NOTICE: This post references card features that have changed, expired, or are not currently available

Are the lost benefits on the Business Platinum really a bad thing? Will the war on gaming change Greg’s Delta Diamond destiny? Was I overly pessimistic in my assessment of that new $8K-per-night Marriott? What does Greg wish he did instead with the time he spent analyzing what to do with his CNB points? See us discuss those key questions and more in this week’s Frequent Miler on the Air broadcast (or download it in podcast format below).

FM on the Air Podcast

For those who would rather listen during the morning commute or while you’re working, the audio of our weekly broadcast is also available for download as a podcast on all of your favorite services:

You’ll also find us on Spotify and hopefully your other favorite platforms. If you’re not finding the podcast via your favorite source of good podcasts, send us a message and let us know what you’d like us to add.

On to our weekend recap of the week’s top stories:

In devaluations

Business Platinum card losing Gogo, WeWork, Premium Roadside assistance, & Boingo in 2020

Is it fair to call this a devaluation? Greg would say it is for sure and I can understand why. But as you’ll see or hear me explain in Frequent Miler on the Air, none of these losses are meaningful to me. In fact, I’m almost excited about them in the sense that I don’t value these benefits and am hopeful that whatever they offer in place of these will more closely align with my needs. As I say in the broadcast, I don’t imagine that Amex struck up partnerships with Away Travel, Clear, and Loungebuddy just for the benefit of Green card holders. I have to imagine there is more up Amex’s sleeve for Platinum cardholders as well — color me hopeful.

Dumping my CNB Crystal Visa Infinite.

Breakups are never enjoyable, and in this post Greg shares the pains he went to in his preparation to kick the CNB card to the curb. Luckily, Greg writes about this stuff for everyone’s benefit. If not for the fact that his effort to maximize his points before closing (and difficulty in doing so) is helpful information for readers, I’d have agreed with his assessment (from FM on the Air, above) that cashing these out for dollars and cents (and then using them to get in on that mint deal) would make more cents. If you need to close your CNB card in a hurry, save yourself some trouble and see how Greg recommends you cash out your points. Just be aware that (as per the comments) Amazon gift cards are currently “out of stock”, so your best bet may be to cash out points for a statement credit rather than hope your order gets fulfilled after you’ve canceled the card or risk getting hit with a new annual fee that CNB may not be willing to waive.

Amex ratchets up their war on gaming with wave of shutdowns

Is Amex’s war on gaming a devaluation? I’d argue that it is. The extremes to which Amex has shown they are willing to go (like reportedly clawing back statement credits even after customers have closed their credit cards in some cases) has made it somewhat uncomfortable to use an Amex for fear of your activity being misconstrued as “gaming”. They have certainly sent a message that they want people to play by their rules “or else”, and in some cases I could see ordinary customers getting caught in the crossfire (like someone who buys a gift card at Sak’s Fifth Ave and then sees an automatic credit and figures it was OK with Amex). In the case of the recent shut downs, it seems that most of the shut downs have a fairly common thread, so avoid self-referrals for starters. Personally, I’m kind of surprised at the aggressiveness of Amex’s response; wouldn’t it be as effective to just turn off the ability to take advantage of the situation (like they did with Amex Offers)? At any rate, there is definite risk in doing things that Amex doesn’t like.

In loyalty

Delta Diamond Choice Benefits: Which to choose and when

You might think that the way Amex has been shutting people down lately that Greg would finally be done with MSing Delta Diamond status as the opportunity cost is just too high all things considered, but you’d be wrong :-). See Frequent Miler on the AIr above for his justification as to why he’ll continue spending for Delta elite status. Whether you earn your status the old fashioned way (with butt-in-seat miles) or you get there through spend, you’ll need to make a choice: which Delta choice benefit should you take? This post has Greg’s analysis.

On my mind (Choice Privileges edition)

The Choice Privileges program doesn’t get much press, but it’s a mistake to sleep on Choice (not a mistake to sleep at Choice! At least, not in some cases.). Like Greg, I’ve purchased Choice points in Daily Getaways a few times and I’ve been glad to have them for the occasional gem. It’s not generally wise to hoard points that one has no intention to use, but I think it makes sense to have a small stash of Choice points for those times when they present a good value — and in order to know whether or not they are useful, you’ll need a few thousand to start. Choice won’t become my primary choice any time soon, but I’m glad to have some points to keep my options open.

The Peacock Inn: A charming inn and great point value in Princeton, NJ

If you need a little proof as to why Choice points are worth holding, see Greg’s review of the Peacock Inn. A bathroom with heated floor tiles, free valet parking, and a charming-looking inn add up to what looks like a great use of points if your travels take you to Princeton.

