NOTICE: This post references card features that have changed, expired, or are not currently available

This week, Capital One took its turn to bat and it stepped to the plate with the swagger of someone ready to swing for the fences. They easily hit for extra bases with the additions of Turkish and British Airways and the new 1:1 transfer ratio with some of their best partners. Now, they are a threat to steal home if Amex and Chase don’t keep their eyes on the runner. See us talk about what we think Capital One needs to do to score big in this week’s Frequent Miler on the Air below. We also talk Southwest’s latest shenanigans, what we’re doing about Radisson, and more on this week’s episode. Watch, listen, or read on for more of this week at Frequent Miler.

Subscribe to our podcast

We publish Frequent Miler on the Air each week in both video form (above) and as an audio podcast. People love listening to the podcast while driving, working-out, etc. Please check it out and subscribe (if we get enough people to subscribe, we might be able to earn some income from this someday. So far, the podcast is just a labor of love).

Our podcast is available on all popular podcast platforms, including:

Apple |

Spotify |

You can also listen here in the browser:

This week at Frequent Miler

Rocking the rewards card world

Capital One ups their game, adds Turkish and some 1:1 partners, airport lounges

Watch out Amex, Chase, and Citi: Capital One arrived and is ready to compete. This week, Capital One announced a new 1:1 transfer tier featuring some of their best partners (Avianca, Asia Miles, Etihad, Qantas, Wyndham, and more), meaning that the Venture and Spark Miles cards now really do earn 2 miles per dollar spent everywhere. They also added key transfer partners in Turkish Miles & Smiles and British Airways Avios (which can be transferred to Aer Lingus and Iberia as well), which tells me they are paying attention and looking to complete with a full-fledged transfer partner program. Capital One is no longer some distant fourth rewards currency. They are still a few pieces short of having the full puzzle, but if they’d implement Greg’s suggestion from Frequent Miler on the Air about how to handle hotel redemptions, they might just become the only rewards program someone needs. None of us saw that coming three or four years ago – what exciting changes are happening here!

Capital One “Miles” no longer make me mad (on my mind)

Capital One’s campaign to Make Greg’s TV Safe Again has succeeded as he has agreed to no longer threaten it with bricks when he sees Jennifer Garner getting smug about Capital One. That’s thanks to the changes above. For more on Greg’s reaction to Capital One’s big news, see this post.

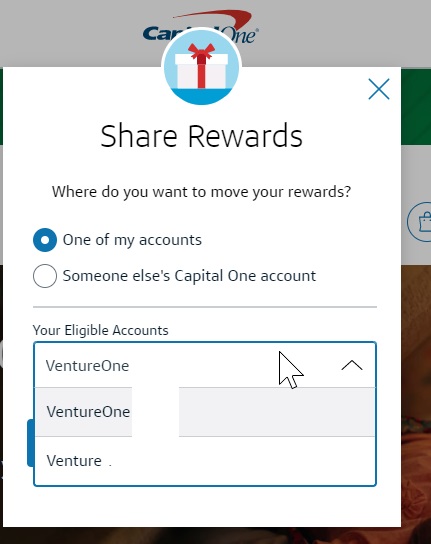

Huge if true: Convert Capital One cash back to miles by moving rewards

While Capital One rocked the points game with the changes announced on Monday, they were still hampered by a key weakness: no bonus categories and very limited opportunities to amass miles through welcome bonuses. As it turns out, they do feature both, just in a round-about way: it turns out that not only can you move miles freely between your accounts (and anyone else who has a Capital One miles-earning card), but you can also move your Capital One cash rewards to miles 1:1 (meaning 1 cent of cash back = 1 mile). That’s huge because it means that the Savor card earns an effective 4x miles on dining and entertainment and the Spark Cash provides both an opportunity to convert a big cash welcome bonus to miles and the chance to have true 2% cash back or miles as long as you have a miles-earning card with which to pair it. See the comments section for reader success reports with various cards.

