NOTICE: This post references card features that have changed, expired, or are not currently available

In high school, a rival track & field team had a great runner who unfortunately broke his arm and had it in a cast for most of our senior season. We called him Mega Man, a reference to a Nintendo character with a canon for an arm both because of the cast and because of his incredible tenacity and speed. My coach liked to front-load our relay teams with our fastest runners going in the first couple of slots, whereas most teams had their fastest runners on the anchor leg. The strategy for us was to jump out to a big enough lead to demoralize the more-talented and surely capable-of-beating-us Mega Man. It worked — we went to the state championships that year, leaving Mega Man huffing and puffing at the finish line despite the fact that he was much faster than our anchor man.

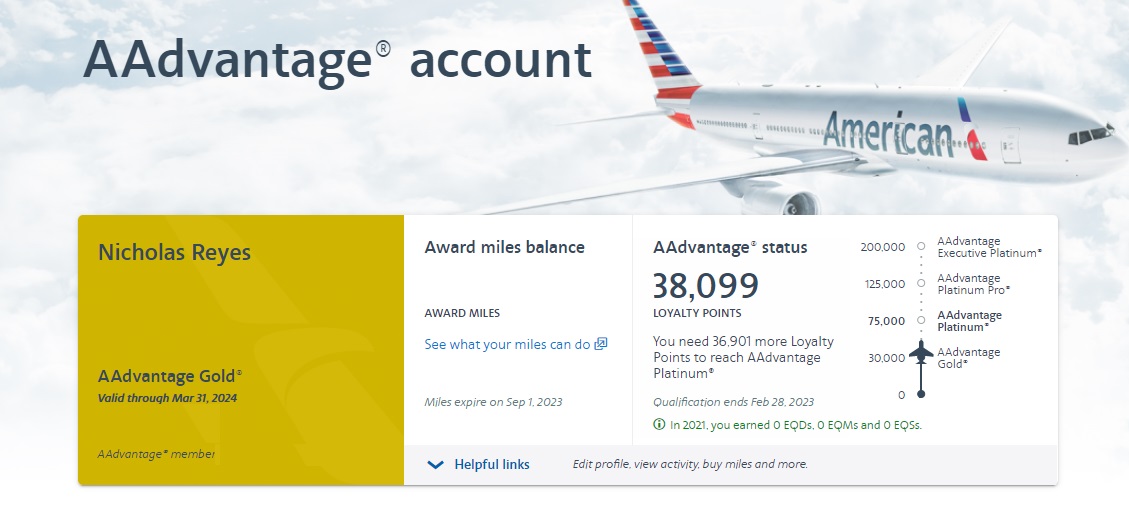

Fast forward to today: Greg is my new Mega Man and I’m doing what I can to sprint out ahead and get some distance on him in the first leg of the race. He recently published an update on his American Airlines Loyalty Point progress, showing that he is on a slow and steady pace toward reaching high-level American Airlines elite status without flying. While his slow and steady pace may prove to win the race, I have come out of the gate a bit stronger yet: I sit at just over 38,000 Loyalty Points — more than enough for American Airlines AAdvantage Gold status and more than halfway to Platinum status in month one.

AA Loyalty Posts & Tools

As a reminder, if you’re interested in earning American Airlines elite status without flying (or wondering why others are interested), these posts will help:

- Introduction (What’s happening? How can you earn AA status without flying? Why should anyone care?): AA’s Loyalty Point Pursuit game: Earn status w/out flying

- Cheat sheet (what works, what doesn’t): How to earn American Airlines Loyalty Points without flying.