Best ways to get to Australia, New Zealand, and the South Pacific using miles from the US

Down Under and the South Pacific are among the most popular award tickets out there. With limited supply in terms of flights to/from the region and high demand, scoring an award ticket (particularly in a premium cabin) can be tough. However, with some flexibility and persistence in searching, there are gems to be found. See this post for a summary of the best mileage deals possible and then get searching as far in advance as you can.

In credit card spend

Miles and money you may be missing

There are so many ways to earn a return on every dollar you spend that it can quickly feel overwhelming, but let me ask you a question posed a few months ago by Becky at SIghtDOING: “If you paid $100 for a tour but found out the person next to you had only paid $80 for the exact same thing, would you feel overcharged? ” If the answer is yes, you’ll want to see this post for the methods you might be missing to reduce your costs / increase your returns. Beyond those that you may just forget to check, there are extra stacking opportunities that add up — many of which require little more effort than you’re currently expending. Who wouldn’t want to turn 4% back into 12% back if they could do so with little additional effort? If you read that questions and thought that triple your cash back sounded pretty good, see this post for the methods you may be missing.

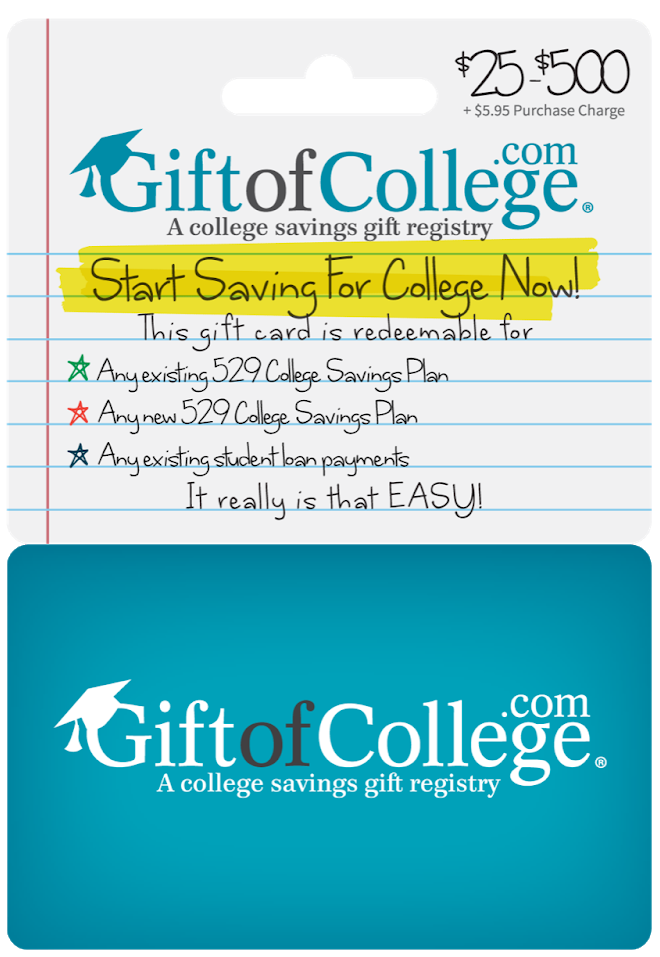

Gift of College now available at regional gas station Cumberland Farms

In great news for those saving for college, paying off college loans, or currently in the process of paying for a student to attend, you can now earn a category bonus when doing so if you live in the Northeast or Florida. Gas station Cumberland Farms certainly doesn’t saturate the market, but it does present a good opportunity for those who live in or drive through a decent stretch of the northeast. I’ve successfully purchased a $500 card with a credit card that earns a category bonus at gas stations and I already had plans to fund my son’s college savings, so I’ll be glad to add to my travel fund in the same swipe. An additional bonus for me is finding that the branch I’ve visited doesn’t seem to mind large gift card purchases, which was a welcome find indeed.

That’s it for this week at Frequent Miler. Check back soon for our week in review around the web and this week’s last chance deals.

![Mileage running 2026-style, playing the AA transition, a coming points conference and more [Week in Review] a group of toy airplanes on a game board](https://frequentmiler.com/wp-content/uploads/2022/01/American-Airlines-Game-218x150.png)

Thanks for the fun episode. I tried the coin deal and was able to get one coin. I was also trying to pick one up for my parents but didn’t realize the billing address couldn’t be the same, so my purchase got rejected. I don’t have my parents credit card info on me but I was carrying an unregistered GC, so I quickly registered it online with my dad’s info. But I was never able to re-connect to make the purchase…doh. I’ll be better prepared next time.