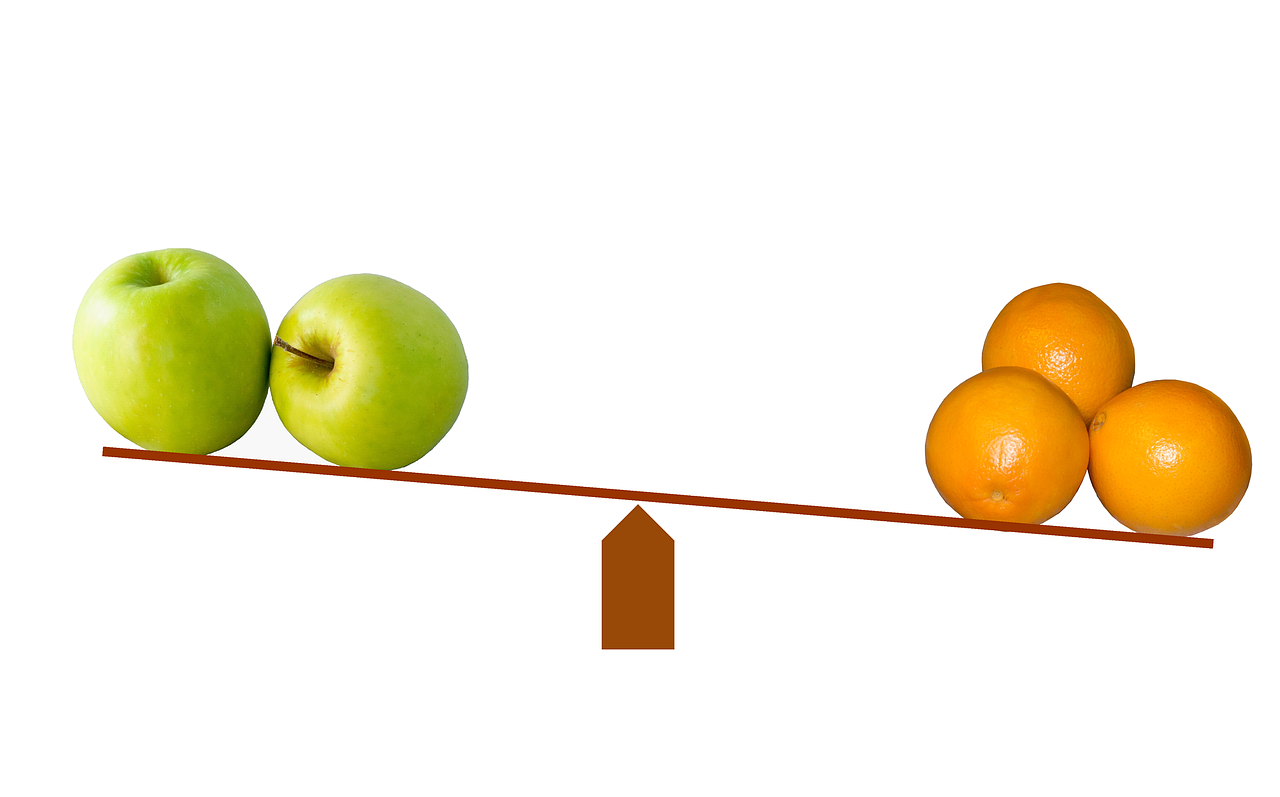

A new transferable currency hierarchy (on Nick’s mind)

If you’ve gotten this far in this week’s post and you’re still sleeping on Capital One, Wake. Up. Chase doesn’t have Turkish, Asia Miles or Etihad, but Capital One does. Citi doesn’t have Aeroplan or British Airways Avios, but Capital One does. Amex doesn’t have Turkish, EVA, or Wyndham (which is hot right now), but Capital One does. These are just a few of the areas where Capital One is taking the best partners from each of the big three and putting them together into a single package that moves them up to no worse than third place in the transferable currency hierarchy and within striking distance for a spot at the top. What a transformation!

Transferable Points Programs: Amex vs Chase vs Citi vs Capital One vs Brex

Greg has updated his transferable points report card, grading each program based on a variety of criteria like the ease of redeeming rewards for cash back or quality of transfer partners and more. See where they all stack up after the Capital One changes.

