NOTICE: This post references card features that have changed, expired, or are not currently available

Note: On January 8, 2015 American Express sent out a notice to a large number of Bluebird & Serve cardholders informing them that loading capabilities on their accounts had been terminated. For more information, see: Amex kills Bluebird and Serve for manufactured spend

Last Fall, American Express released an innovative new prepaid reloadable product called Bluebird (see “Bluebird takes flight and changes the game“). While Bluebird was loaded with features, it wasn’t the features that made it innovative. It was the lack of fees. Bluebird can be used as a quasi-checking account, an ATM card, a credit card, and a peer to peer payment system — for free*. Green Dot, NetSpend, and many other companies have long offered similar capabilities, but with many fees. All charged per transaction and/or per month fees.

* In order to get free ATM access, you do need to use MoneyPass ATMs and you supposedly need to setup direct deposit as well (although I haven’t found that to be necessary in practice. See “Bluebird: Are direct deposits necessary for free ATM use?“).

Bluebird was especially exciting to those interested in earning points & miles. It was (and still is) possible to buy Vanilla Reload cards to earn credit card rewards, then load the money to Bluebird, then use Bluebird to pay bills (including credit card bills). This continues to be one of the best perpetual point machines around.

Recently, a great new Bluebird option opened up. Visa and MasterCard gift cards can now be setup with PINs (see “Gift card PINs“). If you can’t find Vanilla Reload cards, then you can buy Visa gift cards instead (they seem to work better than MasterCards). Take the cards to Walmart and use the PINs to do “swipe reloads” to move the money to Bluebird.

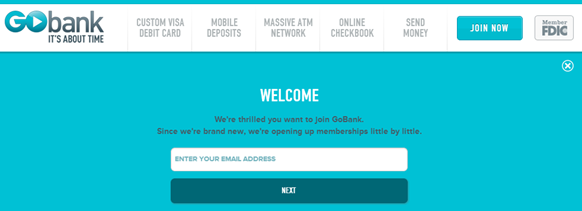

Enter GoBank

Green Dot Bank wasn’t willing to sit on the sidelines and watch American Express take all of its business. So, they developed a worthy competitor: GoBank. Like Bluebird, GoBank has no fees for most uses (except foreign transaction fees, out of network ATM fees, and customized card or replacement fees).

Currently, GoBank is rolling out its service to new members slowly. The best option if you want a card is to sign up at GoBank.com and wait for an invitation.

You can also try contacting GoBank via Twitter or Facebook to see if they can accelerate your membership.

In mid-April, The Free-quent Flyer wrote up GoBank in his post “Gobank’s Launch Challenges Bluebird.” At that time, I signed up for GoBank’s waiting list and even Tweeted them, but I never received an invitation. A few weeks ago, at Free-quent Flyer’s suggestion, I simply entered my email address again and was immediately led to a series of signup pages. I received my card about a week ago.

GoBank vs. Bluebird head to head

Both GoBank and Bluebird are designed to be alternatives to traditional checking accounts. Both allow direct deposit, check capture, peer to peer payments, bill pay, and free in-network ATM use. Let’s see how they compare head to head…

Loading Money

Both services are happy to accept direct deposits, ACH transfers (in, but not out), check deposits (snap picture with your phone), and cash or debit reloads at Walmart. Here is where they differ:

- Walmart reloads: Both cards allow fee-free debit reloads at Walmart. Unlike Bluebird, GoBank currently has a quirk where some swipe reloads do not show up immediately in your balance, but they do show up after 10 or 15 minutes. Bluebird is limited to $1000 per day. GoBank is limited to $2500 per day. Advantage GoBank.

- Online debit loads: GoBank initially offered free online debit loads (up to $200 per day) but they are in the process of phasing out that option. Bluebird allows debit reloads online, but they limit you to $100 per day and $1000 per month with a $2 fee per transaction. Neither card has a good option here.

- Reload cards: Bluebird can be loaded with Vanilla Reload cards. GoBank can be loaded with GreenDot MoneyPaks. MoneyPaks cost more ($4.95 vs. $3.95) and are less often available to be purchased with a credit card. Advantage Bluebird.

Bill Pay / Check Writing

Both services offer free bill pay services. Whenever possible, payments will be sent electronically. If the recipient isn’t setup for electronic bill payments, then payments will be sent by paper check. Here is where the services differ:

- Write your own checks: Bluebird offers optional paper checks that you can write out yourself. This is useful for in-person transactions where credit and debit cards are not accepted. And, until mid August, Bluebird is offering your first book of checks for free. GoBank has no equivalent option. Advantage Bluebird.

- Recurring payments: GoBank allows you to setup recurring payments. Bluebird does not. Advantage GoBank.

