I’m reposting because this morning I received an incredible offer from Capital One Shopping: “24% back from giftcards.com.” Even better, the email specifically reminded me to buy Mastercard gift cards: “Last Day to save 5% on Mastercard gift cards! Use code VETERANSDAYSALE.” Since originally posting about the Capital One Shopping browser extension in May 2022, I’ve continued to received great offers like this every now and then. So, consider this a reminder to install the extension in a browser that you use for price shopping (but use a different browser for purchases from other portals). The original post follows…

Usually, I avoid shopping portal browser extensions like the plague, but I recently installed one anyway and… I like it! Thanks to the extension, I’ve stumbled upon rewards that I wouldn’t have otherwise, and I’ve been targeted for huge reward rates. The Capital One Shopping browser extension (which does not require having a Capital One account) has made me a believer.

Why I usually avoid browser extensions

Shopping portal browser extensions advertise great benefits: earn points or cash back automatically when shopping online, automatically find the best coupon discounts, etc. The problem is that they steal the click-through. Suppose, for example, that a cash back portal is offering 20% back at Macys.com and that you intend to shop there anyway. You start at that portal, click through to Macys.com, and expect to earn 20% of your purchase price back. And you might. But, depending upon what extensions you have installed and how you interact with them, you might not. You might have a shopping portal extension installed that offers just 3% back at Macy’s (for example) and that extension may steal the click-through so that you earn only 3% back instead of 20%.

Why I tried Capital One Shopping

A friend told me that he had received a few great targeted offers from Capital One Shopping. The one that grabbed my attention was 30% back at Dell.com. Wow! For those with one or more Business Platinum cards (which offer $200 Dell rebates every 6 months), an offer like that is attention grabbing. After a bit of investigation we determined that the Capital One Shopping browser extension was necessary to get these offers. In each case, he had received offers after browsing the given merchant’s website. In other words, the browser extension saw the sites he visited and sent promotional offers specifically for some of those sites.

I wanted in on the 30% back party, so I gave in to my long held resistance and installed the browser extension. I then visited a few sites where I hoped to get targeted offers: Dell.com, Saks.com, etc.

