NOTICE: This post references card features that have changed, expired, or are not currently available

Sooner or later, most of us face the prospect of needing a new set of wheels. That time has come for me — and so I’ve been trying to figure out the most advantageous play for getting the vehicle we want for the most attractive net cost. I’m not sure that I’ve come to a firm conclusion yet, so I figured I’d lay out my thought process and ask for reader input on the best choice. New or used? How would you earn the best combination of miles and money? Note that this post won’t be about negotiating the price — but rather trying to figure out whether it makes more sense to buy new or used and how to earn the best possible reward in exchange for the purchase.

New or Pre-owned?

I’ve long thought that there was no sense in buying a new car that will greatly depreciate the second it comes off the lot. That said, we do like the peace of mind in having a warranty if we’re going to spend five figures on a car. That means we’ve mostly been looking at 2015 and up models that still have some factory warranty. We came into this process intending to buy used. However, we haven’t totally ruled out buying new — and I’ll lay out why. I’l start by assuming we’re buying a new car for the next few sections of this post (the first couple of scenarios are really the same either way). Fortunately, we have saved up the money for this purchase — meaning that we are in the position to pay cash or finance depending on what works out to be the best deal for us.

For the sake of example, let’s say that this car costs $30,000 new (I intend to spend less, but dealer invoice price is in this realm). Here are the options we see:

- Pay cash outright and hope that this helps us negotiate a better deal.

- Find a dealer willing to accept the full purchase price on a credit card to earn rewards

- Put some amount on a credit card (whatever the dealer allows) and pay the rest with a credit card via Plastiq to max out rewards

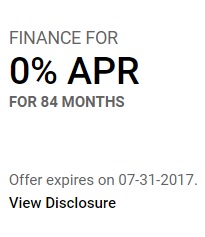

- Finance through Jeep/Chrysler at 0% for 60/72/84 months (all possibilities according to Jeep.com)

I went into my car buying search assuming we were going for option #1 in order to get the best deal and avoid being in any debt for the purchase. Of course, this is no small purchase — wouldn’t we want to earn miles on this? I wondered the best way to earn rewards on this purchase. After putting some thought into it, I think I’m going to do what I thought least likely from the outset: buy a new car and finance it through the dealer. More on why to follow. First, a quick look at the first three options.

Option 1: Cash Outright

This option is the simplest — find a car, negotiate the price, write a check. No debt, no payments, no stress (from the purchase, anyway). But that earns no miles — that’s no fun :-). Of course, it’s not that there are no options for earning rewards. I could probably use a credit card to buy Visa Gift Cards and then use the gift cards to buy money orders and pay the dealer with a stack of money orders. I’d look like a drug dealer, but not much less-so than turning up with a suitcase full of hundreds.

Option 2: Pay for the car completely on a credit card

This option sounds like fun — find a dealer, negotiate a price, and whip out your card to pay. You occasionally read a story like this about someone paying for an entire vehicle on a credit card. However, those stories are the exception rather than the norm. Most dealers won’t allow you to pay much on a credit card. The Amex Auto Buying program says that they will find dealers who accept “up to the full purchase price” on an Amex, but the truth is that most dealers only accept $2,000-$5,000 on a credit card.

That said, it’s not impossible to find a dealer that accepts the full purchase price on a credit card. I’ve done a lot of Amex True Car requests and only noticed one dealer so far that accepts the entire price on a card, but I did find one:

If I went that route, I’d be putting $30K on a credit card (and of course paying it off immediately with the cash I saved up for the purchase — this would be purely for the purpose of earning miles/rewards). For me, the obvious first option would be the Amex Blue Buisness Plus. At 2X everywhere, the $30K car would earn me 60K Membership Rewards points. That’s an attractive return — easily worth $900-$1200 or more depending on how you use the points. For example, that 60K would be more than enough for a business class flight to Africa or South America using ANA as a transfer partner. The problem: My Blue Business Plus account is new and $30K is well over my starting limit. It’s true that I might be able to call Amex and explain the situation. They may allow me to purchase beyond my limit, provided that I pay back the difference between my limit and the purchase price right away — but it might not be easy. On the other hand, I could easily put the car on my Business Platinum card and earn 1.5X since the purchase is more than $5,000. That would be 45K points — still a decent value. If I had a Freedom Unlimited, that would be another good choice for 1.5X. All of those options are interesting — but paying the entire cost on a credit card relies on me finding the best possible deal from one specific dealer. I’m not sure that will work out.

