NOTICE: This post references card features that have changed, expired, or are not currently available

Many people have asked how Capital One’s travel portal stacks up to booking hotels through Chase Travel℠. Capital One Travel holds up surprisingly well. Again and again, Capital One Travel beat Chase Ultimate Rewards on price for the same hotels on the same dates. My sample size in testing the two portals head-to-head was small, but Capital One far surpassed my expectations and this further convinces me that checking Capital One Travel should be part of my ordinary hotel booking routine.

Ever since I previously wrote about why Capital One Travel may be worth a look, I’d had it in mind to compare prices directly against Chase. I know that many Chase Sapphire Reserve cardholders tend to book travel directly through Chase to earn 10x on paid bookings.

Traditionally, loyalty program enthusiasts would have preferred to book directly with the hotel in order to earn elite credit, elite benefits, and hotel points. On the other hand, as hotel loyalty programs have continued to devalue their programs (see Hilton’s war on breakfast and the coming abolition of the Marriott award chart as Exhibits A and B), many have also questioned the wisdom in being loyal to a particular chain. One way to be your own hotel free agent would be to eschew the loyalty programs and book through Capital One or Chase.

This method of booking through the credit card portal has become particularly attractive for those with ultra-premium credit cards since the earnings can potentially replace what is lost by not booking direct with a hotel chain. The Capital One Venture X and Chase Sapphire Reserve cards each earn 10x when booking hotels through their respective cardholder travel portals. That’s 10 transferable points per dollar spent. For some people, the chance to effectively earn 10 airline miles per dollar spent is worth a lot more than the 10 or 20 or more hotel points one might earn per dollar spent when booking direct.

The big question then is value. I previously showed that the Capital One Travel portal sometimes offers rooms for even less than booking directly with a hotel chain (and for less than Expedia and in some cases Amex Fine Hotels & Resorts). I still wondered how they compared with Chase. I was particularly curious about the comparison point with Chase because if someone wanted to primarily book paid stays through a credit card travel portal to effectively earn 10 airline miles per dollar spent, I wondered whether one would be stronger than the other. Again, Capital One has come out on top in my tests.

Comparison points / methodology

While I couldn’t collect every data point from every hotel in every market, I decided to pursue a simple technique that would provide a range of data points. First, I identified five hotel markets: New York, San Francisco, Milwaukee, Miami Beach, and “Hawaii”. I chose those markets to have major business centers on each coast, a more mid-size Midwestern city with a reasonable hotel market, and two “vacation” markets.

I then chose 4 hotels in each market. To do this, I Googled for a Trip Advisor list of the top 10 hotels in each market. I used the numbered list from Trip Advisor in each case to search for the #1, #2, and #3 hotel also the #10 hotel in that market. In some cases, I had to adjust this a bit because of things like the originally-chosen hotel being sold out and I didn’t necessarily hunt for the next hotel in the list. For example, a Best Western Plus in Downtown Milwaukee was #10 on the Milwaukee list, but it wasn’t available. However, the Best Western Plus by Milwaukee airport was available and seemed to provide a reasonable data point on the hotel spectrum so I went ahead with it. I quickly realized that the lists I found were not actually the top 10 most highly rated, but that worked out just fine since it meant that I ended up having hotels ranging in price from $149 all-in to north of $1,000 all-in for a single night.

Speaking of the night, I picked a random Saturday night in the summertime as my comparison date. My main objective was just to see what kind of difference existed if any and it became clear that there was indeed some difference.

In the chart below, I condensed data by averaging the cost per night in each market. To do this, I considered the net cost for the night at each hotel based on the total cost per night including taxes through each portal and subtracting the value of points earned. I valued Capital One points at our Reasonable Redemption Value of 1.45c per point and Chase points at our Reasonable Redemption Value of 1.5c per point.