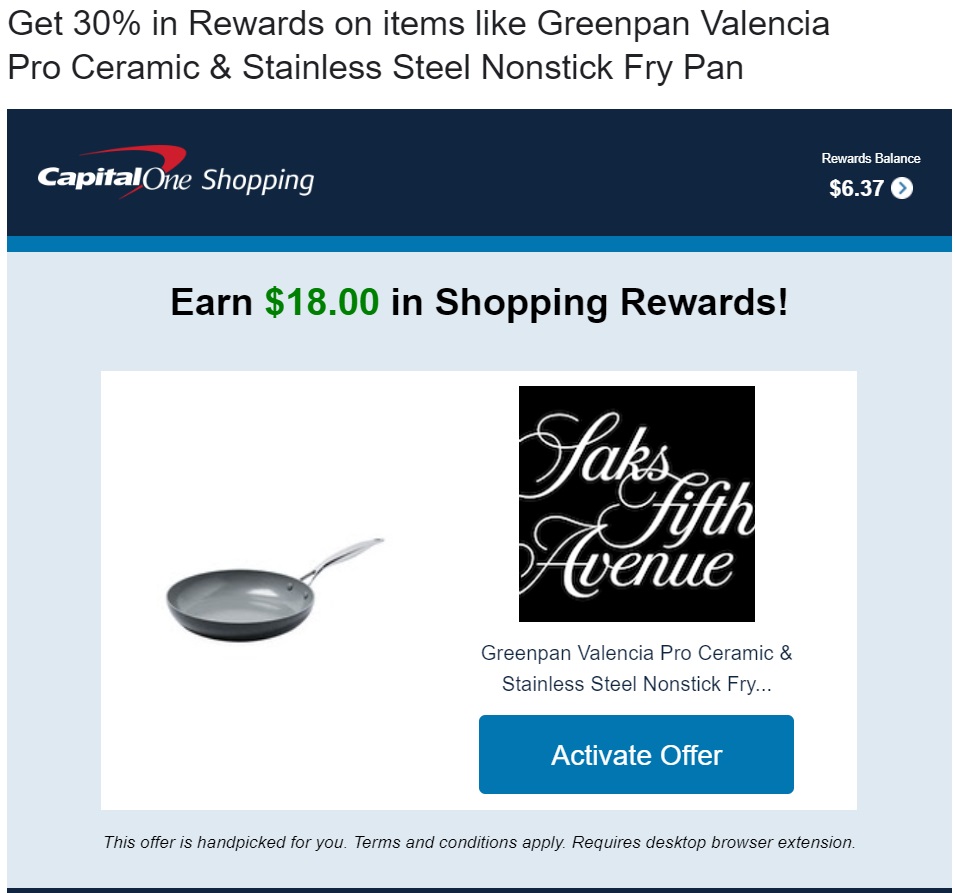

I’m not sure how many days passed (maybe just a few?) before I found this email from hello@capitaloneshopping.com buried in my Gmail Promotions tab:

Score! I had specifically looked at the frying pan after installing the extension. Now, I had the opportunity to earn 30% back at Saks for anything, not just the frying pan.

Eight days later, I got this ho-hum CVS offer:

Two days after the CVS email, I got this excellent offer for IHG Hotels:

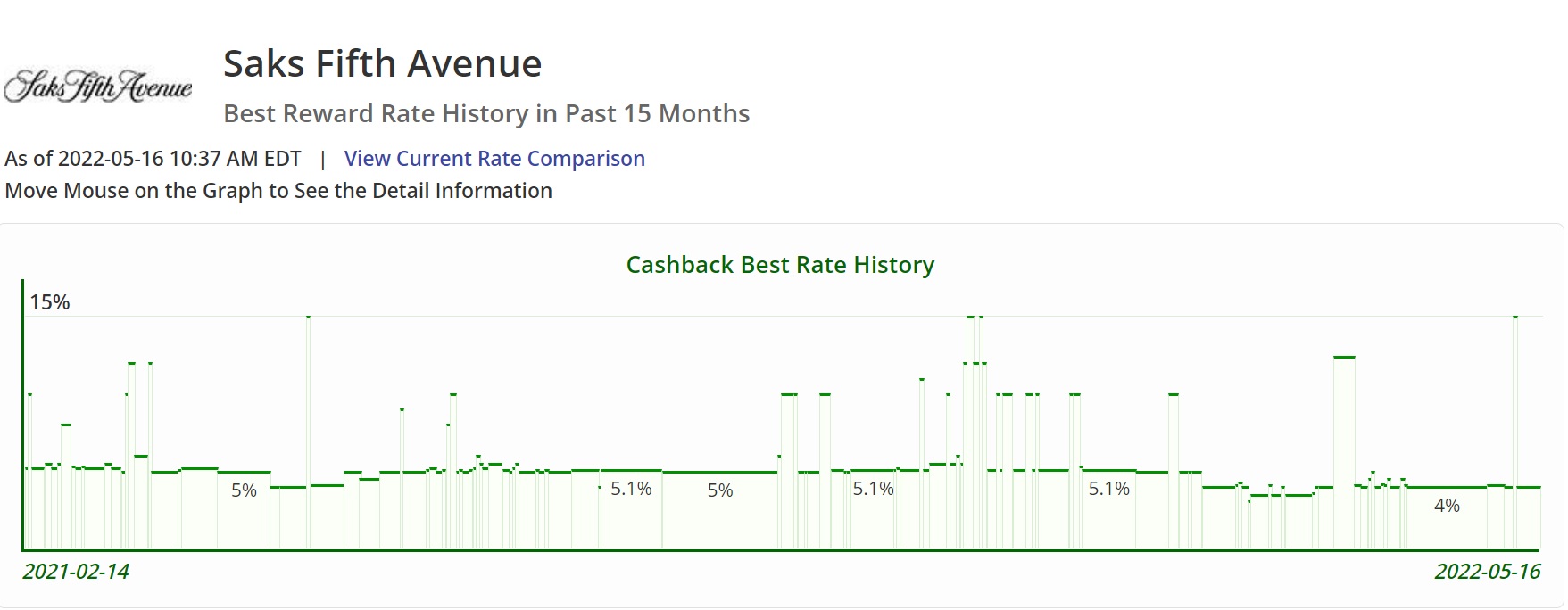

Cashback Monitor is my go-to site for finding which portals offer the best rewards at any given time. Cashback Monitor also lets you see the past 15 months of rates for any given store. I looked up Saks (here) and found that while we’ve seen 15% back now and then, no portal has come close to offering 30% back:

My 18% IHG offer was also better than any public portal offers in the past 15 months, but we saw 12% a few times and 15% once. So, while 18% was really good, it wasn’t nearly as amazing as the Saks offer.