In a nutshell, that’s not bad if it works out — but I don’t want to base my vehicle search on finding a dealer who accepts a card over focusing my search on the dealer with the best combination of service/price/vehicle I want.

Option 3: Pay some with a credit card at the dealer, pay balance with Plastiq

If I end up buying from a dealer who does not accept a credit card for the full purchase price, but I still want to earn credit card rewards, Plastiq could be another good choice. As you’ll remember, Plastiq is a service that allows you to pay with a credit card for things that normally require a check (like rent, utilities, mortgage, car payment, etc). They tout the service as being able to be used to pay for anything you can buy with a check, and they include things like boats and car payments in their list. I’m not sure if the service could be used to pay for a vehicle outright, but it’s something I’m looking into. I sent them an email and am hoping to get some more information on the process. I intend to report back once we have made a purchase.

In the end, the upside here is that I can shop for the best possible deal and at least theoretically use Plastiq no matter where I buy. Another upside is that I could have them cut multiple checks so I could use different credit cards (helpful for hitting the minimum spend for the sign up bonus on a few cards). A downside would be the fee. However, thanks to Plastiq’s generous referral promotions, I have the fee-free dollars to pay for this purchase without a credit card fee — meaning that the end result is the same as option #1 as far as my wallet is concerned.

Option 4: Finance the car through the dealer at 0% APR for 60, 72 or 84 months

This is where the math starts to get more challenging. Going into this process, I totally ignored the prospect of financing through the dealer. After all, we saved up so we could buy a car we can afford, and that means paying cash, right? As I put more thought into things, I realized that it may not be quite so simple.

Right now, the incentives through Jeep/Chrysler include the ability to finance the car for 0% APR for 60, 72, or 84 months with 10% down. This requires excellent credit. With a score over 800, I expect to be good to go at 0%. After 10% down, this means that on a $30K car, we would be financing $27K. Financed over 84 months, that comes out to 84 payments of $321.43. The rest of this post will assume the 84-month financing plan. Of course, I could make these payments through Plastiq for rewards — so while I wouldn’t take down a huge haul of miles in one shot, I would end up with roughly the same number of miles in the end. The added benefit here would be that I could pay with different credit cards monthly if I wanted. Since we know that new credit card bonuses are the most lucrative way to increase your miles, I could end up earning more miles in the long run by spreading out this spend and using it towards multiple sign up bonuses over the years.

But more interesting to me as I considered this option was what I would do with the remaining money I have saved for this purchase. You’ll sometimes hear finance gurus spout off about times when money is so cheap that it’s better to borrow than use cash. At 0% for 7 years, I wondered: are they right?

So I asked myself this: if I financed this car, what would I do with the money in the meantime to make it work for me? Many would tell me to invest in stocks/mutual funds/ETFs. While those people may not be wrong, I don’t want to invest the money in a way that puts the cash at risk. I’m looking for a “guaranteed” return on a pile of money that will mostly be sitting over the next few years. I went to Doctor of Credit’s page on high-yield bank accounts to see what I could earn on a sum like that. I was pleasantly surprised to see that Consumers Credit Union is offering 4.59% APY on balances up to $20,000.

