At a get-together last Saturday, a friend mentioned that she had recently opened a new Marriott Bonvoy Boundless® Credit Card. She was initially excited about being able to add the card to digital wallets right away from the Chase app, but lamented that she was unable to use the card to make a Marriott reservation for an imminent trip (departing on Wednesday) because she didn’t have the full card number to enter on the Marriott site. Given that the physical card would take 7-10 days to arrive, she didn’t think she could use her new Marriott card for that near-term hotel stay (and have that spend count toward their introductory bonus).

As long-time readers probably expect, I advised her to call Chase and request expedited delivery. Chase is typically very good about expediting new cards: they have almost always been able to send our new cards via overnight delivery for free upon request. She called Saturday night, not feeling very confident that things would work out since Monday was a holiday and they were leaving home before deliveries would arrive on Wednesday. But, sure enough, Chase was able to expedite delivery, and they got their card on Tuesday, in time to start working on the spending requirement by using it for their Marriott stay this week.

That’s the type of tip that seems like second nature to those who have done it before, but I realized that it would not at all be intuitive otherwise. I explained to her that the ability to do this varies by issuer. Chase and Amex can often expedite delivery for free (though I’ve had trouble on this with our last few new Amex cards, while finding it very easy to expedite replacement Amex cards), while Barclays and Capital One have wanted to charge a fee to expedite a new card. Regardless, if you are applying for a card to use for a specific near-term purchase, it is always worth asking if you can get the card quickly. After all, the issuer wants you to use your new card, so it is worth giving them a chance to make that easy for you.

Speaking of making it easy, Amex has long been at the forefront in making instant card numbers available immediately after approval on most of their cards. I’d love to see more issuers enable that feature, even if only with a limited portion of the credit line.

This week on the Frequent Miler blog…

Discarding our card collections | Frequent Miler on the Air Ep342 | 1-23-26

Greg and I have a lot of credit cards. Many cards are easy to justify in a vaccum, but both of us have come to realize that enough is enough too many is too many. We both want to cut back, particularly given the brain space occupied by the continued couponification of our cards. On this episode, we talk through how Greg thought through his Sapphire Reserve card and then apply similar logic to some other cards in our wallets. The major caveat to understand is that we are not saying that your numbers should match our numbers (they shouldn’t!) but are rather modeling the framework we are using to decide which cards to keep and which cards to drop.

Is the $795 Sapphire Reserve® coupon card a keeper?

As you’ll hear about on the podcast, Greg ran into a problem that I’ve also had with the “Which cards are keepers?” spreadsheet: there are some card perks that I wouldn’t necessarily pay separately to keep, but that I do value to some degree. His solution was to do some “perk bundling” to give a value to a group of perks, which seems like a reasonable way to look at whether to keep or cancel. That helped him decide that the Sapphire Reserve is a keeper for him. I actually just finally opened a Sapphire Reserve of my own. It will definitely be well worth having in year one, but my own valuations differ from Greg’s (and, as he points out, they should). For instance, we don’t use Apple TV+ or Apple Music at all (we haven’t even activated those benefits from my wife’s card), so I won’t be assigning a value to them. I suspect that I won’t keep the card beyond the first year, but I agree with Greg’s method of evaluating that.

An Amex meltdown: Downgrading or cancelling some premium cards (on Nick’s mind)

I have hit a boiling point of my own with Amex annual fees: it is time to downgrade and get my collection under control. In fact, downgrading is a key part of my strategy: in this post, I explain why I am planning to downgrade a few Business Platinum cards in the coming weeks (even though they had renewed at the old annual fee), the thinking on why I probably won’t downgrade our Gold cards (but probably will cancel them), and what I’m doing about a couple other ultra-premium Amex cards as well.