In award booking & reviews

Vacasa success: Entire cabin booked for 15K Wyndham points per night (transferred from Capital One)

I’ve gotten some awesome suite upgrades at Hyatt and Marriott over the years, but where else in the world am I going to get an entire cabin in the mountains with a pool table, hot tub, and views for miles for just 15,000 hotel points per night? When Greg first wrote about Vacasa, he said that frustration as guaranteed — but now that we’ve learned some key tips from the experience of readers and Travel With Grant, my first booking this week was smooth sailing. The process is a little slow for my taste, but if that’s what it takes to book something like this for 15K per night, I’ve got all the time in the world.

Ritz Carlton Dove Mountain Tucson. Bottom Line Review.

I have a really hard time getting excited about Ritz. Given Marriott’s resort fees and the fact that even high-level Titanium elite members have to pay for breakfast each day, free nights just don’t feel free. So when Greg said he was using a 7-night certificate at a Ritz, my first thought was “better you than me”. After seeing his pictures and videos and reading his description, I’d like to take that sentiment back! This place looks gorgeous and like a great use of 50K free night certs. I’m definitely keeping this one in mind for what might be the best domestic option for the free night certificates from my Ritz card.

Hyatt Alila Marea Beach Resort Encinitas. Bottom Line Review.

I’m glad that Greg stayed at the Alila Marea Beach so that I don’t have to use my points there and be disappointed. Greg’s review highlights some big positives, and that view from his room looked terrific, but I can’t get past the negative points on this one. Between the chance of getting a room that everyone can see into or a lovely view of the parking lot and the sub-par location, this just isn’t calling my name. I’ll take my cabin in the Smokey Mountains for 15K points per night and be happy with it!

A second look at Radisson – did it actually get much better?

Radisson announced its new award chart coming in June 2021 and my initial reaction was strong disappointment (See: Bad news: Radisson devaluation announced and it stinks). Some readers felt it wasn’t so bad, so I write this follow-up post looking at the positive points behind the changes. Still, I see this as a net loss. As someone pointed out in the comments, a lot of the places dropping in price are places where I didn’t want to stay anyway, so I still see the changes as very disappointing overall. On the flip side, if you are playing the game to stretch your points as far as possible, Radisson is opening up more opportunities to sleep cheap at the lower levels, which could be a win for you.

That’s it for this week at Frequent Miler. Don’t forget to check out this week’s last chance deals.

![A coupon book with a credit card, a credit card program with an airline, and more [Week in Review] a person reading a magazine on a couch](https://frequentmiler.com/wp-content/uploads/2017/05/kick-back.jpg)

Greg, technically that would be an “adverb roast.” 🙂

Thanks for the advice on the potential increased leniency of CapOne for new card sign-ups. I had pretty much given up on getting approved for their cards after many years of denials. Lobbed in an application yesterday and was instantly approved with an outsized credit line. Always fun to delve into a new bank and points world. Appreciate the advice to take another swing!

Great!

outstanding show again. I`m a bit confused for Capital one you Mentioned to get Spark or the Venture card. So I went to your link page to give you the referral. Do you suggest miles for business or cash for business or miles select for business or cash select for business….etc etc etc

BTW I own a business hahaha

I’d recommend the Venture right now because it has the better welcome bonus. That could change anytime though. The Venture and Spark Miles cards are pretty much the same except that the latter is a business card. The Spark Cash is a great add-on to the Venture since it earns cash back rather than miles, but that cash back can be moved to one of the miles cards in order to transfer to airline and hotel partners. Also, the Spark Cash doesn’t get reported as a new account to your credit report and so it won’t affect your ability to get Chase cards.

Great show again, guys.

I want to weigh in on the Lifemiles tool being limited. I agree that “severely” (limited) is too strong a word to use for the tool, but “somewhat” is definitely too weak, in my opinion. I have had the same experience as Greg looking on that tool, particularly looking for flights to Europe, as Greg spoke about. If we are only talking about flights to Europe in premium cabins, I think “severely” is appropriate, so maybe overall we can settle on “significantly” limited?

They can steal home from third, when someone else is ‘at bat’.

