NOTICE: This post references card features that have changed, expired, or are not currently available

This post is both a reminder (call recon when denied for a card!) and a story about how to get approved for a Chase credit card. Do you remember the “informed newbie” named Ben? When I last wrote about him, he had earned over 700,000 points from signup bonuses and was considering applying for the SPG Luxury Card (now called Bonvoy Brilliant): Over 700K and slowing down. Should Ben go for 125K more? Since that post, Ben did successfully sign up for the SPG Luxury card. Then, just when a 60K offer for the card was about to go away in early January, he applied for the World of Hyatt card. His application was denied. Over a period of almost two months, he called the reconsideration line multiple times and was finally approved for the card yesterday. Here’s how he did it…

But first this: How to find reconsideration phone numbers

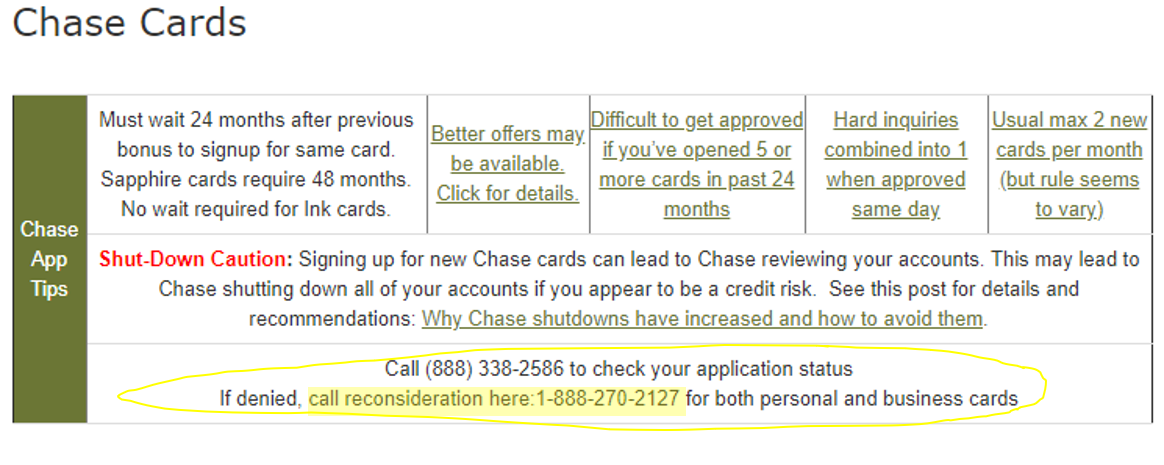

We keep reconsideration phone numbers listed for each bank on our Best Offers page. Simply “Jump To” the section for the bank you applied to. At the top of each bank section you’ll find application tips which include the reconsideration phone number. Here’s an example for Chase (click through the image to find up-to-date information):

Ben’s first call

Ben’s first call

Ben received a denial letter by mail a week or two after applying. The letter stated the following:

- You already have the maximum amount of credit we can offer you

- Your current amount of credit is enough in relation to your income

Ben called the reconsideration line and asked for the decision to be re-evaluated. He said that he would happily reduce the credit line on other Chase cards in order to open this one. The way Ben tells the story, the analyst tried her best to get this done, but just couldn’t do it. The situation was that Ben had only $2K in credit that could be moved around, but the Hyatt card apparently needs $5K:

- Chase had denied Ben for new credit

- The World of Hyatt card requires a minimum $5,000 credit line

- Credit can be moved from other consumer cards but not from business cards

- Ben had less than $2,000 in credit line that could be moved. Specifically, he had two consumer cards: Sapphire Preferred with a $7K credit line; and IHG with a $2K credit line. He was told that the Sapphire Preferred couldn’t be reduced below $5,000, so they could only take $2,000 from that card. And the IHG card requires $2,000 so they couldn’t take any credit from that one. And $2,000 moved from the Sapphire card simply wasn’t enough since the Hyatt card requires $5,000.

Since the analyst couldn’t get the job done herself, she pushed the application through for reconsideration for new credit. She told Ben that he would received the decision by mail. He did. Denied again for the same reason.

Dropping business cards

Ben had a couple of Chase business cards that he wasn’t using anymore, so he called and cancelled them. His thought was that this would reduce the amount of credit granted to him from Chase, and might help with a second reconsideration call. About a week after cancelling the cards, he called again.

Ben’s second call

A week after cancelling a couple of business credit cards, Ben called recon again. The analyst confirmed again that he couldn’t move credit around to get the Hyatt card approved, but was willing to push the application through for a second reconsideration. And, again, Ben would receive the decision by mail. He did. Same reason for denial.

Product change to Freedom

After the second call, Ben asked my advice. Around the time that Ben made the second recon call, the $95 annual fee had appeared on his Sapphire Preferred card and he didn’t want to pay it. I suggested that he might be able to kill two birds with one stone: product change to the no-fee Freedom card, then call recon a week later. The idea was that the Freedom card doesn’t require a $5K line of credit, so they should be able to move enough credit to open the Hyatt card. Ben did as I suggested. He got the annual fee re-credited to his account, and he made his final recon call…

Ben’s third call

The final call was the winner. The analyst told Ben that his Freedom card required only a $500 line of credit, so he could move $6,500 of the $7K credit line to Ben’s new World of Hyatt card. Done! The application was finally approved!

Interesting to hear about the $2k minimum CL. I understand the $5k minimum is for a visa signature. Anyone know what the $2k minimum corresponds to?

$2k for IHG

[…] The bank environment approving you for travel rewards credit cards is tightening more and more. But never give up okay? Here are some tips with Chase: Informed newbie turns Chase denial into approval. Here’s how. […]

Is there some place that details the minimum line of credit required for various cards?

Not that I’m aware of

If he’s only eligible for $9k in credit line then he’s got other fish to fry before worrying about credit cards…

Correct but IF IF he can get it as in a big sign UP Great . The deal is u need MONEY to have fun when u travel or Stay Home till you have it like I did.

CHEERs

Most of his Chase credit was on the business side.

I tried for a Chase business card and denied, asked for review denied again. I Asked to move credit amount around from personal card to get biz card and agent said could not do it.

Does it make sense to call in and lower credit amount on specific cards, RC is a very high credit limit? Any idea if this will impact my credit score, which is north of 800.

My FICO is 807 down from 814 I pay ALL my cc 3 days before the statement posts .I have 2 B cards left try it..

CHEERs

Yes, lowering your credit on your personal accounts before applying (or before asking for recon) can potentially help with business card approval. Ben did exactly that, but in reverse, and it didn’t help him so it’s not a silver bullet.

Greg

I used ur data base to Call in as in Denied BUT I tried ..I got a HELOC my FICO went from 814 to 807 I’ll lay LOW for 6 months and I’ll just have 4 cards then .

THANKS

CHEERs

He canceled chase business cards and his CSP to get a WOH. Can you tell us what card he kept to be able to transfer points because it seems like a pretty big trade off to downgrade from the CSP just to end up with a freedom and woh card.

Sounds like he still has some business cards, perhaps an Ink Preferred.

Yep, I’m pretty sure he still has one of his Ink Business Preferred cards.