NOTICE: This post references card features that have changed, expired, or are not currently available

UPDATE 4/10/2019: Bank of America has updated the terms of the Business Advantage Relationship Rewards program. Now, like with personal cards, the relationship bonus will be applied the the card’s entire earnings. For example, if you earn 3% cash back and have Platinum Honors, you’ll get 3% x 1.75 = 5.25% back. For existing Cash Rewards for Business customers, this new approach starts with purchases made as of May 1 2019. For new cardholders, this new approach is already in effect. Hat Tip: Doctor of Credit.

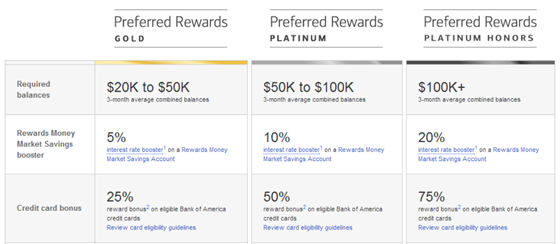

Bank of America offers a loyalty program of sorts where the amount of money you have on deposit with BOA and Merrill determines your elite level. To achieve top tier Platinum Honors with either the consumer loyalty program (Preferred Rewards) or the business loyalty program (Relationship Rewards) you need to have $100K on deposit.

We’ve covered these programs before:

The most interesting benefit of top tier status in these programs is the ability to earn 75% more rewards via certain BOA credit cards. With either the consumer Travel Rewards card or the Business Travel Rewards card, this means that you can earn 2.63% back (towards travel) on all spend:

| Card Name w Details & Review (no offer) |

|---|

No Annual Fee Earning rate: With Platinum Honors status with Bank of America's Preferred Rewards program, this card earns: 2.625X points for all spend (and 5.25X for travel purchased through BOA's travel center) Base: 2.625% Portal Flights: 5.25% Portal Hotels: 5.25% Card Info: Visa Signature issued by BOA. This card has no foreign currency conversion fees. |

No Annual Fee Earning rate: With Platinum Honors status with Bank of America's Business Advantage Relationship Rewards program, this card earns: 2.625X points for all spend (and 5.25X for travel purchased through BOA's travel center) Base: 2.625% Portal Flights: 5.25% Portal Hotels: 5.25% Card Info: Mastercard World issued by BOA. This card has no foreign currency conversion fees. |

But when we look at the Cash Rewards cards instead of the Travel Rewards cards, we see a different picture. Here, the consumer card generously applies the 75% bonus after category bonuses are applied, but the business card applies the bonus before category bonuses are applied. This makes the business Cash Rewards card much less interesting than it could have been (especially since the business card, unlike the consumer card, has very large caps on bonus spend):

| Card Name w Details & Review (no offer) |

|---|

No Annual Fee Earning rate: With Platinum Honors Preferred, 5.25% back on your choice of the following: gas and EV charging, online shopping, cable, streaming, internet & phone plans, dining, travel, drugstores, home improvement & furnishings (can choose a new category monthly). ✦ 3.5% back at grocery stores & wholesale clubs ✦ 1.75% back everywhere else. 5.25% and 3.5% rewards are capped at $2500 in combined purchases per quarter Base: 1.75% Travel: 5.25% Flights: 5.25% Hotels: 5.25% Grocery: 3.5% Dine: 5.25% Gas: 5.25% Card Info: Visa Signature issued by BOA. This card imposes foreign transaction fees. |

I find it surprising that BOA would handle this so differently between their consumer and business products, but there’s nothing new about this finding. I long ago updated my post about BOA’s Business Advantage program to indicate the the Business Cash Rewards card’s bonuses were applied to the base earnings only. However, until today, our credit card database had the wrong info about this. This post is intended to get the word out in case anyone was misled by the previously inaccurate business card information. If you were misled, please accept our deepest apologies.

New: Please see update at the top of this post! Bank of America is now treating the personal and business Cash Rewards cards in the same way.

[…] The card is more interesting if you have Preferred Rewards business status (that’s separate from the Preferred Rewards personal program), which gives you an extra 25-75% points on points earning. This means that 3x category becomes 3.75%% at the highest level (the extra 2% does not get bonused). […]

[…] BOA Platinum Honors: Different treatment for Cash Rewards vs Cash Rewards for Business […]

Pay taxes and come out ahead – what’s not to like about that?

Buy their stock (BAC) not their BS scam Citi pulled the same on me $100,000 HaHa !!

CHEERs

@Greg- I assume that even though one is Platinum Honors through Personal Accounts, that to become Platinum Honors for Business, you would have to deposit into a Business account? Thanks

Sad but true. You have to qualify for the business program via deposits in business accounts.

Something tells me the Consumer Cash Rewards card will get a lot less interesting in the near future.

With the $2500 per quarter cap, it’s already only moderately interesting in my opinion

$2,500 per card. A lot of people should be able to end up with 4 or 5 Cash Rewards cards between old Merrills, Alaskas, and MLBs.