Earning the full 4.59% APY requires you to jump through a few hoops (more on those in a second) — but that return certainly sounded interesting. Remember that my purchase price in this example is $30K and I’m paying $3K down. That leaves me with $27,000 in cash. Let’s say that I put $20,000 in the Consumers Credit Union 4.59% APY account right away. Let’s say just for the sake of simplicity that I put the remaining $7K in a simple no-rewards checking account and just make my monthly car payment out of that. It will be 21 months before I need to touch the money I’m putting into Consumers Credit Union (21 x $321.43 = $6,750.03).

If interest were to compound annually, that’s a return of $918 per year on a $20,000 balance. That’s almost three free monthly payments earned in year 1. Furthermore, due to that interest income, it would be more than two years before my balance were to drop below $20,000 — meaning that I’d earn more than $1,800 in interest in the first two years of the 7-year loan. And that’s assuming that I earned 0 interest on the remaining $7K in my no-rewards checking account. I also get the added benefit of keeping my cash liquid in case of an emergency. These are the assumptions I’m working on:

- I start with the $27,000 cash that I owe after paying my $3K down payment

- I put $20,000 into Consumers Credit Union at 4.59% APY

- I put the other $7,000 in a non-rewards checking account. I use Plastiq to pay $321.43 monthly and pay my credit card off with this money as long as it lasts.

Playing this all out over the life of the loan requires some math that gets pretty heady. Since you only earn 4.59% on the first $20,000, it’s not as easy as using an APY calculator. The APY calculator will include interest on the interest income — but since that interest will bring the account balance over $20K, you will not earn 4.59% on the interest income (Does that make sense?). So figuring out my final profit gets tricky. But we can get a lowball estimate by doing this:

- 2 years of payments at $321.43 = $7,714.32.

- Let’s say I make $7,000 of that from my non-rewards checking account and the other $714 comes out of Year 1’s interest income

Remembering that Year 1’s interest income was $918, that means that after 2 years of payments, I will still have this:

$20,000 initial deposit in Consumers Credit Union

$204 in leftover interest income from Year 1 ($918 – $714 to top off my $7,000 non-rewards checking and pay 24 payments)

$918 in interest income from Year 2 (4.59% APY on $20K compounded annually)

