Let’s make a deal: right now you have 8 round trip airline tickets, but you have a chance to trade them in for a year of your retirement in relative comfort. Deal or no deal?

I love to travel. That love far predates my understanding of award travel, though my love of luxury travel is a direct result of countless hours spent studying miles and points. I have invested a lot of hours in this hobby and that investment has paid off with years of rambling down the yellow brick road of first class flights, 5-star hotels, and memories that will last a lifetime. Beyond the travel itself, one of my favorite things about miles and points is the feeling of freedom that comes from the knowledge that I have enough made-up funny-money currency to take off and go almost anywhere I want at the drop of a hat. The idea of giving up that freedom for 1.25c per point has never felt appealing, hence why there had never been a Schwab Platinum card in my household. That changed this week and I stand ready to pull the trigger on redeeming almost all of my Membership Rewards points. I can’t seem to kick the sadness in what feels like giving up future luxury travel dreams in exchange for something that won’t make any impact on my life for many years. But the magnitude of that future impact is too much to ignore, so I think I’m ready to say goodbye to my Membership Rewards points.

Thinking more about the 1.25c Schwab redemption

We recently reported on a long-standing rumor that the rate at which Membership Rewards points can be redeemed to a Schwab brokerage account would decrease from 1.25c to 1.1c per point on September 1st, 2021. In response to our post, a reader commented saying that redeeming points this way to a Roth IRA did not count against the annual Roth IRA contribution limit. We don’t know that this reader was correct, but we published a post about the concept yesterday after another blog highlighted the opportunity.

Of key importance is the fact that we don’t know that the interpretation offered by that reader and others we cited is correct. The fact that Schwab does not count Membership Rewards redemptions against the annual contribution limit tracker and does not account for those as contributions on the annual 5498 form it sends to the IRS and Roth IRA account holders does not definitively mean that Membership Rewards redemptions don’t count as contributions. And I believe the penalty for overcontributing is 6% of the overcontribution per year until it is corrected. I believe you may also be subject to a withdrawal penalty when correcting an overcontribution assuming you do not yet qualify to withdraw from your IRA. In other words, the penalty could be steep if you make a mistake here.

I am not a CPA, lawyer, financial advisor, or other wizard of tax and investment information, so take my interpretations here as not better than anyone else’s and certainly as being far less qualified than your own CPA, with whom I encourage you to confer before you make any decisions in this realm. This post is not legal, tax, or investment advice. Be entertained by my musings and do your own research.

I don’t know why Schwab doesn’t track Membership Rewards redemptions to a Roth IRA as contributions either in the activity tracker or on the form 5498 that they file with the IRS reporting contributions to the account. Maybe it’s poor IT and they don’t have it in the budget are too lazy to fix it. I imagine that Schwab has a CPA or two on its staff, but it is also certainly possible that they have just overlooked this. Maybe Schwab hasn’t noticed the fact that the amount of cash being deposited into IRAs somehow doesn’t reconcile with their accounting. Maybe they just don’t want the responsibility of figuring it out and expect the accountholder to do so. Maybe Schwab thinks that Membership Rewards redemptions shouldn’t count against the annual contribution limit but they are wrong (and they do disclaim that you should consult with your own tax professional about it in the terms). Ultimately, I don’t know why they handle it the way they do.

One explanation we see within the reddit thread to which I linked is that Schwab considers Membership Rewards redemptions like a bank bonus similar to a brokerage bonus for moving investments to a new custodian (which typically does not count against your annual contribution limit). While a Membership Rewards redemption feels different on the surface, I find the wording of the “Invest with Rewards” section of the application terms interesting for the way it refers to a Membership Rewards Invest with Rewards redemption. Bold here is mine for emphasis:

Invest with Rewards

This reward is only available to the Basic Card Member on a Platinum Card® from American Express Exclusively for Charles Schwab who maintains an eligible account at Schwab (an “eligible account”). An eligible account means (1) a Schwab One® or Schwab General Brokerage Account held in your name or in the name of a revocable living trust where you are the grantor and trustee or (2) a Schwab Traditional, Roth or Rollover IRA that is not managed by an independent investment advisor pursuant to a direct contractual relationship between you and such independent advisor. Additional Card Members and otherwise authorized third parties, including authorized account managers, may not redeem Membership Rewards points for this reward.