As an example, let’s say a hotel costs $100 per night. A Capital One Venture X cardholder would earn 1,000 points (worth $14.50) by booking through Capital One, making the “net” cost $85.50. A Chase Sapphire Reserve cardholder would also earn 1,000 points (worth $15), making the “net” cost $85. I averaged those net costs for each of the 5 hotel markets through each portal.

| City | Capital One net cost | Chase net cost | Cheaper portal | Average Difference |

| New York | $345.91 | $408 | Capital One | $62.09 |

| San Francisco | $269.14 | $311.31 | Capital One | $42.17 |

| Milwaukee | $226.36 | $244.16 | Capital One | $17.80 |

| Miami Beach | $298.61 | $397.59 | Capital One | $98.98 |

| Hawaii | $432.63 | $485.92 | Capital One | $53.29 |

The above is a simplification. In reality, Capital One wasn’t cheaper than Chase 100% of the time. Out of my 20 example hotels, I had two that were available via Chase that were not available via Capital One, so I eliminated them. Out of the 18 remaining data points, Capital One had a cheaper net cost 16 out of 18 times. The two times that Chase had a better price were not by a very large margin: in one case, Chase beat Capital One by $1.45 and the other by $13.56. On the other hand, the Capital One price advantage on the other 16 hotels examined in both portals ranged from a low of $1.58 to $271.33 (the high price difference was at the SLS South Beach in Miami Beach).

Again, that sample set of data is relatively small, but it included a range of hotels including brands like Best Western Plus, Homewood Suites, Marriott’s Autograph Collection, Waldorf-Astoria, Fairmont, and a number of independent brands. I was impressed that Capital One held up a price advantage across such a broad spectrum of price points and hotel types.

Other interesting notes

A few interesting observations that I didn’t record across the board but seemed noteworthy enough to mention:

- Hotel cancellation policies varied, but Capital One tended to have the advantage. While I mostly compared rates with free cancellation, I noticed that in quite a few cases Capital One allowed for cancellation up until a day later than Chase did. This will obviously vary, but it is worth paying attention if this matters to you.

- Chase offered a greater variety of rates including some that included breakfast. In a number of instances, Chase had a second (slightly higher) rate that included breakfast whereas Capital One did not list a separate breakfast-inclusive rate at the same properties.

- Prices through Chase often changed when clicking through to see hotel details.

