NOTICE: This post references card features that have changed, expired, or are not currently available

I recently published a comparison of travel insurance provided automatically by ultra-premium credit cards (Chase Sapphire Reserve, Citi Prestige, and Amex Platinum). You can find the comparison page here: Ultra-Premium Credit Card Travel Insurance. In response to my post analyzing this comparison, a number of readers asked me which cards cover award flights?

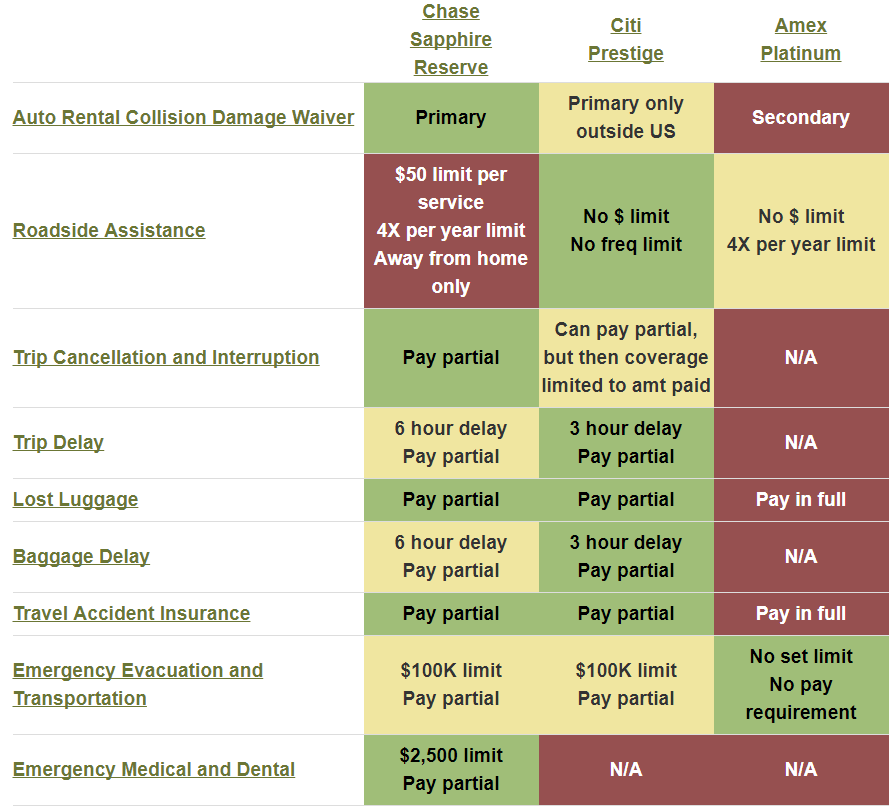

An image of the chart from my comparison page is shown above. Please click through to the source page (Ultra-Premium Credit Card Travel Insurance) for up-to date info. To a large extent, the answer to the question of “which cards cover award flights?” is given above. Wherever it says “Pay partial” you’re covered if you pay award taxes or fees with the card. Even better, Amex Platinum offers emergency evacuation and transportation coverage even if you haven’t used the card at all. You get that benefit simply by having the card.

Note that auto rental insurance always requires paying in full. Roadside assistance, meanwhile, does not require any payment to be used.

Award Flights: Pay with Points

When you use your Chase, Citi, or Amex points to pay for travel you are fully covered as if you had paid in full directly with your credit card. In other words, if you pay with Chase Ultimate Rewards points, Citi ThankYou points, or Amex Membership Rewards points, it counts the same as paying directly with your credit card.

Award Flights: Pay with Airline Miles

When you pay for an award flight with airline miles, you almost always have to pay at least a small amount for taxes and/or fees. In those cases, if you pay the taxes and fees with your credit card then you will be covered as long as partial payments are covered.

For example, let’s say you pay the $5.60 TSA fee for a domestic award flight with either your Chase or Citi card and your luggage gets lost. Both Chase and Citi offer lost luggage protection when you pay in-part with your card. Therefore, you are fully covered. With Amex, though, you are only covered if you pay in-full with your card, so you would not be covered if you paid the TSA fee with your Amex card.

