NOTICE: This post references card features that have changed, expired, or are not currently available

We recently wrote about the new Citi Rewards+ Credit Card that was expected to launch soon. That card features the interesting benefit of rounding up all purchases to the nearest 10 points — which oddly bonuses small purchases more strongly than anything else. That card is now live for applications. I suspect that most readers will either find this one not worth applying for or not be eligible, but the fact that it is live for applications means that it may now or soon be available as a downgrade option. Update: A reader reports having successfully product changed today. Thanks to Buenaventura.

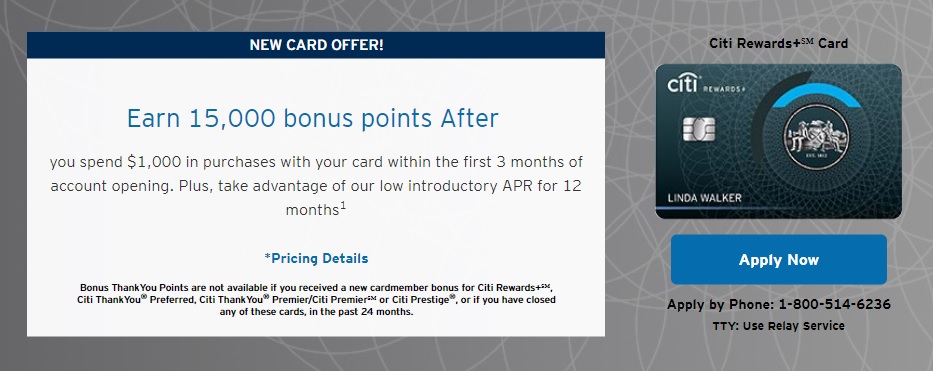

The Offer

| Card Offer |

|---|

Key Card Details

| Card Name w Details & Review (no offer) |

|---|

Quick Thoughts

We wrote about this card previously. See these posts for more information on what makes this card interesting, ripe for abuse, and unlikely to work out as well as we would all hope:

Again, it wouldn’t make sense to apply for this card for most folks. You are not eligible for the welcome bonus if you have received a new cardmember bonus for Citi Rewards+, Citi ThankYou Preferred, Citi Premier, or Citi Prestige, or if you have closed any of these cards, in the past 24 months. Furthermore, I expect that applying for this card would lock you out of the (more lucrative) bonuses on those other cards for the next two years as well. While the Premier is the only one of the bunch currently available for applications, the Prestige is expected to launch again in the not-so-distant future.

The good news on this launch is mostly that this could be a good downgrade path for those who want to product change away from a Premier or Prestige card without closing the account so as to avoid becoming ineligible for future bonuses.

H/T: Doctor of Credit

Just off phone with Citi – will not allow product changes from AA cards until Monday, Jan 14.

(keeping my Preferred as will be only Citi card still offering 2x Entertainment come Sept. may go away on this card, too, but keeping just in case)

Do you think I can switch from my TY Preferred card?

I would expect you can. Have you called?

Yes. Just did.

when you product change into the card, are you eligible for the sign-up bonus of 15k points?

No.

Wow, what a turd of a card.

Does converting a Dividend to an AT&T Access card reset your clock for the ThankYou cards? Fine print on the Premier and this one makes it seem like that card doesn’t matter.