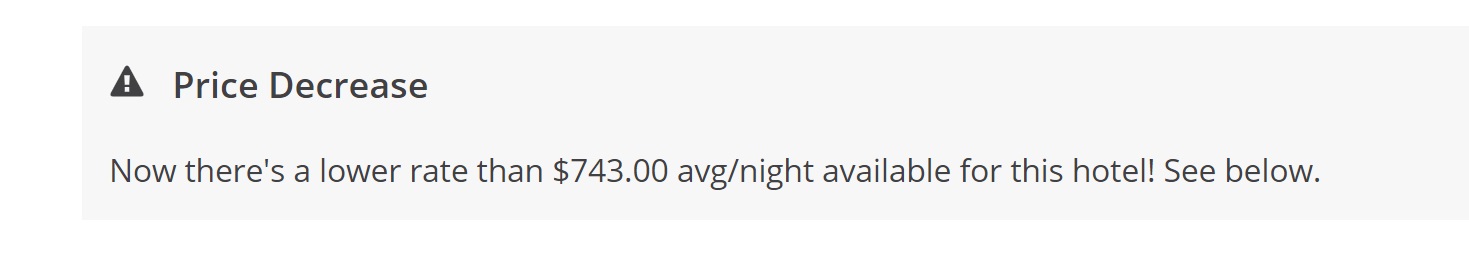

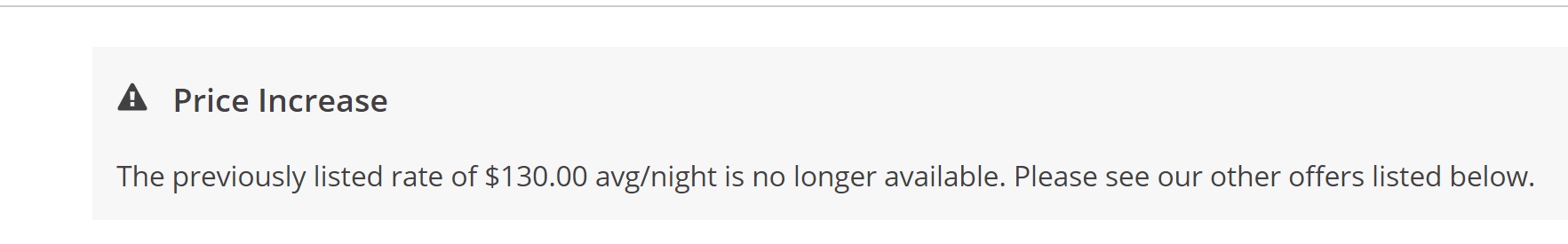

To that last point, I frequently saw the price increase or decrease after clicking for hotel details in Chase Travel. That is to say that the price shown in search results was not always accurate. I frequently saw messages like these:

I therefore recommend clicking through to the hotel page when looking at hotels through Chase as the search results page isn’t always accurate.

Bottom line

After previously finding a number of situations where Capital One Travel was as well priced or even more competitively priced than booking directly or through programs like Fine Hotels & Resorts, I was curious about doing a direct comparison with Chase Travel. Despite my previous experiments with Capital One Travel, I was still surprised to see Capital One consistently price better than Chase. I worked with a limited set of data and in any individual case the pendulum could swing either way, but overall this bodes well for those looking to use the Venture X’s annual $300 travel credit and/or those who would prefer to earn 10x transferable points for paid hotel bookings than earn hotel points.

Chase offers different air fair classes when accessing through different cards, with price when accessing through Freedom Unlimited is much lower comparing to when accessing through Sapphire Reserve. Be aware!!!

One weakness with Capital One Travel portal (when searching for domestic Brazil flights — haven’t tried others) is that it does *not* show all available fare classes (I was looking for “Plus” fares on Gol or Latam because they include checked bag + seat assignment — important for families)… Chase shows them, but not Capital One.

That kind of limitation exists in a lot of situations. I was just looking for something similar on a European carrier and neither Chase nor Amex had the “plus” fare class I wanted. Didn’t check Capital One in that case, but I don’t expect they had multiple classes for economy tickets either. I’m surprised to hear the chase did in your case!

Thank you for the quick response!

Yes, I can confirm when searching for domestic Brazil flights:

I can deal with this traveling alone, but when traveling with a companion, I’d rather avoid Basic Economy.

Hotels.com 10th night free + Cashback + use of Citi Prestige card beats the above, IMO

Hello Nick, I am currently Diamond with Hilton & Globalist with Hyatt, while earning points/elite credit is not as important to me when booking hotels, my question is when booking through Chase/Capital One are your Elite benefits still recognized i.e. upgrades with a portal booking once you’re at the hotel?

How do prices on capital one/chase compare to if you booked directly to the hotel?

Thank you for this. Can you do a comparison between the two with airfare? I tend to use that more than hotels.

Nick, once again-great analysis!

I hate that the Capital One’s portal doesn’t include taxes in the room price on the search overview, or even on the hotel page where you choose your room. Only after choosing your room (last step before actually booking) do they reveal the additional taxes.

Such practices seem deliberately deceptive.

Sample size of one, but a hotel in Madrid near the airport came to $87 with the Capital One portal, and $88 with Chase.

Great Dive into the pricing. I was curious as I have the Sapphire Reserve but with the hikes in the annual fee and getting some of the perks via other card I began to wonder if I should card switch. The capital one X being cheaper and still offering 10 x (I know now 50% more redemtion) but with the essentially no annual fee after the travel credit and a few perks, its making me want to card switch.