Award Flights: Are taxes and fees really part of the Common Carrier fare?

The question of whether paying taxes and fees counts is confused by the language in the credit card policies. Let’s take a look at Citi and Chase’s wording…

Citi:

To be eligible for coverage under this benefit, your Citi card and/or ThankYou® Points must be used to purchase at least a portion of the Common Carrier fare.

It’s understandable that people question whether taxes and fees are really part of the Common Carrier fare. I can’t find an official answer to that question, but in practice it is clear that taxes and fees are part of that fare. A number of people have successfully filed claims with Citi when they paid only taxes and fees. See this post, for example. Also see this reader comment.

Chase:

What is a Common Carrier Covered Trip?

• It’s travel on a Common Carrier (see definitions section) when some portion of the fare for transportation has been charged to your Account issued by Chase Bank USA, N.A. and/or its affiliates.

• It’s also travel on a Common Carrier when free flights have been awarded from frequent flier or Rewards programs, provided that all of the miles or Rewards points were accumulated from a Rewards program sponsored by Chase Bank USA, N.A. and/or its affiliates.

With Chase, you are fully covered if you paid with a rewards program sponsored by Chase. You are also covered if you pay “some portion of the fare for transportation”. I believe that taxes and fees count as a portion of the fare.

In summary: yes, taxes & fees count as a portion of the Common Carrier fare.

What if you pay in full with hotel points or airline miles?

Chase is unique among the travel cards in that their coverage often applies even if you pay in full with hotel points or airline miles as long as those points or miles come from a Chase transfer partner.

For an up-to-date list of transfer partners, please see: Chase Transfer Partners.

At the time of this writing, transfer partners include the following airlines:

- Air France

- British Airways

- Korean Air

- Singapore Airlines

- Southwest

- United

- Virgin Atlantic

And the following hotels:

- Hyatt

- IHG

- Marriott

- Ritz

Note that trip delay, lost luggage, baggage delay, and travel accident insurance do not apply to hotel bookings since they are forms of transportation insurance and they require paying at least part of the transportation costs with your card or with a transfer partner’s points. That said, trip cancellation, emergency evacuation, and emergency medical insurance do apply to hotel stays and should be covered if you pay for your hotel stay with Hyatt, IHG, Marriott, or Ritz points.

Are you covered when you pay with miles? A new chart…

The following chart assumes that you use airline miles to book an award trip and that you pay at least a small amount of taxes and/or fees with your card. Green cells indicate that you are covered but do not indicate the quality of that coverage. For a comparison of the quality of each coverage, see: Ultra-Premium Credit Card Travel Insurance.

Note that this chart makes the assumption that if partial payments are allowed with a ultra-premium card, they are also allowed with other cards from the same bank. I think that’s true, but I obviously haven’t checked every card. In some cases your card may not have the insurance listed here. For example, only ultra-premium cards cover emergency evacuation and transportation.

| Chase | Citi | Amex | |

|---|---|---|---|

| Auto Rental Collision Damage Waiver | No | No | No |

| Roadside Assistance | Yes (No spend required) |

Yes (No spend required) |

Yes (No spend required) |

| Trip Cancellation and Interruption | Yes | Yes* |

N/A |

| Trip Delay | Yes | Yes | N/A |

| Lost Luggage | Yes | Yes | No |

| Baggage Delay | Yes | Yes | No |

| Travel Accident Insurance | Yes | Yes | No |

| Emergency Evacuation and Transportation | Yes | Yes | Yes (No spend required) |

| Emergency Medical and Dental | Yes | N/A | N/A |

* With Citi’s Trip Cancellation and Interruption insurance, if you don’t pay in full with your card then you are covered only up to the amount charged to your card. For example, if you pay $5.60 TSA fees for a domestic flight and you have to cancel your trip for a covered reason, you would recover only $5.60. That said, some have reported success with paying award change or redeposit fees with the card and then using this coverage to reimburse those fees.