$21,122

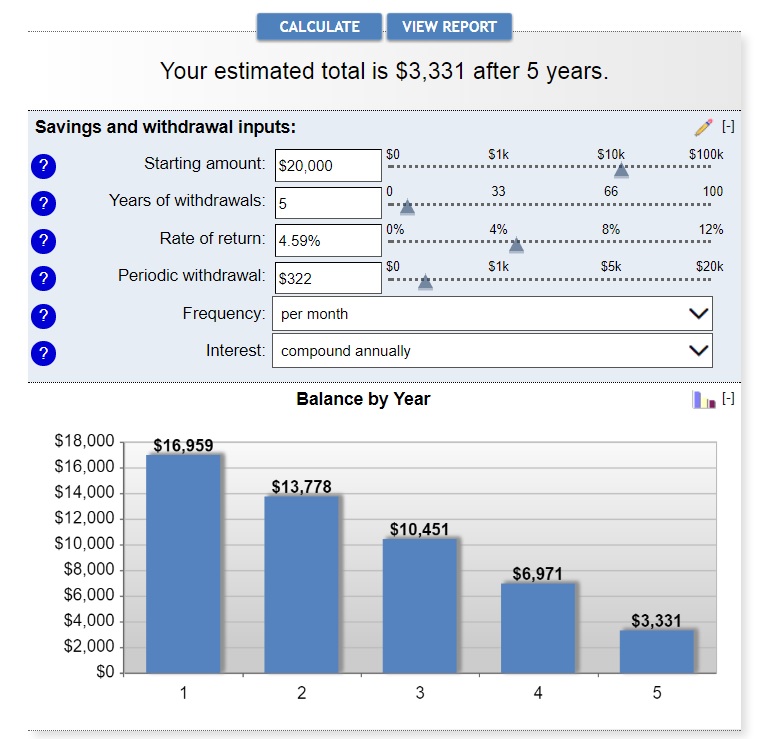

Remembering that I only earn 4.59% APY on $20,000, let’s say that I remove the excess $1,122 from that account and I stuff it in my mattress. Let’s now say that I make my monthly car payment from the Consumers Credit Union account. So far, I’ve made 2 years of payments; I have another 5 years of payments to make. I found a handy declining balance APY calculator to determine what my final balance would be at the end of the next 5 years. Unfortunately, it wouldn’t let me enter a payment amount that wasn’t an even dollar figure. Therefore, to stick with a lowball estimate, I ran the calculator based on making a monthly payment of $322 and interest compounding annually. Here is my final balance at the end of the next 5 years of payments (when my loan would be completely paid off):

As you can see, when my loan is paid off, that account would still have $3,331 in it. Combine that with the $1,122 in my mattress and I would end up with $4,453 left after paying the full $27,000 that I owed. And that’s assuming that I earned $0 in interest on the excess $7,000 during the first two years of payments and $0 on the $1,112 in my mattress. Realistically, I’d put the mattress money back into the Consumers Credit Union account to keep myself at/near $20K for as long as possible and I’d make at least a bit more out of that. There are bank account options to earn interest on the $7,000 I initially put aside as well. I’m confident that I would end up more than $4,500 ahead in interest by financing the car over paying for it outright — and that comes with the added flexibility of having the funds liquid if a catastrophe strikes.

Furthermore, I don’t have to give up anything in terms of rewards earning. In fact, as mentioned above, I might earn more since more of my send would likely be focused on meeting minimum spend for sign up bonuses. I could still use a credit card through Plastiq to make my monthly payment and use my Consumers Credit Union checking account to pay the credit card bill. In fact, that would help me jump through one of the hoops necessary to earn 4.59% APY.

So what are those hoops you need to jump through for 4.59% APY?

According to Doctor of Credit, you must do the following every month:

- Complete 12 debit/check card point-of-sale purchases without a PIN

- Complete one of the following every calendar month:

- One direct deposit OR

- One ACH debit OR

- Pay one bill using Consumers Credit Union online bill pay

- Access online banking at least once

- Receive eDocuments (enroll and accept the disclosure)

- Spend at least $1,000 on Consumers Credit Union Visa credit card purchases

That sounds like somewhat of a headache. Still, 12 debit transactions isn’t too hard — I can go to the grocery store and knock those out in one or two days each month by separating my purchases. Paying a bill is easy as I will eventually be using this account to pay my loan — though, in the beginning, I will have to play the game of depositing and withdrawing once each month. Accessing online banking and receiving eDocuments are easy. Finally, CCU has a number of Visa cards from which to choose. I could earn 1% on one of their cards. I’m sacrificing at least 1% on $12K per year to meet this requirement — or about $120 a year. However, there is a card with a 3% grocery category on the first $6K. And truth be told, we publish a monthly guide on how to increase credit card spend and get most of it back. I’m not too concerned about losing out on any rewards to meet this final requirement.

So used or new?

I did intend to buy a pre-owned car from the beginning. So how does buying new compare? With the model and options we want, it looks like pre-owned will cost us in the neighborhood of $22,000 if we get all of the options we want — maybe less if we settle for something that doesn’t tick all of the boxes. However, if we buy pre-owned, we can’t finance at 0%. The best rates I’ve seen on used car loans are about 1.9% — and typically not for nearly as long of a term. If we were to finance a pre-owned car, we could certainly come out somewhat ahead — but realistically, our earnings would be meager. And we didn’t intend to finance a pre-owned car. We came into this intending to pay outright for a pre-owned 2015 or newer.