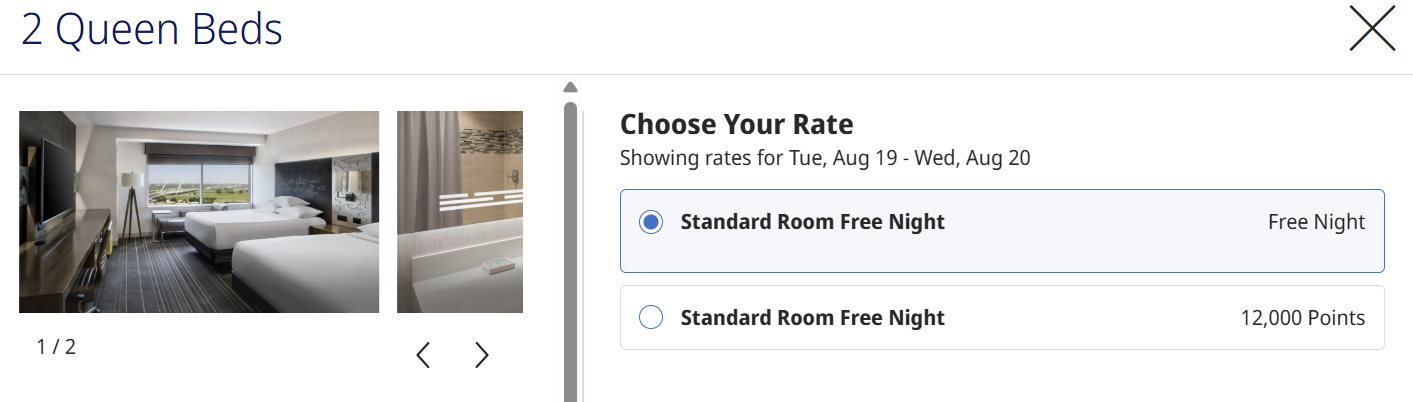

Marriott vs. Hyatt: Which 5 free night offer is better? | Coffee Break Ep89 | 1-20-26

While the posts above deal with ongoing value, keep in mind that most popular rewards credit cards offer plenty of value in the first year. Speaking of plenty of valuel, two popular credit cards are out with offers to earn up to 5 free nights (or maybe more with one of them). Which offer is better? I have my bias as to which offer I prefer, but that isn’t necessarily which offer is better. I think the most important thing to understand about these offers is that they can be terrific if you have the flexibility to travel based on when rooms are available for the right award price and/or you are willing to plan a trip around a great hotel redemption. If you have less flexibile parameters around when and where you travel, you should proceed with caution (or at least a solid plan).

Gift hotel points, free night certificates, and award nights booked with points: Rules by program

When comparing those Free Night Certificate offers, you might want to keep in mind that one of those new welcome offers is easily giftable and one isn’t. Some prorgrams make it easy to share your rewards (which can be really useful in a household where one member has elite status or is working towards it), others not so much. This post has been updated to reflect new restrictions on sharing IHG points, information on transferring Hyatt free night certificates, and more.