My 5% CVS offer, meanwhile, was not even close to the historic best. In fact, as I write this, 5% is Capital One’s current public offer. That said, most portals offer tiered rewards for CVS (e.g. 12% back for a CarePass membership, 5% back for CVS brand items, 1% back for all other items). The fact that Capital One offers just a flat rebate is pretty good.

How I avoid click-through thievery

For many years my approach to online shopping has been to look for deals in one browser and make purchases in another. The reason is that in the process of looking for deals, I might click on a site to reveal a coupon code and that click could invalidate any shopping portal click-through that I’d been counting on. By separating deal hunting from buying, I avoid that kind of problem.

My solution to the browser extension problem was simply to install the extension in my deal hunting browser. I already use that browser to visit various sites to check prices and so this fits perfectly with the Capital One Shopping’s proclivity for watching my shopping trips and sending targeted offers. When I get one of these targeted offers I do use the deal hunting browser to make the purchase (since that’s where the extension is installed), but for all other purchases, I still use my clean non-extended browser.

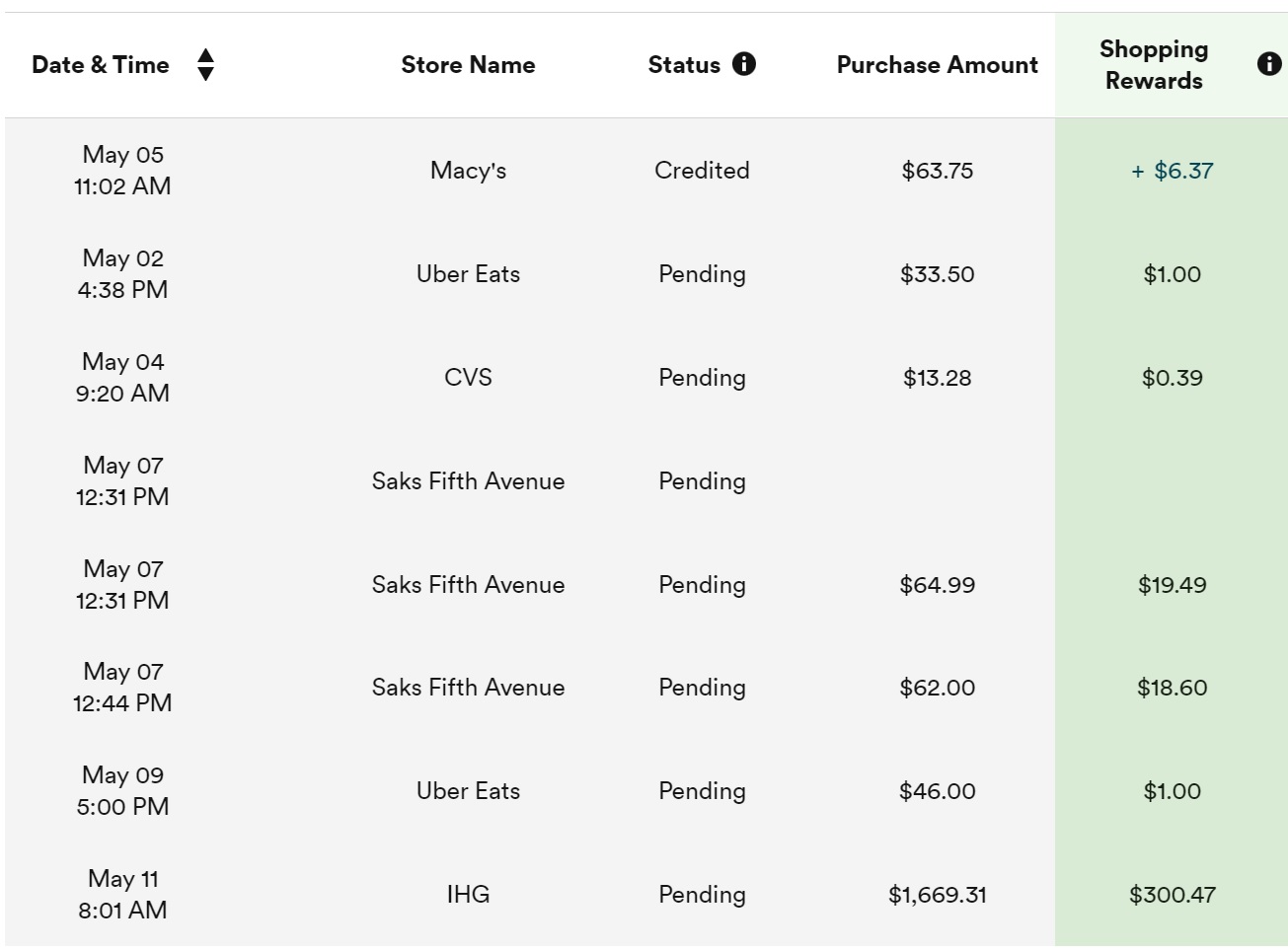

Results so far

The image above shows my Capital One Shopping results to-date. Only my Macy’s purchase has paid out so far. The rest of the rewards are pending. This is expected. Most portals take a few months for rewards to move from pending to credited.

Here is some background about each of the above items:

- Macys: Well before installing the Capital One Shopping extension, I used Capital One Shopping, without the extension, for a purchase at Macys.com because they were offering the best rewards rate at that time.

- Uber Eats: Most portals don’t offer rewards only for customers who are new to Uber Eats. But Capital One Shopping offers $1 each time existing Uber Eats customers place a new order. It’s not much but it’s better than the nothingburger I usually get!

- CVS: I normally shop CVS through the JetBlue portal in order to earn 3 points per dollar. In this case, the purchase was so small that it was easier to use the browser extension and collect 3% back. I made this purchase before receiving an offer for 5% back for CVS.

- Saks Fifth Avenue: In my family, we currently have four Platinum cards that offer $50 back at Saks every six months (Jan through June, and July through December). When I received the amazing 30% back offer from Capital One Shopping, I still had 3 of these $50 credits available. So, I made three separate purchases through the portal in one day in order to earn 30% back for each order (plus $50 back from Amex on each order). With one order I received the wrong item and returned it. That explains why one of the three shopping trips shows a blank purchase amount.