The Cap1 travel portal’s failure to include National/Enterprise/Alamo rental cars is, for me, enough to make the portal decidedly worse than Chase.

Quite a few people have mentioned car rentals. I’m somewhat surprised by how many people are renting through the portals. Do you not use Autoslash, or are you finding prices cheaper through Chase? I ask because I don’t think I’ve ever found renting through a credit card portal to be cheaper than what I find via Autoslash and/or with coupon codes.

I concur Nick, I never book a car rental via a CC portal.

I have enough miles and hotel points that I don’t really have a need to book with cash through a portal, to be honest with you. I had hoped I’d be able to get a sub-optimal rental car as opposed to using cash where points would do.

That’s a good point. I’m not a “frequent enough” miler to really have a need to ever book with cash. My intent is for all my travel to be booked with points.

One thing I noticed for airfare is that Capital One Travel Portal does not show JetBlue flights while Chase does. However, for car rentals, I did find Capital One portal was cheaper (1 day SFO airport car rental) than Chase.

Also, see the partners that each card has because they have some different partners which will also play into which card will be more valuable to you. Also the price eraser feature is something to calculate into the evaluation if you do not plan to use the transfer partners.

The ability to earn 10x on Sapphire Reserve when booking hotels is fantastic. For those of us with the Preferred (no interest in paying the high annual fee), what are the best ways to pile up a bunch of Chase Ultimate Reserve points? This seems a lot more difficult than with Amex or even Capital One (you could sign up for both the Venture and Venture X and get both SUBs, I think). I’ve had the Preferred for just over a year, haven’t tried a retention bonus yet, but I read that Chase is really stingy here. I can’t get a SUB on Reserve since I just got Preferred. The Freedom cards have paltry or no SUB. Chase Business cards all have a $2500/mo+ minimum spend, which is too rich for my blood. Any tips?

Well, I would argue that it’s not so fantastic if you’re overpaying for the hotel — then the ability to earn 10x isn’t so good :-). On average, prices through Chase were much higher even after accounting for Chase earnings being slightly more valuable.

Regarding accumulating Chase points, that’s an excellent question. I think most of us who MS think of Chase points as being really easy to accumulate because of the ability to earn 5x at office supply stores with the Chase Ink Cash (thanks to lots of fee-free or even slightly profitable VGC deals and the ability to buy all sorts of third party GCs at Office Supply stores). But if you’re not interested in MS / using gift cards to pay for things and you can’t meet $2500/mo in spend, it is significantly harder to amass Chase points. That said, this is where it becomes worth it to do things like pay your taxes with a credit card or pay other bills via a service like Plastiq because even at a 2.85% fee it can make sense if it helps you meet the spending requirement for a large welcome bonus.

On the Freedom front, it is possible to product change to end up with multiple Freedom cards. That might help if one of the quarterly 5x categories is useful for you. Otherwise, the business cards are really the way to accumulate.

Great point about the 10x on hotels not being great through the Chase portal. I guess I was trying to be charitable to the Reserve card’s ability to accumulate points 🙂

Right, I don’t ever plan to MS to accumulate Chase points – not my cup of tea, but to each their own.

Good suggestion on using Plastiq for bills or paying taxes to help meet the SUB for business cards. Thanks as always for the info!

Nick are those comparisons for the same room type and cancellation policies (other than the slight day difference you noted)? If so that’s insane and maybe worth getting the CapOne X.

Hey Nick, great comparison of the 2 travel booking portals.

I think the math is off here: “ As an example, let’s say a hotel costs $100 per night. A Capital One Venture X cardholder would earn 1,000 points (worth $14.50) by booking through Capital One, making the “net” cost $95.50. A Chase Sapphire Reserve cardholder would also earn 1,000 points (worth $15), making the “net” cost $95.”

$100 – $14.50 = $85.50 and $100 – $15 = $85.

Thanks! Fixed.