Sending Money

Both services allow you to send money to friends over email. With Bluebird, the recipient needs a Bluebird or Serve account to pickup the money. With GoBank, the recipient can use a GoBank account or a PayPal account to pickup the money. This is a nice option since PayPal is so widely used. Advantage: GoBank.

ATM Use

Both services allow free ATM use at in-network ATMs. Here is where they differ:

- GoBank’s network of free ATM’s is bigger (over 40,000 vs. over 22,000) so it is easier to find a fee free GoBank ATM.

- GoBank charges $2.50 for out of network ATMs. Bluebird charges $2. In both cases you will likely incur an additional fee from the ATM operator.

- Bluebird has no foreign transaction fees on ATM withdrawals. GoBank charges a 3% foreign transaction fee.

Advantage: GoBank within the US, Bluebird outside of the US.

Spending Options

Both cards can be used as credit cards. Here is where they differ:

- GoBank is a Visa card. Bluebird is an American Express card. Visa is accepted in far more places than American Express.

- Bluebird has no foreign transaction fees (but American Express cards are not widely accepted outside of the US). GoBank charges 3%

- GoBank is a debit card and can be used anyplace that accepts debit cards. Bluebird is not a debit card.

- Bluebird’s purchase protection covers losses if your eligible purchase is accidentally damaged or stolen within 90 days of purchase.

Advantage: GoBank

Fund Transfers

Bluebird has the option to transfer funds directly from your Bluebird account to a bank account. As far as I can tell, GoBank has no similar option. Advantage: Bluebird.

Account Closures

I’ve never heard a credible report of anyone having their Bluebird account forcibly shut down, but Green Dot seems to shut people down regularly. Million Mile Secrets provides the following important cautions:

Warning: You should NOT experiment with the Go Bank debit card and reload card if you can’t afford to be without the money loaded in your Go Bank account. Many people complain that Green Dot (which owns Go Bank) arbitrarily closes accounts and that it takes months to get your money back.

– Do NOT fund Go Bank and then immediately withdraw money from an ATM or transfer money to your checking account. That is very easy to detect. Withdraw only as much money as an average person would – that is in the hundreds of dollars and NOT thousands of dollars per week.

– Use Go Bank for lots of routine transactions as well. If all you do with Go Bank is withdraw money from the ATM or to your bank account, you are likely to be shut down because you are unprofitable for GreenDot.

– You WILL get shut down if you try to spend tens of thousands of dollars per month at any store with any one card.

– I can’t give you an exact amount and you’ve got to decide for yourself what is a reasonable limit.

– Alternate with other credit cards so that you’re not buying too many gift cards with just one credit card.

Miscellaneous Other

- GoBank, in my opinion, has a better user interface on both their web site and their mobile application. I especially love how their mobile app lets you search for ATMs and (optionally) check your balance without logging in.

- Some people have reported that GoBank has better customer service than Bluebird.

Summarized Card Features

|

Feature |

Bluebird |

GoBank |

Advantage goes to… |

| Load via debit card at Walmart (Swipe Reload / Rapid Reload) |

Up to $1K per day. Up to $5K per month. No fee. | Up to $2500 per day. Up to $50K balance. No fee. | GoBank |

| Load via reload card | Vanilla Reload. $3.95 Fee to buy card. | Green Dot MoneyPak. $4.95 fee to buy card. | Bluebird |

| Write your own checks | Yes | No | Bluebird |

| Free bill pay | Yes | Yes | Tie |

| Recurring payments | No | Yes | GoBank |

| Transfer funds to bank account | Yes | No | Bluebird |

| ATM Network | >22,000 | >40,000 | GoBank |

| ATM out of network fees | $2 + ATM charge | $2.50 + ATM charge | Bluebird |

| Credit card use | American Express | Visa | GoBank |

| Foreign transaction fee | None | 3% | Bluebird |

| Purchase protection | Yes, 90 days | No | Bluebird |

| User Interface | Good | Very good | GoBank |

| Receive money | Recipient must have Bluebird or Serve account | Recipient must have GoBank or PayPal account | GoBank (since PayPal is more prevalent) |

| Customer Support | Many complaints | So far, so good | GoBank |

| Known to shut down accounts | No | Yes | Bluebird |

My Thoughts

GoBank looks like a worthy competitor to Bluebird. On several measures, it appears to be better than Bluebird. It’s great to see competition in this no-fee bank-alternative space and I’m happy to get a chance to try out GoBank to see how well it works in practice!

Does Gobank have family accounts like Bluebird?

I don’t think so

anyone had an experience w/ https://www.greendot.com/greendot/getacardnow ?

Is this card loadable w/ VGC or MCGC?

