NOTICE: This post references card features that have changed, expired, or are not currently available

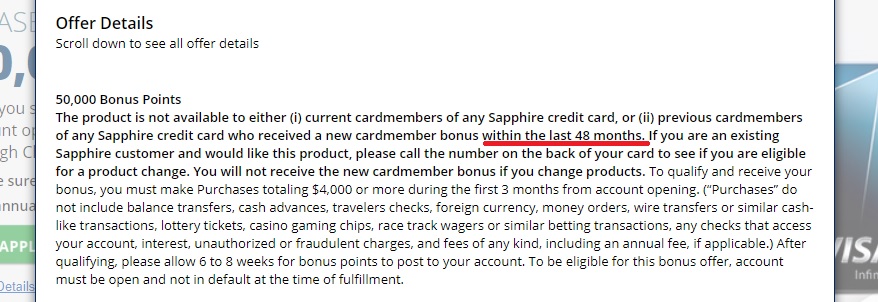

We recently posted about the change in langauge on Chase Sapphire Preferred and Chase Sapphire Reserve application terms: whereas they used to state that the bonus was no longer available if you have or have had this product within the past 24 months, Chase updated the main links on its site a couple of weeks ago to exclude those who have earned a welcome bonus within the past 48 months from earning a new cardmember bonus on either card (See: Sapphire Reserve and Preferred move to 48 month restrictions, but 24 month links still available). At the time of that post (and even as of earlier today), referral links still had 24 month language. Unfortunately, referral links now contain 48-month language in the terms. You will no longer be able to get the new cardmember bonus on a Sapphire Preferred or Reserve if you have gotten a new cardmember bonus on either card in the last four years. That’s unfortunate.

This change came about late this afternoon. I tested on our link at 11:30am this morning and it still had the 24-month language at that time. This is surely a disappointing change for anyone who was about to hit the end of the 24-month clock from the launch of the Sapphire Reserve card as it means you will now be locked out for two more years on the Sapphire cards. As if being under 5/24 weren’t hard enough, I can’t imagine many of those who waited around for a new Sapphire bonus are going to give it another two years of staying under 5/24. Ironically, this reduces the importance of remaining under 5/24 for the first two years after earning a Sapphire bonus — though keep in mind that going hog wild is part of Why Chase Shutdowns Happen.

Part of me wonders if this change foreshadows an increased bonus to come, but it seems that the more realistic explanation is that Chase is simply trying to eliminate the customers it does not want with this move. This is certainly a disappointing development, though the writing was on the wall – this was just a matter of time. Hopefully we do not see this virus spread to other Chase cards.

H/T: pfdpfd on reddit

[…] Doctor of Credit is reporting a great targeted offer that some people are seeing in their Chase accounts for the Chase Sapphire Preferred card: Get 60,000 Ultimate Rewards points after spending $4,000 in the first 3 months plus 5,000 points for adding an authorized user. Best of all, this time of offer (found under “Your Offers” in your online account) bypasses 5/24 and this particular offer maintains 24-month language despite the recent change to 48-month language on the Sapphire cards. […]

My wife and I no longer churn Chase cards. We now use the CSR + unlimited + freedom for lots of ongoing spend. The CSR is the only one with an AF and $300 of that is erased with easy travel credits. Really regret canceling my Ink early last year. Chase may have shut down churning, but the Ultimate Reward really add up fast and we get tremendous value from them. We are returning to the Park Hyatt Paris for another visit this fall.

I received two referrals from my wife, one was a link to copy and paste, the other an email. Today the copy and paste link has been changed to the 48 month language but the email referral, when you click on “offer terms” still shows 24 months. The email referral also says “apply by October 3” – think it will work with the 24 month language?

Any chance you can forward the email with the 24month verbiage?

The new game is pretty clear: figure out the Chase cards you want for the long term and get those cards. Don’t churn Chase cards that you only want for the bonus or for a minor benefit like a free room night. Way too much long term value in a UR generation machine. I think the base of a Chase portfolio would be:

CIP

CIC

CSR

United if you aren’t an elite (XN too valuable not to have this)

That gives you three consumer cards to play around with and maybe a third or fourth biz card if you want to push it.

Yes and less people will b applying for cards so less profit for Blog sites and more profit for banks . Same old story plan ahead but the Blogs can help as better planing of travel .

CHEER