- Keep score: AA Loyalty Game Scorecard

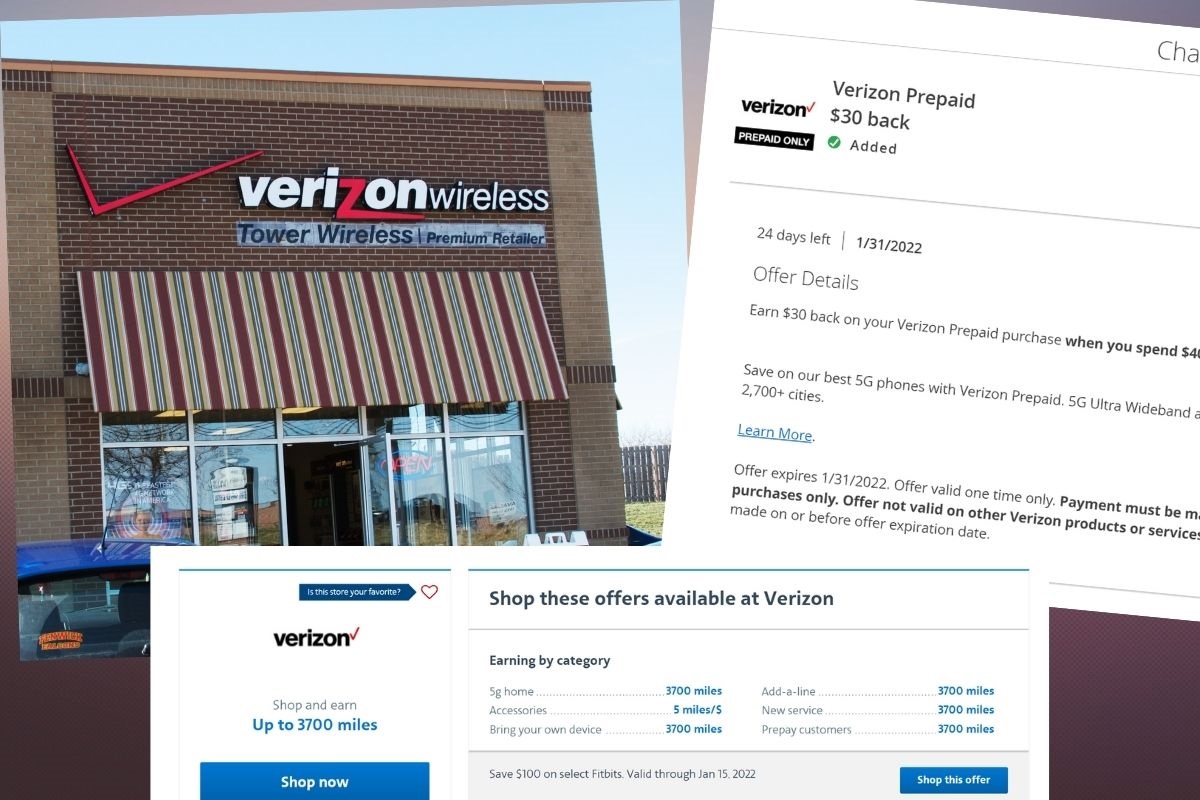

Half-Reversed Claw-backs were good to me. Verizon was my big score.

Greg wrote about half-reversed claw backs and in my case that worked out even better than it did for Greg.

That’s because I opened a total of 5 Verizon prepaid lines through American Airlines eShopping. Four of those lines were opened when the payout was 6200 miles and one was opened when the payout was only 3700 miles. That’s a total of 28,500 miles from Verizon prepaid activations.

Unfortunately, the redeemable miles from those orders were clawed back. Fortunately, I still got the Loyalty Points for those orders.

While losing the redeemable miles was an annoyance, I was able to make some saves. First of all, the lines wouldn’t cost me much if I just kept them for a month and cancelled. I opened two of the lines using a $75 back on $75 offer from Amex, so they cost me about $3 net (I placed a single order for two lines and the total came to just over $78). I had also opened a single line that was $44.40 and I had a Chase Offer for $30 back (which has since paid out), dropping the net cost to about $15. The other two lines cost me $40 each (actually $39, but let’s keep the math easier).

If I had simply canceled the lines after month one, I would have paid out a grand total of less than a hundred bucks for 28,500 Loyalty Points — just over a third of a cent per Loyalty Point.

However, in reality, I’ll do quite a bit better. Had it not been for the chance to earn AA Loyalty Points, I never would have thought to look at opening Verizon lines for the miles. However, since I suddenly had Verizon phone numbers, I thought that maybe I could do something profitable with them. Wireless phone providers often offer incentives to switch carriers.

In perfect timing, Visible Mobile came out with a deal to sign up and switch and bring your own device and get a $200 virtual Mastercard Gift Card. Getting the Mastercard requires maintaining service for 3 months.

I’ve done a similar deal with Visible once before, so I am familiar enough with them to feel confident that the deal will be honored (and the promotion shows up in my account details at Visible).

I therefore ported all 5 lines to Visible. I will pay:

- Line 1 = $25 per month x 3 = $75

- Line 2 = $25 per month x 3 = $75

- Line 3 = $11 per month for the first 2 months + $25 for month #3 = $47

- Line 4 = $11 per month for the first 2 months + $25 for month #3 = $47

- Line 5 = $11 per month for the first 2 months + $25 for month #3 = $47

I opened the first two lines because while there was a promo to pay $22 for the first two months, I didn’t think it would stack with the $200 rebate offer. However, when I found out that it did, I ported the rest of the lines on that deal.