A Basic Card Member may redeem a minimum of 1 thousand and a maximum of 4 million Membership Rewards® points every 7 calendar days for this reward.

Redeemed points will be immediately deducted by American Express from your Membership Rewards® account. Schwab will deposit associated funds into your chosen eligible account within 4 to 6 business days, excluding bank holidays. Points are not refundable once redeemed.

This reward is subject to the Terms and Conditions of the Membership Rewards® program. Please consult with your tax advisor regarding the tax implications of any reward.

They repeatedly refer to this redemption as a “reward” and that they note that Schwab will make a deposit into your account. Does the fact that you are redeeming a “reward” with American Express and Schwab is essentially fulfilling that reward make the difference in terms of coding this differently than a contribution? I am certainly not qualified to answer that, but the terms drew my interest. Elsewhere in the terms I noticed that it was worded similarly:

Invest with Rewards

Use Membership Rewards® points for deposits by Schwab to your eligible account.‡

Again, I don’t know that this means anything and I can’t emphasize in strong enough terms that you should consult with your own tax advisor. Please don’t make any tax or investment decisions based on the questions of a miles and points guy.

But let’s imagine for a moment that the hype is right and the naysayers are wrong: let’s imagine that Membership Rewards points can indeed be redeemed subject only to the program limitations above. Is that enough to give up on my dreams of a family ANA round-the-world trip or one of ANA’s many other sweet spots?

Thinking about the long-term implications

I have had a Roth IRA for more than a decade and have always deposited the maximum amount with the hopes of my money growing for many years and simplifying my retirement with tax-free withdrawals, so I have a decade of experience with a Roth to give me perspective as to how it can possibly grow (though obviously past performance is no guarantee of future performance). On the other hand, I also have plenty of experience with award booking to know just how much fun it could be burning through my Membership Rewards points with travel.

Take a classic example of amazing value: round trip first class on ANA from Eastern/Central cities like New York, Washington, or Chicago to Tokyo would ordinarily cost upwards of $20,000, but when awards are available those same seats could be booked for just 120,000 Virgin Atlantic miles round trip (a 1:1 Amex transfer partner). With my collection of Membership Rewards points, my family of four could do something like that a couple of times (we’d never find award availability for four in first class, this is just an example). With 1,000,000 Membership Rewards points (just a theoretical large number of points), I could book 8 round trips like that. That’s $160,000 worth of first class flying. Each round trip from New York would be more than 24 hours of flight time — so we’re talking more than 8 days of first class flying with a million Membership Rewards points.