Please consider adding BofA premium cards to this list.

Would charging optional seat selection fees to the Chase Sapphire Reserve be sufficient to meet the “partial pay” requirements of the insurance?

I find this helpful but I need clarification. My USAA Amex brochure states the following:

This travel insurance plan is provided to USAA American Express® cardholders, of USAA,

automatically when the entire cost of the passenger fare(s) are charged to a USAA American

Express® account while the insurance is effective. It is not necessary for you to notify USAA,

Are taxes and fees considered the entire cost of the fare when I use miles?

No, my understanding is that if you spend miles you won’t automatically be covered by your credit card unless the card’s benefits explicitly allow for that.

Greg, how about Bank of America Premium Rewards Credit Card? Does it cover award tickets?

I don’t know. Online it says “Certain restrictions apply to each benefit. Details accompany new account materials.” and I don’t yet have that card.

My guess is that it does not cover flights booked with miles. But if you book a paid flight where you use points from this card to pay (which you do after the fact) then I’m sure you’ll be covered.

Are the Travel Insurance coverages from the Chase Ritz-Carlton card identical to those from the Chase Sapphire Reserve card?

I don’t know

Please update this page with info for the CNB Cystal card.

Here is a link to the benefits document for the CNB Crystal card: https://www.cnb.com/SiteCollectionDocuments/cards/Crystal-Benefits.pdf. Unfortunately, the document is protected against text copy, so I had to re-type everything below myself.

It seems the CNB Crystal card only covers Trip Delay when paid in full:

Trip Delay: (ALL CAPS emphasis is mine)

When Terms and Conditions are met, Trip Delay Reimbursemnt is a one-time per ticket/trip coverage that will reimburse you for reasonable additional expenses incurred when a trip you’ve purchased ENTIRELY with your eligible Crystal Visa Infinite Card is delayed for more than six (6) hours or requires an overnight stay. The benefit covers up to five hundred dollars ($500.00) per ticket.

It seems the CNB Crystal card covers Trip Cancellation / Interruption when paid partially:

Trip Cancellation / Interruption: (ALL CAPS emphasis is mine)

Covered Trip means a trip, for which Common Carrier costs (other than taxi) are charged to the Insured Person’s eligible Crystal Visa Infinite Card account for travel on a Common Carrier when the ENTIRE cost of the passenger fare for such transportation, LESS REDEEMABLE certificates, vouchers, or coupons, has been charged to an Insured Person’s eligible eligible Crystal Visa Infinite Card account issued by the Policyholder, occurring while the insurance is in force.

[…] are not sure what credit card to use to pay taxes, I highly recommend this post on Frequent Miler: When does credit card travel insurance cover award flights? Just keep in mind that when filing a claim, you might be in for a nasty surprise. A lot of the […]

How about one-way flights? I’m flying to Columbia, will likely stay for 6 months or more on a one-way awards flight. Using my United MileagePlus Club Card. Since it covers trips of 5-60 days, would I be covered for the 1st 2 months? I also paid for an airbnb for a month with my Sapphire Reserve.

Just trying to figure this out so I can be the correct travel insurance.

I’m not sure about one-way flights. I don’t see anything in the documentation that says that you must purchase round-trip flights, but it may be worth calling to ask. That said, unfortunately I can’t promise that any answer you get over the phone will be correct

Amex Plat does have trip delay and baggage insurance if you are part of their TravelAssure program, that I don’t believe is open to new members.

For Trip Delay it is 6 hours or past 11pm, whatever comes first. The coverage is $250 per day, per person.

The luggage coverage for delayed luggage is after 3 hours and is $500 per person, per trip. For luggage that is never found it is $1500 per person, per trip. For personal property stolen from you in the hotel it is $1500 per person, per trip.

Trip cancellation is $500 per person, per trip.

They also have a travel medical protection insurance benefit, that I also don’t believe is open to new members. I pay $13 a month for it.