I went through the American Airlines AAdvantage shopping portal for the first of my Visible lines for 2,000 miles (not yet posted). The portal had terms indicating that you were only eligible for the miles for Visible service one time per AAdvantage loyalty account. Therefore, I used other shopping portals for my other four lines. I assumed that each portal could be used once, so I opened each of my five lines through a separate portal / account:

- Line 1 = 2,000 American Airlines miles

- Line 2 = 3,000 Membership Rewards points through Player 1’s Rakuten account

- Line 3 = 3,000 Membership Rewards points through Player 2’s Rakuten account

- Line 4 = $30 cash back from Capital One Shopping

- Line 5 = $30 cash back from TopCashBack

My total cash outlay looks like this:

- Verizon: $100 (amount paid for 5 lines after initial Amex / Chase offers)

- Visible: $291 (total for 3 months of service on all 5 lines)

- Total spent = $391

And here’s what I expect to earn:

- Five $200 Mastercard Gift Cards ($1,000 total)

- $60 cash back from cash back portals

- 6,000 total Membership Rewards points

- 2,000 more American Airlines miles / Loyalty Points

- 28,500 Loyalty Points (already earned)

In other words, if we value the Mastercard Gift Cards at about face value, I’ll have earned more than six hundred dollars on this deal and come out with more than 30,000 Loyalty Points (as well as some other miles / points) by the time this is all said and done (that’s 28,500 so far from the Verizon lines and the 2,000 for my first Visible order that I’m still waiting to see). I should note that none of the Visible Mobile portal rewards have shown up yet, but all of the orders tracked with an order number in the respective portals, so I suspect the delay is just in how Visible processes these.

It isn’t right that the AAdvantage portal clawed back the miles on the Verizon orders. Prepaid was listed as an option and they clawed back the miles before I had even ported out the lines, so it isn’t like they had some secret minimum timeframe to maintain service. However, I haven’t bothered to follow up on that since I am satisfied enough that this deal worked out very well for me. Indeed, my AAdvantage Gold status is mostly thanks to this.

What else has worked?

I have almost 10,000 Loyalty Points that did not come from Verizon lines. Those include:

- Sunbaskets: 3,700 Loyalty Points from American Airlines eShopping.

- Babylist: 1,000 Loyalty Points from American Airlines eShopping (miles were clawed back)

- The House: 630 Loyalty Points from American Airlines eShopping (a family member had ordered a Christmas present for my family that was backordered and ultimately canceled, so they asked me to go ahead and order it myself and they would pay me back)

- Lowe’s: 1,980 Loyalty Points. This was an order for a family member who reimbursed me for the purchase.

- Lowe’s: 2289 Loyalty Points. This was an order for a family member who reimbursed me for the purchase.

Those last two Lowe’s orders were kind of an oddity. A family member was looking to buy a snow plow and the local dealer had one for six or seven thousand dollars. I suggested checking around online and we ultimately found one at Lowe’s that surely isn’t as good but was a lot cheaper. We placed the first order and then minutes later he decided he wanted a different plow, so we ordered a different plow from Lowe’s. Without getting into the details, I got the Loyalty Points from both orders and I don’t expect either to get clawed back (you’ll just have to take my word for it on that). He reimbursed me for the plow without complaint as it saved him a few thousand bucks and he didn’t have a use for the miles.

Together with the 28,500 points from Verizon orders, that’s my 38,099 Loyalty Points.

What’s next?

I haven’t yet done a number of the deals in our Cheat Sheet. Specifically, I’ve been checking MarketWatch, Barron’s, and The Wall Street Journal daily waiting to see payouts on those increase beyond 1,000 miles each (right now it is a $21 total investment for 3K miles/Loyalty Points, but I’m hoping to see the payouts go up to 1500 miles each). This month, I expect to earn the 2,000 Loyalty Points that I’m due from Visible Mobile, I’ll do the free Blooom offer for 1200 Loyalty Points and I’ll hope to see a chance for 4500 points from the financial newsletter subscriptions. That’ll be another 7700 miles for a total additional outlay of $21. At one time in my life, I’d have said that you couldn’t pay me enough to chase after American Airlines elite status — but another profitable deal or two and I may prove myself wrong.

For now, I have Mega Man in my rear view mirror and I’m hoping to keep it that way. Now here’s hoping that while I’m peering in the rear view mirror I’m not about to get blindsided by Tim.