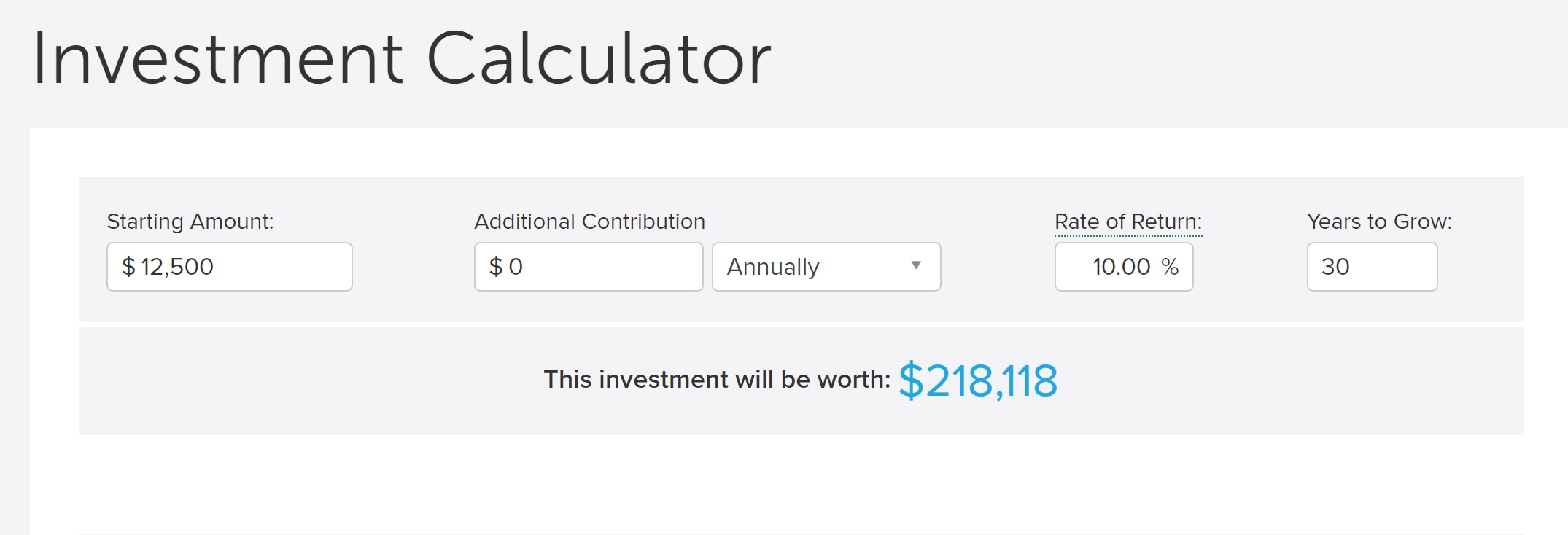

Alternatively, 1,000,000 Membership Rewards points could be redeemed for a $12,500 deposit by Schwab. If this idea of contributing it to a Roth IRA is correct, it could grow for the life of the account without ever owing taxes on the earnings. According to the Internet, average stock market returns over the long-haul have been 10% annualized (obviously this can vary wildly in reality and does not guarantee future returns). So how much could that $12,500 grow to become if returns over the next 30 years match historical returns?

According to an investment calculator, based on 30 years at 10% each year (and based on no other contributions), it would be worth….more than two hundred grand.

It’s not hard to imagine $218,118 funding an entire year or more of relatively comfortable retirement even assuming quite a lot of inflation over the next 30 years.

Let’s make a deal: Would you trade 8 days of first class flights to pay for a year of retirement?

Obviously that’s a question we face every day on some scale when we buy a coffee or a new iPhone or subscribe to HBO Max or open a new credit card with a $550 annual fee. And clearly there is no guarantee that money in any sort of investment account will actually compound at ten percent annually over the next 30 years. Goodness knows that invested money could drop to $0 in value, though if you’re investing broadly the chances of it being quite that dire seem low. At lower returns, the eventual value is less staggering. For example, a 6% annual rate of return only turns that $12,500 into $71,794. And what if it only averages 6% and I retire and need the money in 20 years? It would be just over $40,000. Those numbers are a lot less exciting.

Still, I had to stop and think about all that: even if that $12,500 only turned into $40,000 that I could use in my retirement tax-free, would that be worth the trade? If I were the type to ordinarily pay $20,000 per ticket for that ANA first class example, the answer would obviously be no. But I am certainly not that type of person. So if my options were:

- Use a million points to book ANA first class round trip to Japan 8 times

- Use a million points to put $12,500 into a retirement account

Which would I choose? As much as I love flying up front, when I look at those potential returns, I have a hard time justifying the ANA flights. Even if those 8 round trips only cost me $40,000 of retirement money — a pretty low-return scenario — we’re talking about $5,000 per round trip. Would I be willing to spend $20,000 to fly my family of four round trip to Japan? Heck no I wouldn’t. Sure, the price would be well below sticker price, but I’m not going to spend that kind of cash on flights alone.