Yes, it is loadable with debit gift cards at certain locations (such as Walmart or Rite Aid), but you do have to pay the load fee ($4.95). The card also has pretty hefty monthly fees unless you load at least $1K per month (or, better yet, keep the card balance empty)

So this looks like the monthly fee (most months), plus the $4.00 VGC purchase fee plus the $5.00 load fee and that makes this option pretty expensive.

I love bluebird. I have had them for years and have never hand a customer service problem. They even work wuth UBER. I love the fact that there are virtually no fees. They are no accepted everywhere but they do allow for ATM cash withdrawals. I have seen the gobank user interface .I was not impressed with over bluebird.

I had Bluebird account and someone hacked into it, putting money in and then back out again, Bluebird shut down my account without any notice, and I had direct deposit. I went without a paycheck for 3 weeks and Blue’s only response was it was shut down due to illegal activity. I was blamed for the hacks. I even had money in my account that was never returned. Never again Bluebird.

What are some circumstances that would cause gobank to close or freeze an account?

Only load it using gc in wm

use it only to pay bills.

not using it for every day, diversified spending.

I have had my original greendot card so long it just expired and I received a new one. Never any problems. I add the max ach deposit via Paypal 4x a week. I use it to pay my bills and pull out cash every other week. I always have an available balance.

I heard about gobank and decided to use them. I love the app and ease of sending check payments. I have loaded $600-$800 3-4 x a week for about a month. I have carried more then $2,000 balance the whole time. My account was closed Sat. With $2,500 in it. I called them and they said it looked like it was being used for business so they closed it. They will not reconsider. Their decision is final. They did however, lift the block so I can spend down the balance. Thankfully!! However, I love the app and wish they wouldn’t have closed it.

[…] Go Bank is similar to Bluebird, so similar, Frequent Miler wrote a great post comparing the 2 cards here. You can load up to $2,600 on your Go Bank card in one day, compared to the $1,000 limit for […]

Marshall: That’s a great idea. If anyone has tried that, I haven’t heard of it. There is a trick to loading at the register: after swiping your card, watch carefully for a “cancel” button to show up and press it (you have to be quick). Then you should be given the option to enter a debit PIN.

FM:

Has anyone payed around with the amount of “voluntary” pay each month to see if you select the max of $9 your account isn’t shut down?

Also, I just tried to load with two MC gift cards. Told the WM cashier they were debit cards (the ATM was broken), but it would not let me load with them. I was never asked to enter a PIN number while doing the load. Apparently a real problem with MC loads.

What about using the Green Dot cards to go to the AMEX Serve?

JustSaying: I believe that still works.

And the party is over for GoBank….

Unlike BB they are closing accounts once your statement rolls over if you load and do bill pay. No one has figured out what the pattern is or what will trigger automatic account closure but even low amounts loaded have triggered this. Once your account is closed you can get your money out pretty easily, but you are banned from opening any other Greendot Bank product.

SJCRussell: Thanks for the info about GoBank. It’s very sad!

catlover: Thanks! That’s good news.

It seems MoneyPak’s for ongoing loads is working again. I just tried today. I went to moneypak website and enter my gobank card number in “Reload a Prepaid Card” section. Loaded the money successfully.

Question on ACH transfers, is it stated in the T&Cs that ACH transfers out are not allowed?

I want to setup a small credit card (one recurring transaction) to be automatically paid off in full each month through bluebird. I asked my credit card company if it was possible and they didn’t know what bluebird was but they said as long as the account has a routing number and an account number it should work. Bluebird has these so do you think it will work?

Thanks

Paul: No, Bluebird doesn’t like to have money pulled out of it via ACH. You can initiate an ACH transfer by logging into Bluebird, but you can’t set it up for automatic payments. GoBank, on the other hand, does allow automatic payments.

Also it says goBank costs money to load …this is incorrect..I just go to 7-11 like I have for couple years now …hand them the card and the money And it is totally free …and it says you can’t transfer to a bank account and they are if they haven’t already added that

Some discoveries:

When using the WM machine to load there seems to be a max of 10 loads per day, even if you are under the $ load limit. This seems to be a WM thing.

Using the WM service center each store seems to have its own limit on # of loads. One store I was able to load > 10 small GC (they had no WM ATM) but at another today it maxed out with just 4 loads (and unfortunately their ATM machine seemed unable to read the GoBank card at all).

.

Note – some GC (mostly mastercard) seem to auto-trigger as payment by credit which will trigger a failure to load. If you have the option you need to select the button ‘change payment method’ to debit. The Visa cards seem to read first time as debit load.

SJCRussell: Thanks for the tips. In my experience, the limit at the WM machine seems to be based on amount loaded not number of loads. It seems to get stuck after $1500 of loads, so I just wait a while after doing $1500 before doing any more. That seems to work.