NOTICE: This post references card features that have changed, expired, or are not currently available

With more and more reports of difficulty getting approved for Chase business cards, this week we made a change to our Best Credit Card Offers page. Greg and I discuss that change, an interesting Amex clawback data point, whether or not Intercontinental Ambassador is worth a mattress run, and more on this week’s Frequent Miler on the Air. Watch, listen, or read for more of this week at Frequent Miler.

FM on the Air Podcast

For those who would rather listen than watch, the audio of our weekly broadcast is available on all popular podcast platforms, including:

| iTunes | Google Play | Spotify |

You can even listen right here in this browser:

If you can’t find the podcast on your favorite podcast platform, send us a message and let us know what you’d like us to add.

This week at Frequent Miler:

In credit cards:

On my mind: Pandemic Best Credit Card Offers

In what became our main topic on FM on the Air this week, Greg explains what prompted him to make an adjustment to our best credit card offers page: many Chase business cards have become nearly impossible to get for many readers. We don’t yet have a useful set of data on other issuers, but I still think that Greg was right to move business card offers out of the “Best of the Best” list since those who know the game well enough to be considering business cards can still find the full list and likely won’t be put off by an extra click. As noted in the podcast/video, we’d love to get reader input on business card success / failure: if you have recently (since April) applied for a business credit card, let us know which card(s) and whether or not you’ve been successful.

Chase Freedom vs Freedom Unlimited: Which to choose?

Hint: You really can’t get this wrong since it’s easy enough to product change or reallocate limits later (and in fact only took 13 minutes via secure message in my case). In my family, we would probably earn more points per year on a Freedom Unlimited, but we ultimately decided to add a Freedom card instead. See this post for the rationale and why you can’t really go wrong either way.

In hotels:

“World’s Best” points-bookable hotels & resorts in the continental United States 2020

If you read the comments on this post, you’ve seen that I was underwhelmed by property #5 on this list (which was actually #4 on Travel & Leisure’s list of best city hotels in the United States): the Kimpton La Peer in Beverly Hills. I stayed there last year and it wasn’t special. Of course, that’s just one property on the list: that Hotel Emma is San Antonio is calling my name for a future trip as it looks awfully cool and the reviews sound very interesting. Overall, I thought this was a really interesting look at which of the places on the “best of” lists are accessible for rewards enthusiasts, and that is certainly a fun exercise.

Staying 30+ Nights In A Hotel? You Might Not Have To Pay The Taxes.

Who woulda known that you could potentially avoid all the taxes by staying 30+ nights? I’ll tell you who woulda known: this guy. Still, as someone who is not that guy, I definitely didn’t know how this worked. I have often contemplated trying a stay of such a length — if that daydream ever becomes a reality in the post-pandemic world, I’ll stand to save a decent chunk of change thanks to this post from Stephen.

IHG: Buy/Renew Ambassador Membership Then Stay Once & Get 40k Free Night Certificate (Cert Expires 4/30/21)

This deal was the topic of this week’s Mattress Running the Numbers segment. I have difficulty getting excited about this one. Ambassador status gets you pretty weak benefits and a glorified 2-for-1 coupon (Can we stop calling this a free night, please? It’s not free. It’s discounted. Sure, it can be a good discount in some cases — but it’s still just a coupon, nothing free). The addition here of a 40K cert if you complete a paid stay in time at one of IHG’s 3 most expensive brands isn’t much of a sweetener before even considering the brief window of validity on that cert. Hyatt gives unlimited 2-for-1 Miraval nights and 25% back on awards for cardholders — no purchase required — and the best that IHG can do is sell you a coupon and a free night cert that expires in spring 2021? Hard pass.

In the hunt for deals:

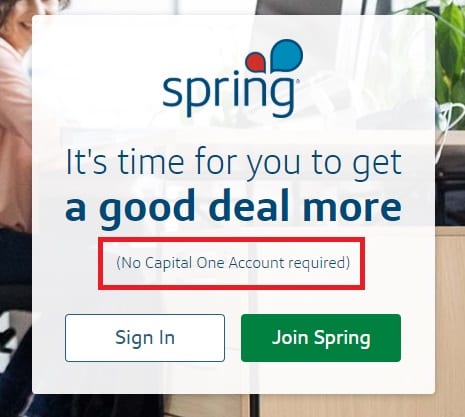

Spring from Capital One: “Business” deals for everyone

If you’re familiar with Visa Savings Edge or Mastercard Easy Savings, you will find Capital One’s program quite similar (though in this case, it is open to anyone). I pulled out two deals to examine: a Dell deal that isn’t amazing but may be decent and a deal on Happy Gift Cards that didn’t turn out so well: I didn’t get approved to buy at the discounted price, but as Stephen published at GC Galore, maybe that was no real loss. C’est la vie.

Extreme Stacking Dell

In this post, I show how, when the right opportunities converge, you could (for example) buy a $599 laptop and get $260 cash back, more than 24,000 Membership Rewards points, and a $100 Visa Gift Card. See how you, too, can stack Dell to walk away with a big bargain.