Due to the death of my father in law, three of us near DTW and 2 of us at AUS, had to alter our family trip this Florida. Rather than flying non-stop to Florida, we all had to fly to JFK, a day earlier than our original tickets, then from JFK to Florida, two days later, or 1 day later than our original tickets. We all flew back on our original tickets. The last minute ticket changes due to the death of our immediate relative cost almost $2,000 extra above our original tickets. Filed a claim with Chase on the Sapphire Reserve card. After lots of time, paperwork and hassle from the 3rd party insurance company, we were only reimbursed for the one night missed at our vrbo home rental.

NOTHING for our extra air expense dollars of almost $2,000.

Greg, can you explain this?

I appealed and just get runaround.

Thanks

No, I don’t know how to explain that. What excuse did they give you for not covering airfare changes?

Two things.

1) Auto coverage with CCs do not cover liability, I’ve had this be an issue with some of the lower cost rental companies who then try to force you to buy separate insurance. Not sure if we non-car owners should have separate liability insurance anyway?

2) AVOID CITI. Insurance is only as good if the company pays out in good faith. In my experience, Citi is awful and do everything they can to deny claims, no matter the situation or evidence. I no longer purchase anything o my Citi because I’d rather forego the slightly better terms (3 vs 6 hours delay) for something reliable. Chase and Amex are much better and more fair.

I missed my connection flight yesterday and I live in Miami. G18 to K10 in ORD in 10 min not that feasible Boy I should have read this article earlier. I was worried since it was booked as an award.

Kudos to AmericanAir , by the time I made it to the gate I was already rebooked.

Oh yeah they all looked at me like crazy for wanted to fly back to Miami

I’m confused. You said CSR has coverage for award flights as long they’re booked with UR partners? What if I book a BA flight with Avios transferred from AMEX? What if I used those Avios to book AA?

It does sound improbable but my reading of the text suggests you’re covered in that case. It might be a good idea to transfer 1K points from Chase before travel just to ensure coverage.

But perhaps the better strategy would be to just pay taxes and fees with the CSR card if you want coverage. Greg, based on my interpretation of your thoughts in the original post this is how I think it breaks down:

We have the two below sections that I’ve labelled (1) and (2). The wording of this section implies that fulfilling either 1 OR 2 would qualify you for coverage. Therefore so long as you book taxes and fees on your CSR {thereby fulfilling section (1)} it becomes moot whether or not the points were from a UR partner, and it would render moot the concept of transferring 1000 points from Chase.

What is a Common Carrier Covered Trip?

(1) It’s travel on a Common Carrier (see definitions section) when some portion of the fare for transportation has been charged to your Account issued by Chase Bank USA, N.A. and/or its affiliates.

(2) It’s also travel on a Common Carrier when free flights have been awarded from frequent flier or Rewards programs, provided that all of the miles or Rewards points were accumulated from a Rewards program sponsored by Chase Bank USA, N.A. and/or its affiliates.

Defending Citi is close to last on my list of desired activities, but since every blog/website comparison I’ve seen compare auto rental coverage across premium cards has grossly overlooked the Prestige.

As further demonstrated by this chart, such comparisons all suffer the same flaw: The assumption that all auto renters have primary auto insurance. Why does this matter? I live in NYC, and so do 8.5 million other people, where the majority of residents do not own a car and thus do not pay for auto insurance. This is true for millions of others in cities across the U.S.

By stating the Prestige ONLY offers primary coverage “Outside the U.S.,” this chart flatly ignores the millions of people who don’t pay for car insurance because they simply don’t own a car, and it misinforms everyone.

Here’s a real life example from my own experience: I sold my car when I moved to NYC last year, so (of course) I no longer pay for car insurance. Six months after moving to NYC, I traveled to California for a friend’s birthday and rented a Lamborghini Aventador.* (*see below for another item overlooked in every chart that compares auto coverage).

On the last day of the trip, I parked the Aventador at a golf course we were playing when it was accidentally backed into. The damage came to $70,000. Citi sent me a CHECK for the full amount. I then deposited the check and used my Sapphire Reserve to pay off the full $70k in order to earn 3x UR (210,000 UR!).