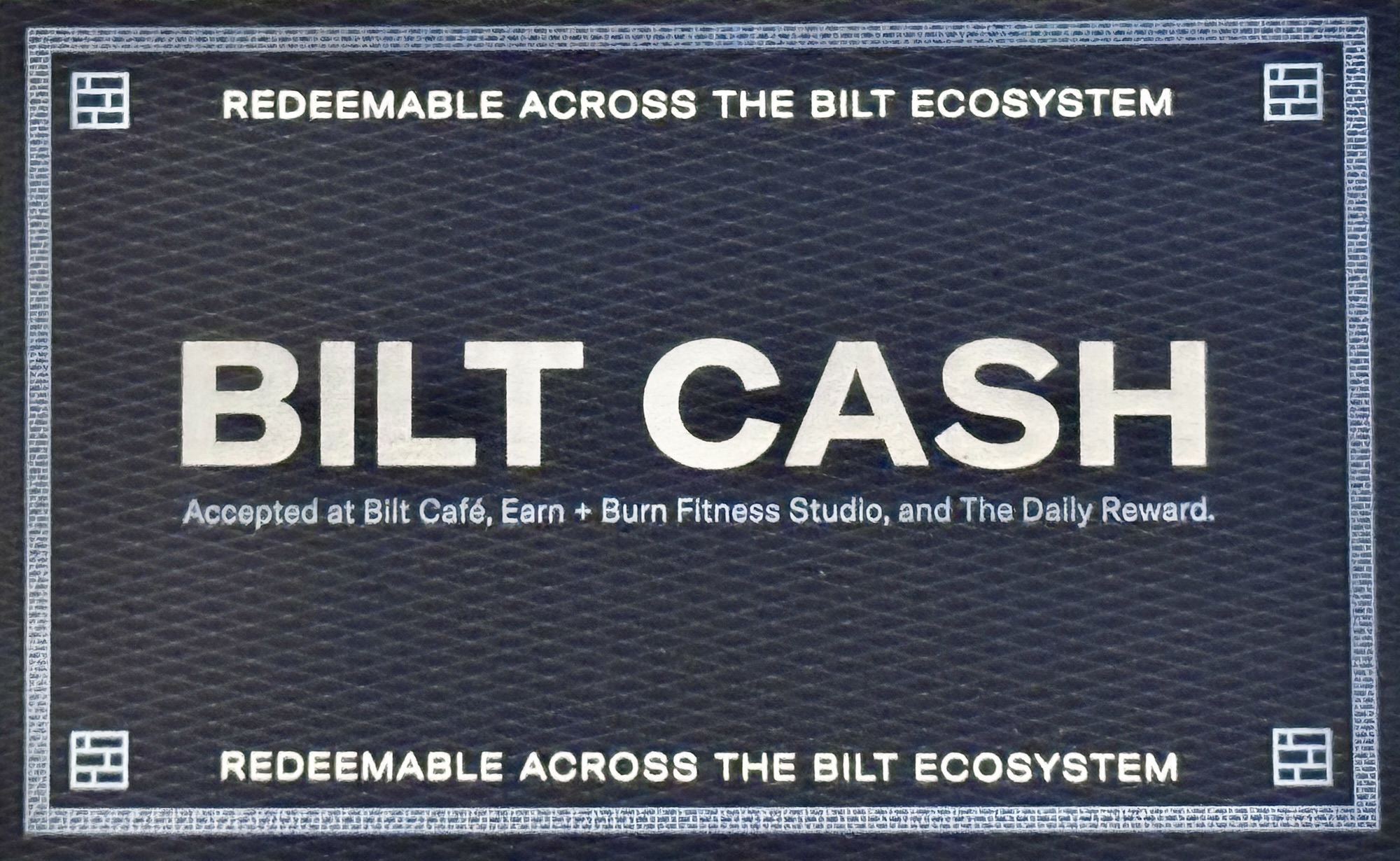

Bilt Cash: The great coupon emporium

Bilt finally released details this week about how Bilt Cash redemptions will work. Unsurprisingly, many of the uses are underwhelming (I say unsurprisingly because, after receiving very little detail about Bilt Cash during the Bilt 2.0 launch event, we expected there to be significant restrictions and complications — and there are). While some will surely find some of the monthly coupons worth hunting, and others will be happy to maximize earn by unlocking points on rent or mortgage, I see the most interesting option being the points accelerators. No, they won’t yield as many points as you can earn using the Bilt Cash for rent or mortgage, but if you don’t have rent or mortgage to pay or you’re just looking for the simple solution, I think the point accelerators will be it for the first $25K in purchases each year (provided that you can remember to activate them after each $5K of spend). Any excess Bilt Cash after that would be my “slush fund” for stuff like a BLADE ride, Blacklane, or something like that. We’ll see.