I was a member of Master Card since 1979 and a paid up member with an excellent credit. I attracted COVID-19 and was out of the picture with no mail or electronic devices. When I was released in my past mail was my Capital One account with multiple interest changes. I called and was told if I would pay them $407. My card would be activated again. After I agreed the Agent told me I would have to reapply. At 97 years old I knew I would never be approved. Now I am in an assisted living facility online is my only option for shopping . Why did the Agent lie? After that many years you would think I was still an honest customer

I think Chase still has a huge advantage in terms of being a one bank stop for transferrable currencies–US based programs where you can get decent to great value. I think listeners to the podcast and commenters here are often the type that play in multiple different currencies because we actually like the game. While I love the end results (getting a fancy hotel or comfortable flight), I actually enjoy the process of maximizing my spending, rewards, etc. So for me, I do not mind having balances in multiple transferrable programs.

I have plenty of friends who are much more mildly interested in the points and miles game. They like the idea of saving money, and have a couple cards because they heard they were good. But they are not going to jump through the hoops needed to book United flights via Turkish, or to transfer points to Wyndham to book a place with Vacasa. Chase has a huge advantage that it has partners like United, Southwest, and Hyatt, and they can top off the point currencies they already have to get awards.

Don’t get me wrong–Capital One really came out swinging this week. I am actually thinking about finally getting a card with them. But I think the ways to get outsized value in the program require a decent amount of expertise in points and miles, and the overlap of people on a Venn diagram who want only one card (or bank) but are willing to put in the work to learn the nuances of the Capital One system is not that large.

That’s an interesting point.

“Severely” is an adverb, not an adjective. Just sayin’ . . .

LOL. True story! I missed my shot at a double roast.

Nick,

You said that you were searching for award space at the Radisson in the Maldives towards the end of schedule next year and weren’t finding availability. However, Radisson only lets you book awards 270 days ahead which means that currently anything beyond mid-January 2022 will NEVER show as available.

Something to keep in mind to save yourself some wasted effort next time.

Good to know! I didn’t realize they changed that. Years ago, when the BOGO ended, I booked some award stays about 2 years in advance.

I have been a huge proponent of Cap1 for years. I love their flexibility for VRBO’s, car rentals etc. But I hate dealing with them. Worse than any of them, even Citi.

They need up the game in customer service. Trying to get a fee waived- NO, no discussion, no options no nothing. Don’t use a card, bam, cancelled with no warning. Not to mention the 3 credit pulls, business cards getting reported on your personal credit, payments taking forever to post and tight limits on how much you can pay over your current balance. Why, you ask would you want to pay way over your balance- well on a business card if you have a large bill pending posting and it is near the end of the billing cycle and you want to get it paid so it isn’t reported on your personal credit, thats why. They are just dam hard to deal with, period. But all their points are worth 2 cents and they are flexible which makes them even more valuable to me.

How is a Capital One point worth 2 cents?

You get two points per dollar of spend. And, for travel related expenses you can erase those expenses for 1 point per penny. Thus $1 of spend = 2 pts which erases 2 cents of travel expenses. I should have been clear that they are worth 2 cents for TRAVEL related expenses. Sorry.

You have some valid points, but a couple of key notes:

1) I’ve successfully gotten AFs waived multiple times (but have also run into times when they were unwilling). YMMV. They are definitely less retention-happy than Citi but better about waiving the fee than Chase in my experience.

2) Especially during pandemic times, every issuer has been closing cards for inactivity. Closing for inactivity has always been a thing across issuers and has become more common since the pandemic began. I try to put a charge on all my cards at least once every six months to avoid this. Some people do an automated monthly $1 Amazon reload to avoid this.

3) Regarding business cards, the Spark Cash no longer shows up on personal reports for new cardholders: https://frequentmiler.com/capital-one-spark-cash-no-longer-showing-up-on-personal-reports-for-new-cardholders/. I believe the Spark Miles still reports though.

4) Not sure what you mean by payments taking forever to post. I paid my cards off on Thursday (two days ago) and they were at $0 balance yesterday (Friday). I’ve always had payments post overnight as long as they are before the Capital One same-day cutoff (which is earlier than other issuers). I haven’t tried to overpay them, so I can’t speak to that.

I used to be able to get them waived. I actually got a lifetime waiver one time because I put around $20,000 a month on the card. I got another Cap1 card and started using it. They of course closed the older “free card” on me. Nice.

Maybe my bank is at fault with the slow payments but I don’t have that problem with AMEX or Chase or Citi.

Thanks for the great blog and article!!!