- IHG: I already had a cash booking at an IHG property, but when I received this targeted offer for 18% back I cancelled the old booking and booked it again through Capital One Shopping. In this case, the actual amount I expect to pay will be far less than what was tracked so it will be interesting to see if they accurately adjust the shopping rewards downwards. This is all part of an experiment I’m doing. I hope to publish details and results in the next week or two.

Portal Downsides

The thing I hate about Capital One Shopping is that rewards can only be redeemed towards gift cards. Worse, Amazon.com gift cards are not an option. Many of the available gift cards are often discounted through various promotions elsewhere. And I don’t often shop at any of the available merchants (there is no Safeway anywhere near where I live). So while I’ll never look a gift horse card in the mouth, I don’t value Capital One Shopping rewards as highly as cash back. I roughly value Capital One Shopping rewards at 80% of face value.

More about Capital One Shopping

First note that Capital One Shopping and Capital One Offers are two different things. Capital One Shopping is what this post is all about and it doesn’t require a Capital One credit card. Capital One Offers is more like Amex Offers and does require having a Capital One card. You can read more about the latter, here: Capital One Offers now featuring many retailers.

For details about Capital One Shopping and the associated browser extension, see this post by Stephen Pepper, or click through to any of these topics within that post:

- Credit Card Not Needed

- Browser Extension

- Shopping Portal

- Local Offers

- Price Comparison

- Watchlist

- Redeeming Shopping Credits

[…] That’s a fantastic result because it was originally looking like we were going to be well over budget. What flipped that was the Capital One Shopping portal. I’d gotten some targeted offers from the portal for 24% cashback on IHG reservations last year. We’ve stayed with IHG a few times since then and several of those tracked transactions became payable. We account for that cashback in our stats, so that moved us from being many hundreds of dollars over budget to many hundreds under budget. Greg has written about the Capital One Shopping portal’s targeted – and extremely lucrative – offers before at Frequent Miler, so check out this post for more details. […]

Quill: 21% on $300 Visa GC…however it does not get added to my cart. I have successfully purchased previously, registered with site, etc. If anyone knows a workaround, that is appreciated. Otherwise I have an email out to Quill.

