process, but there are plenty of free Internet resources to help one navigate that. I like art, but I have no idea if Bilt’s curators have are going to match my taste, so I wouldn’t go spending to the 100K level of that. Interest on rewards points is a neat gimmick, but it isn’t likely to make a significant difference for most cardholders. Given the way that Bilt has improved the card, I have to believe that they will find ways to enhance the status program if they want it to be a driver of card use. Just having an elite program is unique, but hopefully they can add some more benefits.

Bottom line

Bilt Rewards is an intriguing program that becomes a bit more exciting yet today now that the card is open to all and being issued by Wells Fargo. Bilt is clearly here to stay and is making a strong play to get into the wallets of renters nationwide. With no annual fee and the ability to earn 1x points while paying rent — even in cases where the landlord doesn’t accept credit card payments — this program just makes sense for a lot of people. It still won’t make sense for those willing to put in the legwork to jump through a few hoops and earn rewards by indirectly paying rent with a credit card, I can think of plenty of people in my social circle who would stand to win an easy 50K points per year with this card with almost zero effort. Bilt could be a great way to introduce friends and family to travel rewards without them needing to study and learn much. As someone who enjoys introducing people to travel rewards, I find that pretty exciting.

Contrary to what some people say, associated fees part of your rent can be included and get counted as points! As long as it’s not a separate payment outside of the rent as the program only allowed 1 rent payment per calendar month / statement.

I got the 5x bonus points for the first 5 days upon approval as well as 2.5K points per referral!

Has anyone used their own referral link to apply for the Bilt CC? Did it work?

can you use BILT to pay monthly condo maintenance fees? My condo assoc. will take credit cards but there is a 4% fee. Having a check sent monthly from Bilt would be useful.

Thx

No. Just ten

That should have said just rent.

With new referral progam, any chance of allowing posts of referral links (either here or on FB page, etc)?

No. We never allow referral links on the blog (only occasionally in dedicated referral threads in our Facebook group) and we generally only offer referral threads in situations where the referral is the best offer and we don’t have an affiliate link for the same offer. Since we have an affiliate link for this offer, we probably won’t do a referral thread (same as we don’t do referral threads for other cards where the affiliate offer is the best offer and we have an affiliate link).

Thanks for the fast reply — that makes sense on your policies, those certainly sound familiar. Was thinking that maybe an exception to Bilt since there is no SUB offers out there, etc, and it’s sort of the only way for anyone to get something (even relatively small in this case) out of somebody signing up.

Thanks for considering!

able to use Bilt to pay college tuition without being hit with the extra 3-4% fee that’s usually added?

That’s not rent, so I can’t think of any way the Bilt card would help you avoid whatever fee the college charges if they charge one.

didnt know that Bilt would be able to differentiate between rent and college tuition. am i wrong?

Most over-rated and over-hyped card of 2022.

I currently deposit a check directly into my landlords account (old school).

Can Bilt do the same?

Pretty sure they can pay by ACH.

Yes that’s what I do. I just mailed the check to our address and deposit it to landlord’s bank account. BILT’s customer service is fast in answering questions too. You can email them directly.

Can you pay rent for other people, like a brother’s apartment or even friends? How does it work for paying rent to multiple landlords?

See my content below. I think you could pay multiple rents per month. I imagine Bilt would like this. Not sure exactly how the mechanics would work for a lease not in the cardholder name.

Cannot pay multiple rents per months.

Not sure why someone is thumbs-downing this answer, but I’m guessing from name of the person responding that the information is correct.

Bilt is the best constructed program in terms of redemption partners but I will probably never have their card. I don’t pay rent (which would make it a no-brainer) and don’t have enough organic spend to support my points addiction at what would probably work out to be something like 1.5 points per dollar spent.

If I were one of those people who spent $2mm a year on credit cards, I’d be happy to earn 3mm points considering their transfer partners. But for someone with “only” $40k to $60k to “deploy”, earning less than 100k points a year would just leave me twitching for more on the floor of some airport.

I have 2 kids in college paying rent — can you pay more than one rent bill per month (keeping in the limit of $50K annually)?

It seems you could edit your rent payment, but I think your name (cardholder) will still show on the Memo line of the check (if it’s a physical check). Not sure how it works for electronic payments on their network of landlords, as mine requires a physical check.

One rent per month per bilt card.

Not worth a 5/24 slot without any bonus

Is there any advantage to getting this card if you don’t rent?

No signup bonus and the category bonuses are matched/exceeded by a bunch of other cards.

Yes there’s no annual fee and the transfer partners are nice, but it’ll eat a 5/24 slot that could be going to a different card.

Hopefully they plan to add some kind of points earning for mortgages and/or a business version of the card that won’t take a personal slot.

Agreed not worth 5/24. But perhaps those of us with sock drawer WF cards can convert to the Bill card.

(Not sure there is a compelling reason to do so – also perhaps at some point WF will move their rewards to be interchangeable widely expanding the appeal of their 2% cash back card).

Just thinking aloud – this could be a good thing. But the fact that Bilt was developed by folks intimately familiar with our ways makes me think it may offer good value but our tricks to extract even better value are destined to fail.

If you think of this as a fee-free Sapphire Preferred with better transfer partners it might make sense for people with very high organic spend, or lots of dining.

Bilt was/is growing nicely, unfortunately aligning itself with Wells Fargo is a poor move. Wells Fargo has become such a thoroughly untrustworthy brand due to the fraud it perpetrated against its account holders over the unauthorized accounts scandal. Two years since the final judgements against WF is not nearly enough time for any some of customer trust to be regained. I had weighed the Bilt card but unfortunately it’s a hard no if Wells Fargo is involved.

Especially disgusting is that Wells Fargo targeted people of color.

So it’s okay to defraud caucasians? How racist of you. Why make race an issue at all?