NOTICE: This post references card features that have changed, expired, or are not currently available

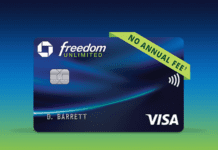

Ever since signing up for the Chase Sapphire Reserve card, I’ve planned to downgrade my Sapphire Preferred to a Freedom Unlimited card. The former gives 3X for dining and travel, whereas the FU (Freedom Unlimited) offers 1.5X everywhere. And points can be transferred to the Sapphire Reserve to make them more valuable. See: FU Sapphire Reserve: Better combos exist.

I first called Chase to downgrade my Sapphire Preferred immediately after signing up for the Sapphire Reserve, but I was told that I had to have the Sapphire Preferred open for at least a year before I could do so. Now the year was up and I called again. I was told no. I could only product change to the no-fee Sapphire card. Doh! I spoke with a supervisor — same answer.

I went ahead and product changed to the Sapphire. My hope is that if I call again in a month or two, they’ll let me change the Sapphire to the FU.

[…] to terrific input from readers in response to Greg’s post about the thwarting of his Freedom Unlimited plans, he was able to find the magic formula to product change From Sapphire Preferred to Freedom […]

[…] Saturday morning I published “Freedom Unlimited plan thwarted.” Since I now have the top-end Sapphire Reserve card, I wanted to downgrade my Sapphire […]

I had my CSP only a few months but was able to convert to Unlimited in two phone calls. First you have to call and switch to basic Sapphire and then a day later they’ll let you convert that to he Unlimited. There’s a reddit thread on this somewhere.

@FM

Are you still Private Client? If so, why? If Chase is unwilling to allow private client to bypass 5/24, what’s the point? So, you can earn 0.01% interest on your deposits?

Yes I am still Private Client. Why? Because they never took it away from me. I don’t keep $250K on deposit with them, if that’s what you assumed?

Does anyone know whether PCing between a Freedom and Freedom Unlimited multiple times per year is an issue or could lead to shutdowns?

My wife and I both have a Freedom and Freedom Unlimited each. Usually at least once or twice a year we could max out the bonus category in a given quarter 4x. It would be nice if during those quarters we could PC the FU to the regular Freedom, wait for the points to post, then PC back to FU. I just don’t know who happy Chase would be about this since they have to mail you new plastic each time you do this.

I don’t know of any data points on this, but personally I would worry that it would draw unwanted attention to your account if you did this often.

Greg, I used my CSP to purchase an iPhone in Oct 2014 and the AppleCare+, in Dec 2016, I product changed the CSP to CFU. Today the home botton on my iPhone is not working and I suspect it’s hardware issue. Since CSP gives 1 more year of extended warranty on top of the 2-year warranty offerred by the purchased AppleCare+, is it possible that I still receive this coverage given I did this product change? DP please.

That’s a great question, but I don’t know the answer. If you can’t find the answer elsewhere you’ll have to contact Chase to ask. If they say no, there’s still a bit of hope that you could upgrade back to the CSP to file for the coverage, but they might argue that if the damage occurred while the card was a Freedom Unlimited, then it’s not covered. So… another option is to upgrade before contacting Chase to ask if it’s covered.

Wait a day and SM chase, they will let you product change from the old Sapphire card to Freedom unlimited. I was just able to do this yesterday, only had the CSP for about 2 months total

[…] Greg’s plans to downgrade a Sapphire Preferred to a Freedom Unlimited didn’t go as plann…. Readers are sharing data points in the comments — stop by and share your own experiences in […]

I can’t remember where I read this from, but supposedly someone made 3 phone calls and completed the following product changes back-to-back, all in one day: CSP->CS->FU->F

After I got the Reserve in December, I was able to change my CSP (~2 yrs) to the original Freedom with rotating categories (I have an existing one as well). They did give me the option to change to the FU but I didn’t take it.

And.. it’s done. I’m now the proud owner of a Freedom Unlimited card! Thanks to many for the advice. Here’s the timeline:

1/15/16: Opened CSP: Sapphire Preferred Private Client (65K offer)

9/3/16: Opened CSR: Sapphire Reserve (100K offer)

10/?/16: Called to downgrade CSP to FU. Was told to wait until it was open 1 year

2/2/16: Called to downgrade CSP to FU. Told CS only option. Did that.

2/4/16: Private messaged Chase to convert CS to FU. Done!

Congrats!

I had my Sapphire Preferred for about six months. I converted it to a Sapphire Regular (they’ll let you do that even before a year), via secure message, and then once I had that, I was able to convert it to my second Freedom Unlimited (also via secure message) with no difficulty.

Thank you everyone for sharing your irrelevant experiences of downgrading 1 Year+ after having a CSP. Nobody ever questioned whether that might be an issue and youngster been unbelievably unhelpful.

Now that I got that out of the way, they’ll let you PC from the sapphire to the CFU immediately. There’s no need to wait a month or whatever.

Wow. Before making a total fool of yourself by being a jerk and then being wrong, you should have read the post more carefully. Greg waited the year anniversary+ and was still told he could not PC the CSP->FU. So, yes, that was raised as an issue. And, no, you don’t need to go CSP->CS->FU at 1yr+…or at least not according to many data points posted by the helpful folks here.

I’ve found secure message to be the best way to deal with everything. I applied for the reserve in branch and the branch banker told me I couldn’t downgrade my preferred I would have to close it and apply for the freedom, I said no. Went home and secure messaged chase they downgraded my preferred to the freedom without issue (I wanted the 5X categories). After that I used secure message to ask for an annual fee refund since I paid it in October. They agreed and a few days later I had a $71 credit.

I just changed CSP to FU last week via Secure Message with no problem. Had CSP for two years at time of conversion. So it is possible to do a direct conversion.