However, if we buy a pre-owned car outright, we would have to consider the following points:

- It comes at the opportunity cost of earning ~$4500 in interest

- We lose the flexibility of having cash in the bank

- We have less warranty vs a new car

- Lower final value at the end of 7 years (whether we sell it or trade it in)

- We lose an easy opportunity to work towards the minimum spend on many cards over the next 7 years

Ignoring #2-#5. the $4500 lost interest earning brings the net cost of used vs new awfully close together. Many sign up bonuses offer more than 10X per dollar on the opening spend (e.g. 50,000 sign up bonus for $3,000 spend = 16.666X). Considering the opportunity cost of using $27K spend in one shot versus spreading it out over multiple opportunities to earn 10X or more, the cost of buying used creeps infinitely closer to the cost of new. If we then value numbers 2 through 4 at anything, it seems to me that buying new makes more sense.

Flaws in my logic

First of all, this post works on a pretty narrow set of presumptions. If I were comparing a slightly older car, for example, the price differential would be wider — and buying used might mean a significant savings. Not all makes and models will be as close in price between a new car and a 2015. We don’t know that Consumers Credit Union will continue to pay out 4.59% APY over the next 7 years — in fact, they have changed their rate in the past and there is no guarantee that they won’t change it tomorrow. I recognize that those variables are not nearly as static as I made them out to be. For those reasons, I’m still not sure I know the correct answer.

And I know that many readers have probably considered the same conundrum at some point before. I imagine a few of you have solved for X and determined the best possible answer. So I ask you: what do you think? Used or new? Miles now or interest + miles later? How would you proceed in my shoes — or how have you done it to maximize your return on a purchase that we all know will depreciate in value more quickly than any profit we can earn. What are your thoughts?

“However, if we buy a pre-owned car outright, we would have to consider the following points:

It comes at the opportunity cost of earning ~$4500 in interest.”

In my mind, this thinking is slightly flawed. That high interest rate can be earned whether you buy new or used. If you buy used and can get a rate of 2.59% (just guessing), you can still earn your $4,500 in interest income, less the interest expense on the loan. in comparing new vs used the interest you can earn is irrelevant. You can earn the $4,500 no matter what. So to me, the real opportunity cost would just be the total interest paid on the used car.

I think one of the first comments basically called out the hidden consideration – my friends who work for dealerships have all told me it’s a shell game. 0% financing, “$5,000 instant rebate”, negotiate lower cost paying cash, etc – They will structure so it all nets out the same in the end.

Not sure I believe that’s 100% true without exception, but as a general rule it makes sense and I’ve always thought I would just take whichever option fits my financial needs best at the time. Just my $.02

The big buzzkill question is . . . do you REALLY need a new car? Toyotas are incredibly reliable. We have one with 200K miles on it that still runs great + we have a 2005 Honda Odyssey with 275K that my teens drive that has very few problems for that many miles. $30K is a lot of money (in my opinion anyway). If it were me, I would invest the $30K you have saved and wait until your Toyota really dies before buying a new vehicle. Not exciting, but I’m practical and frugal!

For fun, take a read – http://www.mrmoneymustache.com/2011/11/28/new-cars-and-auto-financing-stupid-or-sensible/

Dang, this article came out two days late for me because I just bought a new car on Sunday the 9th of July! My wife and I had the same delimma of new vs gently used. We were looking at cars that did not lose as much value as the Jeeps though, so we ended up buying new and basically following your idea #4. We had half the price of the car saved up, but instead of paying it all and financing the rest, we did a 0% APR long term loan with no financing charges and a lower down payment than what we saved up. The leftover will be invested. I wish I had everything saved up though before going through this like you so then I would have had more options.

Alternatively, you can “invest” the 30k (or more) in a whole life insurance policy that pays a meager 4 to 5 percent a year. Becoming your own bank is something the smart rich do. YouTube has videos about this. Once you’re allowed to make a policy loan, take out the amount to pay for the car, but pay yourself back by paying your policy with interest. At the end of seven years, you not only have a car, you have accumulated more than 30k + policy dividends, all this interest is tax free. Not to mention a cash surrender value, a death benefit which is tax free to your heirs, and a host of other benefits. While the percentage of policy dividends you receive does vary year-on-year, just like the high yield savings account, it is far less likely to dip below an unreasonable percentage, unlike the high yield savings account. Insurance companies invest in bonds.