Except that’s sort of what I’d be doing if I redeemed the points for travel. And I both love and vehemently hate the Schwab Platinum card and the Invest with Rewards redemption for forcing me to think about it. The truth is that if we completely throw out the Roth angle and we just assume depositing that million points into a normal taxable brokerage account and letting it grow for 20 or 30 years, we’re still looking at the returns shown above, just subject to tax on gains instead of being tax-advantaged. For all the talk about Roth to this point, ending up with a hopeful $100K-$200K in retirement represents a much wiser use of Membership Rewards points than all my fancy trips. The Roth angle makes a significant difference, but whether the money is invested in a Roth or a normal taxable brokerage account, the 1.25c redemption rate almost feels misleadingly low given that, at 10% annual growth, that money would stand to nearly double (though net would obviously be less than double if taxable, but still far more than 1.25c). That’s true about every cent in our hands today: they could all be worth a lot more in the future if we’re able to invest and hold and the market continues to perform. Obviously we all need to spend money to do things we want to do. Will my trip to XYZ be worth sacrificing a day of retirement? Will my new shoes today be worth an hour of retirement? Obviously I’ve made that type of trade plenty of times to enjoy the “here and now” and surely I will again several times by this afternoon. That concept is neither new nor original and I’m not going to turn into a FIRE-type person because of Schwab Invest with Rewards. Neither am I done with award travel, but I find it too hard to ignore the value of redeeming most or possibly all of my Membership Rewards points right now in exchange for a potential windfall in my retirement years. The potential growth is just too much to ignore.

Isn’t the same thing true with my Chase Ultimate Rewards points, Bank of America Premium Rewards points, and many other award currencies and/or cash back? It absolutely is. I have noted that Chase Pay Yourself Back has made me think of award redemptions in terms of the dollars and cents they will cost me since I could easily have cash at the grocery store with those points. The difference here with Membership Rewards is obviously the gamble as to whether or not one can indeed redeem the points for a Roth IRA reward. If true, it increases the long-term value of Membership Rewards points beyond the value of other transferable currencies. Indeed, it makes Membership Rewards points more valuable than the tangible currency in my pocket if I can redeem it for a tax-free reward that my money can’t buy. Indeed the funny-money is not so funny anymore. That’s the part of this that I couldn’t shake. Those luxury trips that felt like the goal of earning rewards pale in comparison to the potential future value with good old-fashioned saving for a raining day.

At the risk of being repetitive, I don’t know beyond a shadow of a doubt that the Roth angle is possible at a scale greater than the $6,000 you can ordinarily contribute in cash (subject to income limits), but if it is it makes it very hard to justify keeping Membership Rewards points rather than redeeming them. Even when the redemption changes to 1.1c per point it will be hard to ignore, though the current 1.25c rate and a healthy balance of points pushed me to open the Schwab card. I haven’t yet redeemed the points — despite all the logic of a couple thousand words and hours of contemplating this, I still haven’t been able to accept giving up on the travel and freedom that the points represent even though I don’t have impending travel to book. Membership Rewards have been my favorite transferable currency and it is hard to imagine a 0 balance. Maybe I won’t redeem all of my Membership Rewards points, maybe I won’t redeem any of them, or maybe I’ll clean house recognizing that by this time next year I could once again have a healthy enough balance of points and have bought myself a year of retirement by stepping outside my comfort zone with a 0-point balance. Truth be told, I have enough points in various airline and hotel programs that it’s not like I would be grounded for the year or two it would take me to build back up.

Bottom line

I never before considered redeeming Membership Rewards points at 1.25c each. At FTU’s Virtual Seminar this past weekend, Stefan Krasowski of Rapid Travel Chai said that redeeming points like that felt to him like giving up and I completely connect with that sentiment even as I write this post. Yet the long-term potential of a Roth IRA redemption is so compelling as to make me re-think travel redemptions. That’s a problem I’ve come to with Ultimate Rewards over the past year as well, though the sizable bump here if the Roth angle works puts the Schwab angle over the edge in terms of making it so compelling that I feel like it’s time to say goodbye to my current Membership Rewards balance and start over from scratch in building up. On the one hand, I suppose this push comes at the right time since I still don’t have much travel booked and have enough points in other programs to cover my travel needs for at least a year while I work on rebuilding the Membership Rewards balance. I can’t help but feel sad to say goodbye to the yellow brick road I’ve been paving with Membership Rewards points for years, but the future impact is too much to ignore. I’ll still enjoy luxury travel, just a little less than I may have and with other currencies for a while. That seems like a trade I can’t refuse. You win, Schwab. Deal.

![Amazon: Save up to 40% when redeeming at least 1 Membership Rewards point [Targeted] a laptop on a table](https://frequentmiler.com/wp-content/uploads/2022/07/Amazon-Laptop-Featured-Image-218x150.png)

[…] of all, there were numerous commenters on that Frequentmiler post who said they wouldn’t do it. Additionally, there was a response article written that […]

This is a case of Nick simply being wrong and should just admit it and move on.