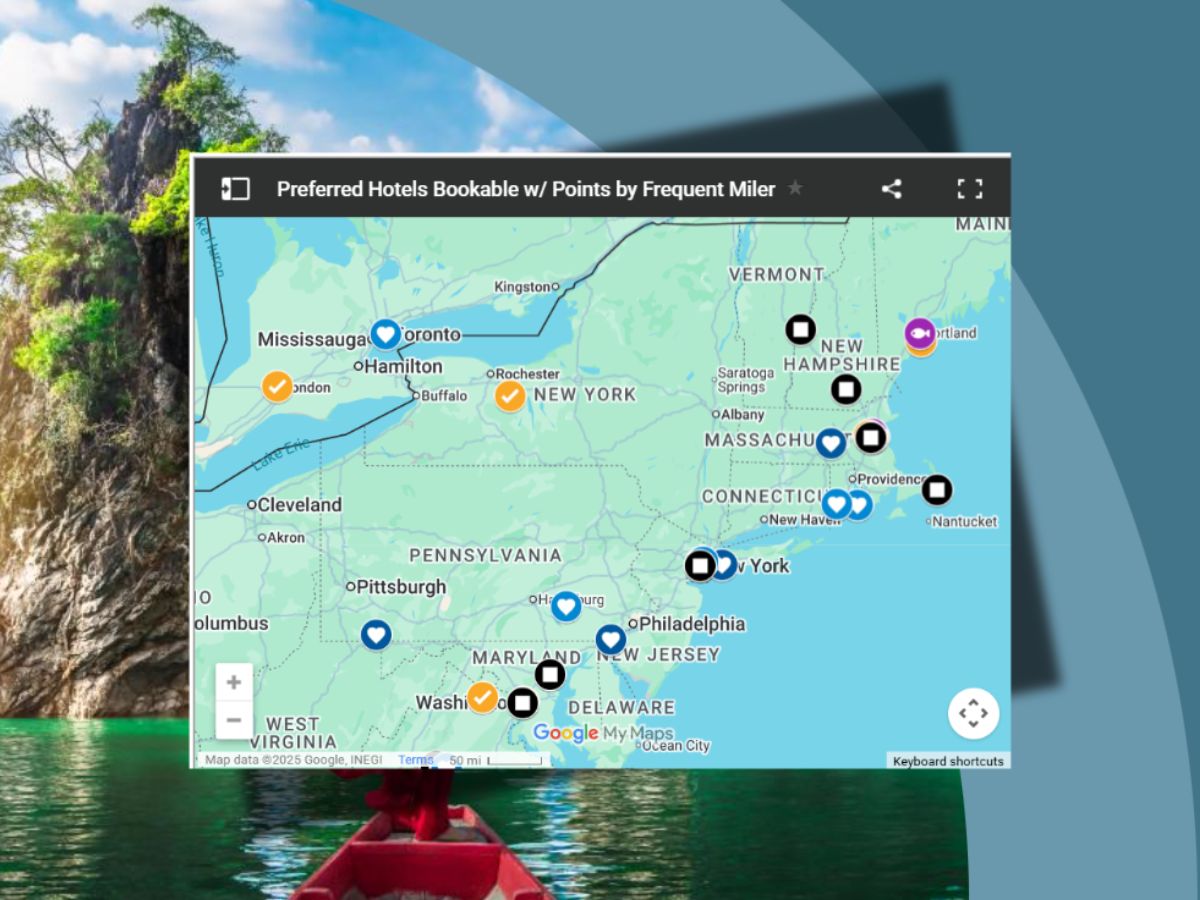

Find Preferred Hotels bookable with points (updated interactive map)

Greg has once again updated this useful post that can help you find Preferred Hotels that may be bookable via either Choice Privileges or Preferred Hotels (or both) and know which currency is likely your better bet. I find this quick-reference map to be really useful in identifying where I might be able to take advantage of one of these properties, which can be really useful.

Alaska / Atmos again allowing multi-city companion fare bookings

Greg and I recently recorded a “How to” video explaining how to use an Alaska companion fare. In that video, we noted that Alaska companion fares could no longer be used with the multi-city booking tool. Alaska wasted no time in changing that: in this post, Tim shows that multi-city bookings are back, and it isn’t hard to see why we welcome their return.

Westin Bora Bora Resort & Spa: Bottom Line Review

I recently traveled to French Polynesia, where I spent a couple of nigths at the Westin Bora Bora (following a 5-night stay at the St. Regis Bora Bora). The Westin has an incredible view of Mount Ontemanu and picturesque tourquoise waters. We didn’t see as much sea life as we would have hoped, but we scored an awesome upgrade using Marriott Nightly Upgrade awards (although not noted in the post, the upgraded room was going for about $1,500 per night more than the standard room). Service is laid-back, but the place is in terrific condition if you’re looking for that new-resort feel.

Best uses for Citi ThankYou Points (2026)

Tim has updated our guide for the best ways to use Citi ThankYou points to reflect numerous changes from the past year, most notably for award chart changes and the ability to transfer your Citi ThankYou points to American Airlines AAdvantage. That transferability to American Airlines can certainly be a superpower of ThankYou points for many folks, though I mostly think of our Citi ThankYou points as a stash to use for unique hotel situations. Last year, we really enjoyed Martha’s Vineyard thanks to a Choice Privileges redemption available there, and we had a great stay at the Cabria Suites in Traverse City, Michigan. Don’t sleep on Citi when it comes to lodging.