Food for thought.

Interesting idea. Thanks for giving me another angle on it!

Glad to help. Looking forward to reading what you eventually do, and meeting you at a conference in the near future. I like your writing style.

I just bought a used vehicle last weekend and used the MS route! It was a 2012 Honda CRV LX at Car Max. Total with everything including extended warranty came out to be 20K. I used their “3 for free” program which basically gave me 3 days to come up with another method of payment besides their internal financing program(this was Saturday evening). I purchased 20K in VGC’s from my local Simon Mall, liquidated them into money orders, deposited to my bank, and wrote them a check to Car Max on Monday for the payoff amount.

I have 28 credit cards so I will just float the loan back and forth between credit cards until it is paid off. Can’t beat 0% interest loan! 😉

I have purchased both a new and used car in the last 8 months. Not easy to find 0% financing with used car purchases, and I’m not crazy about owing $ for cars. Both dealerships let me put $5k on credit cards. And both agreed to let me pay for the rest in visa/mc/amex giftcards, as they are not assessed a fee when used. I’ve been “stocking up” during the promos offered by OD and Staples, and going to my local markets for the rest, as I can justify a 1% fee on a 500 gift card (and get at least double points and earn gas credit). I paid outright for the used Subaru – the salesmen were impressed with the # of receipts I signed, and purchased half my new car the same way. I’ve refinanced that auto loan several times by asking for a better rate to 1.3%(thank you Chase). When I calculated in the costs of the giftcards, I was $321 ahead (thanks to promos) My family enjoyed a trip to Buenos Aires as a bonus! Highly recommend Park Hyatt Palacio Duhau.

And yes, my husband thinks I’m crazy, but he seems to enjoy business class…

Have you ever looked at this site? https://leasehackr.com/

Most of these deals seem to be in California, but it looks like these guys have figured out how to make a lease beneficial.

[…] in case you were thinking about buying a car and earning miles or points with […]

I’m all about the 0 for 60 you’re thinking about. Have gotten this with VW twice. Agree with a lot of your thinking in that the cash is better put towards a high yield checking account, allowing you flexibility (not only for emergencies but for MS opportunities or other high spending deals where you may need to float some larger sums-looking at you discover Apple Pay).

I’ve only been using plastiq since earlier this year but it’s been a great a way to pay off the loan and meet min spend requirements. I’ve gone the gas rewards route quite a bit this way: grocery store visa gift cards during double fuel rewards promos to meet min spend. Use the vgc at plastiq to pay car loan. Like you said, used car loan rates aren’t the best.. plus with a new car, no ones been drilling farts in that drivers seat before you

I am looking for a newish car too…after owning a Chrysler 300C for 5 years I am leaning towards another one. A few points to consider since I have looked into this a couple of times for past cars. Steven is right, cash is not good to a dealer they want to make money financing, and when I paid cash for a new car years ago, it was a pain. My bank was across the street so I went and got a cashiers check…it took almost an hour to process at the dealer. They had me fill oput a form at the bank for withdrawal over 10K, then another form at the dealer to show where the money went. They acted like they had never sold a car without financing with many people having to help to get the transaction completed…..on the other hand if I had financed it would have been a few forms to sign and I would have been driving. They also play a shell game with fees and APR, being a contractor I read all the fine print and while not as big a math geek as you, I am good figuring out the numbers. Some (a majority) of dealers will offer 0%APR financing but add a finance fee for every $1,000 financed that is added to your monthly payment. Technically you are getting 0%APR but the finance fee can add thousands to the bottom line. Many offer no penalty for early payoff, which allows you to tease them into extra incentives or discounts because they think they will make money off of you… until you pay the loan in full a month or 2 later. Some charge a penalty if you pay it off early, beware. I read a few lease agreements in my time too, enough to get a headache….so many ways to get ripped off, it only made sense if you could write it off on taxes as a business expense, didn’t go over the millage limit, and don’t get any scratches, dents, or dings…I once knew a guy that was charged $1500 at lease end because a passenger spilled food and soda on the carpet and he didn’t have it steam cleaned in time to get the stains out.