Why? How? First, because it’s untrue that the Prestige only offers primary outside the U.S. The terms clearly state that primary coverage IS provided in the U.S. unless you already have your own insurance policy, which I (again, like millions of others) do not. So, since I paid for the rental entirely using the Prestige, declined the auto company’s rental coverage, and lacked primary auto insurance, Citi provided me with up to $100,000 in coverage — and on a Lamborghini! This is also never mentioned. Please show me another premium card that covers a Lamborghini or anything in the same ballpark as an “exotic” car.” None.

I’m not an expert on this stuff, but my understanding is that it is always the case that secondary coverage effectively becomes primary when you don’t have your own insurance.

Anyway, I described it as I did because the Prestige benefits guide clearly states the following:

“In the United States, the coverage provided by this benefit is secondary.”

(found on page 4 under the heading: “What’s Covered”)

https://www.cardbenefits.citi.com/~/media/CPP/Files/LegalDocs/SOAPI/MV6704_PrestigeElite_0816.ashx

Your understanding is correct.

So the chart should read, instead of “Primary Only Outside the U.S.”

“Secondary in the U.S. if you own auto insurance, otherwise Primary both Inside and Outside the U.S.”

I completely agree that Citi Prestige auto insurance is underrated on most travel websites. In addition to the correction you mentioned above, I would like to add few more points:

1. Citi Prestige is the only card that covers damage to tires and wheels (falt tire,hitting curbs etc.,) when not part of an accident. Both Chase and Amex don’t cover the tires/wheels unless part of an accident.

2. Citi Prestige is the only card that doesn’t require to deny CDW, if included or purchased by you when you rent a car (rentalcars.com almost always includes basic CDW)

See page 4 of the benefits guide “Outside the United States, the coverage provided

by this benefit is primary even if you have another

insurance policy”.

3. It is also the only card that covers any vehicle with 4 wheels under 100K with no exceptions (countries, luxury, exotic, vehicle measurements etc.,).

Thanks. I didn’t know these details

Interesting story but if you were not at fault for the damage why were you the one paying the 70k bill?

I think some a mean old golfer hit the Lamborghini and left the car damaged.

But I hope the OP replies. Wow 70$k in damages. More than my car.. and I dont drive a toyota or honda.

Have you ever heard of no-fault auto insurance? Just wondering.

Inapplicable to California either way, but to answer your question I fronted (aka Citi fronted) the bill because the car was valet-parked and the SUV that slammed into the Aventador was being driven by a valet at the time. Essentially both Citi and the other guy’s insurance stepped up and paid, knowing they would recover from the club’s outsourced valet company, which had initially tried to hide behind a disclaimer of liability that purportedly absolved them of responsibility for anything and everything, e.g. even negligence. That strategy was abandoned before it even reached court after the police finally got around to subpoenaing the surveillance tapes.

(Also – I really wanted 200k UR :))

Wow that’s wild. what bad luck for the valet that the car he hit happened to be a Lamborghini.

Definitely one of the more interesting stories I’ve heard to rack up some points.

Thx for the follow-up explanation

Greg, thank you for these series of posts, especially this one where travel is booked using points/miles.

I do have a question regarding car rental coverage:

If I pay for car rental with my CSR (no AU), but the car rental agreement is under my spouse’s name (as the driver), am I right to assume that there will be no insurance coverage? Thank you.

Here is exactly what the CSR Benefits guide states:

Who is eligible for coverage?

You, a person to whom a United States (U.S.) credit card has been

issued (“Cardholder”) and your name is embossed on the card. You

are then covered as the primary renter of the vehicle and any additional

drivers permitted to operate it under the terms of the rental agreement

(“Authorized Person”) are also covered.

surely you are probably following this…

http://www.dailymail.co.uk/news/article-4858440/Richard-Branson-set-bunker-Virgin-staff.html

Yes, of course 🙂