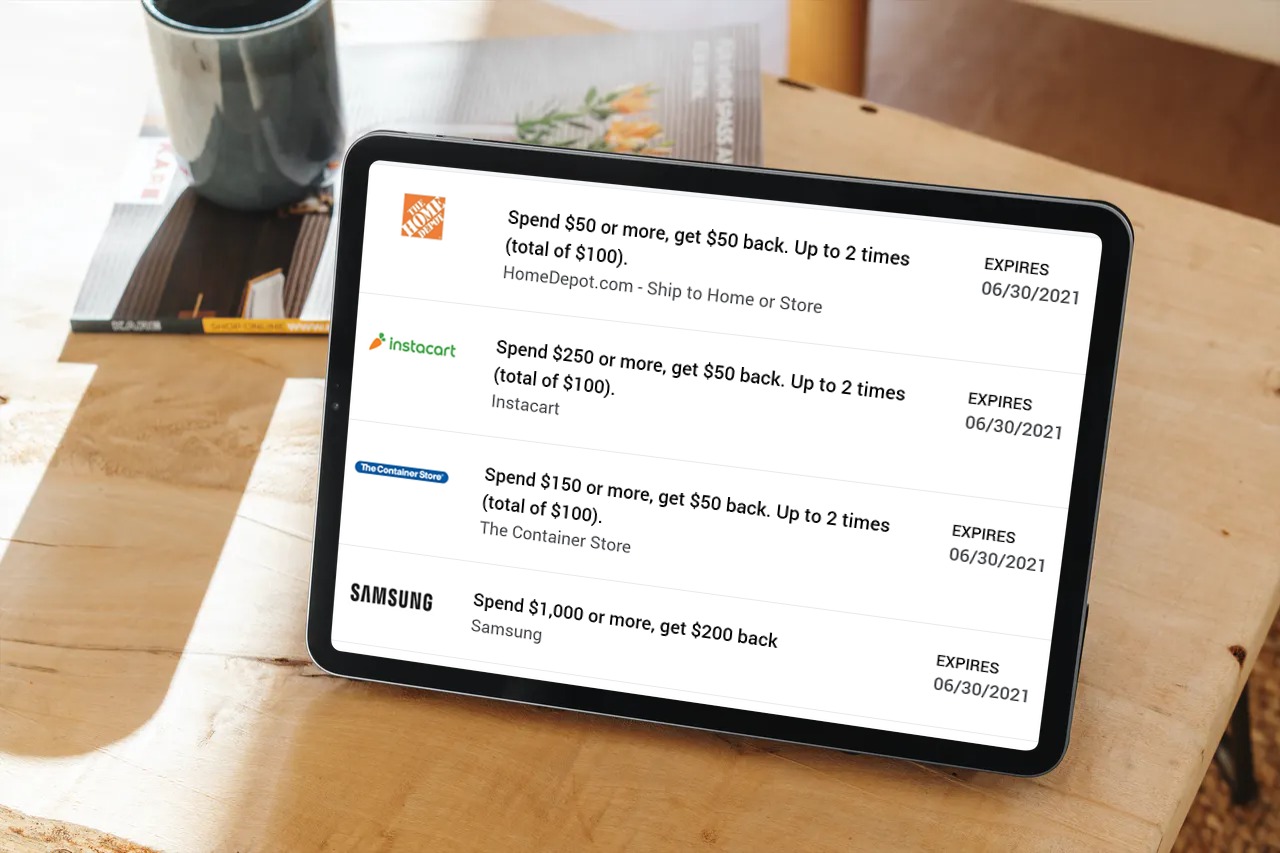

Current Amex Offers

As a reminder, we regularly update our Amex Offers database. Any time I am about to make a major purchase, I tend to come to this page and search to see if there exists an Amex Offer for the merchant in question, as I find that much faster than individually searching all of my Amex cards. Only if I find an offer in our database do I then go and hunt through my individual cards to find it. That’s not to say that you shouldn’t check your own cards for offers, but rather that this can be a handy reference tool, particularly for those who have a lot of Amex cards and would find searching through them all for an offer that may not even exist to be tedious.

That’s it for this week at Frequent Miler. Keep an eye on this week’s last chance deals to grab those that expire in January before they’re gone.

![Re-Bilt already, Fixing Marriott, the best Hyatts for Free Night Certificates and more [Week in Review]](https://frequentmiler.com/wp-content/uploads/2026/01/wp-1768653765552601913603261308925-218x150.jpg)

A good week of info sharing. Thanks FM team.