I think people have made it clear it isn’t legal (which should have been obvious from the start).

[…] for to manipulate the last opporunity, frequentmiler blog writer recommended to squander MR right into a Roth Individual Retirement Account, […]

As a tax and estate planning lawyer to the 1% for over 30 years, including with 2 of the largest law firms in the US, this is a really interesting post to me. There are many different intertwined issues here. I will comment on a few of them. I am a lawyer, but not your lawyer, so the following is not legal/tax/financial planning or any other kind of advice.

As others have pointed out, the limit on IRA contributions is not source dependent. Funds can be contributed to an IRA essentially by anyone – including the IRA owner’s spouse, parents, employer, etc. I don’t see how Amex (or Schwab) could possibly be the contributor here, but even if it was, it would not change the contribution limit. So for this hack to work, the MR award cannot constitute a contribution by anyone

The only argument I see that the MR award redeemed to a Roth isn’t a contribution is that it constitutes investment return. But is it? I do believe that to be Schwab’s position, at least with respect to their brokerage bonuses. I personally earned one with Schwab last year on a taxable account (it was a private offer due to the size of the asset transfer involved, but their position would equally hold for their public offers). I was advised by Schwab at the time that the bonus would be taxable, and in fact, the bonus was reported on a 1099 as interest income. The fact it was reported as interest income confirms Schwab’s apparent view that it constitutes an investment return. I don’t disagree that the bonus is taxable income, but I don’t really see it as investment return. I believe Schwab and the other brokerages have gravitated to this approach because that is how banks typically handle their account bonuses. However, the banks in most cases are required by federal regulations to treat their bonuses as interest. I do not believe there are any comparable regulations governing brokerage account bonuses. These account bonuses seem to me to be more in the nature of compensation income for services – i.e. perform the following services (open account, transfer assets and leave in account for a certain time, set up direct deposit, use debit card, etc) and we will pay you X via deposit to your new account. Of course, for taxable accounts, it doesn’t really matter whether the bonus is classified as interest income or services income, it’s non-preferentially taxed income either way. But it could make a big difference if the account was an IRA (Roth or otherwise). If it is compensation for services, it would be both taxable income to the service provider followed by a contribution by the service provider to the IRA. So how the bonus is classified by the IRS would make a big difference in whether it’s treated as a contribution. I’m not aware of any IRS guidance on this issue.

But even more importantly, I think there is a big difference between the typical bank or brokerage bonus and the redemption of MRs to a Schwab account. One can easily convert the MRs to 1.25 cents in cash by redeeming to a regular taxable account at Schwab, so effectively the cc holder is directing Amex to send the cash to a Roth instead of to him/her. I believe the IRS would treat that election as a contribution to the Roth. I think Fidelity is right and Schwab is wrong on this issue.

I agree with those who have mentioned you don’t want a dispute with the IRS. Even if you eventually win, the costs of defending the position will far exceed any benefit from a transaction of this relative size. The IRS doesn’t really have the time or resources to deal with things like this. That is until someone gets abusive, like the people who generated $300K on the old Blue cash. Would the IRS view a $12.5K contribution to a Roth as abusive? Would it matter if it was made in addition to the regular $6K? Who knows? But if Schwab wakes up one day and decides to change their position and report these to the IRS as Roth contributions on Form 5498s, at a minimum the IRS computers will automatically kick in and start sending bills for the overfunding penalties, which as Nick mentioned are significant.

How much are the MR points worth if this Roth hack is successful? Well, this is going to vary substantially from one person to another and is based on many assumptions, the main ones of which are (a) assumed investment returns, (b) assumed tax rates on that return if held in a taxable account, and (c) assumed length of time the funds would remain in the Roth. The higher/longer these are, the more the Roth hack is worth, and vice versa. None of these are easy to predict, even with the simplifying assumption that the entire amount is invested directly in domestic stocks and held for 1 year or longer, thus resulting in taxable income consisting entirely of qualified dividends and long-term capital gains.