The Deal of the Week:

Wow: iTunes gift cards can now be used for Apple products!

It’s admittedly a stretch to call this the “deal of the week”. Long term, this probably won’t be much of a deal at all in terms of what it does to the discounted iTunes gift card market. That said, if you have a large iTunes balance or a handful of cheap iTunes gift cards you’ve bought, you kind of struck gold with the ability to use those for Apple hardware like iPhones, iPads, or iMacs, Grab cheap iTunes cards or those bundled with fuel points while you still can.

That’s it for this week at Frequent Miler. Check back soon for our week in review around the web and this week’s last chance deals,

![Cutting our collections, comparing free night certificates, and expediting new cards [Week in Review]](https://frequentmiler.com/wp-content/uploads/2025/07/Nick-Platinum-cancel-218x150.jpg)

![Re-Bilt already, Fixing Marriott, the best Hyatts for Free Night Certificates and more [Week in Review]](https://frequentmiler.com/wp-content/uploads/2026/01/wp-1768653765552601913603261308925-218x150.jpg)

Thanks for contributing biz app datapoints!

DP: Just got Chase Ink Preferred in the mail today with 10K credit line. I applied 7/27 online and called recon the next day as I expected not to get instantly approved. I used my SSN as sole proprietor. I have a personal checking acct but no biz relationship or other Ink cards. They didn’t ask for any documents and was quite painless. I also got Amex BBP 3 months ago and Alaska biz 11/19.

DP to add to the discussion. Approved for US Bank Biz Leverage card this past week. Current active relationship with the business with US Bank and personal bank account also, but good nonetheless.

DPs: instant approval amex blue business; no claw back on amex gold vgcs at Kroger and neighborhood Walmart’s (only $2k/mo); Hilton surpass clawed back to 6x ($8k on 2 consecutive months). I believe I still have the $15k free night, but I didn’t score diamond status like I wanted to

Biz card data last few months — approved for citi aa biz (player 1 and 2), Amex Bonvoy biz, and aviator aa biz. Player 2 denied for chase biz unlimited despite true business, EIN, and chase business checking for years.

I thought your answers to the end question was just meh. If your typical reader has an Amex Gold already, the upside to getting a Freedom/Freedom Unlimited is modest. It’s potentially another 12k with $12k in grocery spend, plus 20k sign up bonus. But this burns a 5/24 slot which could be a significant opportunity cost like missing out on the Hyatt card. And I don’t think there’s any real data to support that it’s safer to MSing with Chase than Amex. I suggest you always be careful telling your readers/listeners that it’s “relatively safe” to MS with Chase. Chase has shut down plenty of people for modest MS including my spouse. Also if you’re talking about the realm of MSing then that changes all the calculations since you could be maxing out the Gold’s $25k limit, in which case the Freedom’s $12k grocery spend comes with less opportunity costs, etc.

Yes, “safer” might not be the right term (I can’t remember what they specifically said in the podcast), but certainly much more possible to MS with chase than amex.

I agree with you, and Larry. First off, I find MSing to be a pain in general and only do it if I’m close to meeting a spend requirement (SUB, final spend for free night cert, etc.). Add to that the risks (clawbacks, shutdowns, MO locations drying up, etc.) plus the expenses (lots of grocery stores only carry $100 or $200 gift cards, or maybe $500 max….activation fees for each card are generally $4-7, then let’s say another $1 for the MO…. although I would love to have someone verify these numbers as I’ve only really used Simon Malls with WM MO’s over the past year). In the best case scenario ($500 GCs @ $4 activation & $1 MO’s) that’s $120 in expenses, plus the added risks, plus losing a 5/24 slot, plus your time doing all this and keeping track, all for an additional 60k UR points. I guess that still makes sense for some people, but if you don’t have a grocery store selling $500 GCs, now your expenses are immediately a minimum of $300.

Still, in the best case scenario, you do gain over $1000 (80k total x 1.5 cpp – $120 expenses = $1080) while sacrificing the time, a 5/24 slot and taking on the MS risk. That being said, FM only values the first year of these cards at $840, probably due to the opportunity cost lost from other cards. In that case, they haven’t even accounted for the MS necessary to reap the points if you have another grocery card, so now the first year value is down to $720 at best.

This brings me to my main point: if you have a 5/24 slot open to get a freedom, then you’re definitely eligible for the bonus from several other personal cards, including several chase cards. FM has a number of cards listed with a first year value near or above $700 that you can easily accomplish from everyday spend. It’s an easy decision for me to sign up for one of those cards and essentially get the same value for less effort and less risk. I would only really consider signing up for the freedom if you don’t have any other cards with bonus spend for groceries and you would take advantage of the offer organically.

Counter DP. I used my BCP and bought 5 different $500 gift cards (some Best Buy and some MCGCs) and am showing 6% on amex.

DP Approved for a us bank biz card at 11/24. I have a us bank checking account.