Miles from the Verizon deals from January are finally showing Pending as of 04/22/2022. Hopefully they paid out.

if anyone is following this thread…

TODAY (Mar 25th) WSJ is offering 1300 LP for a digital subscription. $8. / month… you need to be subscribed for min 45 days. So $16.00 for the points. That’s $0.0123 / LP

Have never seen WSJ beyond 1000 miles. 1000 miles/LP for a buck or two is not a bad deal.

It was 1500 miles 2 days last month, 2 days in January. 3 days in December, 2 days in November, and 4 days in September. I only know that because Cash Back Monitor maintains 15 months of data:

https://www.cashbackmonitor.com/cashback-store/the-wall-street-journal/best-rate-history/

I’m sure those loyalty points will be clawed back. I have some stuff I bought through the portal, and I returned some of it. The miles were reversed pretty quickly but I still have the loyalty points for the stuff I returned. I hope I’m wrong of course but I don’t see any way that these will stick as loyalty points.

That was my first impression, too, but Greg made the point on Frequent Miler on the Air over the weekend (and I agree with him) that they probably won’t be clawed back in this case because American awarded the initial Loyalty Points in one lump sum rather than transaction-by-transaction. Since they did it that way, I think they are far less likely to go back and split it all out again. I think moving forward, those offers that get the miles clawed back will also get the Loyalty Points clawed back, but I’m more than 50% optimistic that these initial ones won’t be.

If your redeemable miles were clawed back, my bet is that your LP’s will too… Eventually. With AAdvatage Shopping such a big earner on the new scheme, I believe they will track back & find all of them.

I’m sitting at 71,694 Loyalty Points and that’s without 4 of my 5 Verizon orders posting at all (ticket’s been outstanding for a month now). I bought more wine than I otherwise would have, and I’ve ported out 4 lines to Xfinity Mobile to also make $200/line if all goes well. So should end up profitable with 100k Loyalty Points if these tickets are approved and they stop the clawback shenanigans.

I’m already at 78,000 with 7000 pending.

EP status (again) in no time.

How? Thats impressive

First, I have an OK job, which means that I have some cash reserve available. Looking at the offer, I decided to do a big push and in February I prepaid many of my 2022 expenses. That means Mortgage payments were made early and that was charged to my AA Barclaycard Silver via Plastiq. Then I took a look at utility payments, HOA and property taxes and prepaid all of those early. I also grabbed the Motley Fool offer.

As most of these were going to be items that I would end up paying anyways, it made sense to take advantage of the AA Jan & Feb DoubleDip.

(My plan is to repay myself for the early mortgage payments monthly to rebuild that cash reserve.)

As to the 8000 pending LP’s that is giftcards.com – they have an AA eShopping 3x multiplier. So you buy $2000 of visa cards (which you then use to pay off life’s expenses – that’s teh max allowed per month) and you make the purchase with AA Barclaycard, so that is 8000 LP’s that really just costs a bit over half a penny / loyalty point (service fees and shipping cost $56.35 so 0.007 per LP).

If they offer that 3x multiplier each month, then that will be a 96,000 LP’s.

Can’t wait to see if I can actually but the visa cards with the visa cards purchased the previous month.

I’ve tried to use a Staples MC GC for making a purchase at GiftCards.com (for a branded gift card – I think it was Spotify) and it got declined.

oh… I forgot: when you hit $50K spend on AA Barclaycard, you get 15K bonus LP’s. So that helped create that 78K LP number too.

One more thing… charging huge for a month had the credit score dip… but now it reports a ridiculously heathy 838.

I think that report took into account that my CC loan balance skyrocketed, I charged and paid off, and my mortgage balance dropped.

While doing this, I called and asked Barclaycard for an increase in credit, but they said to do so would be a hard inquiry pull… so instead of going over the limit I charged and paid off during the month, keeping my overall balance less than the credit limit.

Still, charging $40K in one month and paying it off… a nice trick.

Assume that all those “fees” to pay your mortgage, taxes, etc. have reduced the anticipated value from the future AA status and AA miles generated.

Agreed. But it all depends on what you consider value. Sure, there is a cost, but it’s a cost that I accept for what I like to do.

Mapped out against the estimated value of AA EP benefits, I’m still getting what I perceive as value.

Some people see no value at all in traveling at all. Some people drop what little I pay in fees in a few hands of blackjack in Las Vegas.

Whatever works for you.

FYI instead of checking WSJ every day you can mark it as a favorite and be notified when the miles offer goes up. Thanks for the pointer to visible!

@nun I can’t seem to find how to mark a store as a favorite.

Would you mind sharing some more specific instructions?

First you must login at AAdvantageEshopping. Then search for the store you want and click on the heart icon. Red hearts are favorites. You’ll receive email when the multiplier increases.