In calculating the $218K figure, Nick has stated an assumption for (a) investment return of 10%, and (c) time in Roth of 30 years. What about (b) tax rates if held in a taxable account? This is really a product of the nominal tax rate and the realization rate. Currently, our assumed components of return, qualified dividends and long-term capital gains, are generally taxed at rates of 15% or 20% depending on overall income. There is a long history of preferential tax rates on long-term capital gains, but not so much for qualified dividends. There is currently talk of eliminating these preferential rates for taxpayers with higher incomes. And these nominal rates could change at any time, although any changes are likely to be increases rather than decreases (tax increases would increase the value of the Roth hack). The largest component of the return is long term capital gains, and the taxes on those will depend on the realization rate. If someone never sells winners, then their realization rate is zero. OTOH, someone who likes to grab gains and move on quickly (but after one year), their realization rate will approach 100%. So it will vary widely from person to person. Also what happens at the end of the projection period? Currently we have tax basis adjustment to date of death value (the so-called “step-up”, although it can also result in a step-down), so for those who don’t plan to spend these funds during life, there is no cap gains tax in the taxable account at the end of the projection period, due to the basis adjustment at death. OTOH, if someone intends to use these funds in retirement, the investments will likely be sold triggering realization of all gains, for simplicity assumed to occur at end of the projection period. I’m not sure where Nick comes out on all of this, but let’s assume 15% nominal tax rate, 50% paid annually and the other 50% paid after full liquidation at the end of the projection period. Under these assumptions, $12,500 would grow to about $160K in a taxable account after a full liquidation and all income taxes paid at the end of the 30 years. So with the Roth at a value of $218K, we can calculate the value of the MR points if contributed to a Roth under these assumptions, as follows: $218K / $160K x 1.25 = 1.70 cents.

So this leaves 2 questions for Nick and anyone thinking of doing this hack:

1. Is it worth taking the tax risks for the difference between 1.25 cpp and hack value of 1.70 cpp (under the above assumptions, or another cpp based on your individual assumptions)? .45 cpp is $4,500 on 1 million MRs.

2. Is it worth it at all to cash in the MRs at a hack value of 1.7 cpp or even at 1.25 cpp? If the assumption is the 1 million MRs will buy 8 flights, are those flights personally worth at least $2,125 each (1 million MR @ 1.7 cents = $17,000 into 8 flights = 2,125 per flight). Don’t forget to add in your personal value for the joy of free! If yes, don’t do this hack, unless you are confident you will never need these MR points to meet your travel needs (in which case it makes sense to cash them, although personally I would not do the Roth hack).

Don’t do it to Roth

Do it to taxable

Money will still grow and will be worth more than most money or points or any travel hacks worth doing in the long run. Live local save money travel meagerly but enjoyably.

Thanks Mike, I appreciated the analysis!

I agree that Schwab’s position is wrong and if the amount is not high, the IRS doesn’t care / have time to find you, but if Schwab changes their position and starts cutting paperwork, you’re screwed so why hassle with the IRS?

I just wanted to add that there are other solutions that would achieve your goals without the tax risks inherent in this Roth hack. One option that seems closest would be a Roth 401(k). It has the primary advantages of a Roth IRA (no tax on distributions generally, but no deduction going in), but with much higher annual contribution limits (more than the $12.5K being discussed). A disadvantage is that it’s more complicated to setup than just opening a Schwab account. Also, it cannot be setup by employees, it has to be setup by the employer (which includes a self-employed person). There are many other details which go well beyond the scope of this post.

Excellent analysis, Mike. I also want to point out that it’s possible to withdrawal money from a taxable account with effective long term tax loss harvesting and also withdrawing money when you are in a lower marginal tax bracket.

If you have a low enough taxable income (take the standard deduction, have a frugal lifestyle, live on cash and tax-deducted passive income), LTCG tax rate is 0% and you can withdrawal that money tax free 🙂

How is this not the top comment? Excellent.

I’d point out that Schwab does advise keeping the amount “nominal.” Getting in a tussle with the IRS is never a good idea, but they seem much more reasonable than putative, especially when you’re talking about a smaller fraction (say, 10% of the limit, not over 200% of the limit).