Check the thread on DoC – you can go to the page where you can add to cart by item #, put in the card’s item # and voila

Thanks, Troy! Found the thread, workaround works…but my 21% cashback is gone as I look today (it was hanging in there for.a while). Ugh. Will keep this in mind for future opportunities.

Looks like the Walmart redemption option is gone now.

Never mind, it is back now.

I got a targeted 30% off offer on Dell by browsing with the extension. Fine print of the email said use within 24 hours, which I did. Does anyone know how long a Dell purchase takes to track? Stacking with the Amex 20% off yields 50% off!

Also made a dummy pay later reservation at Hertz with the 30% cashback just to see if it will track. Anyone have experience with those? I assume those track quickly but stay pending until the rental is complete?

I made a real booking with the Hertz promotion. My click shows, but not tracking. I’ve complained to Capital One Shopping and they say I have to wait at least 90 days AFTER the rental happens about whether I’ll get the cashback. I think it should show tracking and have complained as such. Another promotion was 30% off Macy’s $100 gift card. Click was there but no tracking. After 30 days, complained, and they issued a courtesy $30, but said it was my fault it didn’t track. This portal is dubious. Prepare for a battle.

Wow! I’ve been in the market for a Steelers jersey but just couldn’t pay the $335 list price. They do occasionally go on sale so checking yesterday the one I wanted was on sale for around $275. However, the Capitol One Shopping extension gave me 30% $100.50 off for a total of $234.49. I also got another $15 off for using my Chase Sapphire Preferred card. I was happy enough but checking my Capitol One Shopping account this morning I have another $70.34 in Shopping Rewards pending. Thanks, Frequent Miler!

How do you sign up for the notifications?

Greg, question: Is there a “favorite stores” feature as seen on other portals? Watch list seems to be product oriented. Thanks.

I don’t think so

Hi Greg,

How long does it take to show up as pending? I bought something from macys almost a month back and it still doesnt show as pending although the extension showed i was getting 35% back when I bought it.

The article says potentially months. Macy’s is problematic. Investigation required.

Hi Greg

I too installed the Capital One Shopping Chrome Extension. Today I received a 21% cash back email for Priceline and I was waiting to use it.

My question is – when I click – I have to click from the email right ?

When I do so – it takes me to priceline.com. It doesnt show me 21% or anything but I can see some tracking details in the web address.

Do I just hope that all the tracking goes well at the backend and I get the 21% committed in the email ? And wait for the purchase to post ?

Thanks

Aby

As long as you open the email link in the browser that has the toolbar extension you should see the 21% on the toolbar

I got an email today from them to “Earn $458.99 in Shopping Rewards!” on a specific espresso maker at Saks. When I go to the Saks page, the browser extension says the cash back amount at Saks is 27%. If I buy this coffee maker do I get the $458 and 27% back? (27% back is not equal to the $458.99 amount.)

No I think you’ll only get 27% back

I’m loving the offers they give me. I browse a lot of sites as a reseller and wait until Honey or Capital One offers me a good rate. I don’t know that I will get all the pending cashback but I tend to use it when the alternative payouts are small. Safeway is close and I can redeem for any gift card and get double gas points, so that’s a double dip for me.

This is a long overdue post! I’ve been double dipping using Capital One Rewards and AAdvantage or Rakuten for a while now. The trick is to activate the Capital One Shopping offer and then activate either AAdvantage or Rakuten. You’re welcome 🙂

Wow!

So you can still click through the Rakuten portal and get the capital one shopping payout? I thought you would lose Rakuten to get the Capital One payout. Wrong?

All good and interesting but “pending” awards can and do get taken away. I have seen my gift card purchases post as pending and then magically they just get blanked out.

Will be curious to know if you get paid on any of your trips.

So far everything has paid out

Interesting, Would the ihg (or any other hotel brand chain like Hyatt) be counted as an elite night if we went through this portal? Or is this like going through a 3rd party (eg booking.com) where we don’t get elite credits?

Yes it would count. When clicking through a portal to the hotel website to book, the reservation is indistinguishable from one booked by starting at the hotel website.

Capital one shopping portal is a scam. I earned over 2400 cash back and cannot redeem a single gift card. Asked customer support and cannot do anything. Waited over 6 months since last black Friday.