New car depreciation is too much to justify, there are 3rd party warranty companies that will sell you a bumper to bumper warranty for less than the first years depreciation. We bought our 300C at CarMax when it was 5 years old and had 30K miles at a good price, we added $1800 for a warranty that covered the car for 5 years or until 110k miles. Service at CarMax was free, anywhere else had a $50 deductible. We didn’t use it much, but it came in handy a couple of times and protected us better than the factory warranty. CarMax would not let us pay with CC and even back then everything I read said $5K was the common limit….for easy MS purposes that is all you can expect..Since our next car will replace my wife’s 300 I am looking for a low millage 2015 or 2016 charger or 300 and will get a 3rd party warranty to kick in when the remainder of the factory one runs out. If I were buying for me, I would be looking at car auctions like Mecum, where if you know what to look for, you can still find a bargain. Too bad they won’t take CC either.

Just from another perspective on a cashier’s check “cash” deal, I bought a vehicle from a dealer last year with a cashier’s check from my bank and paying for it was very easy and smooth (not getting rid of that in this deal). Pro tip: I arrived less than an hour before closing to pay. Sure, I got offered every tire and wheel protection type package, but each pitch was about 10 seconds and when I said no that was it. Finance guy had places to go on Friday night. I didn’t get the title that night — they overnighted it a few days later when the check cleared, but it didn’t seem to throw anyone off. However, I’ve definitely been in dealerships where I can imagine your situation. I think the level of difficulty in paying with a check instead of financing will be somewhat YMMV.

That said, I understand the dealer’s incentive in having you finance — I assumed that they prefer that. I had the Fatwallet thread someone else mentioned in mind on that and/or the dealer’s incentive to close a deal by the end of the month when the last few days come. What I had overlooked, however, was the financing charge for every $1,000. That makes a huge difference in my calculations — because you’re right, that will add up to a significant amount over time. Thank you for pointing it out!

Re: third-party warranties: I know they exist, but I’ve read a lot of mixed reports online about their utility. Did you only bring it to Carmax for warranty service?

yes, because I am cheap we only took it to CarMax for the minor things it needed fixed, but for a $50 deductible I could have taken it to any dealer or garage. These companies do need a little research to make sure they are established and legit, but there are a few good ones out there filling the need now that cars are lasting longer and change hands a few times over their lives….and they really do cover most everything, even the electronics.

Good point on month end and quarter end pressures to meet sales quotas…and this is the time of year when the 18’s will start coming out and any left over 16’s will take a dive in price to get the dealers room on the lot for the new models. It makes me feel like grandpa complaining about the price of things nowadays, but 30k for a car is crazy….I paid $3500 for a 99 ford F150 5 years ago and have maybe $1500 in repairs and maintenance…not counting tags, insurance, or gas which are all cheaper with this older 6 cyl pickup, It cost roughly $1000 a year to own….even my old Jaguars which I drove for 7 or 8 years and cost a fortune to work on came out to about $2000 a year…try to get that number with a modern, plastic, car….you would have to drive it 15 years.

By the way $30,000 in hundreds is no suitcase :). It’s just a stack of 300 bills the thickness of a typical book that you can stuff in a coat pocket without much difficulty. A suitcase of hundreds would be more than a million dollars.