“At Schwab, we’ve historically taken the view that these types of promotions and bonus awards deposited to an IRA, should be treated as bonus earnings and not a contribution. To address Internal Revenue Code prohibited transaction concerns, we have advised that such awards/gestures should be nominal (in relationship to the value of the account) and where possible, to avoid offers, promotions or account gestures that exceed the IRS maximum contribution limit applicable to IRAs for the year in question.”

I think that one aspect that wasn’t raised here is that many people don’t have 30 years to watch their investments grow. For you it’s great but cashing out a million points likely won’t have the growth potential for someone five years away from retirement where there’s a lot less time for compound interest to make the money grow.

Agreed. Many people also don’t have time to go take first class flights.

I could see a shorter term value to this if you need money for education or a house down payment. In 10 years we expect a year of college to cost $75,000. If you’re selling that much stock from a regular brokerage, you’re likely pushing your regular income into an 8% higher tax bracket, especially if you have two kids.

[…] for to take advantage of the final opporunity, frequentmiler blogger instructed to money out MR right into a Roth IRA, reasonably than a brokerage account. […]

[…] to exploit the last opportunity, FrequentMiler suggested to cash out MR into Roth IRA account, instead of a brokerage account. This action has an […]

[…] to exploit the last opportunity, FrequentMiler suggested to cash out MR into Roth IRA account, instead of a brokerage account. This action […]

[…] to exploit the last opportunity, FrequentMiler suggested to cash out MR into Roth IRA account, instead of a brokerage account. This action has an […]

[…] 如此背景下,近日FrequentMiler的博主建议兑换MR时将存入账户选为Roth IRA。有Reddit数据点显示,Schwab会将存入金额算作account incentives,而不是算Roth IRA regular contribution并报告给IRS。这样一来,MR->Schwab Platinum->Roth IRA的方式似乎可以突破Roth IRA每年的存入限制。 […]

Wow – a firm’s failure (in this case Schwab) to report a contribution to a retirement account in your name doesn’t release you from the obligation to report that transaction. The very same issue has happened in the last few years with crypto and the IRS has come down on people despite the complexity of finding those people. https://www.coindesk.com/irs-seize-cryptocurrency-property-us-tax

In this case, you’ll be reporting distributions from a Roth IRA for which you don’t have related deposits. Per the IRS:

Taxpayer must report a Roth IRA distribution as an IRA distribution, regardless of how much, if any, is taxable. If you’re using Form 1040, it goes on line 15a; if using Form 1040A, it goes on line 11a.

In this case, Schwab will be reporting your withdrawls on a 1099. Not much effort required here for them.

You just gotta get Greg to give you access to a Mega Backdoor Roth so you can have your cake and eat it too Nick. Y’all are big tech right? https://www.madfientist.com/after-tax-contributions/

Here’s what you should do: book those flights, then put $160k into retirement investments (tax free or not, the final vale will be a lot larger than the 200k you cite).

If you’re not willing to do that, those $20k first class flights were never worth $20k to you in the first place.

My crazy idea just illustrates that these outsized values people claim for premium travel are pure fantasy and should be disregarded. If you wouldn’t pay cash for it, it’s not “worth” that.

I’m not 100% on this but I’ve seen comments online where ppl spoke to an EA and a CPA and they agreed it’s more of a rebate/investment return so makes sense that it is not taxable. That makes sense to mess As a CPA myself it just seems too hard/grey area so just going to pass on this one

So much unnecessary drama….

Why not simply look at it this way:

A. Keep the 1million Amex MR’s and spend them on future flights, or

B. Cash out via Schwab and fund your Roth IRA with those points instead of the cash you would *normally* use to fund your Roth IRA (up to the normal, published IRS limits). Use that now freed-up cash for something else (like funding your kids’ Roth IRA’s).

easy peasy 🙂

see my above comment about the world not being binary. …or maybe it is now with all the polarization?

Sad to live in a total black and white world. I like greys and colors, too.

You can’t fund your kids’ Roth IRAs beyond their earned income. If they have income, that would already be an option regardless of having MR on hand.

The benefit being discussed in this post is potentially having Schwab put a bonus into your Roth in addition to your own $6k/yr contribution. You’re talking about replacing part of your contribution.