As a former car salesman I have 2 comments. 1. Paying for a car in cash DOES NOT EVER get you a better price on a new car. Not sure how or where this myth started but the truth is the exact opposite. Dealers WANT you to finance, they make a lot of money off of that, the last thing in the world a dealer wants is a customer who pays cash and it won’t help you with price at all. 2. Unless a dealership has a sign clearly stating a limit on credit card transactions pay for it with whatever card you want and for whatever amount. We had this exact situation. Customer makes a deal, pulls out a VISA and says I’m paying for it on my credit card. Dealership owner says no way that costs me too much money. Customer says there’s nothing posted saying I can’t pay with credit card. Owner says well I’m not taking it. Customer calls and complains to VISA, VISA calls dealership and says you have 2 choices. Take the mans credit card or we’re taking your charging privileges away for good. Bottom line, man got to pay the entire amount on his VISA card. You just have to know who to complain to.

Have you considered getting a Tesla? They are much more environmentally sound that the gas powered cars that we drive around in currently. Also, there is a $7500 federal tax rebate on the purchase of a tesla plus additional rebate depending on the state you live in. (Until recently, Illinois was cutting checks for $4k for the purchase of a tesla). Also, installing a charger in your garage would be a small expense (it’s the same outlet as a laundry machine) and many cities/states offer rebates on the installation of an electric vehicle charger as well. I get that this will blow your budget of $30k, but depending on the size of the car you need you could consider the tesla model 3, which would not be very far off from that budget. I know tesla will let you put the reservation cost ($1k-$2500, depending on the model) on a credit card and you can either pay cash, lease or finance, so the Plastiq strategy would come back into play. Let’s not even mention how much you will save on gas!

Environmentally sound? How’s that? A huge proportion of the electricity to charge those very expensive (and non-eco lithium batteries) comes from King Coal. All you are doing is exporting your tailpipe emissions to some poor schmuck who can’t afford to live upwind of a coal power plant.

EVs make no economic sense with gas prices hovering around $2.25/gal nationwide (with some states averaging less than $2/gal).

Tesla are stupid expensive to maintain. Just check their shit warranty and overpriced service charges.

Also, good luck with repairs – everything is extremely expensive. Not even talking about your insurance rates that likely to be commensurately higher.

All other Tesla arguments aside, they just don’t have the range we need and the 3 is too small for my needs. I spend a lot of time on the road on weekends and probably go more than 215 miles in a day at least 2, if not 3 weekends a month. Living in rural America, charging stations are not plentiful. So it’s not even an option that I can consider at this point. But an interesting response that I hadn’t expected. Thanks!

A Tesla is actually one of the more environmentally UNfriendly cars on the road today. Power plant inefficiencies in and of themselves waste more BTUs than the BTU content of all the gasoline sold in the USA. That’s before you include power grid inefficiencies and the charger inefficiencies, battery inefficiencies, and motor inefficiencies of the Tesla itself.

Even a full-size Mercedes S-Class is more environmentally-friendly cradle-to-grave, even if you factor in the gasoline it’s V8 or V12 will consume in its lifetime.

Your fantasy land 4.59% APY is just that. In your calculation you bundle car buying decision and CCU account into one. Can you not put OTHER 20k into CCU?

You are limited with CCU to only 20k. Assuming you have more cash than that, using 4.59% as an opportunity cost is misleading. I would not use anything above 1.3% being paid by regular online savings if you are calculating CASH. You can also invest that money – then these return assumptions get even hazier.

Actually it doesn’t seem that misleading to me. While getting the 4.59% with CCU sounds a bit too much work for me, there are plenty of investment options with at least that kind of return. Of course they carry risks, but not as big as many tend to think. In fact, after you max out the insurance on bank accounts they are basically the most conservative option.

Fair point — paying cash up front doesn’t come at the opportunity cost of putting $20K into CCU — just the opportunity cost of that particular $20K. I guess my line of thinking here is that I’m fine with investing general savings in the market for higher-than-4.59% returns — but I don’t want to risk the money I intended to use for the car in the market. If I were not going to use the $20K “car money” to pay for the car right now, I would want to put that specific pile of $20K into something safe yet high-yield. Maybe I should re-think my approach, but that was my line of thinking.